Global Antifreeze Proteins Market Size, Trends & Analysis - Forecasts to 2026 By Type (Type I, Type II, Type III, Antifreeze Glycoproteins, Others), By Form (Solid, Liquid), By Source (Fish, Plants, Insects, Fungi, Others) By End-User (Medical, Cosmetics, Food, Petroleum, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

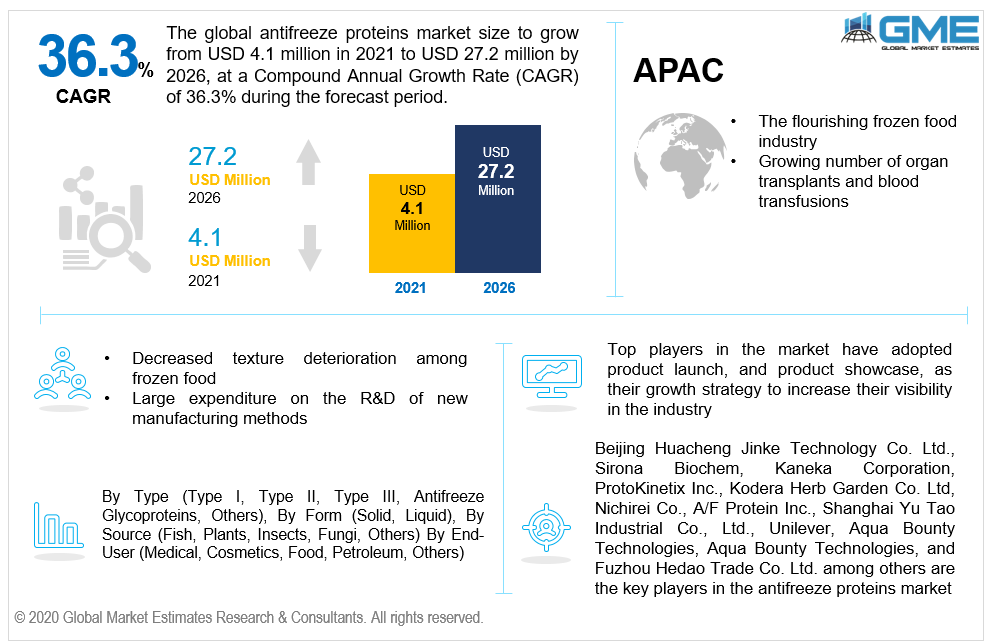

The global antifreeze proteins market is projected to grow from USD 4.1 million in 2021 to USD 27.2 million by 2026 at a CAGR value of 36.3% between 2021 to 2026. Antifreeze proteins are naturally found in organisms that thrive in harsh sub-zero environments. The antifreeze proteins present in these organisms reduce the freezing point of water thereby preventing the growth of ice crystals as they survive in cold environments.

Antifreeze protein has found a very vital role in improving the texture of frozen food. When food items are frozen, they often end up with a much poorer texture compared to food that has not been frozen. The texture difference largely stems from the damage due to the growth of ice crystals from the water content in the food. By introducing these proteins into the foodstuff, water’s freezing point is lowered as the proteins bind to the water molecules in the food, imparting antifreezing properties. Thus, these proteins have been used extensively in prolonging the shelf life and quality of frozen food. They will allow more food items that previously could not be frozen and transported over long distances due to the noticeable change in texture when frozen. The growing use of antifreeze in food is expected to be one of the major elements for the growth of the market.

The antifreeze proteins are extracted from organisms using machinery and equipment that are expensive using a process called thermal hysteresis. The thermal hysteresis process has not been upscaled to allow for bulk extraction and production of the proteins for industrial purposes. Most antifreeze suppliers have formed partnerships and tie-ups with research institutions to find new ways of extraction and to upscale the production to meet industrial requirements. The market is restrained by the high cost of machinery, extensive research and development involved, and the inability for bulk extraction of antifreeze proteins. Despite such restraints, these proteins have found application in various industries like the medical industry, cosmetics industry, food industry, and climate control applications.

The Covid-19 pandemic has caused disruptions to the supply chains of fresh food producers, impacting their revenue as food went to waste. Antifreeze proteins offer food producers the option of freezing their food and prolonging shelf life when supply chains are disrupted without a discernible change in quality and texture. The food industry is expected to increasingly turn to these proteins to improve the shelf lives of products to improve their market reach.

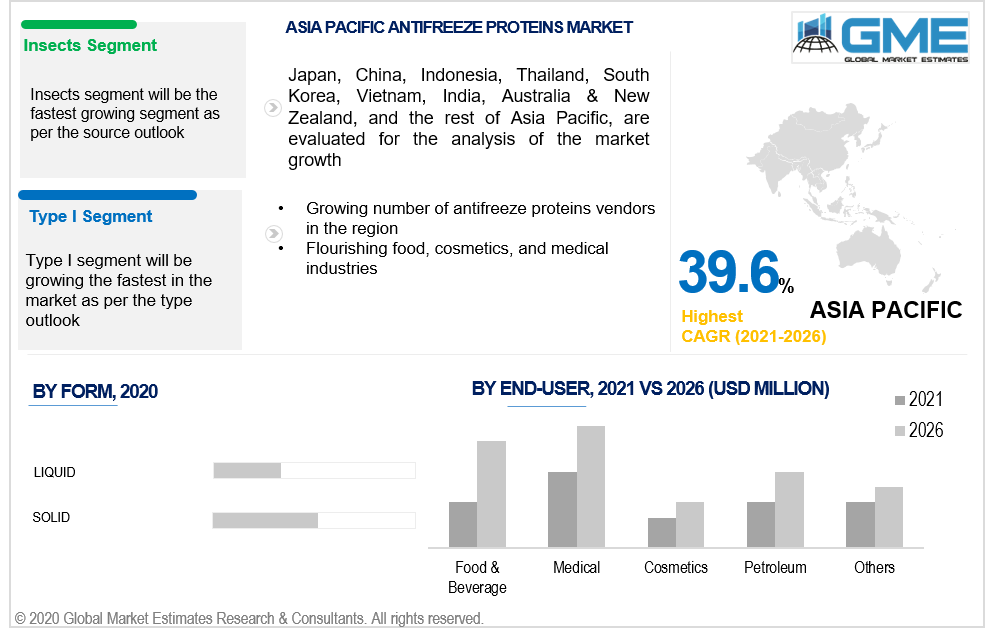

Based on the various types of the protein, the market can be fragmented into type I, type II, type III, antifreeze glycoproteins, and others segments. The type I segment grabbed the lion’s share of the antifreeze proteins market during the forecast period. Type I proteins are extracted from winter fishes and are extensively used in the cosmetics and healthcare industry, making them one of the most commonly used proteins. The growing use of these proteins in the medical and cosmetics industry is envisaged to result in the type I segment is become the fastest-growing segment between 2021 and 2026.

Based on the final forms of the antifreeze protein products, the market can be fragmented into solid and liquid segments. The growing use of solid form proteins in the food industry for applications in ice cream and meat products, combined with their use in the cosmetics and the medical industry has led to the sold segment to clutch the biggest share of the market. The solid segment is also expected to grow at better growth rates than the liquid segment owing to its ease in storage and application.

Based on the sources from which these proteins are extracted, the market can be fragmented as fish, plants, insects, fungi, and others. The fish segment held the biggest chunk of the market between 2021 and 2026. Proteins extracted from winter fishes are the most commonly used in various industries like cosmetics and food which has led to the dominance of the fish segment. The insects segment is envisaged to show better growth rates than the other segments during the forecast period. Insect-derived antifreeze proteins are more effective and have better antifreezing proteins than proteins from other sources. Insect-derived proteins are much more complex and superior which is expected to increase the demand for insect derive proteins during the forecast period.

Based on the various applications of antifreeze proteins in various industries, the market can be segmented into food, cosmetics, medical, and petroleum end-users. The medical segment is envisaged to hold the largest share of the market. Antifreeze proteins are used in the medical segment for organ transplants, store blood for longer periods, and other biological compounds without freeze damage. The growing use of these proteins in the food industry is envisaged to result in the food segment showing better growth rates during the forecast period.

Based on region, the market can be broken into various regions such as North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. The North American region is the region with the biggest chunk of the market. Large expenditure on research and development and the use of antifreeze proteins in the burgeoning frozen food industry, technologically advanced healthcare facilities, and the cosmetics industry have been the major factors behind the dominance of the antifreeze proteins market in the region.

The Asia Pacific region is envisaged to show better growth rates than the other regions during the forecast period. The growing food industry, cosmetics industry, and growing medical applications of antifreeze proteins are the major drivers of the Asia Pacific market.

Beijing Huacheng Jinke Technology Co. Ltd., Sirona Biochem, Kaneka Corporation, ProtoKinetix Inc., Kodera Herb Garden Co. Ltd, Nichirei Co., A/F Protein Inc., Shanghai Yu Tao Industrial Co., Ltd., Unilever, Aqua Bounty Technologies, Aqua Bounty Technologies, and Fuzhou Hedao Trade Co. Ltd. among others are the key players in the antifreeze proteins market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Antifreeze Proteins Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Form Overview

2.1.4 End-User Overview

2.1.5 Source Overview

2.1.6 Regional Overview

Chapter 3 Antifreeze Proteins Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The growing application of antifreeze properties in the food and medical industries

3.3.2 Industry Challenges

3.3.2.1 High cost of manufacturing due to the need for extensive research and development

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Form Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Source Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Source Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Antifreeze Proteins Market, By Type

4.1 Type Outlook

4.2 Type I

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Type II

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Type III

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Antifreeze glycoproteins

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Antifreeze Proteins Market, By End-User

5.1 End-User Outlook

5.2 Medical

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Food

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Cosmetics

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Petroleum

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Antifreeze Proteins Market, By Form

6.1 Solid

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Liquid

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Antifreeze Proteins Market, By Source

7.1 Fish

7.1.1 Market Size, By Region, 2020-2026 (USD Million)

7.2 Plants

7.2.1 Market Size, By Region, 2020-2026 (USD Million)

7.3 Insects

7.3.1 Market Size, By Region, 2020-2026 (USD Million)

7.4 Fungi

7.4.1 Market Size, By Region, 2020-2026 (USD Million)

7.5 Others

7.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 8 Antifreeze Proteins Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Million)

8.2.2 Market Size, By Type, 2020-2026 (USD Million)

8.2.3 Market Size, By Form, 2020-2026 (USD Million)

8.2.4 Market Size, By End-User, 2020-2026 (USD Million)

8.2.5 Market Size, By Source, 2020-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.2.4.2 Market Size, By Form, 2020-2026 (USD Million)

8.2.4.3 Market Size, By End-User, 2020-2026 (USD Million)

8.2.4.4 Market Size, By Source, 2020-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.2.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.2.7.3 Market Size, By End-User, 2020-2026 (USD Million)

8.2.7.4 Market Size, By Source, 2020-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Million)

8.3.2 Market Size, By Type, 2020-2026 (USD Million)

8.3.3 Market Size, By Form, 2020-2026 (USD Million)

8.3.4 Market Size, By End-User, 2020-2026 (USD Million)

8.3.5 Market Size, By Source, 2020-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.6.3 Market Size, By End-User, 2020-2026 (USD Million)

8.3.6.4 Market Size, By Source, 2020-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.7.3 Market Size, By End-User, 2020-2026 (USD Million)

8.3.7.4 Market Size, By Source, 2020-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.8.3 Market Size, By End-User, 2020-2026 (USD Million)

8.3.8.4 Market Size, By Source, 2020-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.9.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.9.3 Market Size, By End-User, 2020-2026 (USD Million)

8.3.9.4 Market Size, By Source, 2020-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.10.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.10.3 Market Size, By End-User, 2020-2026 (USD Million)

8.3.10.4 Market Size, By Source, 2020-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.11.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.11.3 Market Size, By End-User, 2020-2026 (USD Million)

8.3.11.4 Market Size, By Source, 2020-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Million)

8.4.2 Market Size, By Type, 2020-2026 (USD Million)

8.4.3 Market Size, By Form, 2020-2026 (USD Million)

8.4.4 Market Size, By End-User, 2020-2026 (USD Million)

8.4.5 Market Size, By Source, 2020-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.6.3 Market Size, By End-User, 2020-2026 (USD Million)

8.4.6.4 Market Size, By Source, 2020-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

8.4.7.4 Market Size, By Source, 2020-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.8.3 Market Size, By End-User, 2020-2026 (USD Million)

8.4.8.4 Market Size, By Source, 2020-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.9.2 Market size, By Form, 2020-2026 (USD Million)

8.4.9.3 Market Size, By End-User, 2020-2026 (USD Million)

8.4.9.4 Market Size, By Source, 2020-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.10.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.10.3 Market Size, By End-User, 2020-2026 (USD Million)

8.4.10.4 Market Size, By Source, 2020-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Million)

8.5.2 Market Size, By Type, 2020-2026 (USD Million)

8.5.3 Market Size, By Form, 2020-2026 (USD Million)

8.5.4 Market Size, By End-User, 2020-2026 (USD Million)

8.5.5 Market Size, By Source, 2020-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.5.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.5.6.3 Market Size, By End-User, 2020-2026 (USD Million)

8.5.6.4 Market Size, By Source, 2020-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.5.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.5.7.3 Market Size, By End-User, 2020-2026 (USD Million)

8.5.7.4 Market Size, By Source, 2020-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.5.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.5.8.3 Market Size, By End-User, 2020-2026 (USD Million)

8.5.8.4 Market Size, By Source, 2020-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Million)

8.6.2 Market Size, By Type, 2020-2026 (USD Million)

8.6.3 Market Size, By Form, 2020-2026 (USD Million)

8.6.4 Market Size, By End-User, 2020-2026 (USD Million)

8.6.5 Market Size, By Source, 2020-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.6.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

8.6.6.4 Market Size, By Source, 2020-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.6.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

8.6.7.4 Market Size, By Source, 2020-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.6.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.6.8.3 Market Size, By End-User, 2020-2026 (USD Million)

8.6.8.4 Market Size, By Source, 2020-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Beijing Huacheng Jinke Technology Co. Ltd.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Sirona Biochem

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Kaneka Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 ProtoKinetix Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Kodera Herb Garden Co. Ltd.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Nichirei Co.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 A/F Protein Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Shanghai Yu Tao Industrial Co. Ltd.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Unilever

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Antifreeze Proteins Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Antifreeze Proteins Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS