Global Amino Acids Market Size, Trends, and Analysis - Forecasts To 2026 By Source (Plant-Based, Animal-Based), By Product (L-Glutamate, Lysine, Methionine, Threonine, Tryptophan, Leucine, Iso-Leucine, Valine, Glutamine, Arginine, Glycine, Tyrosine, Proline, Citrulline, Creatine, Serine, Others), By Application (Animal Feed, Pharmaceuticals, Food & Dietary Supplements), By Livestock (Swine, Poultry, Cattle, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

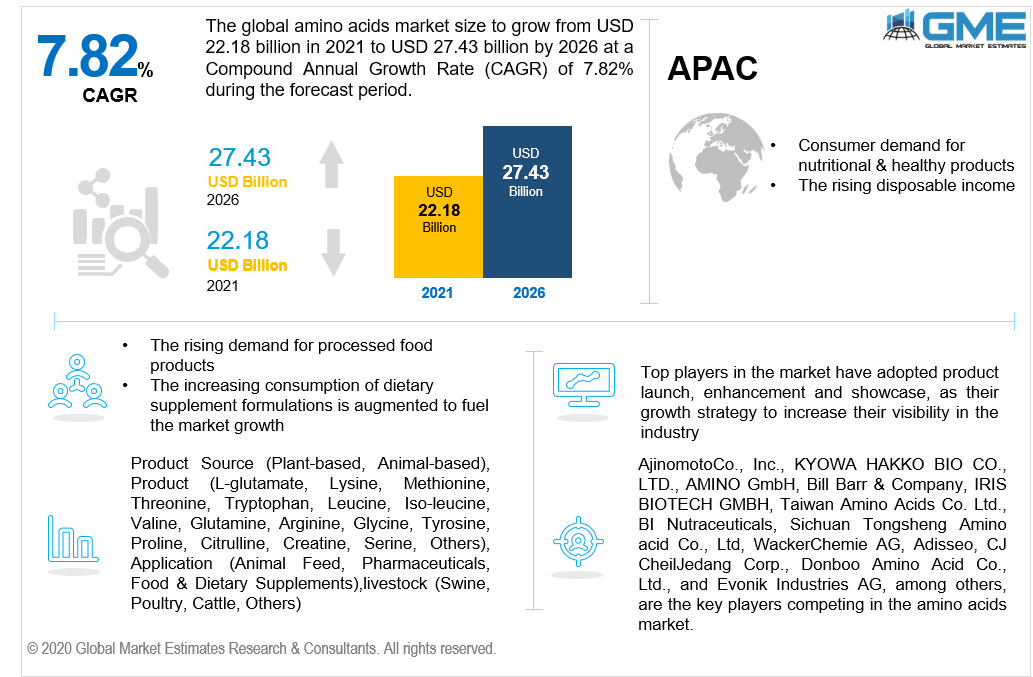

The global amino acids market size was valued at USD 22.18 billion in 2021 and is expected to reach USD 27.43 billion by 2026, growing at a CAGR of 7.82%. The demand for amino acids from the nutraceutical, pharmaceutical and food industries is anticipated to propel the growth of the market. Due to its ability to treat muscle aches, sprains, and mental weariness, the product is commonly utilized as dietary supplement.

Proteins are made up of amino acids, which are essential in both animal and human nutrition. They are required for vital activities in the human body, including the creation of neurotransmitters and hormones. Red meat, eggs, soy products, quinoa, dairy products, and seafood are high in amino acids. They help to boost the immune system, fight arthritis and cancer, and treat tinnitus and rectal illnesses. Amino acids are in high demand these days because they help with depression, quitting smoking, sleeping difficulties, bruxism, premenstrual dysphoric disorder (PMDD), and attention deficit hyperactivity disorder (ADHD).

Consumers' growing health awareness has increased the demand for nutritious foods. As a result, food and beverage producers have introduced goods fortified with critical nutrients like amino acids. This practice has helped rise the demand for amino acids from the food & beverage industry. Moreover, sportsmen and athletes are increasingly turning to protein-rich supplements to improve their performance and muscle mass development. Moreover, the growing demand for convenience and processed foods along with food and dietary products are fueling the food amino acids market over the forecast period. Amino acids are also used in animal feed to fulfill the animals' protein requirements. Furthermore, steady advancements in biotechnology have aided in the manufacturing of proteinogenic amino acids, which are integrated into proteins during translation.

The impact of the Covid-19 on amino acid market has resulted in modest growth. While effective government policies and the implementation of appropriate practices have assisted companies in making profits, the market has thrived despite the pandemic.

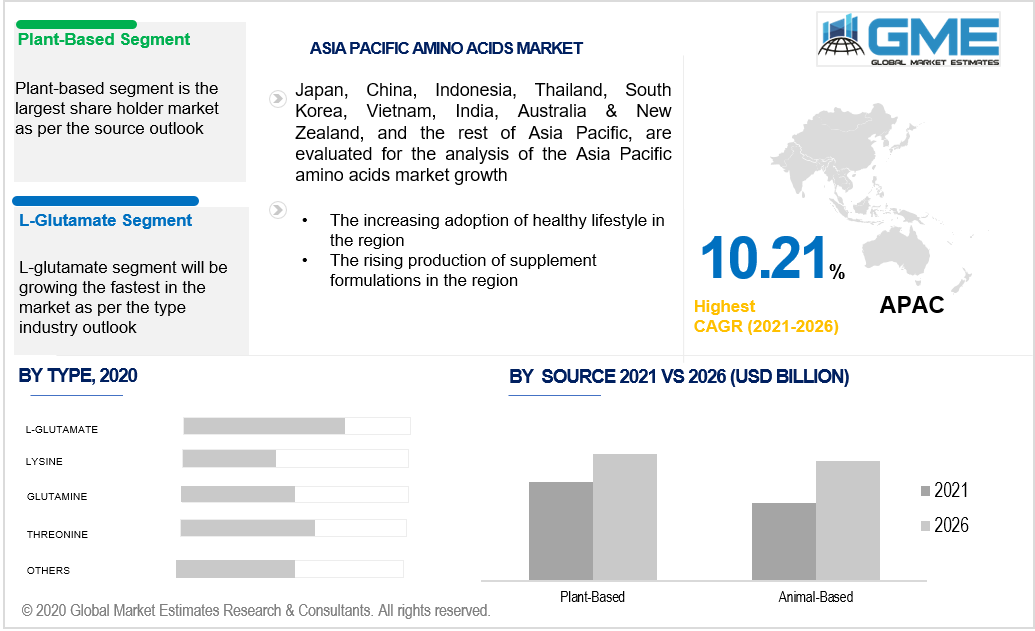

Based on the source market can be segmented into plant-based, and animal-based. During the forecast period, the plant-based source segment is anticipated to hold the largest share of the amino acids market in terms of revenue. Soybeans, wheat, corn, potato, and peas are some of the plant sources. Because of its high consumption and large-scale manufacturing, soybean is being used for the commercial development of the product. However, it is known that soybean processing alters amino acid content, which is a major problem while sourcing raw materials.

The global production and consumption of plant-based amino acids are anticipated to grow as consumer awareness of natural and organic products increases. Also, increasing public awareness of animal killing is projected to boost demand for plant-based alternatives.

During the forecast period, the L-glutamate segment is expected to hold the largest market share in terms of revenue and is expected to maintain the highest CAGR. L-glutamate, commonly known as l-glutamic acid, is a non-essential amino acid. It's widely used as a dietary supplement, flavor enhancer, feed additive, and intermediate in the production of organic chemicals. Monosodium glutamate (MSG), often known as seasoning salt, is a sodium salt of l-glutamate that is commercially used to enhance the palatability of foods in the food and beverage market. During the forecast period, product demand is expected to be driven by rising demand for processed food items and increasing product penetration in animal feed.

Based on the application the market is segmented into animal feed, pharmaceuticals, and food & dietary supplements. The food & dietary supplements segment will hold the lion’s share in terms of revenue during the forecast period. Increasing demand for amino acids as functional and nutritive additives has been fueling the demand for food amino acids market globally. Flavor and taste enhancers such as glycine and alanine are often used.

The animal feed segment is expected to witness the highest compound annual growth rate during the forecast period.

Based on the livestock the market is segmented into swine, poultry, and cattle, among others. The poultry livestock segment will hold the lion’s share in terms of revenue and is also projected to witness the highest CAGR during the forecast period owing to concerns about animal health and awareness about the benefits of amino acids in feedstuffs have increased.

The APAC region is expected to hold the largest market share in terms of volume and also grow at the fastest rate during the forecast period. The growing population in the region combined with the increase in economic conditions has increased the demand for amino acids and thereby the increasing consumer spending in the region. Growing production of amino acids in the region, as well as increased exports of feed additives from key countries like China and Japan, are anticipated to propel regional market growth. Amino acids are commonly used to treat liver and cardiovascular diseases, as well as to prevent muscular fatigue and breakdown. Moreover, increasing acceptance of a healthy lifestyle, as well as the expansion of end-use sectors including cosmetics, nutraceuticals, personal care, and pharmaceuticals are some of the leading drivers driving the regional growth of the amino acid market.

Furthermore, the European region is expected to witness the increased consumption of meat over the past few years. The regional market is likely to be driven by the growing use of animal feed additives containing a sufficient amount of prominent amino acids such as threonine, methionine, and lysine for boosting animal growth performance. Furthermore, growing demand for high-quality meat and meat products is anticipated to fuel the feed additives industry in the region, which will, in turn, fuel amino acid co-production.

AjinomotoCo., Inc., KYOWA HAKKO BIO CO., LTD., AMINO GmbH, Bill Barr & Company, IRIS BIOTECH GMBH, Taiwan Amino Acids Co. Ltd., BI Nutraceuticals, Sichuan Tongsheng Amino acid Co., Ltd, WackerChemie AG, Adisseo, CJ CheilJedang Corp., Donboo Amino Acid Co., Ltd., and Evonik Industries AG, among others, are the key players competing in the amino acids market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Amino Acids Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Growth Scenario

2.1.3 Source Growth Scenario

2.1.4 Livestock Growth Scenario

2.1.5 Application Growth Scenario

2.1.6 Regional Overview

Chapter 3 Global Amino Acids Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for glutamic acid as flavor enhancer

3.3.2 Industry Challenges

3.3.2.1 Increasing usage of multi-page labelling

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Source Growth Scenario

3.4.3 Livestock Growth Scenario

3.4.4 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Amino Acids Market, By Source

4.1 Source Outlook

4.2 Plant-Based

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Animal-Based

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Amino Acids Market, By Product

5.1 Product Outlook

5.2 L-Glutamate

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Lysine

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Methionine

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Arginine

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Tryptophan

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Glycine

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Threonine

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

5.9 Leucine

5.9.1 Market Size, By Region, 2020-2026 (USD Billion)

5.10 Iso-Leucine

5.10.1 Market Size, By Region, 2020-2026 (USD Billion)

5.11 Valine

5.11.1 Market Size, By Region, 2020-2026 (USD Billion)

5.12 Glutamine

5.12.1 Market Size, By Region, 2020-2026 (USD Billion)

5.13 Tyrosine

5.13.1 Market Size, By Region, 2020-2026 (USD Billion)

5.14 Proline

5.14.1 Market Size, By Region, 2020-2026 (USD Billion)

5.15 Citrulline

5.15.1 Market Size, By Region, 2020-2026 (USD Billion)

5.16 Creatine

5.16.1 Market Size, By Region, 2020-2026 (USD Billion)

5.17 Serine

5.17.1 Market Size, By Region, 2020-2026 (USD Billion)

5.18 Others

5.18.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Amino Acids Market, By Livestock

6.1 Livestock Outlook

6.2 Swine

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Poultry

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Cattle

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Others

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Global Amino Acids Market, By Application

7.1 Application Outlook

7.2 Animal-Feed

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Pharmaceuticals

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Food & Dietary Supplements

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Global Amino Acids Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Source, 2020-2026 (USD Billion)

8.2.3 Market Size, By Product, 2020-2026 (USD Billion)

8.2.4 Market Size, By Livestock, 2020-2026 (USD Billion)

8.2.5 Market Size, By Application, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.2.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Source, 2020-2026 (USD Billion)

8.3.3 Market Size, By Product, 2020-2026 (USD Billion)

8.3.4 Market Size, By Livestock, 2020-2026 (USD Billion)

8.3.5 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Source, 2020-2026 (USD Billion)

8.4.3 Market Size, By Product, 2020-2026 (USD Billion)

8.4.4 Market Size, By Livestock, 2020-2026 (USD Billion)

8.4.5 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Product, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Source, 2020-2026 (USD Billion)

8.5.3 Market Size, By Product, 2020-2026 (USD Billion)

8.5.4 Market Size, By Livestock, 2020-2026 (USD Billion)

8.5.5 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Source, 2020-2026 (USD Billion)

8.6.3 Market Size, By Product, 2020-2026 (USD Billion)

8.6.4 Market Size, By Livestock, 2020-2026 (USD Billion)

8.6.5 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Product, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Livestock, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 AjinomotoCo., Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 KYOWA HAKKO BIO CO., LTD.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 AMINO GmbH

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 BYK-Chemie GmbH

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Bill Barr & Company

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 IRIS BIOTECH GMBH

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Evonik Industries AG.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 Taiwan Amino Acids Co. Ltd.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 BI Nutraceuticals

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 WackerChemie AG

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Amino Acids Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Amino Acids Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS