Global Aircraft and Marine Turbochargers Market Size, Trends & Analysis - Forecasts to 2027 By Component (Compressor, Turbine, Shaft, Others (Waste Gate Butterfly, Waste Gate Actuator, Throttle Butterfly, and Over Boost Control Valve)), By Platform (Aircraft, Ultralight (Turboprop), Ultralight (Piston), Marine, Military Ships, Commercial Ships, Unmanned Aerial Vehicle (UAV), Tactical UAV, Strategic UAV, Special Purpose UAV), By Technology (Single-turbo, Twin-turbo, Electro-assist Turbo, Variable Geometry Turbocharger), By Region (North America, Asia Pacific, Central and South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

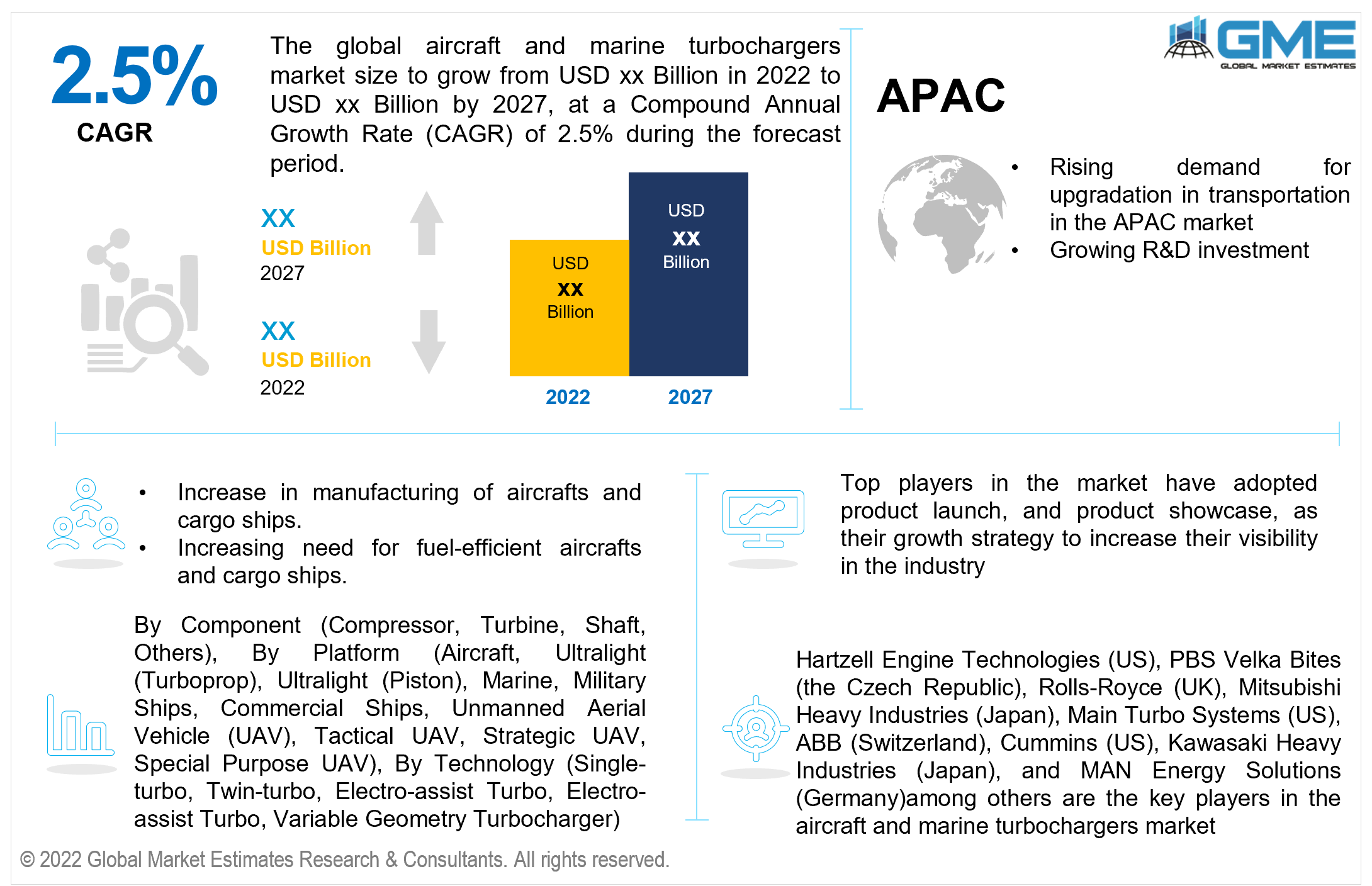

The Global Aircraft and Marine Turbochargers Market is projected to grow at a CAGR value of 2.5% from 2022 to 2027.

Aircrafts and marine transport form a very important part for both tourism and trade. There has been consistent research and development in order to improve the efficiency of these transport systems especially with regards to fuel management and efficiency in speed. Turbochargers are turbine driven device that is used in a piston engine which would lead to higher generation of power. The turbochargers’ ability to recover energy in the exhaust stream to power the turbine led to better fuel results and a more efficient aircraft and marine transport systems.

The market will be driven during the forecast period by growing additions in the number of aircraft and marine transport produced, increasing demand for vehicles that are fuel-efficient and have better engine performance and the tremendous growth of air and maritime tourism and trade.

Furthermore, increasing investments in the aviation and maritime industry by governments and innovative research and development in these industries are also factors that will boost the aircraft and marine turbochargers markets.

The COVID-19 pandemic has disrupted the globalized trade system and has also affected the tourism sector. The pandemic has affected the aircraft and cargo ships manufacturing sectors due to unavailability of skilled labour along with supply-side constraints. The highly contagious nature of the coronavirus disease has also affected the usage of public transportation and manufacturing too, However, the post pandemic period is seeing a boost in the tourism sector with people increasing their demand for flights and cruise travelling. There are also attempts to being bank the globalization situation to normalcy by increasing trade ties between countries and regions. The manufacturers will find the post-pandemic situation to be conducive for the sales of aircraft and marine turbochargers.

The transportation and logistics industry has seen severe disruptions in its activity owing to the conflict between Russia and Ukraine. Disruption in trade routes owing to blockades in the Black Sea and other shipping routes has seen a fall in demand for shipping through seaways. With major shipping companies stopping services to and from Russia, the demand for marine services is expected to fall in the two countries.

The shaft segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

The shaft is an important component of aircraft and marine turbochargers The shaft combines both the compressor wheel and the gas turbine wheel to increase the intake air pressure of the engine. Innovations such as the two-shaft turbocharger which will lead to more efficiency, is also set to propel the segment.

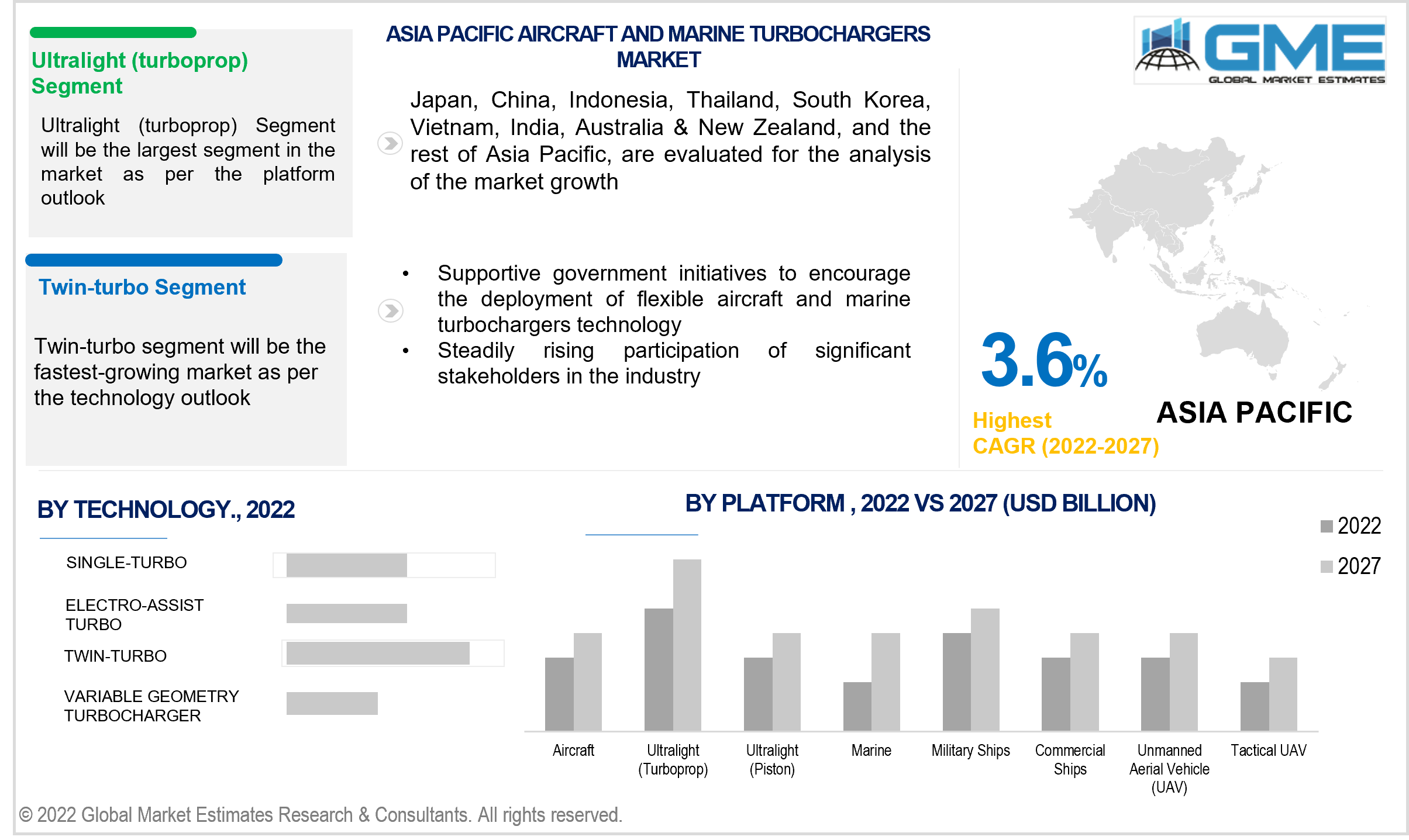

The ultralight (turboprop) segment is expected to be largest segment in the market from 2022 to 2027.

As opposed to traditional jet engines which have engine inlets, ultralight (turboprop) provides a more advanced version with the general aviation applications. The engines provide energy to propellers which rotate at high speeds which is then transferred later to the gear boxes. Ultralight (turboprop) will lead in the market due to its fuel-efficient features.

The twin-turbo charger segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

In twin-turbochargers, the turbine housing is made up of two parts which can be accessed via a flap. Some engines make use of twin-turbochargers in order to maximize the exhaust gas energy. The advantage of a twin-turbo is that it works with the same power as two turbos but takes space of only one turbo making it an efficient investment for manufacturers.

North America (the United States, Canada, and Mexico) will have a dominant share in the Aircraft and Marine Turbochargers market from 2022 to 2027. The major factor driving the growth of the market in the North American region is the increase in manufacturing of aircrafts and cargo ships and cruise ships, rising demand for upgradation in air and water transportation and growing need for fuel-efficient solutions in the transportation sector.

The North American market is dominated by the United States owing to the growing investment in aircraft and defense industries, growing demand for extreme sports, and increasing demand for recreational maritime activities are the major factors of the growth in the United States.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the Aircraft and Marine Turbochargers market during the forecast period. Increasing number of passengers for both air and marine transport, rising technological advancements in the aviation and marine industry and growth of trade and tourism in the region will propel the aircraft and marine turbochargers market in the Asia Pacific region.

The market in China has been growing significantly in recent years. The Chinese market has dominated the APAC region owing to the large demand for shipping and logistics industry. The growing demand for air travel and increased spending on aerospace and defense application in the country.

Hartzell Engine Technologies (US), PBS Velka Bites (the Czech Republic), Rolls-Royce (UK), Mitsubishi Heavy Industries (Japan), Main Turbo Systems (US), ABB (Switzerland), Cummins (US), Kawasaki Heavy Industries (Japan), and MAN Energy Solutions (Germany) among others are the key players in the aircraft and marine turbochargers market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources: World Bank, MPEC, IMF, IMO, and other Maritime Organizations

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Component Outlook

2.3 Platform Outlook

2.4 Technology Outlook

2.5 Regional Outlook

Chapter 3 Global Aircraft and Marine Turbochargers Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Aircraft and Marine Turbochargers Market

3.4 Metric Data on Cash Transactions

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Aircraft and Marine Turbochargers Market: Component Trend Analysis

4.1 Component: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Compressor

4.2.1 Market Estimates & Forecast Analysis of Compressor Segment, By Region, 2019-2027 (USD Billion)

4.3 Turbine

4.3.1 Market Estimates & Forecast Analysis of Turbine Segment, By Region, 2019-2027 (USD Billion)

4.4 Shaft

4.4.1 Market Estimates & Forecast Analysis of Shaft Segment, By Region, 2019-2027 (USD Billion)

4.5 Others

4.5.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Aircraft and Marine Turbochargers Market: Platform Trend Analysis

5.1 Platform: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Aircraft

5.2.1 Market Estimates & Forecast Analysis of Aircraft Segment, By Region, 2019-2027 (USD Billion)

5.3 Ultralight (Turboprop)

5.3.1 Market Estimates & Forecast Analysis of Ultralight (Turboprop) Segment, By Region, 2019-2027 (USD Billion)

5.4 Ultralight (Piston)

5.4.1 Market Estimates & Forecast Analysis of Ultralight (Piston) Segment, By Region, 2019-2027 (USD Billion)

5.5 Marine

5.5.1 Market Estimates & Forecast Analysis of Marine Segment, By Region, 2019-2027 (USD Billion)

5.6 Military Ships

5.6.1 Market Estimates & Forecast Analysis of Military Ships Segment, By Region, 2019-2027 (USD Billion)

5.7 Commercial Ships

5.7.1 Market Estimates & Forecast Analysis of Commercial Ships Segment, By Region, 2019-2027 (USD Billion)

5.8 Unmanned Aerial Vehicle (UAV)

5.8.1 Market Estimates & Forecast Analysis of Unmanned Aerial Vehicle (UAV) Segment, By Region, 2019-2027 (USD Billion)

5.9 Tactical UAV

5.9.1 Market Estimates & Forecast Analysis of Tactical UAV Segment, By Region, 2019-2027 (USD Billion)

5.9 Strategic UAV

5.9.1 Market Estimates & Forecast Analysis of Strategic UAV Segment, By Region, 2019-2027 (USD Billion)

5.10 Special Purpose UAV

5.10.1 Market Estimates & Forecast Analysis of Special Purpose UAV Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Aircraft and Marine Turbochargers Market: Technology Trend Analysis

6.1 Technology: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 Single-turbo

6.2.1 Market Estimates & Forecast Analysis of Single-turbo Technology Segment, By Region, 2019-2027 (USD Billion)

6.3 Twin-turbo

6.3.1 Market Estimates & Forecast Analysis of Twin-turbo Technology Segment, By Region, 2019-2027 (USD Billion)

6.4 Electro-assist Turbo

6.4.1 Market Estimates & Forecast Analysis of Electro-assist Turbo Technology Segment, By Region, 2019-2027 (USD Billion)

6.5 Variable Geometry Turbocharger

6.5.1 Market Estimates & Forecast Analysis of Variable Geometry Turbocharger Technology Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Aircraft and Marine Turbochargers Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.7 Mexico

7.5.5.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.7.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.8 Russia

7.3.8.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.8.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.9.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.11.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.11.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.3.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.6 United Arab Emirates

7.6.6.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

7.5.8 Rest of Middle East & Africa

7.5.8.1 Market Estimates & Forecast Analysis, By Component, 2019-2027 (USD Billion)

7.5.8.2 Market Estimates & Forecast Analysis, By Platform, 2019-2027 (USD Billion)

7.5.8.3 Market Estimates & Forecast Analysis, By Technology, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Hartzell Engine Technologies

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 PBS Velka Bites

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Rolls-Royce

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Mitsubishi Heavy Industries

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Main Turbo Systems

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 ABB

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Cummins

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Kawasaki Heavy Industries

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 MAN Energy Solutions

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Aircraft and Marine Turbochargers Market

2 Global Aircraft and Marine Turbochargers Market: Key Market Drivers

3 Global Aircraft and Marine Turbochargers Market: Key Market Challenges

4 Global Aircraft and Marine Turbochargers Market: Key Market Opportunities

5 Global Aircraft and Marine Turbochargers Market: Key Market Restraints

6 Global Aircraft and Marine Turbochargers Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

8 Compressor: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

9 Turbine: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

10 Shaft: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

11 Others: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

12 Global Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

13 Aircraft: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

14 Ultralight (Turboprop): Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

15 Ultralight (Piston): Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

16 Marine: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

17 Military Ships: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

18 Commercial Ships: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

19 Unmanned Aerial Vehicle (UAV): Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

20 Tactical UAV: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

21 Strategic UAV: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

22 Special Purpose UAV: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

23 Global Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

24 Single-turbo: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

25 Twin-turbo: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

26 Electro-assist Turbo: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

27 Variable Geometry Turbocharger: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

28 Regional Analysis: Global Aircraft and Marine Turbochargers Market, By Region, 2019-2027 (USD Billion)

29 North America: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

30 North America: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

31 North America: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

32 North America: Aircraft and Marine Turbochargers Market, By Country, 2019-2027 (USD Billion)

33 U.S: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

34 U.S: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

35 U.S: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

36 Canada: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

37 Canada: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

38 Canada: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

39 Mexico: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

40 Mexico: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

41 Mexico: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

42 Europe: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

43 Europe: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

44 Europe: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

45 Europe: Aircraft and Marine Turbochargers Market, By Country, 2019-2027 (USD Billion)

46 Germany: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

47 Germany: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

48 Germany: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

49 UK: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

50 UK: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

51 UK: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

52 France: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

53 France: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

54 France: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

55 Italy: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

56 Italy: Aircraft and Marine Turbochargers Market, By T Platform Ype, 2019-2027 (USD Billion)

57 Italy: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

58 Spain: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

59 Spain: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

60 Spain: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

61 Rest Of Europe: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

62 Rest Of Europe: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

63 Rest Of Europe: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

64 Asia Pacific: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

65 Asia Pacific: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

66 Asia Pacific: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

67 Asia Pacific: Aircraft and Marine Turbochargers Market, By Country, 2019-2027 (USD Billion)

68 China: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

69 China: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

70 China: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

71 India: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

72 India: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

73 India: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

74 Japan: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

75 Japan: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

76 Japan: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

77 South Korea: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

78 South Korea: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

79 South Korea: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

80 Middle East & Africa: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

81 Middle East & Africa: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

82 Middle East & Africa: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

83 Middle East & Africa: Aircraft and Marine Turbochargers Market, By Country, 2019-2027 (USD Billion)

84 Saudi Arabia: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

85 Saudi Arabia: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

86 Saudi Arabia: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

87 UAE: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

88 UAE: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

89 UAE: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

90 Central & South America: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

91 Central & South America: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

92 Central & South America: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

93 Central & South America: Aircraft and Marine Turbochargers Market, By Country, 2019-2027 (USD Billion)

94 Brazil: Aircraft and Marine Turbochargers Market, By Component, 2019-2027 (USD Billion)

95 Brazil: Aircraft and Marine Turbochargers Market, By Platform, 2019-2027 (USD Billion)

96 Brazil: Aircraft and Marine Turbochargers Market, By Technology, 2019-2027 (USD Billion)

97 Hartzell Engine Technologies: Products Offered

98 PBS Velka Bites: Products Offered

99 Rolls-Royce: Products Offered

100 Mitsubishi Heavy Industries: Products Offered

101 Main Turbo Systems: Products Offered

102 ABB: Products Offered

103 Cummins: Products Offered

104 Kawasaki Heavy Industries: Products Offered

105 MAN Energy Solutions: Products Offered

106 Other Companies: Products Offered

List of Figures

1. Global Aircraft and Marine Turbochargers Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Aircraft and Marine Turbochargers Market: Penetration & Growth Prospect Mapping

7. Global Aircraft and Marine Turbochargers Market: Value Chain Analysis

8. Global Aircraft and Marine Turbochargers Market Drivers

9. Global Aircraft and Marine Turbochargers Market Restraints

10. Global Aircraft and Marine Turbochargers Market Opportunities

11. Global Aircraft and Marine Turbochargers Market Challenges

12. Key Aircraft and Marine Turbochargers Market Manufacturer Analysis

13. Global Aircraft and Marine Turbochargers Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Hartzell Engine Technologies: Company Snapshot

16. Hartzell Engine Technologies: Swot Analysis

17. PBS Velka Bites: Company Snapshot

18. PBS Velka Bites: Swot Analysis

19. Rolls-Royce: Company Snapshot

20. Rolls-Royce: Swot Analysis

21. Mitsubishi Heavy Industries: Company Snapshot

22. Mitsubishi Heavy Industries: Swot Analysis

23. Main Turbo Systems: Company Snapshot

24. Main Turbo Systems: Swot Analysis

25. ABB: Company Snapshot

26. ABB: Swot Analysis

27. Cummins: Company Snapshot

28. Cummins: Swot Analysis

29. Kawasaki Heavy Industries: Company Snapshot

30. Kawasaki Heavy Industries: Swot Analysis

31. MAN Energy Solutions: Company Snapshot

32. MAN Energy Solutions: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: Swot Analysis

The Global Aircraft and Marine Turbochargers Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aircraft and Marine Turbochargers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS