Global Bio-Based Chemicals Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Bi oplastics [Biodegradable Bioplastics {Polybutyrate Adipate Terephthalate (PBAT), Polybutylene Succinate (PBS), Polylactic Acid (PLA), Polyhydroxyalkanoate (PHA), Others}, Non-Biodegradable Bioplastics {Polyethylene Terephthalate (PET), Polyamide (PA), Polyethylene (PE), Others}, Bio-Lubricants, Bio-Solvents [Glycols, Ketones, Lactate Ester, Others], Bio-Based Acids [Citric Acid, Lactic Acid, Succinic Acid, Others], Bio-Surfactants [Glycolipids, Lipopeptides, Others], Bio-Alcohols [Bio-Ethanol, Sorbitol, Xylitol, Biobutanol, Bio-Methanol, Others], Others), By Application (Industrial Chemicals, Pharmaceuticals, Food & Beverages, Detergents & Cleaners, Personal Care, Agriculture, Packaging, Paints & Coating, Automotive, Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

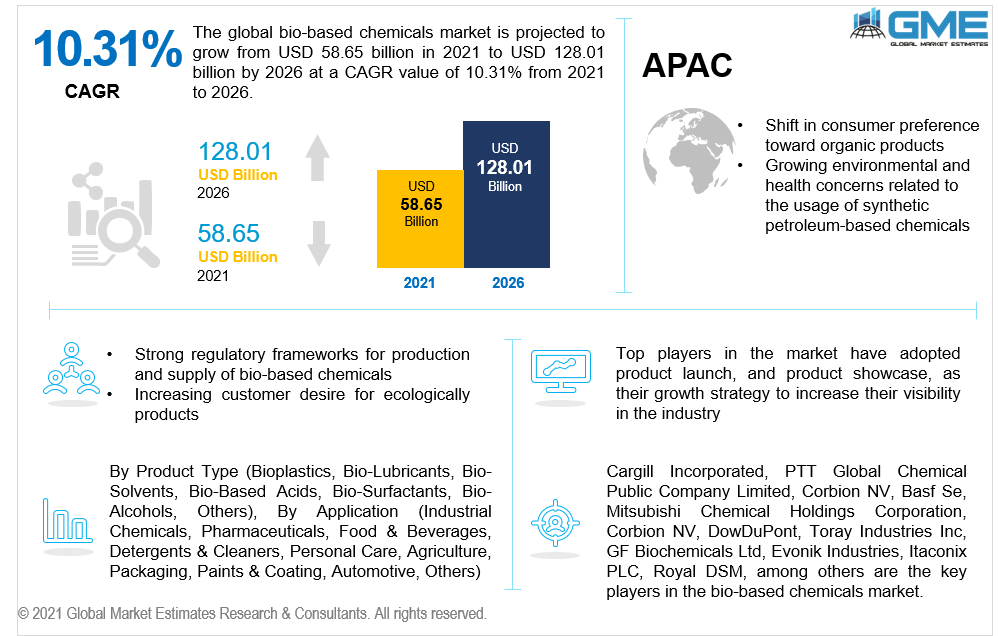

The global bio-based chemicals market is projected to grow from USD 58.65 billion in 2021 to USD 128.01 billion by 2026 at a CAGR value of 10.31% from 2021 to 2026.

Key drivers of global market expansion is strong regulatory frameworks, rising demand for bio-based chemicals from the energy and utility sector, increased oil prices, rapid population expansion, constrained non-renewable resource supplies, and customer desire for ecologically friendly products.

Due to the paucity of fossil fuels and its environmental consequences, the market has been growing tremendously. Bio-based fuel and plastic are the mainstays of the energy sector. Bio-derived alternatives to basic chemicals are being emphasised by scientists and end-users and hence are estimated to be growing the fastest during the forecast period of 2021 to 2026.

The world's natural resources are being depleted by the continuous use of non-renewable assets and petroleum-based products so the sector is on the lookout for carbon-reduction methods. It is critical to design and execute sustainable industrial material production solutions in present era. A major portion of the world is gradually moving away from fossil fuels and toward environmentally viable alternatives.

Governments of various countries are attempting to promote green biotechnology and corporate sustainability programmes, such as prohibiting plastic bags in certain areas and restricting the dissemination of disposable carry bags. Such initiatives are helping to drive the market growth during the forecast period.

Moreover, volatile crude oil prices, as well as the use of eco - friendly products and the significant market opportunity of bio-based chemical products, are all attributing to the market's massive expansion.

Nevertheless, because most countries have declared "stay at home" instructions, operations in different industries such as automotive, chemical, and other market segments are being seriously impacted by the COVID-19 epidemic. As a result, this issue is restraining the expansion of the bio-based chemicals market.

Economic constraints, such as high production costs and access to finance, are the primary market restraints. Market obstacles also include technical limitations in scale-up and characteristics, as well as short-term availability of raw material

.

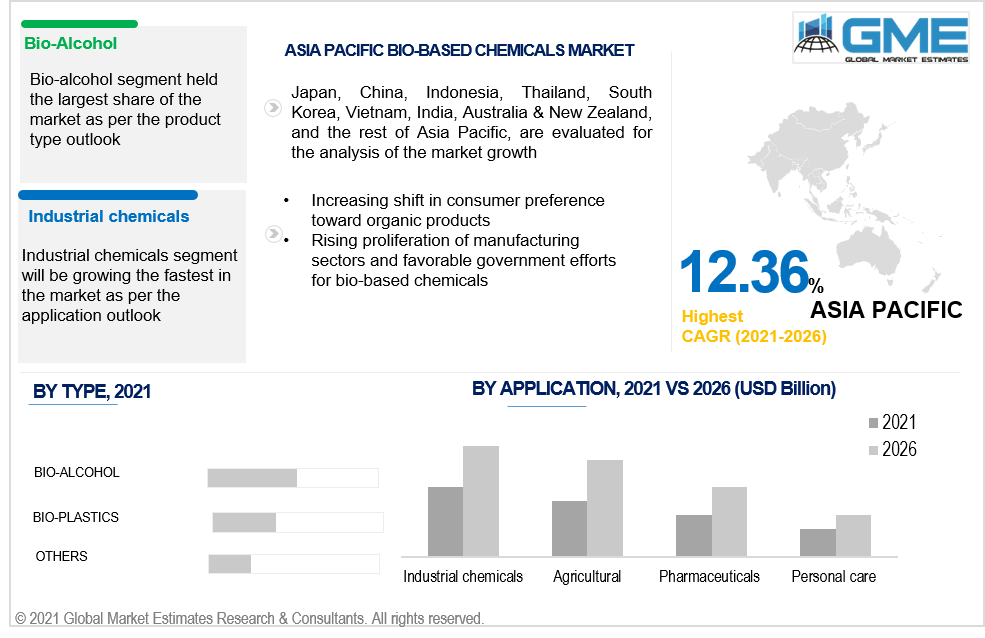

Based on the product type of bio-based chemicals, the market is segmented into bioplastics, bio-lubricants, bio-solvents, bio-based acids, bio-surfactants, bio-alcohols. The bio-alcohols segment accounted for the highest share of the bio-based chemicals market in 2020, owing to bioethanol's widespread use in both industrial and consumable purposes.

In the food and beverage business, bio-alcohols, particularly bioethanol, are frequently employed, and often used in the production of alcoholic beverages such as whiskey, bourbon, gin, rum, scotch, tequila, liqueurs, fortified wine, unfortified wine, and beer to varying degrees as a hallucinogen. Bioethanol is also utilised in the food and beverage sector to extricate and absorb flavours and fragrances, which are subsequently employed as flavourful ingredients. Because of rising alcohol consumption around the world, the worldwide market for alcoholic beverages is booming.

Based on the application, the market is segmented into industrial chemicals, pharmaceuticals, food & beverages, detergents & cleaners, personal care, agriculture, packaging, paints & coating, automotive, others. Industrial chemicals accounted for a major share of the bio-based chemicals market in 2020 and is expected to rise at a higher CAGR rate. The growth of the industrial chemical sector is mainly due to their widespread use of bio-based chemicals in customized polymerization, composite, lubricants applications. The agriculture segment is predicted to rise at a substantial CAGR during the forecast period due to its wide range of uses, such as biopesticides and biofertilizers. The market is being driven by increased demand for high agricultural yields and disease-free crops.

Rising prices for excellent agricultural yields and plaque free crops is driving the market. Additional motivating force for the market is the use of bio-based compounds as vitamin supplements and sustenance [the government's strict rules against synthetic substances, for example]. The growing trend in the automobile industry to use biofuels instead of crude oil is driving demand for bio-based chemicals. Bio-based chemicals-based polymers are often used to encapsulate food goods including vegetable, meats, and confectionery.

Based on region, the market is segmented into regions such as North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa. In 2020, the North American region had the largest market share. The depletion of natural resources, growing crude oil prices, and governments' environmental policies are all contributing to the growth of the NA market.

Furthermore, the European Union's sustainable development norms for reducing greenhouse gas emissions by 40% and reducing energy costs by 27% by 2030 are predicted to open up numerous prospects for the bio-based chemicals market.

Asia Pacific is likewise predicted to have the fastest growth rate. The Asia Pacific bio-based chemicals market is being driven by a shift in consumer preference toward organic products, as well as growing environmental and health concerns related to the usage of synthetic petroleum-based chemicals. Due to the proliferation of manufacturing sectors and favourable government efforts, China and Japan are significant markets that are augmenting the market's expansion. It also recommended subsidising businesses that produce paper-based alternatives to plastic.

With the presence of significant competitors, the market for Bio-Based Chemicals is partially fragmented and dynamic.

Cargill Incorporated, PTT Global Chemical Public Company Limited, Corbion NV, Basf Se, Mitsubishi Chemical Holdings Corporation, Corbion NV, DowDuPont, Toray Industries Inc, GF Biochemicals Ltd, Evonik Industries, Itaconix PLC, Royal DSM, among others are the key players in the bio-based chemicals market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Bio-Based Chemicals Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Product type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Bio-Based Chemicals Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Supportive regulatory policies for distribution and supply of bio-based chemicals

3.3.2 Industry Challenges

3.3.2.1 Economic constraints, such as high production costs and access to finance

3.4 Prospective Growth Scenario

3.4.1 Product type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Bio-Based Chemicals Market, By Product type

4.1 Product type Outlook

4.2 Bioplastics

4.2.1 Biodegradable Bioplastics

4.2.1.1 Polybutyrate Adipate Terephthalate (PBAT)

4.2.1.2 Polybutylene Succinate (PBS)

4.2.1.3 Polylactic Acid (PLA)

4.2.1.4 Polyhydroxyalkanoate (PHA)

4.2.1.5 Others

4.2.2 Non-Biodegradable Bioplastics

4.2.2.1 Polyethylene Terephthalate (PET)

8.2.2.2 Polyamide (PA)

8.2.2.3 Polyethylene (PE)

8.2.2.4 Others

4.3 Bio-Lubricants

4.4 Bio-Solvents

4.4.1 Glycols

4.4.2 Ketones

4.4.3 Lactate Ester

4.4.4 Others

4.5 Bio-Based Acids

4.5.1 Citric Acid

4.5.2 Lactic Acid

4.5.3 Succinic Acid

4.5.4 Others

4.6 Bio-Surfactants

4.6.1 Glycolipids

4.6.2 Lipopeptides

4.6.3 Others

4.7 Bio-Alcohols

4.7.1 Bio-ethanol

4.7.2 Sorbitol

4.7.3 Xylitol

4.7.4 Biobutanol

4.7.5 Bio-methanol

4.7.6 Others

4.8 Others

Chapter 5 Bio-Based Chemicals Market, By Application

5.1 Application Outlook

5.2 Industrial Chemicals

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Food & Beverages

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 Pharmaceuticals

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

5.5 Detergents & Cleaners

5.5.1 Market Size, By Region, 2021-2026 (USD Billion)

5.6 Personal Care

5.6.1 Market Size, By Region, 2021-2026 (USD Billion)

5.6 Agriculture

5.6.1 Market Size, By Region, 2021-2026 (USD Billion)

5.7 Packaging

5.7.1 Market Size, By Region, 2021-2026 (USD Billion)

5.8 Paints & Coating

5.8.1 Market Size, By Region, 2021-2026 (USD Billion)

5.9 Automotive

5.9.1 Market Size, By Region, 2021-2026 (USD Billion)

5.10 Others

5.10.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Bio-Based Chemicals Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2021-2026 (USD Billion)

6.2.2 Market Size, By Product type, 2021-2026 (USD Billion)

6.2.3 Market Size, By Application, 2021-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2021-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2021-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2021-2026 (USD Billion)

6.3.2 Market Size, By Product type, 2021-2026 (USD Billion)

6.3.3 Market Size, By Application, 2021-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2021-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2021-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2021-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2021-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2021-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2021-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2021-2026 (USD Billion)

6.4.2 Market Size, By Product type, 2021-2026 (USD Billion)

6.4.3 Market Size, By Application, 2021-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2021-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2021-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2021-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2021-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2021-2026 (USD Billion)

6.5 Central & South America

6.5.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.5.2 Market Size, By Application, 2021-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2021-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2021-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2021-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2021-2026 (USD Billion)

6.6.2 Market Size, By Product type, 2021-2026 (USD Billion)

6.6.3 Market Size, By Application, 2021-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2021-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2021-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product type, 2021-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2021-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2021

7.2 Cargill Incorporated

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 PTT Global Chemical Public Company Limited

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Corbion NV

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 BASF

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Mitsubishi Chemical Holdings Corporation

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Corbion NV

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 DowDuPont

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Toray Industries Inc

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Bio-Based Chemicals Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bio-Based Chemicals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS