Global Automotive Battery Thermal Management System Market Size, Trends & Analysis - Forecasts to 2027 By Propulsion (Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Fuel Cell Vehicle (FCV)), By Technology (Air Cooling and Heating, Liquid Cooling and Heating), By Battery Type (Conventional, Solid State), By Battery Capacity (<100 kWh, 100–200 kWh, 200–500 kWh, >500 kWh), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Region (North America, Asia Pacific, Central, and South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

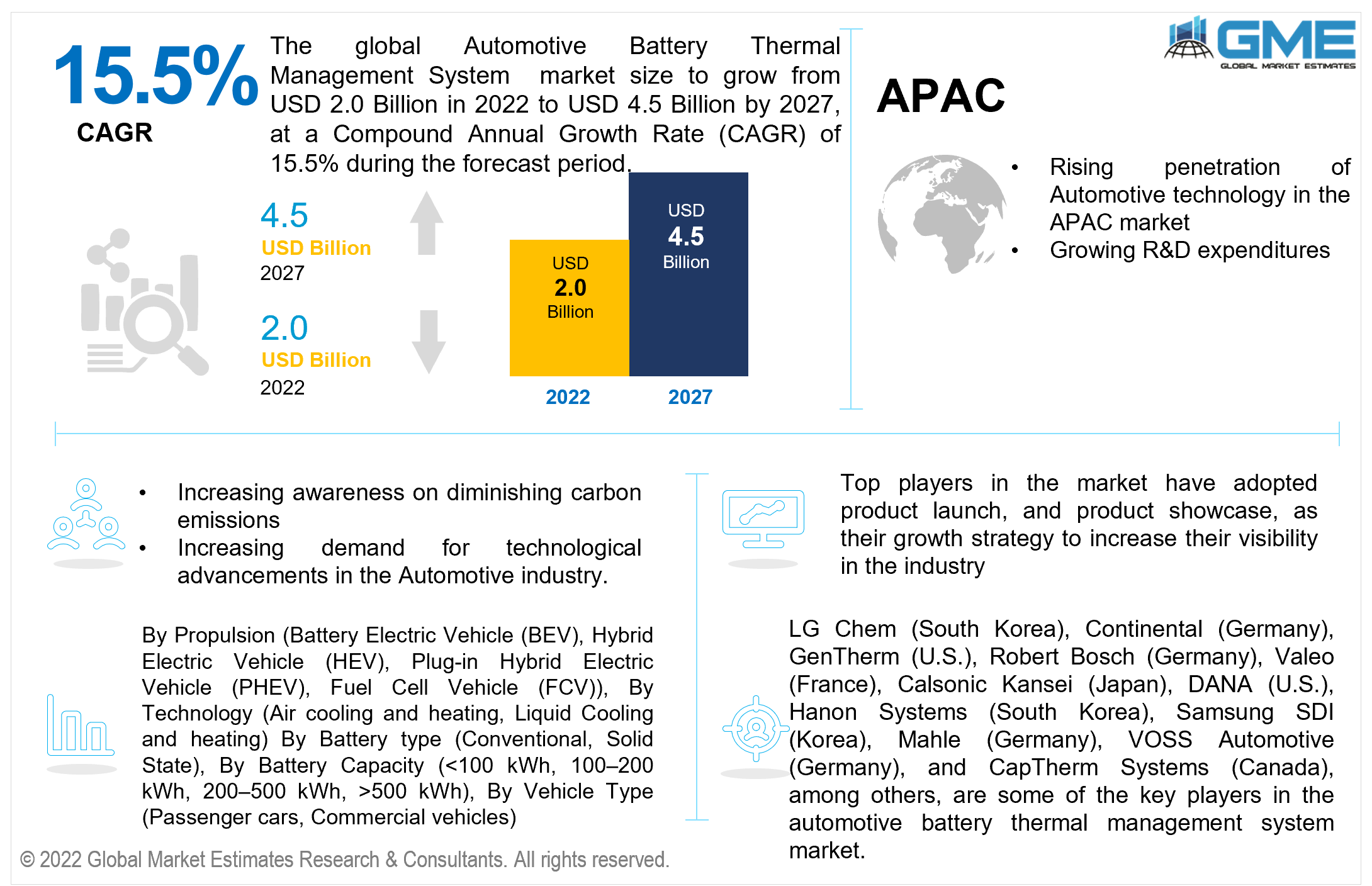

The Global Automotive Battery Thermal Management System Market is projected to grow from USD 2.0 billion in 2022 to USD 4.5 Billion in 2027 at a CAGR value of 15.5% from 2022 to 2027.

The automotive battery thermal management system controls the battery by keeping it in the proper conditions. The thermal management system for car batteries keeps an eye on the established current limit. Controlling the temperature behavior of battery cells requires the Battery Thermal Management System (BTMS). Battery heat management system manufacturing corporations are experimenting with innovative materials, configurations, designs, and technologies in order to improve the overall endurance of powertrain technology. Due to stringent emission rules, significant battery manufacturers are expected to use the most energy-efficient technologies.

Furthermore, by minimizing heat loss through an electric inverter, an electric control unit, and a water pump, energy-efficient technology is projected to enhance the overall dynamics of the battery thermal management system. An effective automotive battery thermal management system can substantially increase battery life and aid to increase the battery's overall longevity. The adoption of automobile battery thermal management systems also assures a suitable thermal working environment and increases the battery's general durability. Thus, these advantages contribute to the growth of the automotive battery thermal management market.

The market for automotive battery thermal management systems is expected to witness many growth opportunities as a result of increased public awareness of electric vehicles, tax exemption programmes, and incentives offered for the adoption of electric vehicles. Two important factors anticipated to promote the advancement of the battery thermal management system market are the depletion of oil reserves and growing investments in EV charging infrastructure. Automobile battery thermal management systems are in growing demand as a result of the automotive industry's emphasis on the requirement for improved ride quality and heat insulation for passenger comfort.

Market share is expected to increase as a result of increased attention on diminishing carbon emissions, rising levels of R&D spending, and increase in the number of R&D projects. Increasing government initiatives to raise awareness together with growing technological advancements in lithium-ion batteries will also open up profitable growth prospects for the market.

The market growth rate is expected to be significantly hindered by the underdeveloped and developing economies' inadequate technological know-how. The high expenditures associated with technological advancements and research & development capabilities may slow the market's rate of expansion. The market's potential for growth will be constrained by changes in raw material prices, problems with overheating-related battery failure, and exorbitant costs related to thermal system technology.

Global markets have suffered extraordinary losses as a result of the severe COVID-19 pandemic. Several industries had suspended their industrial operations as a result of the stringent lockdown imposed by the government agencies. This reduced the demand for the automotive battery thermal management market during the affected period. However, a concerted effort by the government and business sector is anticipated to revive the rest of the world and support the restart of industrial operations.

The automotive industry has seen severe disruptions in its activity due to the conflict between Russia and Ukraine. The industry has witnessed a decline in growth due to disruption in trade routes owing to blockades in the region during the period of conflict. However, rest of the world did not witness the decline in growth in this industry.

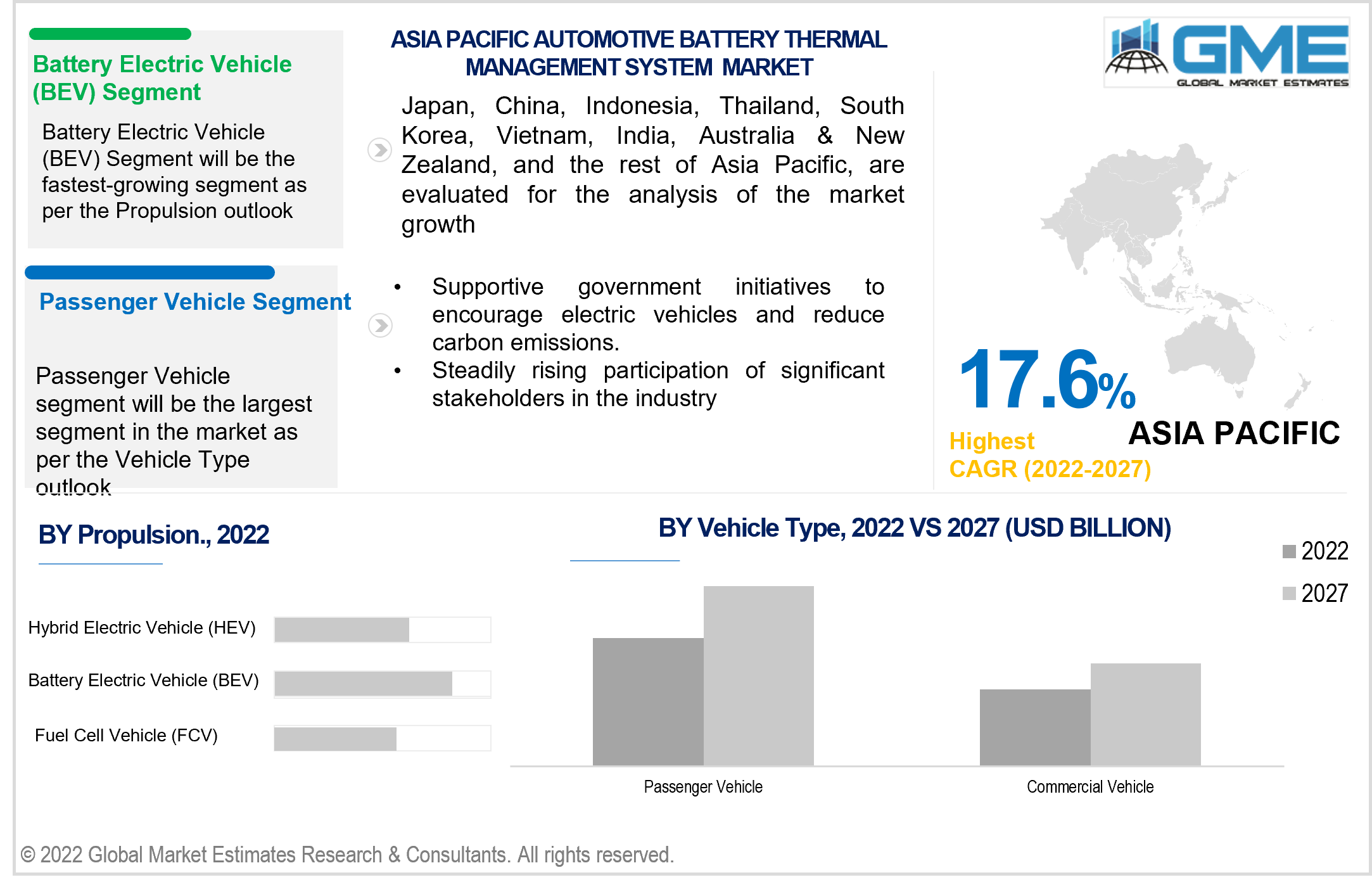

The BEV segment is anticipated to account for the largest market share over the forecast period, on the market segmentation basis of propulsion. This is a result of many growth opportunities including the rising global demand for automobiles with low fuel consumption and carbon emissions. The growth is anticipated in this segment owing to the availability of subsidies and support from the government for them. The demand for BEV sales has further been boosted by increasing charging infrastructure and extending vehicle range.

The air cooling and heating segment is expected to hold the largest market share during the forecast period, on the market segmentation basis of technology. The air cooling and heating system is simpler to use, and is extensively used in low-cost EVs.

The liquid cooling & heating segment is anticipated to have the fastest market growth rate during the forecast period. The liquid coolants have higher heat capacity and conductivity, due to which they perform effectively and efficiently. Due to liquid coolants' superior ability to keep a battery pack within a safe temperature range and advance the safety of electric vehicles, companies like BMW, Tesla, and others began adopting these systems. Over the projected period, the liquid cooling and heating segment is expected to experience significant growth.

The conventional segment is expected to have the largest market share during the projected period. These conventional batteries including lead-acid and lithium-ion batteries, are widely employed in a variety of automobile applications. The majority of thermal battery management devices, including chillers, compressors, heating and cooling units, etc., significantly employ these batteries.

The solid-state segment is anticipated to grow at the fastest rate during the forecast period. Solid-state batteries are safer since they don't contain any liquid electrolyte, and they can be quickly recharged to extend their battery life. By boosting energy density, it also aids in the solid-state battery market's anticipated growth throughout the course of the projected period.

The <100 kWh segment is expected to have the largest market share during the projected period under market by battery capacity. This is because many electric vehicles batteries are typically with a capacity of under 100 kWh. The larger battery capacity enables for the longer the range per charge, making them more feasible for more users.

The passenger vehicle segment is anticipated to have the largest market share over the projected period, under market by vehicle type. The demand for the passenger segment is anticipated to be driven by the rising demand for alternative fuel vehicles in the segment as well as favourable government policies and subsidies.

Asia-Pacific is expected to have the largest market share during the forecast period. This is due to the increasing adoption of highly sophisticated technologies which use Lithium-ion batteries, the presence of significant companies in this area, and increased R&D initiatives. During the projected period, the Asia-Pacific region is also expected to experience extraordinary growth. This is a result of the region's expanding automobile industry and increased disposable personal income.

Asia Pacific region includes developed countries like Japan and South Korea as well as growing economies like China and India, has the world's largest automotive market including many key players such as Hanon Systems and LG Chem. The region has been a centre for the manufacture of automobiles in recent years. Government leaders in the Asia Pacific region are interested in the prospects to reduce carbon emissions by electrifying transportation. Therefore, this region has a very high prevalence of electric vehicle. The governments of numerous nations have taken initiatives such as tax breaks and subsidies, to encourage the use of electric vehicles, thus increasing the demand for electric vehicle batteries.

Europe is anticipated to have the second-largest share of the worldwide automotive battery thermal management system market. This is because there are reputable automotive manufacturers including Robert Bosch, VOSS Automotive and Valeo who are concentrating on creating cutting-edge thermal management technologies.

LG Chem (South Korea), Continental (Germany), GenTherm (U.S.), Robert Bosch (Germany), Valeo (France), Calsonic Kansei (Japan), DANA (U.S.), Hanon Systems (South Korea), Samsung SDI (Korea), Mahle (Germany), VOSS Automotive (Germany), and CapTherm Systems (Canada), among others, are some of the key players in the automotive battery thermal management system market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 DANAmation Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company DANAmation Sources: Annual Reports, Investor Presentation, Press Release, SEC Filing, Company Blogs & Website

1.3.4.2 Secondary Data Sources

1.4 DANAmation or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Voltage & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.6 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Technology Outlook

2.3 Battery Type Outlook

2.4 Enterprise Size Outlook

2.5 Vehicle Type Outlook

2.6 Application Outlook

2.7 Regional Outlook

Chapter 3 Global Automotive Battery Thermal Management System Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Automotive Battery Thermal Management System Market

3.4 Metric Data on Electronics, Semiconductors, and IT Industry

3.5 Market Dynamic

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Automotive Battery Thermal Management System Market: Technology Trend Analysis

4.1 Technology

4.2 Air Cooling and Heating

4.2.1 Market Estimates & Forecast Analysis of Air Cooling and Heating Segment, By Region, 2022-2027 (USD Billion)

4.3 Liquid Cooling and Heating

4.3.1 Market Estimates & Forecast Analysis of Liquid Cooling and Heating Segment, By Region, 2022-2027 (USD Billion)

Chapter 5 Automotive Battery Thermal Management System Market: Propulsion Trend Analysis

5.1.1 Market Estimates & Forecast Analysis of Battery Electric Vehicle (BEV) Segment, By Region, 2022-2027 (USD Billion)

5.2.1 Market Estimates & Forecast Analysis of Hybrid Electric Vehicle (HEV) Segment, By Region, 2022-2027 (USD Billion)

5.3 Plug-in Hybrid Electric Vehicle (PHEV)

5.3.1 Market Estimates & Forecast Analysis of Plug-in Hybrid Electric Vehicle (PHEV) Segment, By Region, 2022-2027 (USD Billion)

5.4 Fuel Cell Vehicle (FCV)

5.4.1 Market Estimates & Forecast Analysis of Fuel Cell Vehicle (FCV) Segment, By Region, 2022-2027 (USD Billion)

Chapter 6 Automotive Battery Thermal Management System Market: Battery Type Trend Analysis

6.1 Conventional

6.1.1 Market Estimates & Forecast Analysis of Conventional Segment, By Region, 2022-2027 (USD Billion)

6.2 Solid State

6.2.1 Market Estimates & Forecast Analysis of Solid State Segment, By Region, 2022-2027 (USD Billion)

Chapter 7 Automotive Battery Thermal Management System Market: Battery Capacity Trend Analysis

7.1 <100 kWh

7.1.1 Market Estimates & Forecast Analysis of <100 kWh Segment, By Region, 2022-2027 (USD Billion)

7.2 100–200 kWh

7.2.1 Market Estimates & Forecast Analysis of 100–200 kWh Segment, By Region, 2022-2027 (USD Billion)

7.3 200–500 kWh

7.3.1 Market Estimates & Forecast Analysis of 200–500 kWh Segment, By Region, 2022-2027 (USD Billion)

7.4 >500 kWh

7.4.1 Market Estimates & Forecast Analysis of >500 kWh Segment, By Region, 2022-2027 (USD Billion)

Chapter 8 Automotive Battery Thermal Management System Market: Vehicle Type Trend Analysis

8.1 Passenger Cars

8.1.1 Market Estimates & Forecast Analysis of Passenger Cars Segment, By Region, 2022-2027 (USD Billion)

8.2 Commercial Vehicles

8.2.1 Market Estimates & Forecast Analysis of Retail Consumer Segment, By Region, 2022-2027 (USD Billion)

8.3 Manufacturing

8.3.1 Market Estimates & Forecast Analysis of Manufacturing Segment, By Region, 2022-2027 (USD Billion)

Chapter 9 Automotive Battery Thermal Management System Market, By Region

9.1 Regional Outlook

9.2 North America

9.2.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027 (USD Billion)

9.2.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027 (USD Billion)

9.2.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.2.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.2.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.3 US

9.3.1 Market Estimates & Forecast Analysis, By Country 2022-2027(USD Billion)

9.3.2 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.3.3 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027 (USD Billion)

9.3.4 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.3.5 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.3.6 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.4 Canada

9.4.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.4.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.4.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.4.5 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.4.6 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.5 Asia Pacific

9.5.1 Market Estimates & Forecast Analysis, By Country 2022-2027(USD Billion)

9.5.2 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.5.3 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.5.4 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.5.5 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.5.6 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.6 China

9.6.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.6.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.6.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.6.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.6.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.7 India

9.7.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.7.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.7.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.7.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.7.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.8 Japan

9.8.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027 (USD Billion)

9.8.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027 (USD Billion)

9.8.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.8.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.8.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.10 Australia

9.10.1 Market Estimates & Forecast Analysis, By Technology, 2022- 2027(USD Billion)

9.10.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.10.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.10.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.10.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.11 Europe

9.11.1 Market Estimates & Forecast Analysis, By Country 2022-2027(USD Billion)

9.11.2 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.11.3 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.11.4Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.11.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.11.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.12 UK

9.12.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.12.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.12.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.12.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.12.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.13 France

9.13.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.13.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.13.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.13.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.13.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

9.14 Germany

9.14.1 Market Estimates & Forecast Analysis, By Technology, 2022-2027(USD Billion)

9.14.2 Market Estimates & Forecast Analysis, By Propulsion, 2022-2027(USD Billion)

9.14.3 Market Estimates & Forecast Analysis, By Battery Type, 2022-2027 (USD Billion)

9.14.4 Market Estimates & Forecast Analysis, By Battery Capacity , 2022-2027 (USD Billion)

9.14.5 Market Estimates & Forecast Analysis, By Vehicle Type, 2022-2027 (USD Billion)

Chapter 10 Competitive Analysis

10.1 Key Global Players, Recent Developments & their Impact on the Industry

10.2 Four Quadrant Competitor Positioning Matrix

10.2.1 Key Innovators

10.2.2 Market Leaders

10.2.3 Emerging Players

10.2.4 Market Challengers

10.3 Vendor Landscape Analysis

10.4 End-User Landscape Analysis

10.5 Company Market Share Analysis, 2022

Chapter 11 Company Profile Analysis

11.1 LG Chem

11.1.1 Company Overview

11.1.2 Financial Analysis

11.1.3 Strategic Initiatives

11.1.4 Product Benchmarking

11.2 Continental

11.2.1 Company Overview

11.2.2 Financial Analysis

11.2.3 Strategic Initiatives

11.2.4 Product Benchmarking

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Strategic Initiatives

11.3.4 Product Benchmarking

11.4 Robert Bosch

11.4.2 Company Overview

11.4.3 Financial Analysis

11.4.3 Strategic Initiatives

11.4.4 Product Benchmarking

11.5 Valeo

11.5.1 Company Overview

11.5.2 Financial Analysis

11.5.3 Strategic Initiatives

11.5.4 Product Benchmarking

11.6 Calsonic Kansei

11.6.1 Company Overview

11.6.2 Financial Analysis

11.6.3 Strategic Initiatives

11.6.4 Product Benchmarking

11.7 DANA

11.7.1 Company Overview

11.7.2 Financial Analysis

11.7.3 Strategic Initiatives

11.7.4 Product Benchmarking

11.8 Hanon Systems

11.8.1 Company Overview

11.8.2 Financial Analysis

11.8.3 Strategic Initiatives

11.8.4 Product Benchmarking

11.9 Samsung SDI

11.9.1 Company Overview

11.9.2 Financial Analysis

11.9.3 Strategic Initiatives

11.9.4 Product Benchmarking

11.10 Mahle

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Strategic Initiatives

11.10.4 Product Benchmarking

11.11 Other Companies

11.111 Company Overview

11.11.2 Financial Analysis

11.11.3 Strategic Initiatives

11.11.4 Product Benchmarking

List of Tables

TABLE 1 Technological Advancements in Automotive Battery Thermal Management System Market

TABLE 2 Global Automotive Battery Thermal Management System Market: Key Market Drivers

TABLE 3 Global Automotive Battery Thermal Management System Market: Key Market Challenges

TABLE 4 Global Automotive Battery Thermal Management System Market: Key Market Opportunities

TABLE 5 Global Automotive Battery Thermal Management System Market: Key Market Restraints

TABLE 6 Global Automotive Battery Thermal Management System Market Estimates & Forecast Analysis, 2022-2027 (USD Billion)

TABLE 7 Global Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 8 Air Cooling and Heating: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 9 Liquid Cooling and Heating: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 10 Global Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 11 Battery Electric Vehicle (BEV): Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 12 Hybrid Electric Vehicle (HEV): Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 13 Reporting and Compliance: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 14 Fuel Cell Vehicle (FCV): Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 15 Global Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 16 Conventional: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 17 Solid State: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 18: Global Automotive Battery Thermal Management System Market, By Battery Capacity , 2022-2027 (USD Billion)

TABLE 19 <100 kWh: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 20 100–200 kWh: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 21 Global Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 22 Passenger Cars: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 26 Commercial Vehicles: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 29 Regional Analysis: Global Automotive Battery Thermal Management System Market, By Region, 2022-2027 (USD Billion)

TABLE 30 North America: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 31 North America: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 32 North America: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 33 North America: Automotive Battery Thermal Management System Market, By Battery Capacity , 2022-2027 (USD Billion)

TABLE 34 North America: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 35 North America: Automotive Battery Thermal Management System Market, By Country, 2022-2027 (USD Billion)

TABLE 36 U.S: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 37 U.S: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 38 US: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 39 US: Automotive Battery Thermal Management System Market, By Organization Type, 2022-2027 (USD Billion)

TABLE 40 US: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 41 Canada: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 42 Canada: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 43 Canada: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 44 Canada: Automotive Battery Thermal Management System Market, By Organization Type, 2022-2027 (USD Billion)

TABLE 45 Canada: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 46 Asia Pacific: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 47 Asia Pacific: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 48 Asia Pacific: Automotive Battery Thermal Management System Market, By Organization Type, 2022-2027 (USD Billion)

TABLE 49 Asia Pacific: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 50 Asia Pacific: Automotive Battery Thermal Management System Market, By Vehicle Type Type, 2022-2027 (USD Billion)

TABLE 51 Asia Pacific: Automotive Battery Thermal Management System Market, By Country, 2022-2027 (USD Billion)

TABLE 52 China: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 53 China: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 54 China: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 55 China: Automotive Battery Thermal Management System Market, By Organization Type, 2022-2027 (USD Billion)

TABLE 56 China: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 57 India: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 58 India: Office, By Propulsion, 2022-2027 (USD Billion)

TABLE 59 India: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 60 India: Automotive Battery Thermal Management System Market, By organization Type, 2022-2027 (USD Billion)

TABLE 61 India: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 62 Japan: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 63 Japan: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 64 Japan: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 65 Japan: Automotive Battery Thermal Management System Market, By organization Type, 2022-2027 (USD Billion)

TABLE 66 Japan: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 67 Australia: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 68 Australia: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 69 Australia: Automotive Battery Thermal Management System Market, By organization Type, 2022-2027 (USD Billion)

TABLE 70 Australia: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 71 Australia: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 72 Europe: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 73 Europe: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 74 Europe: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 75 Europe: Automotive Battery Thermal Management System Market, By organization Type, 2022-2027 (USD Billion)

TABLE 76 Europe: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 77 Germany: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 78 Germany: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 79 Germany: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 80 Germany: Automotive Battery Thermal Management System Market, By organization Type, 2022-2027 (USD Billion)

TABLE 81 Germany: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 82 UK: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 83 UK: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 84 UK: Automotive Battery Thermal Management System Market, By organizationType, 2022-2027 (USD Billion)

TABLE 85 UK: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 86 UK: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 87 France: Automotive Battery Thermal Management System Market, By Technology, 2022-2027 (USD Billion)

TABLE 88 France: Automotive Battery Thermal Management System Market, By Propulsion, 2022-2027 (USD Billion)

TABLE 89 France: Automotive Battery Thermal Management System Market, By Battery Type, 2022-2027 (USD Billion)

TABLE 90 France: Automotive Battery Thermal Management System Market, By organization Type, 2022-2027 (USD Billion)

TABLE 91 France: Automotive Battery Thermal Management System Market, By Vehicle Type, 2022-2027 (USD Billion)

TABLE 92 GenTherm- Products Offered

TABLE 93 LG Chem- Products Offered

Table 94 Valeo- Products Offered

Table 95 Continental-Products Offered

Table 96 Mahle- Products Offered

Table 97 Robert Bosch-Products Offered

Table 98 Epicor Conventional- Products Offered

Table 99 Calsonic Kansei- Products Offered

Table 100 DANA- Products Offered

Table 101 Hanon Systems- Products Offered

Table 102 Samsung SDI- Products Offered

List of Figures

1. Global Automotive Battery Thermal Management System Market Segmentation & Research Scope

2. Primary Research Partners and Local DANAmers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Automotive Battery Thermal Management System Market: Penetration & Growth Prospect Mapping

7. Global Automotive Battery Thermal Management System Market: Value Chain Analysis

8. Global Automotive Battery Thermal Management System Market Drivers

9. Global Automotive Battery Thermal Management System Market Restraints

10. Global Automotive Battery Thermal Management System Market Opportunities

11. Global Automotive Battery Thermal Management System Market Challenges

12. Key Automotive Battery Thermal Management System Market Manufacturer Analysis

13. Global Automotive Battery Thermal Management System Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. GenTherm: Company Snapshot

16. GenTherm: Swot Analysis

17. DANA: Company Snapshot

18. DANA: Swot Analysis

19. Valeo: Company Snapshot

20. Valeo: Swot Analysis

21. Calsonic Kansei: Company Snapshot

22. Calsonic Kansei: Swot Analysis

23. Hanon Systems: Company Snapshot

24. Hanon Systems: Swot Analysis

25. Samsung SDI: Company Snapshot

26. Samsung SDI: Swot Analysis

27. Mahle: Company Snapshot

28. Mahle: Swot Analysis

29. Robert Bosch: Company Snapshot

30. Robert Bosch: Swot Analysis

31. LG Chem: Company Snapshot

32. LG Chem: Swot Analysis

33. Continental: Company Snapshot

34. Continental: Swot Analysis

35. Other Companies: Company Snapshot

36. Other Companies: Swot Analysis

The Global Automotive Battery Thermal Management System Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Battery Thermal Management System Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS