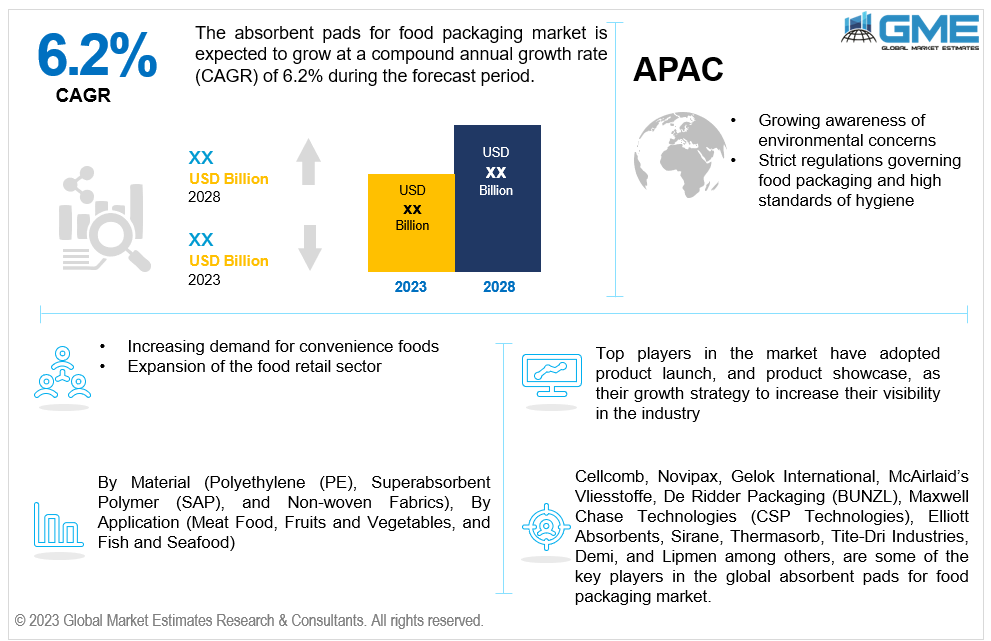

Global Absorbent Pads for Food Packaging Market Size, Trends & Analysis - Forecasts to 2028 By Material (Polyethylene (PE), Superabsorbent Polymer (SAP), and Non-woven Fabrics), By Application (Meat Food, Fruits and Vegetables, and Fish and Seafood), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global absorbent pads for food packaging market is estimated to exhibit a CAGR of 6.2% from 2023 to 2028.

Growing awareness of environmental concerns, stringent regulations governing food packaging, and high standards of hygiene are the main drivers of market growth. The need for efficient food packaging solutions that preserve food safety and are environmentally friendly is rising as customers become more aware of environmental concerns. This need is met by absorbent pads made of environmentally friendly materials, which balance maintaining food quality and lessening the environmental impact. Moreover, the regulatory environment is placing more and more emphasis on ecologically friendly and sustainable food packaging practices, particularly those pertaining to food safety packaging. In response to these laws, producers of absorbent pads are tackling environmental issues and maintaining food safety standards by integrating sustainable materials and production methods. For instance, according to a 2020 Capgemini survey on sustainability and changing consumer behavior, 79% of customers are changing their shopping patterns, primarily because of concerns about social responsibility, inclusion, and the environment. Additionally, 53% of consumers and 57% between 18 and 24 have shifted to less well-known brands since they are more environmentally friendly.

Increasing demand for convenience foods and the expanding food retail sector is expected to support the market growth throughout the forecast period. Packed with fresh ingredients, ready-to-eat meals, and other convenience foods are in high demand. Absorbent pads for fresh food are essential for maintaining the quality and freshness of ingredients as they control moisture levels and stop texture and flavor deterioration during storage and transit. Moreover, when fresh and visually appealing, convenience foods typically have a longer shelf life. Absorbent pads, especially those designed for fresh produce packaging, contribute to extending the shelf life of ready-to-eat meals by controlling excess moisture, which can otherwise lead to spoilage. For instance, in 2020–21, India exported final food products, including Ready to Eat (RTE), Ready to Cook (RTC), and Ready to Serve (RTS), valued at around USD 2.14 billion.

Advancements in active packaging technologies and growing awareness of food waste reduction propel market growth. Advances in active packaging technologies involve developing innovative food packaging absorbent materials beyond traditional solutions. With better moisture management, odor control, and food quality preservation, these absorbent packaging materials are intended to improve absorbent pad performance. Additionally, advancements in active packaging include integrating antimicrobial packaging solutions materials. This is especially relevant for absorbent tray liners, as they inhibit the growth of bacteria and pathogens, enhance the safety of packaged foods, and meet stringent food safety packaging standards.

There is an opportunity in the food industry for modified atmosphere packaging (MAP), which involves altering the composition of gases within a package for food shelf life extension. In MAP systems, absorbent pads can be beneficial in controlling excess moisture and promoting the best possible gas exchange. Moreover, manufacturers of absorbent pads have an opportunity to inform the food sector about the advantages of eco-friendly food packaging. This entails promoting and adopting eco-friendly practices across the supply chain and highlighting the benefits of utilizing absorbent pads made of sustainable materials for the environment. However, the high cost of raw materials and stringent regulations and standards may hinder market growth.

The polyethylene (PE) segment is expected to hold the largest share of the market. Polyethylene (PE) is a versatile material for various food packaging innovations. Due to its versatility, it can be used in absorbent pads that are made to fit changing food packaging industry trends. Using PE, manufacturers can produce novel absorbent materials with improved moisture management and compatibility with cutting-edge food packaging technology. Additionally, PE-based absorbent pads are ideal for assuring the safety and cleanliness of packaged food items since they can be tailored to fulfill stringent hygiene requirements. Manufacturers can innovate within this segment to enhance absorbent pad designs that prioritize food packaging hygiene, addressing consumer concerns and industry regulations.

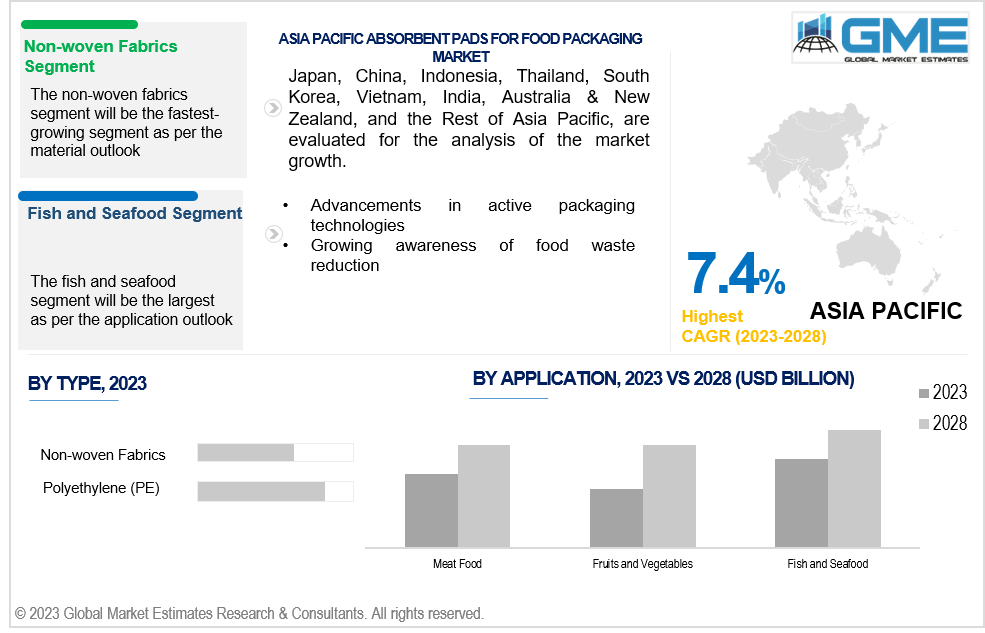

The non-woven fabrics segment is expected to be the fastest-growing segment in the market from 2023-2028. It is feasible to develop non-woven fabrics with improved absorption capabilities, making them very useful for controlling the moisture content of packaged foods. The food packaging industry's adoption of non-woven textiles is mainly driven by the ability to build absorbent pads with greater absorption capacities, particularly for products with changing moisture content. Additionally, non-woven textiles are less expensive and lighter than typical woven materials. Non-woven absorbent pads' low weight can help save expenses associated with packing and shipping.

The fish and seafood segment is expected to hold the largest share of the market over the forecast period. Fish and seafood are sensitive to changes in texture and appearance. Absorbent pads regulate moisture levels to assist in avoiding texture loss caused by excess moisture. Maintaining the texture and look of fish and seafood items is essential for customer satisfaction and general marketability. Moreover, by preventing the growth of germs and pathogens, absorbent pads, especially those with antimicrobial qualities, can help ensure food safety. This is essential for ensuring that seafood and fish products adhere to strict food safety regulations.

The meat food segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Meat is highly perishable and prone to spoilage due to microbial growth, oxidation, and excess moisture. Absorbent pads are essential when it comes to controlling moisture levels, avoiding microbiological contamination, and maintaining the freshness of meat products throughout storage and transit. Moreover, the meat industry offers various cuts and varieties, each with different moisture content needs and packaging specifications. As absorbent pads can be tailored to meet the unique requirements of various meat cuts, they can fit the meat market's diversity and aid in the segment's growth.

North America is expected to be the largest region in the global market due to the rising meat consumption and stringent food safety and hygiene regulations. Meat products are subject to stringent food safety and hygiene regulations. As they stop germs and viruses from growing, absorbent pads, especially those with antimicrobial qualities, help keep packed meat hygienic. This is essential to ensuring that meat products are safe to eat and satisfy North American regulatory standards. For instance, according to the United States Department of Agriculture, the U.S. reached 264 pounds of meat consumption per person in 2020.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific’s growing reliance on online grocery shopping and e-commerce platforms propels demand for dependable and effective food packaging solutions. During transportation and delivery, absorbent pads are crucial for maintaining the freshness of perishable goods, especially meat and seafood. For instance, Digital Commerce 360 reports that Asian consumers spent a staggering USD 2.525 trillion on retail websites and multi-merchant marketplaces in 2020, a 19.2% rise from USD 2.118 trillion in 2019.

Cellcomb, Novipax, Gelok International, McAirlaid’s Vliesstoffe, De Ridder Packaging (BUNZL), Maxwell Chase Technologies (CSP Technologies), Elliott Absorbents, Sirane, Thermasorb, Tite-Dri Industries, Demi, and Lipmen among others, are some of the key players in the global absorbent pads for food packaging market.

Please note: This is not an exhaustive list of companies profiled in the report.

Sirane stated in 2021 that On Pack Recycling Label Limited (OPRL) approved its paper-recyclable absorbent pad for fruit packaging for recycling, making it the first biodegradable absorbent pad in the world.

In 2022, Cellcomb launched a new cellulose-based absorbent pad, Cellsorb Circular, for fresh food packaging such as meat, fish, and poultry. The cellulose-based pad contributes to reduced food waste as well as climate-smart and safe food packaging.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ABSORBENT PADS FOR FOOD PACKAGING MARKET, BY MATERIAL

4.1 Introduction

4.2 Absorbent Pads for Food Packaging Market: Material Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Polyethylene (PE)

4.4.1 Polyethylene (PE) Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Superabsorbent Polymer (SAP)

4.5.1 Superabsorbent Polymer (SAP) Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Non-woven Fabrics

4.6.1 Non-woven Fabrics Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL ABSORBENT PADS FOR FOOD PACKAGING MARKET, BY APPLICATION

5.1 Introduction

5.2 Absorbent Pads for Food Packaging Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Meat Food

5.4.1 Meat Food Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Fruits and Vegetables

5.5.1 Fruits and Vegetables Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Fish and Seafood

5.6.1 Fish and Seafood Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL ABSORBENT PADS FOR FOOD PACKAGING MARKET, BY REGION

6.1 Introduction

6.2 North America Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.1 By Material

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1.1 By Material

6.2.3.1.2 By Application

6.2.3.2 Canada Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2.1 By Material

6.2.3.2.2 By Application

6.2.3.3 Mexico Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3.1 By Material

6.2.3.3.2 By Application

6.3 Europe Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.1 By Material

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1.1 By Material

6.3.3.1.2 By Application

6.3.3.2 U.K. Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2.1 By Material

6.3.3.2.2 By Application

6.3.3.3 France Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3.1 By Material

6.3.3.3.2 By Application

6.3.3.4 Italy Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4.1 By Material

6.3.3.4.2 By Application

6.3.3.5 Spain Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5.1 By Material

6.3.3.5.2 By Application

6.3.3.6 Netherlands Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Material

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Material

6.3.3.6.2 By Application

6.4 Asia Pacific Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.1 By Material

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1.1 By Material

6.4.3.1.2 By Application

6.4.3.2 Japan Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2.1 By Material

6.4.3.2.2 By Application

6.4.3.3 India Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3.1 By Material

6.4.3.3.2 By Application

6.4.3.4 South Korea Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4.1 By Material

6.4.3.4.2 By Application

6.4.3.5 Singapore Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5.1 By Material

6.4.3.5.2 By Application

6.4.3.6 Malaysia Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Material

6.4.3.6.2 By Application

6.4.3.7 Thailand Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Material

6.4.3.6.2 By Application

6.4.3.8 Indonesia Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7.1 By Material

6.4.3.7.2 By Application

6.4.3.9 Vietnam Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8.1 By Material

6.4.3.8.2 By Application

6.4.3.10 Taiwan Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10.1 By Material

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11.1 By Material

6.4.3.11.2 By Application

6.5 Middle East and Africa Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 By Material

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1.1 By Material

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2.1 By Material

6.5.3.2.2 By Application

6.5.3.3 Israel Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3.1 By Material

6.5.3.3.2 By Application

6.5.3.4 South Africa Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4.1 By Material

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.5.1 By Material

6.5.3.5.2 By Application

6.6 Central and South America Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 By Material

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1.1 By Material

6.6.3.1.2 By Application

6.6.3.2 Argentina Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2.1 By Material

6.6.3.2.2 By Application

6.6.3.3 Chile Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Material

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Absorbent Pads for Food Packaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Material

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Cellcomb

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Novipax

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Gelok International

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 McAirlaid’s Vliesstoffe

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 De Ridder Packaging (BUNZL)

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 MAXWELL CHASE TECHNOLOGIES (CSP TECHNOLOGIES)

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Elliott Absorbents

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Sirane

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Thermasorb

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Tite-Dri Industries

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

2 Polyethylene (PE) Market, By Region, 2020-2028 (USD Mllion)

3 Superabsorbent Polymer (SAP) Market, By Region, 2020-2028 (USD Mllion)

4 Non-woven Fabrics Market, By Region, 2020-2028 (USD Mllion)

5 Global Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

6 Meat Food Market, By Region, 2020-2028 (USD Mllion)

7 Fruits and Vegetables Market, By Region, 2020-2028 (USD Mllion)

8 Fish and Seafood Market, By Region, 2020-2028 (USD Mllion)

9 Regional Analysis, 2020-2028 (USD Mllion)

10 North America Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

11 North America Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

12 North America Absorbent Pads for Food Packaging Market, By COUNTRY, 2020-2028 (USD Mllion)

13 U.S. Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

14 U.S. Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

15 Canada Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

16 Canada Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

17 Mexico Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

18 Mexico Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

19 Europe Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

20 Europe Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

21 EUROPE Absorbent Pads for Food Packaging Market, By COUNTRY, 2020-2028 (USD Mllion)

22 Germany Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

23 Germany Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

24 U.K. Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

25 U.K. Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

26 France Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

27 France Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

28 Italy Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

29 Italy Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

30 Spain Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

31 Spain Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

32 Netherlands Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

33 Netherlands Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

34 Rest Of Europe Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

35 Rest Of Europe Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

36 Asia Pacific Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

37 Asia Pacific Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

38 ASIA PACIFIC Absorbent Pads for Food Packaging Market, By COUNTRY, 2020-2028 (USD Mllion)

39 China Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

40 China Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

41 Japan Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

42 Japan Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

43 India Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

44 India Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

45 South Korea Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

46 South Korea Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

47 Singapore Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

48 Singapore Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

49 Thailand Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

50 Thailand Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

51 Malaysia Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

52 Malaysia Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

53 Indonesia Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

54 Indonesia Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

55 Vietnam Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

56 Vietnam Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

57 Taiwan Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

58 Taiwan Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

59 Rest of APAC Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

60 Rest of APAC Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

61 Middle East and Africa Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

62 Middle East and Africa Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

63 MIDDLE EAST & ADRICA Absorbent Pads for Food Packaging Market, By COUNTRY, 2020-2028 (USD Mllion)

64 Saudi Arabia Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

65 Saudi Arabia Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

66 UAE Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

67 UAE Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

68 Israel Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

69 Israel Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

70 South Africa Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

71 South Africa Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

72 Rest Of Middle East and Africa Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

73 Rest Of Middle East and Africa Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

74 Central and South America Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

75 Central and South America Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

76 CENTRAL AND SOUTH AMERICA Absorbent Pads for Food Packaging Market, By COUNTRY, 2020-2028 (USD Mllion)

77 Brazil Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

78 Brazil Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

79 Chile Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

80 Chile Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

81 Argentina Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

82 Argentina Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

83 Rest Of Central and South America Absorbent Pads for Food Packaging Market, By Material, 2020-2028 (USD Mllion)

84 Rest Of Central and South America Absorbent Pads for Food Packaging Market, By Application, 2020-2028 (USD Mllion)

85 Cellcomb: Products & Services Offering

86 Novipax: Products & Services Offering

87 Gelok International: Products & Services Offering

88 McAirlaid’s Vliesstoffe: Products & Services Offering

89 De Ridder Packaging (BUNZL): Products & Services Offering

90 MAXWELL CHASE TECHNOLOGIES (CSP TECHNOLOGIES): Products & Services Offering

91 Elliott Absorbents : Products & Services Offering

92 Sirane: Products & Services Offering

93 Thermasorb, Inc: Products & Services Offering

94 Tite-Dri Industries: Products & Services Offering

95 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Absorbent Pads for Food Packaging Market Overview

2 Global Absorbent Pads for Food Packaging Market Value From 2020-2028 (USD Mllion)

3 Global Absorbent Pads for Food Packaging Market Share, By Material (2022)

4 Global Absorbent Pads for Food Packaging Market Share, By Application (2022)

5 Global Absorbent Pads for Food Packaging Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Absorbent Pads for Food Packaging Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Absorbent Pads for Food Packaging Market

10 Impact Of Challenges On The Global Absorbent Pads for Food Packaging Market

11 Porter’s Five Forces Analysis

12 Global Absorbent Pads for Food Packaging Market: By Material Scope Key Takeaways

13 Global Absorbent Pads for Food Packaging Market, By Material Segment: Revenue Growth Analysis

14 Polyethylene (PE) Market, By Region, 2020-2028 (USD Mllion)

15 Superabsorbent Polymer (SAP) Market, By Region, 2020-2028 (USD Mllion)

16 Non-woven Fabrics Market, By Region, 2020-2028 (USD Mllion)

17 Global Absorbent Pads for Food Packaging Market: By Application Scope Key Takeaways

18 Global Absorbent Pads for Food Packaging Market, By Application Segment: Revenue Growth Analysis

19 Meat Food Market, By Region, 2020-2028 (USD Mllion)

20 Fruits and Vegetables Market, By Region, 2020-2028 (USD Mllion)

21 Fish and Seafood Market, By Region, 2020-2028 (USD Mllion)

22 Regional Segment: Revenue Growth Analysis

23 Global Absorbent Pads for Food Packaging Market: Regional Analysis

24 North America Absorbent Pads for Food Packaging Market Overview

25 North America Absorbent Pads for Food Packaging Market, By Material

26 North America Absorbent Pads for Food Packaging Market, By Application

27 North America Absorbent Pads for Food Packaging Market, By Country

28 U.S. Absorbent Pads for Food Packaging Market, By Material

29 U.S. Absorbent Pads for Food Packaging Market, By Application

30 Canada Absorbent Pads for Food Packaging Market, By Material

31 Canada Absorbent Pads for Food Packaging Market, By Application

32 Mexico Absorbent Pads for Food Packaging Market, By Material

33 Mexico Absorbent Pads for Food Packaging Market, By Application

34 Four Quadrant Positioning Matrix

35 Company Market Share Analysis

36 Cellcomb: Company Snapshot

37 Cellcomb: SWOT Analysis

38 Cellcomb: Geographic Presence

39 Novipax: Company Snapshot

40 Novipax: SWOT Analysis

41 Novipax: Geographic Presence

42 Gelok International: Company Snapshot

43 Gelok International: SWOT Analysis

44 Gelok International: Geographic Presence

45 McAirlaid’s Vliesstoffe: Company Snapshot

46 McAirlaid’s Vliesstoffe: Swot Analysis

47 McAirlaid’s Vliesstoffe: Geographic Presence

48 De Ridder Packaging (BUNZL): Company Snapshot

49 De Ridder Packaging (BUNZL): SWOT Analysis

50 De Ridder Packaging (BUNZL): Geographic Presence

51 MAXWELL CHASE TECHNOLOGIES (CSP TECHNOLOGIES): Company Snapshot

52 MAXWELL CHASE TECHNOLOGIES (CSP TECHNOLOGIES): SWOT Analysis

53 MAXWELL CHASE TECHNOLOGIES (CSP TECHNOLOGIES): Geographic Presence

54 Elliott Absorbents : Company Snapshot

55 Elliott Absorbents : SWOT Analysis

56 Elliott Absorbents : Geographic Presence

57 Sirane: Company Snapshot

58 Sirane: SWOT Analysis

59 Sirane: Geographic Presence

60 Thermasorb, Inc.: Company Snapshot

61 Thermasorb, Inc.: SWOT Analysis

62 Thermasorb, Inc.: Geographic Presence

63 Tite-Dri Industries: Company Snapshot

64 Tite-Dri Industries: SWOT Analysis

65 Tite-Dri Industries: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

68 Other Companies: Geographic Presence

The Global Absorbent Pads for Food Packaging Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Absorbent Pads for Food Packaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS