Global Aircraft Cabin Upgrades Market Size, Trends & Analysis - Forecasts to 2026 By Type (Interior Modifications, Cabin Connectivity, Painting, Airworthiness, In-Flight Entertainment, Avionics Systems, and Others), By Aircraft (Commercial Aircraft, Regional Aircraft, General Aircraft, and Military Aircraft), By End-Use (Passenger Airlines, Freight Companies, Leasing Companies, Corporate Jets, and VIPs & Military Derivatives), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

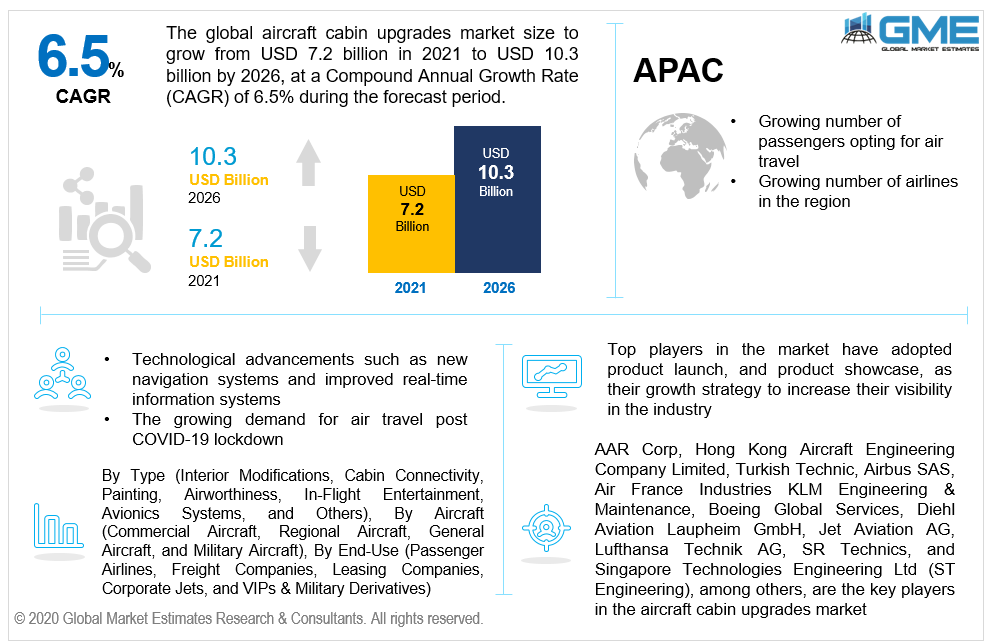

The global aircraft cabin upgrades market is projected to grow from USD 7.2 billion in 2021 to USD 10.3 billion by 2026 at a CAGR value of 6.5% between 2021 to 2026.

The cabin space of an aircraft is vital to enhance the image and brand of commercial airlines. Newer commercial airlines often turn to purchasing older airlines and refurbishing the interiors to influence brand image and build brand loyalty among customers. Military aircrafts use cabin upgrade services to modify the interiors to meet their unique requirements and are often modified regularly to meet the changing demands as well as adopt new technologies.

The market is mainly driven by the large demand from commercial airlines owing to the rising demand for air travel. Cabin upgrades offer airlines the opportunity to truly set themselves apart from their rivals and build customer loyalty. Airlines offer different cabins to the economy, business, and first-class travelers.

Growing demand for in-flight entertainment systems, advanced navigation systems, and real-time information systems are driving the demand for cabin upgrades. Technological advancements in materials, information, entertainment, communication, and navigation systems result in airlines turning to cabin upgrade service providers to modify and update their airlines.

Cabin upgrades allow airlines to control the amount of space available in the aircraft for passengers and crew, create lasting impressions on passengers, and reduce cabin weight. Lower cabin weight allows airlines to increase revenues by saving costs on fuel. Increased space availability for the crew can help improve operational efficiency and create a better working environment which can translate to customer satisfaction. By balancing the space available to each passenger with the number of passengers that can be served allows airlines to provide quality services without affecting revenues and improve customer retention and increase the number of repeat customers. While the long-term impact of cabin upgrades is largely positive, in the short term airlines face revenue loss due to the airline being grounded and the high cost of such modifications.

Cabin upgrades are time-consuming and have high initial costs and are required to clear various safety parameters and testing to ensure they are safe for flight. Flight safety regulation bodies across the world have varying degrees of safety standards that have to be satisfied by airlines and cabin upgrades will require clearances from such bodies which adds to the cost of upgrades and inhibit the growth of the cabin upgrades market.

The COVID-19 pandemic has restrained air travel owing to the nature of the spread of the coronavirus. With governments imposing travel bans and restrictions on passengers entering and leaving countries, airlines have taken a massive hit in their business during the pandemic. With flights being grounded and low revenue sources, airlines have had to cut back spending which has reduced the demand for cabin upgrades.

Restrictions on air travel are being slowly relaxed and increased vaccination drives are resulting in a slow uptick in air travel. As airlines are returning, they are expected to turn to cabin upgrades to improve customer experience through new cabins with better aesthetic features that create the impression of luxury and allow passengers to feel they are getting their money’s worth.

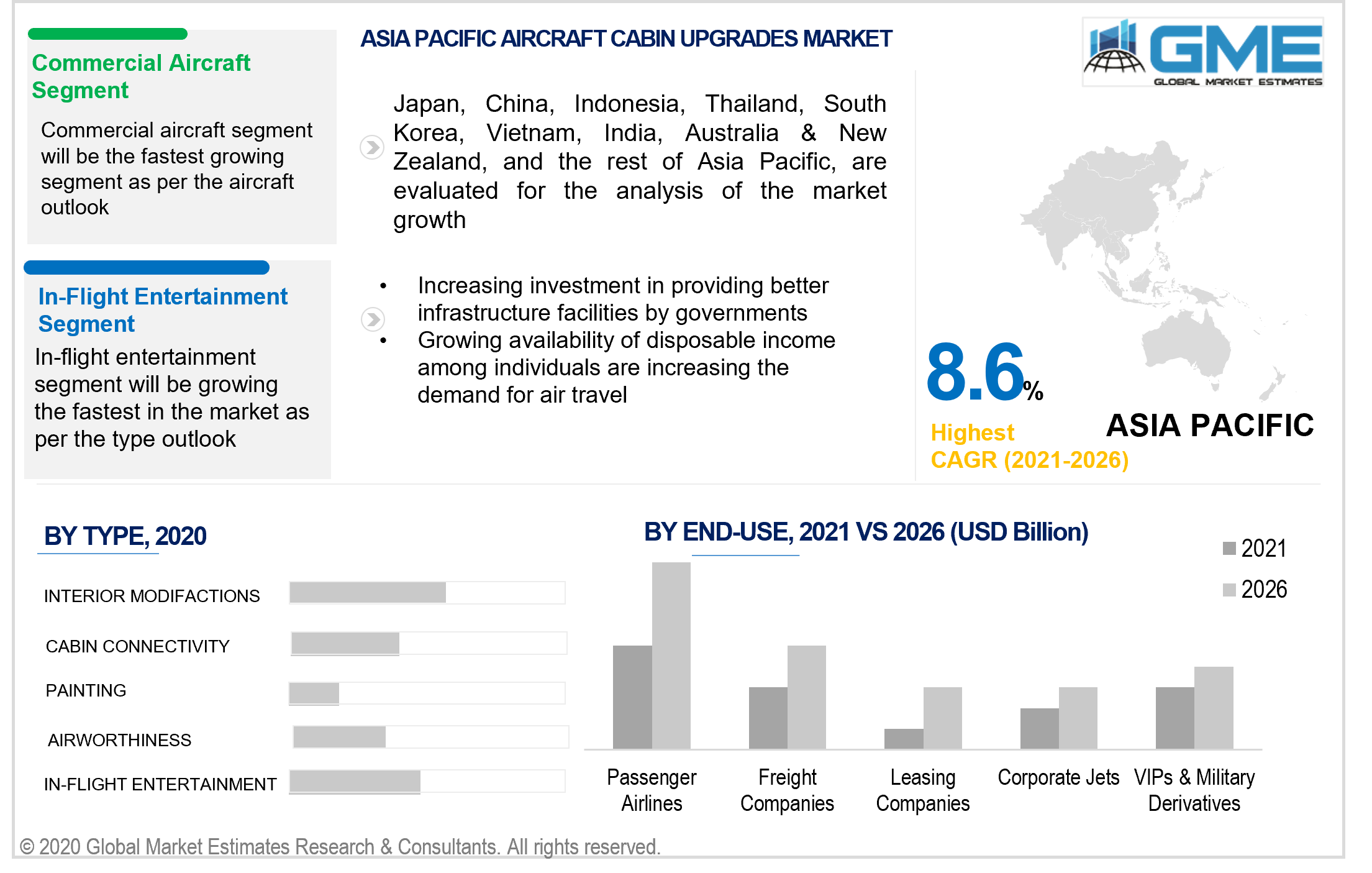

Based on the type of upgrade employed by the airlines, the market is segmented into interior modifications, cabin connectivity, painting, airworthiness, in-flight entertainment, avionics systems, and others. The interior modifications segment is expected to hold the dominant share of the revenues generated in the market. The large number of interior modifications that are available such as stowage, galleys, passenger seating, lighting and LEDs, and equipment upgrades, among others, has been one of the major drivers of this segment. Interior modifications allow airlines to increase brand loyalty and enjoy greater customer retention which translated to greater revenues for airlines. The in-flight entertainment segment is expected to become the fastest-growing segment. In-flight entertainment systems provide greater customer satisfaction and create the impression of luxury among passengers. The growing adoption of such systems in various airlines is expected to be one of the major contributors to the growth of the aircraft cabin upgrades market.

Based on the type of aircraft, the market is segmented into commercial aircraft, regional aircraft, general aircraft, and military aircraft. The commercial aircraft segment is expected to hold the lion’s share of the market and continue to grow at a greater growth rate than the other segments. The large and continuously growing demand for air travel is the major factor for the dominance of this segment. Airlines require frequent upgrades to ensure passenger satisfaction. Growing demand for air travel within Asian countries is expected to further expedite the growth of the market.

Based on the end-users, the aircraft cabin upgrades market is segmented into passenger airlines, freight companies, leasing companies, corporate jets, and VIPs & military derivatives. The passenger airlines segment is expected to hold the dominant share of the market owing to the growing demand for airlines to improve cabin space to increase their seating capacity. Freighter companies are expected to turn to cabin upgrade service providers as they look to convert passenger flights into freighters.

Based on region, the market can be broken into various regions such as North America, Europe, Central and South America, Middle East and Africa, and Asia Pacific regions. The North American region is expected to be the dominant region in the cabin upgrade market. A large number of airlines operating in the region and high demand for air travel both domestic and international have been some of the major drivers for the dominant share held by the region. The APAC region is expected to be the fastest-growing region in the aircraft cabin upgrades market. Growing demand for air travel through improved infrastructure facilities and greater spending power among individuals in the region are expected to be some of the major drivers of the market in the APAC region.

AAR Corp, Hong Kong Aircraft Engineering Company Limited, Turkish Technic, Airbus SAS, Air France Industries KLM Engineering & Maintenance, Boeing Global Services, Diehl Aviation Laupheim GmbH, Jet Aviation AG, Lufthansa Technik AG, SR Technics, and Singapore Technologies Engineering Ltd (ST Engineering), among others are the key players in the aircraft cabin upgrades market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aircraft Cabin Upgrades Market Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Aircraft Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Aircraft Cabin Upgrades Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for air travel and increasing seating capacity within commercial airlines

3.3.2 Industry Challenges

3.3.2.1 High cost of cabin upgrades and stringent regulations

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Aircraft Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Aircraft Cabin Upgrades Market, By Type

4.1 Type Outlook

4.2 Interior Modifications

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Cabin Connectivity

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Airworthiness

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 In-Flight Entertainment

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Avionics Systems

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Painting

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Others

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Aircraft Cabin Upgrades Market, By Aircraft

5.1 Aircraft Outlook

5.2 Commercial Aircraft

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Regional Aircraft

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 General Aircraft

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Military Aircraft

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Aircraft Cabin Upgrades Market, By End-User

6.1 Passenger Airlines

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Freight Companies

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Leasing Companies

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Corporate Jets

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 VIPs & Military Derivatives

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Aircraft Cabin Upgrades Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Aircraft, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Aircraft, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 AAR Corp

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Hong Kong Aircraft Engineering Company Limited

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Turkish Technic

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Airbus SAS

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Air France Industries KLM Engineering & Maintenance

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Boeing Global Services

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Diehl Aviation Laupheim GmbH

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Jet Aviation AG

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Lufthansa Technik AG

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.12 SR Technics

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Aircraft Cabin Upgrades Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aircraft Cabin Upgrades Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS