India Agritech Market Size, Trends & Analysis - Forecasts to 2029 By Type (Biotechnology and Biochemical, Big Data and Analytics, Sensors and Connected Devices, Mobility, and Others) and By Application (Irrigation, Production and Maintenance, Supply Chain, Marketplace, and Others) Competitive Landscape, Company Market Share Analysis, and End User Analysis

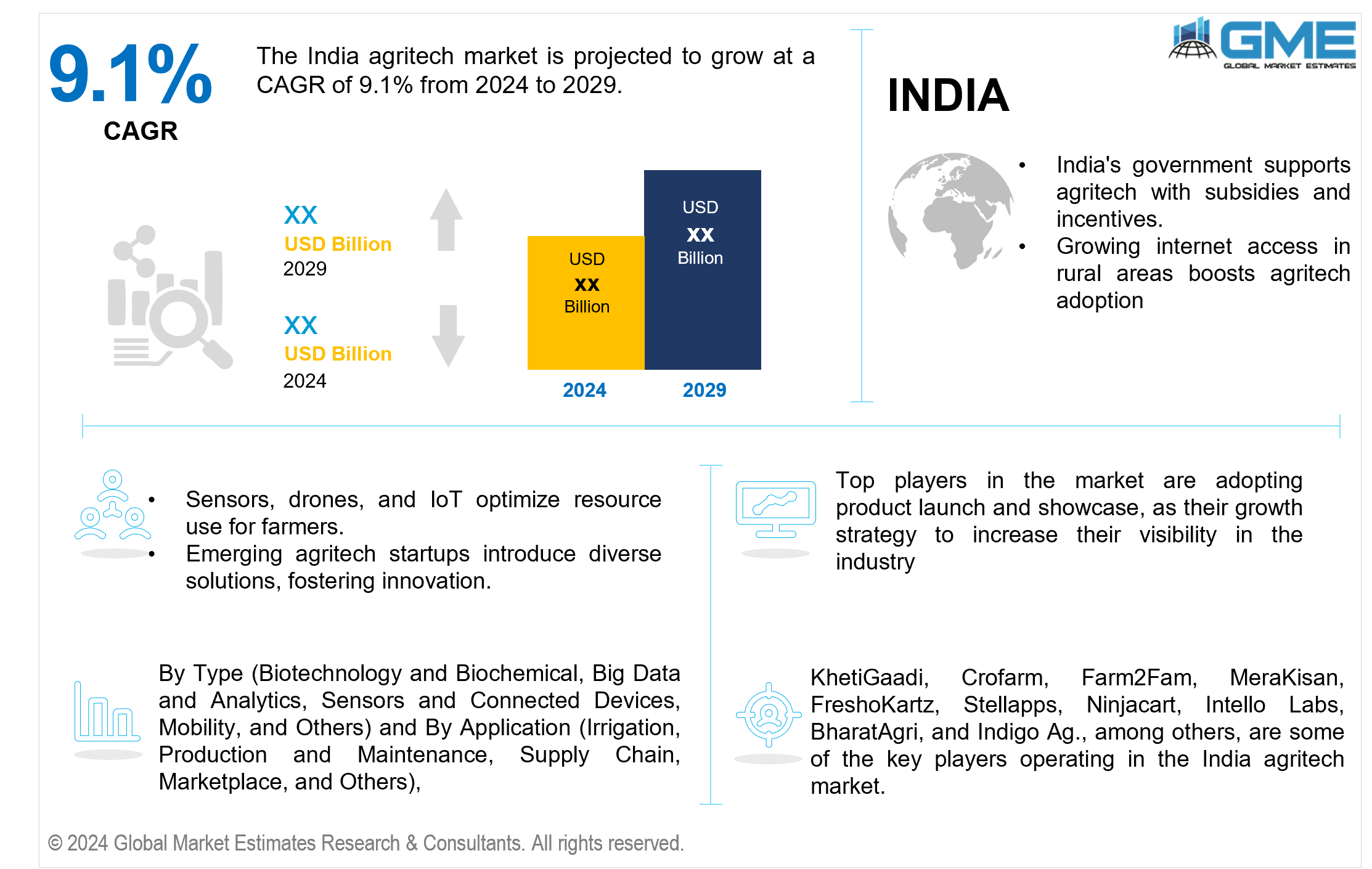

The India agritech market is projected to grow at a CAGR of 9.1% from 2024 to 2029.

The Indian government actively promotes agricultural modernization and income enhancement for farmers through initiatives offering schemes, subsidies, and financial support for adopting agritech solutions. These measures aim to encourage farmers to embrace innovative technologies, fostering a more sustainable and efficient agricultural sector.

The effects of climate change on agriculture require resilient technologies. Agritech solutions that tackle problems like shrinking water supplies and shifting climate patterns are becoming increasingly significant. Adaptive technologies are required to provide security so that agricultural systems can endure and adjust to the changing climatic circumstances.

The growing availability and affordability of internet connectivity in rural India has allowed for the widespread use of online platforms, data-driven solutions, and mobile applications in agriculture. Internet accessibility enables farmers to acquire critical information, track market prices, and receive real-time weather forecasts. As a result, farmers may make more informed decisions, increasing overall efficiency and productivity in agricultural techniques. According to a report published by the Internet and Mobile Association of India (IAMAI), 52% of the country's population, totalling 759 million people, accessed the internet at least once a month in 2022.

As a result of digitization, farmers are more connected than ever, encouraging them to favor innovative technologies like cloud and IoT while implementing new agricultural ecosystems. Agribusiness marketplaces, biotechnology, sensing & IoT, and agricultural robotics are all examples of agritech aspects. Sensing technologies, IoT gadgets, innovative farming systems, and agricultural biotechnology are all receiving significant investments. These technology expenditures are influenced by the growth of the agricultural technology sector and are a result of the emergence of agritech companies and the broad use of sensor-based technology.

The adoption of modern agritech solutions faces challenges in remote or traditional agricultural regions due to insufficient education and awareness programs. Limited understanding among farmers in these areas hampers the widespread uptake of technology, affecting the potential benefits it could offer to the agricultural sector.

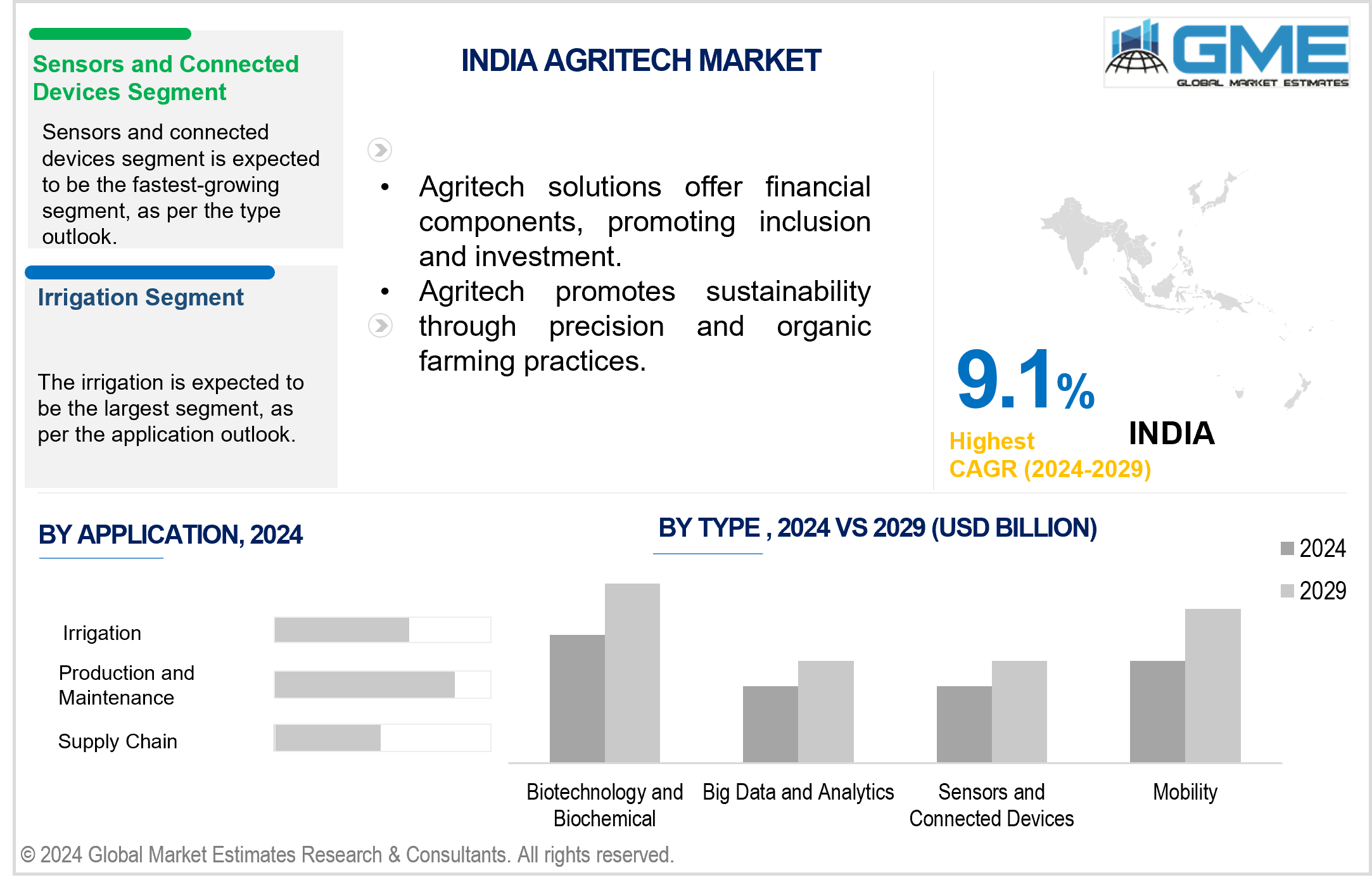

The biotechnology and biochemical segment is expected to hold the largest share of the market. This is due to its importance in improving crop characteristics, disease resistance, and total production. As genetic engineering and biotech applications gain traction in tackling agricultural difficulties, this category is expected to witness significant growth.

The sensors and connected devices segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is attributed to the rising demand for precision agriculture. The increased use of IoT devices and sensor technology provides real-time monitoring of crops, soil conditions, and machinery performance. This improves decision-making, resource management, and overall farm efficiency, contributing to the segment's rapid expansion.

The production and maintenance segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is due to the increasing emphasis on optimizing agricultural processes. This segment includes technologies for crop production, machinery maintenance, and farm management. As farmers seek to increase output and streamline operations, the adoption of sophisticated solutions for production efficiency and equipment maintenance is expected to increase significantly.

The irrigation segment is expected to hold the largest share of the market over the forecast period. The segment’s anticipated dominance is due to the importance of efficient irrigation practices in increasing agricultural yields. Precision irrigation and smart water management are two examples of agritech irrigation systems that are gaining popularity due to their emphasis on resource efficiency and water conservation.

KhetiGaadi, Crofarm, Farm2Fam, MeraKisan, FreshoKartz, Stellapps, Ninjacart, Intello Labs, BharatAgri, and Indigo Ag., among others, are some of the key players operating in the India agritech market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2022, KhetiGaadi launched an advisory service called KhetiGuru to address issues affecting Indian farmlands. Recognizing the impact of climate change and poor farming practices, the startup aims to provide science-backed assistance to farmers.

In September 2023, Ninjacart launched the 'Agri Next' initiative to bridge the technological gap within the agricultural ecosystem. The initiative focuses on advancements in enabling commerce, logistics, and fulfillment solutions and providing accessible capital options for stakeholders such as farmers, traders, and retailers.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA AGRITECH MARKET, BY APPLICATION

4.1 Introduction

4.2 Agritech Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Irrigation

4.4.1 Irrigation Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Production and Maintenance

4.5.1 Production and Maintenance Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Supply Chain

4.6.1 Supply Chain Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Marketplace

4.7.1 Marketplace Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Others

4.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA AGRITECH MARKET, BY TYPE

5.1 Introduction

5.2 Agritech Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Biotechnology and Biochemical

5.4.1 Biotechnology and Biochemical Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Big Data and Analytics

5.5.1 Big Data and Analytics Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Sensors and Connected Devices

5.6.1 Sensors and Connected Devices Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Mobility

5.7.1 Mobility Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 INDIA AGRITECH MARKET

6.1 Introduction

6.2 India Agritech Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Application

6.2.2 By Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 India

7.4 Company Profiles

7.4.1 KhetiGaadi

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Crofarm

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Farm2Fam

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 MeraKisan

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 FreshoKartz

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Stellapps

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Ninjacart

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Intello Labs

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 BharatAgri

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Indigo Ag

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 India Agritech Market, By Application , 2021-2029 (USD Million)

2 Irrigation Market, 2021-2029 (USD Million)

3 Production and Maintenance Market, 2021-2029 (USD Million)

4 Supply Chain Market, 2021-2029 (USD Million)

5 Marketplace Market, 2021-2029 (USD Million)

6 Others Market, 2021-2029 (USD Million)

7 India Agritech Market, By Type, 2021-2029 (USD Million)

8 Biotechnology and Biochemical Market, 2021-2029 (USD Million)

9 Big Data and Analytics Market, 2021-2029 (USD Million)

10 Sensors and Connected Devices Market, 2021-2029 (USD Million)

11 Mobility Market, 2021-2029 (USD Million)

12 Others Market, 2021-2029 (USD Million)

13 Regional Analysis, 2021-2029 (USD Million)

14 India Agritech Market, By Application , 2021-2029 (USD Million)

15 India Agritech Market, By Type, 2021-2029 (USD Million)

16 KHETIGAADI: Products & Services Offering

17 Crofarm : Products & Services Offering

18 Farm2Fam: Products & Services Offering

19 MeraKisan : Products & Services Offering

20 FreshoKartz: Products & Services Offering

21 STELLAPPS : Products & Services Offering

22 Ninjacart : Products & Services Offering

23 Intello Labs: Products & Services Offering

24 BharatAgri, Inc: Products & Services Offering

25 Indigo Ag: Products & Services Offering

26 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Agritech Market Overview

2 India Agritech Market Value From 2021-2029 (USD Million)

3 India Agritech Market Share, By Application (2023)

4 India Agritech Market Share, By Type (2023)

5 India Agritech Market, By Region (Asia Pacific Market)

6 Technological Trends In India Agritech Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Agritech Market

10 Impact Of Challenges On The India Agritech Market

11 Porter’s Five Forces Analysis

12 India Agritech Market: By Application Scope Key Takeaways

13 India Agritech Market, By Application Segment: Revenue Growth Analysis

14 Irrigation Market, 2021-2029 (USD Million)

15 Production and Maintenance Market, 2021-2029 (USD Million)

16 Supply Chain Market, 2021-2029 (USD Million)

17 Marketplace Market, 2021-2029 (USD Million)

18 Others Market, 2021-2029 (USD Million)

19 India Agritech Market: By Type Scope Key Takeaways

20 India Agritech Market, By Type Segment: Revenue Growth Analysis

21 Biotechnology and Biochemical Market, 2021-2029 (USD Million)

22 Big Data and Analytics Market, 2021-2029 (USD Million)

23 Sensors and Connected Devices Market, 2021-2029 (USD Million)

24 Mobility Market, 2021-2029 (USD Million)

25 Others Market, 2021-2029 (USD Million)

26 India Agritech Market Overview

27 India Agritech Market, By Application

28 India Agritech Market, By Type

29 India Agritech Market, By Country

30 Four Quadrant Positioning Matrix

31 Company Market Share Analysis

32 KhetiGaadi: Company Snapshot

33 KhetiGaadi: SWOT Analysis

34 KhetiGaadi: Geographic Presence

35 Crofarm : Company Snapshot

36 Crofarm : SWOT Analysis

37 Crofarm : Geographic Presence

38 Farm2Fam: Company Snapshot

39 Farm2Fam: SWOT Analysis

40 Farm2Fam: Geographic Presence

41 MeraKisan : Company Snapshot

42 MeraKisan : Swot Analysis

43 MeraKisan : Geographic Presence

44 FreshoKartz: Company Snapshot

45 FreshoKartz: SWOT Analysis

46 FreshoKartz: Geographic Presence

47 Stellapps : Company Snapshot

48 Stellapps : Swot Analysis

49 Stellapps : Geographic Presence

50 Ninjacart : Company Snapshot

51 Ninjacart : SWOT Analysis

52 Ninjacart : Geographic Presence

53 Intello Labs: Company Snapshot

54 Intello Labs: SWOT Analysis

55 Intello Labs: Geographic Presence

56 BharatAgri, Inc.: Company Snapshot

57 BharatAgri, Inc.: SWOT Analysis

58 BharatAgri, Inc.: Geographic Presence

59 Indigo Ag: Company Snapshot

60 Indigo Ag: SWOT Analysis

61 Indigo Ag: Geographic Presence

62 Other Companies: Company Snapshot

63 Other Companies: SWOT Analysis

64 Other Companies: Geographic Presence

The India India Agritech Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Agritech Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS