Global Autonomous Tractors Market Size, Trends & Analysis - Forecasts to 2028 By Component (Sensor, GPS, Vision System, Others), By Application (Tillage, Harvesting, Seed Sowing, Others), By Power Output (Up to 30HP, 31-100HP, and Above 100HP), By Region (North America, Asia Pacific, Central & South America, Europe, the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

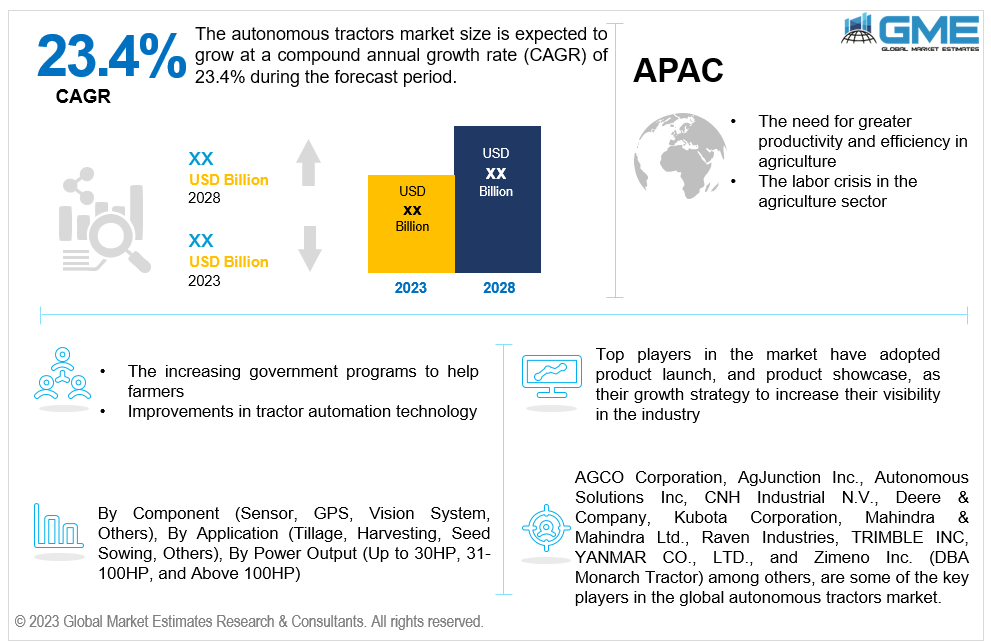

The global autonomous tractors market is projected to grow at a CAGR of 23.4% from 2023 to 2028.

Autonomous tractors, also known as self-driving tractors, are automobiles outfitted with cutting-edge technology that enables them to function with little or no human help. These tractors are capable of carrying out a number of agricultural chores, including seeding, harvesting, sowing, ploughing, etc. Without human assistance, autonomous tractors can move through a field and go along predefined routes. For maximum productivity and efficiency, they can operate day and night. To analyze soil conditions, crop health, and other criteria, these tractors can utilize data from sensors and satellite photography. Inputs like seed, fertilizer, and pesticides may be applied more efficiently with the use of this information, increasing crop yields while lowering costs. Increased operational efficiency and less downtime are the results of autonomous tractors' ability to work constantly without breaks or exhaustion. As a result, resource management is improved. They may also optimize routes, prevent overlapping, and minimize input waste.

The need for greater productivity and efficiency in agriculture, the labor crisis in the agriculture sector, and the increasing government programs to help farmers are the factors driving the autonomous tractors market. Moreover, improvements in tractor automation technology, a rise in the use of autonomous agricultural tools, and a greater emphasis among farmers on increasing farm yields of the farm are propelling the growth of the market.

Artificial intelligence, machine learning, computer vision, and sensor technologies are all advancing continuously, creating fresh opportunities for innovation and improvement in autonomous tractors. Additionally, by offering precise and focused input applications, autonomous tractors make it possible to practice precision agriculture. As a result, businesses that provide precision agricultural solutions, such as sensors, imaging systems, software platforms, and data analytics tools, have more opportunities. However, the market for autonomous tractors is being constrained by the increased land fragmentation and the high initial cost of modern agricultural equipment. These are a few market challenges and opportunities for autonomous tractors.

The growth projections for the autonomous tractors market are quite promising. The potential advantages of autonomous tractors in the agricultural industry are being acknowledged by the governments of various nations and supporting them with subsidies, grants, and incentives. Such measures can increase the uptake of automated tractors and spur market expansion. Additionally, autonomous tractors are becoming more productive and economical due to advancements in technology like sensors, GPS, artificial intelligence, and robotics.

Emerging technologies in autonomous farming are continuously shaping, revolutionizing agricultural practices, and enabling increased efficiency and productivity. Autonomous agricultural systems are built on AI and machine learning techniques. With the aid of these technologies, autonomous vehicles, including tractors, are now able to sense and comprehend their environment, make quick judgments, and adjust to shifting field conditions. Large volumes of data gathered from sensors and cameras may be analyzed by AI algorithms to improve farm management and operations. The IoT links numerous farm equipment and sensors, enabling easy data exchange and communication. IoT sensors can provide real-time data on crop health, soil moisture, temperature, and equipment condition in autonomous farming. Making sensible choices, maximizing resource use, and spotting abnormalities or possible problems may all be done with the use of this data.

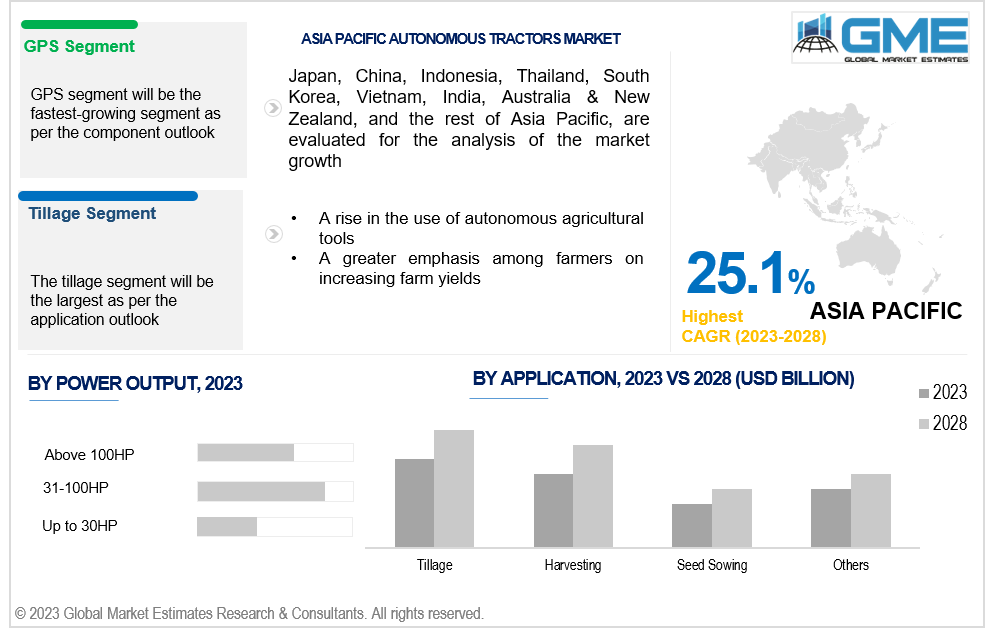

The GPS segment is expected to be the fastest-growing segment in the market from 2023-2028. Autonomous tractors leverage GPS technology to receive accurate and reliable positional data, enabling them to navigate terrains and follow pre-defined paths with exceptional precision. This advanced capability allows autonomous tractors to operate efficiently by eliminating unnecessary overlaps, optimizing routes, and ensuring precise coverage of agricultural tasks. With GPS integration, farmers can actively monitor their fleet of autonomous tractors in real-time, gaining valuable insights into their position, speed, and activities. This remote monitoring capability empowers farmers to ensure that the tractors are functioning according to plan, enabling them to make informed decisions and take necessary actions promptly.

The harvesting segment is expected to witness significant growth in the Autonomous Tractors Market due to several factors. Harvesting is a labor-intensive and time-sensitive process in agriculture, and the adoption of autonomous tractors can greatly enhance efficiency and productivity. Autonomous tractors equipped with advanced sensing and imaging technologies can accurately identify ripe crops, determine optimal harvesting times, and autonomously carry out harvesting operations with precision.

This eliminates the need for manual labor, reduces operational costs, and minimizes crop losses. Moreover, autonomous tractors can work continuously without fatigue, enabling faster harvesting cycles and improved overall output. As a result, the harvesting segment is poised to experience substantial growth in the Autonomous Tractors Market as farmers seek innovative solutions to enhance their harvesting capabilities and maximize agricultural yields.

The above 100HP segment is expected to witness rapid growth in the Autonomous Tractors Market due to its suitability for a wide range of heavy-duty agricultural tasks. Autonomous tractors with a power rating above 100 horsepower offer higher performance and greater capacity, making them ideal for large-scale farming operations. These tractors can efficiently handle demanding tasks such as ploughing, planting, and tillage, as well as operate heavy machinery and equipment. Their advanced automation features and robust power capabilities enable them to handle complex field conditions and work with larger implements, resulting in enhanced productivity and improved operational efficiency. With increasing adoption by commercial farmers and agricultural enterprises, the above 100HP segment is poised for significant growth in the Autonomous Tractors Market, driving advancements in the field of autonomous farming.

The 31-100HP segment is the dominant segment in the Autonomous Tractors Market, holding the largest market share. This segment caters to a wide range of agricultural applications, making it highly versatile and in-demand among farmers. Tractors within this power range offer a balanced combination of power, agility, and fuel efficiency, making them suitable for various tasks, including field preparation, seeding, and light-to-medium-duty operations. They are commonly used in small to medium-sized farms where versatility and manoeuvrability are essential. The popularity of the 31-100HP segment can be attributed to its ability to deliver reliable performance, cost-effectiveness, and improved productivity, driving its market dominance in the Autonomous Tractors Market.

The North American segment is projected to be the largest segment in the autonomous tractors market, accounting for a significant market share. This dominance can be attributed to several factors. Firstly, North America has a highly developed agricultural sector and is known for its large-scale farming operations. The adoption of advanced farming technologies and automation is high in this region, including the use of autonomous tractors to enhance operational efficiency and productivity. Additionally, the presence of major agricultural machinery manufacturers and technological advancements in precision agriculture contribute to the market's growth in North America. The region's favorable government initiatives, supportive regulations, and robust infrastructure further bolster the market's expansion, making it the largest segment in the autonomous tractors market.

Asia Pacific is poised to experience rapid growth in the Autonomous Tractors Market due to several key factors. Firstly, the region has a significant presence of emerging economies with a strong focus on modernizing their agricultural practices. The adoption of advanced farming technologies, including autonomous tractors, is gaining traction in countries like China and India to increase agricultural productivity and efficiency. Secondly, the rising population and increasing food demand in the region are driving the need for innovative agricultural solutions. Autonomous tractors offer higher productivity, precision, and reduced labor costs, making them attractive for farmers in Asia Pacific. Furthermore, government initiatives to promote sustainable agriculture and technological advancements in precision farming are creating a favorable environment for the growth of the Autonomous Tractors Market in the region.

AGCO Corporation, AgJunction Inc., Autonomous Solutions Inc, CNH Industrial N.V., Deere & Company, Kubota Corporation, Mahindra & Mahindra Ltd., Raven Industries, TRIMBLE INC, YANMAR CO., LTD., and Zimeno Inc. (DBA Monarch Tractor) among others, are some of the key players in the global autonomous tractors market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL AUTONOMOUS TRACTORS MARKET OUTLOOK

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL AUTONOMOUS TRACTORS MARKET, BY COMPONENT

4.2 Autonomous Tractors Market: Component Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Sensor Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 GPS Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Vision System Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL AUTONOMOUS TRACTORS MARKET, BY APPLICATION

5.2 Autonomous Tractors Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Tillage Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Harvesting Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Seed Sowing Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL AUTONOMOUS TRACTORS MARKET, BY POWER OUTPUT

6.2 Autonomous Tractors Market: Power Output Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Up to 30HP Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 31-100HP Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Above 100HP Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL AUTONOMOUS TRACTORS MARKET, BY REGION

7.2 North America Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1 U.S. Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2 Canada Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3 Mexico Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3 Europe Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1 Germany Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2 U.K. Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3 France Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4 Italy Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5 Spain Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6 Netherlands Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7 Rest of Europe Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4 Asia Pacific Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1 China Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2 Japan Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3 India Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4 South Korea Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5 Singapore Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6 Malaysia Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7 Thailand Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8 Indonesia Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9 Vietnam Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10 Taiwan Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.5 Middle East & Africa Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1 Saudi Arabia Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2 U.A.E. Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3 Israel Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4 South Africa Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1 Brazil Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3 Chile Autonomous Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Autonomous Solutions Inc

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6.1 Business Description & Financial Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Mahindra & Mahindra Ltd.

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11.1 Business Description & Financial Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various Type of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Autonomous Tractors Market, By Component, 2020-2028 (USD Mllion)

2 Sensor Market, By Region, 2020-2028 (USD Mllion)

3 GPS Market, By Region, 2020-2028 (USD Mllion)

4 Vision System Market, By Region, 2020-2028 (USD Mllion)

5 Others Market, By Region, 2020-2028 (USD Mllion)

6 Global Autonomous Tractors Market, By Application, 2020-2028 (USD Mllion)

7 Tillage Market, By Region, 2020-2028 (USD Mllion)

8 Harvesting Market, By Region, 2020-2028 (USD Mllion)

9 Seed Sowing Market, By Region, 2020-2028 (USD Mllion)

10 Others Market, By Region, 2020-2028 (USD Mllion)

11 Global Autonomous Tractors Market, By Power Output, 2020-2028 (USD Mllion)

12 Up to 30HP Market, By Region, 2020-2028 (USD Mllion)

13 31-100HP Market, By Region, 2020-2028 (USD Mllion)

14 Above 100HP Market, By Region, 2020-2028 (USD Mllion)

15 Regional Analysis, 2020-2028 (USD Mllion)

16 North America Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

17 North America Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

18 North America Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

19 North America Autonomous Tractors Market, By Country, 2020-2028 (USD Million)

20 U.S Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

21 U.S Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

22 U.S Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

23 Canada Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

24 Canada Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

25 Canada Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

26 Mexico Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

27 Mexico Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

28 Mexico Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

29 Europe Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

30 Europe Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

31 Europe Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

32 Germany Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

33 Germany Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

34 Germany Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

35 UK Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

36 UK Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

37 UK Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

38 France Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

39 France Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

40 France Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

41 Italy Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

42 Italy Autonomous Tractors Market, By T Application Type, 2020-2028 (USD Million)

43 Italy Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

44 Spain Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

45 Spain Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

46 Spain Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

47 Rest Of Europe Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

48 Rest Of Europe Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

49 Rest of Europe Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

50 Asia Pacific Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

51 Asia Pacific Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

52 Asia Pacific Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

53 Asia Pacific Autonomous Tractors Market, By Country, 2020-2028 (USD Million)

54 China Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

55 China Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

56 China Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

57 India Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

58 India Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

59 India Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

60 Japan Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

61 Japan Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

62 Japan Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

63 South Korea Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

64 South Korea Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

65 South Korea Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

66 Middle East & Africa Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

67 Middle East & Africa Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

68 Middle East & Africa Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

69 Middle East & Africa Autonomous Tractors Market, By Country, 2020-2028 (USD Million)

70 Saudi Arabia Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

71 Saudi Arabia Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

72 Saudi Arabia Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

73 UAE Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

74 UAE Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

75 UAE Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

76 Central & South America Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

77 Central & South America Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

78 Central & South America Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

79 Central & South America Autonomous Tractors Market, By Country, 2020-2028 (USD Million)

80 Brazil Autonomous Tractors Market, By Component, 2020-2028 (USD Million)

81 Brazil Autonomous Tractors Market, By Application, 2020-2028 (USD Million)

82 Brazil Autonomous Tractors Market, By Power Output, 2020-2028 (USD Million)

83 AGCO Corporation: Products & Services Offering

84 AgJunction Inc.: Products & Services Offering

85 Autonomous Solutions Inc: Products & Services Offering

86 CNH Industrial N.V.: Products & Services Offering

87 Deere & Company: Products & Services Offering

88 KUBOTA CORPORATION: Products & Services Offering

89 Mahindra & Mahindra Ltd. : Products & Services Offering

90 Raven Industries: Products & Services Offering

91 TRIMBLE INC, Inc: Products & Services Offering

92 YANMAR CO., LTD.: Products & Services Offering

93 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Autonomous Tractors Market Overview

2 Global Autonomous Tractors Market Value From 2020-2028 (USD Mllion)

3 Global Autonomous Tractors Market Share, By Component (2022)

4 Global Autonomous Tractors Market Share, By Application (2022)

5 Global Autonomous Tractors Market Share, By Power Output (2022)

6 Global Autonomous Tractors Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Autonomous Tractors Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Autonomous Tractors Market

11 Impact Of Challenges On The Global Autonomous Tractors Market

12 Porter’s Five Forces Analysis

13 Global Autonomous Tractors Market: By Component Scope Key Takeaways

14 Global Autonomous Tractors Market, By Component Segment: Revenue Growth Analysis

15 Sensor Market, By Region, 2020-2028 (USD Mllion)

16 GPS Market, By Region, 2020-2028 (USD Mllion)

17 Vision System Market, By Region, 2020-2028 (USD Mllion)

18 Others Market, By Region, 2020-2028 (USD Mllion)

19 Global Autonomous Tractors Market: By Application Scope Key Takeaways

20 Global Autonomous Tractors Market, By Application Segment: Revenue Growth Analysis

21 Tillage Market, By Region, 2020-2028 (USD Mllion)

22 Harvesting Market, By Region, 2020-2028 (USD Mllion)

23 Seed Sowing Market, By Region, 2020-2028 (USD Mllion)

24 Others Market, By Region, 2020-2028 (USD Mllion)

25 Global Autonomous Tractors Market: By Power Output Scope Key Takeaways

26 Global Autonomous Tractors Market, By Power Output Segment: Revenue Growth Analysis

27 Up to 30HP Market, By Region, 2020-2028 (USD Mllion)

28 31-100HP Market, By Region, 2020-2028 (USD Mllion)

29 Above 100HP Market, By Region, 2020-2028 (USD Mllion)

30 Regional Segment: Revenue Growth Analysis

31 Global Autonomous Tractors Market: Regional Analysis

32 North America Autonomous Tractors Market Overview

33 North America Autonomous Tractors Market, By Component

34 North America Autonomous Tractors Market, By Application

35 North America Autonomous Tractors Market, By Power Output

36 North America Autonomous Tractors Market, By Country

37 U.S. Autonomous Tractors Market, By Component

38 U.S. Autonomous Tractors Market, By Application

39 U.S. Autonomous Tractors Market, By Power Output

40 Canada Autonomous Tractors Market, By Component

41 Canada Autonomous Tractors Market, By Application

42 Canada Autonomous Tractors Market, By Power Output

43 Mexico Autonomous Tractors Market, By Component

44 Mexico Autonomous Tractors Market, By Application

45 Mexico Autonomous Tractors Market, By Power Output

46 Four Quadrant Positioning Matrix

47 Company Market Share Analysis

48 AGCO Corporation: Company Snapshot

49 AGCO Corporation: SWOT Analysis

50 AGCO Corporation: Geographic Presence

51 AgJunction Inc.: Company Snapshot

52 AgJunction Inc.: SWOT Analysis

53 AgJunction Inc.: Geographic Presence

54 Autonomous Solutions Inc: Company Snapshot

55 Autonomous Solutions Inc: SWOT Analysis

56 Autonomous Solutions Inc: Geographic Presence

57 CNH Industrial N.V.: Company Snapshot

58 CNH Industrial N.V.: Swot Analysis

59 CNH Industrial N.V.: Geographic Presence

60 Deere & Company: Company Snapshot

61 Deere & Company: SWOT Analysis

62 Deere & Company: Geographic Presence

63 KUBOTA CORPORATION: Company Snapshot

64 KUBOTA CORPORATION: SWOT Analysis

65 KUBOTA CORPORATION: Geographic Presence

66 Mahindra & Mahindra Ltd. : Company Snapshot

67 Mahindra & Mahindra Ltd. : SWOT Analysis

68 Mahindra & Mahindra Ltd. : Geographic Presence

69 Raven Industries: Company Snapshot

70 Raven Industries: SWOT Analysis

71 Raven Industries: Geographic Presence

72 TRIMBLE INC, Inc.: Company Snapshot

73 TRIMBLE INC, Inc.: SWOT Analysis

74 TRIMBLE INC, Inc.: Geographic Presence

75 YANMAR CO., LTD.: Company Snapshot

76 YANMAR CO., LTD.: SWOT Analysis

77 YANMAR CO., LTD.: Geographic Presence

78 Other Companies: Company Snapshot

79 Other Companies: SWOT Analysis

80 Other Companies: Geographic Presence

The Global Autonomous Tractors Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Autonomous Tractors Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS