Global Automotive E-Compressor Market Size, Trends & Analysis - Forecasts to 2027 By Vehicle Type (Passenger Cars, LCV, HCV), By Product (Scroll, Screw, Swash and Others), By Drivetrain (BEV, HEV, PHEV), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

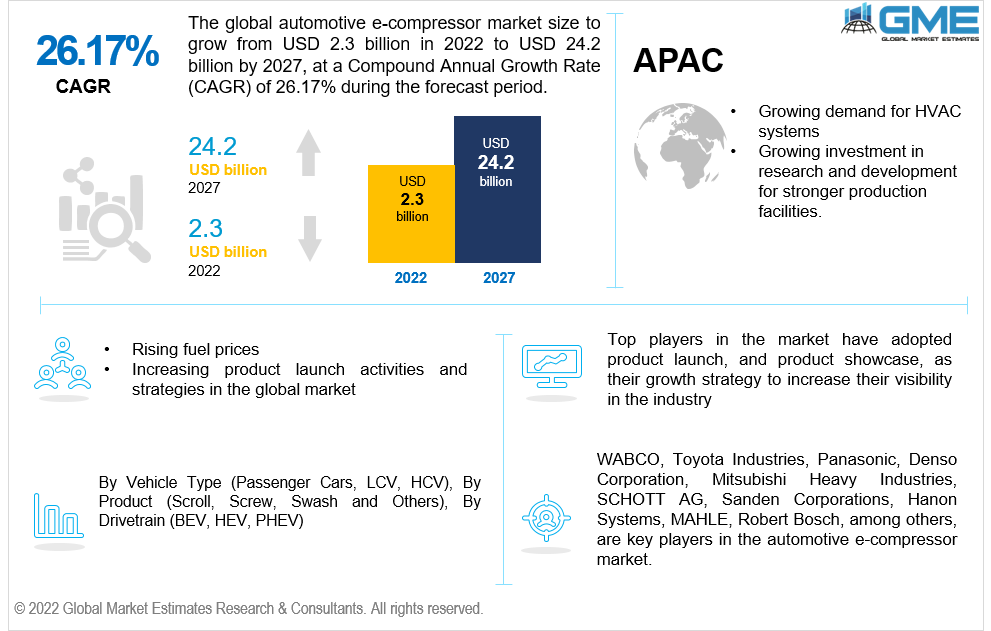

The Global Automotive E-Compressor Market is projected to grow from USD 2.3 billion in 2022 to USD 24.2 billion in 2027 at a CAGR of 26.17% from 2022 to 2027.

Automotive e-compressors are compressors that are equipped with a built-in motor. The built-in motor can still operate even when the vehicle's engine is stopped allowing for better fuel efficiency and continued use of the air conditioner for a comfortable cabin temperature even during an idling stop.

Automotive companies are using strategies for developing technologically advanced compressors in order to increase product quality, product life and meet rising consumer demands. Furthermore, the market will be heavily driven by rising demand and popularity of HVAC systems, e-vehicles and its hybridization.

Consistent growth in adoption of EVs and hybrid is a key driver for the growth of the global automotive e-compressor market. Fuel saving benefits in adopting automotive e-compressor further enhances consumer preference for purchasing hybrid and electric vehicles and in-turn will support the market growth during the forecast period

The automotive e-compressor market has been witnessing an intense competition amongst the top and local automobile manufactures. GME’s research report shows that there has been a rapid increase in market share of top players due to rising demand for e-vehicles. Moreover, innovation of electric and hybrid vehicles have been attracting foreign investment and hence, this will boost the growth of the market during the forecast period.

However, the high cost of installation and maintenance of automotive e-compressors, as well as the complexity of repair and maintenance, are a major restraint on the worldwide automotive e-compressor market's growth.

The COVID-19 pandemic slowed the automotive e-compressor industry's growth in 2020, and its influence is still witnessed in the market. Automotive e-compressors requires an electric compressor and motor which helps in smooth functioning. Due to blockage in trade and services over the globe, due to lack of raw material supply, due to surge in instrument and equipment price, ban on transportation and disruptions in supply chain managements, the market was impacted heavily. However, in the post pandemic times, manufacturers now are recovering from the losses and there has been a significant rise in number of demand of electric vehicles. Consumers across the globe are shifting their preferences from diesel or gas cars to e-cars, owing to rising gas prices and negative impact on the environment. Hence, this is expected to help the market pick up the pace and grow at a steady rate during the forecast period.

Russia and Ukraine both supply large quantities of neon gas, nickel and palladium. The on-going war has heavily impacted the trade and transportation business. This has also disrupted the supply chain management as there was a halt in the raw material supply. Most of the material used for electric vehicles such as batteries, converters and chips were imported from Europe (pre-war era). Moreover, the production delays have raised oil & gas prices too. Furthermore, automotive manufacturing companies such Hyundai, Volkswagen, Toyota have partially stopped their business and export in Russia. Considering the trend analysis, the overall market is ought to be impacted in the long run.

Based on market segmentation of vehicle type, passenger car is expected to have the largest share in the global automotive e-compressor market during the forecast period of 2022-2027. Rising disposable income of developing countries, increasing number of passenger car bookings and increasing professional and leisure bookings are some of the factors driving the growth of this segment.

Light Commercial Vehicle (LCV) is analyzed to be the fastest growing in the global automotive e-compressor market during 2022-2027. Increasing demand for LCVs across the globe, and increasing product launch strategies are the major factors driving the growth of this segment.

Scroll segment is expected to have the largest share in the global automotive e-compressor market during the forecast period of 2022-2027. Automobile manufacturers are focusing on providing low-cost scroll e-compressors. The rising demand for goods with improved acoustics and cooling capacity is driving the growth of this segment. Swash segment is expected to grow the fastest during 2022-2027. Its pistons help the internal palate to rotate and its ends helps pressurize and discharge refrigerant. Because of the technical advancements of swash over scrolls, the segment of swash is ought to be growing the fastest.

The BEV segment is expected to have the largest share in the global automotive e-compressor market during the forecast period of 2022-2027. EVs differ from most other automobiles as they have no internal combustion engines. They run entirely on battery power rather than fuel and customers can charge them at their leisure. Rising fuel consumption, increasing gas prices, and increasing awareness regarding environmental impact, are some of the factors supporting the adoption of BEVs.

The HEV segment is the fastest growing segment during 2022-2027. HEVs need internal combustion engine and an electric motor. Rapid industrialization and urbanisation, presence of key automotive manufacturers, rising population, and expansion in manufacturing sectors, particularly in developing nations, are all predicted to boost this segment's growth.

Europe has traditionally been a significant producer of cars and vehicles. Presence of top automobile manufacturers, rising expenditure in research and development activities, and increasing demand for e-vehicles are driving the growth of this segment.

Germany is expected to have the largest share in the global automotive e-compressor market during the forecast period of 2022-2027. The HEV sector in Germany is a rapidly rising and hence there is an increase in public-private investment strategies.

Asia-Pacific and North America both are expected to the fastest during 2022-2027. This is attributed to increasing demand for e-cars, two wheelers and heavy vehicles. The majority of automotive e-compressor providers are expecting to expand in energy-efficient EVs in this region. Strong supply chain management in Asia-Pacific will help the market grow rapidly.

The markets in China, India, South Korea and Japan have become significant production centres due to strong R&D potential and efficient capacity to manufacture automotive e-compressors and electric motors.

WABCO, Toyota Industries, Panasonic, Denso Corporation, Mitsubishi Heavy Industries, SCHOTT AG, Sanden Corporations, Hanon Systems,MAHLE, Robert Bosch, among others, are key players in the automotive e-compressor market.

Please note: This is not an exhaustive list of companies profiled in the report.

The global Automotive E-Compressor market in the equipment and tool market has observed several strategic alliances between company profiles to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Product Type Outlook

2.3 Vehicle Type Outlook

2.4 Drivetrain Outlook

2.5 Regional Outlook

Chapter 3 Global Automotive E-Compressor Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Automotive E-Compressor Market

3.4 Metric Data based on the industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Automotive E-Compressor Market: Product Trend Analysis

4.1 Product: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Scroll

4.2.1 Market Estimates & Forecast Analysis of Scroll Segment, By Region, 2019-2027 (USD Billion)

4.3 Screw

4.3.1 Market Estimates & Forecast Analysis of Screw Segment, By Region, 2019-2027 (USD Billion)

4.4 Swash

4.4.1 Market Estimates & Forecast Analysis of Swash Segment, By Region, 2019-2027 (USD Billion)

4.5 Others

4.5.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Automotive E-Compressor Market: By Drivetrain Trend Analysis

5.1 By Drivetrain: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 PHEV

5.2.1 Market Estimates & Forecast Analysis of PHEV, By Region, 2019-2027 (USD Billion)

5.3 HEV

5.3.1 Market Estimates & Forecast Analysis of HEV Market Segment, By Region, 2019-2027 (USD Billion)

5.4 BEV

5.4.1 Market Estimates & Forecast Analysis of BEV Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Automotive E-Compressor Market: Vehicle Type Trend Analysis

6.1 Vehicle Type: Historic Data vs. Forecast Data Analysis, 2022 vs. 2027

6.2 Passenger Cars

6.2.1 Market Estimates & Forecast Analysis of Passenger Cars Segment, By Region, 2019-2027 (USD Billion)

6.3 LCV

6.3.1 Market Estimates & Forecast Analysis of LCV Segment, By Region, 2019-2027 (USD Billion)

6.4 HCV

6.4.1 Market Estimates & Forecast Analysis of HCV Segment, By Region, 2019-2027 (USD Billion)

Chapter 7 Automotive E-Compressor Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.7 Mexico

7.5.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.7.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.8 Russia

7.3.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.8.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.9.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.11.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.11.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.3.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6.6 United Arab Emirates

7.6.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

7.5.8 Rest of Middle East & Africa

7.5.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.8.2 Market Estimates & Forecast Analysis, By Drivetrain, 2019-2027 (USD Billion)

7.5.8.3 Market Estimates & Forecast Analysis, By Vehicle Type, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 WABCO

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 Toyota Industries

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Panasonic

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Denso Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Mitsubishi Heavy Industries

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Hyundai Steel

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Sanden Corporations

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Hanon Systems

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Mahle

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Automotive E-Compressor Market

2 Global Automotive E-Compressor Market: Key Market Drivers

3 Global Automotive E-Compressor Market: Key Market Challenges

4 Global Automotive E-Compressor Market: Key Market Opportunities

5 Global Automotive E-Compressor Market: Key Market Restraints

6 Global Automotive E-Compressor Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

8 Scroll: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

9 Screw: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

10 Swash: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

11 Others: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

12 Global Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

13 PHEV: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

14 BEV: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

15 HEV: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

16 Global Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

17 Passenger Cars: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

18 Automotive: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

19 LCV: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

20 Regional Analysis: Global Automotive E-Compressor Market, By Region, 2019-2027 (USD Billion)

21 North America: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

22 North America: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

23 North America: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

24 North America: Automotive E-Compressor Market, By Country, 2019-2027 (USD Billion)

25 U.S: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

26 U.S: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

27 U.S: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

28 Canada: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

29 Canada: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

30 Canada: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

31 Mexico: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

32 Mexico: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

33 Mexico: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

34 Europe: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

35 Europe: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

36 Europe: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

37 Europe: Automotive E-Compressor Market, By Country, 2019-2027 (USD Billion)

38 Germany: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

39 Germany: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

40 Germany: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

41 UK: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

42 UK: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

43 UK: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

44 France: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

45 France: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

46 France: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

47 Italy: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

48 Italy: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

49 Italy: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

50 Spain: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

51 Spain: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

52 Spain: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

53 Rest Of Europe: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

54 Rest Of Europe: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

55 Rest Of Europe: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

56 Asia Pacific: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

57 Asia Pacific: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

58 Asia Pacific: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

59 Asia Pacific: Automotive E-Compressor Market, By Country, 2019-2027 (USD Billion)

60 China: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

61 China: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

62 China: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

63 India: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

64 India: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

65 India: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

66 Japan: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

67 Japan: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

68 Japan: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

69 South Korea: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

70 South Korea: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

71 South Korea: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

72 Middle East & Africa: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

73 Middle East & Africa: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

74 Middle East & Africa: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

75 Middle East & Africa: Automotive E-Compressor Market, By Country, 2019-2027 (USD Billion)

76 Saudi Arabia: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

77 Saudi Arabia: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

78 Saudi Arabia: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

79 UAE: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

80 UAE: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

81 UAE: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

82 Central & South America: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

83 Central & South America: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

84 Central & South America: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

85 Central & South America: Automotive E-Compressor Market, By Country, 2019-2027 (USD Billion)

86 Brazil: Automotive E-Compressor Market, By Product, 2019-2027 (USD Billion)

87 Brazil: Automotive E-Compressor Market, By Drivetrain, 2019-2027 (USD Billion)

88 Brazil: Automotive E-Compressor Market, By Vehicle Type, 2019-2027 (USD Billion)

89 WABCO: Products Offered

90 Toyota Industries: Products Offered

91 Panasonic: Products Offered

92 Denso Corporation: Products Offered

93 Mitsubishi Heavy Industries: Products Offered

94 Schott AG: Products Offered

95 Sanden Corporations: Products Offered

96 HANON SYSTEMS: Products Offered

97 MAHLE: Products Offered

98 Other Companies: Products Offered

List of Figures

1. Global Automotive E-Compressor Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Automotive E-Compressor Market: Penetration & Growth Prospect Mapping

7. Global Automotive E-Compressor Market: Value Chain Analysis

8. Global Automotive E-Compressor Market Drivers

9. Global Automotive E-Compressor Market Restraints

10. Global Automotive E-Compressor Market Opportunities

11. Global Automotive E-Compressor Market Challenges

12. Key Automotive E-Compressor Market Manufacturer Analysis

13. Global Automotive E-Compressor Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. WABCO: Company Snapshot

16. WABCO: SWOT Analysis

17. Toyota Industries: Company Snapshot

18. Toyota Industries: SWOT Analysis

19. Panasonic: Company Snapshot

20. Panasonic: SWOT Analysis

21. Denso Corporation: Company Snapshot

22. Denso Corporation: SWOT Analysis

23. Mitsubishi Heavy Industries: Company Snapshot

24. Mitsubishi Heavy Industries: SWOT Analysis

25. Schott AG: Company Snapshot

26. Schott AG: SWOT Analysis

27. Sanden Corporations: Company Snapshot

28. Sanden Corporations: SWOT Analysis

29. Hanon Systems: Company Snapshot

30. Hanon Systems: SWOT Analysis

31. MAHLE: Company Snapshot

32. MAHLE: SWOT Analysis

33. Other Companies: Company Snapshot

34. Other Companies: SWOT Analysis

The Global Automotive E-Compressor Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive E-Compressor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS