Global Antiscalant Market Size, Trends & Analysis - Forecasts to 2027 By Type (Phosphonates, Carboxylates, Sulfonates), By Application (Power & Construction, Mining, Water & Waste Treatment, Oil & Gas), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

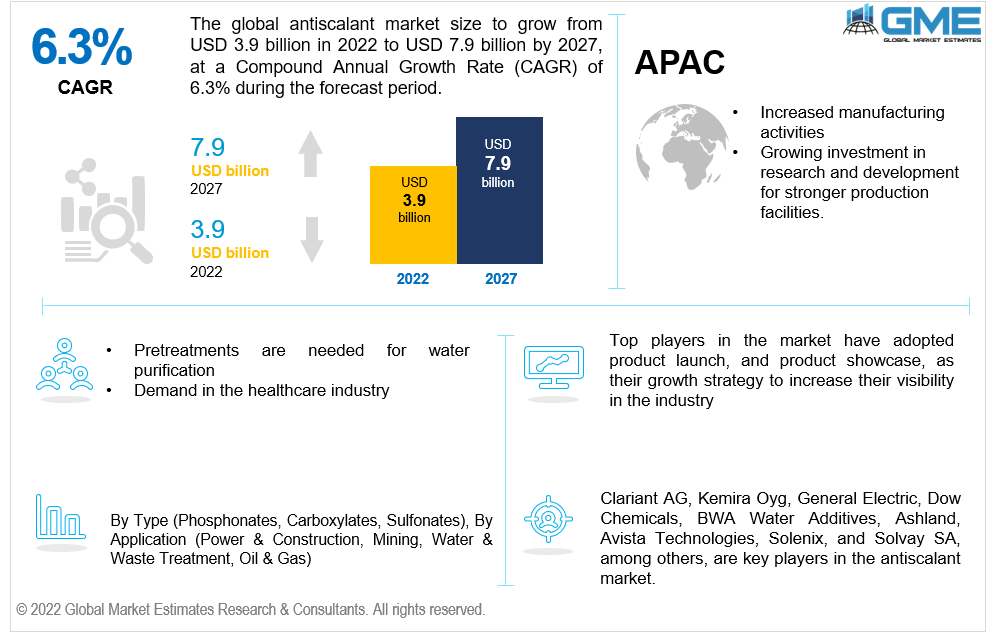

The Global Antiscalant Market is projected to grow from USD 3.9 billion in 2022 to USD 7.9 billion in 2027 at a CAGR of 6.3% from 2022 to 2027.

Antiscalant acts as a pre-treatment that filters the liquid used in various industries which helps prevent scaling and pores from getting blocked. It is designed to prevent crystal mineral salts from forming scaling.

The major drivers in the antiscalant market include the increasing demand for antiscalants in the oil & gas industry, water treatment industry, industrial manufacturing, and technological advancements in reverse osmosis and water filtration technologies. Antiscalant is cost-effective and reduces operational activities and maintenance by preventing membrane filters from being damaged by salt formation. The antiscalant market is growing rapidly because it keeps the raw materials clean and has many end-user applications across various industries. Demand for clean water for industrial, residential, and research purposes drives the market during the forecast period.

The major restraints in the global antiscalant market are the rise in toxicity concerns, the need for specialized handling, and price fluctuations.

The COVID-19 pandemic impacted the global antiscalant market significantly. The global Antiscalant market saw a surge during the pandemic. During the pandemic, the water & waste treatment sector boosted the market share. To prevent infections and the spread of diseases through water sources the global antiscalant market is expected to increase rapidly. The filtration process help keep the product pure and ensures the safety of feedwater utilized in various chemicals and drug manufacturing. The healthcare sector changed the market dynamics and accelerated the market share. The growing demand for the antiscalant market will boost the market's revenue between 2022 and 2027.

The war between Russia and Ukraine had a substantial impact on the global antiscalant market. Ukraine and Russia are facing production delays, a rise in transportation costs, and low sales due to the ongoing war. This also affects the other regions in Europe. Many countries trade with Russia and they are facing stockpiling and low demand due to increased prices. This impacts the political relations in the international market. Many companies are shutting down their business in Russia temporarily and this affects their other production plants as they have increased pressure of producing goods.

The sulfonates segment is expected to witness the largest share in the global antiscalant market during the forecast period of 2022-2027. It is used as a pre-treatment for the water and oil sector because it prevents scaling. Scaling diminishes the product’s purity and keeps it resistant and durable for a longer duration. It helps keep the product in its natural phenomena. Hence, considering all these advantages the sulfonates segment is expected to witness the largest share.

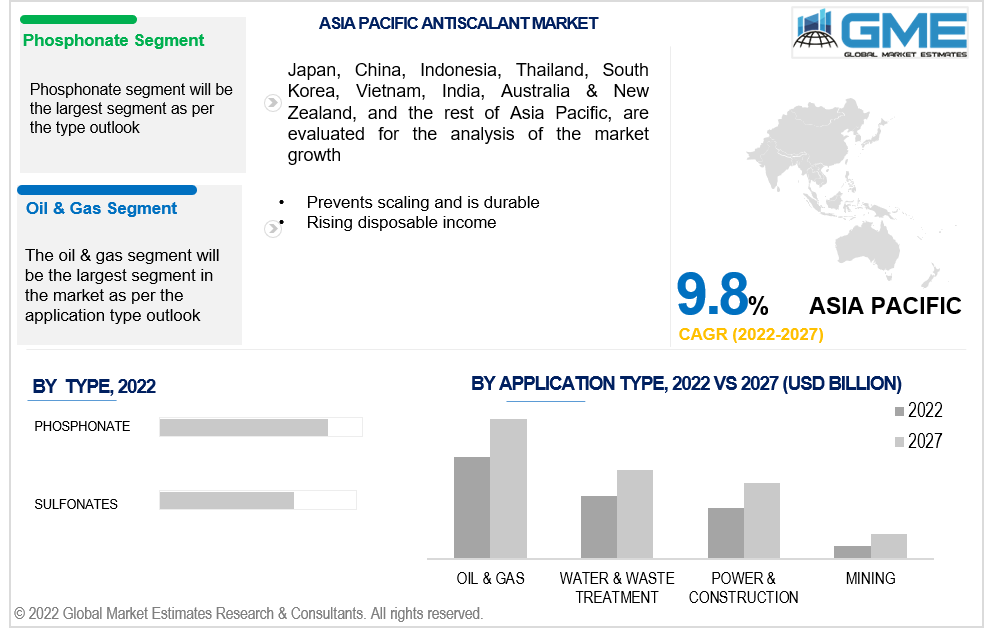

The phosphonate segment is expected to grow the fastest during 2022-2027. Phosphonate antiscalant is used in membranes to prevent fouling. It has functional electrons and antiscalants that help in preventing these compounds. It is commonly used in the healthcare, oil & gas, and water industry.

The oil & gas segment is expected to witness the largest share in the global antiscalant market during the forecast period of 2022-2027. Oil & gas production needs stimulation and polymer scale inhibitors. They prevent deposits from scaling and save the cost of production due to less expensive treatments for maintenance.

The waste & water treatment segment is expected to grow the fastest during 2022-2027. Antiscalants help in purifying and achieving clean water. The global antiscalant market will have a significant market share to prevent the spread of diseases, and infections due to the impact of covid-19. Hence, considering these advantages waste & water treatment will grow the fastest.

The North America segment is expected to witness the largest share in the global antiscalant market during the forecast period of 2022-2027. Due to the increase in disposable income of consumers and increased construction sites, the North America segment will dominate the global antiscalant market.

An increase in the standard of living, demand in the healthcare industry, and new technologies in the aerospace sector are a few reasons which drive the market in the United States. The antiscalant industry in the United States has been substantially strong for a few years and due to the increasing demand for horticulture farming, it is estimated to grow further during the forecast period.

Asia-Pacific is expected to grow the fastest during 2022-2027. Asia-Pacific region is developing huge manufacturing industries, and infrastructure for the healthcare industry, and there are many medical advancements. Antiscalants help purify water which is used in manufacturing technologies and help in reducing the maintenance period making them cost-effective.

The markets in India, China, and South Korea are developing new technologies and are also expanding businesses, this increases their production capacity. These industries need antiscalant chemicals for chemical manufacturing, [haramceutical manufacturing, and feedwater applications in various manufacturing industries. Hence, considering these advantages the global antiscalant market is expected to grow.

The Middle East and Africa account for a significant market share. There is substantial growth due to investments in research and development, increased industrial activities, and businesses that are expanding in the global economy. The competitive landscape helps in the growth rate of the global antiscalant market.

Clariant AG, Kemira Oyg, General Electric, Dow Chemicals, BWA Water Additives, Ashland, Avista Technologies, Solenix, and Solvay SA, among others, are key players in the antiscalant market.

Please note: This is not an exhaustive list of companies profiled in the report.

The global antiscalant market has observed several strategic alliances between company profiles to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1 Global Market Outlook

2.2 Application Type Outlook

2.3 Type Outlook

2.4 Regional Outlook

Chapter 3 Global Antiscalant Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Antiscalant Market

3.4 Metric Data based on the industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Antiscalant Market: By Type Trend Analysis

5.1 By Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Phosphonate

5.2.1 Market Estimates & Forecast Analysis of Phosphonate, By Region, 2019-2027 (USD Billion)

5.3 Carboxylates

5.3.1 Market Estimates & Forecast Analysis of Carboxylates Market Segment, By Region, 2019-2027 (USD Billion)

5.4 Sulfonates

5.4.1 Market Estimates & Forecast Analysis of Sulfonates Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Antiscalant Market: Application Type Trend Analysis

6.1 Application Type: Historic Data vs. Forecast Data Analysis, 2022 vs. 2027

6.2 Power & Consumption

6.2.1 Market Estimates & Forecast Analysis of Power & Consumption Segment, By Region, 2019-2027 (USD Billion)

6.3 Water & Waste Treatment

6.3.1 Market Estimates & Forecast Analysis of Water & Waste Treatment Segment, By Region, 2019-2027 (USD Billion)

6.4 Oil & Gas

6.4.1 Market Estimates & Forecast Analysis of Oil & Gas Segment, By Region, 2019-2027 (USD Billion)

6.5 Mining

6.5.1 Market Estimates & Forecast Analysis of Mining Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Antiscalant Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.2.4 U.S.

7.2.4.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.2.4.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.2.5 Canada

7.2.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.2.6 Mexico

7.2.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.4 Germany

7.3.4.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.4.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.5 UK

7.3.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.6 France

7.3.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.7 Russia

7.3.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.10 Rest of Europe

7.3.10.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.4.4 China

7.4.4.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.4.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.4.5 India

7.4.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.4.6 Japan

7.4.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.4.7 Australia

7.4.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.4.8 South Korea

7.4.8.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.3.9 Rest of Asia Pacific

7.3.9.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.5.4 Brazil

7.5.4.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.5.4.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.5.5 Rest of Central & South America

7.5.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.6.4 Saudi Arabia

7.6.4.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.4.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.6.5 United Arab Emirates

7.6.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.6.6 South Africa

7.6.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

7.6.7 Rest of Middle East & Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Application Type, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

9.1 Clariant AG

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 Kemira Oyg

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 General Electric

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Dow Chemicals

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 BWA Water Additives

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Ashland

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Avista Technologies

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Solenix

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Solvay SA

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Antiscalant Market

2 Global Antiscalant Market: Key Market Drivers

3 Global Antiscalant Market: Key Market Challenges

4 Global Antiscalant Market: Key Market Opportunities

5 Global Antiscalant Market: Key Market Restraints

6 Global Antiscalant Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Antiscalant Market, By Type, 2019-2027 (USD Billion)

8 Phosphonate: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

9 Sulfonates: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

10 Carboxylates: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

11 Global Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

12 Power & Consumption: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

13 Water & Waste Treatment: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

14 Oil & Gas: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

15 Mining: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

16 Regional Analysis: Global Antiscalant Market, By Region, 2019-2027 (USD Billion)

17 North America: Antiscalant Market, By Type, 2019-2027 (USD Billion)

18 North America: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

19 North America: Antiscalant Market, By Country, 2019-2027 (USD Billion)

20 U.S: Antiscalant Market, By Type, 2019-2027 (USD Billion)

21 U.S: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

22 Canada: Antiscalant Market, By Type, 2019-2027 (USD Billion)

23 Canada: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

24 Mexico: Antiscalant Market, By Type, 2019-2027 (USD Billion)

25 Mexico: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

26 Europe: Antiscalant Market, By Type, 2019-2027 (USD Billion)

27 Europe: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

28 Europe: Antiscalant Market, By Country, 2019-2027 (USD Billion)

29 Germany: Antiscalant Market, By Type, 2019-2027 (USD Billion)

30 Germany: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

31 UK: Antiscalant Market, By Type, 2019-2027 (USD Billion)

32 UK: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

33 France: Antiscalant Market, By Type, 2019-2027 (USD Billion)

34 France: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

35 Italy: Antiscalant Market, By Type, 2019-2027 (USD Billion)

36 Italy: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

37 Spain: Antiscalant Market, By Type, 2019-2027 (USD Billion)

38 Spain: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

39 Rest Of Europe: Antiscalant Market, By Type, 2019-2027 (USD Billion)

40 Rest Of Europe: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

41 Asia Pacific: Antiscalant Market, By Type, 2019-2027 (USD Billion)

42 Asia Pacific: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

43 Asia Pacific: Antiscalant Market, By Country, 2019-2027 (USD Billion)

44 China: Antiscalant Market, By Type, 2019-2027 (USD Billion)

45 China: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

46 India: Antiscalant Market, By Type, 2019-2027 (USD Billion)

47 India: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

48 Japan: Antiscalant Market, By Type, 2019-2027 (USD Billion)

49 Japan: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

50 South Korea: Antiscalant Market, By Type, 2019-2027 (USD Billion)

51 South Korea: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

52 Middle East & Africa: Antiscalant Market, By Type, 2019-2027 (USD Billion)

53 Middle East & Africa: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

54 Middle East & Africa: Antiscalant Market, By Country, 2019-2027 (USD Billion)

55 Saudi Arabia: Antiscalant Market, By Type, 2019-2027 (USD Billion)

56 Saudi Arabia: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

57 UAE: Antiscalant Market, By Type, 2019-2027 (USD Billion)

58 UAE: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

59 Central & South America: Antiscalant Market, By Type, 2019-2027 (USD Billion)

60 Central & South America: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

61 Central & South America: Antiscalant Market, By Country, 2019-2027 (USD Billion)

62 Brazil: Antiscalant Market, By Type, 2019-2027 (USD Billion)

63 Brazil: Antiscalant Market, By Application Type, 2019-2027 (USD Billion)

64 Clariant AG: Products Offered

65 Kemira Oyg: Products Offered

66 General Electric: Products Offered

67 Dow Chemicals: Products Offered

68 BWA Water Additives: Products Offered

69 Ashland: Products Offered

70 Solvay SA: Products Offered

71 Avista Technologies: Products Offered

72 Solenix: Products Offered

73 Other Companies: Products Offered

List of Figures

1. Global Antiscalant Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Antiscalant Market: Penetration & Growth Prospect Mapping

7. Global Antiscalant Market: Value Chain Analysis

8. Global Antiscalant Market Drivers

9. Global Antiscalant Market Restraints

10. Global Antiscalant Market Opportunities

11. Global Antiscalant Market Challenges

12. Key Antiscalant Market Manufacturer Analysis

13. Global Antiscalant Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Clariant AG: Company Snapshot

16. Clariant AG: Swot Analysis

17. Kemira Oyg: Company Snapshot

18. Kemira Oyg: Swot Analysis

19. General Electric: Company Snapshot

20. General Electric: Swot Analysis

21. Dow Chemicals: Company Snapshot

22. Dow Chemicals: Swot Analysis

23. BWA Water Additives: Company Snapshot

24. BWA Water Additives: Swot Analysis

25. Solvay SA: Company Snapshot

26. Solvay SA: Swot Analysis

27. Avista Technologies: Company Snapshot

28. Avista Technologies: Swot Analysis

29. Solenix: Company Snapshot

30. Solenix: Swot Analysis

31. Ashland: Company Snapshot

32. Ashland: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: SWOT Analysis

The Global Antiscalant Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Antiscalant Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS