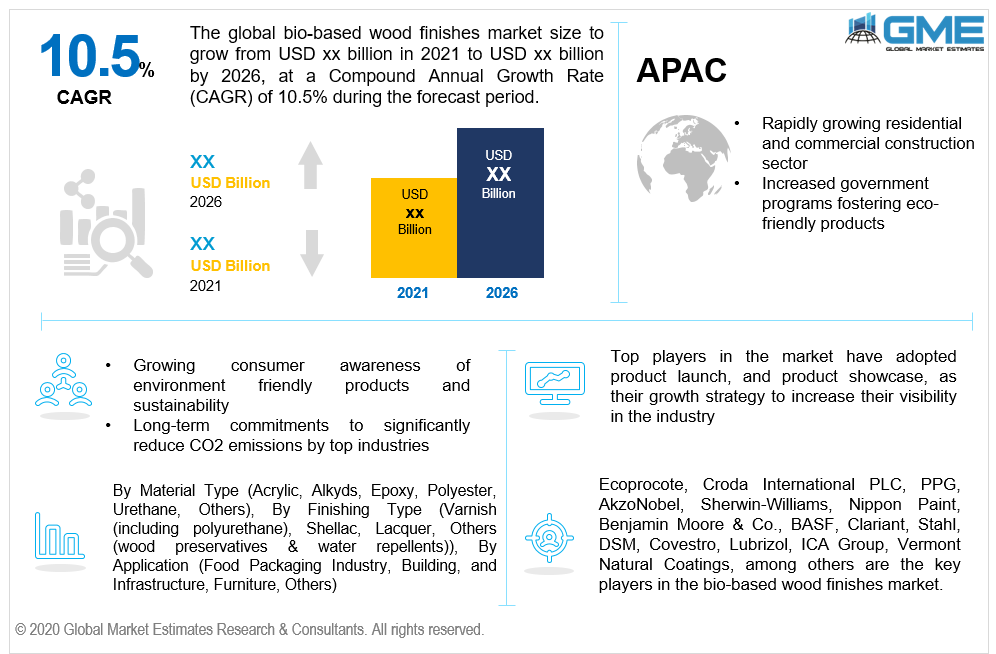

Global Bio-based Wood Finishes Market Size, Trends & Analysis - Forecasts to 2026 By Material Type (Acrylic, Alkyds, Epoxy, Polyester, Urethane, Others), By Finishing Type (Varnish (Including Polyurethane), Shellac, Lacquer, Others [Wood Preservatives & Water Repellents]), By Application (Food Packaging Industry, Building, and Infrastructure, Furniture, Others), By Region (North America, Asia Pacific, Europe, Middle East & Africa and Central & South America), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global bio-based wood finishes market is projected to grow at a CAGR value of around 10.5% during the forecast period [2021 to 2026].

Wood finishing refers to the process of refining or protecting a wooden surface which is done by applying a special liquid to the wood surfaces which then dries into a protective layer. Bio based wood finishes is an ecological, high quality varnish for outdoor use. It contains renewable plant-based or animal based raw materials.

Rising importance to achieve minimal emissions of harmful gases and chemicals along with rising awareness amongst consumers about natural sources in the form of wood finishes, are driving the market growth. Additionally, long-term commitments to significantly reduce CO2 emissions by top industries in both developed and developing countries is also one of the important factors propelling the bio-based wood finishes market to grow during the forecast period.

Manufacturers have become keen on integrating the latest technologies and investing more in research and development projects to facilitate quality improvements, which would be a significant contributor to bio-based wood finish sales expansion year over year.

The bio-based wood finishes are made with "green" ingredients and have low or no VOC (Volatile Organic Compound) content. The increased benefits of low VOC products have helped the trend shift from traditional coatings to newer bio-based coatings. Minimal toxicity, minimal groundwater, and ozone depletion contaminants, ease of maintenance, environmental friendliness, decreased odor, reduced carbon footprint, and simple disposal are a few of the advantages that are supporting the growth of the market.

Rising environmental concerns has been one of the prime reasons for the growth of the bio-based wood finishes market. The usage of harmful or toxic compounds by the paints and coatings industry has been observed to be decreasing owing to the augmentation of these alternatives. One of the primary drivers of the market is the rising stringent norms by government to adopt natural oil-based finishes. During the development of bio-based wood finishes, green chemical technology plays a major role. Besides, rising government initiatives to curb the use of mineral oil-based coatings is expected to promote the growth of the market during the forecast period.

COVID-19 pandemic has had a significant impact on the industry, as the cost of raw materials fluctuated drastically. Moreover, because of the price distortion, disturbed supply chain, and lack of priority given to indoor and outdoor painting during the pandemic, revenue sales of the decorative paint industry reduced to a great extent, which ultimately affected the bio-based raw material sales.

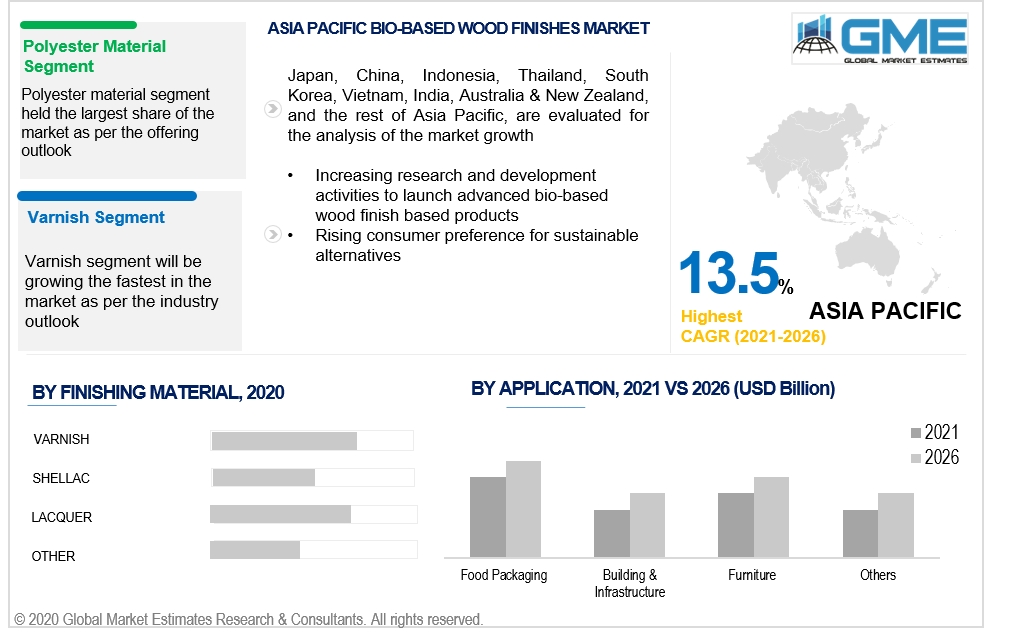

Based on material type, the bio-based wood finishes market is segmented into acrylic, alkyds, epoxy, polyester, urethane, and others. The alkyd material segment is expected to have the largest share during the forecast period. Advantages such as having exceptional chemical resistance, outstanding clarity, high gloss, and excellent mechanical qualities like hardness, flexibility, and abrasion resistance have helped increase their demand in the market. Furthermore, they provide a wide range of customization options, making them adaptable to a variety of applications and climates.

On the other hand, acrylic material segment is analyzed to be growing the fastest during the forecast period. Acrylic is also incredibly weather-resistant, making it suitable for usage outside.

Based on finishing type, the market is segmented into varnish (including polyurethane), shellac, lacquer, and others (wood preservatives & water repellents). The varnish (including polyurethane) segment is expected to have the lion’s share in the market during the forecast period. Varnishes are typically clear, highly durable, and UV resistant, making them ideal for doors and marine finishes on bare or stained wood. They are less expensive than polyurethane, but they cure slowly, rendering them vulnerable to dust and debris. Polyurethane wood finishes are synthetic coatings that are extremely durable and resistant to water, making them the finest clear coat for wood protection. These advantages have helped increase the adoption rate for varnishes in both developed and developing regions.

On the other hand, Lacquer segment is analyzed to be the growing the fastest during the forecast period.

As per the geographical analysis, the bio-based wood finishes market can be classified into North America (United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The United States is the largest producer of bio-based wood coatings. ??

During the forecast period, the Asia-Pacific is analyzed to be the fastest growing regional segment in the market. China has been primarily driven by abundant expansions in the residential and commercial construction sector along with increased research and development activities. In China, the Hong Kong housing authorities announced several initiatives to jump-start the development of low-cost homes using bio-based wood finishes. Officials hope to provide 301,000 public housing units over the next ten years, until 2030. Hence, support from the government organizations will help the APAC market grow rapidly. China, Japan, and South Korea are at the forefront of bio-based wood finishes market.

Ecoprocote, Croda International PLC, PPG, AkzoNobel, Sherwin-Williams, Nippon Paint, Benjamin Moore & Co., BASF, Clariant, Stahl, DSM, Covestro, Lubrizol, ICA Group, Vermont Natural Coatings, among others are the key players in the bio-based wood finishes market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Bio-based Wood Finishes Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Material Type Overview

2.1.3 Finishing Type Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Bio-based Wood Finishes Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising need to curb CO2 emission from top industries in developed and developing regions

3.3.2 End-User Challenges

3.3.2.1 High cost associated with bio-based raw materials

3.4 Prospective Growth Scenario

3.4.1 Material Type Growth Scenario

3.4.2 Finishing Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Bio-based Wood Finishes Market, By Material Type

4.1 Material Type Outlook

4.2 Acrylic

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Alkyds

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Epoxy

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Polyester

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Urethane

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Others

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Bio-based Wood Finishes Market, By Finishing Type

5.1 Finishing Type Outlook

5.2 Varnish (including Polyurethane)

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Shellac

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Lacquer

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others (Wood Preservatives & Water Repellents)

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Bio-based Wood Finishes Market, By Application

6.1 Food Packaging Industry

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Building and Infrastructure

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Furniture

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Bio-based Wood Finishes Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Finishing Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Material Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Finishing Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Ecoprocote

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info-Graphic Analysis

8.3 Croda International PLC

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 PPG

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 AkzoNobel

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Sherwin-Williams

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Nippon Paint

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 Benjamin Moore & Co.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 BASF

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.10 Clariant

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 Stahl

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Bio-based Wood Finishes Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bio-based Wood Finishes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS