Global Artificial Intelligence in Livestock Farming Market Size, Trends & Analysis - Forecasts to 2026 By Component (Solution/ Software/ App, IoT Sensors, and Service) By Application (Real Time Livestock Behavior Monitoring, Healthcare & Disease Monitoring, Livestock Feed & Water Monitoring, Livestock Control & Fencing Management, and Livestock Production Management), By Technology (Computer Vision, Machine Learning, and Predictive Analysis), By Farm Size (Small and Medium-Sized Farms, and Large Sized Farms) Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

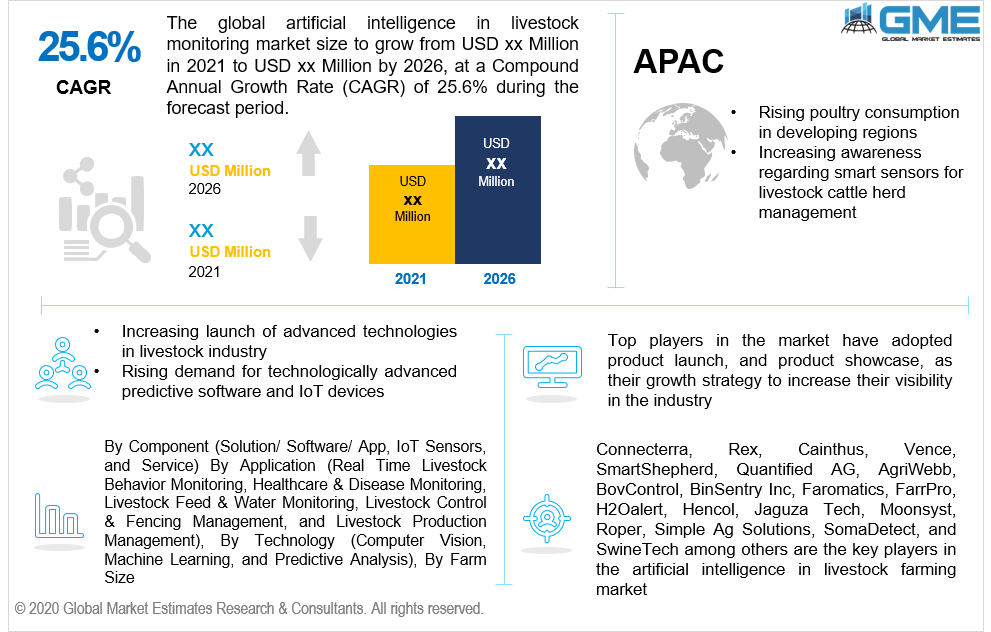

The global artificial intelligence in livestock farming market is projected to grow at a CAGR value of around 25.6% during the forecast period [2021 to 2026].

The artificial intelligence in livestock farming market growth is augmented by the rising awareness regarding data-driven decision methodology to manage livestock feed; end-product and overall herd health. Moreover, the increasing demand for livestock productivity through deep-learning technology, and rising government support through product launch activities and funding programs to promote adoption of modern livestock management software and platforms are some of the other factors supporting the growth of this segment. Also, the rapidly rising population clubbed with increasing poultry and dairy product consumption, and rising concern associated with livestock health and disease spread will positively affect the growth of the market.

Farmers often face challenges and issues such as poor infrastructure, low connectivity, unmet demands for animal proteins, and rapidly spreading disease amongst livestock. AI Technology is disrupting all industries in the modern age and livestock management is no exception. Since the past few years, the entire dairy and livestock industry has drastically changed due to the augmentation of disruptive digital transformation, which has made traditional procedures simpler and has helped farmers make data-driven decisions. With the launch of AI technologies in livestock farming, many farmers were able to accelerate their livestock production, overall revenue, enhance livestock health and carefully monitor budding diseases that could likely be a threat to the animals.

AI is simply a mirror of human intelligence which uses the application of algorithms that can perform a series of tasks that were performed earlier by farmers. The major component of AI technology includes software, apps and IoT based sensors. To manage and closely monitor livestock the prime AI technologies used are machine learning, deep learning and predictive analytics.

The application area covered by AI technologies is improvement of feed quality, computer aided vision algorithms, livestock health monitoring, supply chain optimization and real-time behavior monitoring. With the disruption of AI in livestock industry, the market has witnessed the entry of many start-up firms that have launched innovative IoT sensors to combat the unmet needs of farmers. For instance, Connecterra is a United States based company that is involved in offering engineered sensor & cloud based tools with machine learning technologies to successfully predict the real time behavior of farm animals. The real time monitoring helps farmers enjoy better health management and accelerate their revenue streams.

The COVID-19 has positively impacted this market owing to factors such as the rising need for animal health data for health management, increasing demand for hands-free technologies for the feeding process to avoid contamination, and rapidly rising food demand. However, the cost of such technologies may pose a challenging factor for the developing country’s market growth.

Based on component, the market is segmented into solution/ software/ app, IoT sensors, and service. Owing to the rising need for sensors and intelligent devices in farm setups to avoid labor cost, and manual maintenance cost the market for IoT sensors will be growing the fastest with the highest CAGR value. Also, rising awareness amongst farmers from the developed regions about sensors and devices that can monitor their farms' feed levels and livestock vital levels, plays a vital role in the segment’s growth.

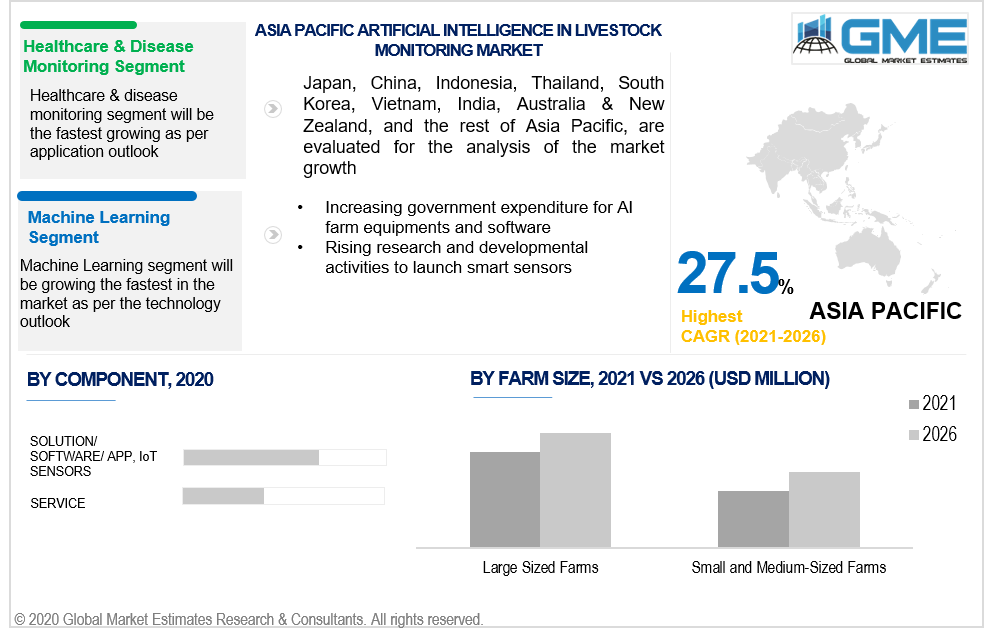

Based on the application segment, the market is classified into real time livestock behavior monitoring, healthcare & disease monitoring, livestock feed & water monitoring, livestock control & fencing management, and livestock production management. Healthcare & disease monitoring segment is predicted to be the fastest-growing segment followed by the livestock feed & water monitoring segment. Rising concerns regarding low milk and poultry production due to disease or infection outbreak is the major factor leading to the growth of this segment.

Based on the technology used by AI platforms in livestock farming, the segmentation of the market is Computer Vision, Machine Learning, and Predictive Analysis. Computer Vision will be the largest shareholder of the market whereas Machine Learning will be the fastest-growing segment from 2021 to 2026. Machine learning-enabled software is rapidly getting adopted by various livestock organizations and farmers across the globe in order to enhance their productivity and gain a competitive edge in business operations.

Based on the farm size, the AI in livestock farming market can be segmented into small and medium-sized farms and large sized farms. Large sized farms will be the largest shareholder of the market. This is mainly because the benefits of AI technologies offered to a large sized livestock farm are much advantageous than the use of AI technologies to small family farms. Management of large herd size, high quantity feed monitoring and heavily populated livestock disease monitoring are some of the advantages of large sized farms that adopt AI technologies.

As per the geographical analysis, the artificial intelligence in livestock farming market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The dominant share of North America is mainly attributed to rising awareness regarding the latest technology to manage farm animals, increasing cases of low-quality milk and dairy products, and rising demand for hands-free cattle handling. The Asia Pacific segment will be growing the fastest owing to rising disease burden prevalence amongst cattle and livestock animals and increasing food volume consumption.

Connecterra, Rex, Cainthus, Vence, SmartShepherd, Quantified AG, AgriWebb, BovControl, BinSentry Inc, Faromatics, FarrPro, H2Oalert, Hencol, Jaguza Tech, Moonsyst, Roper, Simple Ag Solutions, SomaDetect, and SwineTech among others are the key players in the artificial intelligence in livestock farming market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Artificial Intelligence in Livestock Monitoring Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Application Overview

2.1.4 Technology Overview

2.1.5 Farm Size Overview

2.1.6 Regional Overview

Chapter 3 Artificial Intelligence in Livestock Monitoring Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for livestock behaviour monitoring software and sensors

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Technology Growth Scenario

3.4.4 Farm Size Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Farm Size Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Artificial Intelligence in Livestock Monitoring Market, By Component

4.1 Component Outlook

4.2 Solution/ Software/ App

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 IoT Sensors

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

4.4 Service

4.4.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Artificial Intelligence in Livestock Monitoring Market, By Technology

5.1 Technology Outlook

5.2 Computer Vision

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Machine Learning

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

5.4 Predictive Analysis

5.4.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 6 Artificial Intelligence in Livestock Monitoring Market, By Application

6.1 Real Time Livestock Behavior Monitoring

6.1.1 Market Size, By Region, 2021-2026 (USD Million)

6.2 Healthcare & Disease Monitoring

6.2.1 Market Size, By Region, 2021-2026 (USD Million)

6.3 Livestock Feed & Water Monitoring

6.3.1 Market Size, By Region, 2021-2026 (USD Million)

6.4 Livestock Control & Fencing Management

6.4.1 Market Size, By Region, 2021-2026 (USD Million)

6.5 Livestock Production Management

6.5.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 7 Artificial Intelligence in Livestock Monitoring Market, By Farm Size

7.1 Small and Medium-Sized Farms

7.1.1 Market Size, By Region, 2021-2026 (USD Million)

7.2 Large Sized Farms

7.2.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 8 Artificial Intelligence in Livestock Monitoring Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2021-2026 (USD Million)

8.2.2 Market Size, By Component, 2021-2026 (USD Million)

8.2.3 Market Size, By Application, 2021-2026 (USD Million)

8.2.4 Market Size, By Technology, 2021-2026 (USD Million)

8.2.5 Market Size, By Farm Size, 2021-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Component, 2021-2026 (USD Million)

8.2.4.2 Market Size, By Application, 2021-2026 (USD Million)

8.2.4.3 Market Size, By Technology, 2021-2026 (USD Million)

Market Size, By Farm Size, 2021-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Component, 2021-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2021-2026 (USD Million)

8.2.7.3 Market Size, By Technology, 2021-2026 (USD Million)

8.2.7.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2021-2026 (USD Million)

8.3.2 Market Size, By Component, 2021-2026 (USD Million)

8.3.3 Market Size, By Application, 2021-2026 (USD Million)

8.3.4 Market Size, By Technology, 2021-2026 (USD Million)

8.3.5 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Component, 2021-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2021-2026 (USD Million)

8.3.6.3 Market Size, By Technology, 2021-2026 (USD Million)

8.3.6.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Component, 2021-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2021-2026 (USD Million)

8.3.7.3 Market Size, By Technology, 2021-2026 (USD Million)

8.3.7.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Component, 2021-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2021-2026 (USD Million)

8.3.8.3 Market Size, By Technology, 2021-2026 (USD Million)

8.3.8.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Component, 2021-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2021-2026 (USD Million)

8.3.9.3 Market Size, By Technology, 2021-2026 (USD Million)

8.3.9.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Component, 2021-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2021-2026 (USD Million)

8.3.10.3 Market Size, By Technology, 2021-2026 (USD Million)

8.3.10.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Component, 2021-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2021-2026 (USD Million)

8.3.11.3 Market Size, By Technology, 2021-2026 (USD Million)

8.3.11.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2021-2026 (USD Million)

8.4.2 Market Size, By Component, 2021-2026 (USD Million)

8.4.3 Market Size, By Application, 2021-2026 (USD Million)

8.4.4 Market Size, By Technology, 2021-2026 (USD Million)

8.4.5 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Component, 2021-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2021-2026 (USD Million)

8.4.6.3 Market Size, By Technology, 2021-2026 (USD Million)

8.4.6.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Component, 2021-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2021-2026 (USD Million)

8.4.7.3 Market Size, By Technology, 2021-2026 (USD Million)

8.4.7.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Component, 2021-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2021-2026 (USD Million)

8.4.8.3 Market Size, By Technology, 2021-2026 (USD Million)

8.4.8.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Component, 2021-2026 (USD Million)

8.4.9.2 Market size, By Application, 2021-2026 (USD Million)

8.4.9.3 Market Size, By Technology, 2021-2026 (USD Million)

8.4.9.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Component, 2021-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2021-2026 (USD Million)

8.4.10.3 Market Size, By Technology, 2021-2026 (USD Million)

8.4.10.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2021-2026 (USD Million)

8.5.2 Market Size, By Component, 2021-2026 (USD Million)

8.5.3 Market Size, By Application, 2021-2026 (USD Million)

8.5.4 Market Size, By Technology, 2021-2026 (USD Million)

8.5.5 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Component, 2021-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2021-2026 (USD Million)

8.5.6.3 Market Size, By Technology, 2021-2026 (USD Million)

8.5.6.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Component, 2021-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2021-2026 (USD Million)

8.5.7.3 Market Size, By Technology, 2021-2026 (USD Million)

8.5.7.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Component, 2021-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2021-2026 (USD Million)

8.5.8.3 Market Size, By Technology, 2021-2026 (USD Million)

8.5.8.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2021-2026 (USD Million)

8.6.2 Market Size, By Component, 2021-2026 (USD Million)

8.6.3 Market Size, By Application, 2021-2026 (USD Million)

8.6.4 Market Size, By Technology, 2021-2026 (USD Million)

8.6.5 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Component, 2021-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2021-2026 (USD Million)

8.6.6.3 Market Size, By Technology, 2021-2026 (USD Million)

8.6.6.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Component, 2021-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2021-2026 (USD Million)

8.6.7.3 Market Size, By Technology, 2021-2026 (USD Million)

8.6.7.4 Market Size, By Farm Size, 2021-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Component, 2021-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2021-2026 (USD Million)

8.6.8.3 Market Size, By Technology, 2021-2026 (USD Million)

8.6.8.4 Market Size, By Farm Size, 2021-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Connecterra

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Rex

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Cainthus

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Vence

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 SmartShepherd

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Quantified AG

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 AgriWebb

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 BovControl

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 BinSentry Inc

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Artificial Intelligence in Livestock Farming Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Artificial Intelligence in Livestock Farming Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS