Global Aircraft Radome Maintenance Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Nose Radome, Fuselage Mounted Radome), By Material Type (Glass-Fibre, Resin, Quartz), By Type of Aircraft (Commercial/Passenger Aircraft [Narrow Body Aircraft, Wide Body Aircraft, Very Large Body Aircraft, Regional Aircraft], Military Aircraft, Business Jets, Helicopters), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

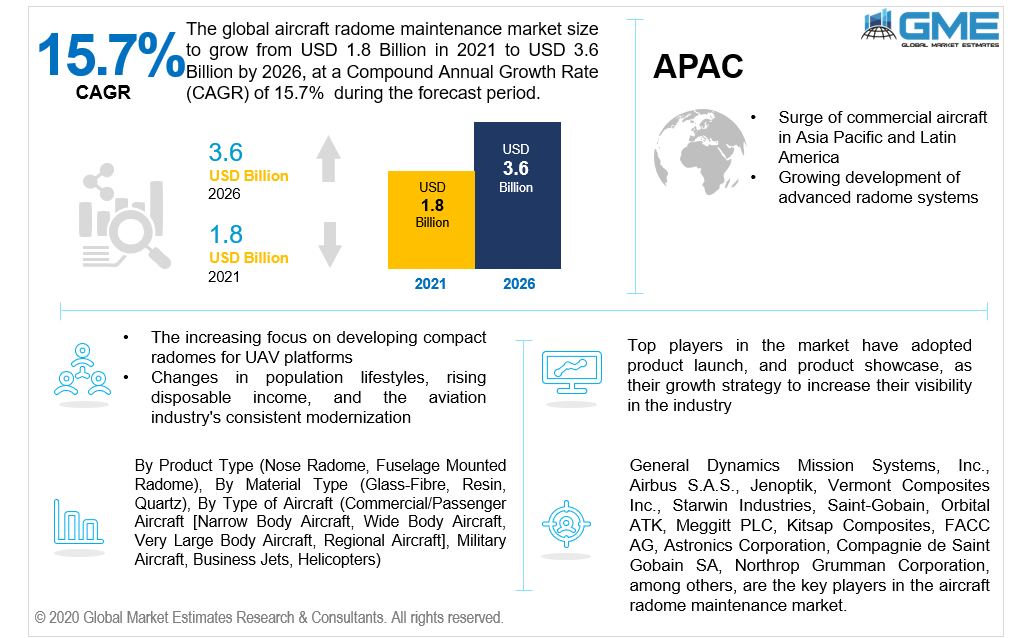

The global aircraft radome maintenance market is projected to grow from USD 1.8 billion in 2021 to USD 3.6 billion by 2026 at a CAGR value of 15.7% from 2021 to 2026. The radar system is protected by the radome, which is a structural enclosure. The electromagnetic signal broadcast intercepted by the antenna is barely attenuated by the aircraft radome, which is completely opaque to radio waves. The increased demand for aeroplanes has resulted in a major increase in the global aviation radome market.

The radome market is growing due to developments in polymer nanocomposites technology for radome construction, increasing focus on developing compact radomes for UAV platforms, rising demand for technologically improved radome systems for next-generation aircraft, and the use of radomes in warfare. The aviation industry's consistent modernization attempts are boosting the growth of the global aircraft radome repair market throughout the forecast period.

The aviation business creates planes for a variety of industries, including commercial and military. The planes are upgraded on a regular basis to keep the model's productivity and effectiveness on the field. As a result, the aircraft bring economic benefits and modernizing activities, which propels the aircraft radome market forward. Furthermore, the global expansion of the aviation radome market is being fuelled by an increase in many countries' defence budgets to upgrade military aircraft and make them war-ready.

The radomes are used to shield the antenna from inclement weather. Furthermore, the use of radomes increases system availability and performance by preventing the antenna from coming into direct contact with wind, rain, or ice. Furthermore, the use of radomes in aeroplane antennas lowers maintenance costs significantly because the antenna is protected during transit, allowing for uninterrupted communication.

The COVID-19 epidemic caused a drop in demand for commercial aircraft in 2020. Due to the fact that global passenger traffic is likely to take 2-3 years to completely recuperate, demand for commercial aircraft is expected to be lower, limiting demand for commercial aircraft radomes. Demand for radomes from business jets is able to recover faster than demand from commercial aircraft, also with military aviation demand being resilient comparison to the conventional and general aviation, demand for radomes from the defense segment is anticipated to expand.

In the near future, the expansion of aerospace companies in Asia Pacific and Latin America will be a big potential for the radome industry to flourish. Additional air passenger traffic is predicted to enhance demand for passenger airliners, regional jets, and intermediate transport aircraft, providing these manufacturers with growth prospects for new aircraft manufacturing and, as a result, the aircraft radome market. The tiniest alteration in randomes physical attributes, on the other hand, can adversely affect the performance of radar and antenna installations and stymie communication. As a result, regular radome maintenance is critical, and high cost of maintenance might stifle market growth.

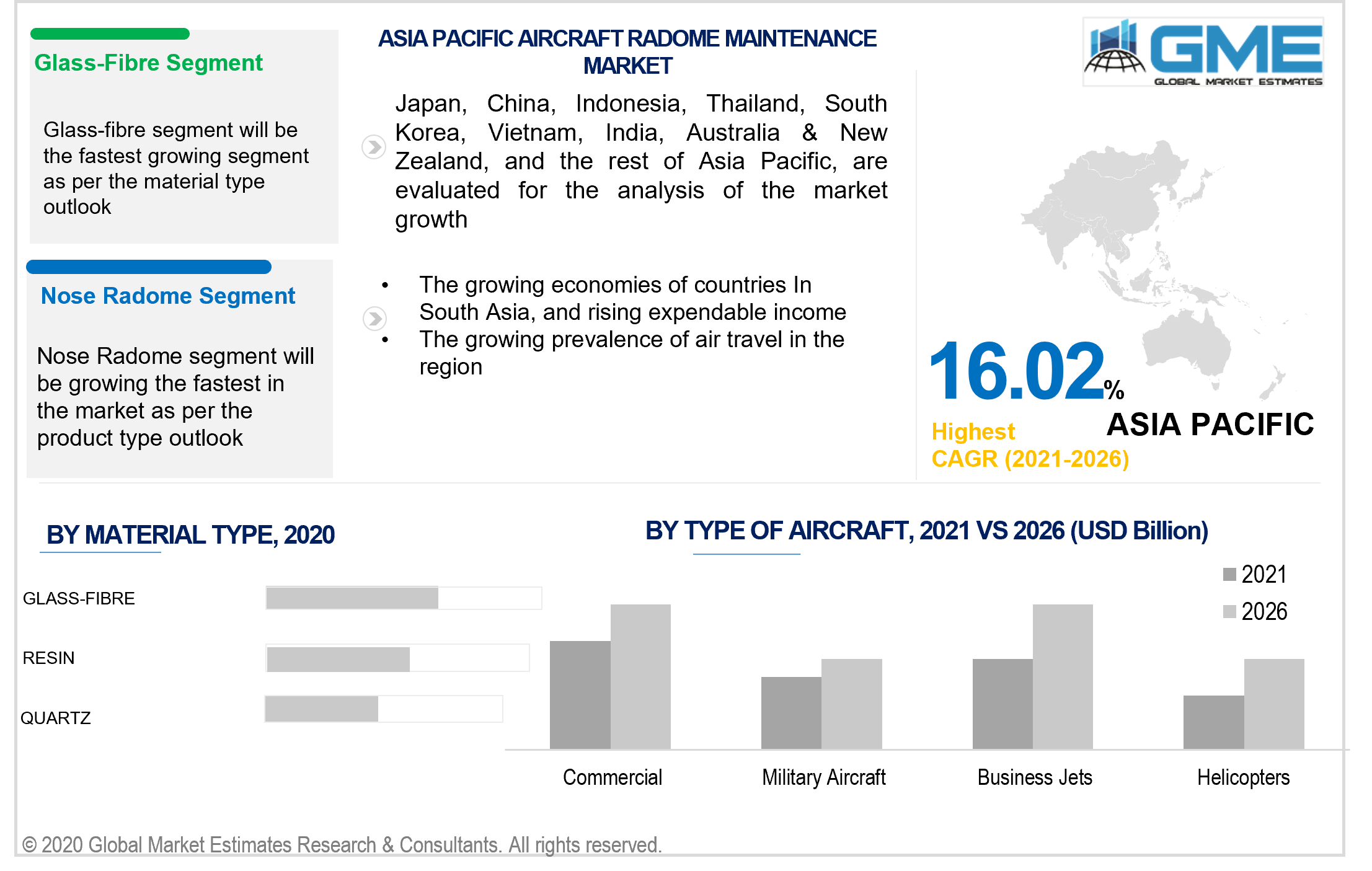

Based on the product type, the market is segmented into nose radome, and fuselage mounted radome. The nose radome segment is expected to have the largest share in the market during the forecast period. The nose radome is more beneficial since it instantly shelters the aircraft's components from strong winds, snowfall, and precipitation, all of which contribute to growth. The effectiveness of a radome is often specified by metrics such as the distant radiation pattern, energy permeability, boresight error, and boresight error gradient. Nose radomes function as casings for antennas and are usually angled to minimize aerodynamic downforce.

Based on the type of material, the market is divided into glass-fibre, resin, and quartz. The glass fibre segment is anticipated to have the largest share in the market during the forecast period. This is due to its high thermal conductor and penetration, both of which contribute to the growth. The surface of the fibreglass radome is strengthened with compounds to improve adhesion within them, ensuring that the exterior paint does not peel, wrinkle, or lose its colour in extreme conditions.

Based on the type of aircraft, the market is segmented into commercial/passenger aircraft, military aircraft, business jets, and helicopters. The commercial aircraft segment which is sub-divided into narrow body aircraft, wide body aircraft, very large body aircraft, and regional aircraft is anticipated to have the largest share in the market during the forecast period. The increase can be ascribed to the increased demand on airlines to upgrade and extend their fleets as a result of the growing preference for air travel over the last decade.

Furthermore, as radomes are a vital feature of an aeroplane, demand for radome structures is expanding in tandem with demand for new aircraft. With supply of new planes projected to pick up in the coming years, aircraft manufacturers are increasing productivity levels. In addition, the introduction of new aircraft models in the near future may increase supply of new aircraft radomes.

Based on region, the market can be broken into various regions such as North America, Europe, Central, and South America, the Middle East and Africa, and Asia Pacific regions. The North American region is expected to have a lion’s share in the market during the forecast period. Significant expenditures in R&D efforts by key companies for the advancement of enhanced radome solutions, as well as growing development of advanced radome systems, are projected to drive the radome market in this region forward. Due to the easy access to numerous technological innovations and substantial investment made by manufacturers in the world for the development of more effective military ISR and interaction & monitoring systems, the U.S. is expected to drive the growth of the North American radome market during the forecast period.

The Asia Pacific region is also expected to become the dominant region with highest CAGR during the forecast period. The region is experiencing a surge in air passenger travel. During the forecast period, China and India are expected to be among the world's largest aviation markets. Furthermore, the expansion of commercial aircraft in Asia Pacific and Latin America represents a significant opportunity for the radome industry to grow in the coming years. Additionally, the rise of globalisation and environmentalism has increased necessity for air travel. As a result, there is an increase in demand for commercial aeroplanes. The market for aerospace radomes is directly driven by the increase in aircraft orders in the region.

General Dynamics Mission Systems, Inc., Airbus S.A.S., Jenoptik, Vermont Composites Inc., Starwin Industries, Saint-Gobain, Orbital ATK, Meggitt PLC, Kitsap Composites, FACC AG, Astronics Corporation, Compagnie de Saint Gobain SA, Northrop Grumman Corporation, among others, are the key players in the aircraft radome maintenance market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aircraft Radome Maintenance Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Material Type Overview

2.1.3 Product Type Overview

2.1.4 Type of Aircraft Overview

2.1.6 Regional Overview

Chapter 3 Aircraft Radome Maintenance Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing developments in polymer nanocomposites technology for radome construction

3.3.2 End-User Challenges

3.3.2.1 High cost associated with maintenance

3.4 Prospective Growth Scenario

3.4.1 Material Type Growth Scenario

3.4.2 Product Type Growth Scenario

3.4.3 Type of Aircraft Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Aircraft Radome Maintenance Market, By Material Type

4.1 Material Type Outlook

4.2 Glass-Fibre

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Resin

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Quartz

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Aircraft Radome Maintenance Market, By Product Type

5.1 Product Type Outlook

5.2 Nose Radome

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Fuselage Mounted Radome

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Aircraft Radome Maintenance Market, By Type of Aircraft

6.1 Commercial/Passenger Aircraft

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Military Aircraft

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Business Jets

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Helicopters

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Aircraft Radome Maintenance Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Product Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Type of Aircraft, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 General Dynamics Mission Systems, Inc

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Airbus S.A.S

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Jenoptik

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Vermont Composites Inc

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Starwin Industries

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Saint-Gobain

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Orbital ATK

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Meggitt PLC

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Kitsap Composites

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 FACC AG

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Infographic Analysis

The Global Aircraft Radome Maintenance Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aircraft Radome Maintenance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS