Global AI-enabled Cybersecurity Chip-Set Market Size, Trends & Analysis - Forecasts to 2027 By Application (Network Threat Analysis, Malware Detection, Security Analyst Augmentation, Threat Mitigation, and Other Applications), By Technology (Machine Learning, Natural Language Processing, Context-aware Computing, Computer Vision, and Predictive Analysis) By Region (North America, Asia Pacific, Europe, Central & South America, Middle East & Africa), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

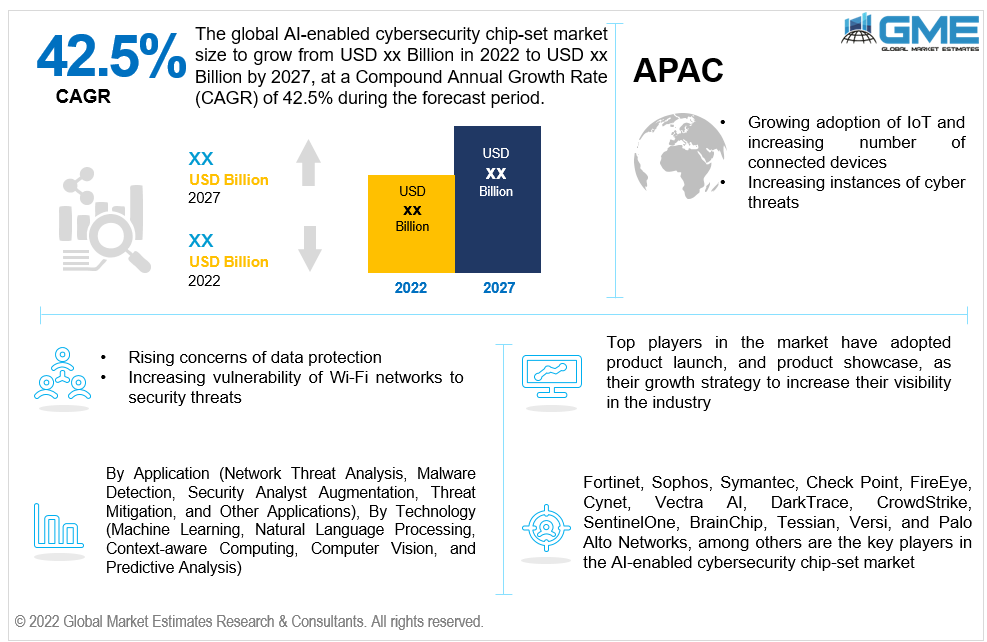

The global AI-enabled cybersecurity chip-set market will grow at a CAGR value of 42.5% during the forecast period of 2022 to 2027.

Specially designed chips which possess the AI technology and are used for machine learning purposes are called as AI enabled chip-set market, and the application of this technology in the cybersecurity industry is coined as AI-enabled cybersecurity chip-set. With the help of AI, most of the industries are bridging the gap between the consumer and the products. With the rising volume data across various end-user verticals, there is a need for a protocol that can solve mathematical and computational issues more efficiently.

According to a recent publication by the security giant McAfee, the global capital loss due to increasing cybercrime rate, is exceeded to over USD 1 trillion. This was an increase of more than 50% since 2018. Hence, due to which, the cybersecurity segment started adopting the AI-based chip-set technology which allowed the entry of artificial intelligence in the cyber world. The major companies focusing on AI-enabled cybersecurity chip-set are Tessian, Fortinet, Sophos, Symantec, Check Point, FireEye, and Cynet.

These companies use artificial intelligence in order to build a customisable email pattern that can easily detect and eradicate malware, help in accelerating threat detection in real-time, capital threat, to optimize the self-healing networks, and secure networks users, & endpoints against exploits ransomware & phishing.

Various countries including the United States has witnessed a gush of start-ups entering into the AI-enabled cybersecurity chip-set market. All these companies are mostly backed up with a range of venture capitalists and funding programs that will eventually help the market grow rapidly.

The global AI-enabled cybersecurity chip-set market is expected to propel rapidly during the forecast period mainly due to the factors, such as rapidly rising adoption of IoT and increasing purchase and sale of a wide range of connected devices in all sectors (especially healthcare), rising cases of cyber malware and cyber threats, increasing demand for data management, and increasing need for advanced level threat mitigation and network threat analysis.

Furthermore, rising demand for cloud-based security solutions among smaller players and rising adoption and use of social media platform for business promotions and marketing strategies are some of the prime reasons for the global market to grow rapidly.

The outbreak of the COVID-19 pandemic has impacted the AI-enabled cybersecurity chip-set market and it’s likely to be plunged in terms of growth rate since 2020. This is mainly affected because of supply chain disruption and the initial stage of AI chipset adoption getting hampered due to lockdowns and shift of industry priorities. Moreover, the supply chain disruption has led to a delay in the positive adoption of AI-based software and hardware products for cybersecurity industry. However, with the rising need for post pandemic data management and rapid malware detection, the market is likely to uplift itself post 2022.

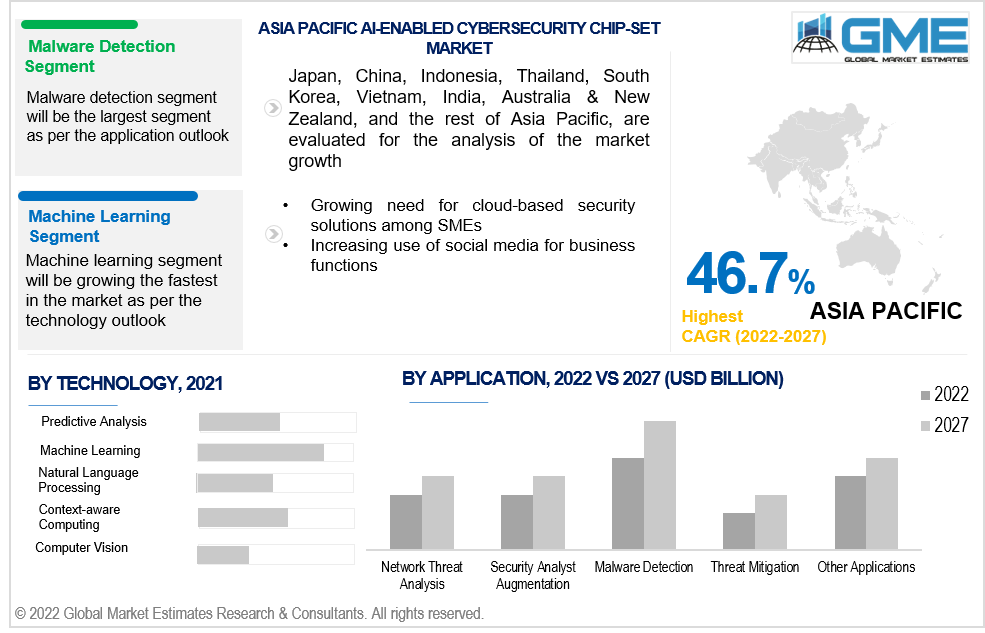

Based on the application segmentation, the AI-enabled cybersecurity chip-set market is divided into network threat analysis, malware detection, security analyst augmentation, threat mitigation, and other applications. The malware detection segment is expected to be the largest segment in the AI-enabled cybersecurity chip-set market from 2022 to 2027. Increasing number of cyber bulling, and cyber threats and rising demand for advanced malware detection systems are some of the factors supporting the growth of the segment in the market.

Based on the technology, the global AI-enabled cybersecurity chip-set market is divided into Machine Learning, Natural Language Processing, Context-aware Computing, Computer Vision, and Predictive Analysis. The machine learning segment are expected to be the fastest-growing segment in the market from 2022 to 2027. Machine learning uses artificial neural networks to learn multiple levels of data, such as texts, images, and sounds. Its algorithms help in identifying patterns from a set of unstructured data. The growing application of deep learning algorithms in the cybersecurity industry is a major driving force for the market.

As per the geographical analysis, the AI-enabled cybersecurity chip-set market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the AI-enabled Cybersecurity Chip-Set market from 2022 to 2027. The major factor driving the growth of the market in the North American region is the presence of top players in United States and rising concern related to security of critical infrastructure, data management, and rising adoption of antivirus and antimalware products. The rapid adoption of cloud-based services, along with the user-friendly approach of antivirus/antimalware solutions, are some of the other factors contributing to the regional growth.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the global AI-enabled cybersecurity chip-set market during the forecast period. Rising penetration of smart phones and increasing malware threats and cybercrimes across the region are few of the drivers supporting the growth of the AI-enabled cybersecurity chip-set market.

Fortinet, Sophos, Symantec, Check Point, FireEye, Cynet, Vectra AI, DarkTrace, CrowdStrike, SentinelOne, BrainChip, Tessian, Versi, and Palo Alto Networks, among others are the key players in the AI-enabled cybersecurity chip-set market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global AI-enabled Cybersecurity Chip-Set Market Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Technology Overview

2.1.4 Regional Overview

Chapter 3 Global AI-enabled Cybersecurity Chip-Set Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rapidly rising adoption of IoT and increasing purchase and sale of a wide range of connected devices in all sectors

3.3.2 Industry Challenges

3.3.2.1 Impact of COVID-19

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2022

3.11.1 Company Positioning Overview, 2022

Chapter 4 Global AI-enabled Cybersecurity Chip-Set Market, By Application

4.1 Application Outlook

4.2 Network Threat Analysis

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Malware Detection

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Security Analyst Augmentation

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Threat Mitigation

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

4.6 Other Applications

4.6.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Global AI-enabled Cybersecurity Chip-Set Market, By Technology

5.1 Technology Outlook

5.2 Machine Learning

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Natural Language Processing

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Context-aware Computing

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Computer Vision

5.5.1 Mark8et Size, By Region, 2022-2027 (USD Billion)

5.6 Predictive Analysis

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Global AI-enabled Cybersecurity Chip-Set Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Billion)

6.2.2 Market Size, By Application, 2022-2027 (USD Billion)

6.2.3 Market Size, By Technology, 2022-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2022-2027 (USD Billion)

6.2.4.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2022-2027 (USD Billion)

6.2.5.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Billion)

6.3.2 Market Size, By Application, 2022-2027 (USD Billion)

6.3.3 Market Size, By Technology, 2022-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2022-2027 (USD Billion)

6.3.4.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2022-2027 (USD Billion)

6.3.5.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Application, 2022-2027 (USD Billion)

6.3.6.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2022-2027 (USD Billion)

6.3.7.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2022-2027 (USD Billion)

6.3.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2022-2027 (USD Billion)

6.3.9.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Billion)

6.4.2 Market Size, By Application, 2022-2027 (USD Billion)

6.4.3 Market Size, By Technology, 2022-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Application, 2022-2027 (USD Billion)

6.4.4.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Application, 2022-2027 (USD Billion)

6.4.5.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2022-2027 (USD Billion)

6.4.6.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2022-2027 (USD Billion)

6.4.7.2 Market size, By Technology, 2022-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2022-2027 (USD Billion)

6.4.8.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Billion)

6.5.2 Market Size, By Application, 2022-2027 (USD Billion)

6.5.3 Market Size, By Technology, 2022-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2022-2027 (USD Billion)

6.5.4.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2022-2027 (USD Billion)

6.5.5.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2022-2027 (USD Billion)

6.5.6.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Billion)

6.6.2 Market Size, By Application, 2022-2027 (USD Billion)

6.6.3 Market Size, By Technology, 2022-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2022-2027 (USD Billion)

6.6.4.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2022-2027 (USD Billion)

6.6.5.2 Market Size, By Technology, 2022-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2022-2027 (USD Billion)

6.6.6.2 Market Size, By Technology, 2022-2027 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2022

7.2 Fortinet

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Sophos

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Symantec

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Check Point

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 FireEye

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Cynet

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Vectra AI

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 DarkTrace

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 CrowdStrike

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 SentinelOne

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 BrainChip

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Tessian

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Versi

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Palo Alto Networks

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.16 Other Companies

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info Graphic Analysis

The Global AI-enabled Cybersecurity Chip-Set Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the AI-enabled Cybersecurity Chip-Set Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS