Global Automotive IoT Market Size, Trends & Analysis - Forecasts to 2027 By Offering (Hardware, Software, and Services), By Connectivity Form Factor (Embedded, Tethered, Integrated), By Communication Type (In-Vehicle Communication, Vehicle-to-Vehicle Communication, Vehicle-to-Infrastructure Communication), By Application (Infotainment, Navigation, Telematics), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

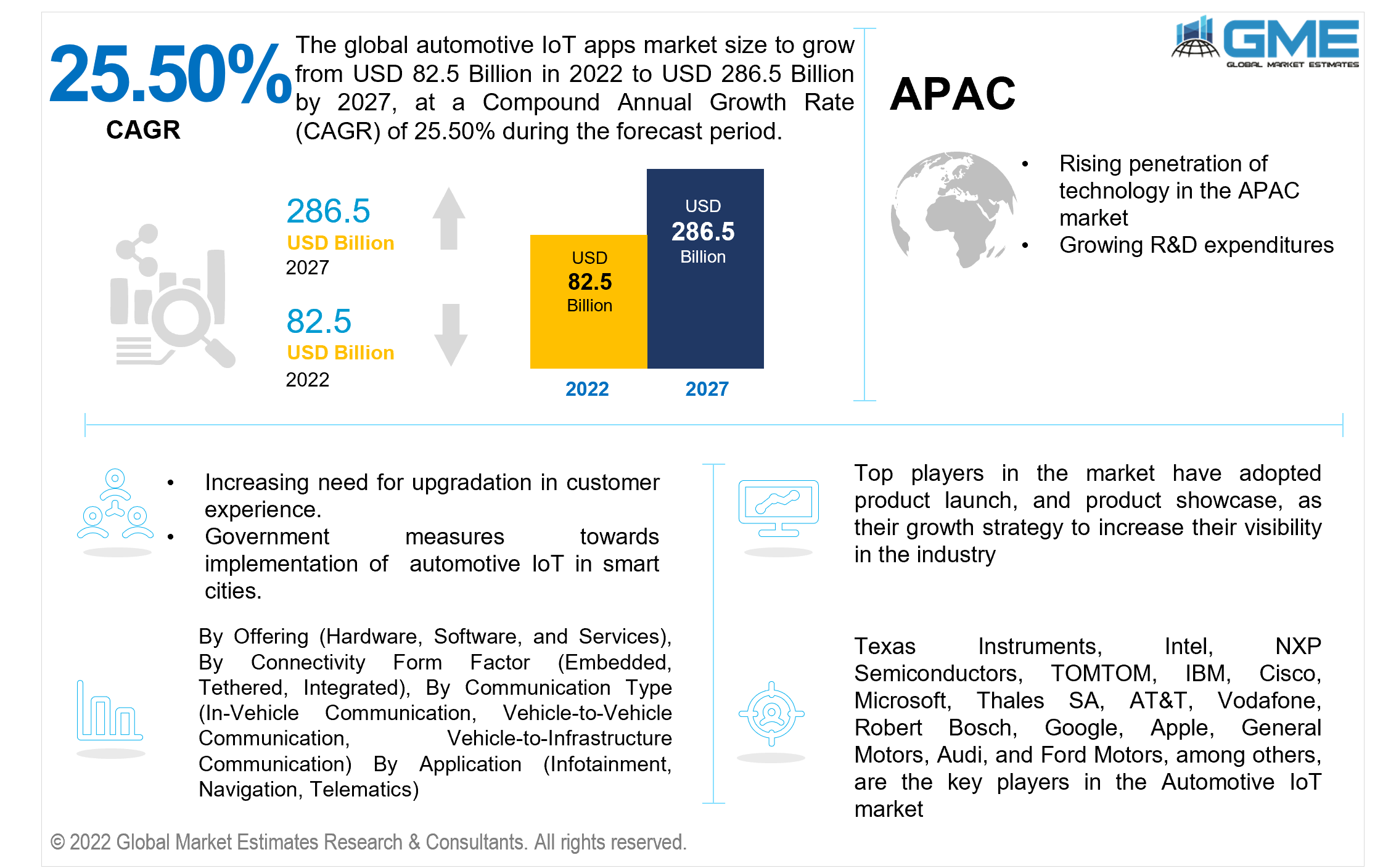

The Global Automotive IoT Market is projected to grow from USD 82.5 billion in 2022 to USD 286.5 billion in 2027 at a CAGR value of 25.50% from 2022 to 2027.

The Internet of Things has revolutionized a variety of day-to-day appliances and machinery in an exceptional manner. The automotive industry has taken note of this revolutionary technology and has very actively tried to incorporate it in its sector over the many years.

Customization and personalization have become the norm for effective customer experience. In the futuristic world, consumers are actively looking for not just a car with a steering wheel and comfortable seats but a fully digitalized smooth experience. The automotive IoT has also found takers in governments that are promoting ‘Smart City Projects’ with features such as smart parking, efficient urban mobility, and environmentally friendly transport. We see both emerging and developed economies making use of the IoT in the automotive industry via policies that promote their usage. Developed countries like Australia have decided to implement programs such as the ‘Integrated Smart Parking System’ which has given a boost to the growth of the automotive IoT industry.

The market is driven by factors such as demand for an increasingly satisfying customer experience, the emergence of environmentally-conscious consumers, the need for a safer driving experience, and the encouragement of governments across the globe to adopt IoT in their policies, especially regarding transportation.

Furthermore, automotive IoT has not only taken consumers by storm but also the manufacturers equally. The use of IoT in the automotive industry technological advancements of the Internet of Things has made it necessary for the automotive industry to incorporate it in its daily manufacturing.

Because of its customizable nature, companies can earn revenue through various streams such as added subscriptions of news, traffic, and air conditions. Companies can choose to provide their customers with personalized features such as IoT infused on-the-spot decision-making cars to prevent accidents or provide them with on-the-go Audible books during a long drive. The customization of these features helps manufacturers with regards to saving cost by not just developing an all-encompassing Automotive IoT-based vehicle but one with features according to the customers' preference.

The COVID-19 pandemic has made companies rethink about their innovations in the automotive industry. The manufacturers have now realized that there are consumers who want to enjoy a safer experience. Autonomous vehicles have seen an upsurge during the pandemic with countries like China adopting the technology for greater efficiency. Restrictions are imposed by countries on various service-related jobs which require humans. The onset of IoT in the automotive industry with innovations such as autonomous vehicles has reduced the burden of humans to function in an environment containing a deadly virus. China used its autonomous vehicles very effectively to deliver vaccines, food and even admit COVID-affected patients to hospitals.

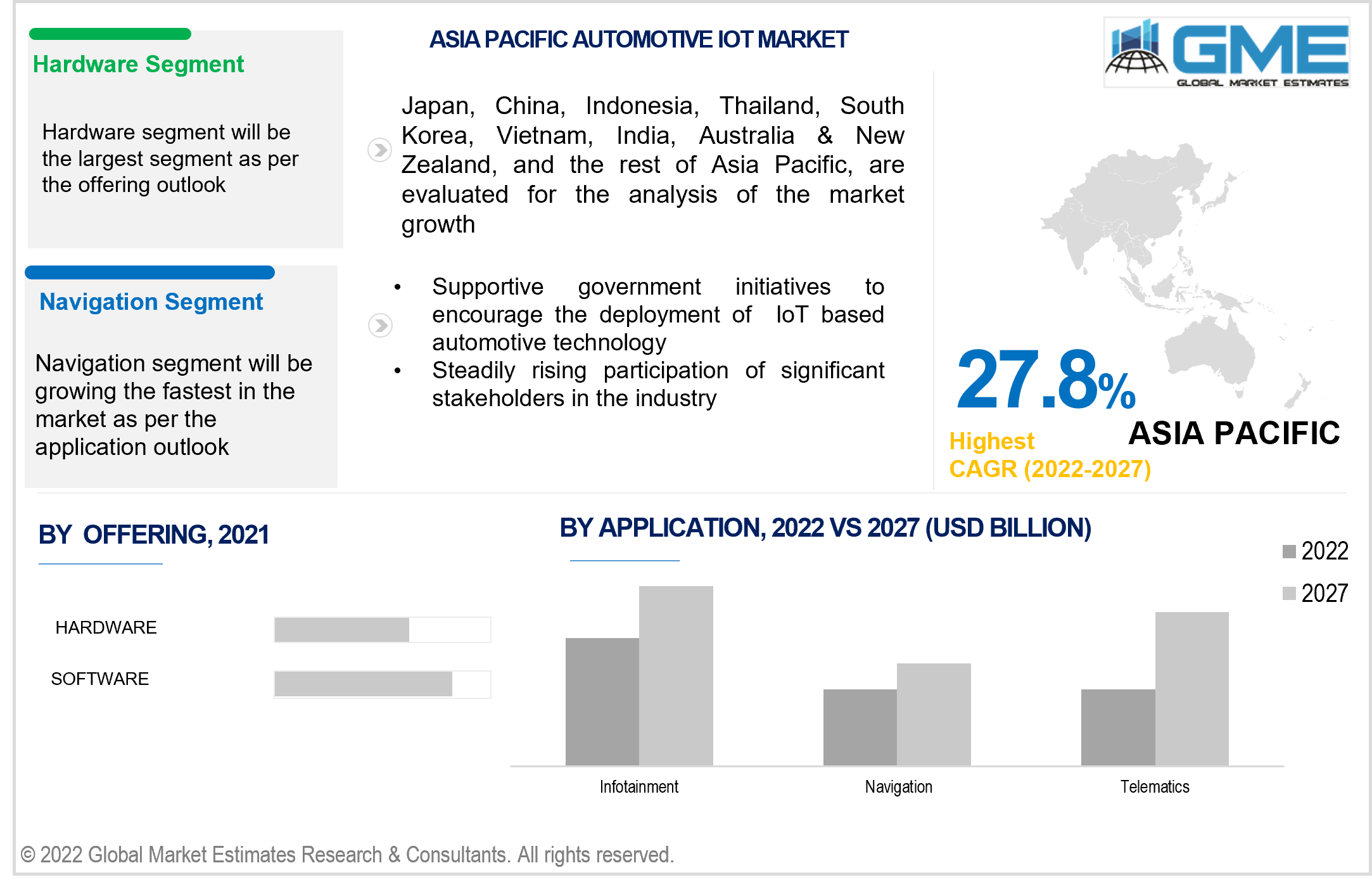

Based on the offering, the automotive IoT market is divided into hardware, software, and services. Software is rapidly finding a place in the automotive industry. Automotive vehicles with software have played an essential role in deciding the vehicle price as the inclusion of this technology requires testing, validation, and maintenance.

Based on the connectivity form factor, the automotive IoT market is divided into embedded, tethered, and integrated. The embedded segment is expected to hold the dominant share of the market and is expected to grow at the fastest rate during the forecast period. The growing number of interconnected devices being implemented in automobiles for improved functionality has been the major driver of the segment.

Based on the communication type, the automotive IoT market is divided into In-vehicle communication, vehicle-to-vehicle communication (V2V), and vehicle-to-infrastructure communication(V2I). The V2V segment is expected to hold the dominant share of the market. With the increasing global population, the government is taking measures to fix the prevalent traffic problem. Vehicle-to-vehicle communication minimizes this problem by providing real-time data of the traffic in an area.

In May 2020, Audi, a leading car manufacturing company, had suggested the usage of V2V technology to increase the safety of school buses. Vehicle-to-Infrastructure technology captures data on weather calamities, traffic congestion, flight status, etc. It has also become a part of the intelligence transportation system program of the U.S. and is fast gaining acceptance as a required feature in the automotive industry.

Based on the application, the automotive IoT market is divided into infotainment, navigation, and telematics. The infotainment segment is expected to hold the dominant share of the market. The growing demand for in-vehicle entertainment functionalities has been a major driver of this segment. Software developers in the automotive industry are concentrated in infotainment (around 30%).

As per the geographical analysis, the Automotive IoT market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the automotive IoT market from 2022 to 2027. The major factor driving the growth of the market in the North American region is the rising prevalence of adherence to environmental guidelines set by the Sustainable Development Goals of the United Nations. North America also finds itself to be home for leading market players, partnerships between government and companies for the development of smart cities and with-it smart parking, and increased awareness for the need for safer driving experiences

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the Automotive IoT market during the forecast period. Surveys and research have shown that more than half (56%) of consumers are willing to switch to IoT based connected cars.

Texas Instruments, Intel, NXP Semiconductors, TOMTOM, IBM, Cisco, Microsoft, Thales SA, AT&T, Vodafone, Robert Bosch, Google, Apple, General Motors, Audi, and Ford Motors among others are the key players in the automotive IoT market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Automotive IoT Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Connectivity Form Factor Overview

2.1.4 Communication Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Automotive IoT Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing need for safer and technologically efficient automotive vehicles.

3.3.1.2 Implementation of Government policies encouraging IoT in automotive industry across the globe.

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated industrial systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Connectivity Form Factor Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Communication Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Materials Overview

3.11 Market Share Analysis, 2022

3.11.1 Company Positioning Overview, 2022

Chapter 4 Automotive IoT Market, By Offering

4.1 Offering Outlook

4.2 Hardware

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Software

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Services

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Automotive IoT Market, By Connectivity Form Factor

5.1 Connectivity Form Factor Outlook

5.2 Embedded

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Tethered

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Integrated

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Automotive IoT Market, By Communication Type

6.1 In-Vehicle Communication

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Vehicle-to-Vehicle Communication

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Vehicle-to-Infrastructure Communication

6.3.1 Market Size, By Region, 2022-2027(USD Billion)

Chapter 7 Automotive IoT Market, By Application

7.1 Infotainment

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Navigation

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Telematics

7.3.1 Market Size, By Region, 2022-2027(USD Billion)

Chapter 8 Automotive IoT Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2022-2027 (USD Billion)

8.2.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.2.3 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.2.4 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.2.5 Market Size, By Application, 2022-2027 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.2.4.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.2.4.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

Market Size, By Application, 2022-2027 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.2.7.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.2.7.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.2.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2022-2027 (USD Billion)

8.3.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.3 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.3.4 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.3.5 Market Size, By Application, 2022-2027 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.6.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.3.6.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.3.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.7.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.3.7.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.3.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.8.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.3.8.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.3.8.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.9.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.3.9.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.3.9.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.10.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.3.10.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.3.10.4 Market Size, By Application, 2022-2027 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.3.11.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.3.11.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.3.11.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2022-2027 (USD Billion)

8.4.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.3 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.4.4 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.4.5 Market Size, By Application, 2022-2027 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.6.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.4.6.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.4.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.7.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.4.7.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.4.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.8.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.4.8.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.4.8.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.9.2 Market size, By Communication Form Factor, 2022-2027 (USD Billion)

8.4.9.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.4.9.4 Market Size, By Application, 2022-2027 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.4.10.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.4.10.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.4.10.4 Market Size, By Application, 2022-2027 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2022-2027 (USD Billion)

8.5.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.3 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.5.4 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.5.5 Market Size, By Application, 2022-2027 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.6.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.5.6.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.5.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.7.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.5.7.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.5.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.5.8.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.5.8.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.5.8.4 Market Size, By Application, 2022-2027 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2022-2027 (USD Billion)

8.6.2 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.3 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.6.4 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.6.5 Market Size, By Application, 2022-2027 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.6.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.6.6.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.6.6.4 Market Size, By Application, 2022-2027 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.7.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.6.7.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.6.7.4 Market Size, By Application, 2022-2027 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Offering, 2022-2027 (USD Billion)

8.6.8.2 Market Size, By Communication Form Factor, 2022-2027 (USD Billion)

8.6.8.3 Market Size, By Communication Type, 2022-2027 (USD Billion)

8.6.8.4 Market Size, By Application, 2022-2027 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2022

9.2 Texas Instruments

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Intel

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 NXP Semiconductors

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 TOMTOM

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 IBM

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Cisco

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Microsoft

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Thales SA

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 AT&T

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Automotive IoT Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive IoT Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS