Global Aerospace 3D Printing Market Size, Trends & Analysis - Forecasts to 2027 By Offering (Printers, Materials, Services, and Software), By Technology (Polymerization, Powder Bed Fusion, Material Extrusion or Fusion Deposition Modeling (FDM), and Others), By Platform (Aircraft, UAVs, and Spacecraft), By End Product (Engine Components, Structural Components, and Others), By End User (OEM and MRO), By Application (Prototyping, Tooling and Functional Parts), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

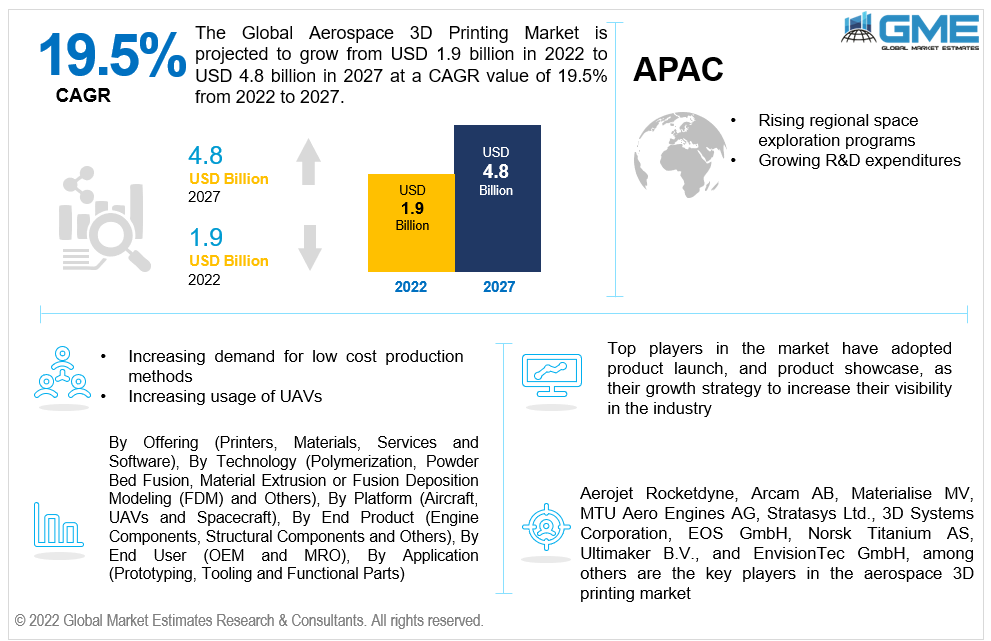

The Global Aerospace 3D Printing Market is projected to grow from USD 1.9 billion in 2022 to USD 4.8 billion in 2027 at a CAGR value of 19.5% from 2022 to 2027.

3D printing, also known as Additive Manufacturing (AM), is a layer-by-layer combination of materials to create objects from 3D model data. The method of 3D printing is automated and relies on CAD software, and there is a 40% decrease in waste products in metal applications of 3D printing compared to subtractive manufacturing.

Furthermore, it can reuse 95–98% of waste material generated by 3D printing. During the forecast period, the aviation industry's low production volume of aircraft components, growing preference for lightweight materials, the need to consume less energy production, and the requirement for cost-effective and sustainable materials are expected to drive the requirement for aerospace 3D printing.

According to a study conducted by Airbus Group Innovations in the United Kingdom and its partners, AM can cut raw material use by up to 75%. According to certain research, AM has a 70 percent lower environmental impact than traditional machining. 3D printing allows for the creation of lightweight, enhanced, and complicated geometries, lowering product life cycle costs. Furthermore, 3D printing can substantially cut material use, energy usage, and process-related CO2 emissions per unit of GDP.

AM technology could also contribute to fuel savings in the aircraft industry, where every kilogram of substance saved decreases annual fuel costs by US$ 3000, propelling the market growth.

AM technology's advantages include reducing downtime, overall management expenses, and efficiency, meeting client needs more effectively, enhancing supply chain management, and lowering inventory requirements with the usage of 3D Technology in the aviation industry, all of which move the market ahead.

Furthermore, the rising desire for ultralight, long-lasting equipment in the aerospace industry, the growing demand for UAVs, technologically advanced space parts for space expeditions, and the continuously increasing preference for product customization and cost-cutting manufacturing processes are all fueling market expansion.

The aerospace 3D printing market was also adversely impacted by the outbreak of the COVID-19 pandemic. The lockdowns led to disruptions in the production process as the supply of raw materials and labor fell short. Pandemic has also resulted in delays in deliveries as manufacturing, transportation, and overall supply chains got constrained.

However, when it comes to the fabrication of certain significant aircraft structures, additive manufacturing, performs poorly compared to traditional manufacturing. In addition, additive manufacturing suffers manufacturing consistency issues, especially when generating completely thick metal parts, slowing market expansion.

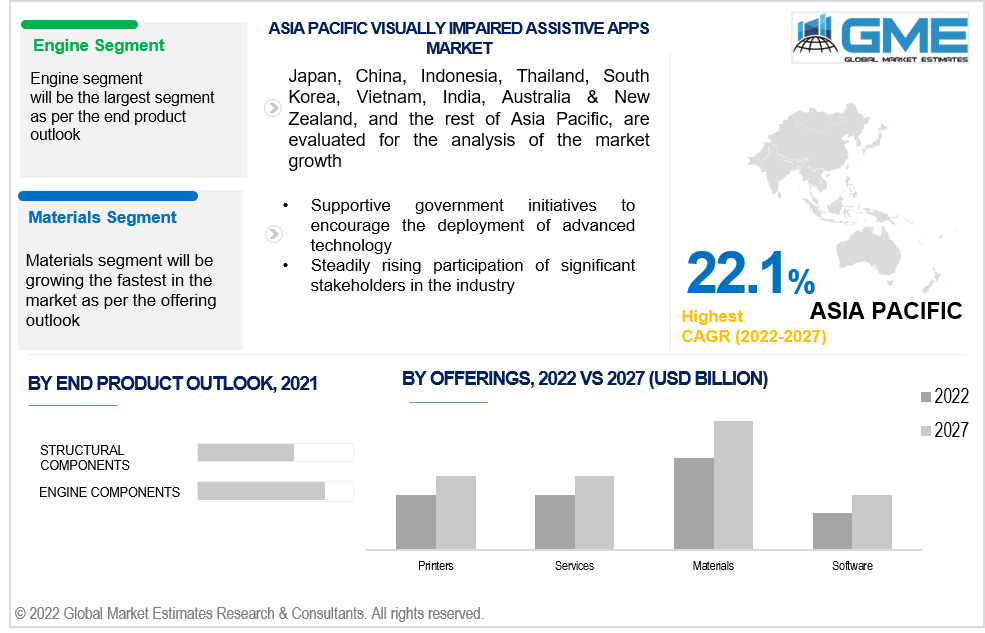

The aerospace 3D printing market is divided into printers, materials, services, and software based on the Offering. The materials segment is expected to be the fastest-growing segment in the forecast period of 2022-2027. The demand for high strength-to-weight-ratio components for product manufacture is driving this expansion. Lightweight, durable materials are also preferred as they cut down production costs by a significant margin.

Based on the Technology, the aerospace 3D printing market is divided into polymerization, powder bed fusion, material extrusion or fusion deposition modeling (FDM), and others. The fusion deposition modeling (FDM) segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

FDM's capacity to consistently and reliably generate geometric structures, produce components with good stability and strength and offer a broad array of thermoplastic materials contribute to the segment's growth.

The aerospace 3D printing market is divided into aircraft, UAVs, and spacecraft based on the platform segmentation. The aircraft segment is expected to be the largest segment in the market from 2022 to 2027. The growth can be attributed to the growing demand for safe and efficient aircraft in the defense and aerospace sector and a rise in investments in lightweight, cost-efficient aircraft for various applications.

The aerospace 3D printing market is divided into engine components, structural components, and others based on the end product. The engine segment is expected to be the largest segment in the market from 2022 to 2027. The rise of end goods is aided by the simplicity of design, better durability, portability, the longevity of produced components, and associated cost-effectiveness.

The aerospace 3D printing market is divided into OEM and MRO based on end-user segmentation. The MRO segment is expected to be the fastest-growing segment in the market from 2022 to 2027. The MRO asset management system provides a big-picture overview of all inventories. It facilitates sharing, more effective fixable part administration, more strategic buying techniques, and better technical team deployment, driving the segment growth.

The aerospace 3D printing market is divided into prototyping, tooling, and functional parts based on the application type. The parts segment is expected to be the fastest-growing segment in the market from 2022 to 2027. The developments in 3D printing technology and increased acceptance of 3D printers into production processes across sectors can be related to the expansion of the functional parts market.

As per the geographical analysis, the aerospace 3D printing market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will dominate the aerospace 3D printing market from 2022 to 2027. 3D printing technology to create sophisticated, lightweight 3D components is becoming more common. Additionally, aviation equipment and aircraft makers are turning to 3D printing technologies to deliver low-volume parts, fueling the aerospace 3D printing market's growth in this region.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing aerospace 3D printing market segment during the forecast period. Countries like China, India, and Japan are increasing their investment in 3D printing research and development. South Korea's growing number of OEMs, startups' increased focus on 3D printing technology, and strong advocacy of 3D printing technologies result in minimal material waste, and are following their lean manufacturing principles are all driving regional growth.

Aerojet Rocketdyne, Arcam AB, Materialise MV, MTU Aero Engines AG, Stratasys Ltd., 3D Systems Corporation, EOS GmbH, Norsk Titanium AS, Ultimaker B.V., and EnvisionTEC GmbH, among others, are the key players in the aerospace 3D printing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aerospace 3D Printing Market Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Technology Overview

2.1.4 Platform Overview

2.1.5 End Product Overview

2.1.6 End User Overview

2.1.6 Application Overview

2.1.6 Regional Overview

Chapter 3 Aerospace 3D Printing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for low cost and light weight aircraft components

3.3.2 Industry Challenges

3.3.2.1 High investment costs

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Platform Growth Overview

3.4.4 End Product Growth Overview

3.4.5 End User Growth Overview

3.4.6 Application Growth Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 Central and South America

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Aerospace 3D Printing Market, By Offering

4.1 Offering Outlook

4.2 Printers

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Materials

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Services

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Software

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Aerospace 3D Printing Market, By End Product

5.1 Technology Outlook

5.2 Polymerization

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Powder Bed Fusion

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Material Extrusion or Fusion Deposition Modeling (FDM)

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Aerospace 3D Printing Market, By Platform

6.1 Aircraft

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 UAVs

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Spacecraft

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Aerospace 3D Printing Market, By End Product

7.1 Engine Components

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Structural Components

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Others

7.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Aerospace 3D Printing Market, By End User

8.1 OEM

8.1.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 MRO

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 9 Aerospace 3D Printing Market, By Application

9.1 Prototyping

9.1.1 Market Size, By Region, 2022-2027 (USD Billion)

9.2 Tooling

9.2.1 Market Size, By Region, 2022-2027 (USD Billion)

9.2 Functional Parts

9.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 10 Aerospace 3D Printing Market, By Region

10.1 Regional outlook

10.2 North America

10.2.1 Market Size, By Country 2022-2027 (USD Billion)

10.2.2 Market Size, By Offering, 2022-2027 (USD Billion)

10.2.3 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.4 Market Size, By Platform, 2022-2027 (USD Billion)

10.2.5 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.6 Market Size, By End User, 2022-2027 (USD Billion)

10.2.7 Market Size, By Application, 2022-2027 (USD Billion)

10.2.8 U.S.

10.2.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.2.8.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.8.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.2.8.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.8.5 Market Size, By End User, 2022-2027 (USD Billion)

10.2.8.6 Market Size, By Application, 2022-2027 (USD Billion)

10.2.9 Canada

10.2.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.2.9.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.9.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.2.9.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.9.5 Market Size, By End User, 2022-2027 (USD Billion)

10.2.9.6 Market Size, By Application, 2022-2027 (USD Billion)

10.2.10 Mexico

10.2.10.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.2.10.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.10.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.2.10.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.2.10.5 Market Size, By End User, 2022-2027 (USD Billion)

10.2.10.6 Market Size, By Application, 2022-2027 (USD Billion)

10.3 Europe

10.3.1 Market Size, By Country 2022-2027 (USD Billion)

10.3.2 Market Size, By Offering, 2022-2027 (USD Billion)

10.3.3 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.4 Market Size, By Platform, 2022-2027 (USD Billion)

10.3.5 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.6 Market Size, By End User, 2022-2027 (USD Billion)

10.3.7 Market Size, By Application, 2022-2027 (USD Billion)

10.3.8 Germany

10.3.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.3.8.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.8.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.3.8.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.8.5 Market Size, By End User, 2022-2027 (USD Billion)

10.3.8.6 Market Size, By Application, 2022-2027 (USD Billion)

10.3.9 UK

10.3.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.3.9.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.9.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.3.9.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.9.5 Market Size, By End User, 2022-2027 (USD Billion)

10.3.9.6 Market Size, By Application, 2022-2027 (USD Billion)

10.3.10 France

10.3.10.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.3.10.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.10.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.3.10.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.10.5 Market Size, By End User, 2022-2027 (USD Billion)

10.3.10.6 Market Size, By Application, 2022-2027 (USD Billion)

10.3.11 Italy

10.3.11.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.3.11.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.11.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.3.11.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.3.11.5 Market Size, By End User, 2022-2027 (USD Billion)

10.3.11.6 Market Size, By Application, 2022-2027 (USD Billion)

10.4 Asia Pacific

10.4.1 Market Size, By Country 2022-2027 (USD Billion)

10.4.2 Market Size, By Offering, 2022-2027 (USD Billion)

10.4.3 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.4 Market Size, By Platform, 2022-2027 (USD Billion)

10.4.5 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.6 Market Size, By End User, 2022-2027 (USD Billion)

10.4.7 Market Size, By Application, 2022-2027 (USD Billion)

10.4.8 China

10.4.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.4.8.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.8.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.4.8.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.8.5 Market Size, By End User, 2022-2027 (USD Billion)

10.4.8.6 Market Size, By Application, 2022-2027 (USD Billion)

10.4.9 India

10.4.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.4.9.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.9.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.4.9.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.9.5 Market Size, By End User, 2022-2027 (USD Billion)

10.4.9.6 Market Size, By Application, 2022-2027 (USD Billion)

10.4.10 Japan

10.4.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.4.8.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.8.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.4.8.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.4.8.5 Market Size, By End User, 2022-2027 (USD Billion)

10.4.8.6 Market Size, By Application, 2022-2027 (USD Billion)

10.5 MEA

10.5.1 Market Size, By Country 2022-2027 (USD Billion)

10.5.2 Market Size, By Offering, 2022-2027 (USD Billion)

10.5.3 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.4 Market Size, By Platform, 2022-2027 (USD Billion)

10.5.5 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.6 Market Size, By End User, 2022-2027 (USD Billion)

10.5.7 Market Size, By Application, 2022-2027 (USD Billion)

10.5.8 Saudi Arabia

10.5.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.5.8.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.8.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.5.8.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.8.5 Market Size, By End User, 2022-2027 (USD Billion)

10.5.8.6 Market Size, By Application, 2022-2027 (USD Billion)

10.5.9 UAE

10.5.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.5.9.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.9.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.5.9.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.9.5 Market Size, By End User, 2022-2027 (USD Billion)

10.5.9.6 Market Size, By Application, 2022-2027 (USD Billion)

10.5.10 South Africa

10.5.10.1 Market Size, By Offering, 2022-2027 (USD Billion)

10.5.10.2 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.10.3 Market Size, By Platform, 2022-2027 (USD Billion)

10.5.10.4 Market Size, By End Product, 2022-2027 (USD Billion)

10.5.10.5 Market Size, By End User, 2022-2027 (USD Billion)

10.5.10.6 Market Size, By Application, 2022-2027 (USD Billion)

Chapter 11 Company Landscape

11.1 Competitive Analysis, 2022

11.2 Stratasys Ltd.

11.2.1 Company Overview

11.2.2 Financial Analysis

11.2.3 Strategic Positioning

11.2.4 Info Graphic Analysis

11.3 3D Systems Corporation

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Strategic Positioning

11.3.4 Info Graphic Analysis

11.4 EOS GmbH

11.4.1 Company Overview

11.4.2 Financial Analysis

11.4.3 Strategic Positioning

11.4.4 Info Graphic Analysis

11.5 Norsk Titanium AS

11.5.1 Company Overview

11.5.2 Financial Analysis

11.5.3 Strategic Positioning

11.5.4 Info Graphic Analysis

11.6 Ultimaker B.V.

11.6.1 Company Overview

11.6.2 Financial Analysis

11.6.3 Strategic Positioning

11.6.4 Info Graphic Analysis

11.7 EnvisionTec GmbH

11.7.1 Company Overview

11.7.2 Financial Analysis

11.7.3 Strategic Positioning

11.7.4 Info Graphic Analysis

11.8 Aerojet Rocketdyne

11.8.1 Company Overview

11.8.2 Financial Analysis

11.8.3 Strategic Positioning

11.8.4 Info Graphic Analysis

11.9 Arcam AB

11.9.1 Company Overview

11.9.2 Financial Analysis

11.9.3 Strategic Positioning

11.9.4 Info Graphic Analysis

11.10 Materialise MV

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Strategic Positioning

11.10.4 Info Graphic Analysis

11.11 MTU Aero Engines AG

11.11.1 Company Overview

11.11.2 Financial Analysis

11.11.3 Strategic Positioning

11.11.4 Info Graphic Analysis

11.12 Other Companies

11.12.1 Company Overview

11.12.2 Financial Analysis

11.12.3 Strategic Positioning

11.12.4 Info Graphic Analysis

The Global Aerospace 3D Printing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aerospace 3D Printing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS