Global Aerospace Robotics Market Size, Trends & Analysis - Forecasts to 2027 By Solution (Traditional Robots, Collaborative Robots), By Component (Controller, Sensor, Drive, End Effector), By Application (Drilling & Fastening, Non-Destructive Testing & Inspection, Welding & Soldering, Sealing & Dispensing, Processing, Handling, Assembling & Disassembling), By Payload (Upto 16.00 kg, 16.01-60.00 kg, 60.01-225.00 kg, More Than 225.00 kg), By Region (North America, Asia Pacific, Central and South America, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

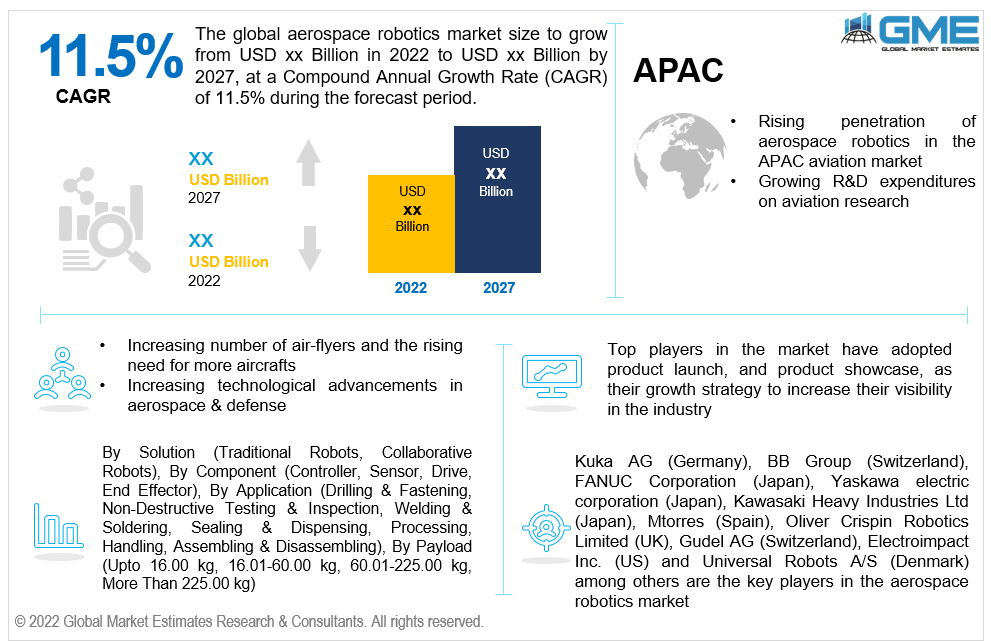

The Global Aerospace Robotics Market is projected to grow at a CAGR value of 11.5% from 2022 to 2027.

Robotics technology has taken over different sectors and has rapidly reached the aerospace industry. Robotics technology is heavily involved in the manufacturing of aircraft and aircraft engines and the maintenance and management of the aircraft by efficiently performing welding, painting and drilling tasks.

Aerospace robotics are precise with work, efficient and reliable. Embedding the Internet of Things (IoT) in the aerospace industry has led to cost-effectiveness by reducing labor dependence. Aerospace robotics allows manufacturers to explore innovative technologies and processes and have the opportunity to reduce costs and increase the reliability and quality of products.

The global aerospace robotics market is expected to grow owing to factors such as increasing technological advancements in the aviation industry, rising demand for aircraft due to the increasing number of air-flyers, increasing opportunity for labor employment, rising demand for low retention costs and rising need for upgraded airplanes in both defense and commercial sector.

Furthermore, increasing government funding in the defense sector and the rising demand for efficient but voluminous aircraft production are also some of the other factors that will boost the aerospace robotics market.

The onset of the viral pandemic had negatively impacted the tourism and aviation industry. However, post the 1st year of the pandemic, the aviation industry is keen in promoting innovative, cost-effective and efficient manufacturing solutions. Aerospace robotics provides the aviation industry with cheaper manufacturing solutions and a reduction of dependence on the workforce.

The COVID-19 situation has led to the migration of labourers to rural towns resulting in the delay of aircraft components. Aerospace robotics mitigates this problem by manufacturing aircraft components that do not require manual assistance.

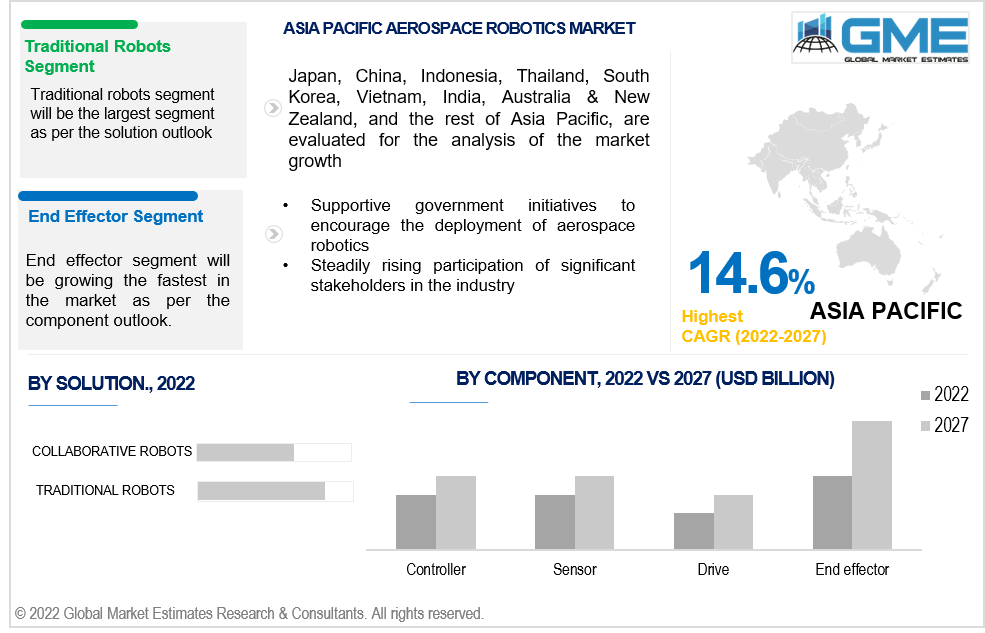

The aerospace robotics market is divided into traditional and collaborative robots based on the solution type. The traditional robots segment is expected to be the largest segment in the market from 2022 to 2027.

Traditional robots are used in various applications such as painting, coasting, and drilling aircraft. Traditional robots accomplish a vast number of tasks instead of workers who would take additional hours to do the same task. Aircraft structures are massive and require multiple traditional robots to finish the job efficiently.

The aerospace robotics market is divided into controller, sensor, drive, and end effector based on the component. The end effector segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

The end effector in aerospace robotics interacts with the immediate environment and accomplishes the task. End effectors are in various forms, from two-fingered grippers to complex devices embedded with sensors. Sensor-based end effectors are gaining prominence in the aerospace robotics market.

Based on the application, aerospace robotics is divided into drilling & fastening, non-destructive testing & inspection, welding & soldering, sealing & dispensing, processing, handling, assembling & disassembling. The processing segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

The processing segment is expected to have a significant growth rate due to aerospace manufacturing companies increasing investments and research in the field. The processing segment of aerospace robotics is usually involved in processing products before it reaches the customer.

Based on the payload, the aerospace robotics market is divided into 16.00 kg, 16.01-60.00 kg, 60.01-225.00 kg, and more than 225.00 kg. The 16.01 to 60.00 kg payload segment is expected to be the largest segment in the market from 2022 to 2027.

The rise in the small-medium payload-based aerospace robotics would be due to continued high demand by big, medium and small enterprises in the aviation manufacturing industry.

As per the geographical analysis, the aerospace robotics market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will dominate the aerospace robotics market from 2022 to 2027. The primary factor driving the growth of the market in the North American region is the increasing demand for upgradation in aerospace and defense technology, the rising number of customers who prefer air traveling and the presence of significant players in the region. Companies in the area are constantly increasing investments in automation-based services to increase efficiency and precision.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the aerospace robotics market during the forecast period. The rapidly rising rate of air-flyers resulting in an increased demand for aircraft production and growing technological advances will initiate the growth of the aerospace robotics market in the region.

Kuka AG (Germany), BB Group (Switzerland), FANUC Corporation (Japan), Yaskawa electric corporation (Japan), Kawasaki Heavy Industries Ltd (Japan), Mtorres (Spain), Oliver Crispin Robotics Limited (UK), Gudel AG (Switzerland), Electroimpact Inc. (US) and Universal Robots A/S (Denmark) among others are the key players in the aerospace robotics market..

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aerospace Robotics Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Solution Overview

2.1.3 Component Overview

2.1.4 Application Overview

2.1.5 Payload Overview

2.1.6 Regional Overview

Chapter 3 Aerospace Robotics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the aerospace robotics industry

3.3.1.2 Growing technological advancements in the aviation industry of the APAC region

3.3.2 Industry Challenges

3.3.2.1 Lack of skilled operators and initial cost of implementing aerospace robotics

3.4 Prospective Growth Scenario

3.4.1 Solution Growth Scenario

3.4.2 Component Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Payload Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Payload Overview

3.11 Market Share Analysis, 2022

3.11.1 Company Positioning Overview, 2022

Chapter 4 Aerospace Robotics Market, By Solution

4.1 Solution Outlook

4.2 Traditional Robots

4.2.1 Market Size, By Region, 2022-2027 (USD Million)

4.3 Collaborative Robots

4.3.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 5 Aerospace Robotics Market, By Application

5.1 Application Outlook

5.2 Drilling & Fastening

5.2.1 Market Size, By Region, 2022-2027 (USD Million)

5.3 Non-Destructive Testing & Inspection

5.3.1 Market Size, By Region, 2022-2027 (USD Million)

5.4 Welding & Soldering

5.4.1 Market Size, By Region, 2022-2027 (USD Million)

5.5 Sealing & Dispensing

5.5.1 Market Size, By Region, 2022-2027 (USD Million)

5.6 Processing

5.6.1 Market Size, By Region, 2022-2027 (USD Million)

5.7.1 Market Size, By Region, 2022-2027 (USD Million)

5.8 Assembling & Disassembling

5.8.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 6 Aerospace Robotics Market, By Component

6.1 Controller

6.1.1 Market Size, By Region, 2022-2027 (USD Million)

6.2 Sensor

6.2.1 Market Size, By Region, 2022-2027 (USD Million)

6.3 Drive

6.3.1 Market Size, By Region, 2022-2027 (USD Million)

6.4 End Effector

6.4.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 7 Aerospace Robotics Market, By Payload

7.1 Upto 16.00 kg

7.1.1 Market Size, By Region, 2022-2027 (USD Million)

7.2.1 Market Size, By Region, 2022-2027 (USD Million)

7.3 60.00- 225.00 kg

7.3.1 Market Size, By Region, 2022-2027 (USD Million)

7.4 More than 225.00 kg

7.4.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 8 Aerospace Robotics Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2022-2027 (USD Million)

8.2.2 Market Size, By Solution, 2022-2027 (USD Million)

8.2.3 Market Size, By Component, 2022-2027 (USD Million)

8.2.4 Market Size, By Application, 2022-2027 (USD Million)

8.2.5 Market Size, By Payload, 2022-2027 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Solution, 2022-2027 (USD Million)

8.2.4.2 Market Size, By Component, 2022-2027 (USD Million)

8.2.4.3 Market Size, By Application, 2022-2027 (USD Million)

Market Size, By Payload, 2022-2027 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Solution, 2022-2027 (USD Million)

8.2.7.2 Market Size, By Component, 2022-2027 (USD Million)

8.2.7.3 Market Size, By Application, 2022-2027 (USD Million)

8.2.7.4 Market Size, By Payload, 2022-2027 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2022-2027 (USD Million)

8.3.2 Market Size, By Solution, 2022-2027 (USD Million)

8.3.3 Market Size, By Component, 2022-2027 (USD Million)

8.3.4 Market Size, By Application, 2022-2027 (USD Million)

8.3.5 Market Size, By Payload, 2022-2027 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Solution, 2022-2027 (USD Million)

8.3.6.2 Market Size, By Component, 2022-2027 (USD Million)

8.3.6.3 Market Size, By Application, 2022-2027 (USD Million)

8.3.6.4 Market Size, By Payload, 2022-2027 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Solution, 2022-2027 (USD Million)

8.3.7.2 Market Size, By Component, 2022-2027 (USD Million)

8.3.7.3 Market Size, By Application, 2022-2027 (USD Million)

8.3.7.4 Market Size, By Payload, 2022-2027 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Solution, 2022-2027 (USD Million)

8.3.8.2 Market Size, By Component, 2022-2027 (USD Million)

8.3.8.3 Market Size, By Application, 2022-2027 (USD Million)

8.3.8.4 Market Size, By Payload, 2022-2027 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Solution, 2022-2027 (USD Million)

8.3.9.2 Market Size, By Component, 2022-2027 (USD Million)

8.3.9.3 Market Size, By Application, 2022-2027 (USD Million)

8.3.9.4 Market Size, By Payload, 2022-2027 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Solution, 2022-2027 (USD Million)

8.3.10.2 Market Size, By Component, 2022-2027 (USD Million)

8.3.10.3 Market Size, By Application, 2022-2027 (USD Million)

8.3.10.4 Market Size, By Payload, 2022-2027 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Solution, 2022-2027 (USD Million)

8.3.11.2 Market Size, By Component, 2022-2027 (USD Million)

8.3.11.3 Market Size, By Application, 2022-2027 (USD Million)

8.3.11.4 Market Size, By Payload, 2022-2027 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2022-2027 (USD Million)

8.4.2 Market Size, By Solution, 2022-2027 (USD Million)

8.4.3 Market Size, By Component, 2022-2027 (USD Million)

8.4.4 Market Size, By Application, 2022-2027 (USD Million)

8.4.5 Market Size, By Payload, 2022-2027 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Solution, 2022-2027 (USD Million)

8.4.6.2 Market Size, By Component, 2022-2027 (USD Million)

8.4.6.3 Market Size, By Application, 2022-2027 (USD Million)

8.4.6.4 Market Size, By Payload, 2022-2027 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Solution, 2022-2027 (USD Million)

8.4.7.2 Market Size, By Component, 2022-2027 (USD Million)

8.4.7.3 Market Size, By Application, 2022-2027 (USD Million)

8.4.7.4 Market Size, By Payload, 2022-2027 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Solution, 2022-2027 (USD Million)

8.4.8.2 Market Size, By Component, 2022-2027 (USD Million)

8.4.8.3 Market Size, By Application, 2022-2027 (USD Million)

8.4.8.4 Market Size, By Payload, 2022-2027 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Solution, 2022-2027 (USD Million)

8.4.9.2 Market size, By Component, 2022-2027 (USD Million)

8.4.9.3 Market Size, By Application, 2022-2027 (USD Million)

8.4.9.4 Market Size, By Payload, 2022-2027 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Solution, 2022-2027 (USD Million)

8.4.10.2 Market Size, By Component, 2022-2027 (USD Million)

8.4.10.3 Market Size, By Application, 2022-2027 (USD Million)

8.4.10.4 Market Size, By Payload, 2022-2027 (USD Million)

8.5 Central and South America

8.5.1 Market Size, By Country 2022-2027 (USD Million)

8.5.2 Market Size, By Solution, 2022-2027 (USD Million)

8.5.3 Market Size, By Component, 2022-2027 (USD Million)

8.5.4 Market Size, By Application, 2022-2027 (USD Million)

8.5.5 Market Size, By Payload, 2022-2027 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Solution, 2022-2027 (USD Million)

8.5.6.2 Market Size, By Component, 2022-2027 (USD Million)

8.5.6.3 Market Size, By Application, 2022-2027 (USD Million)

8.5.6.4 Market Size, By Payload, 2022-2027 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Solution, 2022-2027 (USD Million)

8.5.7.2 Market Size, By Component, 2022-2027 (USD Million)

8.5.7.3 Market Size, By Application, 2022-2027 (USD Million)

8.5.7.4 Market Size, By Payload, 2022-2027 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Solution, 2022-2027 (USD Million)

8.5.8.2 Market Size, By Component, 2022-2027 (USD Million)

8.5.8.3 Market Size, By Application, 2022-2027 (USD Million)

8.5.8.4 Market Size, By Payload, 2022-2027 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2022-2027 (USD Million)

8.6.2 Market Size, By Solution, 2022-2027 (USD Million)

8.6.3 Market Size, By Component, 2022-2027 (USD Million)

8.6.4 Market Size, By Application, 2022-2027 (USD Million)

8.6.5 Market Size, By Payload, 2022-2027 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Solution, 2022-2027 (USD Million)

8.6.6.2 Market Size, By Component, 2022-2027 (USD Million)

8.6.6.3 Market Size, By Application, 2022-2027 (USD Million)

8.6.6.4 Market Size, By Payload, 2022-2027 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Solution, 2022-2027 (USD Million)

8.6.7.2 Market Size, By Component, 2022-2027 (USD Million)

8.6.7.3 Market Size, By Application, 2022-2027 (USD Million)

8.6.7.4 Market Size, By Payload, 2022-2027 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Solution, 2022-2027 (USD Million)

8.6.8.2 Market Size, By Component, 2022-2027 (USD Million)

8.6.8.3 Market Size, By Application, 2022-2027 (USD Million)

8.6.8.4 Market Size, By Payload, 2022-2027 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2022

9.2 Kuka AG (Germany)

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 ABB Group (Switzerland)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 FANUC Corporation (Japan)

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Yaskawa electric corporation (Japan)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Kawasaki Limited Heavy Industries Ltd (Japan)

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Mtorres (Spain)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Oliver Crispin Robotics Limited (UK)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Gudel AG (Switzerland)

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Electroimpact Inc. (US)

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Universal Robots A/S (Denmark)

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Aerospace Robotics Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aerospace Robotics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS