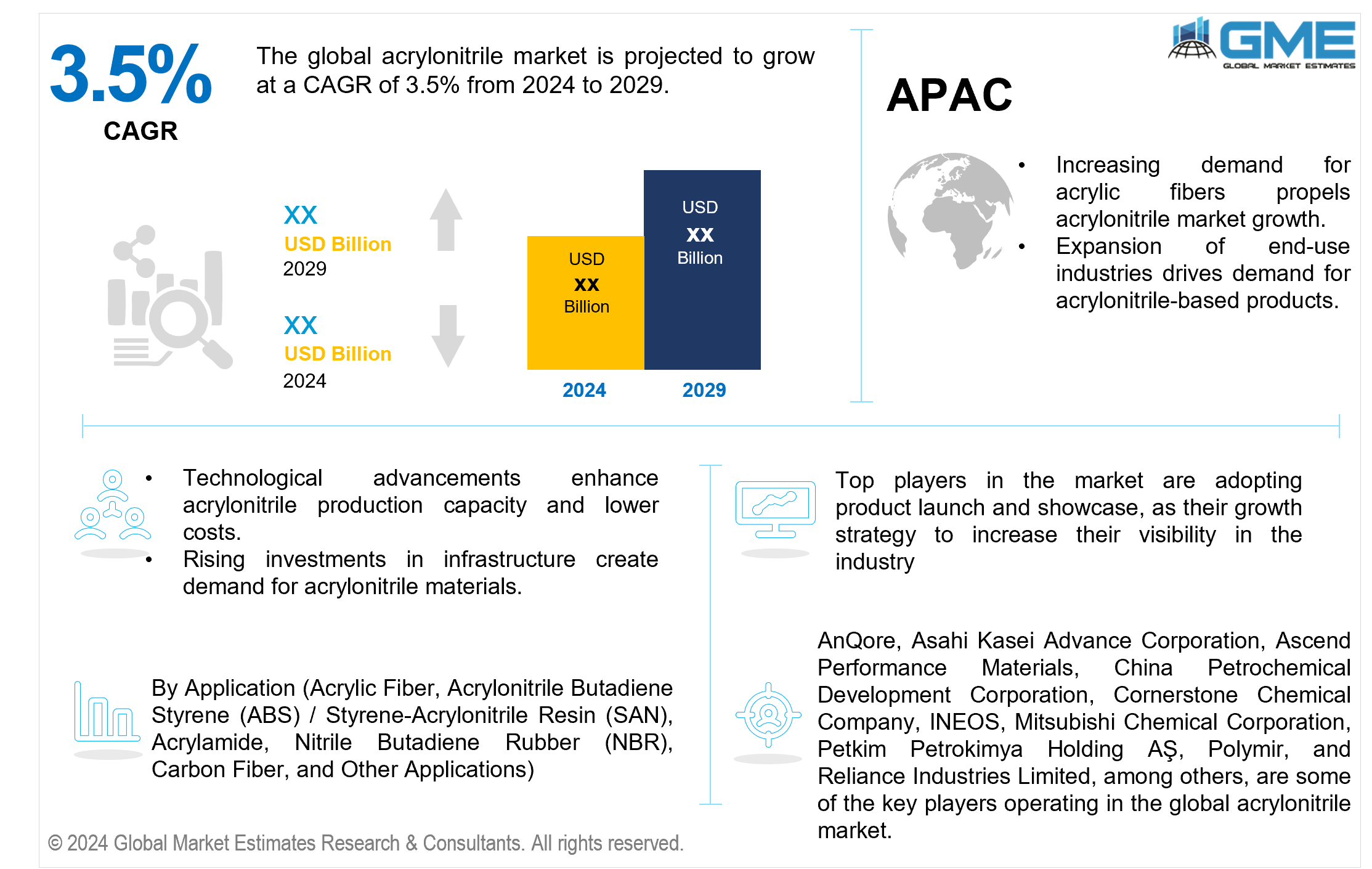

Global Acrylonitrile Market Size, Trends & Analysis - Forecasts to 2029 By Application (Acrylic Fiber, Acrylonitrile Butadiene Styrene (ABS) / Styrene-Acrylonitrile Resin (SAN), Acrylamide, Nitrile Butadiene Rubber (NBR), Carbon Fiber, and Other Applications) and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global acrylonitrile market is projected to grow at a CAGR of 3.5% from 2024 to 2029.

Acrylonitrile is a key precursor for acrylic fibers and is widely used in the textile, garment, and home furnishings industries. Acrylic fibers are becoming increasingly popular due to their extraordinary softness, warmth retention, and strong resistance to solar deterioration. These characteristics not only improve consumer comfort but also increase the longevity and aesthetic appeal of the finished items. As consumer preferences shift toward greater quality and performance, the demand for acrylonitrile rises.

Acrylonitrile-based polymers are used in construction products such as fittings, pipes, and insulation. The expansion of the construction industry, fueled by infrastructure development, urbanization, and housing projects, generates demand for acrylonitrile-based products, promoting market growth. According to the World Bank, in 2023, approximately 56% of the global population resides in urban areas, totaling about 4.4 billion people. This figure is projected to more than double by 2050, reaching nearly 7 out of 10 people living in cities.

The automobile industry's growth, particularly in emerging economies, drives demand for acrylonitrile-based polymers such as acrylonitrile-butadiene-styrene (ABS) resins. ABS is widely used in automotive components such as dashboards, bumpers, and interior trim due to its high strength, impact resistance, and aesthetic appeal. As vehicle manufacturing ramps to meet rising worldwide demand, particularly in emerging areas with rapid urbanization and infrastructure expansion, the demand for durable and lightweight materials grows. As a result, the increasing use of ABS resins in automobile manufacturing strengthens the acrylonitrile industry, highlighting the compound's critical role in molding current vehicle design and production.

Acrylonitrile is also utilized in the manufacture of plastics and packaging products. The growing consumption of packaged goods, fueled by urbanization, shifting consumer lifestyles, and e-commerce expansion, drives demand for acrylonitrile-based plastics and packaging, contributing to market growth.

However, acrylonitrile is considered hazardous and toxic, posing environmental and human health risks. Stringent environmental regulations regarding its production, handling, and disposal may increase compliance costs for manufacturers and limit market expansion.

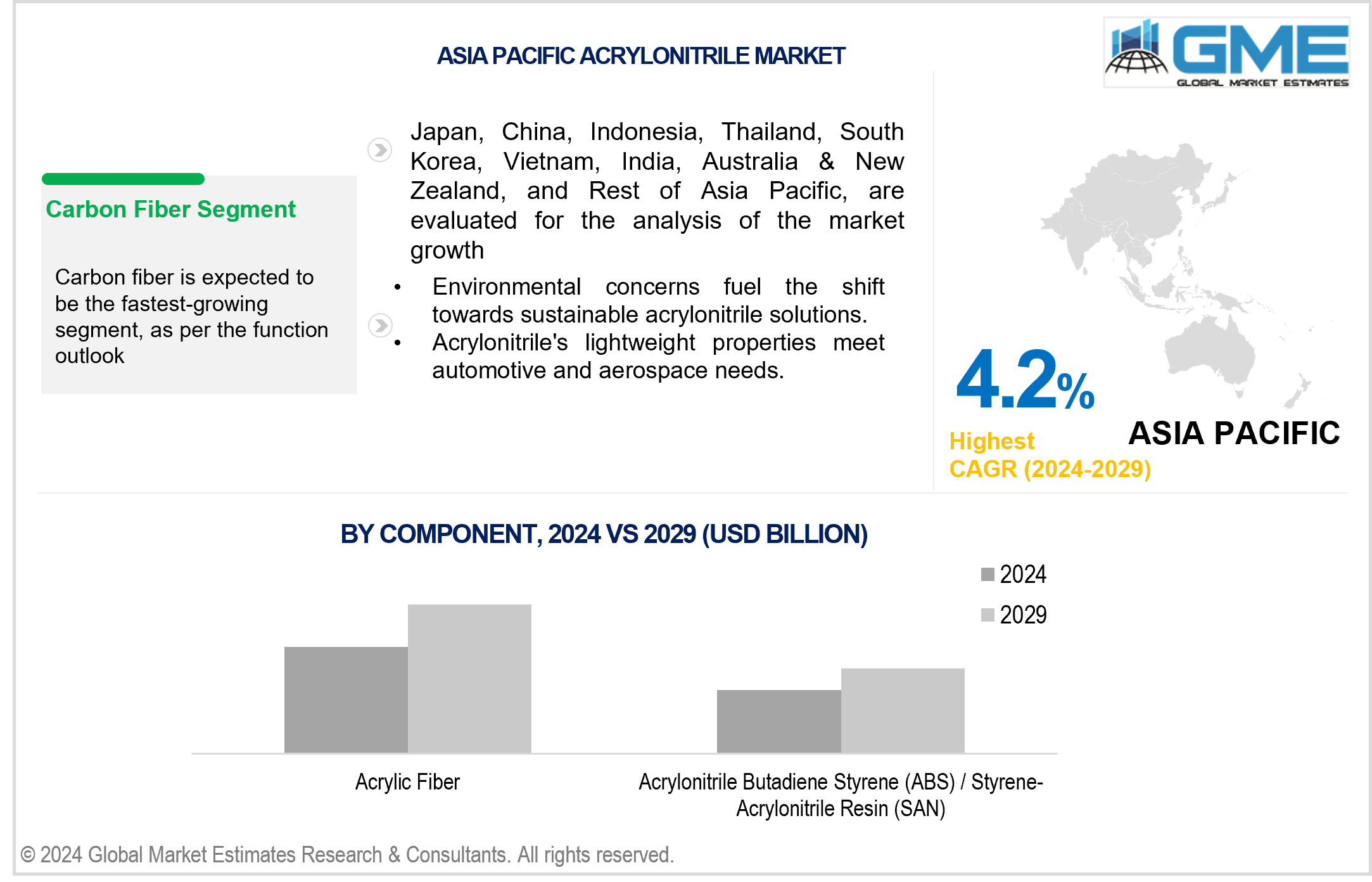

The carbon fiber segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The growth is due to its increased demand in industries such as automotive, aerospace, and wind energy. Carbon fiber has an excellent strength-to-weight ratio, resistance, corrosion, and durability, making it perfect for lightweight, high-performance applications. Technological advancements, expanding applications, and sustainability measures drive demand for carbon fiber in different industries, contributing to the segment growth.

The acrylonitrile butadiene styrene (ABS) / styrene-acrylonitrile resin (SAN) segment is expected to hold the largest share of the market. ABS has great mechanical features like as strength, impact resistance, and heat stability, making it suitable for automotive components, appliances, consumer electronics, and building materials. Its widespread utility in durable items, ease of processing, and cost-effectiveness promote its popularity. Furthermore, the rising automotive and electronics sectors, particularly in emerging economies, contribute to ABS' dominance in the acrylonitrile market.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include increasing demand for acrylonitrile from end-use industries such as automotive, aerospace, and electronics. Technological innovation and favorable government measures for industrial growth all help to boost the region's importance. Furthermore, increased investments in R&D and a strong emphasis on sustainability are driving up demand for acrylonitrile-based products in North America, cementing its position as the region's leading market.

Asia Pacific is predicted to witness rapid growth during the forecast period. The region's growing population, rapid industrialization, and rising urbanization create a strong demand for acrylonitrile-based goods in various end-use sectors. Furthermore, increased investments in infrastructure, automotive production, and building activities drive market expansion in Asia Pacific. China leads the global electric car market, with the government offering substantial financial and non-financial incentives to stimulate sales. According to the China Passenger Car Association, globally passenger electric vehicle (EV) sales surged by 169.1% in 2021 compared to 2020, totaling nearly 2.99 million units. This figure represents approximately half of all electric vehicles sold worldwide.

AnQore, Asahi Kasei Advance Corporation, Ascend Performance Materials, China Petrochemical Development Corporation, Cornerstone Chemical Company, INEOS, Mitsubishi Chemical Corporation, Petkim Petrokimya Holding AS, Polymir, and Reliance Industries Limited, among others, are some of the key players operating in the global acrylonitrile market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2023, INEOS Nitriles, a leading chemical company, introduced its innovative product line, InvireoTM, as a bio-based alternative to conventional acrylonitrile. InvireoTM, manufactured in Germany, utilizes bio-attributed propylene, significantly reducing the carbon footprint by up to 90%.

In February 2023, Sumitomo Chemical achieved its first ISCC PLUS certification for acrylonitrile produced at its Ehime Works in Japan. Acrylonitrile is extensively used in various products like synthetic fibers, resins, paper enhancers, and polymer flocculants. The certification assures the utilization of sustainable raw materials throughout the supply chain, enabling the use of a mass-balance approach for selling acrylonitrile.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ACRYLONITRILE MARKET, BY APPLICATION

4.1 Introduction

4.2 Acrylonitrile Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Acrylic Fiber

4.4.1 Acrylic Fiber Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Acrylonitrile Butadiene Styrene (ABS) / Styrene-Acrylonitrile Resin (SAN)

4.5.1 Acrylonitrile Butadiene Styrene (ABS) / Styrene-Acrylonitrile Resin (SAN) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Acrylamide

4.6.1 Acrylamide Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Nitrile Butadiene Rubber (NBR)

4.7.1 Nitrile Butadiene Rubber (NBR) Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Other Applications

4.8.1 Other Applications Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL ACRYLONITRILE MARKET, BY REGION

5.1 Introduction

5.2 North America Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.2.1 By Application

5.2.3 By Country

5.2.3.1 U.S. Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.2.3.1.1 By Application

5.2.3.2 Canada Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.2.3.2.1 By Application

5.2.3.3 Mexico Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.2.3.3.1 By Application

5.3 Europe Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.1 By Application

5.3.3 By Country

5.3.3.1 Germany Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.3.1.1 By Application

5.3.3.2 U.K. Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.3.2.1 By Application

5.3.3.3 France Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.3.3.1 By Application

5.3.3.4 Italy Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.3.4.1 By Application

5.3.3.5 Spain Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.3.5.1 By Application

5.3.3.6 Netherlands Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.3.6.1 By Application

5.3.3.7 Rest of Europe Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.3.3.5.1 By Application

5.4 Asia Pacific Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.1 By Application

5.4.3 By Country

5.4.3.1 China Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.1.1 By Application

5.4.3.2 Japan Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.2.1 By Application

5.4.3.3 India Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.3.1 By Application

5.4.3.4 South Korea Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.4.1 By Application

5.4.3.5 Singapore Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.5.1 By Application

5.4.3.6 Malaysia Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.6.1 By Application

5.4.3.7 Thailand Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.6.1 By Application

5.4.3.8 Indonesia Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.7.1 By Application

5.4.3.9 Vietnam Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.8.1 By Application

5.4.3.10 Taiwan Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.10.1 By Application

5.4.3.11 Rest of Asia Pacific Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.4.3.11.1 By Application

5.5 Middle East and Africa Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.5.1 By Application

5.5.3 By Country

5.5.3.1 Saudi Arabia Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.5.3.1.1 By Application

5.5.3.2 U.A.E. Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.5.3.2.1 By Application

5.5.3.3 Israel Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.5.3.3.1 By Application

5.5.3.4 South Africa Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.5.3.4.1 By Application

5.5.3.5 Rest of Middle East and Africa Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.5.3.5.1 By Application

5.6 Central and South America Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.6.1 By Application

5.6.3 By Country

5.6.3.1 Brazil Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.6.3.1.1 By Application

5.6.3.2 Argentina Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.6.3.2.1 By Application

5.6.3.3 Chile Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.6.3.3.1 By Application

5.6.3.3 Rest of Central and South America Acrylonitrile Market Estimates and Forecast, 2021-2029 (USD Million)

5.6.3.3.1 By Application

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 North America

6.3.2 Europe

6.3.3 Asia Pacific

6.3.4 Rest of the World

6.4 Company Profiles

6.4.1 AnQore

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 Asahi Kasei Advance Corporation

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 Ascend Performance Materials

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 China Petrochemical Development Corporation

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 Cornerstone Chemical Company

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 INEOS

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 Mitsubishi Chemical Corporation

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.7.4 Strategic Alliances between Business Partners

6.4.8 Petkim Petrokimya Holding A?

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 Polymir

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Reliance Industries Limited

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.6.1 Research Assumptions

7.6.2 Research Limitations

LIST OF TABLES

1 Global Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

2 Acrylic Fiber Market, By Region, 2021-2029 (USD Mllion)

3 Acrylonitrile Butadiene Styrene (ABS) / Styrene-Acrylonitrile Resin (SAN) Market, By Region, 2021-2029 (USD Mllion)

4 Acrylamide Market, By Region, 2021-2029 (USD Mllion)

5 Nitrile Butadiene Rubber (NBR) Market, By Region, 2021-2029 (USD Mllion)

6 Other Applications Market, By Region, 2021-2029 (USD Mllion)

7 Regional Analysis, 2021-2029 (USD Mllion)

8 North America Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

9 North America Acrylonitrile Market, By COUNTRY, 2021-2029 (USD Mllion)

10 U.S. Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

11 Canada Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

12 Mexico Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

13 Europe Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

14 Europe Acrylonitrile Market, By Country, 2021-2029 (USD Mllion)

15 Germany Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

16 U.K. Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

17 France Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

18 Italy Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

19 Spain Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

20 Netherlands Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

21 Rest Of Europe Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

22 Asia Pacific Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

23 Asia Pacific Acrylonitrile Market, By Country, 2021-2029 (USD Mllion)

24 China Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

25 Japan Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

26 India Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

27 South Korea Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

28 Singapore Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

29 Thailand Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

30 Malaysia Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

31 Indonesia Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

32 Vietnam Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

33 Taiwan Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

34 Rest of APAC Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

35 Middle East and Africa Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

36 Middle East and Africa Acrylonitrile Market, By Country, 2021-2029 (USD Mllion)

37 Saudi Arabia Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

38 UAE Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

39 Israel Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

40 South Africa Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

41 Rest Of Middle East and Africa Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

42 Central and South America Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

43 Central and South America Acrylonitrile Market, By Country, 2021-2029 (USD Mllion)

44 Brazil Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

45 Chile Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

46 Argentina Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

47 Rest Of Central and South America Acrylonitrile Market, By Application, 2021-2029 (USD Mllion)

48 AnQore: Products & Services Offering

49 Asahi Kasei Advance Corporation: Products & Services Offering

50 Ascend Performance Materials: Products & Services Offering

51 China Petrochemical Development Corporation: Products & Services Offering

52 Cornerstone Chemical Company: Products & Services Offering

53 INEOS: Products & Services Offering

54 Mitsubishi Chemical Corporation : Products & Services Offering

55 Petkim Petrokimya Holding A?: Products & Services Offering

56 Polymir, Inc: Products & Services Offering

57 Reliance Industries Limited: Products & Services Offering

58 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Acrylonitrile Market Overview

2 Global Acrylonitrile Market Value From 2021-2029 (USD Mllion)

3 Global Acrylonitrile Market Share, By Application (2022)

4 Global Acrylonitrile Market Share, By Deployment Mode (2022)

5 Global Acrylonitrile Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Acrylonitrile Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Acrylonitrile Market

10 Impact Of Challenges On The Global Acrylonitrile Market

11 Porter’s Five Forces Analysis

12 Global Acrylonitrile Market: By Application Scope Key Takeaways

13 Global Acrylonitrile Market, By Application Segment: Revenue Growth Analysis

14 Acrylic Fiber Market, By Region, 2021-2029 (USD Mllion)

15 Acrylonitrile Butadiene Styrene (ABS) / Styrene-Acrylonitrile Resin (SAN) Market, By Region, 2021-2029 (USD Mllion)

16 Acrylamide Market, By Region, 2021-2029 (USD Mllion)

17 Nitrile Butadiene Rubber (NBR) Market, By Region, 2021-2029 (USD Mllion)

18 Other Applications Market, By Region, 2021-2029 (USD Mllion)

19 Regional Segment: Revenue Growth Analysis

20 Global Acrylonitrile Market: Regional Analysis

21 North America Acrylonitrile Market Overview

22 North America Acrylonitrile Market, By Application

23 North America Acrylonitrile Market, By Country

24 U.S. Acrylonitrile Market, By Application

25 Canada Acrylonitrile Market, By Application

26 Mexico Acrylonitrile Market, By Application

27 Four Quadrant Positioning Matrix

28 Company Market Share Analysis

29 AnQore: Company Snapshot

30 AnQore: SWOT Analysis

31 AnQore: Geographic Presence

32 Asahi Kasei Advance Corporation: Company Snapshot

33 Asahi Kasei Advance Corporation: SWOT Analysis

34 Asahi Kasei Advance Corporation: Geographic Presence

35 Ascend Performance Materials: Company Snapshot

36 Ascend Performance Materials: SWOT Analysis

37 Ascend Performance Materials: Geographic Presence

38 China Petrochemical Development Corporation: Company Snapshot

39 China Petrochemical Development Corporation: Swot Analysis

40 China Petrochemical Development Corporation: Geographic Presence

41 Cornerstone Chemical Company: Company Snapshot

42 Cornerstone Chemical Company: SWOT Analysis

43 Cornerstone Chemical Company: Geographic Presence

44 INEOS: Company Snapshot

45 INEOS: SWOT Analysis

46 INEOS: Geographic Presence

47 Mitsubishi Chemical Corporation : Company Snapshot

48 Mitsubishi Chemical Corporation : SWOT Analysis

49 Mitsubishi Chemical Corporation : Geographic Presence

50 Petkim Petrokimya Holding A?: Company Snapshot

51 Petkim Petrokimya Holding A?: SWOT Analysis

52 Petkim Petrokimya Holding A?: Geographic Presence

53 Polymir, Inc.: Company Snapshot

54 Polymir, Inc.: SWOT Analysis

55 Polymir, Inc.: Geographic Presence

56 Reliance Industries Limited: Company Snapshot

57 Reliance Industries Limited: SWOT Analysis

58 Reliance Industries Limited: Geographic Presence

59 Other Companies: Company Snapshot

60 Other Companies: SWOT Analysis

61 Other Companies: Geographic Presence

The Global Acrylonitrile Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Acrylonitrile Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS