Global Bacteria Analyzer Market Size, Trends, and Analysis - Forecasts to 2026 By Type (Manual, Semi-Automated), By Application (Food and Beverage, Personal Care Products, Non-Sterile Pharmaceuticals, Process Water), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

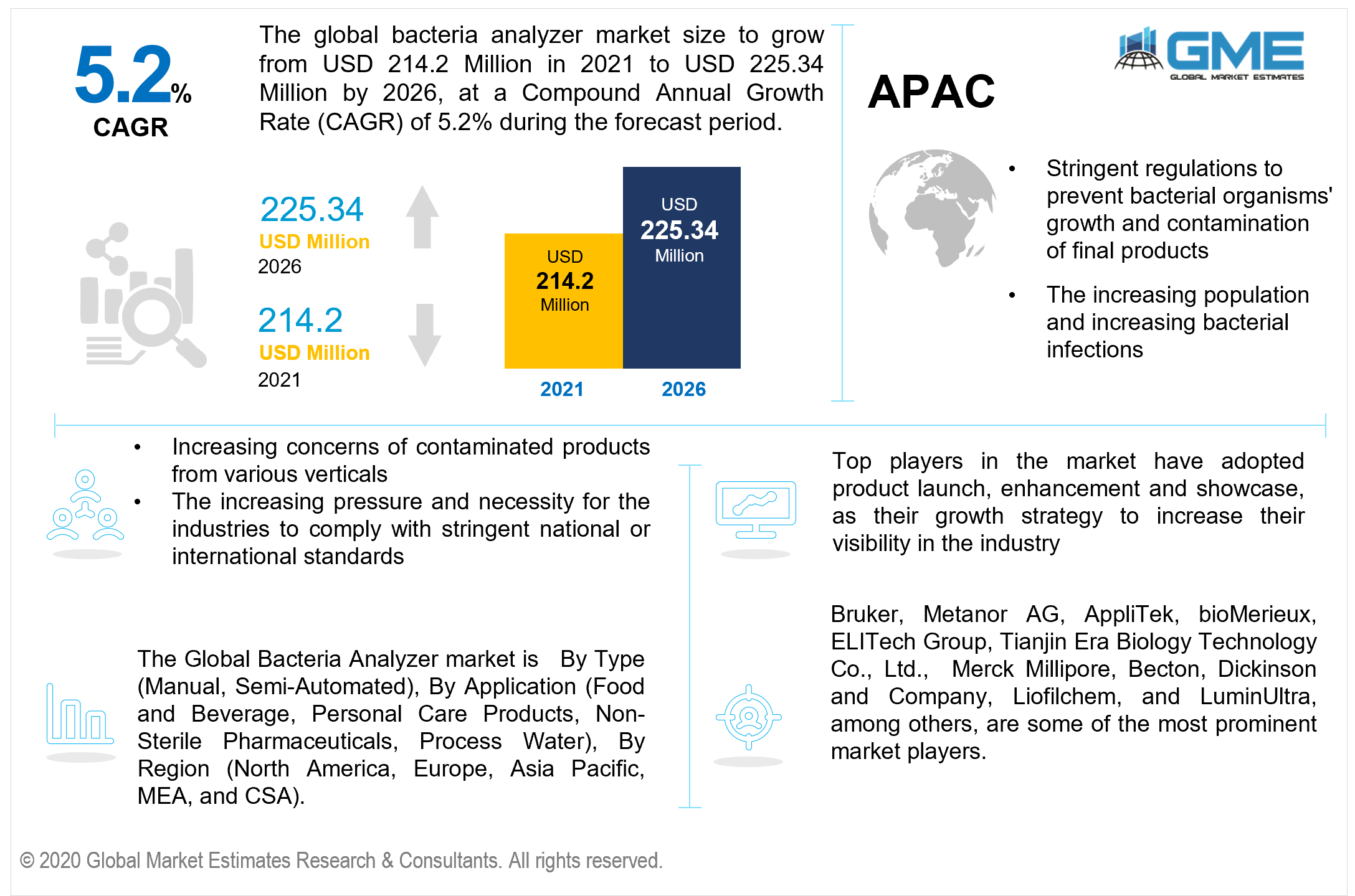

The global bacteria analyzer market is projected to grow from USD 214.2 million in 2021 to USD 225.34 million by 2026 at a CAGR value of 5.2% between 2021 to 2026. Bacterial identification or analyzers has become one of the growing industries in today’s world. The presence of bacteria in various substrates and identifying these microorganisms has become an essential part of microbiological areas. Studies have shown that there are approximately 30,000 bacterial species present that are identified, named, and have been investigated. Increasing concerns of contaminated products from various verticals are increasing the demand for bacteria analyzers. The presence of unidentified bacterial microorganisms in various end products is the reason behind the outbreak of contamination issues across various industries.

The increasing pressure and necessity for the industries to comply with stringent national or international standards like Bacteriological Analytical Manual (BAM), American Public Health Association (APHA), Indian Standards, Association of Official Agricultural Chemists (AOAC) have accelerated the demand and requirement of bacteria analyzer systems in the market. Analyzing the presence of these bacterial organisms and interpreting their characteristics can prevent the potential issues and problems way before they affect and bring the production activities to a halt. The growth of the bacterial organisms in products can be encouraged due to high exposition to air or compressed air. This phenomenon worsens the quality of medical treatment, thus increasing the demand for bacteria analyzers.

Today the industry players of the bacteria analyzer market make sure to provide analyzing tools that facilitate efficient results in identifying the presence of bacterial microorganisms in various products and have their unique features for the application that ensure efficiency in measurement procedures. The bacteria analyzer market has been experiencing technological transformation over the last few years. Irrespective of the technological advancements and automation, this market has not left its roots in traditionally identifying and analyzing the species of bacteria and has a stronghold on labor-intensive procedures.

Besides all the mentioned factors, certain other factors like increasing microbiological testings, increasing bacterial infections and diseases due to direct contact or bacterial consumption through food or water, and increasing mutation and prevalence of unidentified bacterial microorganisms have also been surging the demand for bacteria analyzer tools or systems.

Considering the characteristics and natural presence of bacteria, the quality of various products is a constant concern. Selective analyzing measurements are intermittent and are insufficient to determine the quality standards of the products and the level of bacterial presence. Permanent and effective measures like bacteria analyzer systems have become very essential. Bacteria analyzer measurement systems to monitor and identify the presence of different species of microbiological organisms that are most likely to deteriorate the industry output are being installed in various verticals across countries.

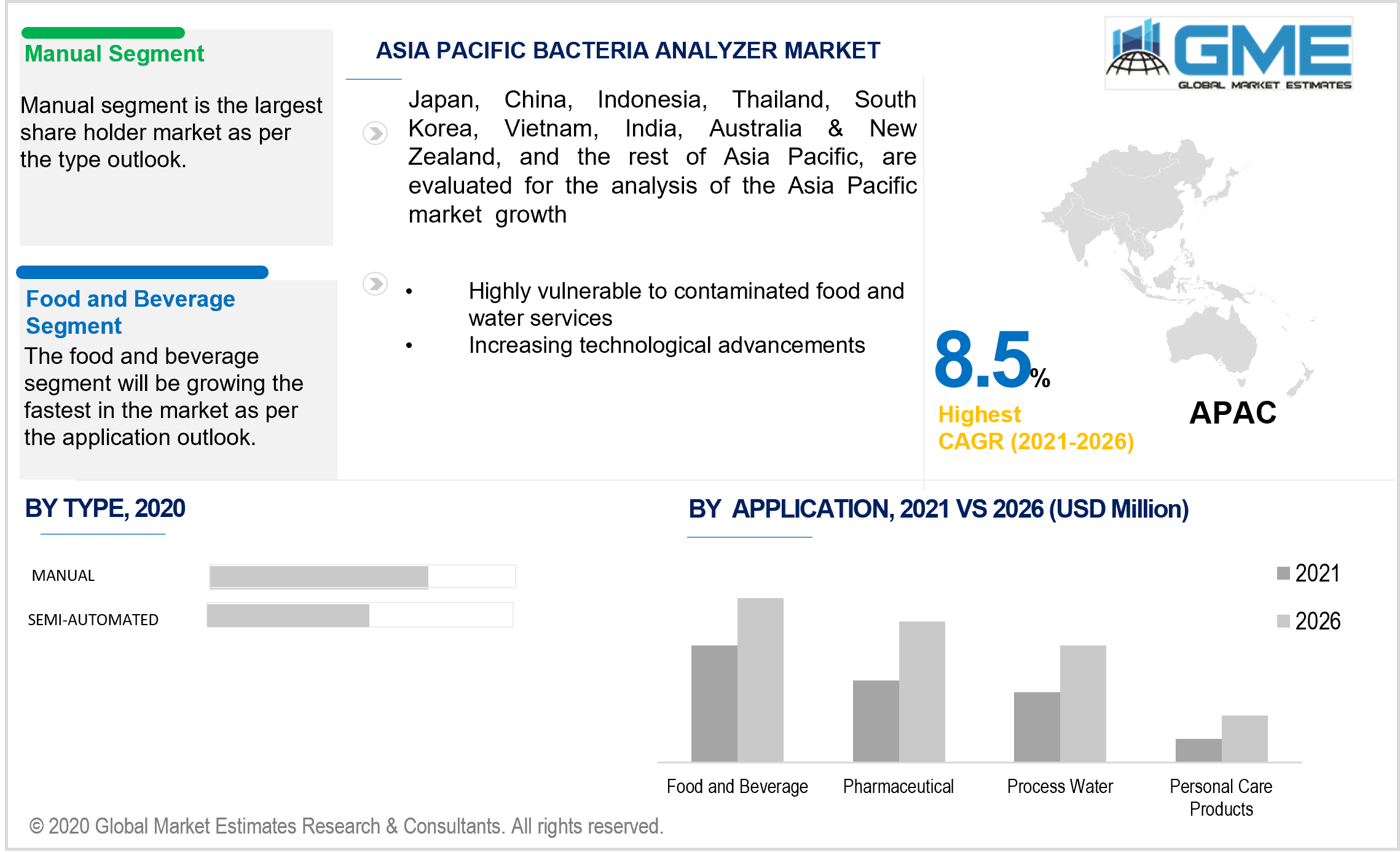

Based on the type, the market is categorized into manual and semi-automated. Manual bacterial analyzer methods have been prevalent in this market for many decades. End users and product manufacturers still utilize the traditional method of manually testing and analyzing the bacterial presence in the products produced. This market has been experiencing a lag in technological transformations compared to other markets globally. Manufacturers have majorly been using various manual types of bacteria analyzers like swab testings of the product surfaces, or in case of products with personal handling, manufacturers undertake swab tests of hands or fingers to ensure efficiency in identification.

These manual bacterial analyzers are very efficient as well as are cheaper to undertake. These manual tests provide the manufacturers ease in operating or undertaking bacterial analysis and are very well suited to products and situations that have flexible, uneven, and highly suspected contaminated manufacturing areas.

However, just like in other industries, slowly and very gradually the technological advancements are replacing the manual type of bacterial analyzers. Today yet, the market still is working on bringing fully automated bacteria analyzers. However, many end-users and countries have started adopting themselves to semi-automated bacteria analyzers. The semi-automated analyzers assist the analysts in identifying and interpret the characteristics of bacteria at a much fast rate as compared to manual analyzing techniques.

These semi-automated analyzers also provide better accuracy in the results, repeatability, and lower labor costs, thus accelerating the growth of bacteria analyzers. Also, features like flexibility and less amount of samples or specimens required in semi-automated analyzers are also attracting the manufacturers. Although many studies and research have shown that the analysts should not shift to semi-automated or automated techniques, especially with products like food items or pharmaceuticals, as with the intension of fast analysis, these automated analyzers give less time for the bacteria to culture, which can result in biased and inefficient results.

Based on the application, the market is categorized into food and beverage, personal care products, non-sterile pharmaceuticals, and process water. The food and beverage industry is the most significant sector which utilizes the bacteria analyzer. Food items are highly vulnerable to bacteria growth and contamination. These growing bacterial microorganisms cause infections and intoxications, thus degrading and spoiling the food items. These factors are undoubtedly the reason to harm the health of the consumers and spread food-borne diseases. According to the World Health Organisation report (WHO) published in 2020, unsafe food with various bacterial species prevalent in it is the reason for more than 200 diseases.

These foodborne bacterial diseases range from diarrhea to food poisoning and cancer. Bacterial species like Salmonella, Vibrio cholerae, Campylobacter, and Enterohaemorrhagic Escherichia coli are the most common bacterial pathogens contaminating the food and resulting in fatal diseases. These foodborne bacterial diseases cause death in almost 1 in every 10 people across every corner of the world, resulting in 420000 death every year due to contaminated bacterial food.

Food and Agricultural Organisation (FAO), along with WHO, have come up with International Food Safety Authority Network (INFOSAN) that enables countries and guides them to implement appropriate food systems. These initiatives have encouraged end-users to implement and utilize bacteria analyzers and conduct appropriate Research and Development.

Other sectors like water processing and the pharmaceutical industry also incorporate bacteria analyzers extensively while manufacturing the products. These applications also show significant growth in the usage of bacteria analyzers, followed by the food and beverage industry.

The North American region has its dominance in the bacteria analyzers market. The countries in this region are the biggest markets for food and beverage, pharmaceutical, and personal care products. The North American region being the founder of intergovernmental organizations like The United Nations (The UN) and other agencies like the Food and Agriculture Organisation of the United Nations (FAO), have significant contributions into analysis pertaining to bacteria and other microbiological organisms. The countries like USA and Canada are the biggest promoters of bacteria analyzers to ensure the final product’s safety from bacterial growth and contamination.

Asia Pacific region has also been experiencing fast growth with manufacturers of various industries utilizing bacteria analyzers. The governments in these countries are bringing in stringent regulations like Indian Standards and other rules to prevent bacterial organisms' growth and contamination of final products. The increasing population and increasing bacterial infections and other fatal diseases propel these countries to adopt bacteria analyzers into their manufacturing processes.

Countries like India, Pakistan, Thailand, Bangladesh, and China are densely populated and are highly vulnerable to contaminated food and water services, thus increasing the number of fatal diseases across nations. These factors and their severe impacts have been compelling these countries to undertake appropriate measures and bacteria analyzers.

Bruker, Metanor AG, AppliTek, bioMerieux, ELITech Group, Tianjin Era Biology Technology Co., Ltd., Merck Millipore, Becton, Dickinson and Company, Liofilchem, and LuminUltra, among others, are some of the most prominent market players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Bacteria Analyzer Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Bacteria Analyzer Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing concerns of contaminated products from various verticals

3.3.1.2 The increasing pressure and necessity for the industries to comply with stringent national or international standards

3.3.2 Industry Challenges

3.3.2.1 Limited study and industry participants

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Bacteria Analyzer Market, By Type

4.1 Type Outlook

4.2 Manual

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 Semi-Automated

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Global Bacteria Analyzer Market, By Application

5.1 Application Outlook

5.2 Food and Beverage

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Personal Care Products

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

5.4 Non-Sterile Pharmaceuticals

5.4.1 Market Size, By Region, 2021-2026 (USD Million)

5.5 Process Water

5.5.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 6 Global Bacteria Analyzer Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2021-2026 (USD Million)

6.2.2 Market Size, By Type, 2021-2026 (USD Million)

6.2.3 Market Size, By Application, 2021-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2021-2026 (USD Million)

6.3.2 Market Size, By Type, 2021-2026 (USD Million)

6.3.3 Market Size, By Application, 2021-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2021-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2021-2026 (USD Million)

6.4.2 Market Size, By Type, 2021-2026 (USD Million)

6.4.3 Market Size, By Application, 2021-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2021-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.7.2 Market size, By Application, 2021-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2021-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2021-2026 (USD Million)

6.5.2 Market Size, By Type, 2021-2026 (USD Million)

6.5.3 Market Size, By Application, 2021-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2021-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2021-2026 (USD Million)

6.6.2 Market Size, By Type, 2021-2026 (USD Million)

6.6.3 Market Size, By Application, 2021-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2021-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Bruker

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Metanor AG

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 AppliTek

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 bioMerieux

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 ELITech Group

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Tianjin Era Biology Technology Co., Ltd.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Merck Millipore

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Becton, Dickinson and Company

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Liofilchem

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 LuminUltra

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

The Global Bacteria Analyzer Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bacteria Analyzer Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS