Global Animal Antimicrobials and Antibiotics Market Size, Trends & Analysis - Forecasts to 2028 By Product Type (Antimicrobial, Antibiotics), Livestock (Cattle, Pork, Poultry, Aquaculture, Other Livestock), Region (North America, Asia Pacific, Central & South America, Europe, Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

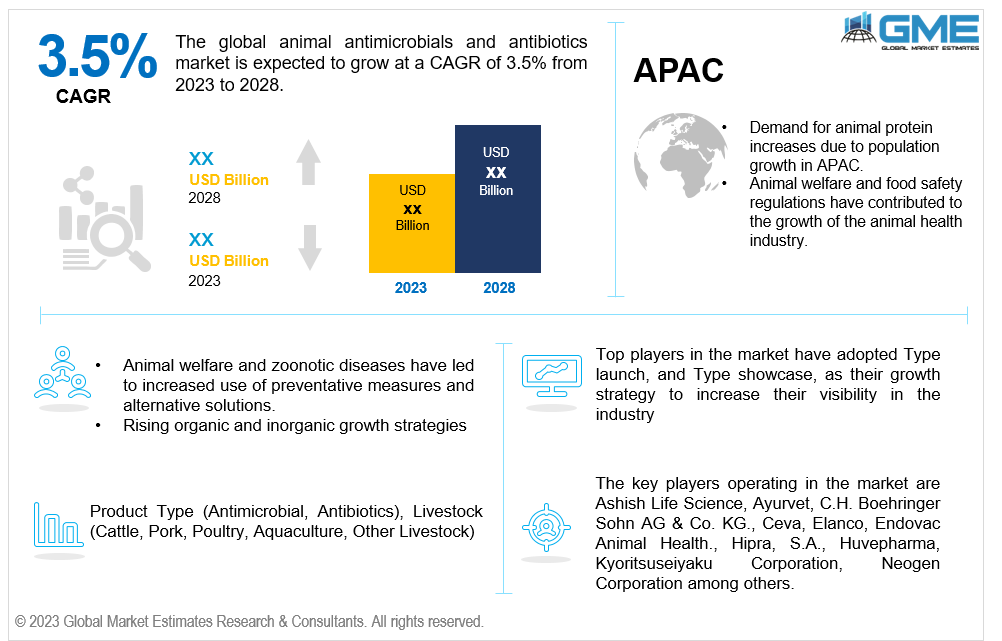

The global animal antimicrobials and antibiotics market is expected to grow at a CAGR of 3.5% from 2023 to 2028. The industry that manufactures and distributes pharmaceuticals including prescription and over-the-counter medications for cattle, poultry, and companion animals intended to prevent and treat bacterial infections in animals is referred to as the animal antimicrobials and antibiotics market. Because of the worries about the growth of antibiotic-resistant bacteria and their influence on human health, the use of antibiotics in animal husbandry has become a contentious subject. As a result, there is a growing need in the animal health business for antibiotic alternatives such as probiotics and vaccinations. The animal antimicrobials and antibiotics market is an important area within the larger animal health business, and it is predicted to develop in the future years due to rising demand for protein-rich diets and increased awareness of animal welfare.

Several reasons drive the animal antimicrobials and antibiotics business, including rising demand for animal protein, increased awareness of animal welfare, and increased scrutiny of antibiotic usage in animal agriculture. Government rules, such as prohibitions on the use of antibiotics in animal feed and veterinary monitoring for their use in animals, also play a key influence in the market. Technological improvements and breakthroughs in the realm of animal health have also contributed to the market's expansion. New products, such as next-generation sequencing technology and precision livestock farming, have the potential to change the way bacterial infections in animals are detected and treated.

The animal antimicrobials and antibiotics market is constrained by several factors, including growing concern about the development of antibiotic-resistant bacteria, rising demand for alternative solutions, the high cost of developing new antibiotic medications, and the growing trend toward plant-based diets and vegetarianism. These reasons have resulted in a decrease in the use of antibiotics in some locations, affecting market growth. Furthermore, the expense of producing new antibiotic drugs, as well as the lengthy regulatory clearance process, might discourage investment in R&D, resulting in a limited number of new products on the market. Finally, the rising trend toward plant-based diets and vegetarianism may have an influence on the animal antimicrobials and antibiotics industry; as more customers limit or eliminate their intake of animal products, demand for drugs used in animal agriculture may decline.

As per the product type, the antimicrobial segment is expected to dominate the market in the forecast period. The animal antimicrobials and antibiotics market is divided into type, including antimicrobial and antibiotics. Antimicrobials are extensively used in animal farms to prevent and cure infectious illnesses, stimulate animal development, and enhance the efficiency of feed. However, misuse and overuse of antimicrobial agents can result in the formation and spread of antimicrobial-resistant bacteria, which can endanger the well-being of humans and animals.

As per the livestock segment, the poultry segment is expected to dominate the market in the forecast period. Based on livestock, the market is segmented into cattle, pork, aquaculture, poultry and other livestock. To prevent and cure diseases, antimicrobials and antibiotics are routinely used in chicken feed. Antimicrobials are substances that have the ability to kill or prevent the growth of microorganisms such as bacteria, viruses, and fungus. They can be mixed directly into the feed or water, or provided by injections or other means.

The North American region is analyzed to be the largest segment in the global animal antimicrobials and antibiotics market in the forecast period. Due to a variety of variables, the North American area is the largest sector in the animal antimicrobials and antibiotics market. These factors include a strong demand for animal protein, a well-developed animal health business, a huge and diversified companion animal market, and a well-educated and health-conscious populace. Because of these characteristics, firms have been able to create and produce novel products that suit the expanding need for effective and safe animal health solutions.

Furthermore, the North American area has a vast and diversified companion animal market, resulting in an increase in demand for drugs to treat and prevent bacterial infections in companion animals. Moreover, the North American area has a well-educated and health-conscious populace, which has raised awareness of the possible hazards linked with antibiotic usage in animal husbandry.

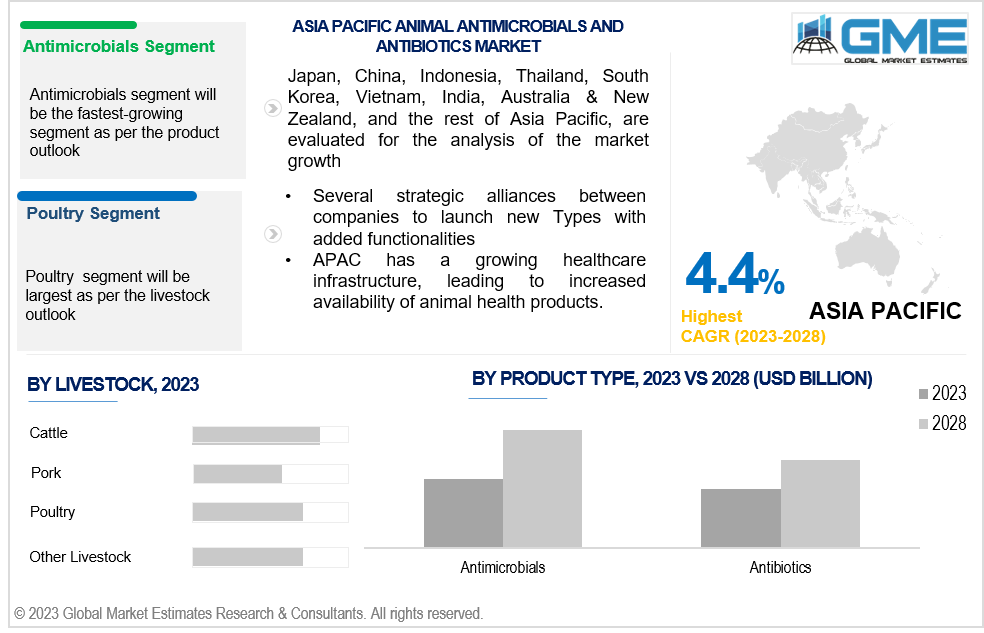

Asia Pacific is analyzed to be the fastest growing segment across the global animal antimicrobials and antibiotics market. Because of population growth, rising affluence, and urbanization, the Asia-Pacific (APAC) region is the fastest-growing sector in the animal antimicrobials and antibiotics market. This has resulted in more intensive animal husbandry techniques and a higher prevalence of bacterial illnesses in animals.

Furthermore, the APAC area has a huge population of livestock animals, which are key users of animal health products. Moreover, the APAC area has a fast-rising healthcare infrastructure, with an increasing number of veterinary hospitals and clinics and a growing number of competent veterinarians. Also, several global animal health firms are increasing their presence in the APAC area through strategic collaborations and acquisitions in order to capitalize on the growing market potential. This has resulted in increasing rivalry and innovation in the APAC animal antimicrobials and antibiotics industry.

The key players operating in the market are Ashish Life Science, Ayurvet, C.H. Boehringer Sohn AG & Co. KG., Ceva, Elanco, Endovac Animal Health., Hipra, S.A., Huvepharma, Kyoritsuseiyaku Corporation, and Neogen Corporation among others.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market OpportunIties: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL ANIMAL ANTIMICROBIALS AND ANTIBIOTICS, BY PRODUCT TYPE

4.2 Animal Antimicrobials and Antibiotics: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Antimicrobials Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Antibiotics Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL ANIMAL ANTIMICROBIALS AND ANTIBIOTICS, BY LIVESTOCK

5.2 Animal Antimicrobials and Antibiotics: Livestock Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Cattle Market Estimates And Forecast, 2020-2028 (USD Million)

5.5.1 Pork Market Estimates And Forecast, 2020-2028 (USD Million)

5.6.1 Poultry Market Estimates And Forecast, 2020-2028 (USD Million)

5.7.1 Aquaculture Market Estimates And Forecast, 2020-2028 (USD Million)

5.8.1 Other Livestock Market Estimates And Forecast, 2020-2028 (USD Million)

6 GLOBAL ANIMAL ANTIMICROBIALS AND ANTIBIOTICS, BY REGION

6.2.3.1 U.S. Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2 Canada Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3 Mexico Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.3 Europe Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2 U.K. Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3 France Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4 Italy Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5 Spain Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1 China Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2 Japan Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3 India Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2 U.A.E. Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3 Israel Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1 Brazil Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3 Chile Animal Antimicrobials and Antibiotics Estimates and Forecast, 2020-2028 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 C.H. Boehringer Sohn AG & Co. KG.

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Kyoritsuseiyaku Corporation

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Application of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

2 Antimicrobials Market, By Region, 2020-2028 (USD Mllion)

3 Antibiotics Market, By Region, 2020-2028 (USD Mllion)

4 Global Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

5 Cattle Market, By Region, 2020-2028 (USD Mllion)

6 Pork Market, By Region, 2020-2028 (USD Mllion)

7 Poultry Market, By Region, 2020-2028 (USD Mllion)

8 Aquaculture Market, By Region, 2020-2028 (USD Mllion)

9 Other Livestock Market, By Region, 2020-2028 (USD Mllion)

10 Regional Analysis, 2020-2028 (USD Mllion)

11 North America Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

12 North America Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

13 U.S. Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

14 U.S. Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

15 Canada Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

16 Canada Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

17 Mexico Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

18 Mexico Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

19 Europe Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

20 Europe Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

21 Germany Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

22 Germany Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

23 U.K. Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

24 U.K. Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

25 France Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

26 France Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

27 Italy Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

28 Italy Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

29 Spain Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

30 Spain Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

31 Netherlands Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

32 Netherlands Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

33 Rest Of Europe Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

34 Rest Of Europe Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

35 Asia Pacific Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

36 Asia Pacific Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

37 China Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

38 China Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

39 Japan Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

40 Japan Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

41 India Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

42 India Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

43 South Korea Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

44 South Korea Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

45 Singapore Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

46 Singapore Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

47 Thailand Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

48 Thailand Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

49 Malaysia Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

50 Malaysia Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

51 Indonesia Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

52 Indonesia Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

53 Vietnam Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

54 Vietnam Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

55 Taiwan Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

56 Taiwan Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

57 Rest of APAC Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

58 Rest of APAC Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

59 Middle East & Africa Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

60 Middle East & Africa Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

61 Saudi Arabia Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

62 Saudi Arabia Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

63 UAE Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

64 UAE Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

65 Israel Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

66 Israel Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

67 South Africa Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

68 South Africa Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

69 Rest Of Middle East & Africa Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

70 Rest Of Middle East & Africa Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

71 Central & South America Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

72 Central & South America Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

73 Brazil Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

74 Brazil Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

75 Chile Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

76 Chile Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

77 Argentina Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

78 Argentina Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

79 Rest Of Central & South America Animal Antimicrobials and Antibiotics, By Product Type, 2020-2028 (USD Mllion)

80 Rest Of Central & South America Animal Antimicrobials and Antibiotics, By Livestock, 2020-2028 (USD Mllion)

81 Ashish Life Science : Products & Services Offering

82 C.H. Boehringer Sohn AG & Co. KG.: Products & Services Offering

83 Ceva: Products & Services Offering

84 Elanco: Products & Services Offering

85 Endovac Animal Health: Products & Services Offering

86 HIPRA S.A.: Products & Services Offering

87 HuvePharma : Products & Services Offering

88 Kyoritsuseiyaku Corporation: Products & Services Offering

89 Ayurvet, Inc: Products & Services Offering

90 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Animal Antimicrobials and Antibiotics Overview

2 Global Animal Antimicrobials and Antibiotics Value From 2020-2028 (USD Mllion)

3 Global Animal Antimicrobials and Antibiotics Share, By Product Type (2022)

4 Global Animal Antimicrobials and Antibiotics Share, By Livestock (2022)

5 Global Animal Antimicrobials and Antibiotics, By Region (Asia Pacific Market)

6 Technological Trends In Global Animal Antimicrobials and Antibiotics

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Animal Antimicrobials and Antibiotics

10 Impact Of Challenges On The Global Animal Antimicrobials and Antibiotics

11 Porter’s Five Forces Analysis

12 Global Animal Antimicrobials and Antibiotics: By Product Type Scope Key Takeaways

13 Global Animal Antimicrobials and Antibiotics, By Product Type Segment: Revenue Growth Analysis

14 Antimicrobials Market, By Region, 2020-2028 (USD Mllion)

15 Antibiotics Market, By Region, 2020-2028 (USD Mllion)

16 Global Animal Antimicrobials and Antibiotics: By Livestock Scope Key Takeaways

17 Global Animal Antimicrobials and Antibiotics, By Livestock Segment: Revenue Growth Analysis

18 Cattle Market, By Region, 2020-2028 (USD Mllion)

19 Pork Market, By Region, 2020-2028 (USD Mllion)

20 Poultry Market, By Region, 2020-2028 (USD Mllion)

21 Aquaculture Market, By Region, 2020-2028 (USD Mllion)

22 Other Livestock Market, By Region, 2020-2028 (USD Mllion)

23 Regional Segment: Revenue Growth Analysis

24 Global Animal Antimicrobials and Antibiotics: Regional Analysis

25 North America Animal Antimicrobials and Antibiotics Overview

26 North America Animal Antimicrobials and Antibiotics, By Product Type

27 North America Animal Antimicrobials and Antibiotics, By Livestock

28 North America Animal Antimicrobials and Antibiotics, By Country

29 U.S. Animal Antimicrobials and Antibiotics, By Product Type

30 U.S. Animal Antimicrobials and Antibiotics, By Livestock

31 Canada Animal Antimicrobials and Antibiotics, By Product Type

32 Canada Animal Antimicrobials and Antibiotics, By Livestock

33 Mexico Animal Antimicrobials and Antibiotics, By Product Type

34 Mexico Animal Antimicrobials and Antibiotics, By Livestock

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Ashish Life Science : Company Snapshot

38 Ashish Life Science : SWOT Analysis

39 Ashish Life Science : Geographic Presence

40 C.H. Boehringer Sohn AG & Co. KG.: Company Snapshot

41 C.H. Boehringer Sohn AG & Co. KG.: SWOT Analysis

42 C.H. Boehringer Sohn AG & Co. KG.: Geographic Presence

43 Ceva: Company Snapshot

44 Ceva: SWOT Analysis

45 Ceva: Geographic Presence

46 Elanco: Company Snapshot

47 Elanco: Swot Analysis

48 Elanco: Geographic Presence

49 Endovac Animal Health: Company Snapshot

50 Endovac Animal Health: SWOT Analysis

51 Endovac Animal Health: Geographic Presence

52 Hipra S.A.: Company Snapshot

53 Hipra S.A.: SWOT Analysis

54 Hipra S.A.: Geographic Presence

55 HuvePharma : Company Snapshot

56 HuvePharma : SWOT Analysis

57 HuvePharma : Geographic Presence

58 Kyoritsuseiyaku Corporation: Company Snapshot

59 Kyoritsuseiyaku Corporation: SWOT Analysis

60 Kyoritsuseiyaku Corporation: Geographic Presence

61 Ayurvet, Inc.: Company Snapshot

62 Ayurvet, Inc.: SWOT Analysis

63 Ayurvet, Inc.: Geographic Presence

64 Other Companies: Company Snapshot

65 Other Companies: SWOT Analysis

66 Other Companies: Geographic Presence

The Global Animal Antimicrobials and Antibiotics Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Animal Antimicrobials and Antibiotics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS