Global Autotransfusion Devices Market Size, Trends & Analysis - Forecasts to 2026 By Type (Autotransfusion Products [Intraoperative Autotransfusion Devices, Postoperative Autotransfusion Devices, Dual-Mode Autotransfusion Devices], Consumables Accessories), By Application (Cardiovascular Surgeries, Orthopedic Surgeries, Neurological Surgeries, Obstetrics & Gynaecological Surgeries, Others), By End-User (Hospital, Specialty Clinics & Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

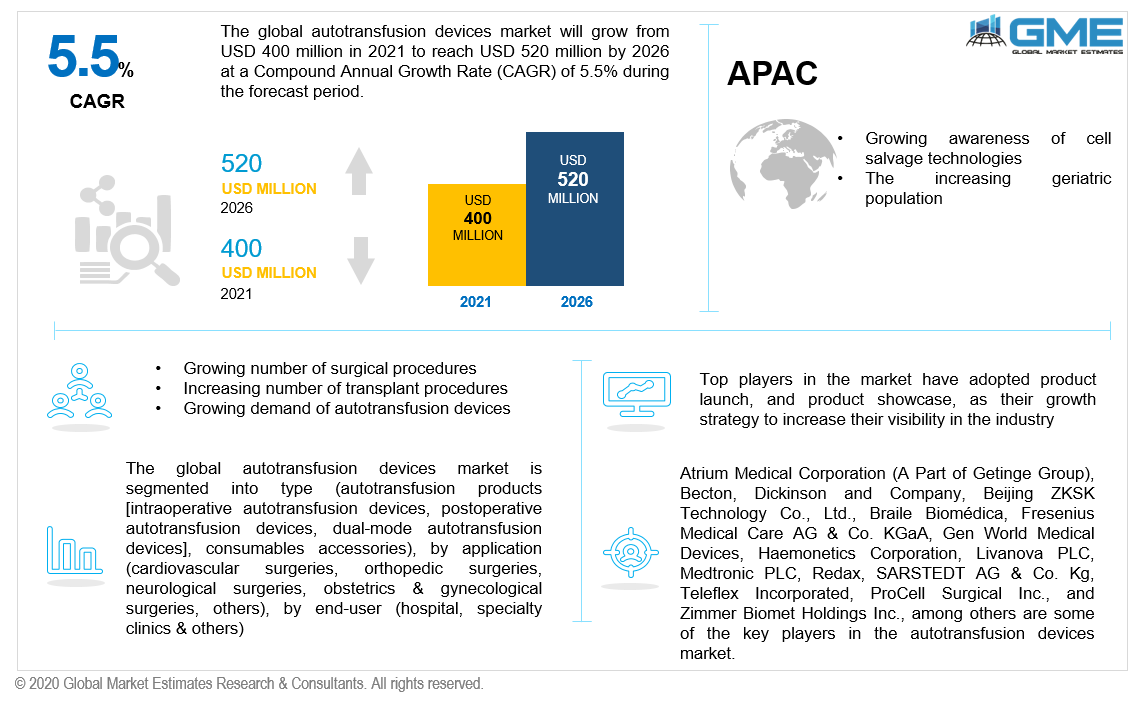

The global autotransfusion devices market will grow from USD 400 million in 2021 to reach USD 520 million in 2026, with a CAGR of 5.5% from 2021-2026.

Autotransfusion is a process wherein a person receives their own blood for a transfusion, instead of banked allogeneic (separate-donor) blood. As a result, machines utilized for this purpose are referred to as autotransfusion devices. These are sophisticated devices with an exceptionally effective design that provides autologous blood during surgical procedures.

The rising cases of chronic diseases across the developing regions, an increasing number of surgical procedures, and the increasing number of liver or other organ transplant procedures are some of the key factors expected to drive market growth during the forecast period. Moreover, the increasing global burden of the elderly population and rising demand for cardiac devices is anticipated to augment the market expansion. The other factors supporting the growth of the blood transfusion device are an increase in the number of blood disorders, rising trauma, and accidents cases, and technological developments.

According to the American Heart Association in 2019, more than 80 million people worldwide are victims of heart diseases caused by an unhealthy diet, increased stress, and a lifestyle change, which has resulted in a hemorrhage. According to the World Health Organization, the majority of infants with thalassemia are born in low-income countries where access to blood transfusion is difficult or available to just a small percentage of the population. Hence this factor may pose a challenge for the auto blood transfusion market to grow exponentially.

According to the comprehensive forecast trend analysis by GME, autolog cell savers are becoming more popular as a safer and more cost-effective alternative to homologous blood transfusion (however they are not recommended for patients with infection or metastatic cancer). These autolog cell saver instruments are used to collect blood during the surgery. The RBCs are washed using normal saline and concentrated to form a 225 mL unit with a hematocrit of 55% in the autologous blood recovery system.

The rising support from government organizations in the form of research funds to launch autotransfusion devices and the rising demand for non-invasive surgeries is also helping the market attain rapid growth. The absence of any risk of immunization to blood cells, as well as the absence of any risk of transfusion or transmitting devices, are some of the other drivers anticipated to boost the autotransfusion system market during the forecast period.

The COVID-19 pandemic had a negative impact on healthcare systems all across the globe. Health organizations implemented lockdown policies to prevent the spread of coronavirus and had postponed the majority of elective and non-urgent surgeries. Furthermore, the pandemic has caused a reduction in the number of voluntary blood donations and routine blood transfusion programs and interrupted the medical device supply chain across the globe.

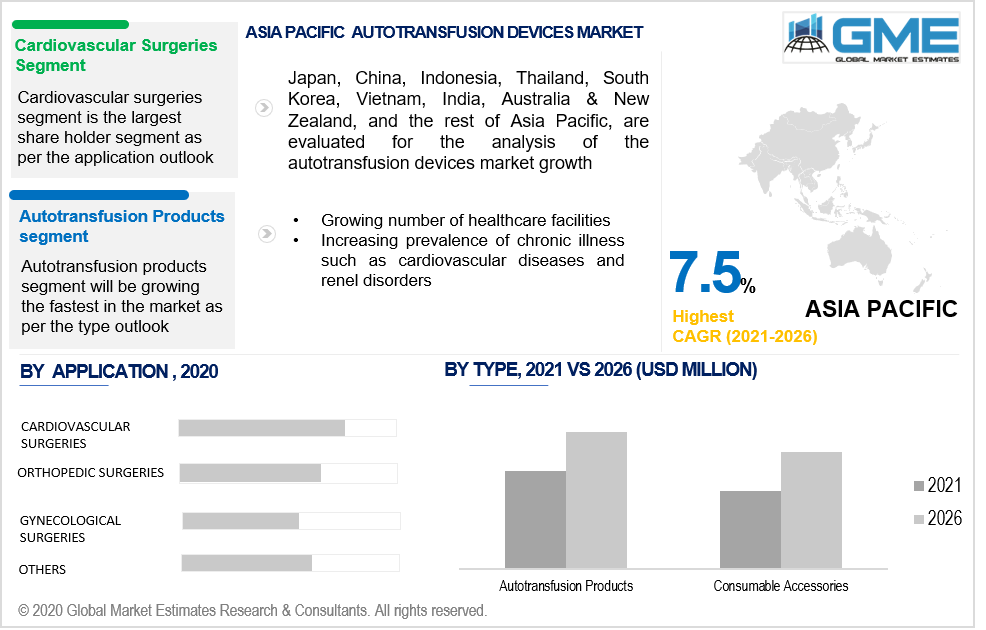

The type segment is categorized into autotransfusion products and consumables accessories. The auto transformation products segment is expected to hold the largest market share as well as grow at the highest CAGR in terms of revenue from 2021 to 2026. The segment is further classified as intraoperative autotransfusion devices, postoperative autotransfusion devices, and dual-mode autotransfusion devices. The rising acceptance of autotransfusion devices in developing countries owing to rising chronic disease prevalence and increasing demand for blood transfusion programs is likely to accelerate the segment growth throughout the forecast period.

Cardiovascular surgeries, orthopedic surgeries, neurological surgeries, obstetrics & gynaecological surgeries, and other applications are the major segments of the autotransfusion device market. The cardiovascular surgeries segment is expected to hold the lion’s share in terms of revenue during the forecast period. The rising number of cardiac diseases and the rising number of cardiovascular procedures has increased the demand and usage of autotransfusion devices. Furthermore, the increasing use of post-operative cell salvage in orthopedic procedures is likely to fuel the orthopedics surgeries segment market during the forecast period.

The end-user segment is categorized into hospital and specialty clinics & others. The hospital segment is expected to dominate the market terms of revenue during the forecast period. It is attributable to an increase in the number of surgical procedures performed in hospital settings. Furthermore, the increasing acceptance of post-operative and intraoperative cell salvage instruments in specialty clinics, especially in the developed regions, will drive the specialty clinics & others segment throughout the forecast period.

As per the geographical analysis, the global autotransfusion devices market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The largest share of the autotransfusion devices market size in the U.S. is mainly due to the presence of key players in the country, rising healthcare expenses, and the increasing number of surgeries. Moreover, the growing government frameworks along with the rising healthcare infrastructure, and increasing awareness of autotransfusion devices due to lack of allogeneic blood in the region are some of the factors increasing the autotransfusion devices market size during the forecast period.

Furthermore, the Asia Pacific region will grow with the highest CAGR. Rising chronic illness, increasing awareness of cell salvage technologies, rising expenses in healthcare infrastructure, will impact the autotransfusion devices market size positively.

Atrium Medical Corporation (A Part of Getinge Group), Becton, Dickinson and Company, Beijing ZKSK Technology Co., Ltd., Braile Biomédica, Fresenius Medical Care AG & Co. KGaA (Fresenius cell saver), Gen World Medical Devices, Haemonetics Corporation, Livanova PLC, Medtronic PLC, Redax, SARSTEDT AG & Co. Kg, Teleflex Incorporated, ProCell Surgical Inc., and Zimmer Biomet Holdings Inc., among others are some of the key players in the autotransfusion systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2020, ProCell Surgical Inc. introduced its first medical device designed effectively to automate the outdated and manual activity of surgical sponge-blood recovery for intraoperative autotransfusion.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Autotransfusion Systems Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 End-User Overview

2.1.3 Application Overview

2.1.4 Type Overview

2.1.5 Regional Overview

Chapter 3 Global Autotransfusion Systems Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising number of surgical procedures

3.3.1.2 Increasing number of transplant procedures

3.3.2 Industry Challenges

3.3.2.1 Lack of skilled surgical technicians and perfusionists in developing countries

3.4 Prospective Growth Scenario

3.4.1 End-User Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Autotransfusion Systems Market, By End-User

4.1 End-User Outlook

4.2 Hospitals

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Specialty Clinics & Others

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Global Autotransfusion Systems Market, By Application

5.1 Application Outlook

5.2 Cardiovascular Surgeries

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Orthopedic Surgeries

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Neurological Surgeries

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Obstetrics & Gynecological Surgeries

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Autotransfusion Systems Market, By Type

6.1 Type Outlook

6.2 Consumables & Accessories

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

6.3 Autotransfusion System

6.3.1 Market Size, By Region, 2020-2026 (USD Million)

6.3.1.1 Intraoperative Autotransfusion System Market Size, By Region, 2020-2026 (USD Million)

6.3.1.2 Post-operative Autotransfusion System Market Size, By Region, 2020-2026 (USD Million)

6.3.1.3 Dual-Mode Autotransfusion System Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Autotransfusion Systems Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By End-User, 2020-2026 (USD Million)

7.2.3 Market Size, By Application, 2020-2026 (USD Million)

7.2.4 Market Size, By Type, 2020-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By End-User, 2020-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.5.3 Market Size, By Type, 2020-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By End-User, 2020-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.6.3 Market Size, By Type, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By End-User, 2020-2026 (USD Million)

7.3.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.4 Market Size, By Type, 2020-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By End-User, 2020-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.5.3 Market Size, By Type, 2020-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By End-User, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.6.3 Market Size, By Type, 2020-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By End-User, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Type, 2020-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By End-User, 2020-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.8.3 Market Size, By Type, 2020-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By End-User, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.9.3 Market Size, By Type, 2020-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By End-User, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.10.3 Market Size, By Type, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Million)

7.4.2 Market Size, By End-User, 2020-2026 (USD Million)

7.4.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.4 Market Size, By Type, 2020-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By End-User, 2020-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.5.3 Market Size, By Type, 2020-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By End-User, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.6.3 Market Size, By Type, 2020-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By End-User, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Type, 2020-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By End-User, 2020-2026 (USD Million)

7.4.8.2 Market size, By Application, 2020-2026 (USD Million)

7.4.8.3 Market Size, By Type, 2020-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By End-User, 2020-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.9.3 Market Size, By Type, 2020-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By End-User, 2020-2026 (USD Million)

7.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.4 Market Size, By Type, 2020-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By End-User, 2020-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.5.3 Market Size, By Type, 2020-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By End-User, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.6.3 Market Size, By Type, 2020-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By End-User, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Type, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By End-User, 2020-2026 (USD Million)

7.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.4 Market Size, By Type, 2020-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By End-User, 2020-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.5.3 Market Size, By Type, 2020-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By End-User, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.6.3 Market Size, By Type, 2020-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By End-User, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Type, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Atrium Medical Corporation (A Part of Getinge Group)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Medtronic PLC

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 Livanova PLC

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Becton, Dickinson and Company

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Zimmer Biomet Holdings Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Teleflex Incorporated

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 Haemonetics Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Fresenius Medical Care AG & Co. KGaA

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Redax

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 Beijing ZKSK Technology Co., Ltd.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Autotransfusion Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Autotransfusion Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS