Global 5G in Manufacturing Market Size, Trends & Analysis - Forecasts to 2026 By Application (Planning and Design Systems, Predictive Maintenance, Business Process Optimization, Asset Tracking and Management, Logistics and Supply Chain Management, Real-Time Workforce Tracking and Management, Automation Control and Management, Emergency and Incident Management, and Business Communication and Field Devices), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-User ( Process Industries, Discrete Industries), By Communication Type (Fixed Wireless Access (FWA), Enhanced Mobile Broadband (eMBB), ultra-reliable low latency communications (URLLC), Massive Machine Type Communication (MMTC), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis.

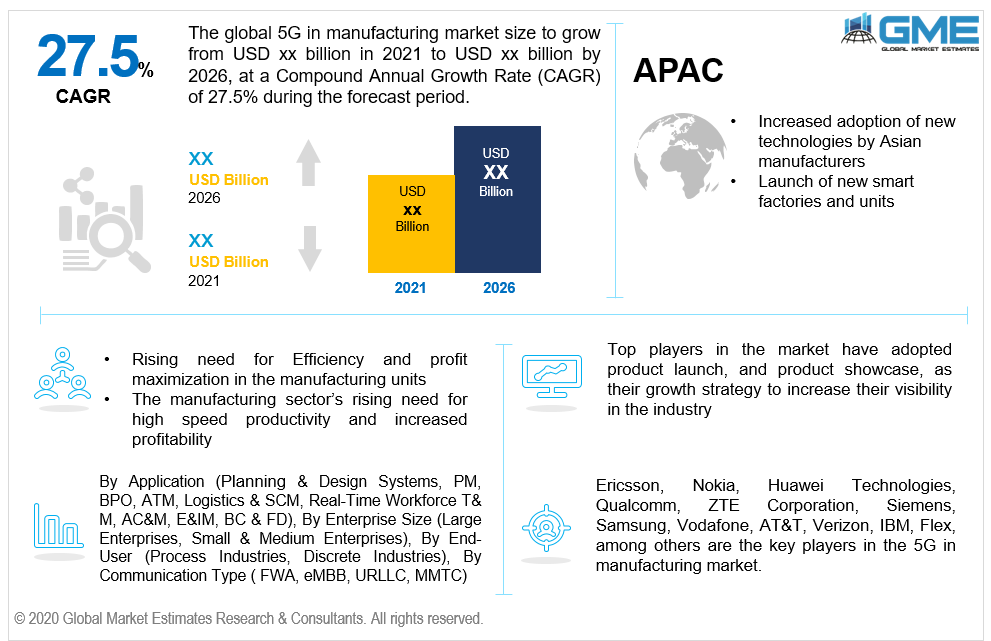

The global 5G in manufacturing market is projected to grow at a CAGR value of around 27.5% during the forecast period [2021 to 2026].

Efficiency and profit maximization in the manufacturing units has become one of the top priorities of manufacturers across the globe. 5G networks enables manufacturers and telecom carriers to develop smart factories that fully utilise technology such as automation, artificial intelligence, augmented reality for troubleshooting, and the Internet of Things (IoT). Operators can generate new revenue streams by implementing 5G network to their systems. Manufacturing, along with energy and utilities, is one of the most fast moving industries that are adopting 5G technology to adopt new revenue potentials.

The manufacturing sector’s rising need for high speed productivity and increased profitability is driving the growth of the market during the forecast period. The deployment of 5G throughout the manufacturing industry is part of the drive towards Industry 4.0.

Modern manufacturing consists of using multiple devices that interact with one another, and result in massive generation of data on a regular basis. Additional data collection can be transported and analysed faster if the unit is equipped with 5G's low latency and high bandwidth capacity. The ultra-computing capabilities provided by 5G will allow manufacturers to create robots that will help in improvising data integration and support in real-time decision making strategies.

The fourth industrial revolution is focused on digitalizing the modern manufacturing unit, increasing automation, and introducing smart gadgets to the world of manufacturing & retail. 5G enables supply chains to evolve from a series of separately controlled locations to an increasingly linked network of devices that shares knowledge in real-time. Some of the reasons driving the market's growth during the forecast period include 5G's ability to allow efficient communication amongst devices as well as unify the manufacturing process.

Even though 3G and 4G provide incremental gains in speed and bandwidth, 5G will be the first cellular, or wireless platform, to provide dependable machine-to-machine and Industrial IoT systems. 5G in industrial automation will pave the way for real-time wireless sensor networks as well as asset and position tracking. Even the most demanding applications, such as motion control and high throughput vision systems, will be able to use 5G networks to replace cable connections in the future.

During the COVID-19 pandemic, the manufacturing industry was at the tip of the 5G implementation iceberg. However, unlike other domains getting negatively affected, this sector was analyzed to not get affected but gain more traction and is estimated to have tremendous growth from 2021 to 2026. Also, companies are being forced to innovate on data at unprecedented rates in today's economic landscape. The COVID-19 pandemic has merely expedited these requirements, putting more pressure on businesses to maintain pre-pandemic customer service.

The move from 4G to 5G technologies would necessitate significant expenditure. The cost of 5G infrastructure is highly influenced by the required throughput density, the periodic interest rate, and the price of base stations. Reduced costs are critical for effective and ultra-dense small cell installations, and hence during the forecast period, the cost constraints are analyzed to be the challenge for the market to grow.

Based on application, the market is segmented into planning and design systems, predictive maintenance, business process optimization, asset tracking and management, logistics and supply chain management, real-time workforce tracking and management, automation control and management, emergency and incident management, and business communication and field devices.

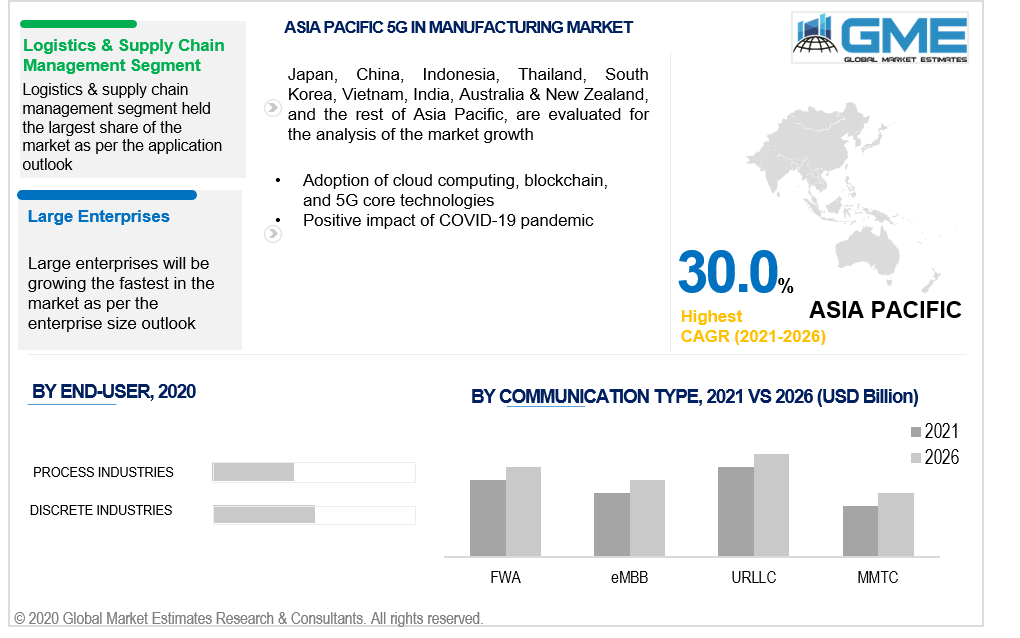

The logistics and supply chain management segment is expected to have a lion’s share in the market. The use of 5G technology in supply chain sector has offered considerable improvements in terms of automating various processes as well as improving track and trace visibility. This technology has the ability to alleviate typical logistics issues such as cargo loss or container misplacement. 5G is also very valuable for supply chains as it has low latency, and enables to acquire data as soon as a sensor detects which is then used to evaluate performance and create predictive analysis algorithms.

Based on enterprise size, the market is segmented into large enterprises and small & medium enterprises. The large enterprises segment is expected to have the lion’s share in the market during the forecast period. Cyber physical systems and IoT are projected to power Industry 4.0, which would necessitate the use of 5G networks and hence the market for large enterprises would grow rapidly.

Based on end-user, the market is segmented into process industries and discrete industries. The use of 5G technology for discrete industries is expected to have the largest share in the market during the forecast period. 5G technology offers expansion of total bandwidth, permits a large number of IoT devices to connect with one another, and assist discrete producers in increasing their manufacturing efficiency. By providing greater connectivity among IoT devices, 5G industrial IoT solutions are projected to improve the operational efficiency of the discrete manufacturing process.

Based on communication type, the market is segmented into Fixed Wireless Access (FWA), Enhanced Mobile Broadband (eMBB), ultra-reliable low latency communications (URLLC), Massive Machine Type Communication (MMTC).

The ultra-reliable low latency communications (URLLC) communication type has the lion’s share in the market during the forecast period. One of the major pillars of 5G technology is ultra-reliable low latency communications (URLLC), which delivers ultra-high network dependability of more than 99.999 percent and very low latency (of 1 millisecond) for packet transmission.

As per the geographical analysis, the 5G in manufacturing market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The US and Canada are the top contributing countries in the market of this region. These countries have established economies, which empower them to strongly invest in R&D activities.

The Asia-Pacific region is estimated to be the fastest-growing segment in the market during the forecast period. APAC is experiencing dynamic changes due to the adoption of new technologies and is predicted to be growing faster than other regions. It is a region with a diverse variety of countries undergoing digital transformation. Many countries such as Singapore, South Korea, China, Australia, and Japan are adopting technologies such as edge computing, blockchain, AI, and 5G core technologies.

Ericsson, Nokia, Huawei Technologies, Qualcomm, ZTE Corporation, Siemens, Samsung, Vodafone, AT&T, Verizon, IBM, Flex, among others are the key players in the 5G in manufacturing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 5G in Manufacturing Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Enterprise Size Overview

2.1.4 End-User Overview

2.1.5 Communication Type Overview

2.1.6 Regional Overview

Chapter 3 5G in Manufacturing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising need for high profitability and productivity in manufacturing units

3.3.2 Industry Challenges

3.3.2.1 High cost associated with the shift from 4G to 5G

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Enterprise Size Growth Scenario

3.4.4 Communication Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 5G in Manufacturing Market, By Application

4.1 Application Outlook

4.2 Planning and Design Systems

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Predictive Maintenance

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Business Process Optimization

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Asset Tracking and Management

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Logistics and Supply Chain Management

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Real-Time Workforce Tracking and Management

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Automation Control and Management

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Emergency and Incident Management, and Business Communication

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

4.10 Field Devices

4.10.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 5G in Manufacturing Market, By Enterprise Size

5.1 Enterprise Size Outlook

5.2 Large Enterprises

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Small & Medium Enterprises

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 5G in Manufacturing Market, By End-User

6.1 Process Industries

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Discrete Industries

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 5G in Manufacturing Market, By Communication Type

7.1 Fixed Wireless Access (FWA)

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Enhanced Mobile Broadband (eMBB)

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Ultra-reliable low latency communications (URLLC)

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Massive Machine Type Communication (MMTC)

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 5G in Manufacturing Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.5 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

Market Size, By Communication Type, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.5 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.5 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.5 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.5 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Communication Type, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Communication Type , 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Bentley Systems

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 TCS

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Cosmo Consult

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Enka Systems

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Software One

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 L&T

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Virtual Building Studio

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Invonto

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Oracle

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 SAP

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Autodesk

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Cognizant

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 VisiLean

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Cisco

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 Accenture

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

9.17 AG Technologies

9.17.1 Company Overview

9.17.2 Financial Analysis

9.17.3 Strategic Positioning

9.17.4 Info Graphic Analysis

9.18 ADOBE SYSTEMS

9.18.1 Company Overview

9.18.2 Financial Analysis

9.18.3 Strategic Positioning

9.18.4 Info Graphic Analysis

9.19 Autodesk Inc.

9.19.1 Company Overview

9.19.2 Financial Analysis

9.19.3 Strategic Positioning

9.19.4 Info Graphic Analysis

9.20 DELL EMC

9.20.1 Company Overview

9.20.2 Financial Analysis

9.20.3 Strategic Positioning

9.20.4 Info Graphic Analysis

9.21 IBM

9.21.1 Company Overview

9.21.2 Financial Analysis

9.21.3 Strategic Positioning

9.21.4 Info Graphic Analysis

9.22 GOOGLE

9.22.1 Company Overview

9.22.2 Financial Analysis

9.22.3 Strategic Positioning

9.22.4 Info Graphic Analysis

9.23 MARLABS

9.23.1 Company Overview

9.23.2 Financial Analysis

9.23.3 Strategic Positioning

9.23.4 Info Graphic Analysis

9.24 EQUINIX

9.24.1 Company Overview

9.24.2 Financial Analysis

9.24.3 Strategic Positioning

9.24.4 Info Graphic Analysis

9.25 Other Companies

9.25.1 Company Overview

9.25.2 Financial Analysis

9.25.3 Strategic Positioning

9.25.4 Info Graphic Analysis

The Global 5G in Manufacturing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the 5G in Manufacturing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS