Global Bio Carboxylic Acids Market Size, Trends & Analysis - Forecasts to 2028 By Type (Acetic Acid, Iso-butyric Acid, Butyric Acid, Iso-valeric Acid, Valeric Acid, Caproic Acid, and Others), By Application Type (Polymers, Solvents, Food Additives, Pharmaceutical Intermediates, Personal Care Products, Animal Feed, and Others), By End-use Industry (Chemical, Plastics, Pharmaceutical, Food and Beverage, Agriculture, Cosmetics, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

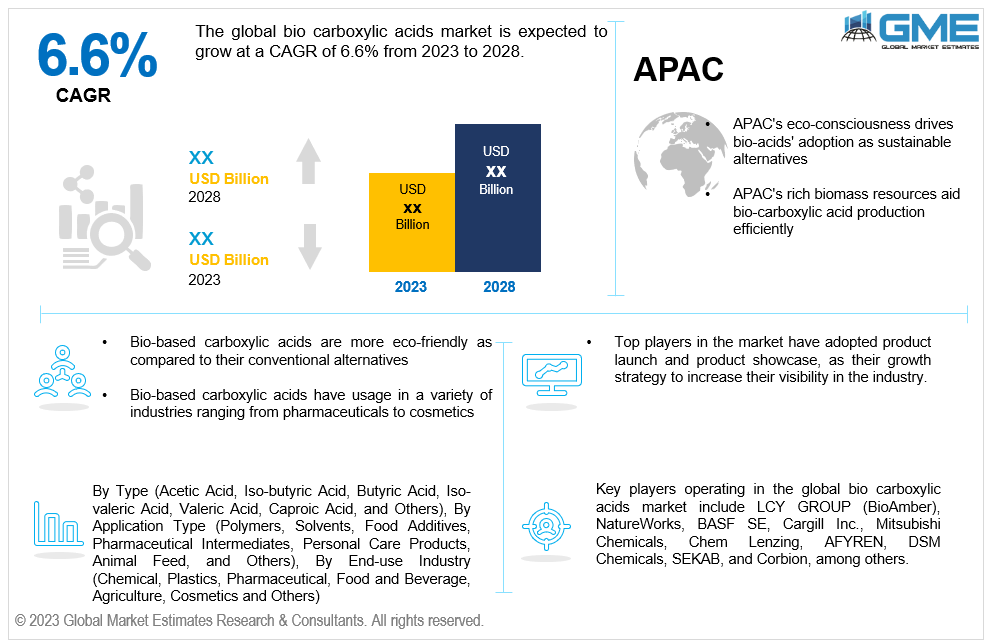

The global bio carboxylic acids market is expected to exhibit a CAGR of 6.6% from 2023 to 2028. Bio-based carboxylic acids are organic compounds containing a carboxyl group (COOH) derived from renewable biological sources such as plants, algae, or waste biomass. These acids play a crucial role in various industries due to their versatility and potential sustainability compared to their petroleum-derived counterparts. The production of bio-based carboxylic acids aligns with the principles of green chemistry, aiming to reduce reliance on fossil fuels and minimize the environmental impact of chemical production processes. Because of their environmentally favorable features, bio-based carboxylic acids are employed in various sectors. They are used in food additives, pharmaceuticals, cosmetics, polymers, plastics, chemicals, and others.

Demand for bio-based carboxylic acids is being driven by a growing recognition of environmental concerns and the quest for more sustainable methods. They offer reduced carbon footprint, lower reliance on fossil fuels, and contribute to a circular economy by utilizing renewable resources. Growing consumer awareness and preference for natural and eco-friendly products in various sectors, including food, cosmetics, and personal care, drive the demand for bio-based carboxylic acids as natural additives and ingredients. Bio-based carboxylic acids offer renewable sourcing, lower carbon footprint, biodegradability, versatility across industries, and reduced toxicity and health benefits. They are derived from renewable biomass, generate fewer greenhouse gas emissions, and are safer for certain applications. These advantages contribute to the growing adoption of sustainable and eco-friendly practices.

The production costs of bio-based carboxylic acids are higher than those of their petroleum-derived counterparts. This cost challenge limits their competitiveness in the market, mainly if there are no significant economies of scale or advancements in production technology. The availability and consistency of feedstock (biomass) for bio-based acids can be unpredictable, impacting production scalability and stability of supply chains. Dependence on specific crops or biomass sources might lead to competition with food production or land use concerns. Bio-based carboxylic acids require sophisticated or specialized production processes, which poses technical challenges, especially in achieving high yields or maintaining consistent quality.

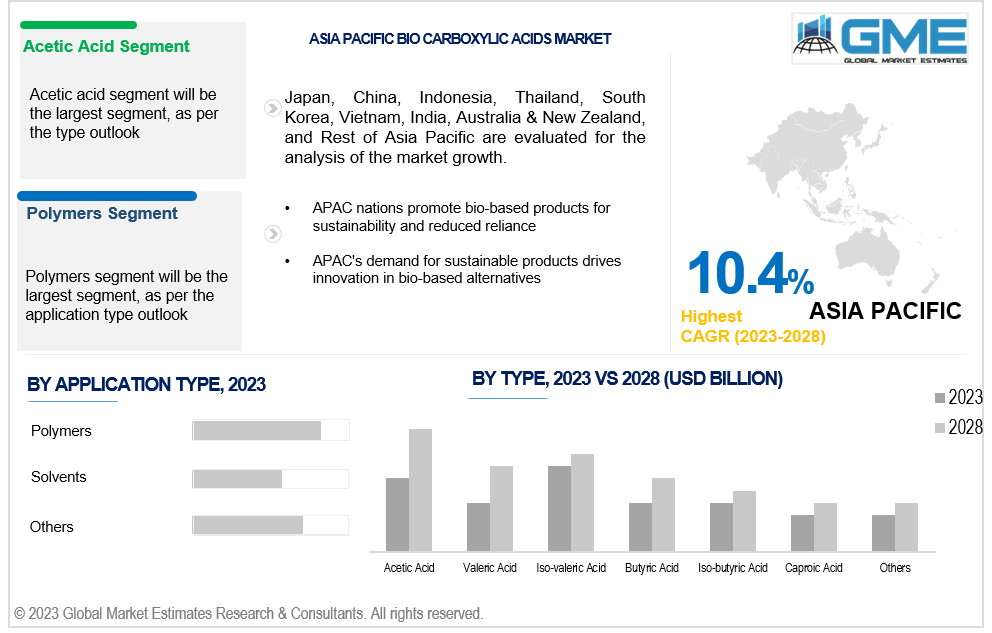

Based on the type, the market is segmented into acetic acid, iso-butyric acid, butyric acid, iso-valeric acid, valeric acid, caproic acid, and others. The acetic acid segment is expected to be the largest segment during the forecast period. Acetic acid is a crucial intermediate in various industries, including chemicals, textiles, and pharmaceuticals. Its versatility in manufacturing polymers like vinyl acetate monomer (VAM), solvents, and numerous chemical derivatives, combined with well-established fermentation and chemical synthesis routes, contributes to its dominance, driving demand and making it the primary and largest segment within the bio-based carboxylic acids market.

The butyric acid segment is expected to be the fastest-growing segment in the global bio carboxylic acids market during the forecast period. Butyric acid finds extensive use in animal feed additives, pharmaceuticals, and chemical intermediates. Its role in improving gut health in livestock, promoting better digestion, and serving as a precursor for various products in pharmaceutical and chemical industries drives its rapid growth. Additionally, the rising demand for sustainable alternatives in these sectors fuels the expansion of bio-based butyric acid.

Based on end-use industry, the market is segmented into chemical, plastics, pharmaceutical, food and beverage, agriculture, cosmetics, and others. The chemicals segment is expected to be the largest segment during the forecast period. The acids’ compatibility with existing chemical processes and versatility in creating derivatives for numerous applications make them indispensable. Additionally, their renewable sourcing aligns with the industry's growing emphasis on sustainability, driving adoption and making the chemical sector a key consumer in this market.

The plastics segment is expected to be the fastest-growing segment in the global bio carboxylic acids market. Bio-based carboxylic acids, particularly lactic acid used in producing polylactic acid (PLA), cater to the rising need for biodegradable plastics. With consumers and industries emphasizing eco-friendly packaging solutions, these acids offer a renewable, biodegradable option, aligning with stringent environmental regulations. Their versatility in replacing conventional plastics fuels rapid growth in the plastics sector of the bio-based carboxylic acids market.

On the basis of application type, the market is segmented into polymers, solvents, food additives, pharmaceutical intermediates, personal care products, animal feed, and others. The polymers segment is expected to be the largest segment during the forecast period. This stems from the substantial demand for sustainable options in polymer manufacturing. For instance, bio-based carboxylic acids such as succinic acid are instrumental in producing polybutylene succinate (PBS), a biodegradable polymer used in packaging, textiles, and automotive components. The market's focus on eco-conscious materials, combined with PBS's biodegradability and versatile applications, has led to the polymers segment's prominence within the bio-based carboxylic acids market.

The solvents segment is expected to be the fastest-growing segment in the global bio carboxylic acids market during the forecast period. Bio-based carboxylic acids offer lower toxicity, biodegradability, and reduced environmental impact compared to conventional solvents. Paints, coatings, and chemical production industries are turning to these alternatives, spurred by rigorous environmental requirements and customer desires for greener goods. This trend fuels rapid growth as companies seeks bio-based solvents to meet sustainability targets and comply with eco-conscious market demands.

North America is analysed to account for the largest share in the global bio carboxylic acids market during the forecast period. The region exhibits advanced research infrastructure, fostering innovation and development in sustainable technologies. Additionally, increasing investments in eco-friendly biotechnology by top pharmaceutical and chemical companies to meet their ESG standards, and a strong consumer preference for sustainable products drive the demand for bio-based carboxylic acids. Increasing collaborations between academia and industry in the U.S. and Canada, positions the region as a frontrunner in the production and utilization of bio-based carboxylic acids.

Asia Pacific is expected to be the fastest-growing region across the global bio carboxylic acids market. APAC nations, like China and India, possess robust agricultural sectors, providing abundant biomass feedstock for acid production. Additionally, supportive government policies promoting sustainability and renewable resources foster market growth. The presence of many top market players and chemical companies, and increasing demand across various sectors like food, pharmaceuticals, and packaging drive significant adoption of bio-based carboxylic acids.

Key players operating in the global bio carboxylic acids market include LCY GROUP (BioAmber), NatureWorks, BASF SE, Cargill Inc., Mitsubishi Chemicals, Chem Lenzing, AFYREN, DSM Chemicals, SEKAB, and Corbion, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2023, Eastman Chemical Company agreed to sell its Texas City Operations to INEOS Acetyls, a global supplier of acetic acid and related chemicals. The deal will keep Eastman's plasticizer business at the site, which INEOS will operate for Eastman. A memorandum of understanding (MoU) has also been signed to explore long-term supply options for vinyl acetate monomer.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL BIO CARBOXYLIC ACIDS MARKET, BY END-USE INDUSTRY

4.1 Introduction

4.2 Bio Carboxylic Acids Market: End-use Industry Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Chemical

4.4.1 Chemical Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Plastics

4.5.1 Plastics Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Pharmaceutical

4.6.1 Pharmaceutical Market Estimates and Forecast, 2020-2028 (USD Billion)

4.7 Food and Beverage

4.7.1 Food and Beverage Market Estimates and Forecast, 2020-2028 (USD Billion)

4.8 Agriculture

4.8.1 Agriculture Market Estimates and Forecast, 2020-2028 (USD Billion)

4.9 Cosmetics

4.9.1 Cosmetics Market Estimates and Forecast, 2020-2028 (USD Billion)

4.10 Other Industries

4.10.1 Other Industries Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL BIO CARBOXYLIC ACIDS MARKET, BY TYPE

5.1 Introduction

5.2 Bio Carboxylic Acids Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Acetic Acid

5.4.1 Acetic Acid Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Valeric Acid

5.5.1 Valeric Acid Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6 Iso-valeric Acid

5.6.1 Iso-valeric Acid Market Estimates and Forecast, 2020-2028 (USD Billion)

5.7 Butyric Acid

5.7.1 Butyric Acid Market Estimates and Forecast, 2020-2028 (USD Billion)

5.8 Iso-butyric Acid

5.8.1 Iso-butyric Acid Market Estimates and Forecast, 2020-2028 (USD Billion)

5.9 Caproic Acid

5.9.1 Caproic Acid Market Estimates and Forecast, 2020-2028 (USD Billion)

5.10 Other Types

5.10.1 Other Types Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL BIO CARBOXYLIC ACIDS MARKET, BY APPLICATION TYPE

6.1 Introduction

6.2 Bio Carboxylic Acids Market: Application Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Polymers

6.4.1 Polymers Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Solvents

6.5.1 Solvents Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6 Food Additives

6.6.1 Food Additives Market Estimates and Forecast, 2020-2028 (USD Billion)

6.7 Pharmaceutical Intermediates

6.7.1 Pharmaceutical Intermediates Market Estimates and Forecast, 2020-2028 (USD Billion)

6.8 Animal Feed

6.8.1 Animal Feed Market Estimates and Forecast, 2020-2028 (USD Billion)

6.9 Personal Care Products

6.9.1 Personal Care Products Market Estimates and Forecast, 2020-2028 (USD Billion)

6.10 Other Applications

6.10.1 Other Applications Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL BIO CARBOXYLIC ACIDS MARKET, BY REGION

7.1 Introduction

7.2 North America Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.1 By End-use Industry

7.2.2 By Type

7.2.3 By Application Type

7.2.4 By Country

7.2.4.1 U.S. Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.1.1 By End-use Industry

7.2.4.1.2 By Type

7.2.4.1.3 By Application Type

7.2.4.2 Canada Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.2.1 By End-use Industry

7.2.4.2.2 By Type

7.2.4.2.3 By Application Type

7.2.4.3 Mexico Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.3.1 By End-use Industry

7.2.4.3.2 By Type

7.2.4.3.3 By Application Type

7.3 Europe Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.1 By End-use Industry

7.3.2 By Type

7.3.3 By Application Type

7.3.4 By Country

7.3.4.1 Germany Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.1.1 By End-use Industry

7.3.4.1.2 By Type

7.3.4.1.3 By Application Type

7.3.4.2 U.K. Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.2.1 By End-use Industry

7.3.4.2.2 By Type

7.3.4.2.3 By Application Type

7.3.4.3 France Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.3.1 By End-use Industry

7.3.4.3.2 By Type

7.3.4.3.3 By Application Type

7.3.4.4 Italy Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.4.1 By End-use Industry

7.3.4.4.2 By Type

7.2.4.4.3 By Application Type

7.3.4.5 Spain Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.5.1 By End-use Industry

7.3.4.5.2 By Type

7.2.4.5.3 By Application Type

7.3.4.6 Netherlands Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.7.1 By End-use Industry

7.3.4.7.2 By Type

7.2.4.7.3 By Application Type

7.3.4.7 Rest of Europe Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.7.1 By End-use Industry

7.3.4.7.2 By Type

7.2.4.7.3 By Application Type

7.4 Asia Pacific Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.1 By End-use Industry

7.4.2 By Type

7.4.3 By Application Type

7.4.4 By Country

7.4.4.1 China Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.1.1 By End-use Industry

7.4.4.1.2 By Type

7.4.4.1.3 By Application Type

7.4.4.2 Japan Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.2.1 By End-use Industry

7.4.4.2.2 By Type

7.4.4.2.3 By Application Type

7.4.4.3 India Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.3.1 By End-use Industry

7.4.4.3.2 By Type

7.4.4.3.3 By Application Type

7.4.4.4 South Korea Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.4.1 By End-use Industry

7.4.4.4.2 By Type

7.4.4.4.3 By Application Type

7.4.4.5 Singapore Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.5.1 By End-use Industry

7.4.4.5.2 By Type

7.4.4.5.3 By Application Type

7.4.4.6 Malaysia Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.1 By End-use Industry

7.4.4.7.2 By Type

7.4.4.7.3 By Application Type

7.4.4.7 Thailand Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.1 By End-use Industry

7.4.4.7.2 By Type

7.4.4.7.3 By Application Type

7.4.4.8 Indonesia Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.8.1 By End-use Industry

7.4.4.8.2 By Type

7.4.4.8.3 By Application Type

7.4.4.9 Vietnam Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.9.1 By End-use Industry

7.4.4.9.2 By Type

7.4.4.9.3 By Application Type

7.4.4.10 Taiwan Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.10.1 By End-use Industry

7.4.4.10.2 By Type

7.4.4.10.3 By Application Type

7.4.4.11 Rest of Asia Pacific Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.11.1 By End-use Industry

7.4.4.11.2 By Type

7.4.4.11.3 By Application Type

7.5 Middle East and Africa Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.1 By End-use Industry

7.5.2 By Type

7.5.3 By Application Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.1.1 By End-use Industry

7.5.4.1.2 By Type

7.5.4.1.3 By Application Type

7.5.4.2 U.A.E. Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.2.1 By End-use Industry

7.5.4.2.2 By Type

7.5.4.2.3 By Application Type

7.5.4.3 Israel Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.3.1 By End-use Industry

7.5.4.3.2 By Type

7.5.4.3.3 By Application Type

7.5.4.4 South Africa Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.4.1 By End-use Industry

7.5.4.4.2 By Type

7.5.4.4.3 By Application Type

7.5.4.5 Rest of Middle East and Africa Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.5.1 By End-use Industry

7.5.4.5.2 By Type

7.5.4.5.2 By Application Type

7.6 Central and South America Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.1 By End-use Industry

7.7.2 By Type

7.7.3 By Application Type

7.7.4 By Country

7.7.4.1 Brazil Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.1.1 By End-use Industry

7.7.4.1.2 By Type

7.7.4.1.3 By Application Type

7.7.4.2 Argentina Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.2.1 By End-use Industry

7.7.4.2.2 By Type

7.7.4.2.3 By Application Type

7.7.4.3 Chile Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.3.1 By End-use Industry

7.7.4.3.2 By Type

7.7.4.3.3 By Application Type

7.7.4.4 Rest of Central and South America Bio Carboxylic Acids Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.4.1 By End-use Industry

7.7.4.4.2 By Type

7.7.4.4.3 By Application Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 LCY Group (BioAmber)

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 NatureWorks

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Cargill Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 BASF SE

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Mitsubishi Chemicals

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Chem Lenzing

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 AFYREN

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 DSM Chemicals

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 SEKAB

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Corbian

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

2 Chemical Market, By Region, 2020-2028 (USD Billion)

3 Plastics Market, By Region, 2020-2028 (USD Billion)

4 PHARMACEUTICAL Market, By Region, 2020-2028 (USD Billion)

5 Food and Beverage Market, By Region, 2020-2028 (USD Billion)

6 Agriculture Market, By Region, 2020-2028 (USD Billion)

7 Cosmetics Market, By Region, 2020-2028 (USD Billion)

8 Other Industries Market, By Region, 2020-2028 (USD Billion)

9 Global Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

10 Acetic Acid Market, By Region, 2020-2028 (USD Billion)

11 Valeric Acid Market, By Region, 2020-2028 (USD Billion)

12 Iso-Valeric Acid Market, By Region, 2020-2028 (USD Billion)

13 Butyric Acid Market, By Region, 2020-2028 (USD Billion)

14 Iso-Butyric Acid Market, By Region, 2020-2028 (USD Billion)

15 Caproic Acid Market, By Region, 2020-2028 (USD Billion)

16 Other Types Market, By Region, 2020-2028 (USD Billion)

17 Global Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

18 Polymers Market, By Region, 2020-2028 (USD Billion)

19 Solvents Market, By Region, 2020-2028 (USD Billion)

20 Food Additives Market, By Region, 2020-2028 (USD Billion)

21 Pharmaceutical Intermediates Market, By Region, 2020-2028 (USD Billion)

22 Animal Feed Market, By Region, 2020-2028 (USD Billion)

23 Personal Care Products Market, By Region, 2020-2028 (USD Billion)

24 Other Applications Market, By Region, 2020-2028 (USD Billion)

25 Regional Analysis, 2020-2028 (USD Billion)

26 North America Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

27 North America Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

28 North America Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

29 North America Bio Carboxylic Acids Market, By Country, 2020-2028 (USD Billion)

30 U.S. Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

31 U.S. Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

32 U.S. Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

33 Canada Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

34 Canada Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

35 Canada Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

36 Mexico Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

37 Mexico Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

38 Mexico Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

39 Europe Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

40 Europe Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

41 Europe Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

42 Europe Bio Carboxylic Acids Market, By COUNTRY, 2020-2028 (USD Billion)

43 Germany Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

44 Germany Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

45 Germany Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

46 U.K. Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

47 U.K. Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

48 U.K. Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

49 France Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

50 France Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

51 France Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

52 Italy Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

53 Italy Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

54 Italy Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

55 Spain Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

56 Spain Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

57 Spain Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

58 Netherlands Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

59 Netherlands Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

60 Netherlands Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

61 Rest Of Europe Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

62 Rest Of Europe Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

63 Rest of Europe Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

64 Asia Pacific Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

65 Asia Pacific Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

66 Asia Pacific Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

67 Asia Pacific Bio Carboxylic Acids Market, By Country, 2020-2028 (USD Billion)

68 China Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

69 China Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

70 China Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

71 India Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

72 India Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

73 India Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

74 Japan Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

75 Japan Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

76 Japan Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

77 South Korea Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

78 South Korea Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

79 South Korea Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

80 Thailand Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

81 Thailand Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

82 Thailand Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

83 Indonesia Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

84 Indonesia Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

85 Indonesia Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

86 Australia Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

87 Australia Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

88 Australia Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

89 Vietnam Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

90 Vietnam Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

91 Vietnam Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

92 Malaysia Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

93 Malaysia Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

94 Malaysia Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

95 Singapore Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

96 Singapore Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

97 Singapore Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

98 Philippines Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

99 Philippines Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

100 Philippines Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

101 Rest Of Asia pacific Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

102 Rest Of Asia Pacific Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

103 Rest of Asia pacific Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

104 Middle East and Africa Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

105 Middle East and Africa Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

106 Middle East and Africa Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

107 Middle East and Africa Bio Carboxylic Acids Market, By Country, 2020-2028 (USD Billion)

108 Saudi Arabia Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

109 Saudi Arabia Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

110 Saudi Arabia Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

111 UAE Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

112 UAE Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

113 UAE Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

114 Israel Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

115 Israel Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

116 Israel Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

117 South Africa Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

118 South Africa Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

119 South Africa Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

120 Rest Of Middle East and Africa Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

121 Rest Of Middle East and Africa Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

122 Rest of Middle East and Africa Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

123 Central and South America Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

124 Central and South America Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

125 Central and South America Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

126 Central and South America Bio Carboxylic Acids Market, By Country, 2020-2028 (USD Billion)

127 Brazil Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

128 Brazil Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

129 Brazil Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

130 Argentina Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

131 Argentina Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

132 Argentina Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

133 Chile Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

134 Chile Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

135 Chile Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

136 Rest Of Central and South America Bio Carboxylic Acids Market, By End-use Industry, 2020-2028 (USD Billion)

137 Rest Of Central and South America Bio Carboxylic Acids Market, By Type, 2020-2028 (USD Billion)

138 Rest of Central and South America Bio Carboxylic Acids Market, By Application Type, 2020-2028 (USD Billion)

139 LCY Group (BioAmber): Products & Services Offering

140 NatureWorks: Products & Services Offering

141 Cargill Inc.: Products & Services Offering

142 BASF SE: Products & Services Offering

143 Mitsubishi Chemicals: Products & Services Offering

144 Chem Lenzing: Products & Services Offering

145 AFYREN: Products & Services Offering

146 DSM Chemicals: Products & Services Offering

147 SEKAB: Products & Services Offering

148 Corbian: Products & Services Offering

149 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Bio Carboxylic Acids Market Overview

2 Global Bio Carboxylic Acids Market Value From 2020-2028 (USD Billion)

3 Global Bio Carboxylic Acids Market Share, By End-use Industry (2022)

4 Global Bio Carboxylic Acids Market Share, By Type (2022)

5 Global Bio Carboxylic Acids Market Share, By Application Type (2022)

6 Global Bio Carboxylic Acids Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Bio Carboxylic Acids Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Bio Carboxylic Acids Market

11 Impact Of Challenges On The Global Bio Carboxylic Acids Market

12 Porter’s Five Forces Analysis

13 Global Bio Carboxylic Acids Market: By End-use Industry Scope Key Takeaways

14 Global Bio Carboxylic Acids Market, By End-use Industry Segment: Revenue Growth Analysis

15 Chemical Market, By Region, 2020-2028 (USD Billion)

16 Plastics Market, By Region, 2020-2028 (USD Billion)

17 Pharmaceutical Market, By Region, 2020-2028 (USD Billion)

18 Food and Beverage Market, By Region, 2020-2028 (USD Billion)

19 Agriculture Market, By Region, 2020-2028 (USD Billion)

20 Cosmetics Market, By Region, 2020-2028 (USD Billion)

21 Other Industries Market, By Region, 2020-2028 (USD Billion)

22 Global Bio Carboxylic Acids Market: By Type Scope Key Takeaways

23 Global Bio Carboxylic Acids Market, By Type Segment: Revenue Growth Analysis

24 Acetic Acid Market, By Region, 2020-2028 (USD Billion)

25 Valeric Acid Market, By Region, 2020-2028 (USD Billion)

26 Iso-valeric Acid Market, By Region, 2020-2028 (USD Billion)

27 Butyric Acid Market, By Region, 2020-2028 (USD Billion)

28 Iso-butyric Acid Market, By Region, 2020-2028 (USD Billion)

29 Caproic Acid Market, By Region, 2020-2028 (USD Billion)

30 Other Types Market, By Region, 2020-2028 (USD Billion)

31 Global Bio Carboxylic Acids Market: By Application Type Scope Key Takeaways

32 Global Bio Carboxylic Acids Market, By Application Type Segment: Revenue Growth Analysis

33 Polymers Market, By Region, 2020-2028 (USD Billion)

34 Solvents Market, By Region, 2020-2028 (USD Billion)

35 Food Additives Market, By Region, 2020-2028 (USD Billion)

36 Pharmaceutical Intermediates Market, By Region, 2020-2028 (USD Billion)

37 Animal Feed Market, By Region, 2020-2028 (USD Billion)

38 Personal Care Products Market, By Region, 2020-2028 (USD Billion)

39 Other Applications Market, By Region, 2020-2028 (USD Billion)

40 Regional Segment: Revenue Growth Analysis

41 Global Bio Carboxylic Acids Market: Regional Analysis

42 North America Bio Carboxylic Acids Market Overview

43 North America Bio Carboxylic Acids Market, By End-use Industry

44 North America Bio Carboxylic Acids Market, By Type

45 North America Bio Carboxylic Acids Market, By Application Type

46 North America Bio Carboxylic Acids Market, By Country

47 U.S. Bio Carboxylic Acids Market, By End-use Industry

48 U.S. Bio Carboxylic Acids Market, By Type

49 U.S. Bio Carboxylic Acids Market, By Application Type

50 Canada Bio Carboxylic Acids Market, By End-use Industry

51 Canada Bio Carboxylic Acids Market, By Type

52 Canada Bio Carboxylic Acids Market, By Application Type

53 Mexico Bio Carboxylic Acids Market, By End-use Industry

54 Mexico Bio Carboxylic Acids Market, By Type

55 Mexico Bio Carboxylic Acids Market, By Application Type

56 Four Quadrant Positioning Matrix

57 Company Market Share Analysis

58 LCY Group (BioAmber): Company Snapshot

59 LCY Group (BioAmber): SWOT Analysis

60 LCY Group (BioAmber): Geographic Presence

61 NatureWorks: Company Snapshot

62 NatureWorks: SWOT Analysis

63 NatureWorks: Geographic Presence

64 Cargill Inc.: Company Snapshot

65 Cargill Inc.: SWOT Analysis

66 Cargill Inc.: Geographic Presence

67 BASF SE: Company Snapshot

68 BASF SE: Swot Analysis

69 BASF SE: Geographic Presence

70 Mitsubishi Chemicals: Company Snapshot

71 Mitsubishi Chemicals: SWOT Analysis

72 Mitsubishi Chemicals: Geographic Presence

73 Chem Lenzing: Company Snapshot

74 Chem Lenzing: SWOT Analysis

75 Chem Lenzing: Geographic Presence

76 AFYREN : Company Snapshot

77 AFYREN : SWOT Analysis

78 AFYREN : Geographic Presence

79 DSM Chemicals: Company Snapshot

80 DSM Chemicals: SWOT Analysis

81 DSM Chemicals: Geographic Presence

82 SEKAB: Company Snapshot

83 SEKAB: SWOT Analysis

84 SEKAB: Geographic Presence

85 Corbian: Company Snapshot

86 Corbian: SWOT Analysis

87 Corbian: Geographic Presence

88 Other Companies: Company Snapshot

89 Other Companies: SWOT Analysis

90 Other Companies: Geographic Presence

The Global Bio Carboxylic Acids Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bio Carboxylic Acids Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS