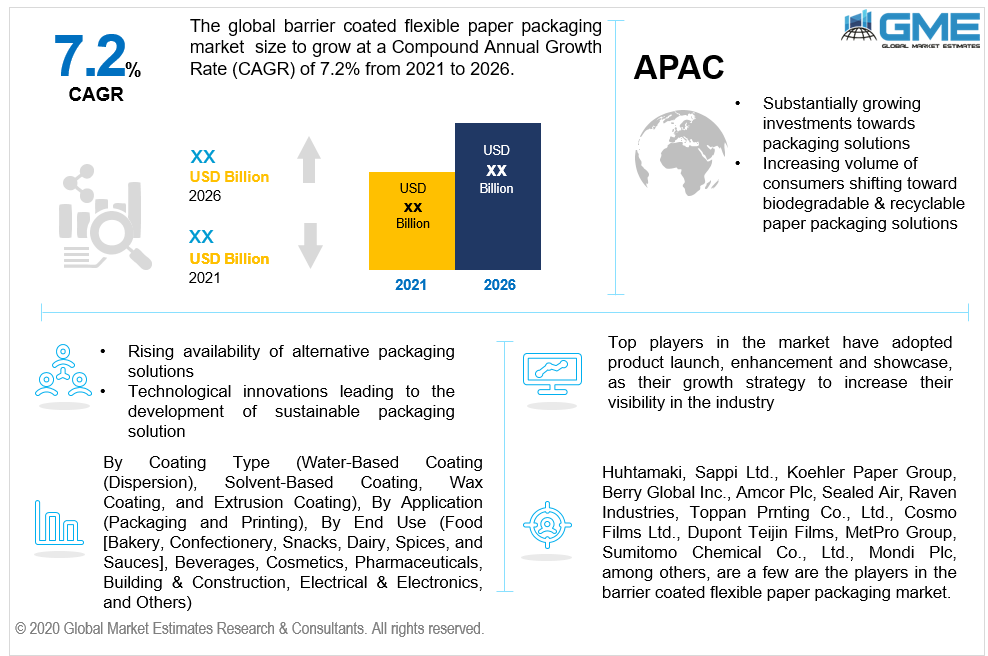

Global Barrier Coated Flexible Paper Packaging Market Size, Trends & Analysis- Forecasts to 2026 By Coating Type (Water-Based Coating (Dispersion), Solvent-Based Coating, Wax Coating, and Extrusion Coating), By Application (Packaging [Cups & Lids, Trays, Boxes, Bags & Pouches, Labels, Blisters, Wraps, and Tapes] and Printing), By End Use (Food [Bakery, Confectionery, Snacks, Dairy, Spices, and Sauces], Beverages, Cosmetics, Pharmaceuticals, Building & Construction, Electrical & Electronics, and Others [Publications, Automotive, Etc]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); Competitive Landscape, Company Market Share Analysis, And Competitor Analysis

The deposition of an elevated strength barrier coating on the paper surfaces to provide insulation against moisture, oil, and lubricant is referred to as barrier coated flexible paper packaging. Flexible paper having a barrier coating is commonly employed to package, store, and transport a variety of food and non-food products. Paper packaging is one of the most common types of packaging however global barrier coated flexible paper packaging is still in the infancy stage with major markets being located in Europe. Globally, there is an increasing demand for goods that can give exceptional levels of safety to products, notably in the food and beverage industry. The old packaging technology is being replaced with barrier packaging technology. Thus, it is foreseen that this will eventually aid in the expansion of barrier coated flexible paper packaging in other regions of the world during the forecast period.

Global growth prospects exist in every location. Major growth, on the other hand, is being assisted by a strengthened global economy and the evolution of impoverished nations and areas. Furthermore, demographic lifestyle modifications, quickly evolving customer tastes, and the advent of modern technologies have reduced the need for conventional packaging. Throughout the forecast period, these considerations are projected to boost the worldwide barrier coated flexible paper packaging market. Likewise, the rising popularity of microwave cooking and ready-to-eat foods is likely to fuel the expansion of this market in the foreseeable future.

Globally, governments have demonstrated their dedication to encouraging increasingly sustainable packaging technologies by designating recyclability, downsizing, and down gauging important priority for regional producers and global corporations. The growing consumer and business owner consciousness, as well as the plastic ban rule, offer an excellent prospect to develop barrier coated flexible paper packaging solutions. Even yet, there are several drawbacks to utilizing paper for packing, such as weak barrier characteristics. Optimizing the barrier characteristics of paper is a critical step in enhancing its viability as a packaging material. Enhanced moisture, gas, water, oil, and grease barrier technologies can overcome the limits of paper packaging. Thus, this up-gradation achieved in conventional paper packaging by employing advanced barrier packaging technology is presumed to create skyrocketing demand from all the application domains and end-use industries.

Manufacturers are increasing their production capacity in recyclable flexible packaging. Organizations are partnering with environmental specialists and technology consultants to allow package solutions for recycling to obtain a competitive advantage in the worldwide barrier coated flexible paper packaging market. Extensive knowledge and expertise are critical in the development of biodegradable and sustainable barrier-coated flexible paper packaging solutions. Organizations are launching well-engineered paper-based flexible packaging that lowers dependency on fossil-fuel-based materials. As a result, demand for barrier coated flexible paper packaging will rise.

Additionally, intelligent printing on barrier coated flexible paper packaging improves the appearance of the product, provides necessary content about food, beverages, cosmetics, and pharmaceutical items, and draws the customer's interest in the product. The increasing use of such imprinted barrier coated flexible paper packaging by market participants to entice a large number of clients is significantly driving market expansion. The ever-expanding e-commerce sector is also influencing global growth prospects in barrier coated flexible paper packaging applications, and multifunctional & barrier coating technologies will provide the qualities required to send more items directly to buyers across the world.

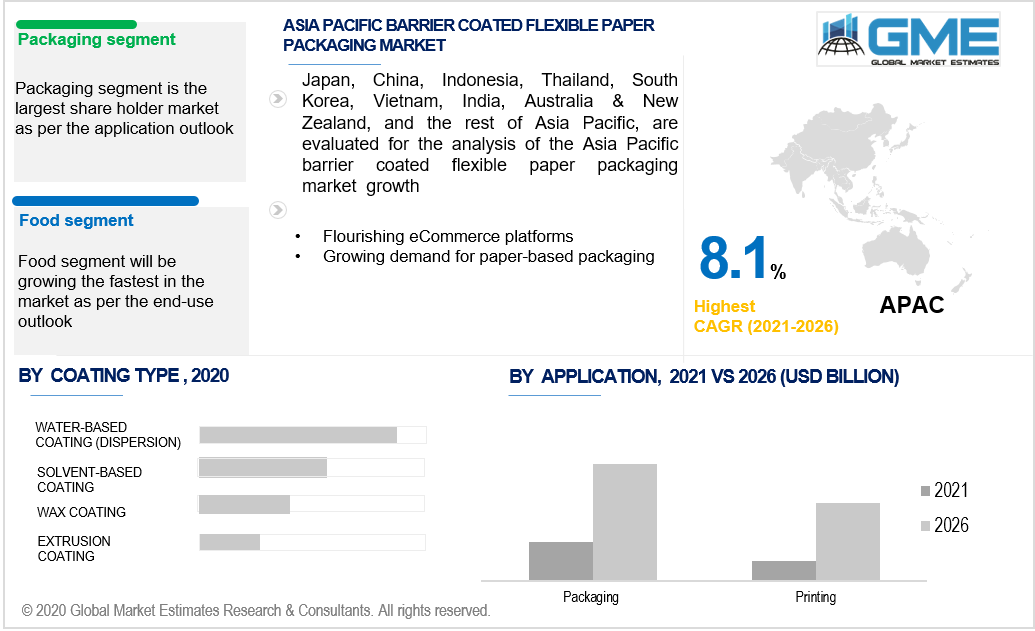

Based on the type of coating, the market is categorized as, water-based coating (dispersion), solvent-based coating, wax coating, and extrusion coating. The water-based coating (dispersion) segment is presumed to predominate. This segment is expected to acquire substantial traction due to its exceptional strength barrier coating and great moisture resistance properties. Water-based coatings are widely utilized in specialty and consumer goods industries as coatings on paper. Such coatings are more resistant to high temperatures and have improved gas and moisture characteristics. Water-based coatings are reasonably inexpensive and widely accessible. Furthermore, water-based coatings are biodegradable, lessening the consequence of ecological degradation. All these aspects are recognized by package producers and customers, resulting in increased manufacturing and demand for water-based coated paper packaging solutions.

Depending on the application the market is being categorized as packaging and printing. The packaging segment is further classified as cups & lids, trays, boxes, bags & pouches, labels, blisters, wraps, and tapes. Packaging is likely to lead in this market. The packaging application strives to require multifunctional and flexible barrier coatings for the paper that will assist the product, retailer, and customer. This is driving demand for more functional and proactive barrier coated flexible paper packaging, such as antimicrobial goods and ecologically friendly coatings which could be used for different forms of packaging for food, beverages, cosmetics, and drugs. Likewise, in numerous packaging applications where sustainability is a problem or lower weight substitutes are needed, flexible barrier coated paper is displacing treated wood and plastics. These are biodegradable, lightweight, and can survive extreme weather without reducing the strength required for operations. Barrier coated flexible paper packaging solutions are often used to package and transport a variety of industrial and non-industrial items. This packaging is being used as an efficient marketing strategy by players in the eCommerce and logistics markets. This packaging is in high demand in this industry because of its outstanding resistance to spoilage, deformation, and wear-and-tear. All these drivers are responsible for this segment’s supremacy.

Depending on the end use the market is being categorized as food, beverages, cosmetics, pharmaceuticals, building & construction, electrical & electronics, and others. The food segment includes bakery, confectionery, snacks, dairy, spices, and sauces. While others segment includes publications, automotive, and many more. The food segment is presumed to dominate in this market because food items, notably, require insulation, and lower-cost and more sustainable alternatives which are also being investigated to substitute non-sustainable products now in usage. An emerging field of application is responsive barrier coated flexible paper packaging solutions, which are meant to respond to stimulus in the food products or the atmosphere to provide real-time hygiene and protection surveillance. These coatings can modify their physical and chemical characteristics in accordance with an environmental stimulus such as pH, temperature, lighting, and bioactivity, hence minimizing wastage. Antimicrobial packaging is another new ‘smart' coating technology field of intrigue and it is fast progressing with the use of nanotechnology and organic antimicrobial agents. Thus, it is introduced by numerous market players which are leading to segment supremacy at the global level.

The facade systems market by region can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Europe is presumed to be the global market leader. The European barrier packaging industry is presumed to contribute for a significant portion. This may be due to rising consumer demand for products with a longer shelf life, the existence of key market players throughout the area, technical breakthroughs in food packaging, and prompt adoption of novel packaging technologies by numerous industry participants and consumers. Due to the rising percentage of health-conscious individuals and people's active lifestyles Asia Pacific is dominating in terms of CAGR. Moreover, expanding urban populations and stringent government rules around food packing and the plastic ban is expected to propel this APAC market even more.

The dominant players of the market are Nippon Paper Industries, BASF, Solenis, Ahlstrom Munksjo OYJ, Mitsubishi Paper Mill, Westrock Company, Billerudkorsnas AB, International Paper Company, Graphic Packaging International, DOW Chemical, Upm-Kymmene OYJ, Sappi Ltd, Stora Enso OYJ, Mondi Plc, Gascogne Group, Metpro Group, PG Paper Company Ltd, Feldmuehle, Nordic Paper, and other companies.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Coating Types

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Barrier Coated Flexible Paper Packaging Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Coating Type Overview

2.1.3 Application Overview

2.1.4 End Use Overview

2.1.5 Regional Overview

Chapter 3 Global Barrier Coated Flexible Paper Packaging Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rapidly Expanding Potential of Food & Beverages Industry

3.3.1.2 Increasing Inclination toward Paper-based Packaging Solutions

3.3.2 Industry Challenges

3.3.2.1 Availability of Alternative Packaging Solutions

3.4 Prospective Growth Scenario

3.4.1 Coating Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Barrier Coated Flexible Paper Packaging Market, By Coating Type

4.1 Coating Type Outlook

4.2 Water-Based Coating (Dispersion)

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Solvent-Based Coating

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Wax Coating

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Extrusion Coating

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Barrier Coated Flexible Paper Packaging Market, By Application

5.1 Application Outlook

5.2 Packaging

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.2 Cups & Lids

5.2.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.3 Trays

5.2.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.4 Boxes

5.2.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.5 Bags & Pouches

5.2.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.6 Labels

5.2.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.7 Blisters

5.2.7.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.8 Wraps

5.2.8.1 Market Size, By Region, 2016-2026 (USD Million)

5.2.9 Tapes

5.2.9.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Printing

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Barrier Coated Flexible Paper Packaging Market, By End Use

6.1 End Use Outlook

6.2 Food

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.2 Bakery

6.2.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.3 Confectionery

6.2.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.4 Snack

6.2.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.5 Dairy

6.2.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.6 Spices

6.2.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.7 Sauces

6.2.7.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Beverages

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Cosmetics

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Building & Construction

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Pharmaceuticals

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.7 Electrical & Electronics

6.7.1 Market Size, By Region, 2016-2026 (USD Million)

6.8 Others

6.8.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Barrier Coated Flexible Paper Packaging Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Coating Type, 2016-2026 (USD Million)

7.2.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.4 Market Size, By End Use, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.5.3 Market Size, By End Use, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.6.3 Market Size, By End Use, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Coating Type, 2016-2026 (USD Million)

7.3.3 Market Size, By End Use, 2016-2026 (USD Million)

7.3.4 Market Size, By End Use, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.5.3 Market Size, By End Use, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.6.3 Market Size, By End Use, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End Use, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.8.3 Market Size, By End Use, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.9.3 Market Size, By End Use, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.10.3 Market Size, By End Use, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Coating Type, 2016-2026 (USD Million)

7.4.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.4 Market Size, By End Use, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.5.3 Market Size, By End Use, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.6.3 Market Size, By End Use, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End Use, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.4.8.2 Market size, By Application, 2016-2026 (USD Million)

7.4.8.3 Market Size, By End Use, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.9.3 Market Size, By End Use, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Coating Type, 2016-2026 (USD Million)

7.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.4 Market Size, By End Use, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.5.3 Market Size, By End Use, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.6.3 Market Size, By End Use, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End Use, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Coating Type, 2016-2026 (USD Million)

7.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.4 Market Size, By End Use, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.5.3 Market Size, By End Use, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.6.3 Market Size, By End Use, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Coating Type, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End Use, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Huhtamaki

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Sappi Ltd.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Koehler Paper Group

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Berry Global Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Amcor Plc

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Sealed Air

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Raven Industries

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Toppan Prnting Co., Ltd., R Application

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Cosmo Films Ltd.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Dupont Teijin Films

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 MetPro Group

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Sumitomo Chemical Co. Ltd.

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Mondi Plc

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 Other Companies

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

The Global Barrier Coated Flexible Paper Packaging Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Barrier Coated Flexible Paper Packaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS