Global Beverage Flavours Market Size, Trends & Analysis - Forecasts to 2028 By Ingredient Type (Flavouring Agents, Flavouring Carriers, Flavour Enhancers, and Others), By Beverage Type (Alcoholic and Non-alcoholic), By Form Type (Dry and Liquid), By Origin Type (Artificial and Natural), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

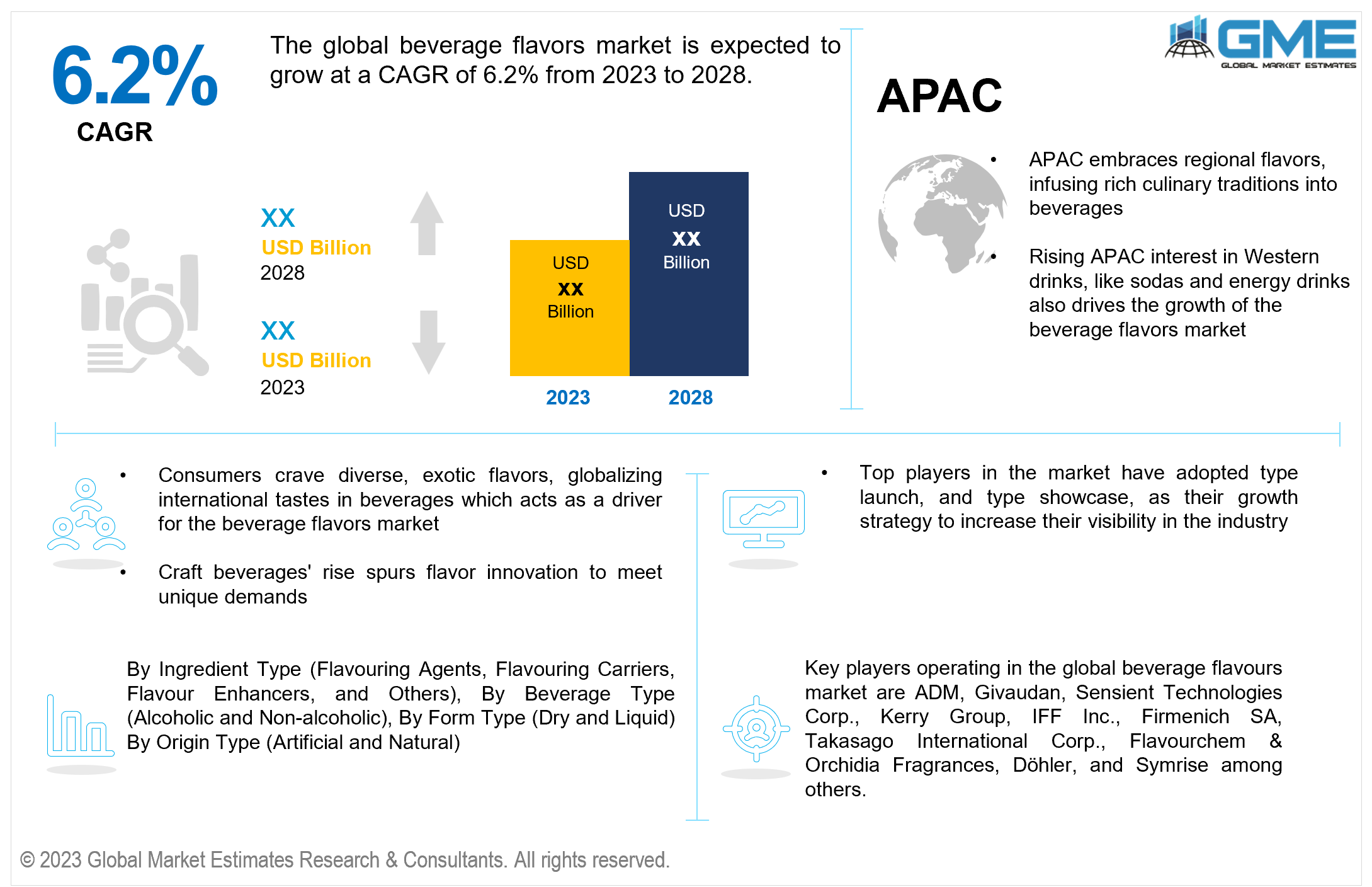

The global beverage flavours market is expected to grow at a CAGR of 6.2% from 2023 to 2028. The beverage flavours market is a dynamic and rapidly evolving sector within the global food and beverage industry. It encompasses a wide range of products and ingredients designed to enhance the taste and aroma of beverages, including soft drinks, alcoholic beverages, juices, and others.

Several factors drive the growth of the global beverage flavours market. Consumers are increasingly open to diverse and exotic flavour experiences, which has led to the globalization of flavours. Traditional tastes worldwide, such as Asian, Latin American, and Middle Eastern flavours, are becoming popular in mainstream beverages. This trend is expanding the horizons of flavour options and driving the demand for unique and exciting beverage profiles. The market is shifting towards premium and artisanal drinks.

Moreover, consumers are ready to spend surplus for high-quality, distinctive, and sophisticated flavor profiles. This premiumization trend is fuelling innovation in flavour development, leading to a broader array of upscale beverage options, including craft beers, artisanal cocktails, and specialty non-alcoholic drinks. With increased health-conscious customers and the growing popularity of plant-based and dairy-free alternatives, flavour producers are working hard to develop enticing flavour profiles for these goods. Whether plant-based milk, vegan protein shakes, or non-dairy yogurts, the demand for flavours that mimic traditional dairy while offering unique plant-based profiles strongly drives the beverage flavours market growth.

Despite the growth prospects, the global beverage flavours market faces certain restraints, one of the prominent ones being the increasing perception among consumers that flavouring agents can potentially contaminate the products they consume. This perception is rooted in concerns about the use of artificial and synthetic flavouring agents, which are often associated with health risks or artificial additives. As customers become more aware of the contents in their beverages, there is a rising desire for natural and clean label goods, prompting beverage manufacturers to reconsider their usage of artificial flavourings and additives.

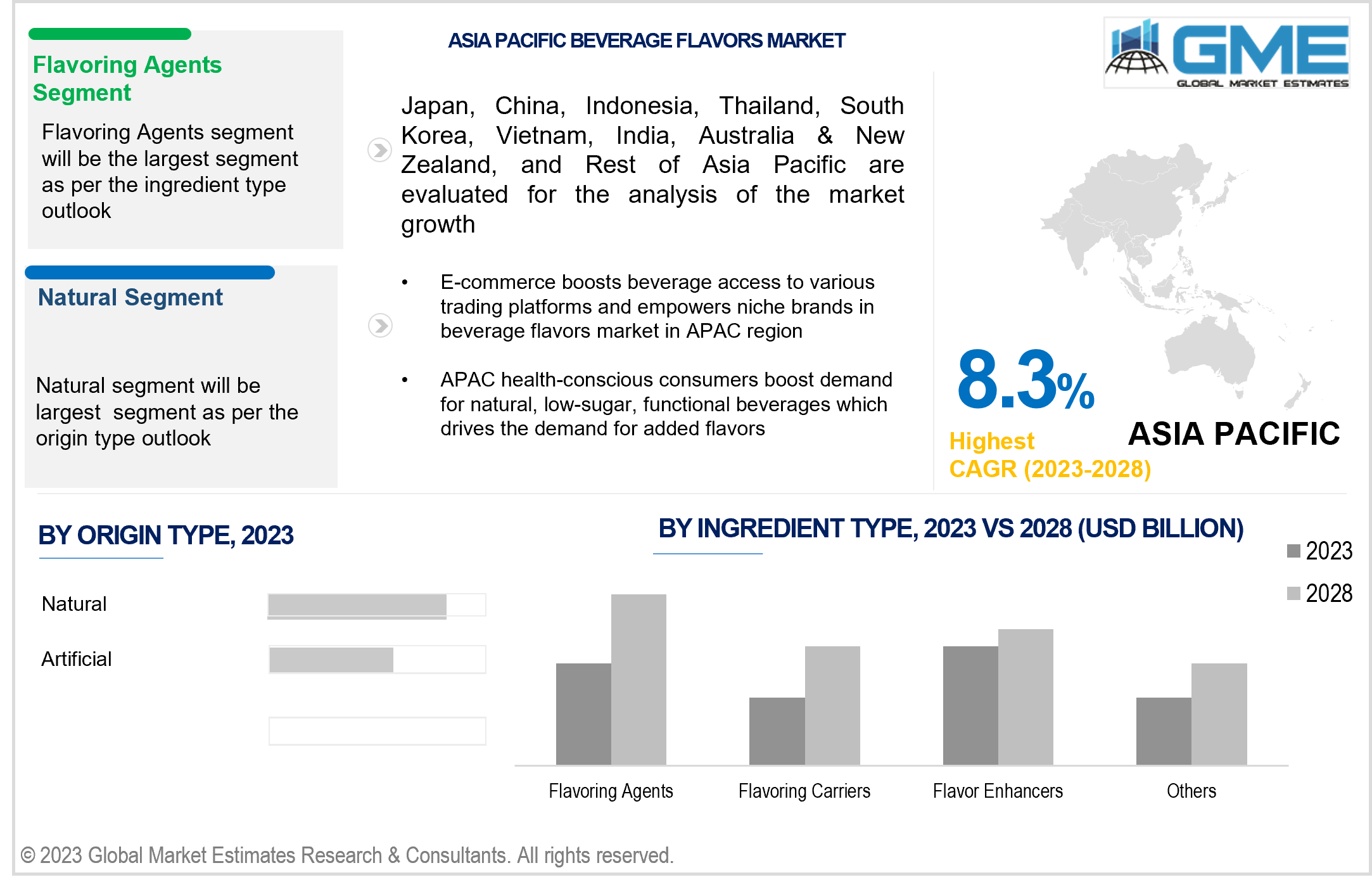

On the basis of ingredient type, the market is segmented into flavouring agents, flavouring carriers, flavour enhancers, and others. The flavouring agent segment is expected to be the largest segment during the forecast period. This is due to its critical role in enhancing taste and aroma. Consumers seek diverse and appealing flavour profiles, driving the demand for a wide range of natural and synthetic flavouring agents. Additionally, innovation in flavour development and customization has further boosted this segment growth, as beverage companies strive to create unique and enticing taste experiences to cater to evolving consumer preferences.

The flavour carrier segment is expected to be the fastest-growing segment in the global beverage flavours market due to its role in enhancing flavour stability and longevity in products. Beverage manufacturers increasingly rely on advanced carriers to protect sensitive flavour compounds, ensuring a consistent taste experience for consumers. This technology-driven segment addresses the beverage industry's demand for improved flavour delivery, allowing for the creation of innovative and longer-lasting flavour profiles in various beverages.

On the basis of beverage type, the market is segmented into alcoholic and non-alcoholic beverages. The non-alcoholic beverage segment is anticipated to be the largest segment during the forecast period. The segment growth is attributed to availability of various non-alcoholic beverages including energy drinks, flavoured milk, water, mocktails, and juices. Additionally, the segment benefits from the growing awareness of health advantages associated with non-alcoholic beverages, such as post-exercise recovery, hydration, improved cardiovascular health, and reduced anxiety. This appeals to health-conscious consumers, especially among the younger population, along with the rising demand for energy and sports drinks, further bolsters the segment's dominance.

The alcoholic beverage segment is expected to be the fastest-growing segment due to shifting consumer preferences towards premium and craft drinks, innovations in flavour profiles, and an expanding market for specialty cocktails and spirits. Additionally, the rise of e-commerce platforms, such as Swiggy and Living Liquidz has allowed for greater market access and product diversity, thereby driving growth of the segment.

On the basis of form type, the market is segmented into dry and liquid forms. The liquid form segment is expected to be the largest segment during the forecast period. Liquid flavours can be readily mixed into a wide range of beverages, offering precise control over taste profiles. This form allows for efficient production processes, making it a preferred choice for manufacturers seeking to create diverse and appealing beverage options, from soft drinks to alcoholic beverages, while ensuring consistent flavour quality and distribution.

The dry form segment is expected to be the fastest-growing segment in the global beverage flavours market due to its several advantages, including longer shelf life, ease of storage, and cost-efficiency in transportation. Beverage manufacturers increasingly adopted dry forms such as powders and concentrates for their convenience, allowing for efficient flavour incorporation into a wide range of beverages including mojitos, flavoured water, and coffee, contributing to rapid market growth.

On the basis of origin type, the market is segmented into natural and artificial. The natural segment is projected to be the largest segment during the forecast period. As health-conscious consumers seek more natural and clean ingredients, beverage companies have shifted towards using natural flavourings, which is driving demand for natural origin flavours, making it as a dominant segment in the market.

The artificial segment is expected to be the fastest-growing segment in the global beverage flavours market due to its cost-effectiveness, consistency in flavour profiles, and longer shelf life. It is gaining popularity for providing readily available and affordable flavour solutions, especially for large-scale beverage production.

North America is analysed to be the largest region in the global beverage flavours market in the forecast period. The region's robust beverage industry, including soft drinks, alcoholic beverages, and health-focused options, fuels demand for a wide array of flavour profiles. Additionally, the North American consumer base's preference for diverse taste experiences and the rising popularity of premium and craft beverages contributes to the regional market growth. The region's preference for organic and natural ingredients has spurred taste development. Overall, North America's dynamic beverage landscape, coupled with evolving consumer tastes, positioned it as the leading market in the global beverage flavours market.

Asia Pacific is also analysed to be the fastest growing region in the global beverage flavours market. This is due to the region’s rapidly growing population and cost-effective flavour production capabilities. The APAC region exhibits a burgeoning consumer base with rising middle class, leading to increased consumption of a wide range of beverages. Additionally, the relatively lower cost of production, including labour and raw materials, has made the region an attractive hub for flavour manufacturing. This combination of a growing market and cost-efficiency has encouraged both domestic and international flavour companies like Khosla Group and First Beverage Group to invest in the APAC region, propelling its rapid expansion within the global beverage flavours market.

Key players operating in the global beverage flavours market include ADM, Givaudan, Sensient Technologies Corp., Kerry Group, IFF Inc., Firmenich SA, Takasago International Corp., Flavourchem & Orchidia Fragrances, Döhler, and Symrise among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2022, Archer Daniels Midland Company acquired Comhan, one of the leading South Africa-based flavour distributors. ADM has worked together with the local business for several years, with the formal acquisition now providing new and current customers more direct access to ADM’s extensive portfolio and network of experts.

REPORT CONTENT

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL BEVERAGE FLAVOURS MARKET, BY INGREDIENT TYPE

4.2 Beverage Flavours Market: Ingredient Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Flavouring Agents Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Flavouring Carriers Market Estimates And Forecast, 2020-2028 (USD Billion)

4.6.1 Flavour Enhancers Market Estimates and Forecast, 2020-2028 (USD Billion)

4.7.1 Other Ingredients Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL BEVERAGE FLAVOURS MARKET, BY BEVERAGE TYPE

5.2 Beverage Flavours Market: Beverage Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Alcoholic Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5.1 Non-alcoholic Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL BEVERAGE FLAVOURS MARKET, BY FORM TYPE

6.2 Beverage Flavours Market: Form Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Liquid Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 Dry Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL BEVERAGE FLAVOURS MARKET, BY ORIGIN TYPE

7.2 Beverage Flavours Market: Origin Type Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 Natural Market Estimates and Forecast, 2020-2028 (USD Billion)

8 GLOBAL BEVERAGE FLAVOURS MARKET, BY REGION

8.2 North America Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.1 U.S. Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.2 Canada Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.3 Mexico Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3 Europe Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.1 Germany Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.3 France Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.4 Italy Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.5 Spain Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.6 Netherlands Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.7 Rest of Europe Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4 Asia Pacific Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.1 China Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.2 Japan Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.3 India Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.4 South Korea Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.5 Singapore Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.6 Malaysia Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.7 Thailand Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.8 Indonesia Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.9 Vietnam Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.10 Taiwan Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5 Middle East and Africa Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.1 Saudi Arabia Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.2 U.A.E. Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.3 Israel Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.4 South Africa Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.1 Brazil Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.2 Argentina Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.3 Chile Beverage Flavours Market Estimates and Forecast, 2020-2028 (USD Billion)

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 Sensient Technologies Corporation

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 International Flavors and Fragrances Inc.

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Takasago International Corporation

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Flavorchem & Orchidia Fragrances

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & Segmentation

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

2 Flavouring Agents Market, By Region, 2020-2028 (USD Billion)

3 Flavouring Carriers Market, By Region, 2020-2028 (USD Billion)

4 Flavour Enhancers Market, By Region, 2020-2028 (USD Billion)

5 Other Ingredients Market, By Region, 2020-2028 (USD Billion)

6 Global Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

7 Alcoholic Market, By Region, 2020-2028 (USD Billion)

8 NON-ALCOHOLIC Market, By Region, 2020-2028 (USD Billion)

9 Global Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

10 Liquid Market, By Region, 2020-2028 (USD Billion)

11 Dry Market, By Region, 2020-2028 (USD Billion)

12 Global Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

13 Natural Market, By Region, 2020-2028 (USD Billion)

14 Artificial Market, By Region, 2020-2028 (USD Billion)

15 Regional Analysis, 2020-2028 (USD Billion)

16 North America Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

17 North America Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

18 North America Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

19 North America Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

20 North America Beverage Flavours Market, By Country, 2020-2028 (USD Billion)

21 U.S Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

22 U.S Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

23 U.S Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

24 U.S Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

25 Canada Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

26 Canada Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

27 Canada Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

28 CANADA Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

29 Mexico Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

30 Mexico Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

31 Mexico Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

32 mexico Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

33 Europe Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

34 Europe Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

35 Europe Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

36 europe Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

37 Germany Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

38 Germany Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

39 Germany Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

40 germany Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

41 UK Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

42 UK Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

43 UK Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

44 U.k Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

45 France Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

46 France Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

47 France Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

48 france Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

49 Italy Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

50 Italy Beverage Flavours Market, By T Beverage Type Type, 2020-2028 (USD Billion)

51 Italy Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

52 italy Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

53 Spain Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

54 Spain Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

55 Spain Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

56 spain Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

57 Rest Of Europe Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

58 Rest Of Europe Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

59 Rest of Europe Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

60 REST OF EUROPE Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

61 Asia Pacific Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

62 Asia Pacific Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

63 Asia Pacific Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

64 asia Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

65 Asia Pacific Beverage Flavours Market, By Country, 2020-2028 (USD Billion)

66 China Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

67 China Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

68 China Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

69 china Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

70 India Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

71 India Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

72 India Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

73 india Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

74 Japan Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

75 Japan Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

76 Japan Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

77 japan Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

78 South Korea Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

79 South Korea Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

80 South Korea Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

81 south korea Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

82 Middle East and Africa Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

83 Middle East and Africa Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

84 Middle East and Africa Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

85 MIDDLE EAST AND AFRICA Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

86 Middle East and Africa Beverage Flavours Market, By Country, 2020-2028 (USD Billion)

87 Saudi Arabia Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

88 Saudi Arabia Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

89 Saudi Arabia Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

90 saudi arabia Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

91 UAE Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

92 UAE Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

93 UAE Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

94 uae Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

95 Central and South America Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

96 Central and South America Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

97 Central and South America Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

98 CENTRAL AND SOUTH AMERICA Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

99 Central and South America Beverage Flavours Market, By Country, 2020-2028 (USD Billion)

100 Brazil Beverage Flavours Market, By Ingredient Type, 2020-2028 (USD Billion)

101 Brazil Beverage Flavours Market, By Beverage Type, 2020-2028 (USD Billion)

102 Brazil Beverage Flavours Market, By Form Type, 2020-2028 (USD Billion)

103 brazil Beverage Flavours Market, By Origin Type, 2020-2028 (USD Billion)

104 Archer Midland Daniels: Products & Services Offering

105 Givaudan: Products & Services Offering

106 Sensient Technologies Corporation: Products & Services Offering

107 Kerry Group: Products & Services Offering

108 International Flavors and Fragrances Inc.: Products & Services Offering

109 FIRMENICH SA: Products & Services Offering

110 Takasago International Corporation: Products & Services Offering

111 Flavorchem & Orchidia Fragrances: Products & Services Offering

112 Döhler, Inc: Products & Services Offering

113 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Beverage Flavours Market Overview

2 Global Beverage Flavours Market Value From 2020-2028 (USD Billion)

3 Global Beverage Flavours Market Share, By Ingredient Type (2022)

4 Global Beverage Flavours Market Share, By Beverage Type (2022)

5 Global Beverage Flavours Market Share, By Form Type (2022)

6 Global Beverage Flavours Market Share, By Origin Type (2022)

7 Global Beverage Flavours Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Beverage Flavours Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Beverage Flavours Market

12 Impact Of Challenges On The Global Beverage Flavours Market

13 Porter’s Five Forces Analysis

14 Global Beverage Flavours Market: By Ingredient Type Scope Key Takeaways

15 Global Beverage Flavours Market, By Ingredient Type Segment: Revenue Growth Analysis

16 Flavouring Agents Market, By Region, 2020-2028 (USD Billion)

17 Flavouring Carriers Market, By Region, 2020-2028 (USD Billion)

18 Flavour Enhancers Market, By Region, 2020-2028 (USD Billion)

19 Other Ingredients Market, By Region, 2020-2028 (USD Billion)

20 Global Beverage Flavours Market: By Beverage Type Scope Key Takeaways

21 Global Beverage Flavours Market, By Beverage Type Segment: Revenue Growth Analysis

22 Alcoholic Market, By Region, 2020-2028 (USD Billion)

23 Non-alcoholic Market, By Region, 2020-2028 (USD Billion)

24 Global Beverage Flavours Market: By Form Type Scope Key Takeaways

25 Global Beverage Flavours Market, By Form Type Segment: Revenue Growth Analysis

26 Liquid Market, By Region, 2020-2028 (USD Billion)

27 Dry Market, By Region, 2020-2028 (USD Billion)

28 Global Beverage Flavours Market: By Origin Type Scope Key Takeaways

29 Global Beverage Flavours Market, By Origin Type Segment: Revenue Growth Analysis

30 Natural Market, By Region, 2020-2028 (USD Billion)

31 Artificial Market, By Region, 2020-2028 (USD Billion)

32 Regional Segment: Revenue Growth Analysis

33 Global Beverage Flavours Market: Regional Analysis

34 North America Beverage Flavours Market Overview

35 North America Beverage Flavours Market, By Ingredient Type

36 North America Beverage Flavours Market, By Beverage Type

37 North America Beverage Flavours Market, By Form Type

38 North America Beverage Flavours Market, By Origin Type

39 North America Beverage Flavours Market, By Country

40 U.S. Beverage Flavours Market, By Ingredient Type

41 U.S. Beverage Flavours Market, By Beverage Type

42 U.S. Beverage Flavours Market, By Form Type

43 U.S. Beverage Flavours Market, By Origin Type

44 Canada Beverage Flavours Market, By Ingredient Type

45 Canada Beverage Flavours Market, By Beverage Type

46 Canada Beverage Flavours Market, By Form Type

47 Canada Beverage Flavours Market, By Origin Type

48 Mexico Beverage Flavours Market, By Ingredient Type

49 Mexico Beverage Flavours Market, By Beverage Type

50 Mexico Beverage Flavours Market, By Form Type

51 Mexico Beverage Flavours Market, By Origin Type

52 Four Quadrant Positioning Matrix

53 Company Market Share Analysis

54 Archer Midland Daniels: Company Snapshot

55 Archer Midland Daniels: SWOT Analysis

56 Archer Midland Daniels: Geographic Presence

57 Givaudan: Company Snapshot

58 Givaudan: SWOT Analysis

59 Givaudan: Geographic Presence

60 Sensient Technologies Corporation: Company Snapshot

61 Sensient Technologies Corporation: SWOT Analysis

62 Sensient Technologies Corporation: Geographic Presence

63 Kerry Group: Company Snapshot

64 Kerry Group: Swot Analysis

65 Kerry Group: Geographic Presence

66 International Flavors and Fragrances Inc.: Company Snapshot

67 International Flavors and Fragrances Inc.: SWOT Analysis

68 International Flavors and Fragrances Inc.: Geographic Presence

69 Firmenich SA: Company Snapshot

70 Firmenich SA: SWOT Analysis

71 Firmenich SA: Geographic Presence

72 Takasago International Corporation: Company Snapshot

73 Takasago International Corporation: SWOT Analysis

74 Takasago International Corporation: Geographic Presence

75 Flavorchem & Orchidia Fragrances: Company Snapshot

76 Flavorchem & Orchidia Fragrances: SWOT Analysis

77 Flavorchem & Orchidia Fragrances: Geographic Presence

78 Döhler, Inc.: Company Snapshot

79 Döhler, Inc.: SWOT Analysis

80 Döhler, Inc.: Geographic Presence

81 Other Companies: Company Snapshot

82 Other Companies: SWOT Analysis

83 Other Companies: Geographic Presence

The Global Beverage Flavours Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Beverage Flavours Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS