Global Agrigenomics Market Size, Trends & Analysis - Forecasts to 2026 By Objective (RNA/Agrigenomics, DNA Extraction & Purification, Genotyping, Gene Expression Profiling, Market-Assisted Selection, GMO/Trait Purity Testing, Others), By Sequencer Type (Sanger Sequencing, Solid Sequencers, Pacbio Sequencers, Illumina HSEQ Family, Other Sequencers), By Application (Crops, Livestock), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

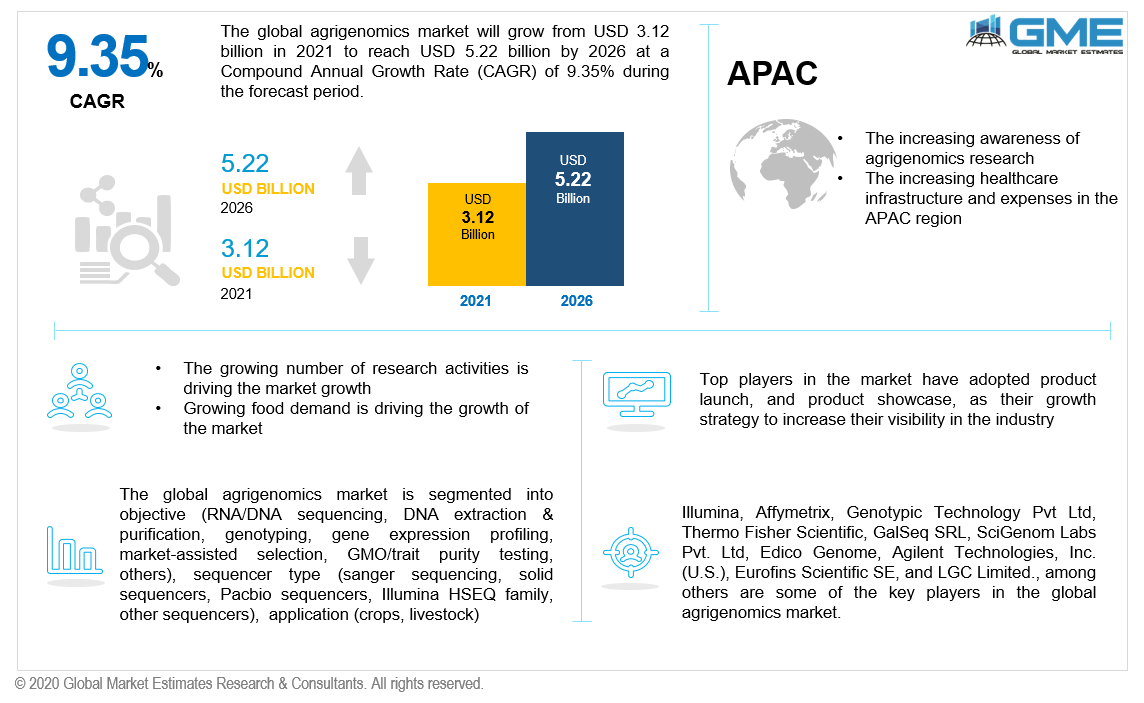

The global agrigenomics market will grow from USD 3.12 billion in 2021 to reach USD 5.22 billion in 2026, with a CAGR of 9.35% during the forecast period.

The rising applications of agrigenomics in routine agriculture activities, the increasing number of DNA/RNA sequencing project grants, and technological developments in the field of genomics and agriculture are some of the key drivers expected to drive market growth during the forecast period. The other factors supporting the growth of the global agrigenomics market are the increasing food consumption volume, the growing use of advanced tools and techniques of genome research testing, and rising investments in research & development activities by government-funded organizations.

Moreover, the growing global burden of the population and increasing demand for livestock and dairy products are some of the other factors influencing the global agrigenomics market growth across the globe. The introduction of technological advancements in genome databases by livestock breeders and increasing demand from breeders for high quality livestock animals are some of the parameters helping the market to grow.

Agrigenomics is described as the study of plants' genetic makeup and how the genes contribute to the production of the crop. The application of next-generation sequencing (NGS) plays a vital role in agrigenomics research. The aim of the research is to have a complete understanding of yield optimization, plant evolution, disease resistance, phylogenetic relationships, pest control, stress tolerance, and food & biofuel optimization.

The COVID-19 pandemic has a favorable impact on the market, as it has increased demand for the use of agrigenomics technologies in the field of animal and crop disease diagnostic. As a result, the market for agrigenomics will be growing rapidly during the forecast period of 2021 to 2026. Agricultural genomics is progressing in the direction of using gene-editing techniques to create a variety of antibacterial, antifungal, and antiviral products. This trend will support the market to grow exponentially.

The market is categorized into RNA/Agrigenomics, DNA extraction & purification, genotyping, gene expression profiling, market-assisted selection, GMO/Trait purity testing based on objective outlook. The market-assisted selection segment is expected to hold the largest market share from 2021 to 2026. Due to the substantial research support and presence of key technology suppliers in the United States, market-assisted selection has been gaining popularity in North America.

Furthermore, due to the rising demand for sequencers that can sequence a high number of samples at a low cost, the DNA/RNA sequencing segment is the 2nd most leading segment projected to expand at the fastest rate throughout the forecasted period. DNA/RNA sequencing and genotyping, on the other hand, were the standard prerequisites for agrigenomics testing services in 2020. It is due to the high genotyping accuracy that allows researchers to customize fine-mapping cost-effectively.

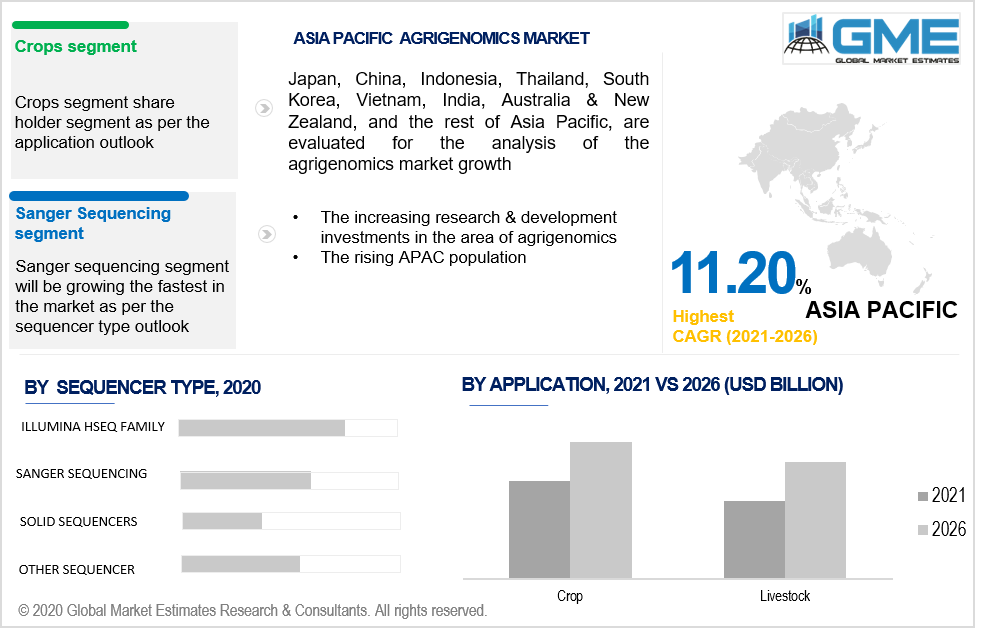

Crops and livestock are the major applications of the global agrigenomics market. The crops application is expected to hold the largest share in the market from 2021 to 2026. Genotyping and next-generation sequencing (NGS) techniques have been increasingly used in research on a wide range of agricultural species to obtain a better understanding of the genetic variation that influences phenotypic properties. Moreover, the growing demand for higher output from farmers is accelerating the crop application segment growth.

Based on type, the market is segmented into Sanger sequencing, solid sequencers, Pacbio sequencers, Illumina HSEQ family, and other sequencers. The Illumina HSEQ family segment dominated the market and is also expected to hold the largest market share from 2021 to 2026. It's an extremely powerful sequencing system that can handle a variety of analysis tasks. Sanger sequencing is expected to be the second-most popular among research institutions and service providers from 2021 to 2026, due to low machine cost.

Sanger Agrigenomics is commonly used in research to target smaller genome sequences in a larger number of samples and validate results from next-generation sequencing (NGS) research.

As per the geographical analysis, the agrigenomics market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026 due to the presence of key sequencing players in the U.S. market, increasing investments in genome R&D activities, and rising healthcare infrastructure & expenses, and growing technological advancements. The National Institute of Food and Agriculture (NIFA) of the United States Department of Agriculture (USDA) and the Department of Energy (DOE) funded USD 10 million for agriculture feedstock improvement programs and biofuel production. This helped the market grow rapidly.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. Rising demand for livestock and crop, increasing R&D investments in the area of agrigenomics will impact the agrigenomics market size in the region positively.

Illumina, Affymetrix, Genotypic Technology Pvt Ltd, Thermo Fisher Scientific, GalSeq SRL, SciGenom Labs Pvt. Ltd, Edico Genome, Agilent Technologies, Inc. (U.S.), Eurofins Scientific SE, and LGC Limited., among others are some of the key players in the global agrigenomics market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2019, Thermo Fisher Scientific launched its new product the Ion Torrent Genexus System. It is the first fully integrated next-generation sequencing (NGS) platform with an automated specimen-to-report workflow that provides results in a single day at a reasonable cost.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Agrigenomics Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Objective Overview

2.1.3 Sequencer Type Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Global Agrigenomics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising number of DNA/RNA sequencing project grants

3.3.1.2 Rising investments in research & development activities by government organizations

3.3.2 Industry Challenges

3.3.2.1 Technological constraints of applied genetics in agriculture

3.4 Prospective Growth Scenario

3.4.1 Objective Growth Scenario

3.4.2 Sequencer Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Agrigenomics Market, By Objective

4.1 Objective Outlook

4.2 RNA/DNA Sequencing

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 DNA Extraction & Purification

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Genotyping

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Gene Expression Profiling

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Market-Assisted Selection

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 GMO/Trait Purity Testing

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Others

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Agrigenomics Market, By Sequencer Type

5.1 Sequencer Type Outlook

5.2 Sanger Sequencing

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Solid Sequencers

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Pacbio Sequencers

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Illumina HSEQ Family

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Other Sequencers

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Agrigenomics Market, By Application

6.1 Application Outlook

6.2 Crop

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Livestock

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Agrigenomics Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Objective, 2020-2026 (USD Billion)

7.2.3 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Objective, 2020-2026 (USD Billion)

7.3.3 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Billion)

7.4.2 Market Size, By Objective, 2020-2026 (USD Billion)

7.4.3 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Sequencer Type, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.4.9.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Objective, 2020-2026 (USD Billion)

7.5.3 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Objective, 2020-2026 (USD Billion)

7.6.3 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Objective, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Sequencer Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Illumina

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Affymetrix

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 InfoGraphic Analysis

8.4 Genotypic Technology Pvt Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 InfoGraphic Analysis

8.5 Thermo Fisher Scientific

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 InfoGraphic Analysis

8.6 GalSeq

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 InfoGraphic Analysis

8.7 SRL

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 InfoGraphic Analysis

8.8 SciGenom Labs Pvt. Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 InfoGraphic Analysis

8.9 Edico Genome

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 InfoGraphic Analysis

8.10 Agilent Technologies, Inc. (U.S.)

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 InfoGraphic Analysis

8.11 Eurofins Scientific SE

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 InfoGraphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 InfoGraphic Analysis

The Global Agrigenomics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Agrigenomics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS