Global Augmented and Virtual Reality in Healthcare Market Size, Trends & Analysis - Forecasts to 2027 By Offering (Sensors, Semiconductor Component, Displays and Projectors, Position Tracker, Cameras, Software and Others), By Device Type (Head-Mounted Display (HMD), Handheld Device, Gesture Tracking Devices, Data Gloves, Projectors and Display Walls and Others), By Application (Surgery, Fitness Management, Patient Care Management, Pharmacy Management, Medical Training and Educational and Others), By End-User(Hospitals, Clinics, and Surgical Centers, Research Organizations and Pharma Companies, Research and Diagnostics Laboratories, Government and Defense Institutions and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

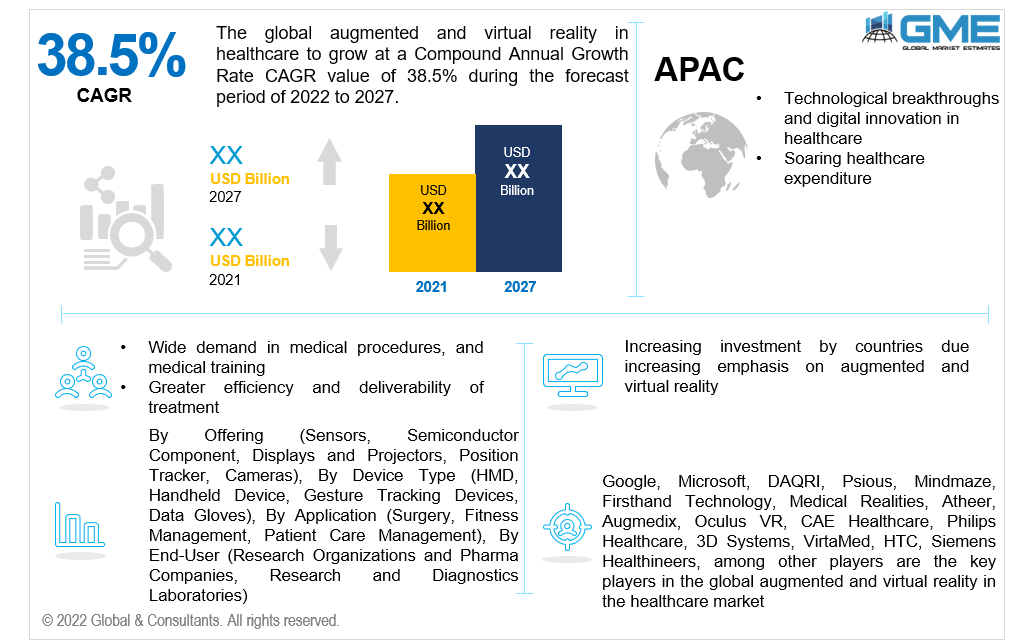

The global augmented and virtual reality in the healthcare market is projected to grow at a CAGR rate of 38.5% from 2022 to 2027.

Virtual reality (VR) and augmented reality (AR) are digital technologies that enable automation and can be utilized in industries where repeated operations must be completed and often refined. Healthcare education and training, especially in surgery, is a prominent application of VR and AR in the medical industry. Some of the fundamental factors expected to boost the growth and adoption of augmented reality (AR) and virtual reality (VR) technologies in the healthcare industry include technological breakthroughs and digitalization in healthcare, favourable government proposals, soaring healthcare spending, increasing application in surgical procedures, and medical background.

The use of such technology in healthcare enables many iterations of simple activities in a simulated environment without any need for constant monitoring by medical personnel, potentially lowering the expenses of training centers and medical personnel. Furthermore, head-mounted devices could be safely deployed in patients' residences, especially for immobile patients, reducing the need for hospitalization thus driving the market growth.

The ability of VR and AR experiences to design attractive and user-friendly experiences, lowering patient attrition and providing a more pleasurable environment, as well as the use of such innovations in clinical education could massively reduce the likelihood of surgical errors, resulting in substantial improvement of patient safety, which are driving the market growth. Furthermore, the usage of AR and VR may assist rehab physicians in conducting telerehabilitation on a remote basis, in which the patient performs exercises at home in a simulated space and the data is subsequently transferred to the clinician, is pushing market expansion.

AR is more widely employed in medical procedures than VR, which is largely used for training and simulations. As per CBInsights, CrunchBase, and AngelList's extensive data inquiry, there are presently roughly 30 start-ups concentrating on AR medical applications around the world. Nine of them have received funding totalling $552 million, indicating a 30% investment attractiveness rate. The use of augmented reality in medical care is still in its early stages. VR can be utilized for amblyopia therapy, rehab training, and the management of some mental diseases, while AR can be used to help surgeons and direct robots during surgery.

Due to various technical breakthroughs in this sector, AR & VR in healthcare was positively influenced during the emergence of the covid-19 pandemic. This positive rise can be linked to the usage of augmented reality and virtual reality in healthcare to better handle treatment schedules, medication delivery, and planning more effectively, and this is anticipated to expand tremendously during the pandemic.

Some of the market's drawbacks include a lack of knowledge in the implementation of AR and VR solutions, as well as a lack of competence among healthcare professionals to develop products. In addition, the market faces obstacles such as addressing social challenges, worries about privacy protection, and a lack of interoperability and compatibility between AR and VR solutions proposed by various suppliers.

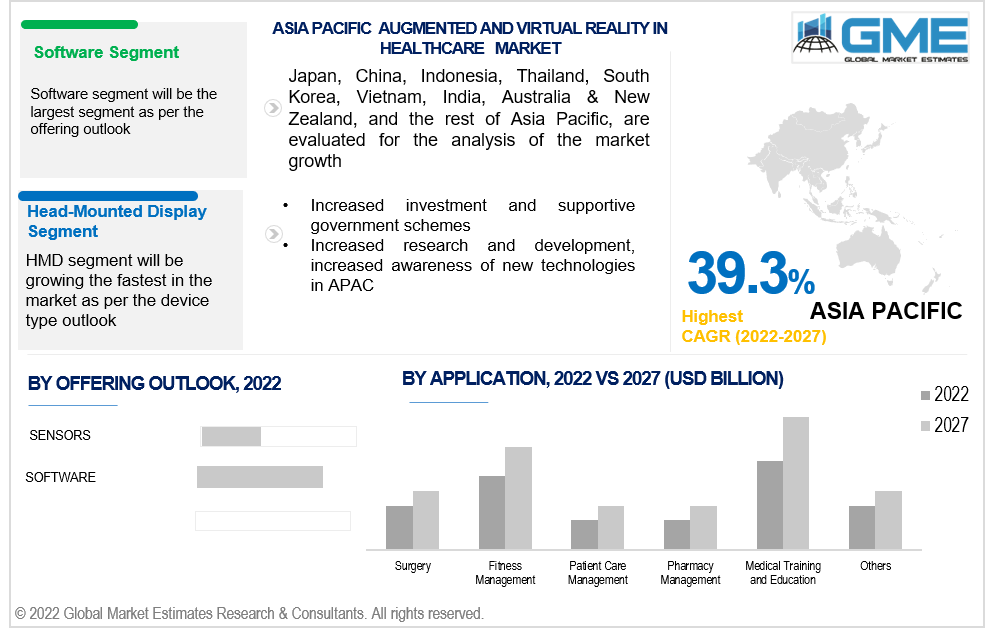

Based on the offering, augmented and virtual reality in the healthcare market is divided into sensors, semiconductor components, displays and projectors, position trackers, cameras, and software. The software segment is expected to grow the fastest in the augmented and virtual reality healthcare market from 2022 to 2027. Recent technological breakthroughs in the in-app design, such as EyeDecide, have contributed to this increase. It measures a variety of characteristics to detect eye problems. Furthermore, programs like Applied VR assist patients in overcoming anxiety throughout any medical treatment.

Based on the device type, the augmented and virtual reality in the healthcare market is divided into head-mounted display (HMD), handheld device, gesture tracking devices, data gloves, projectors and display walls, and others.

The head-mounted display (HMD) segment is expected to grow the fastest in augmented and virtual reality in the healthcare market from 2022 to 2027. HMDs offer one-of-a-kind possibilities for conducting experiments into real-world work performance. They not only save money when compared to field investigations, but they will also allow for more precise control of experiment variables.

Based on the application, the global augmented and virtual reality in the healthcare market is divided into surgery, fitness management, patient care management, pharmacy management, medical training and education, and others. The patient care management segment is expected to hold a larger share as compared to the other segments. The elements can be ascribed to the rapid improvement of technology in the healthcare sector, as well as a growth in health-related difficulties around the world.

Based on the end-user, the augmented and virtual reality in the healthcare market is divided into hospitals, clinics, and surgical centers, research organizations and pharma companies, research and diagnostics laboratories, government and defense institutions, and others. This increase is due to an increase in the number of patients with chronic diseases and the growing need for better patient outcomes. Technological advancements aid healthcare facilities in improving the quality of services by allowing them to provide care at a lower cost and in less time.

As per the geographical analysis, the augmented and virtual reality in the healthcare market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in augmented and virtual reality in the healthcare market from 2022 to 2027. Higher adoption of technology, investments in R&D efforts, and favorable government measures are all driving growth in this region. Furthermore, due to rising competition from healthcare providers and payers to lower healthcare expenses, there is a growth in outsourced healthcare IT services in North America fuelling regional growth.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing region in the augmented and virtual reality in the healthcare market during the forecast period. The drivers for augmented and virtual reality in the healthcare industry are increased research and development, increased awareness of new technologies in APAC, increased population consciousness, and improved healthcare infrastructure.

Google, Microsoft, DAQRI, Psious, Mindmaze, Firsthand Technology, Medical Realities, Atheer, Augmedix, Oculus VR, CAE Healthcare, Philips Healthcare, 3D Systems, VirtaMed, HTC, Siemens Healthineers, among other players are the key players in the global augmented and virtual reality in the healthcare market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Augmented and Virtual Reality in Healthcare Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Device Type Overview

2.1.4 Application Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Augmented and Virtual Reality in Healthcare Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1. Technological breakthroughs and digitalization in healthcare

3.3.1.2 Increasing application in surgical procedures, and medical background

3.3.2 Application Challenges

3.3.2.1 Lack of competence among healthcare professionals to develop products

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Device Type Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Augmented and Virtual Reality in Healthcare Market, By Offering

4.1 Offering Outlook

4.2 Sensors

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Semiconductor Component

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Displays and Projectors

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Position Tracker

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

4.6 Cameras

4.6.1 Market Size, By Region, 2022-2027 (USD Billion)

4.7 Others

4.7.1 Market Size, By Region, 2022-2027 (USD Billion)

4.8 Software

4.8.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Augmented and Virtual Reality in Healthcare Market, By Application

5.1 Industry Outlook

5.2 Surgery

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Fitness Management

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Patient Care Management

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Pharmacy Management

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Medical Training and Education

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

5.7 Others

5.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Augmented and Virtual Reality in Healthcare Market, By Device Type

6.1 Head-Mounted Display (HMD)

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Handheld Device

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Gesture Tracking Devices

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Data Gloves

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

6.5 Projectors and Display Walls

6.5.1 Market Size, By Region, 2022-2027 (USD Billion)

6.6 Others

6.6.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Augmented and Virtual Reality in Healthcare Market, By End-User

7.1 Hospitals, Clinics, and Surgical Centers

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Research Organizations and Pharma Companies

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Research and Diagnostics Laboratories

7.3.1 Market Size, By Region, 2022-2027 (USD Billion)

7.4 Government and Defense Institutions

7.4.1 Market Size, By Region, 2022-2027 (USD Billion)

7.5 Others

7.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Augmented and Virtual Reality in Healthcare Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2022-2027 (USD Billion)

8.2.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.2.3 Market Size, By Device Type, 2022-2027 (USD Billion)

8.2.4 Market Size, By Application, 2022-2027 (USD Billion)

8.2.5 Market Size, By End-User, 2022-2027 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.2.4.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.2.4.3 Market Size, By Application, 2022-2027 (USD Billion)

Market Size, By End-User, 2022-2027 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.2.7.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.2.7.3 Market Size, By Application, 2022-2027 (USD Billion)

8.2.7.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2022-2027 (USD Billion)

8.3.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.3 Market Size, By Device Type, 2022-2027 (USD Billion)

8.3.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.5 Market Size, By End-User, 2022-2027 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.6.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.3.6.3 Market Size, By Application, 2022-2027 (USD Billion)

8.3.6.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.7.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.3.7.3 Market Size, By Application, 2022-2027 (USD Billion)

8.3.7.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.8.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.3.8.3 Market Size, By Application, 2022-2027 (USD Billion)

8.3.8.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.9.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.3.9.3 Market Size, By Application, 2022-2027 (USD Billion)

8.3.9.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.10.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.3.10.3 Market Size, By Application, 2022-2027 (USD Billion)

8.3.10.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.11.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.3.11.3 Market Size, By Application, 2022-2027 (USD Billion)

8.3.11.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2022-2027 (USD Billion)

8.4.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.3 Market Size, By Device Type, 2022-2027 (USD Billion)

8.4.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.5 Market Size, By End-User, 2022-2027 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.6.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.4.6.3 Market Size, By Application, 2022-2027 (USD Billion)

8.4.6.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.7.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.4.7.3 Market Size, By Application, 2022-2027 (USD Billion)

8.4.7.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.8.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.4.8.3 Market Size, By Application, 2022-2027 (USD Billion)

8.4.8.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.9.2 Market size, By Device Type, 2022-2027 (USD Billion)

8.4.9.3 Market Size, By Application, 2022-2027 (USD Billion)

8.4.9.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.10.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.4.10.3 Market Size, By Application, 2022-2027 (USD Billion)

8.4.10.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2022-2027 (USD Billion)

8.5.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.3 Market Size, By Device Type, 2022-2027 (USD Billion)

8.5.4 Market Size, By Application, 2022-2027 (USD Billion)

8.5.5 Market Size, By End-User, 2022-2027 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.6.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.5.6.3 Market Size, By Application, 2022-2027 (USD Billion)

8.5.6.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.7.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.5.7.3 Market Size, By Application, 2022-2027 (USD Billion)

8.5.7.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.8.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.5.8.3 Market Size, By Application, 2022-2027 (USD Billion)

8.5.8.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2022-2027 (USD Billion)

8.6.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.3 Market Size, By Device Type, 2022-2027 (USD Billion)

8.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.6.5 Market Size, By End-User, 2022-2027 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.6.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.6.6.3 Market Size, By Application, 2022-2027 (USD Billion)

8.6.6.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.7.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.6.7.3 Market Size, By Application, 2022-2027 (USD Billion)

8.6.7.4 Market Size, By End-User, 2022-2027 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.8.2 Market Size, By Device Type, 2022-2027 (USD Billion)

8.6.8.3 Market Size, By Application, 2022-2027 (USD Billion)

8.6.8.4 Market Size, By End-User, 2022-2027 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2021

9.2 Google

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Microsoft

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 DAQRI

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Psious

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Mindmaze

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Firsthand Technology

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Medical Realities

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Atheer

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Augmedix

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Augmented and Virtual Reality in Healthcare Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Augmented and Virtual Reality in Healthcare Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS