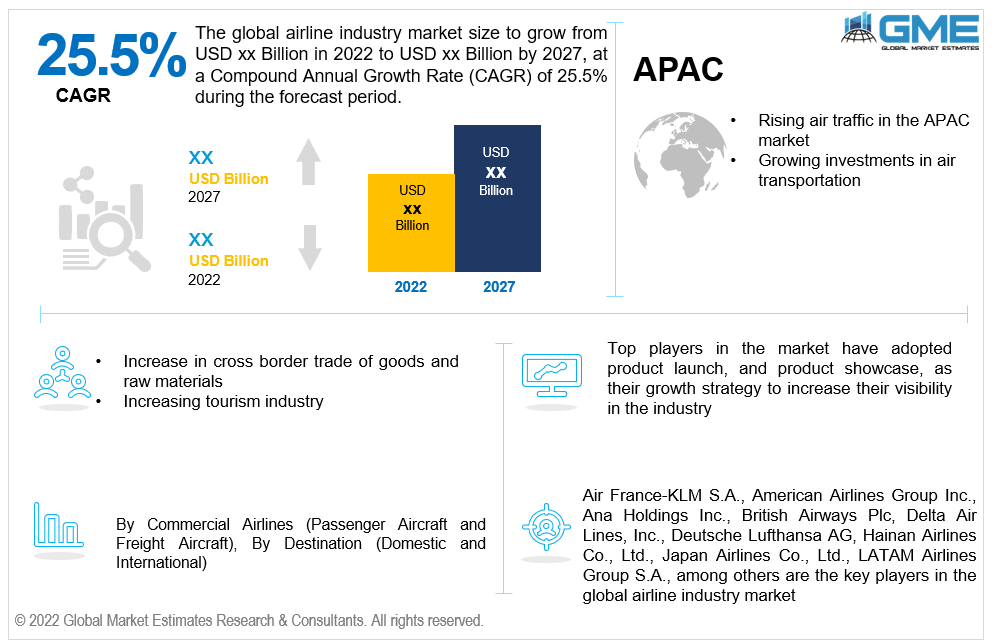

Global Airline Industry Market Size, Trends & Analysis - Forecasts to 2027 By Commercial Airlines (Passenger Aircraft and Freight Aircraft), By Destination (Domestic and International), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global airline industry market is projected to grow at a CAGR value of 25.5% from 2022 to 2027. The worldwide airline sector is expected to grow in the next few years, owing to rising disposable income, rapidly growing middle class, and increased travel demand. Furthermore, the price of jet fuel is expected to stay relatively stable over the forecast period, allowing airlines to levy surcharges and earn additional revenue from passenger and freight transport.

Air transportation is critical for international trade in manufactured products, especially in the components industry, which accounts for a significant portion of cross-border current trade. The value of international trade shipped by air this year will be $7.5 trillion, up 15% from 2019, and will rise by another 7.2 percent in 2022. Also propelling market growth is an increase in tourist expenditure on air travel; in 2021, tourist spending on air travel totalled $354 billion.

Employment possibilities in the airline industry are predicted to grow by 10.8% in 2022, with increased government support in the form of capital injections, loans, delaying tax payments, and lowering tax liabilities for airlines among the factors driving market expansion throughout the forecast period. Furthermore, rising private sector participation and investments, increased business engagement leading to increased demand for non-scheduled aircraft, increased usage of construction fees by terminal builders and operators, increased exports and imports, and increased freight traffic are all factors driving market expansion.

For three decades, aviation fuel accessibility and expenditures have managed to remain one of the major economic factors affecting the airline industry, and the dearth of and the need for aerospace climate governance potentially at national and regional scales to address emissions from aviation are among the challenges that the market will face during the forecast period.

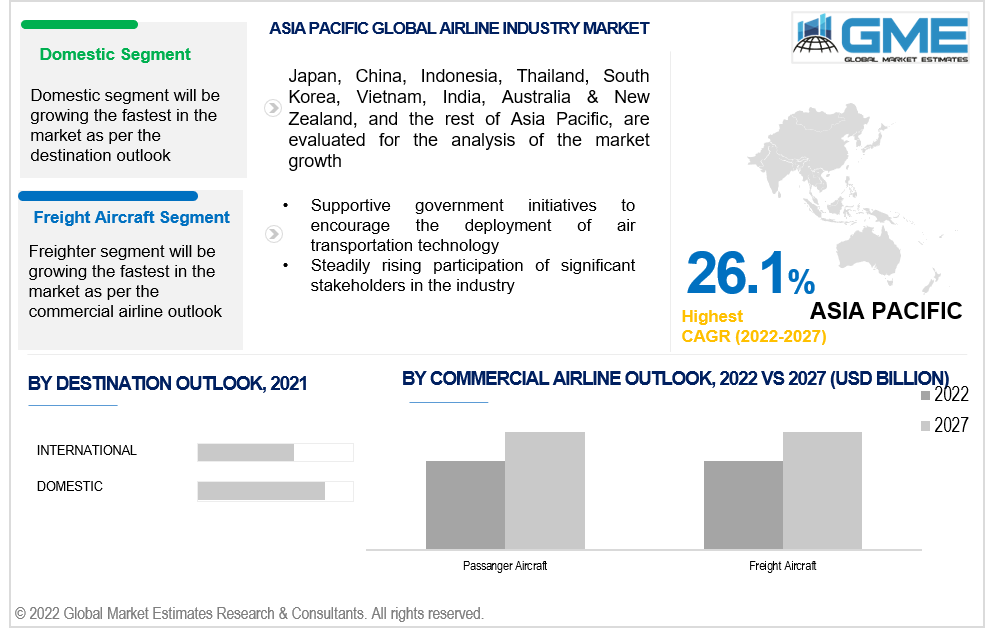

Based on the commercial airline's segmentation, the airline industry market is divided into passenger aircraft and freight aircraft. The freight aircraft segment is expected to be the fastest-growing segment in the market from 2022 to 2027. This segment is expected to develop leading to rapid shipment delivery compared to other alternative logistics options and the increasing popularity of integrated airfreight services. Furthermore, the increasing use of cool-chain technology, robots, automated systems, artificial intelligence (AI), Big Data, deep learning, IoT, and augmented & virtual reality across a variety of processes is expected to drive the air freight segment forward over the forecast period.

Based on the destination, the airline industry market is divided into domestic and international. The domestic segment is expected to be the fastest-growing segment in the market from 2022 to 2027. Low plane fares, rising living standards, and a predicted recovery in the global gross domestic product are driving this trend. The market for domestic aircraft is also fuelled by fleet development, increased demand for fuel-efficient aircraft, unrelenting breakthroughs in aviation technology, including the use of light carbon composites for aircraft manufacturing, and a rise in the number of air travellers.

As per the geographical analysis, the airline industry market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the airline industry market from 2022 to 2027. The major factor driving the growth of the market in the North American region is the high number of air travel passengers contributing to high airline demand. Furthermore, the increase in regional traffic (North America to Latin America), as well as the restoration of North Atlantic travel, would be beneficial, since net profit is expected to reach $9.9 billion in 2022, driving regional growth.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the airline industry market during the forecast period. Market expansion is being driven by the creation of a healthy ecosystem, favourable government policies, and high demand from civilian and military clients. Furthermore, the region's role as a manufacturing hub boosts local airlines' cargo profits, and the region's rising demand for commercial air travel aids expansion. According to forecast reports published by Boeing, in the next two decades, the APAC region will account for approximately half of the global air traffic and about 40% of all new aircraft deliveries.

Air France-KLM S.A., American Airlines Group Inc., Ana Holdings Inc., British Airways Plc, Delta Air Lines, Inc., Deutsche Lufthansa AG, Hainan Airlines Co., Ltd., Japan Airlines Co., Ltd., LATAM Airlines Group S.A., Qantas Airways Limited, Ryanair DAC, Singapore Airlines, Southwest Airlines Co., Thai Airways International PCL, United Airlines Holdings, Inc., WestJet Airlines Ltd, among others are the key players in the global airline industry market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Airline Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Commercial airlines Overview

2.1.3 Destination Overview

2.1.4 Regional Overview

Chapter 3 Airline Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rise in demand for air travel

3.3.2 Industry Challenges

3.3.2.1 The increased aviation fuel accessibility and expenditures

3.4 Prospective Growth Scenario

3.4.1 Commercial airlines Growth Scenario

3.4.2 Destination Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Airline Market, By Destination

4.1 Destination Outlook

4.2 Domestic

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 International

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Airline Market, By Commercial Airlines

5.1 Commercial Airlines Outlook

5.2 Passenger Aircraft

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Freight Aircraft

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Airline Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Billion)

6.2.2 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.2.3 Market Size, By Destination, 2022-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.2.4.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.2.5.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Billion)

6.3.2 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.3.3 Market Size, By Destination, 2022-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.3.4.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.3.5.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.3.6.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.3.7.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.3.8.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.3.9.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Billion)

6.4.2 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.4.3 Market Size, By Destination, 2022-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.4.4.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.4.5.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.4.6.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.4.7.2 Market size, By Destination, 2022-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.4.8.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Billion)

6.5.2 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.5.3 Market Size, By Destination, 2022-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.5.4.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.5.5.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.5.6.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Billion)

6.6.2 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.6.3 Market Size, By Destination, 2022-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.6.4.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.6.5.2 Market Size, By Destination, 2022-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Commercial airlines, 2022-2027 (USD Billion)

6.6.6.2 Market Size, By Destination, 2022-2027 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2022

7.2 Air France-KLM S.A.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 American Airlines Group Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Ana Holdings Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 British Airways Plc

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.7 Delta Air Lines, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.7 Deutsche Lufthansa AG

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Hainan Airlines Co., Ltd

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Japan Airlines Co., Ltd.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 LATAM Airlines Group S.A.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Qantas Airways Limited

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Ryanair DAC

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Singapore Airlines

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Southwest Airlines Co.

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Thai Airways International PCL

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.17 United Airlines Holdings, Inc.

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info Graphic Analysis

7.17 WestJet Airlines Ltd.

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info Graphic Analysis

7.18 Other Companies

7.18.1 Company Overview

7.18.2 Financial Analysis

7.18.3 Strategic Positioning

7.18.4 Info Graphic Analysis

The Global Airline Industry Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Airline Industry Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS