Global Alternative Payment Methods Market Size, Trends & Analysis - Forecasts to 2029 By Payment Type (Digital Wallets, Bank Transfers, Buy Now, Pay Later (BNPL), Cryptocurrencies, Mobile Payments, Prepaid Cards, and Others), By End User (Retail and E-commerce, Travel and Hospitality, Healthcare, Education, Entertainment and Media, and Others), By Platform (Online, Mobile Apps, and Point-of-Sale (POS)), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

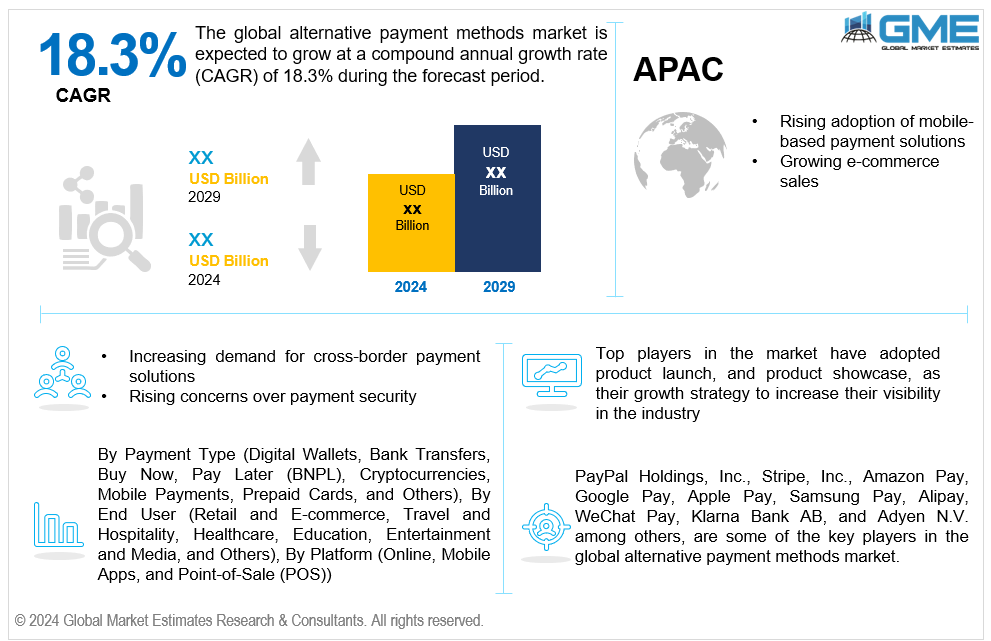

The global alternative payment methods market is estimated to exhibit a CAGR of 18.3% from 2024 to 2029.

The primary factors propelling the market growth are the rising adoption of mobile-based payment solutions and the growing e-commerce sales. As smartphones become more affordable and internet penetration increases, mobile payment platforms like digital wallets, QR-based payments, and contactless systems are witnessing exponential growth. The increasing need for smooth and cashless transactions in both developed and emerging economies is met by these technologies. Mobile-based payment methods also offer features like integrated loyalty programs, easy fund transfers, and real-time updates, which enhance the overall user experience. Integration with biometrics, near-field communication (NFC), and tokenization has further boosted their security, fostering greater consumer trust. Consequently, the proliferation of mobile payment solutions is transforming how transactions are conducted, propelling the alternative payment methods market forward. For instance, in 2023, 66% of US and Canadian restaurants accepted mobile payments, compared to 63% that accept credit cards and 38% that accept debit cards, according to TouchBistro.

The increasing demand for cross-border payment solutions and the rising concerns over payment security are expected to support the market growth. Businesses and consumers require efficient, cost-effective, and secure ways to transfer money across borders, fueling the adoption of digital payment platforms. Traditional banking systems often involve high fees, slow processing times, and lack of transparency, creating opportunities for alternative solutions like digital wallets, cryptocurrency, and blockchain-based platforms. These methods offer faster transactions, lower costs, and enhanced security, addressing the limitations of conventional systems. Additionally, the rise of e-commerce and the gig economy has heightened the need for seamless international payments, particularly for small and medium-sized businesses (SMBs) and freelancers. Regulatory advancements and fintech innovations, such as real-time payment systems and multi-currency wallets, further enhance the cross-border payment landscape. This growing demand is driving the adoption of alternative payment methods worldwide.

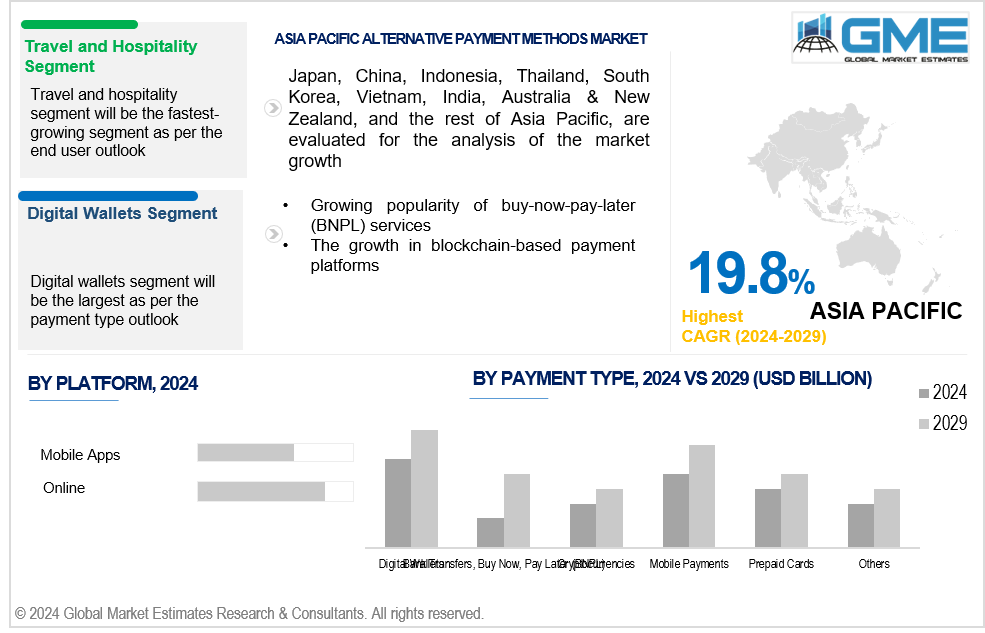

The growing popularity of buy-now-pay-later (BNPL) services coupled with the growth in blockchain-based payment platforms propel market growth. BNPL solutions allow consumers to split their purchases into manageable installments, often without interest or fees, making them an attractive option for both large and small-ticket items. This flexibility appeals to a broad range of consumers, particularly younger generations who may not have access to traditional credit or prefer avoiding credit card debt. As BNPL services integrate into e-commerce platforms, retailers benefit from increased conversion rates and higher average order values, further fueling the growth of this payment method. The ease of use, instant approval processes, and minimal barriers to entry make BNPL increasingly popular, particularly in markets like North America, Europe, and Asia-Pacific.

The rise of subscription-based business models presents an opportunity for alternative payment methods to cater to recurring payment needs. Innovative solutions can streamline billing and improve customer retention through flexible, automated payment systems. Additionally, as mobile-first generations embrace digital financial tools, P2P payment platforms present an opportunity to offer low-cost, instant money transfers.

However, the lack of uniform global regulations and concerns over data breaches, fraud, and identity theft impede market growth.

The digital wallets segment is expected to hold the largest share of the market over the forecast period. Digital wallets (such as Apple Pay, Google Pay, and PayPal) dominate the market in terms of volume and user adoption. Their widespread acceptance in e-commerce, mobile payments, and in-store transactions, along with the growing shift toward cashless transactions, positions them as the largest payment type in the market.

The buy now, pay later (BNPL) segment is expected to be the fastest-growing segment in the market from 2024 to 2029. BNPL services have seen rapid adoption, especially in e-commerce, where consumers increasingly prefer flexible payment options. With major players like Afterpay, Klarna, and Affirm expanding globally, BNPL is growing quickly, particularly in markets such as North America, Europe, and Australia.

The retail and e-commerce segment is expected to hold the largest share of the market over the forecast period. This is due to the increasing shift toward online shopping and the adoption of alternative payment methods like digital wallets, BNPL, and mobile payments. The convenience, speed, and security offered by these methods make them highly popular for online transactions, driving significant market volume.

The travel and hospitality segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. As more travelers prefer to book flights, accommodations, and activities online, the demand for fast, secure, and flexible payment solutions is rising. Alternative payment methods, such as digital wallets, BNPL services, and mobile payments, offer convenience and speed for international transactions, making them highly attractive to consumers in the travel sector.

The online segment is expected to hold the largest share of the market over the forecast period. Online payment methods such as digital wallets, BNPL, and mobile payments are widely adopted by consumers for online shopping, subscription services, and cross-border payments. The increasing trend of online shopping and digital services continues to drive the dominance of this platform.

The mobile apps segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. With the rise of smartphones and mobile banking, consumers increasingly prefer using mobile payment solutions like digital wallets and QR code payments for both online and in-store transactions. The ease and convenience of paying via mobile apps are contributing to the rapid growth of this segment.

North America is expected to be the largest region in the global market. The region has a well-established and advanced financial ecosystem, including robust digital payment systems and secure online transaction frameworks, enabling seamless adoption of alternative payment methods. The presence of major fintech companies such as PayPal, Apple Pay, and Square further boosts the market.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Governments and financial institutions in the Asia Pacific are actively promoting cashless societies, driving the adoption of alternative payment methods. Initiatives to reduce cash dependency, such as digital payment incentives and QR code-based payments, are contributing to the rapid expansion of alternative payment systems.

PayPal Holdings, Inc., Stripe, Inc., Amazon Pay, Google Pay, Apple Pay, Samsung Pay, Alipay, WeChat Pay, Klarna Bank AB, and Adyen N.V. among others, are some of the key players in the global alternative payment methods market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, Adyen and Billie joined forces to introduce Buy Now, Pay Later to European companies. Adyen and Billie's solution works together flawlessly, and retailers only need to click a few times to activate it.

In November 2023, PayU, the leading supplier of digital payment solutions in India, announced the release of its three ground-breaking Software Development Kits (SDKs) for mobile apps. Transaction success rates can be increased by up to 56% due to these innovations, which are specially designed to satisfy the need for seamless payment experiences on mobile devices.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL ALTERNATIVE PAYMENT METHODS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ALTERNATIVE PAYMENT METHODS MARKET, BY PAYMENT TYPE

4.1 Introduction

4.2 Alternative Payment Methods Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Digital Wallets

4.4.1 Digital Wallets Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Bank Transfers, Buy Now, Pay Later (BNPL)

4.5.1 Bank Transfers, Buy Now, Pay Later (BNPL) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Cryptocurrencies

4.6.1 Cryptocurrencies Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Mobile Payments

4.7.1 Mobile Payments Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Prepaid Cards

4.8.1 Prepaid Cards Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL ALTERNATIVE PAYMENT METHODS MARKET, BY END USER

5.1 Introduction

5.2 Alternative Payment Methods Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Retail and E-commerce

5.4.1 Retail and E-commerce Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Travel and Hospitality

5.5.1 Travel and Hospitality Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Healthcare

5.6.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Education

5.7.1 Education Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Entertainment and Media

5.8.1 Entertainment and Media Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL ALTERNATIVE PAYMENT METHODS MARKET, BY PLATFORM

6.1 Introduction

6.2 Alternative Payment Methods Market: Platform Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Online

6.4.1 Online Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Mobile Apps

6.5.1 Mobile Apps Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Point-of-Sale (POS)

6.6.1 Point-of-Sale (POS) Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL ALTERNATIVE PAYMENT METHODS MARKET, BY REGION

7.1 Introduction

7.2 North America Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Payment Type

7.2.2 By End User

7.2.3 By Platform

7.2.4 By Country

7.2.4.1 U.S. Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Payment Type

7.2.4.1.2 By End User

7.2.4.1.3 By Platform

7.2.4.2 Canada Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Payment Type

7.2.4.2.2 By End User

7.2.4.2.3 By Platform

7.2.4.3 Mexico Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Payment Type

7.2.4.3.2 By End User

7.2.4.3.3 By Platform

7.3 Europe Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Payment Type

7.3.2 By End User

7.3.3 By Platform

7.3.4 By Country

7.3.4.1 Germany Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Payment Type

7.3.4.1.2 By End User

7.3.4.1.3 By Platform

7.3.4.2 U.K. Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Payment Type

7.3.4.2.2 By End User

7.3.4.2.3 By Platform

7.3.4.3 France Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Payment Type

7.3.4.3.2 By End User

7.3.4.3.3 By Platform

7.3.4.4 Italy Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Payment Type

7.3.4.4.2 By End User

7.2.4.4.3 By Platform

7.3.4.5 Spain Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Payment Type

7.3.4.5.2 By End User

7.2.4.5.3 By Platform

7.3.4.6 Netherlands Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Payment Type

7.3.4.6.2 By End User

7.2.4.6.3 By Platform

7.3.4.7 Rest of Europe Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Payment Type

7.3.4.7.2 By End User

7.2.4.7.3 By Platform

7.4 Asia Pacific Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Payment Type

7.4.2 By End User

7.4.3 By Platform

7.4.4 By Country

7.4.4.1 China Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Payment Type

7.4.4.1.2 By End User

7.4.4.1.3 By Platform

7.4.4.2 Japan Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Payment Type

7.4.4.2.2 By End User

7.4.4.2.3 By Platform

7.4.4.3 India Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Payment Type

7.4.4.3.2 By End User

7.4.4.3.3 By Platform

7.4.4.4 South Korea Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Payment Type

7.4.4.4.2 By End User

7.4.4.4.3 By Platform

7.4.4.5 Singapore Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Payment Type

7.4.4.5.2 By End User

7.4.4.5.3 By Platform

7.4.4.6 Malaysia Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Payment Type

7.4.4.6.2 By End User

7.4.4.6.3 By Platform

7.4.4.7 Thailand Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Payment Type

7.4.4.7.2 By End User

7.4.4.7.3 By Platform

7.4.4.8 Indonesia Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Payment Type

7.4.4.8.2 By End User

7.4.4.8.3 By Platform

7.4.4.9 Vietnam Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Payment Type

7.4.4.9.2 By End User

7.4.4.9.3 By Platform

7.4.4.10 Taiwan Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Payment Type

7.4.4.10.2 By End User

7.4.4.10.3 By Platform

7.4.4.11 Rest of Asia Pacific Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Payment Type

7.4.4.11.2 By End User

7.4.4.11.3 By Platform

7.5 Middle East and Africa Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Payment Type

7.5.2 By End User

7.5.3 By Platform

7.5.4 By Country

7.5.4.1 Saudi Arabia Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Payment Type

7.5.4.1.2 By End User

7.5.4.1.3 By Platform

7.5.4.2 U.A.E. Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Payment Type

7.5.4.2.2 By End User

7.5.4.2.3 By Platform

7.5.4.3 Israel Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Payment Type

7.5.4.3.2 By End User

7.5.4.3.3 By Platform

7.5.4.4 South Africa Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Payment Type

7.5.4.4.2 By End User

7.5.4.4.3 By Platform

7.5.4.5 Rest of Middle East and Africa Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Payment Type

7.5.4.5.2 By End User

7.5.4.5.2 By Platform

7.6 Central and South America Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Payment Type

7.6.2 By End User

7.6.3 By Platform

7.6.4 By Country

7.6.4.1 Brazil Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Payment Type

7.6.4.1.2 By End User

7.6.4.1.3 By Platform

7.6.4.2 Argentina Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Payment Type

7.6.4.2.2 By End User

7.6.4.2.3 By Platform

7.6.4.3 Chile Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Payment Type

7.6.4.3.2 By End User

7.6.4.3.3 By Platform

7.6.4.4 Rest of Central and South America Alternative Payment Methods Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Payment Type

7.6.4.4.2 By End User

7.6.4.4.3 By Platform

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 PayPal Holdings, Inc.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Stripe, Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Amazon Pay

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Google Pay

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Apple Pay

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 SAMSUNG PAY

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Alipay

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 WeChat Pay

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Klarna Bank AB

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Adyen N.V.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

2 Digital Wallets Market, By Region, 2021-2029 (USD Million)

3 Bank Transfers, Buy Now, Pay Later (BNPL) Market, By Region, 2021-2029 (USD Million)

4 Cryptocurrencies Market, By Region, 2021-2029 (USD Million)

5 Mobile Payments Market, By Region, 2021-2029 (USD Million)

6 Prepaid Cards Market, By Region, 2021-2029 (USD Million)

7 Others Market, By Region, 2021-2029 (USD Million)

8 Global Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

9 Retail and E-commerce Market, By Region, 2021-2029 (USD Million)

10 Travel and Hospitality Market, By Region, 2021-2029 (USD Million)

11 Healthcare Market, By Region, 2021-2029 (USD Million)

12 Education Market, By Region, 2021-2029 (USD Million)

13 Entertainment and Media Market, By Region, 2021-2029 (USD Million)

14 Others Market, By Region, 2021-2029 (USD Million)

15 Global Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

16 Online Market, By Region, 2021-2029 (USD Million)

17 Mobile Apps Market, By Region, 2021-2029 (USD Million)

18 Point-of-Sale (POS) Market, By Region, 2021-2029 (USD Million)

19 Regional Analysis, 2021-2029 (USD Million)

20 North America Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

21 North America Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

22 North America Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

23 North America Alternative Payment Methods Market, By Country, 2021-2029 (USD Million)

24 U.S Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

25 U.S Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

26 U.S Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

27 Canada Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

28 Canada Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

29 Canada Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

30 Mexico Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

31 Mexico Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

32 Mexico Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

33 Europe Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

34 Europe Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

35 Europe Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

36 Europe Alternative Payment Methods Market, By Country 2021-2029 (USD Million)

37 Germany Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

38 Germany Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

39 Germany Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

40 U.K Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

41 U.K Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

42 U.K Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

43 France Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

44 France Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

45 France Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

46 Italy Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

47 Italy Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

48 Italy Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

49 Spain Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

50 Spain Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

51 Spain Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

52 Netherlands Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

53 Netherlands Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

54 Netherlands Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

55 Rest Of Europe Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

56 Rest Of Europe Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

57 Rest of Europe Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

58 Asia Pacific Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

59 Asia Pacific Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

60 Asia Pacific Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

61 Asia Pacific Alternative Payment Methods Market, By Country, 2021-2029 (USD Million)

62 China Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

63 China Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

64 China Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

65 India Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

66 India Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

67 India Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

68 Japan Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

69 Japan Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

70 Japan Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

71 South Korea Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

72 South Korea Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

73 South Korea Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

74 malaysia Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

75 malaysia Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

76 malaysia Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

77 Thailand Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

78 Thailand Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

79 Thailand Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

80 Indonesia Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

81 Indonesia Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

82 Indonesia Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

83 Vietnam Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

84 Vietnam Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

85 Vietnam Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

86 Taiwan Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

87 Taiwan Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

88 Taiwan Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

89 Rest of Asia Pacific Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

90 Rest of Asia Pacific Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

91 Rest of Asia Pacific Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

92 Middle East and Africa Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

93 Middle East and Africa Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

94 Middle East and Africa Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

95 Middle East and Africa Alternative Payment Methods Market, By Country, 2021-2029 (USD Million)

96 Saudi Arabia Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

97 Saudi Arabia Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

98 Saudi Arabia Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

99 UAE Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

100 UAE Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

101 UAE Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

102 Israel Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

103 Israel Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

104 Israel Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

105 South Africa Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

106 South Africa Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

107 South Africa Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

108 Rest of Middle East and Africa Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

109 Rest of Middle East and Africa Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

110 Rest of Middle East and Africa Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

111 Central and South America Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

112 Central and South America Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

113 Central and South America Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

114 Central and South America Alternative Payment Methods Market, By Country, 2021-2029 (USD Million)

115 Brazil Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

116 Brazil Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

117 Brazil Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

118 Argentina Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

119 Argentina Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

120 Argentina Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

121 Chile Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

122 Chile Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

123 Chile Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

124 Rest of Central and South America Alternative Payment Methods Market, By Payment Type, 2021-2029 (USD Million)

125 Rest of Central and South America Alternative Payment Methods Market, By End User, 2021-2029 (USD Million)

126 Rest of Central and South America Alternative Payment Methods Market, By Platform, 2021-2029 (USD Million)

127 PayPal Holdings, Inc.: Products & Services Offering

128 Stripe, Inc.: Products & Services Offering

129 Amazon Pay: Products & Services Offering

130 Google Pay: Products & Services Offering

131 Apple Pay: Products & Services Offering

132 SAMSUNG PAY: Products & Services Offering

133 Alipay: Products & Services Offering

134 WeChat Pay: Products & Services Offering

135 Klarna Bank AB, Inc: Products & Services Offering

136 Adyen N.V.: Products & Services Offering

137 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Alternative Payment Methods Market Overview

2 Global Alternative Payment Methods Market Value From 2021-2029 (USD Million)

3 Global Alternative Payment Methods Market Share, By Payment Type (2023)

4 Global Alternative Payment Methods Market Share, By End User (2023)

5 Global Alternative Payment Methods Market Share, By Platform (2023)

6 Global Alternative Payment Methods Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Alternative Payment Methods Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Alternative Payment Methods Market

11 Impact Of Challenges On The Global Alternative Payment Methods Market

12 Porter’s Five Forces Analysis

13 Global Alternative Payment Methods Market: By Payment Type Scope Key Takeaways

14 Global Alternative Payment Methods Market, By Payment Type Segment: Revenue Growth Analysis

15 Digital Wallets Market, By Region, 2021-2029 (USD Million)

16 Bank Transfers, Buy Now, Pay Later (BNPL) Market, By Region, 2021-2029 (USD Million)

17 Cryptocurrencies Market, By Region, 2021-2029 (USD Million)

18 Mobile Payments Market, By Region, 2021-2029 (USD Million)

19 Prepaid Cards Market, By Region, 2021-2029 (USD Million)

20 Others Market, By Region, 2021-2029 (USD Million)

21 Global Alternative Payment Methods Market: By End User Scope Key Takeaways

22 Global Alternative Payment Methods Market, By End User Segment: Revenue Growth Analysis

23 Retail and E-commerce Market, By Region, 2021-2029 (USD Million)

24 Travel and Hospitality Market, By Region, 2021-2029 (USD Million)

25 Healthcare Market, By Region, 2021-2029 (USD Million)

26 Education Market, By Region, 2021-2029 (USD Million)

27 Entertainment and Media Market, By Region, 2021-2029 (USD Million)

28 Others Market, By Region, 2021-2029 (USD Million)

29 Global Alternative Payment Methods Market: By Platform Scope Key Takeaways

30 Global Alternative Payment Methods Market, By Platform Segment: Revenue Growth Analysis

31 Online Market, By Region, 2021-2029 (USD Million)

32 Mobile Apps Market, By Region, 2021-2029 (USD Million)

33 Point-of-Sale (POS) Market, By Region, 2021-2029 (USD Million)

34 Regional Segment: Revenue Growth Analysis

35 Global Alternative Payment Methods Market: Regional Analysis

36 North America Alternative Payment Methods Market Overview

37 North America Alternative Payment Methods Market, By Payment Type

38 North America Alternative Payment Methods Market, By End User

39 North America Alternative Payment Methods Market, By Platform

40 North America Alternative Payment Methods Market, By Country

41 U.S. Alternative Payment Methods Market, By Payment Type

42 U.S. Alternative Payment Methods Market, By End User

43 U.S. Alternative Payment Methods Market, By Platform

44 Canada Alternative Payment Methods Market, By Payment Type

45 Canada Alternative Payment Methods Market, By End User

46 Canada Alternative Payment Methods Market, By Platform

47 Mexico Alternative Payment Methods Market, By Payment Type

48 Mexico Alternative Payment Methods Market, By End User

49 Mexico Alternative Payment Methods Market, By Platform

50 Four Quadrant Positioning Matrix

51 Company Market Share Analysis

52 PayPal Holdings, Inc.: Company Snapshot

53 PayPal Holdings, Inc.: SWOT Analysis

54 PayPal Holdings, Inc.: Geographic Presence

55 Stripe, Inc.: Company Snapshot

56 Stripe, Inc.: SWOT Analysis

57 Stripe, Inc.: Geographic Presence

58 Amazon Pay: Company Snapshot

59 Amazon Pay: SWOT Analysis

60 Amazon Pay: Geographic Presence

61 Google Pay: Company Snapshot

62 Google Pay: Swot Analysis

63 Google Pay: Geographic Presence

64 Apple Pay: Company Snapshot

65 Apple Pay: SWOT Analysis

66 Apple Pay: Geographic Presence

67 SAMSUNG PAY: Company Snapshot

68 SAMSUNG PAY: SWOT Analysis

69 SAMSUNG PAY: Geographic Presence

70 Alipay : Company Snapshot

71 Alipay : SWOT Analysis

72 Alipay : Geographic Presence

73 WeChat Pay: Company Snapshot

74 WeChat Pay: SWOT Analysis

75 WeChat Pay: Geographic Presence

76 Klarna Bank AB, Inc.: Company Snapshot

77 Klarna Bank AB, Inc.: SWOT Analysis

78 Klarna Bank AB, Inc.: Geographic Presence

79 Adyen N.V.: Company Snapshot

80 Adyen N.V.: SWOT Analysis

81 Adyen N.V.: Geographic Presence

82 Other Companies: Company Snapshot

83 Other Companies: SWOT Analysis

84 Other Companies: Geographic Presence

The Global Alternative Payment Methods Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Alternative Payment Methods Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS