Global AI Enabled E-Commerce Solutions Market Size, Trends & Analysis - Forecasts to 2026 By Technology (Deep Learning, Machine Learning, NLP), By Deployment (On-Premise, Cloud), By Application (Customer Relationship Management, Supply Chain Analysis, Fake Review Analysis, Warehouse Automation [Sorting and Placing, Inventory Storage], Merchandizing [Facets and Filter Selection, Multi Device Interaction], Product Recommendation, Customer Service [Chatbots]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

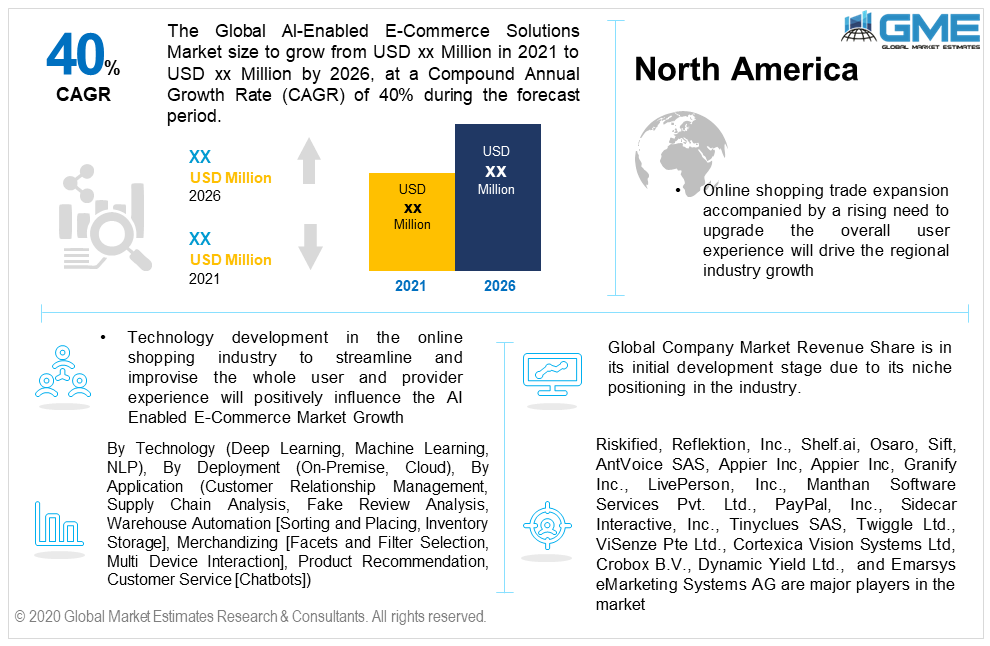

The Global AI Enabled E-Commerce Solutions Market is likely to observe around 40% CAGR up to 2026, with APAC witnessing the fastest growth. Technology development in the online shopping industry to streamline and improvise the whole user and provider experience will positively influence the AI Enabled E-Commerce Market Growth.

Understanding consumers' needs and preferences based on their shopping history, product searches, and demographic details provides a competitive edge to the vendor. This feature makes it easier for the sellers to target a specific customer group for a particular product category. Other factors which are helping the online vendors through artificial intelligence are inventory management, warehouse management, and merchandising.

Instant customer services related to product delivery, return, and complaints can be easily resolved through artificial intelligence-enabled chat boxes. Other features which are gaining high popularity in recent years are supply chain analysis, warehouse automation, product recommendation, fleet management, and merchandising. Artificial Intelligence deployment in online shopping has opened wide opportunities to sellers at a large level.

Deep learning, machine learning, and NLP among others are widely used technologies in the industry. Deep learning is the widely used technology in the industry due to its benefits and usage related to speech recognition, language translation, decision-making skillsets, and object detection program.

Machine learning technology allow software applications to function more accurately in terms of predictive analysis. This technology uses historical data to predict future outcomes. Machine learning helps the vendors in targeting different customer groups based on their shopping history, preference, and recurrence of the order.

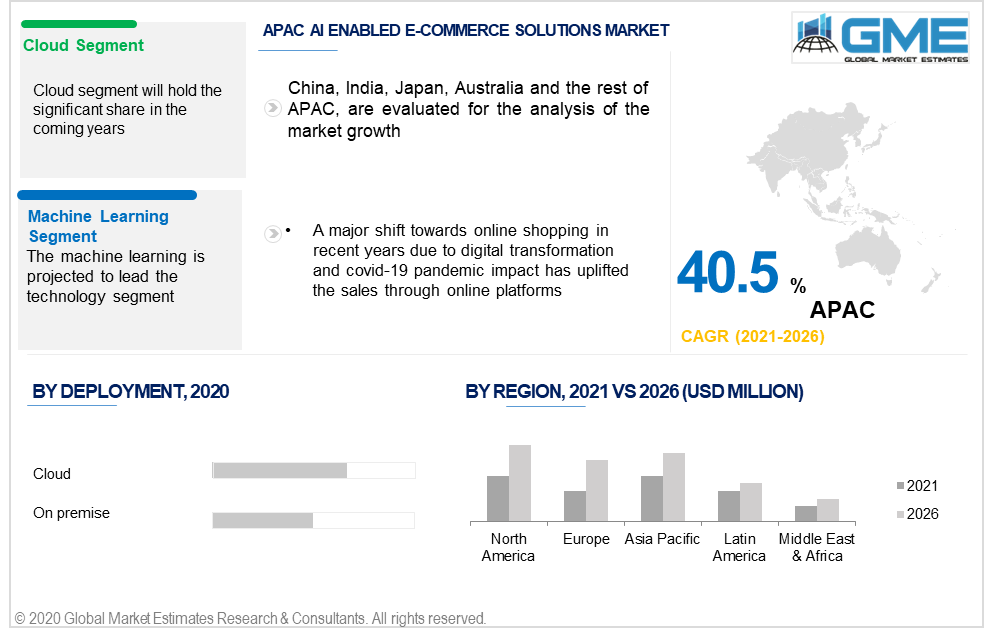

By deployment, the market is divided into cloud and on-premise. The cloud service dominated the overall deployment segment and is predicted to hold their dominance during the forecast period. Improved compatibility and suitability with the provider and end-user is among the major benefit offered in this segment. Other factors such as eliminating unnecessary elements and upgrading the overall user experience will support growth in this segment.

By application, the industry is categorized into customer relationship management, supply chain analysis, fake review analysis, warehouse automation, merchandising, product recommendation, customer service, and fleet management among others. Customer relationship management, customer service, and product recommendation are among the vastly used features in the industry. On target sales recommendation, customer retention, and repetitive sales are among the prime benefits gained from these applications.

Other applications which are gaining high usage are merchandising, supply chain analysis, and fleet management. These features help the vendor to save excessive cost, improving time management and streamline their inventory.

Due to the covid-19 impact, it became necessary for vendors to automate their warehouses. This not only curtails the extra cost but also results in restructuring the facility. The warehouse automation is further sub-segmented into sorting & placing and inventory storage.

North America, led by the U.S. and Canada will dominate the regional revenue share in 2019. The region is intended to account for more than 30% of the sales by 2026. Online shopping trade expansion accompanied by a rising need to upgrade the overall user experience will drive the regional industry growth. Consumer shopping pattern analysis, personalized product recommendations based on user shopping history, and targeting a specific consumer group for a particular product are the prime features adopted by many online vendors.

The Asia Pacific region is likely to observe the highest penetration and adoption during the forecast period. A major shift towards online shopping in recent years due to digital transformation and covid-19 pandemic impact has uplifted the sales through online platforms. The sale is not limited to any particular product, various products and services from diversified industries faced a surge in demand from the online sales channel. Grocery, apparel, medicine, and food takeout are the key categories that witnessed the highest demand in the region.

Huge technology advancement specifically in Artificial Intelligence adoption in the diversified consumer-centric field is likely to stimulate European AI Enabled E-Commerce Solutions Market growth. The presence of numerous providers along with increasing vendors' interest to expand their business online will support the regional industry growth.

Global company market revenue share is in its initial development stage due to its niche positioning in the industry. As of now, the market coverage is very limited, and only a few companies offering their services to the industry. However, increasing investment in trending technologies to upgrade an online shopping experience, will result in the entry of new market entrants to exploit the available white space in the industry.

Riskified, Reflektion, Inc., Shelf.ai, Osaro, Sift, AntVoice SAS, Appier Inc, Granify Inc., LivePerson, Inc., Manthan Software Services Pvt. Ltd., PayPal, Inc., Sidecar Interactive, Inc., Tinyclues SAS, Twiggle Ltd., ViSenze Pte Ltd., Cortexica Vision Systems Ltd, Crobox B.V., Dynamic Yield Ltd., and Emarsys eMarketing Systems AG are major players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

As of now, no company holds a significant revenue share to dominate the market. Wide scope in the industry due to rapid advancement in artificial intelligence-based shopping services will result in dynamic market growth.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 AI enabled e-commerce solutions industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Technology overview

2.1.3 Deployment overview

2.1.4 Application overview

2.1.5 Regional overview

Chapter 3 AI Enabled E-Commerce Solutions Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 AI Enabled E-Commerce Solutions Market, By Technology

4.1 Technology Outlook

4.2 Deep Learning

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Machine Learning

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 NLP

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Others

4.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 AI Enabled E-Commerce Solutions Market, By Deployment

5.1 Deployment Outlook

5.2 On-Premise

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Cloud

5.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 AI Enabled E-Commerce Solutions Market, By Application

6.1 Application Outlook

6.2 Customer Relationship Management

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Supply Chain Analysis

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Fake Review Analysis

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Warehouse Automation

6.5.1 Market size, by region, 2019-2026 (USD Million)

6.5.2 Sorting & placing

6.5.2.1 Market size, by region, 2019-2026 (USD Million)

6.5.3 Inventory storage

6.5.3.1 Market size, by region, 2019-2026 (USD Million)

6.5.4 Others

6.5.4.1 Market size, by region, 2019-2026 (USD Million)

6.6 Merchandising

6.6.1 Market size, by region, 2019-2026 (USD Million)

6.6.2 Facets and Filter selection

6.6.2.1 Market size, by region, 2019-2026 (USD Million)

6.6.3 Multi-Device Interaction

6.6.3.1 Market size, by region, 2019-2026 (USD Million)

6.6.4 Others

6.6.4.1 Market size, by region, 2019-2026 (USD Million)

6.7 Product Recommendation

6.7.1 Market size, by region, 2019-2026 (USD Million)

6.8 Customer Service

6.8.1 Market size, by region, 2019-2026 (USD Million)

6.8.2 Chat-bots

6.8.2.1 Market size, by region, 2019-2026 (USD Million)

6.8.3 Others

6.8.3.1 Market size, by region, 2019-2026 (USD Million)

6.9 Fleet Management

6.9.1 Market size, by region, 2019-2026 (USD Million)

6.10 Others

6.10.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 AI Enabled E-Commerce Solutions Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by technology, 2019-2026 (USD Million)

7.2.3 Market size, by deployment, 2019-2026 (USD Million)

7.2.4 Market size, by application, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by technology, 2019-2026 (USD Million)

7.2.5.2 Market size, by deployment, 2019-2026 (USD Million)

7.2.5.3 Market size, by application, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by technology, 2019-2026 (USD Million)

7.2.6.2 Market size, by deployment, 2019-2026 (USD Million)

7.2.6.3 Market size, by application, 2019-2026 (USD Million)

7.2.7 Mexico

7.2.7.1 Market size, by technology, 2019-2026 (USD Million)

7.2.7.2 Market size, by deployment, 2019-2026 (USD Million)

7.2.7.3 Market size, by application, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by technology, 2019-2026 (USD Million)

7.3.3 Market size, by deployment, 2019-2026 (USD Million)

7.3.4 Market size, by application, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by technology, 2019-2026 (USD Million)

7.2.5.2 Market size, by deployment, 2019-2026 (USD Million)

7.2.5.3 Market size, by application, 2019-2026 (USD Million)

7.3.6 Spain

7.3.6.1 Market size, by technology, 2019-2026 (USD Million)

7.3.6.2 Market size, by deployment, 2019-2026 (USD Million)

7.3.6.3 Market size, by application, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by technology, 2019-2026 (USD Million)

7.3.7.2 Market size, by deployment, 2019-2026 (USD Million)

7.3.7.3 Market size, by application, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by technology, 2019-2026 (USD Million)

7.3.8.2 Market size, by deployment, 2019-2026 (USD Million)

7.3.8.3 Market size, by application, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by technology, 2019-2026 (USD Million)

7.4.3 Market size, by deployment, 2019-2026 (USD Million)

7.4.4 Market size, by application, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by technology, 2019-2026 (USD Million)

7.4.5.2 Market size, by deployment, 2019-2026 (USD Million)

7.4.5.3 Market size, by application, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by technology, 2019-2026 (USD Million)

7.4.6.2 Market size, by deployment, 2019-2026 (USD Million)

7.4.6.3 Market size, by application, 2019-2026 (USD Million)

7.4.7 Malaysia

7.4.7.1 Market size, by technology, 2019-2026 (USD Million)

7.4.7.2 Market size, by deployment, 2019-2026 (USD Million)

7.4.7.3 Market size, by application, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by technology, 2019-2026 (USD Million)

7.4.8.2 Market size, by deployment, 2019-2026 (USD Million)

7.4.8.3 Market size, by application, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by technology, 2019-2026 (USD Million)

7.4.9.2 Market size, by deployment, 2019-2026 (USD Million)

7.4.9.3 Market size, by application, 2019-2026 (USD Million)

7.5 Central & South America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by technology, 2019-2026 (USD Million)

7.5.3 Market size, by deployment, 2019-2026 (USD Million)

7.5.4 Market size, by application, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by technology, 2019-2026 (USD Million)

7.5.5.2 Market size, by deployment, 2019-2026 (USD Million)

7.5.5.3 Market size, by application, 2019-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market size, by technology, 2019-2026 (USD Million)

7.5.6.2 Market size, by deployment, 2019-2026 (USD Million)

7.5.6.3 Market size, by application, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by technology, 2019-2026 (USD Million)

7.6.3 Market size, by deployment, 2019-2026 (USD Million)

7.6.4 Market size, by application, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by technology, 2019-2026 (USD Million)

7.6.5.2 Market size, by deployment, 2019-2026 (USD Million)

7.6.5.3 Market size, by application, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by technology, 2019-2026 (USD Million)

7.6.6.2 Market size, by deployment, 2019-2026 (USD Million)

7.6.6.3 Market size, by application, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by technology, 2019-2026 (USD Million)

7.6.7.2 Market size, by deployment, 2019-2026 (USD Million)

7.6.7.3 Market size, by application, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Riskified

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Reflektion, Inc.

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Shelf.ai

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Osaro

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Sift

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 AntVoice SAS

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Appier Inc

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Eversight, Inc.

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Granify Inc.

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 LivePerson, Inc.

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Manthan Software Services Pvt. Ltd.

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 PayPal, Inc.

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Sidecar Interactive, Inc.

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Tinyclues SAS

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Twiggle Ltd.

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

The Global AI Enabled E-Commerce Solutions Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the AI Enabled E-Commerce Solutions Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS