Global Automotive Test Equipment Market Size, Trends & Analysis - Forecasts to 2026 By Product (Chassis Dynamometer, Engine Dynamometer, Vehicle Emission Test System, Wheel Alignment Tester); By Application (Handheld Scan Tool, Mobile Device-Based Scan Tool, PC/Laptop-Based Scan Tool); By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle); By Region (North America, Europe, Asia-Pacific, Central & South America, Middle East & Africa); Competitive Landscape Company Market Share Analysis, and Competitor Analysis

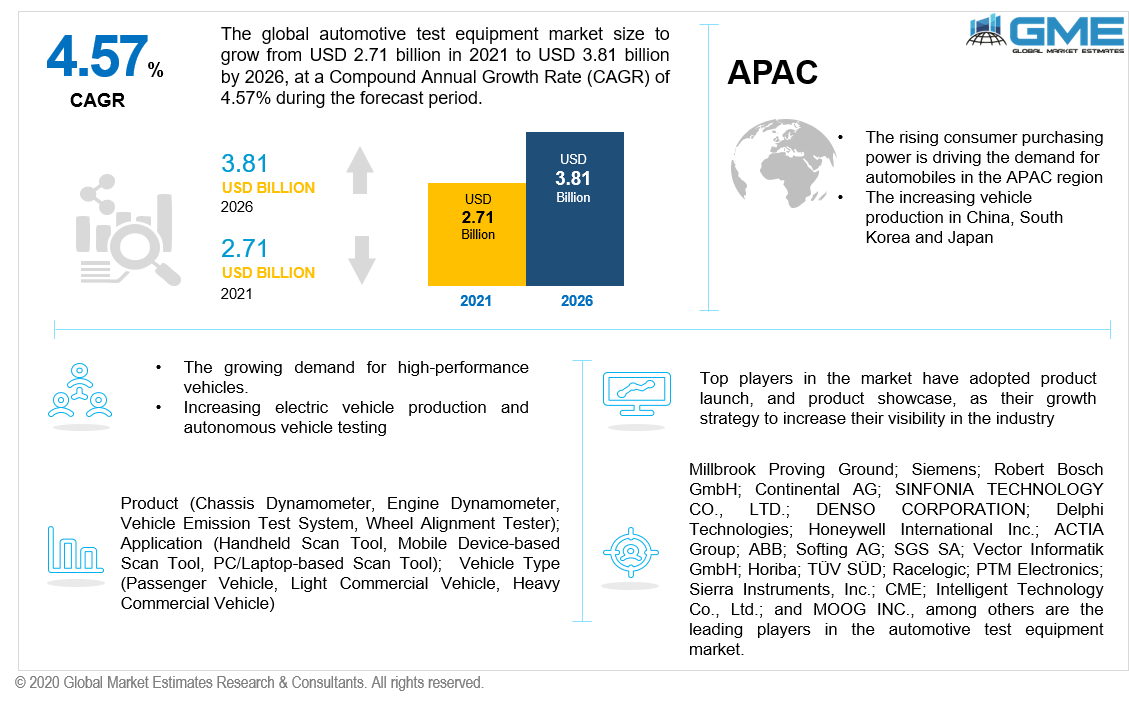

The global automotive test equipment market will grow from USD 2.71 billion in 2021 to USD 3.81 billion by 2026 with a CAGR value of 4.57% during the forecast period [2021 to 2026]. Automotive test equipment helps in maintaining vehicle efficiency and consequently contributes to the vehicle's overall longevity. The automotive test equipment are used to evaluate the vehicle's performance. It allows them to achieve increased vehicle efficiency while still meeting all safety standards. It is made up of all the technologies and equipment that are used to detect flaws in vehicles by testing their performance and operations. Hence, it has a wide range of applications in the automobile industry.

The emergence of electronic vehicle construction is a key driver supporting the market expansion. A high-voltage battery, an electric motor with a power electronic controller, and a single-speed gearbox comprise the most straightforward architecture.

During the forecast period, rising consumer demand for automobiles with improved stability and an increasing need for riding comfort is expected to propel the automotive test equipment market. Around the world, efforts are being made to build hybrid vehicles. Hybrid vehicles are powered by a combination of diesel and gasoline engines, as well as electric motors. During the projected period, the rising need for maintenance of diesel engines is expected to boost the automotive test equipment market.

Moreover, the increasing passenger and commercial vehicle production volumes and rising demand for high-performance vehicles are expected to drive the automotive test equipment market. Furthermore, the growing demand for safety and comfort features has urged automotive suppliers and OEMs to engage in R&D to ensure that electronic components are adequately tested and that they comply with government norms and regulations.

The COVID-19 outbreak has caused vehicle production to be halted and created supply issues, effectively halting the automotive market.

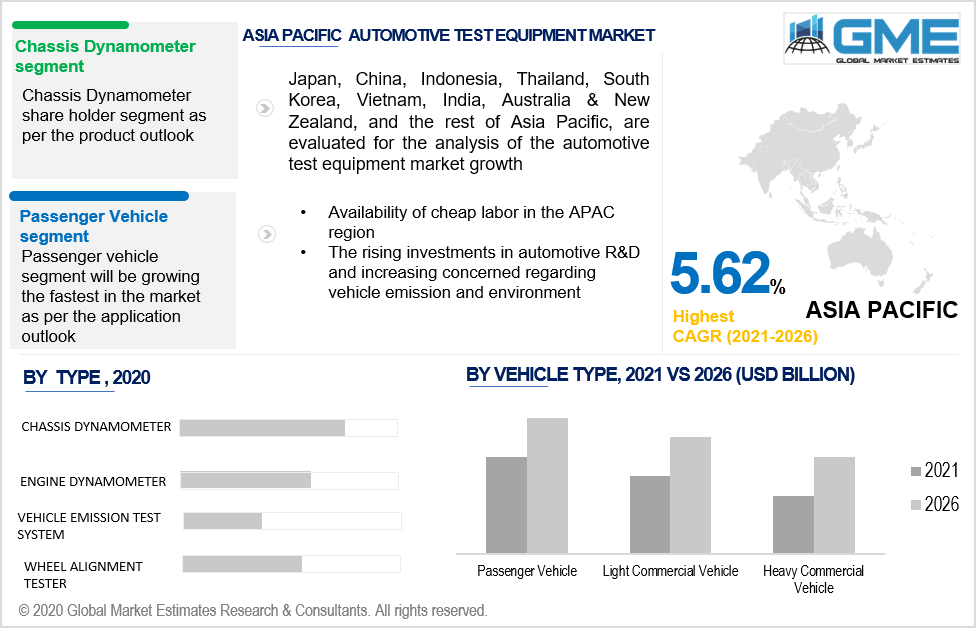

Based on the product, the market is segmented into chassis dynamometer, engine dynamometer, vehicle emission test system, and wheel alignment tester. The chassis dynamometer segment is expected to hold the largest market share during the forecast period owing to low-cost manufacturing and an increase in the number of automobile manufacturing plants in emerging countries. Moreover, due to increasing concerns about vehicle emissions, demand for smaller carbon impact, and strict government standards, the vehicle emission test system segment will be the fastest-growing segment in the automotive test equipment market during the forecast period.

Passenger vehicles, light commercial vehicles, and heavy commercial vehicles are the segmentation based on the type of vehicle in the automotive test equipment market. The passenger vehicle segment will be the fastest growing and also the largest one in terms of revenue sales and market share. This is mainly attributed to the increasing spending power of customers, clubbed with the rising demand for passenger vehicles in both established and developing countries, which has fueled segment growth. Also, the increasing stringency of emission and vehicle safety performance regulations in many nations has boosted the demand for automotive test equipment.

Based on the application, the market can be split into handheld scan tool, mobile device-based scan tool, PC/laptop-based scan tool. The handheld scan tool segment is analyzed to be growing the fastest and is also expected to hold the largest market share in terms of revenue from 2021 to 2026. Vacuum and air pressure testers, gas analyzers, thermometers, fuel pressure testers, battery testers, and emission analyzers are some of the handheld scan tools.

Furthermore, the PC/laptop-based scan tool is expected to hold the second-largest share of the market in terms of revenue during the forecast period. It's essentially a hardware and software package that includes all of the necessary cables and software. These instruments are capable of estimating torque and horsepower, calculating fuel efficiency, and plotting and logging sensor data.

As per the geographical analysis, the automotive test equipment market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Asia Pacific region is expected to be the fastest-growing segment in the market. The rapid growth is attributed to the rising demand for automobiles, strong economic growth, high spending power, and the growing availability of cheap labor, many automakers have either established their manufacturing facilities or partnered with domestic automakers.

However, the European region is expected to account for the considerable market share in the market during the forecast period. This is mainly due to several well-developed vehicle manufacturers have a dominant presence in the region. Furthermore, due to the adoption of safety certification, producers in the region are engaging in offering top-notch safety features that are tested according to many government-suggested safety criteria.

Millbrook Proving Ground; Siemens; Robert Bosch GmbH; Continental AG; SINFONIA TECHNOLOGY CO., LTD.; DSA Daten- und Systemtechnik GmbH; MTS Systems Corporation; DENSO CORPORATION; Delphi Technologies; Honeywell International Inc.; ACTIA Group; ABB; Softing AG; SGS SA; Vector Informatik GmbH; Horiba; TÜV SÜD; Racelogic; PTM Electronics; Sierra Instruments, Inc.; MAHA Maschinenbau Haldenwang GmbH & Co. KG; CME; Intelligent Technology Co., Ltd.; and MOOG INC., among others are the leading players in the automotive test equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2020, In the Philippines and Laos, Actia developed vehicle inspection centers with test benches for heavy commercial vehicles, light cars, and motorbikes. The first 40 inspection facilities were established in the Philippines under the name QWIK.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Automotive Test Equipment Market Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Product Overview

2.1.4 Vehicle Type Overview

2.1.5 Regional Overview

Chapter 3 Global Automotive Test Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing electric vehicle production and autonomous vehicle testing

3.3.2 Industry Challenges

3.3.2.1 Maintaining a balance between high cost & performance of test equipment

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Product Growth Scenario

3.4.3 Vehicle Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Automotive Test Equipment Market, By Application

4.1 Application Outlook

4.2 Handheld Scan Tool

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Mobile Device-Based Scan Tool

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 PC/Laptop-Based Scan Tool

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Automotive Test Equipment Market, By Product

5.1 Product Outlook

5.2 Chassis Dynamometer

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Engine Dynamometer

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Vehicle Emission Test System

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Wheel Alignment Tester

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Automotive Test Equipment Market, By Vehicle Type

6.1 Vehicle Type Outlook

6.2 Passenger Vehicle

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Light Commercial Vehicle

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Heavy Commercial Vehicle

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Global Automotive Test Equipment Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.3 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Application, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.3 Market Size, By Product, 2020-2026 (USD Billion)

7.3.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Product, 2020-2026(USD Billion)

7.3.10.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.3 Market Size, By Product, 2020-2026 (USD Billion)

7.4.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Product, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.3 Market Size, By Product, 2020-2026 (USD Billion)

7.5.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Application, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.7 MEA

7.7.1 Market Size, By Country 2020-2026 (USD Billion)

7.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.7.3 Market Size, By Product, 2020-2026 (USD Billion)

7.7.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.7.5 Saudi Arabia

7.7.5.1 Market Size, By Application, 2020-2026 (USD Billion)

7.7.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.7.5.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.7.6 UAE

7.7.6.1 Market Size, By Application, 2020-2026 (USD Billion)

7.7.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.7.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.7.7 South Africa

7.7.7.1 Market Size, By Application, 2020-2026 (USD Billion)

7.7.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.7.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Millbrook Proving Ground

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info-Graphic Analysis

8.3 Siemens

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 Robert Bosch GmbH

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 ACTIA Group

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 ABB

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Vector Informatik GmbH

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 Horiba

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 PTM Electronics

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Sierra Instruments, Inc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 MAHA Maschinenbau Haldenwang GmbH & Co. KG

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

8.12 Honeywell International Inc

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

8.13 Delphi Technologies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info-Graphic Analysis

8.14 MOOG INC.

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info-Graphic Analysis

8.15 Other Companies

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info-Graphic Analysis

The Global Automotive Test Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Test Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS