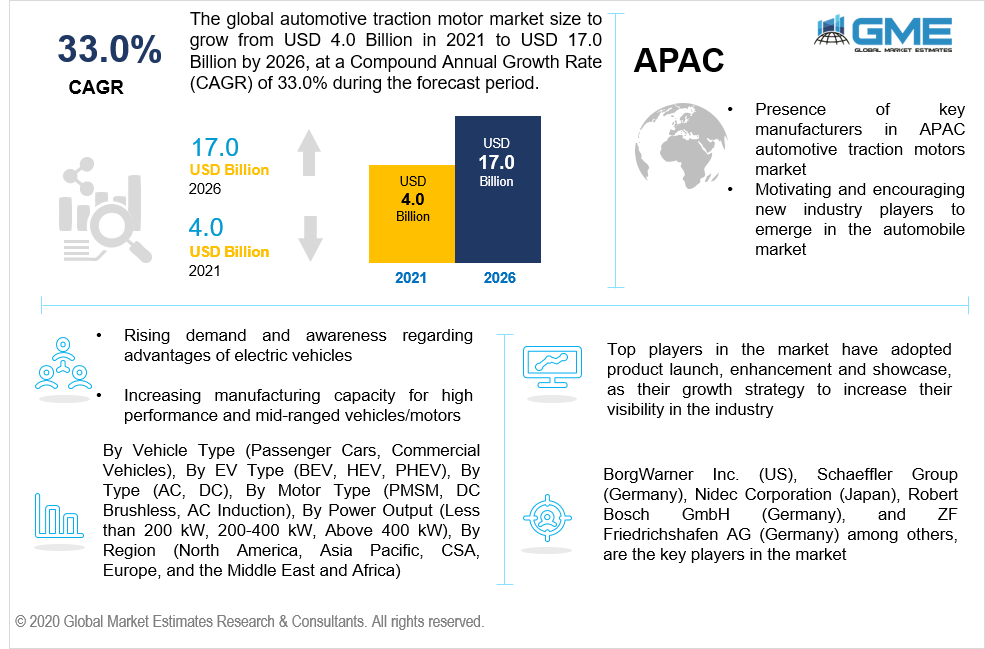

Global Automotive Traction Motor Market Size, Trends, and Analysis - Forecasts to 2026 By Vehicle Type (Passenger Cars, Commercial Vehicles), By EV Type (BEV, HEV, PHEV), By Type (AC, DC), By Motor Type (PMSM, DC Brushless, AC Induction), By Power Output (Less than 200 kW, 200-400 kW, Above 400 kW), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global automotive traction motor market is projected to grow from USD 4.0 billion in 2021 to USD 17.0 billion by 2026 at a CAGR value of 33.0%.

Rising demand and awareness regarding advantages of electric vehicles, increasing manufacturing capacity for high performance and mid-ranged vehicles/motors, and rising government supportive policies to launch battery and electric operated cars in developing and developed nations are few of the factors responsible to drive the automotive traction motor market. Moreover, technological advancements in electric vehicles have a direct positive effect on the traction motors market.

For instance, in October 2019, BMW Group awarded Magna International as its largest production order for transmission technologies. The multi-year contract includes all front-wheel drive dual-clutch transmissions, including hybrid transmission variants. The transmission technologies will be used in more than 170 different vehicle applications. Magna’s new hybrid solution has no impact on the overall package size of the transmission, thus providing BMW with manufacturing flexibility.

Traction motor is used in automobiles to create propulsion through its electric motors. Most of the countries are suppliers and manufacturers of diesel or petrol engine motors. However, with improving lifestyles and changing requirements as per environmental need, the automotive industry is also bringing in innovations that are more technologically and advancement driven. The traditional mechanical transmission systems, consume more significant amount of resources than an EV or battery operated vehicle. The newly developing automobiles with electrical transmission systems can reuse and regenerate the energy consumed, thus enhancing the service delivery and efficiency. These automotive traction motors are mainly installed in hybrid electric vehicles or battery electric vehicles.

Automotive traction motors enable the operators a smooth start and stop to the engine, thus bringing more efficiency. The rising population and changing lifestyles are increasing the demand for the efficient EV vehicles thus driving the automotive traction motors market.

The COVID-19 pandemic hampered the automotive industry on a large scale. Most of the manufacturing facilities and sites were shut due to worldwide lockdown. Moreover the raw material supply chain was heavily disturbed due to lack of labour source. However, during the forecast period, the automotive traction motor market is expected to grow exponentially owing to rising need for EV and battery based vehicles.

Based on the vehicle type the market is segmented into passenger cars, and commercial vehicles. Traction motors in recent times have been extensively used in commercial vehicles like metros or railways, and hence, the commercial vehicles segment is analyzed to be the largest segment in the market.

Commercial vehicles are majorly used modes of transportation as well as for other services all across the world. Besides the metro and suburban railways, commercial vehicles also include buses, vans, construction vehicles, garbage vans, ambulances, and many more. These commercial vehicles, however, account to emit 25% of CO2 into the air. This increasing concern has brought awareness among countries, and governments across the globe are gradually investing more into converting these commercial vehicles to electric traction motors instead of fossil fuels like diesel or petrol.

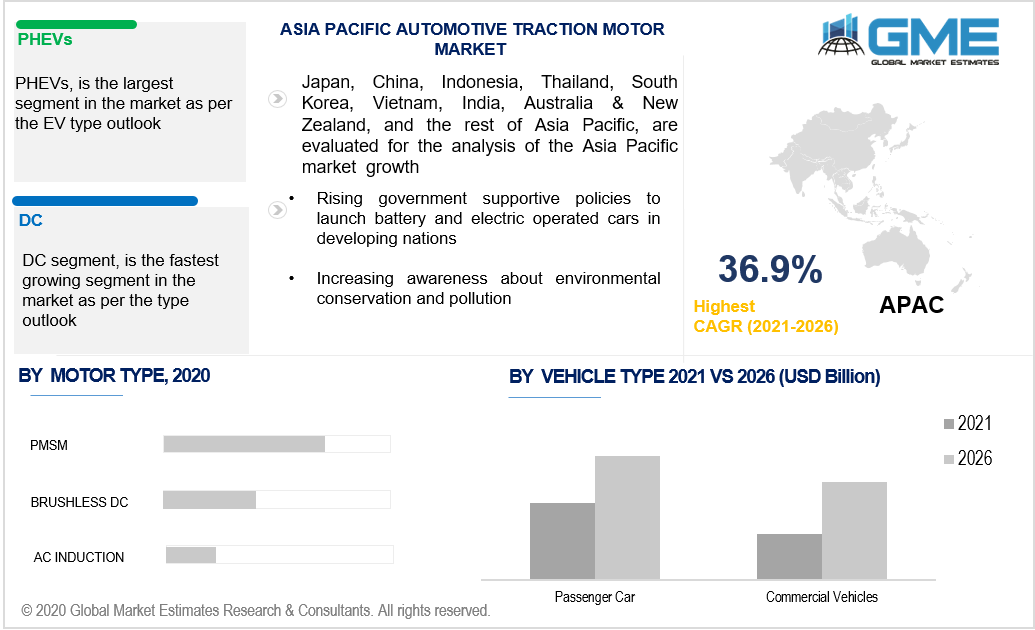

Based on the EV type, the market is segmented into battery electric vehicle (BEV), hybrid electric vehicles (HEV), and plug-in hybrid electric vehicle (PHEV). The PHEV will be the fastest growing segment in the market from 2021 to 2026. Plug-in hybrid electric vehicles, utilize both batteries and fuel based engines. These hybrid vehicles use batteries to charge their traction motors and use petroleum fuel to charge the internal combustions. With increasing number of electric vehicle manufacturers, the segment is ought to be the growing the fastest.

Based on type, the market is segmented into alternating current (AC), and direct current (DC).

The DC segment is analyzed to be the largest shareholder of the market as it is significantly used for automotive traction motor. The electric vehicles, majorly working on batteries, are based on direct current power supplies. The alternating current power, is most commonly used through power outlets in domestic or household usage. However, with rising demand for traction motors and electric vehicles, the DC power type segment will grow rapidly as it is considered to be the most beneficial part of the system.

Based on the motor type, the market is segmented into permanent magnet synchronous motor (PMSM), DC brushless, and AC induction. The automotive traction motor industry highly utilizes PMSM attributing to its various beneficial features and hence it is the fastest growing segment. Compared to the Brushless DC, the PMSM facilitates more beneficial features than regular. The PMSM motors are prominent and produce less noise while operating. These motors are highly used in hybrid and battery-driven electric vehicles, and also ensure energy-efficient usage in automobiles.

Based on the power output, the market is segmented into less than 200 kW, 200-400 kW, and above 400 kW. With the increasing implication of traction motors in electric vehicles, the most commonly required or average power output in these vehicles is less than 200 kW and hence, this segment is ought to be the largest segment in the market. Standard or regular use passenger electric vehicle or car require 30 to 50 kW of power output traction motors to run smoothly and give efficient results. However, for heavy-duty commercial vehicles like metro or railway, the power output of traction motors is relatively high at more than 400 kW.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and Africa, and Asia Pacific regions.

Europe is the most dominant region in the manufacturing of traction motors and the automobile industry and is also the top regional segment in the automotive traction motor market from 2021 to 2026. Europe is known to be home for the world’s largest automobile manufacturing companies especially for automotive traction motors.

However, followed by Europe, APAC is another powerful region which is expected to grow the fastest in the market. Countries like India, Japan, China, Korea, and many others have powerfully held their place in the traction motor industry. China is one of the top manufacturers of automotive traction motors. China has also been one of the top countries in exporting electric vehicles across international markets. Companies like Kirloskar Brothers Limited, ABB Ltd, Mitsubishi Electric Corporation, and many others are strong players in the APAC region.

BorgWarner Inc. (US), Schaeffler Group (Germany), Nidec Corporation (Japan), Robert Bosch GmbH (Germany), and ZF Friedrichshafen AG (Germany) among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Automotive Traction Motors Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Motor Type Overview

2.1.3 Vehicle Type Overview

2.1.4 EV Type Overview

2.1.5 Type Overview

2.1.6 Power Output Overview

2.1.7 Regional Overview

Chapter 3 Automotive Traction Motors Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand and awareness regarding advantages of electric vehicles

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness to e-vehicles in low-income countries

3.4 Prospective Growth Scenario

3.4.1 Motor Type Growth Scenario

3.4.2 Vehicle Type Growth Scenario

3.4.3 EV Type Growth Scenario

3.4.4 Type Growth Scenario

3.4.5 Power Output Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Type Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Automotive Traction Motors Market, By Motor Type

4.1 Motor Type Outlook

4.2 PMSM,

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 DC Brushless

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 AC Induction

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Automotive Traction Motors Market, By Vehicle Type

5.1 Vehicle Type Outlook

5.2 Passenger Cars

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Commercial Vehicles

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Automotive Traction Motors Market, By EV Type

6.1 BEV

6.1.1 Market Size, By Region, 2019-2026 (USD Billion)

6.2 HEV

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 PHEV

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Automotive Traction Motors Market, By Type

7.1 AC

7.1.1 Market Size, By Region, 2019-2026 (USD Billion)

7.2 DC

7.2.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 8 Automotive Traction Motors Market, By Power Output

8.1 Less than 200 kW

8.1.1 Market Size, By Region, 2019-2026 (USD Billion)

8.2 200-400 kW

8.2.1 Market Size, By Region, 2019-2026 (USD Billion)

8.2 Above 400 kW

8.2.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 9 Automotive Traction Motors Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2019-2026 (USD Billion)

9.2.2 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.2.3 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.2.4 Market Size, By EV Type, 2019-2026 (USD Billion)

9.2.5 Market Size, By Type, 2019-2026 (USD Billion)

9.2.6 Market Size, By Power Output, 2019-2026 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.2.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.2.7.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.2.7.4 Market Size, By Type, 2019-2026 (USD Billion)

9.2.7.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.2.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.2.8.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.2.8.4 Market Size, By Type, 2019-2026 (USD Billion)

9.2.8.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.2.9.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.2.9.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.2.9.4 Market Size, By Type, 2019-2026 (USD Billion)

9.2.9.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2019-2026 (USD Billion)

9.3.2 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.3.3 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.3.4 Market Size, By EV Type, 2019-2026 (USD Billion)

9.3.5 Market Size, By Type, 2019-2026 (USD Billion)

9.3.6 Market Size, By Power Output, 2019-2026 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.3.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.3.7.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.3.7.4 Market Size, By Type, 2019-2026 (USD Billion)

9.3.7.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.3.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.3.8.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.3.8.4 Market Size, By Type, 2019-2026 (USD Billion)

9.3.8.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.3.9.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.3.9.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.3.9.4 Market Size, By Type, 2019-2026 (USD Billion)

9.3.9.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.3.10.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.3.10.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.3.10.4 Market Size, By Type, 2019-2026 (USD Billion)

9.3.10.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2019-2026 (USD Billion)

9.4.2 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.4.3 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.4.4 Market Size, By EV Type, 2019-2026 (USD Billion)

9.4.5 Market Size, By Type, 2019-2026 (USD Billion)

9.4.6 Market Size, By Power Output, 2019-2026 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.4.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.4.7.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.4.7.4 Market Size, By Type, 2019-2026 (USD Billion)

9.4.7.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.4.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.4.8.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.4.8.4 Market Size, By Type, 2019-2026 (USD Billion)

9.4.8.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.4.9.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.4.9.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.4.9.4 Market Size, By Type, 2019-2026 (USD Billion)

9.4.9.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2019-2026 (USD Billion)

9.5.2 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.5.3 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.5.4 Market Size, By EV Type, 2019-2026 (USD Billion)

9.5.5 Market Size, By Type, 2019-2026 (USD Billion)

9.5.6 Market Size, By Power Output, 2019-2026 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.5.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.5.7.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.5.7.4 Market Size, By Type, 2019-2026 (USD Billion)

9.5.7.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.5.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.5.8.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.5.8.4 Market Size, By Type, 2019-2026 (USD Billion)

9.5.8.5 Market Size, By Power Output, 2019-2026 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Motor Type, 2019-2026 (USD Billion)

9.5.9.2 Market Size, By Vehicle Type, 2019-2026 (USD Billion)

9.5.9.3 Market Size, By EV Type, 2019-2026 (USD Billion)

9.5.9.4 Market Size, By Type, 2019-2026 (USD Billion)

9.5.9.5 Market Size, By Power Output, 2019-2026 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 BorgWarner Inc.

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 Schaeffler Group

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Nidec Corporation

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 Robert Bosch GmbH

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 ZF Friedrichshafen AG

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 BYD CO.LTD

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 Tesla

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.9 Eaton

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.10 Other Companies

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

The Global Automotive Traction Motor Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Traction Motor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS