Global Automated Food Delivery Market Size, Trends & Analysis - Forecasts to 2028 By Type (4 Wheels, 6 Wheels, and Others), By End User (Restaurants and Delivery Companies), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

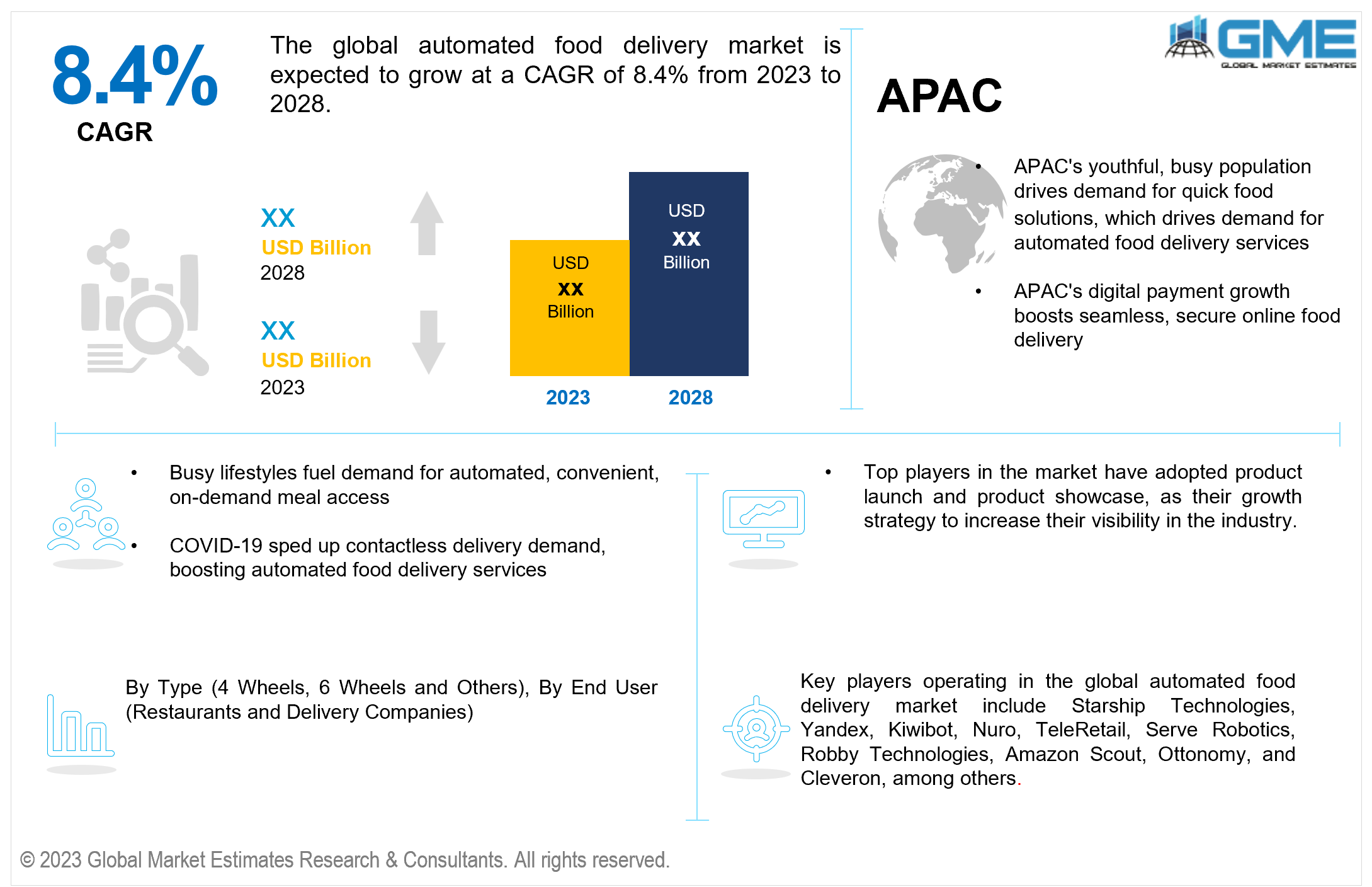

The global automated food delivery market is expected to grow at a CAGR of 8.4% from 2023 to 2028. Automated food delivery, employing robots or self-driving vehicles, has gained traction for its efficiency and convenience. Companies like Starship Technologies and Nuro use these technologies, allowing customers to place orders via apps or websites. Once prepared, the food is loaded into autonomous vehicles that navigate to the customer's location. Benefits include enhanced efficiency, potential cost savings, and convenient on-demand delivery. However, challenges such as regulatory complexities, technical limitations, and societal acceptance remain, with concerns about potential job displacement as automation evolves. While promising, widespread adoption may take time as technology improves and regulations adapt to accommodate these innovations.

Many market drivers positively affect the growth of the automated food delivery market. The growing consumer demand for convenience and speed in food delivery services fuels the adoption of automated solutions, catering to the on-demand culture. Also, technological advancements, particularly in robotics, AI, and autonomous vehicles, contribute significantly by enabling more efficient and cost-effective delivery methods. Furthermore, the COVID-19 epidemic has increased the need for contactless delivery solutions, driving up demand for automated systems. Furthermore, the increasing investments by major players and startups in developing and scaling automated delivery technologies are propelling market growth by enhancing capabilities and expanding service coverage, driving the overall expansion of this market segment.

Several constraints hinder the rapid expansion of the automated food delivery market. Regulatory hurdles and legal complexities surrounding the deployment of autonomous vehicles and robots in public spaces pose significant challenges. Concerns related to safety, liability, and compliance with local laws and regulations impede widespread adoption. Moreover, the high initial costs associated with developing and implementing these advanced technologies, including maintenance expenses and infrastructure requirements, act as barriers for smaller businesses or startups looking to enter this market. Additionally, societal acceptance and trust in automated delivery systems remain uncertain, impacting the pace of adoption and deployment of these technologies on a broader scale.

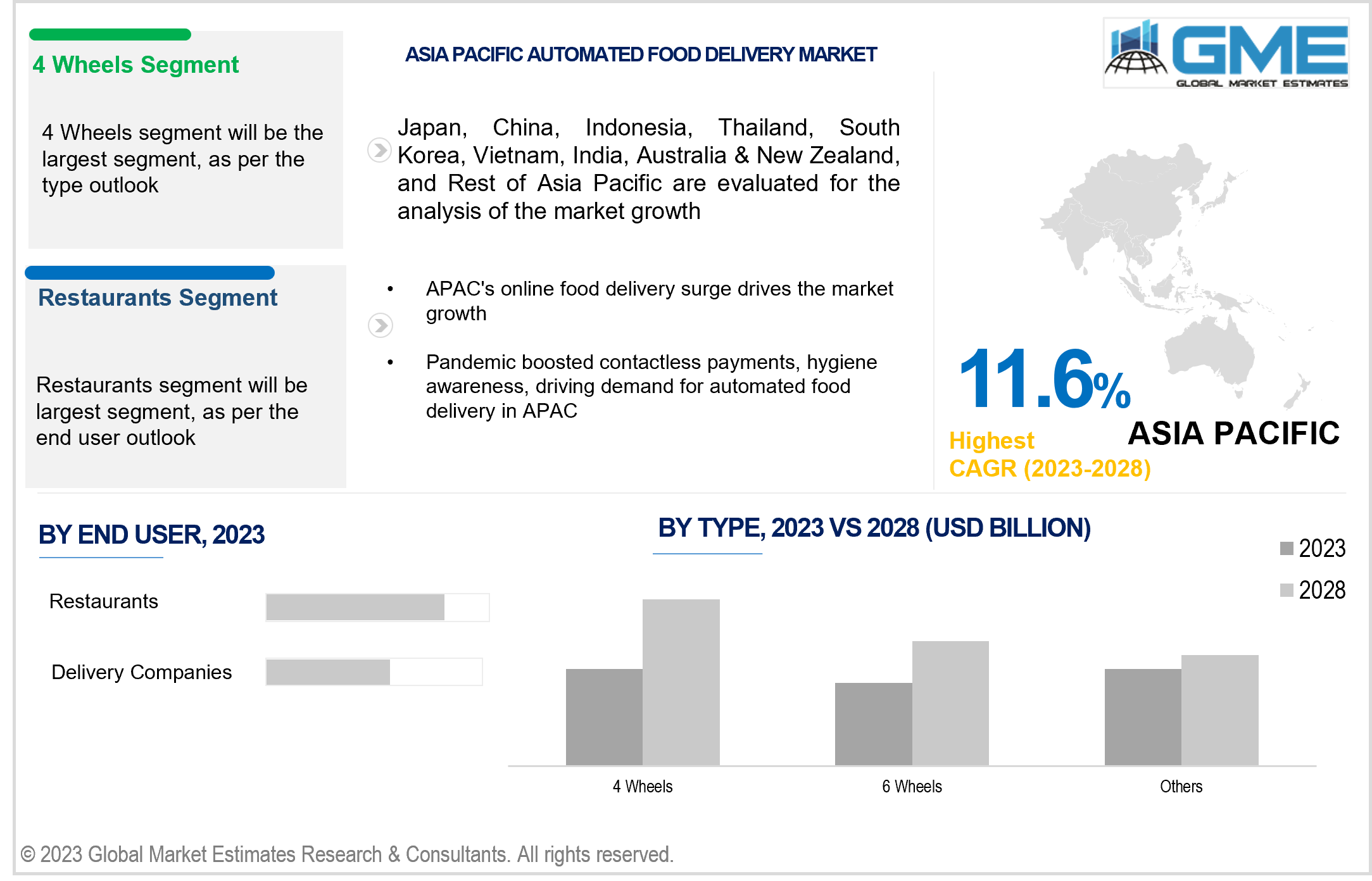

Based on type, the market is segmented into 4 wheels, 6 wheels, and others. The 4 wheels segment is expected to be the largest and fastest-growing segment during the forecast period. These robots leverage advanced technology, including sensors and AI, enabling them to traverse sidewalks, cross streets, and manoeuvre through crowded areas efficiently. Their four-wheel design provides stability and agility, allowing larger payloads and diverse food delivery options. Moreover, these robots are often more cost-effective to develop and maintain compared to other specialized delivery systems, contributing to their widespread adoption and market leadership.

Based on end user, the market is segmented into delivery companies and restaurants. The restaurants segment is expected to be the largest segment during the forecast period. Restaurants are leveraging automated delivery to expand their reach and cater to the growing demand for convenience-driven services. By integrating with third-party delivery platforms or developing in-house automated systems, restaurants capitalize on their brand recognition, diverse menu offerings, and customer loyalty, enabling them to tap into the burgeoning market for on-demand, tech-driven food delivery.

The delivery companies segment is expected to be the fastest-growing segment in the global automated food delivery market over the forecast period. These companies possess the infrastructure, resources, and expertise to invest in and deploy automated systems efficiently. They leverage technology advancements, partnerships with tech firms, and strategic collaborations with restaurants to enhance delivery capabilities. Their ability to innovate, optimize routes, and handle large-scale operations enables swift adoption of autonomous vehicles and robots, driving the segment's rapid growth within the market.

North America is analysed to be the region with the largest share in the global automated food delivery market during the forecast period. The region boasts a robust technological infrastructure and high consumer acceptance of innovative solutions, fostering an environment conducive to adopting automated delivery systems. Major players and startups within North America continually invest in research and development, driving advancements in robotics, AI, and autonomous vehicle technologies. For instance, Nuro, a key market player in this market invested about USD 600 million in 2021 to set up a new production facility for delivery robots in the U.S. Moreover, Walmart plans to automate 65% of its stores by 2026, reducing processing time at online fulfilment centers and utilizing its large stores for online deliveries. The market is buoyed by a strong demand for convenience and on-demand services, coupled with a willingness to embrace new delivery methods, thus solidifying North America's position as a leader in this evolving market.

Asia Pacific is projected to be the fastest-growing region across the global automated food delivery market over the forecast period. The region's rapid expansion is attributed to the substantial growth of the online food delivery market in countries like China, India, Japan, and Australia. The two-year pandemic significantly accelerated the adoption of contactless and digital payment methods, fostering the expansion of online food delivery services. Moreover, the region's large population of young, busy individuals seeking convenience aligns perfectly with the on-demand nature of automated food delivery, driving its exponential growth in the APAC region during the forecast period.

Key players operating in the global automated food delivery market include Starship Technologies, Yandex, Kiwibot, Nuro, TeleRetail, Serve Robotics, Robby Technologies, Amazon Scout, Ottonomy, and Cleveron, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2023, Uber indicated an interest in autonomous technology for its services, with Serve Robotics planning to expand its partnership with Uber Eats to deploy 2,000 delivery robots across the U.S. and Canada from later this year or early 2024.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market OpportunIties: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AUTOMATED FOOD DELIVERY MARKET, BY END USER

4.1 Introduction

4.2 Global Automated Food Delivery Market: End User Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Restaurants

4.4.1 Restaurants Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Delivery Companies

4.5.1 Delivery Companies Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL AUTOMATED FOOD DELIVERY MARKET, BY TYPE

5.1 Introduction

5.2 Global Automated Food Delivery Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 4 Wheels

5.4.1 4 Wheels Market Estimates And Forecast, 2020-2028 (USD Billion)

5.5 6 Wheels

5.5.1 6 Wheels Market Estimates And Forecast, 2020-2028 (USD Billion)

5.6 Other Types

5.6.1 Other Types Market Estimates And Forecast, 2020-2028 (USD Billion)

6 GLOBAL AUTOMATED FOOD DELIVERY MARKET, BY REGION

6.1 Introduction

6.2 North America Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.1 By End User

6.2.2 By Type

6.2.3 By Country

6.2.3.1 U.S. Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.1.1 By End User

6.2.3.1.2 By Type

6.2.3.2 Canada Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.2.1 By End User

6.2.3.2.2 By Type

6.2.3.3 Mexico Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.3.1 By End User

6.2.3.3.2 By Type

6.3 Europe Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.1 By End User

6.3.2 By Type

6.3.3 By Country

6.3.3.1 Germany Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.1.1 By End User

6.3.3.1.2 By Type

6.3.3.2 U.K. Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.2.1 By End User

6.3.3.2.2 By Type

6.3.3.3 France Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.3.1 By End User

6.3.3.3.2 By Type

6.3.3.4 Italy Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.4.1 By End User

6.3.3.4.2 By Type

6.3.3.5 Spain Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.5.1 By End User

6.3.3.5.2 By Type

6.3.3.6 Netherlands Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By End User

6.3.3.6.2 By Type

6.3.3.7 Rest of Europe Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By End User

6.3.3.6.2 By Type

6.4 Asia Pacific Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.1 By End User

6.4.2 By Type

6.4.3 By Country

6.4.3.1 China Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.1.1 By End User

6.4.3.1.2 By Type

6.4.3.2 Japan Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.2.1 By End User

6.4.3.2.2 By Type

6.4.3.3 India Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.3.1 By End User

6.4.3.3.2 By Type

6.4.3.4 South Korea Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.4.1 By End User

6.4.3.4.2 By Type

6.4.3.5 Singapore Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.5.1 By End User

6.4.3.5.2 By Type

6.4.3.6 Malaysia Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By End User

6.4.3.6.2 By Type

6.4.3.7 Thailand Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By End User

6.4.3.6.2 By Type

6.4.3.8 Indonesia Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.7.1 By End User

6.4.3.7.2 By Type

6.4.3.9 Vietnam Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.8.1 By End User

6.4.3.8.2 By Type

6.4.3.10 Taiwan Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.10.1 By End User

6.4.3.10.2 By Type

6.4.3.11 Rest of Asia Pacific Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.11.1 By End User

6.4.3.11.2 By Type

6.5 Middle East and Africa Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 By End User

6.5.2 By Type

6.5.3 By Country

6.5.3.1 Saudi Arabia Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.1.1 By End User

6.5.3.1.2 By Type

6.5.3.2 U.A.E. Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.2.1 By End User

6.5.3.2.2 By Type

6.5.3.3 Israel Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.3.1 By End User

6.5.3.3.2 By Type

6.5.3.4 South Africa Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.4.1 By End User

6.5.3.4.2 By Type

6.5.3.5 Rest of Middle East and Africa Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.5.1 By End User

6.5.3.5.2 By Type

6.6 Central and South America Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.1 By End User

6.6.2 By Type

6.6.3 By Country

6.6.3.1 Brazil Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.1.1 By End User

6.6.3.1.2 By Type

6.6.3.2 Argentina Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.2.1 By End User

6.6.3.2.2 By Type

6.6.3.3 Chile Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By End User

6.6.3.3.2 By Type

6.6.3.3 Rest of Central and South America Automated Food Delivery Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By End User

6.6.3.3.2 By Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Starship Technologies

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Nuro

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Kiwibot

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Yandex

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Ottonomy

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Tele Robot

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Serve Robotics

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Robby Technologies

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Amazon Scout

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Cleveron

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

2 Restaurants Market, By Region, 2020-2028 (USD Billion)

3 Delivery Companies Market, By Region, 2020-2028 (USD Billion)

4 Global Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

5 4 Wheels Market, By Region, 2020-2028 (USD Billion)

6 6 Wheels Market, By Region, 2020-2028 (USD Billion)

7 Other Types Market, By Region, 2020-2028 (USD Billion)

8 Regional Analysis, 2020-2028 (USD Billion)

9 North America Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

10 North America Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

11 North America Automated Food Delivery Market, By Country, 2020-2028 (USD Billion)

12 U.S. Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

13 U.S. Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

14 Canada Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

15 Canada Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

16 Mexico Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

17 Mexico Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

18 Europe Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

19 Europe Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

20 Europe Automated Food Delivery Market, By Country, 2020-2028 (USD Billion)

21 Germany Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

22 Germany Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

23 U.K. Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

24 U.K. Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

25 France Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

26 France Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

27 Italy Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

28 Italy Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

29 Spain Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

30 Spain Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

31 Netherlands Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

32 Netherlands Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

33 Rest Of Europe Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

34 Rest Of Europe Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

35 Asia Pacific Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

36 Asia Pacific Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

37 Asia pacific Automated Food Delivery Market, By Country, 2020-2028 (USD Billion)

38 China Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

39 China Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

40 Japan Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

41 Japan Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

42 India Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

43 India Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

44 South Korea Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

45 South Korea Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

46 Singapore Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

47 Singapore Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

48 Thailand Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

49 Thailand Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

50 Malaysia Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

51 Malaysia Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

52 Indonesia Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

53 Indonesia Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

54 Vietnam Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

55 Vietnam Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

56 Taiwan Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

57 Taiwan Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

58 Australia Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

59 Australia Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

60 Singapore Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

61 Singapore Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

62 Rest of APAC Global Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

63 Rest of APAC Global Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

64 Middle East and Africa Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

65 Middle East and Africa Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

66 Middle East and Africa Automated Food Delivery Market, By Country, 2020-2028 (USD Billion)

67 Saudi Arabia Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

68 Saudi Arabia Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

69 UAE Global Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

70 UAE Global Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

71 Israel Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

72 Israel Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

73 South Africa Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

74 South Africa Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

75 Rest Of Middle East and Africa Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

76 Rest Of Middle East and Africa Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

77 Central and South America Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

78 Central and South America Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

79 Central and South America Automated Food Delivery Market, By Country, 2020-2028 (USD Billion)

80 Brazil Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

81 Brazil Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

82 Chile Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

83 Chile Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

84 Argentina Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

85 Argentina Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

86 Rest Of Central and South America Automated Food Delivery Market, By End User, 2020-2028 (USD Billion)

87 Rest Of Central and South America Automated Food Delivery Market, By Type, 2020-2028 (USD Billion)

88 Starship Technologies: Products & Services Offering

89 NURO: Products & Services Offering

90 Kiwibot: Products & Services Offering

91 YANDEX: Products & Services Offering

92 Ottonomy: Products & Services Offering

93 TELE ROBOT: Products & Services Offering

94 Serve Robotics: Products & Services Offering

95 Robby Technologies: Products & Services Offering

96 Amazon Scout: Products & Services Offering

97 Cleveron: Products & Services Offering

98 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Automated Food Delivery Market Overview

2 Global Automated Food Delivery Market Value From 2020-2028 (USD Billion)

3 Global Automated Food Delivery Market Share, By End User (2022)

4 Global Automated Food Delivery Market Share, By Type (2022)

5 Global Automated Food Delivery Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Automated Food Delivery Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Automated Food Delivery Market

10 Impact Of Challenges On The Global Automated Food Delivery Market

11 Porter’s Five Forces Analysis

12 Global Automated Food Delivery Market: By End User Scope Key Takeaways

13 Global Automated Food Delivery Market, By End User Segment: Revenue Growth Analysis

14 Restaurants Market, By Region, 2020-2028 (USD Billion)

15 Delivery Companies Market, By Region, 2020-2028 (USD Billion)

16 Global Automated Food Delivery Market: By Type Scope Key Takeaways

17 Global Automated Food Delivery Market, By Type Segment: Revenue Growth Analysis

18 4 Wheels Market, By Region, 2020-2028 (USD Billion)

19 6 Wheels Market, By Region, 2020-2028 (USD Billion)

20 Other Types Market, By Region, 2020-2028 (USD Billion)

21 Regional Segment: Revenue Growth Analysis

22 Global Automated Food Delivery Market: Regional Analysis

23 North America Automated Food Delivery Market Overview

24 North America Automated Food Delivery Market, By End User

25 North America Automated Food Delivery Market, By Type

26 North America Automated Food Delivery Market, By Country

27 U.S. Automated Food Delivery Market, By End User

28 U.S. Automated Food Delivery Market, By Type

29 Canada Automated Food Delivery Market, By End User

30 Canada Automated Food Delivery Market, By Type

31 Mexico Automated Food Delivery Market, By End User

32 Mexico Automated Food Delivery Market, By Type

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 Starship Technologies: Company Snapshot

36 Starship Technologies: SWOT Analysis

37 Starship Technologies: Geographic Presence

38 Nuro: Company Snapshot

39 Nuro: SWOT Analysis

40 Nuro: Geographic Presence

41 Kiwibot: Company Snapshot

42 Kiwibot: SWOT Analysis

43 Kiwibot: Geographic Presence

44 Yandex: Company Snapshot

45 Yandex: SWOT Analysis

46 Yandex: Geographic Presence

47 Ottonomy: Company Snapshot

48 Ottonomy: SWOT Analysis

49 Ottonomy: Geographic Presence

50 Tele Robot: Company Snapshot

51 Tele Robot: SWOT Analysis

52 Tele Robot: Geographic Presence

53 Serve Robotics: Company Snapshot

54 Serve Robotics: SWOT Analysis

55 Serve Robotics: Geographic Presence

56 Robby Technologies: Company Snapshot

57 Robby Technologies: SWOT Analysis

58 Robby Technologies: Geographic Presence

59 Amazon Scout: Company Snapshot

60 Amazon Scout: SWOT Analysis

61 Amazon Scout: Geographic Presence

62 Cleveron: Company Snapshot

63 Cleveron: SWOT Analysis

64 Cleveron: Geographic Presence

65 Other Companies: Company Snapshot

66 Other Companies: SWOT Analysis

67 Other Companies: Geographic Presence

The Global Automated Food Delivery Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automated Food Delivery Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS