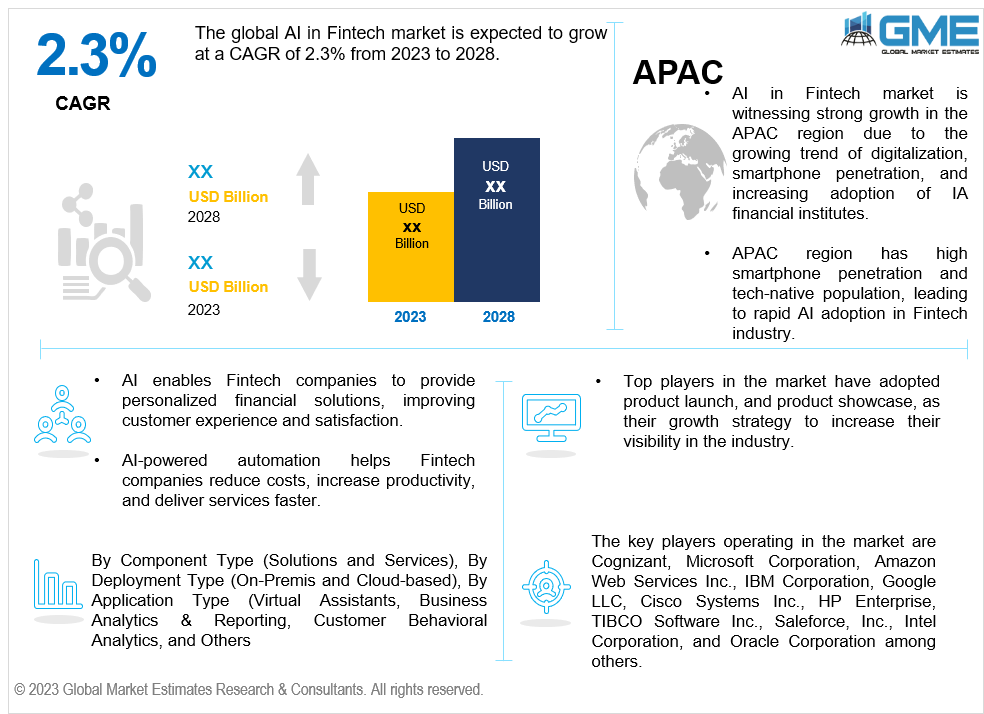

Global AI in Fintech Market Size, Trends & Analysis - Forecasts to 2028 By Component Type (Solutions and Services), By Deployment Type (On-Premise and Cloud-based), By Application Type (Virtual Assistants, Business Analytics & Reporting, Customer Behavioral Analytics, and Others) and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global AI in Fintech market is expected to grow at a CAGR of 2.3% from 2023 to 2028. AI is increasingly gaining adoption in finance organizations for the detection and prevention of fraud, risk assessment and underwriting, customer service and chatbots, robo-advisors, algorithmic trading, compliance and regulatory processes, and automated portfolio management. The use of AI in finance sector can easily analyze the large volume to find trends and discrepancies. Hence, the adoption of AI technology has enabled financial institutions, startups, and other Fintech companies to automate processes, enhance decision-making, and deliver personalized services to customers. Moreover, the use of AI in fintech sector has enabled digital loans, credit scores, mobile banking, insurance, purchasing and selling operations, and asset management. For instance, the Data intelligence platform Bud Financial introduced a new AI-powered product, ‘Drive’, in November 2023, that allows financial institutions to perform advanced data analytics tasks for personalization, marketing, customer segmentation and customer monitoring. The solution also allows companies to identify “patterns and real-time opportunities” for cross-selling and up-selling and can be integrated into banks’ existing tech stacks.

The global AI in Fintech market is experiencing significant growth and can be attributed to increasing demand for personalized financial services, automation and cost efficiency, enhanced fraud detection and security, advanced data analytics, regulatory compliance, digital banking and mobile payments, and collaboration between

Fintech startup and established financial institutions. Furthermore, key players in the market are coming up with new products with added features to serve better is expected to further escalate the market growth. The growing trend of digitalization due to increasing penetration of the internet is expected to favor market growth in the near future. International Telecommunication Union estimates that approximately 5.4 billion people – or 67 percent of the world’s population – are using the Internet in 2023. This represents an increase of 45 percent since 2018, with 1.7 billion people estimated to have come online during that period.

However, factors such as privacy and security concerns, lack of regulatory clarity, ethical considerations and biases, lack of skilled professionals, resistance to change, complex legacy systems, trust and user acceptance, and economic factors are projected to hamper the market growth.

Based on component type, the market is segmented into solutions and services. The solutions segment is expected to dominate the market during the forecast period. This is attributed to software tools that support easy AI deployment for extracting complete and correct data, detecting financial fraud, and enhance customer relationships.

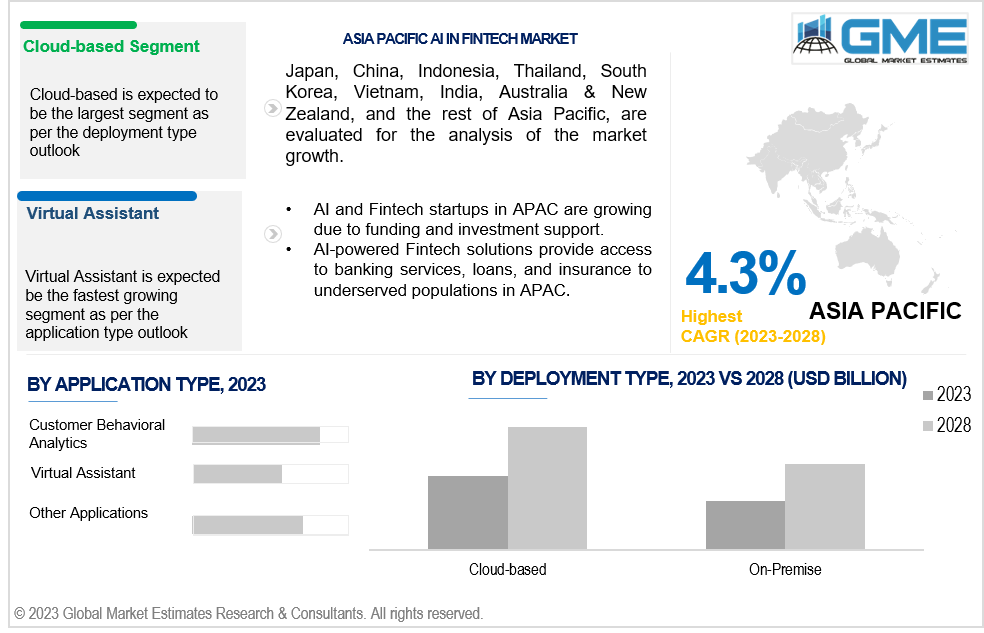

Based on deployment type, the market is segmented into on-premise and cloud-based. The cloud-based segment is expected to hold a leading position in market during the forecast period. Cloud-based solutions offer scalability, cost efficiency, rapid deployment, access and collaboration, and data storage and processing for Fintech companies seeking to implement AI technologies. Cloud platforms also provide data storage, security, compliance, and integration with AI services, making them attractive for Fintech companies.

Based on application type, the market is segmented into virtual assistants, business analytics & reporting, customer behavioral analytics, and others. The virtual assistant segment is projected to dominate the market during the forecast period owing to the growing need for identifying hazards related to customers and monitoring client behaviour. Virtual assistants offer an efficient and personalized customer service experience, cost savings, convenience and accessibility, natural language processing capabilities, integration with multiple services, continuous learning and improvement, and voice assistants and smart speakers.

Regionally, North America is estimated to hold the dominant position in the global AI in Fintech market during the forecast period. This is attributed to the fact that it has a robust ecosystem that fosters the development and adoption of AI technologies in various industries, including Fintech. Moreover, the region is home to many established financial institutions, such as banks, investment firms, and insurance companies, which have the resources and willingness to invest in AI technologies. North America has a well-defined regulatory environment that supports innovation and entrepreneurship. Venture capital investments in the Fintech sector fuel the growth of Fintech startups and encourage the development of AI-based solutions. However, North America is mature in terms of Fintech adoption, with a high level of digitalization in financial services. Collaboration between Fintech and traditional financial institutions has increased, making North America a prominent region in the global market.

Asia Pacific is projected to experience the fastest growth in the global AI in Fintech market with a CAGR of over 4.3%. The APAC region has seen a significant rise in the adoption of Fintech solutions due to factors such as rising digitalization, increasing smartphone penetration, and a large unbanked population seeking access to financial services. AI-powered Fintech solutions offer the potential to bridge the financial inclusion gap by providing access to banking services, loans, and insurance to previously underserved populations. Fintech companies and financial institutions in the APAC region are actively collaborating with technology companies and startups to leverage AI capabilities. These partnerships enable the development of innovative AI-powered solutions and accelerate their adoption in the market. Hence, the APAC region has emerged as a promising region for AI in Fintech market.

The key players operating in the market are Cognizant, Microsoft Corporation, Amazon Web Services Inc., IBM Corporation, Google LLC, Cisco Systems Inc., HP Enterprise, TIBCO Software Inc., Saleforce, Inc., Intel Corporation, and Oracle Corporation among others. The global AI in Fintech market has observed several strategic alliances between companies to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AI IN FINTECH MARKET, BY COMPONENT TYPE

4.1 Introduction

4.2 AI in Fintech Market: Component Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Solutions

4.4.1 Solutions Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Services

4.5.1 Services Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL AI IN FINTECH MARKET, BY DEPLOYMENT TYPE

5.1 Introduction

5.2 AI in Fintech Market: Deployment Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 On-Premise

5.4.1 On-Premise Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Cloud-based

5.5.1 Cloud-based Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL AI IN FINTECH MARKET, BY APPLICATION TYPE

6.1 Introduction

6.2 AI in Fintech Market: Application Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Virtual Assistants

6.4.1 Virtual Assistants Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Business Analytics & Reporting

6.5.1 Business Analytics & Reporting Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Customer Behavioral Analytics

6.9.1 Customer Behavioral Analytics Market Estimates and Forecast, 2020-2028 (USD Million)

6.7 Other Applications

6.7.1 Other Applications Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL AI IN FINTECH MARKET, BY REGION

7.1 Introduction

7.2 North America AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Component Type

7.2.2 By Deployment Type

7.2.3 By Application Type

7.2.4 By Country

7.2.4.1 U.S. AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Component Type

7.2.4.1.2 By Deployment Type

7.2.4.1.3 By Application Type

7.2.4.2 Canada AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Component Type

7.2.4.2.2 By Deployment Type

7.2.4.2.3 By Application Type

7.2.4.3 Mexico AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Component Type

7.2.4.3.2 By Deployment Type

7.2.4.3.3 By Application Type

7.3 Europe AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Component Type

7.3.2 By Deployment Type

7.3.3 By Application Type

7.3.4 By Country

7.3.4.1 Germany AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Component Type

7.3.4.1.2 By Deployment Type

7.3.4.1.3 By Application Type

7.3.4.2 U.K. AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Component Type

7.3.4.2.2 By Deployment Type

7.3.4.2.3 By Application Type

7.3.4.3 France AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Component Type

7.3.4.3.2 By Deployment Type

7.3.4.3.3 By Application Type

7.3.4.4 Italy AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Component Type

7.3.4.4.2 By Deployment Type

7.2.4.4.3 By Application Type

7.3.4.5 Spain AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5.1 By Component Type

7.3.4.5.2 By Deployment Type

7.2.4.5.3 By Application Type

7.3.4.6 Netherlands AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Component Type

7.3.4.7.2 By Deployment Type

7.2.4.7.3 By Application Type

7.3.4.7 Rest of Europe AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Component Type

7.3.4.7.2 By Deployment Type

7.2.4.7.3 By Application Type

7.4 Asia Pacific AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.1 By Component Type

7.4.2 By Deployment Type

7.4.3 By Application Type

7.4.4 By Country

7.4.4.1 China AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1.1 By Component Type

7.4.4.1.2 By Deployment Type

7.4.4.1.3 By Application Type

7.4.4.2 Japan AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2.1 By Component Type

7.4.4.2.2 By Deployment Type

7.4.4.2.3 By Application Type

7.4.4.3 India AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3.1 By Component Type

7.4.4.3.2 By Deployment Type

7.4.4.3.3 By Application Type

7.4.4.4 South Korea AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4.1 By Component Type

7.4.4.4.2 By Deployment Type

7.4.4.4.3 By Application Type

7.4.4.5 Singapore AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5.1 By Component Type

7.4.4.5.2 By Deployment Type

7.4.4.5.3 By Application Type

7.4.4.6 Malaysia AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Component Type

7.4.4.7.2 By Deployment Type

7.4.4.7.3 By Application Type

7.4.4.7 Thailand AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Component Type

7.4.4.7.2 By Deployment Type

7.4.4.7.3 By Application Type

7.4.4.8 Indonesia AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8.1 By Component Type

7.4.4.8.2 By Deployment Type

7.4.4.8.3 By Application Type

7.4.4.9 Vietnam AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9.1 By Component Type

7.4.4.9.2 By Deployment Type

7.4.4.9.3 By Application Type

7.4.4.10 Taiwan AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.1 By Component Type

7.4.4.10.2 By Deployment Type

7.4.4.10.3 By Application Type

7.4.4.11 Rest of Asia Pacific AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.1 By Component Type

7.4.4.11.2 By Deployment Type

7.4.4.11.3 By Application Type

7.5 Middle East and Africa AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 By Component Type

7.5.2 By Deployment Type

7.5.3 By Application Type

7.5.4 By Country

7.5.4.1 Saudi Arabia AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1.1 By Component Type

7.5.4.1.2 By Deployment Type

7.5.4.1.3 By Application Type

7.5.4.2 U.A.E. AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2.1 By Component Type

7.5.4.2.2 By Deployment Type

7.5.4.2.3 By Application Type

7.5.4.3 Israel AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3.1 By Component Type

7.5.4.3.2 By Deployment Type

7.5.4.3.3 By Application Type

7.5.4.4 South Africa AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4.1 By Component Type

7.5.4.4.2 By Deployment Type

7.5.4.4.3 By Application Type

7.5.4.5 Rest of Middle East and Africa AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.5.1 By Component Type

7.5.4.5.2 By Deployment Type

7.5.4.5.2 By Application Type

7.6 Central & South America AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.1 By Component Type

7.7.2 By Deployment Type

7.7.3 By Application Type

7.7.4 By Country

7.7.4.1 Brazil AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.1.1 By Component Type

7.7.4.1.2 By Deployment Type

7.7.4.1.3 By Application Type

7.7.4.2 Argentina AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.2.1 By Component Type

7.7.4.2.2 By Deployment Type

7.7.4.2.3 By Application Type

7.7.4.3 Chile AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.3.1 By Component Type

7.7.4.3.2 By Deployment Type

7.7.4.3.3 By Application Type

7.7.4.4 Rest of Central & South America AI in Fintech Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.4.1 By Component Type

7.7.4.4.2 By Deployment Type

7.7.4.4.3 By Application Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Intel Corp.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Oracle Corp.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 IBM Corp.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Microsoft Corp.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Google LLC

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 AWS Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 Cisco Systems Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 HP Enterprise

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Cognizant

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Other Companies

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Type of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global AI in Fintech Market, By Component Type, 2020-2028 (USD Mllion)

2 Solutions Market, By Region, 2020-2028 (USD Mllion)

3 Services Market, By Region, 2020-2028 (USD Mllion)

4 Global AI in Fintech Market, By Deployment Type, 2020-2028 (USD Mllion)

5 On-Premise Market, By Region, 2020-2028 (USD Mllion)

6 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

7 Global AI in Fintech Market, By Application Type, 2020-2028 (USD Mllion)

8 Virtual Assistants Market, By Region, 2020-2028 (USD Mllion)

9 Business Analytics & Reporting Market, By Region, 2020-2028 (USD Mllion)

10 Customer Behavioral Analytics Market, By Region, 2020-2028 (USD Mllion)

11 Other Applications Market, By Region, 2020-2028 (USD Mllion)

12 Regional Analysis, 2020-2028 (USD Mllion)

13 North America AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

14 North America AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

15 North America AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

16 North America AI in Fintech Market, By Country, 2020-2028 (USD Million)

17 U.S AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

18 U.S AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

19 U.S AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

20 Canada AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

21 Canada AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

22 Canada AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

23 Mexico AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

24 Mexico AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

25 Mexico AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

26 Europe AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

27 Europe AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

28 Europe AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

29 Europe AI in Fintech Market, By country, 2020-2028 (USD Million)

30 Germany AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

31 Germany AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

32 Germany AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

33 UK AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

34 UK AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

35 UK AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

36 France AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

37 France AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

38 France AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

39 Italy AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

40 Italy AI in Fintech Market, By T Deployment Type Type, 2020-2028 (USD Million)

41 Italy AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

42 Spain AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

43 Spain AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

44 Spain AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

45 Rest Of Europe AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

46 Rest Of Europe AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

47 Rest of Europe AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

48 Asia Pacific AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

49 Asia Pacific AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

50 Asia Pacific AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

51 Asia Pacific AI in Fintech Market, By Country, 2020-2028 (USD Million)

52 China AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

53 China AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

54 China AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

55 India AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

56 India AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

57 India AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

58 Japan AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

59 Japan AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

60 Japan AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

61 South Korea AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

62 South Korea AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

63 South Korea AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

64 Middle East and Africa AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

65 Middle East and Africa AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

66 Middle East and Africa AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

67 Middle East and Africa AI in Fintech Market, By Country, 2020-2028 (USD Million)

68 Saudi Arabia AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

69 Saudi Arabia AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

70 Saudi Arabia AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

71 UAE AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

72 UAE AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

73 UAE AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

74 Central & South America AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

75 Central & South America AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

76 Central & South America AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

77 Central & South America AI in Fintech Market, By Country, 2020-2028 (USD Million)

78 Brazil AI in Fintech Market, By Component Type, 2020-2028 (USD Million)

79 Brazil AI in Fintech Market, By Deployment Type, 2020-2028 (USD Million)

80 Brazil AI in Fintech Market, By Application Type, 2020-2028 (USD Million)

81 Intel Corp.: Products & Services Offering

82 Oracle Corp.: Products & Services Offering

83 IBM Corp.: Products & Services Offering

84 Microsoft Corp.: Products & Services Offering

85 Google LLC: Products & Services Offering

86 AWS INC.: Products & Services Offering

87 Cisco Systems Inc.: Products & Services Offering

88 HP Enterprise: Products & Services Offering

89 Cognizant, Inc: Products & Services Offering

90 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global AI in Fintech Market Overview

2 Global AI in Fintech Market Value From 2020-2028 (USD Mllion)

3 Global AI in Fintech Market Share, By Component Type (2022)

4 Global AI in Fintech Market Share, By Deployment Type (2022)

5 Global AI in Fintech Market Share, By Application Type (2022)

6 Global AI in Fintech Market, By Region (Asia Pacific Market)

7 Technological Trends In Global AI in Fintech Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global AI in Fintech Market

11 Impact Of Challenges On The Global AI in Fintech Market

12 Porter’s Five Forces Analysis

13 Global AI in Fintech Market: By Component Type Scope Key Takeaways

14 Global AI in Fintech Market, By Component Type Segment: Revenue Growth Analysis

15 Solutions Market, By Region, 2020-2028 (USD Mllion)

16 Services Market, By Region, 2020-2028 (USD Mllion)

17 Global AI in Fintech Market: By Deployment Type Scope Key Takeaways

18 Global AI in Fintech Market, By Deployment Type Segment: Revenue Growth Analysis

19 On-Premise Market, By Region, 2020-2028 (USD Mllion)

20 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

21 Global AI in Fintech Market: By Application Type Scope Key Takeaways

22 Global AI in Fintech Market, By Application Type Segment: Revenue Growth Analysis

23 Virtual Assistants Market, By Region, 2020-2028 (USD Mllion)

24 Business Analytics & Reporting Market, By Region, 2020-2028 (USD Mllion)

25 Customer Behavioral Analytics Market, By Region, 2020-2028 (USD Mllion)

26 Other Applications Market, By Region, 2020-2028 (USD Mllion)

27 Regional Segment: Revenue Growth Analysis

28 Global AI in Fintech Market: Regional Analysis

29 North America AI in Fintech Market Overview

30 North America AI in Fintech Market, By Component Type

31 North America AI in Fintech Market, By Deployment Type

32 North America AI in Fintech Market, By Application Type

33 North America AI in Fintech Market, By Country

34 U.S. AI in Fintech Market, By Component Type

35 U.S. AI in Fintech Market, By Deployment Type

36 U.S. AI in Fintech Market, By Application Type

37 Canada AI in Fintech Market, By Component Type

38 Canada AI in Fintech Market, By Deployment Type

39 Canada AI in Fintech Market, By Application Type

40 Mexico AI in Fintech Market, By Component Type

41 Mexico AI in Fintech Market, By Deployment Type

42 Mexico AI in Fintech Market, By Application Type

43 Four Quadrant Positioning Matrix

44 Company Market Share Analysis

45 Intel Corp.: Company Snapshot

46 Intel Corp.: SWOT Analysis

47 Intel Corp.: Geographic Presence

48 Oracle Corp.: Company Snapshot

49 Oracle Corp.: SWOT Analysis

50 Oracle Corp.: Geographic Presence

51 IBM Corp.: Company Snapshot

52 IBM Corp.: SWOT Analysis

53 IBM Corp.: Geographic Presence

54 Microsoft Corp.: Company Snapshot

55 Microsoft Corp.: Swot Analysis

56 Microsoft Corp.: Geographic Presence

57 Google LLC: Company Snapshot

58 Google LLC: SWOT Analysis

59 Google LLC: Geographic Presence

60 AWS Inc.: Company Snapshot

61 AWS Inc.: SWOT Analysis

62 AWS Inc.: Geographic Presence

63 Cisco Systems Inc.: Company Snapshot

64 Cisco Systems Inc.: SWOT Analysis

65 Cisco Systems Inc.: Geographic Presence

66 HP Enterprise: Company Snapshot

67 HP Enterprise: SWOT Analysis

68 HP Enterprise: Geographic Presence

69 Cognizant, Inc.: Company Snapshot

70 Cognizant, Inc.: SWOT Analysis

71 Cognizant, Inc.: Geographic Presence

72 Other Companies: Company Snapshot

73 Other Companies: SWOT Analysis

74 Other Companies: Geographic Presence

The Global AI in Fintech Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the AI in Fintech Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS