Global Access Control Market Size, Trends & Analysis - Forecasts to 2026 By Type (Mandatory Access Control (MAC), Discretionary Access Control (DAC), Role-based Access Control (RBAC), Touchless Access Control [Smartphone-Based Access Control, Touchless Switches, Facial Recognition Devices, and Bluetooth Access Control]), By Offering (Hardware [Card-based Readers, Biometric Readers, Multi-technology Readers, Electronic Locks, Controllers, Others], Software [Visitor Management System, Database and software Tools], Services [Installation & Integration Services, Support & Maintenance Services]), By Vertical (Commercial [Enterprises & Data Centers, BFSI, Hotels, Stadiums, & Amusement Parks, Retail Stores and Malls], Military & Defense, Government, Residential, Education, Healthcare, Manufacturing & Industrial, Transportation), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

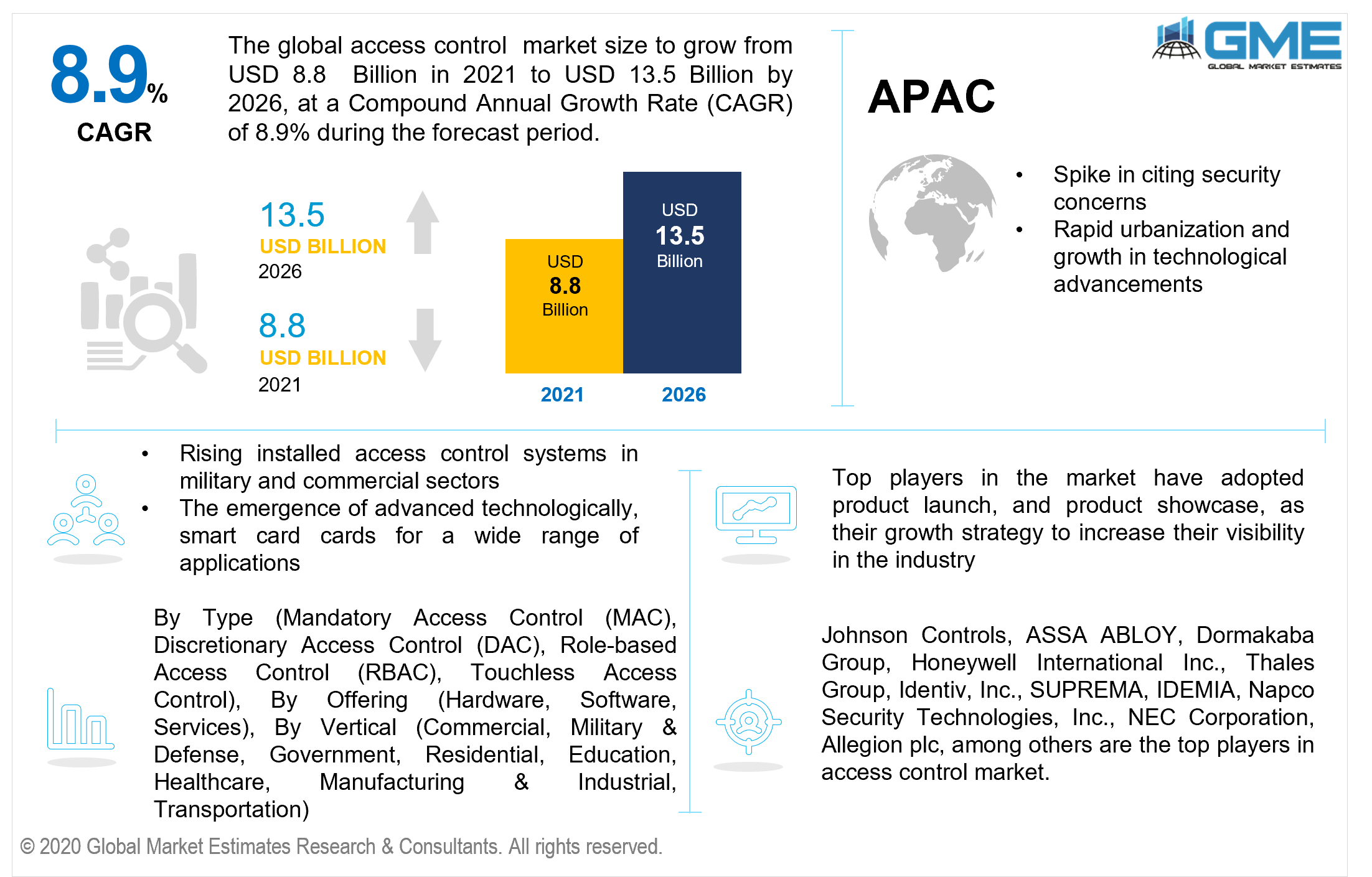

The global access control market is projected to grow from USD 8.8 billion in 2021 and is expected to reach USD 13.5 billion by 2026 at a CAGR of 8.9% from 2021 to 2026.

The access control system recognizes, validates, and approves an eligible person's admission and leave from the premises, assuring total security. Biometric or proximity/smart cards can be used in access control systems. It protects sensitive data from being compromised and helps in preventing unauthorized viruses and hackers from misusing such sensitive data crucial to the business. Rising consumer awareness of surveillance cameras and increased penetration of wireless security systems are driving the access control market forward.

During the forecast period, factors such as rapidly installed access control systems in military and commercial sectors are currently boosting market growth, and the emergence of advanced smart cards for a wide range of applications is further catalyzing product demand, due to their user-friendly and seamless experience. Aside from that, as a result of the rising crime rates in the world, various commercial establishments, such as IT businesses, corporations, data centers, and so on, are building access control systems to safeguard employees and information breaches, as well as to track personnel entry and exit times propelling the market growth.

The access control market is being driven by significant innovations in cloud services and identity management, as well as the rising penetration of smart home solutions, which is raising the demand for interconnected access control systems for residences that can be remotely activated. The surge in popularity of access control systems, which provide features such as data-keeping, transparency, and the security and safety of office environments, as well as consumers' preference for solutions that provide accessibility of access control, as well as high adoption of IoT, are all variables that impact the access control market.

The COVID-19 pandemic has increased the focus on touchless access control, especially in healthcare facilities to prevent the spread of Hospital Acquired Infections (HAIs). Technological advancements such as facial recognition, Bluetooth access control, and other technologies are expected to drive the market during the forecast period.

Due to growing market competition, the access control market has seen extraordinary growth over the last decade. As a result, demand for contactless biometrics and smart card solutions for environmental security has skyrocketed. The outbreak, on the other hand, has slowed the market's expansion. Once end-user industries recover from the effects of the pandemic, the market is likely to regain its development momentum.

On the contrary, high expenses involved with access control system implementation, upkeep, and ownership, as well as an increase in security and privacy issues connected to illegal access and data breach in the access control environment, are projected to stymie the market expansion. In the forecast period, the access control market is expected to face challenges due to a lack of user awareness about the availability and benefits of modern security solutions.

Based on type, the market is segmented into mandatory access control (MAC), discretionary access control (DAC), role-based access control (RBAC), and touchless access control.

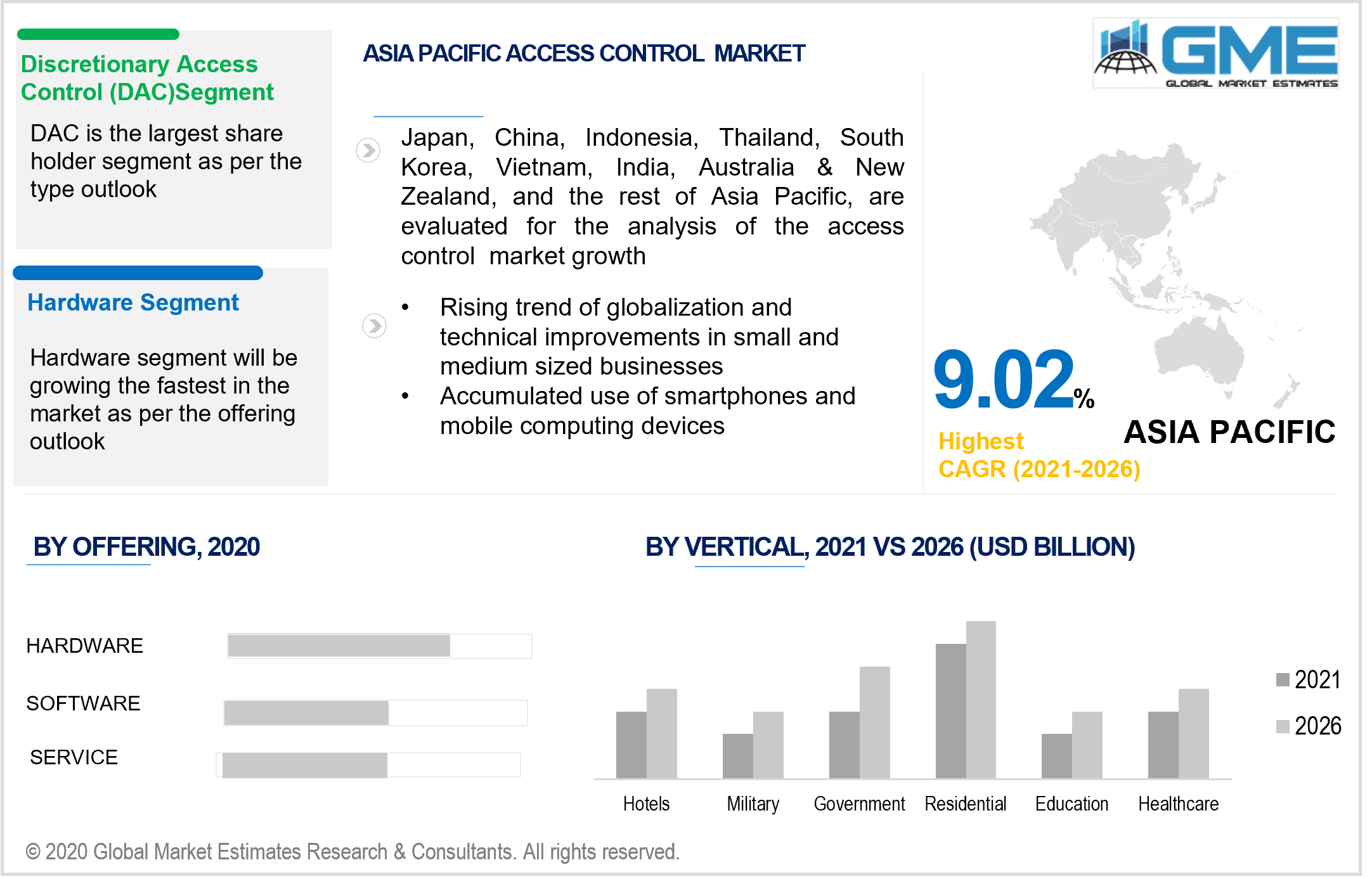

The market for discretionary access control (DAC) segment is expected to have the largest share during the forecast period. The growth might be attributed to the fact that DAC makes it easier to manage data and rights. Since the user experience is so simple to use, there is no need to plan everything out all at once.

Based on offering, the market is segmented into hardware, software, and services. The hardware market is further sub-divided into card-based readers, biometric readers, multi-technology readers, electronic locks, controllers, others, out of which the biometric reader segment is estimated to have the largest share in the market as biometric techniques can improve various physiological indicators for identification and verification purposes.

Biometric technology is among the most rapidly evolving perimeter encryption technology. This system allows for the identification of a person's physical features to provide facilities with controlled access.

Based on the vertical, the market is segmented into commercial, military & defense, government, residential, education, healthcare, manufacturing & industrial, and transportation. The residential segment is expected to have a lion’s share in the market during the forecast period.

As per the geographical analysis, the market can be classified into North America, Europe, Central, and South America, the Middle East and Africa, and the Asia Pacific regions.

The North American region is expected to hold the lion’s share of the global revenue generated in the market. The rising number of cybercrime and malware assaults in the region has prompted various authorities and intelligence communities to improve security features in their transactions by deploying RFID and biometric technologies, which is fuelling the access control market's overall expansion.

Due to the growing demand for software solutions, Asia Pacific is expected to see significant market expansion during the forecast period.

Johnson Controls, ASSA ABLOY, Dormakaba Group, Honeywell International Inc., Thales Group, Identiv Inc., SUPREMA, IDEMIA, Napco Security Technologies, Inc., NEC Corporation, Allegion plc, among others are the top players in the access control market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Access Control Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Offering Overview

2.1.4 Vertical Overview

2.1.6 Regional Overview

Chapter 3 Access Control Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rapidly installed access control systems in military and commercial sectors

3.3.2 End-User Challenges

3.3.2.1 High cost associated with access control system implementation

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Offering Growth Scenario

3.4.3 Vertical Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Access Control Market, By Type

4.1 Type Outlook

4.2 Mandatory Access Control (MAC)

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Discretionary Access Control (DAC)

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Role-based Access Control (RBAC)

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Touchless Access Control

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Access Control Market, By Offering

5.1 Offering Outlook

5.2 Hardware

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Software

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Services

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Access Control Market, By Vertical

6.1 Commercial

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Military & Defense

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Government

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Residential

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Education

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Healthcare

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Manufacturing & Industrial

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Transportation

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Access Control Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Offering, 2020-2026 (USD Billion)

7.2.4 Market Size, By Vertical, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.4 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.4 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Offering, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.4 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.4 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Vertical, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Johnson Controls

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 InfoGraphic Analysis

8.3 ASSA ABLOY

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 InfoGraphic Analysis

8.4 Dormakaba Group

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 InfoGraphic Analysis

8.5 Honeywell International Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 InfoGraphic Analysis

8.6 Thales Group

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 InfoGraphic Analysis

8.7 Identiv Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 InfoGraphic Analysis

8.8 SUPREMA

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 InfoGraphic Analysis

8.9 IDEMIA

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 InfoGraphic Analysis

8.10 Napco Security Technologies, Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 InfoGraphic Analysis

8.11 NEC Corporation

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 InfoGraphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 InfoGraphic Analysis

The Global Access Control Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Access Control Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS