Global Bioequivalence Studies Market Size, Trends & Analysis - Forecasts to 2028 By Molecule Type (Small Molecule and Large Molecule), By Dosage Form (Solid Oral Dosage, Parenteral Formulations, Topical Products, and Others), By Therapeutic Area Type (Oncology, Neurology, Metabolic Disorders, Haematology, Immunology, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

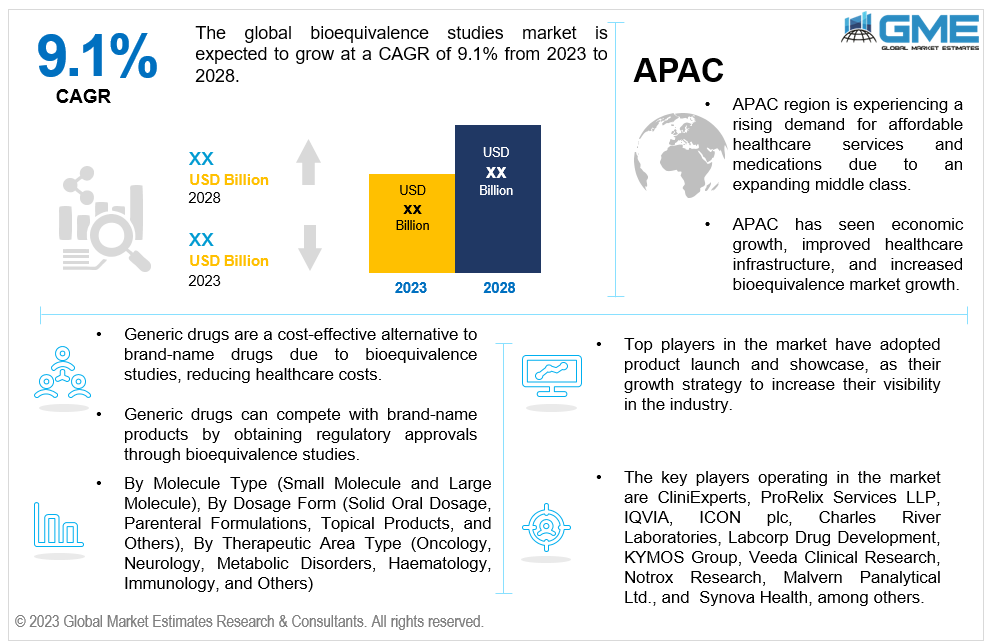

The global bioequivalence studies market is expected to grow at a CAGR of 9.1% from 2023 to 2028. The bioequivalence studies market is the segment of the pharmaceutical industry that focuses on ensuring that generic drugs are equivalent to their brand-name counterparts in terms of dosage form, strength, route of administration, and intended use. Bioequivalence studies compare the pharmacokinetic parameters of the generic drug to those of the brand-name drug, allowing researchers to assess whether the generic drug produces similar blood concentrations of the active ingredient as the brand-name drug. The bioequivalence market has seen significant growth in recent years due to pressure to reduce healthcare costs, expiration of patents, and growing awareness among healthcare providers and patients about the safety and efficacy of generic drugs.

The bioequivalence market growth is driven by cost containment, patent expirations, generic drug adoption, regulatory requirements, increasing disease burden, emerging markets, and advances in analytical techniques.

The bioequivalence market has several drivers that promote its growth, but there are also certain restraints or challenges that can impede its development. These include stringent regulatory requirements, intellectual property rights, safety concerns, quality control and manufacturing challenges, limited awareness and perception, market fragmentation, litigation and patent disputes, limited data exclusivity period, and biologics and complex drugs. These challenges can lead to pricing pressures, reduced profit margins, and intense competition, as well as litigation and patent disputes between brand-name drug manufacturers and generic drug companies.

Based on molecule type, the market is segmented into small molecule and large molecule. The small molecule is expected to be the largest segment during the forecast period. The small molecule segment has been in existence for a longer time than other segments, contributing to its larger market size. It has a higher number of generic equivalents due to the availability of established regulatory pathways and guidelines for demonstrating bioequivalence. Patent expirations have allowed generic manufacturers to enter the market, leading to increased competition and market expansion. Small molecule drugs cover a wide range of therapeutic areas, making them easier to manufacture and more cost-effective than their brand-name counterparts.

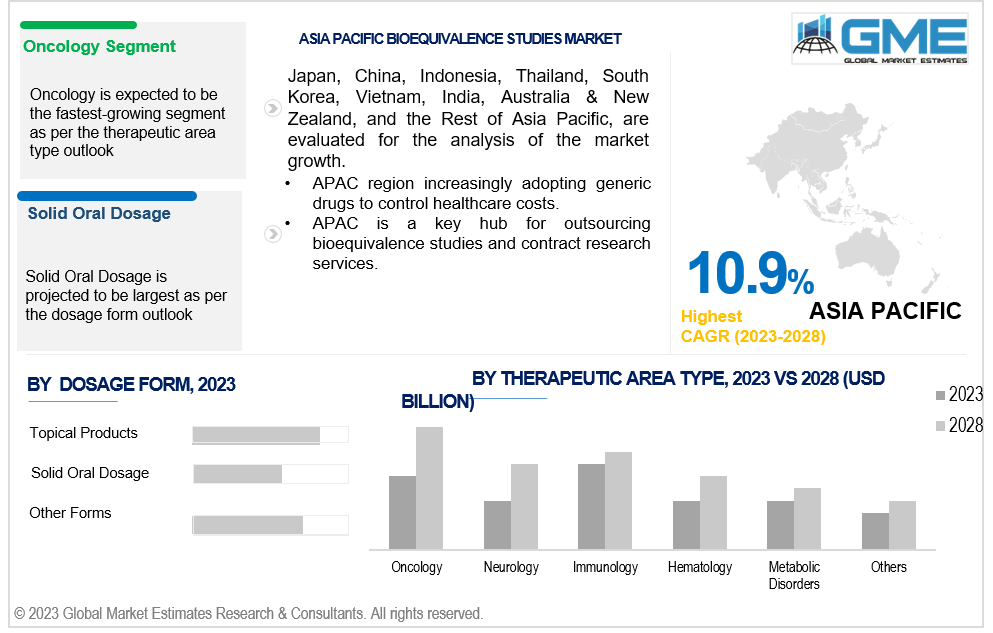

Based on dosage form, the market is segmented into solid oral dosage, parenteral formulations, topical products, and others. The solid oral dosage forms are popular due to convenience, ease of administration, stability, and shelf life. Moreover, in solid oral dosage manufacturing efficiency is streamlined.

Based on therapeutic area type, the market is segmented into oncology, neurology, metabolic disorders, haematology, immunology and others. Oncology is expected to be the largest segment during the forecast period. Cancer is a leading cause of morbidity and mortality worldwide. Complex and expensive treatments, patent expirations, and biosimilars have increased competition in the oncology segment. Research and development (R&D) focus has led to the development of new oncology drugs, personalized medicine, supportive care, and early detection. Increasing awareness and screening has led to an increase in cancer screenings, leading to better treatment outcomes.

North America region is analysed to be the largest region in the global bioequivalence studies market during the forecast period. The North America region, particularly the United States and Canada, has a well-established market for generic drugs due to robust regulatory frameworks such as the Hatch-Waxman Act. This has led to a significant presence of generic drug manufacturers and a wide range of generic drug options available in the market. The demand for cost-effective treatment options has contributed to the expansion of the bioequivalence market in the region. Patent expirations have opened opportunities for generic drug manufacturers, and stringent regulatory requirements have fostered the development and growth of the bioequivalence market in the region. Healthcare providers and patients in the NA region have a relatively high level of awareness and acceptance of generic drugs, which has contributed to the larger market size in the region.

Asia Pacific is expected to witness the fastest growth in the global bioequivalence studies market with a CAGR of over 10.9%. The APAC region is home to a large and rapidly growing population, leading to an increasing demand for healthcare services and medications. Economic development and healthcare infrastructure has improved healthcare facilities, expanded pharmaceutical manufacturing capabilities, and improved distribution networks. Additionally, the region has experienced a favorable regulatory environment, which has attracted pharmaceutical companies to invest in the region and has facilitated the growth of the bioequivalence market. Additionally, the APAC region has witnessed an increasing acceptance and adoption of generic drugs, leading to increased outsourcing opportunities and market potential. Furthermore, the APAC region encompasses diverse and rapidly developing markets, offering significant market potential due to their population size, increasing healthcare investments, and evolving regulatory frameworks.

The key players operating in the market are CliniExperts, ProRelix Services LLP, IQVIA, ICON plc, Charles River Laboratories, Labcorp Drug Development, KYMOS Group, Veeda Clinical Research, Notrox Research, Malvern Panalytical Ltd., and Synova Health, among others. The global bioequivalence studies market has observed several strategic alliances between companies to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL BIOEQUIVALENCE STUDIES MARKET, BY MOLECULE TYPE

4.1 Introduction

4.2 Bioequivalence Studies Market: Molecule Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Small Molecules

4.4.1 Small Molecules Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Large Molecules

4.5.1 Large Molecules Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL BIOEQUIVALENCE STUDIES MARKET, BY DOSAGE FORM

5.1 Introduction

5.2 Bioequivalence Studies Market: Dosage Form Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Topical Products

5.4.1 Topical Products Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Parenteral Formulations

5.5.1 Parenteral Formulations Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Solid Oral Dosage

5.6.1 Solid Oral Dosage Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Other Forms

5.7.1 Other Forms Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL BIOEQUIVALENCE STUDIES MARKET, BY THERAPEUTIC AREA TYPE

6.1 Introduction

6.2 Bioequivalence Studies Market: Therapeutic Area Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Oncology

6.4.1 Oncology Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Neurology

6.5.1 Neurology Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Haematology

6.9.1 Haematology Market Estimates and Forecast, 2020-2028 (USD Million)

6.7 Metabolic Disorders

6.7.1 Metabolic Disorders Market Estimates and Forecast, 2020-2028 (USD Million)

6.8 Immunology

6.8.1 Immunology Market Estimates and Forecast, 2020-2028 (USD Million)

6.9 Other Areas

6.9.1 Other Areas Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL BIOEQUIVALENCE STUDIES MARKET, BY REGION

7.1 Introduction

7.2 North America Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Molecule Type

7.2.2 By Dosage Form

7.2.3 By Therapeutic Area Type

7.2.4 By Country

7.2.4.1 U.S. Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Molecule Type

7.2.4.1.2 By Dosage Form

7.2.4.1.3 By Therapeutic Area Type

7.2.4.2 Canada Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Molecule Type

7.2.4.2.2 By Dosage Form

7.2.4.2.3 By Therapeutic Area Type

7.2.4.3 Mexico Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Molecule Type

7.2.4.3.2 By Dosage Form

7.2.4.3.3 By Therapeutic Area Type

7.3 Europe Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Molecule Type

7.3.2 By Dosage Form

7.3.3 By Therapeutic Area Type

7.3.4 By Country

7.3.4.1 Germany Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Molecule Type

7.3.4.1.2 By Dosage Form

7.3.4.1.3 By Therapeutic Area Type

7.3.4.2 U.K. Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Molecule Type

7.3.4.2.2 By Dosage Form

7.3.4.2.3 By Therapeutic Area Type

7.3.4.3 France Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Molecule Type

7.3.4.3.2 By Dosage Form

7.3.4.3.3 By Therapeutic Area Type

7.3.4.4 Italy Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Molecule Type

7.3.4.4.2 By Dosage Form

7.2.4.4.3 By Therapeutic Area Type

7.3.4.5 Spain Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5.1 By Molecule Type

7.3.4.5.2 By Dosage Form

7.2.4.5.3 By Therapeutic Area Type

7.3.4.6 Netherlands Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Molecule Type

7.3.4.7.2 By Dosage Form

7.2.4.7.3 By Therapeutic Area Type

7.3.4.7 Rest of Europe Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Molecule Type

7.3.4.7.2 By Dosage Form

7.2.4.7.3 By Therapeutic Area Type

7.4 Asia Pacific Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.1 By Molecule Type

7.4.2 By Dosage Form

7.4.3 By Therapeutic Area Type

7.4.4 By Country

7.4.4.1 China Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1.1 By Molecule Type

7.4.4.1.2 By Dosage Form

7.4.4.1.3 By Therapeutic Area Type

7.4.4.2 Japan Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2.1 By Molecule Type

7.4.4.2.2 By Dosage Form

7.4.4.2.3 By Therapeutic Area Type

7.4.4.3 India Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3.1 By Molecule Type

7.4.4.3.2 By Dosage Form

7.4.4.3.3 By Therapeutic Area Type

7.4.4.4 South Korea Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4.1 By Molecule Type

7.4.4.4.2 By Dosage Form

7.4.4.4.3 By Therapeutic Area Type

7.4.4.5 Singapore Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5.1 By Molecule Type

7.4.4.5.2 By Dosage Form

7.4.4.5.3 By Therapeutic Area Type

7.4.4.6 Malaysia Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Molecule Type

7.4.4.7.2 By Dosage Form

7.4.4.7.3 By Therapeutic Area Type

7.4.4.7 Thailand Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Molecule Type

7.4.4.7.2 By Dosage Form

7.4.4.7.3 By Therapeutic Area Type

7.4.4.8 Indonesia Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8.1 By Molecule Type

7.4.4.8.2 By Dosage Form

7.4.4.8.3 By Therapeutic Area Type

7.4.4.9 Vietnam Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9.1 By Molecule Type

7.4.4.9.2 By Dosage Form

7.4.4.9.3 By Therapeutic Area Type

7.4.4.10 Taiwan Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.1 By Molecule Type

7.4.4.10.2 By Dosage Form

7.4.4.10.3 By Therapeutic Area Type

7.4.4.11 Rest of Asia Pacific Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.1 By Molecule Type

7.4.4.11.2 By Dosage Form

7.4.4.11.3 By Therapeutic Area Type

7.5 Middle East and Africa Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 By Molecule Type

7.5.2 By Dosage Form

7.5.3 By Therapeutic Area Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1.1 By Molecule Type

7.5.4.1.2 By Dosage Form

7.5.4.1.3 By Therapeutic Area Type

7.5.4.2 U.A.E. Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2.1 By Molecule Type

7.5.4.2.2 By Dosage Form

7.5.4.2.3 By Therapeutic Area Type

7.5.4.3 Israel Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3.1 By Molecule Type

7.5.4.3.2 By Dosage Form

7.5.4.3.3 By Therapeutic Area Type

7.5.4.4 South Africa Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4.1 By Molecule Type

7.5.4.4.2 By Dosage Form

7.5.4.4.3 By Therapeutic Area Type

7.5.4.5 Rest of Middle East and Africa Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.5.1 By Molecule Type

7.5.4.5.2 By Dosage Form

7.5.4.5.2 By Therapeutic Area Type

7.6 Central & South America Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.1 By Molecule Type

7.7.2 By Dosage Form

7.7.3 By Therapeutic Area Type

7.7.4 By Country

7.7.4.1 Brazil Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.1.1 By Molecule Type

7.7.4.1.2 By Dosage Form

7.7.4.1.3 By Therapeutic Area Type

7.7.4.2 Argentina Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.2.1 By Molecule Type

7.7.4.2.2 By Dosage Form

7.7.4.2.3 By Therapeutic Area Type

7.7.4.3 Chile Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.3.1 By Molecule Type

7.7.4.3.2 By Dosage Form

7.7.4.3.3 By Therapeutic Area Type

7.7.4.4 Rest of Central & South America Bioequivalence Studies Market Estimates and Forecast, 2020-2028 (USD Million)

7.7.4.4.1 By Molecule Type

7.7.4.4.2 By Dosage Form

7.7.4.4.3 By Therapeutic Area Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Synova Health

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Malvern Panalytical Ltd.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Notrox Research

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Charles River Laboratory

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Icon Plc

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Veeda Clinical Research

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 ProRelix Services LLP

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Kymos Group

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 CliniExperts

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Other Companies

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Mllion)

2 Small Molecules Market, By Region, 2020-2028 (USD Mllion)

3 Large Molecules Market, By Region, 2020-2028 (USD Mllion)

4 Global Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Mllion)

5 Topical Products Market, By Region, 2020-2028 (USD Mllion)

6 Parenteral Formulations Market, By Region, 2020-2028 (USD Mllion)

7 Solid Oral Dosage Market, By Region, 2020-2028 (USD Mllion)

8 Other Forms Market, By Region, 2020-2028 (USD Mllion)

9 Global Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Mllion)

10 Oncology Market, By Region, 2020-2028 (USD Mllion)

11 Neurology Market, By Region, 2020-2028 (USD Mllion)

12 Haematology Market, By Region, 2020-2028 (USD Mllion)

13 Metabolic Disorders Market, By Region, 2020-2028 (USD Mllion)

14 Immunology Market, By Region, 2020-2028 (USD Mllion)

15 Other Areas Market, By Region, 2020-2028 (USD Mllion)

16 Regional Analysis, 2020-2028 (USD Mllion)

17 North America Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

18 North America Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

19 North America Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

20 North America Bioequivalence Studies Market, By Country, 2020-2028 (USD Million)

21 U.S Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

22 U.S Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

23 U.S Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

24 Canada Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

25 Canada Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

26 Canada Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

27 Mexico Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

28 Mexico Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

29 Mexico Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

30 Europe Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

31 Europe Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

32 Europe Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

33 Germany Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

34 Germany Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

35 Germany Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

36 UK Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

37 UK Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

38 UK Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

39 France Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

40 France Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

41 France Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

42 Italy Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

43 Italy Bioequivalence Studies Market, By T Dosage Form Type, 2020-2028 (USD Million)

44 Italy Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

45 Spain Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

46 Spain Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

47 Spain Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

48 Rest Of Europe Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

49 Rest Of Europe Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

50 Rest of Europe Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

51 Asia Pacific Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

52 Asia Pacific Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

53 Asia Pacific Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

54 Asia Pacific Bioequivalence Studies Market, By Country, 2020-2028 (USD Million)

55 China Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

56 China Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

57 China Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

58 India Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

59 India Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

60 India Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

61 Japan Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

62 Japan Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

63 Japan Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

64 South Korea Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

65 South Korea Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

66 South Korea Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

67 Middle East and Africa Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

68 Middle East and Africa Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

69 Middle East and Africa Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

70 Middle East and Africa Bioequivalence Studies Market, By Country, 2020-2028 (USD Million)

71 Saudi Arabia Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

72 Saudi Arabia Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

73 Saudi Arabia Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

74 UAE Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

75 UAE Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

76 UAE Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

77 Central & South America Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

78 Central & South America Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

79 Central & South America Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

80 Central & South America Bioequivalence Studies Market, By Country, 2020-2028 (USD Million)

81 Brazil Bioequivalence Studies Market, By Molecule Type, 2020-2028 (USD Million)

82 Brazil Bioequivalence Studies Market, By Dosage Form, 2020-2028 (USD Million)

83 Brazil Bioequivalence Studies Market, By Therapeutic Area Type, 2020-2028 (USD Million)

84 Synova Health: Products & Services Offering

85 Malvern Panalytical Ltd.: Products & Services Offering

86 Notrox Research: Products & Services Offering

87 Charles River Laboratory: Products & Services Offering

88 Icon Plc: Products & Services Offering

89 VEEDA CLINICAL RESEARCH: Products & Services Offering

90 ProRelix Services LLP : Products & Services Offering

91 Kymos Group: Products & Services Offering

92 CliniExperts, Inc: Products & Services Offering

93 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Bioequivalence Studies Market Overview

2 Global Bioequivalence Studies Market Value From 2020-2028 (USD Mllion)

3 Global Bioequivalence Studies Market Share, By Molecule Type (2022)

4 Global Bioequivalence Studies Market Share, By Dosage Form (2022)

5 Global Bioequivalence Studies Market Share, By Therapeutic Area Type (2022)

6 Global Bioequivalence Studies Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Bioequivalence Studies Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Bioequivalence Studies Market

11 Impact Of Challenges On The Global Bioequivalence Studies Market

12 Porter’s Five Forces Analysis

13 Global Bioequivalence Studies Market: By Molecule Type Scope Key Takeaways

14 Global Bioequivalence Studies Market, By Molecule Type Segment: Revenue Growth Analysis

15 Small Molecules Market, By Region, 2020-2028 (USD Mllion)

16 Large Molecules Market, By Region, 2020-2028 (USD Mllion)

17 Global Bioequivalence Studies Market: By Dosage Form Scope Key Takeaways

18 Global Bioequivalence Studies Market, By Dosage Form Segment: Revenue Growth Analysis

19 Topical Products Market, By Region, 2020-2028 (USD Mllion)

20 Parenteral Formulations Market, By Region, 2020-2028 (USD Mllion)

21 Solid Oral Dosage Market, By Region, 2020-2028 (USD Mllion)

22 Other Forms Market, By Region, 2020-2028 (USD Mllion)

23 Global Bioequivalence Studies Market: By Therapeutic Area Type Scope Key Takeaways

24 Global Bioequivalence Studies Market, By Therapeutic Area Type Segment: Revenue Growth Analysis

25 Oncology Market, By Region, 2020-2028 (USD Mllion)

26 Neurology Market, By Region, 2020-2028 (USD Mllion)

27 Haematology Market, By Region, 2020-2028 (USD Mllion)

28 Metabolic Disorders Market, By Region, 2020-2028 (USD Mllion)

29 Immunology Market, By Region, 2020-2028 (USD Mllion)

30 Other Areas Market, By Region, 2020-2028 (USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global Bioequivalence Studies Market: Regional Analysis

33 North America Bioequivalence Studies Market Overview

34 North America Bioequivalence Studies Market, By Molecule Type

35 North America Bioequivalence Studies Market, By Dosage Form

36 North America Bioequivalence Studies Market, By Therapeutic Area Type

37 North America Bioequivalence Studies Market, By Country

38 U.S. Bioequivalence Studies Market, By Molecule Type

39 U.S. Bioequivalence Studies Market, By Dosage Form

40 U.S. Bioequivalence Studies Market, By Therapeutic Area Type

41 Canada Bioequivalence Studies Market, By Molecule Type

42 Canada Bioequivalence Studies Market, By Dosage Form

43 Canada Bioequivalence Studies Market, By Therapeutic Area Type

44 Mexico Bioequivalence Studies Market, By Molecule Type

45 Mexico Bioequivalence Studies Market, By Dosage Form

46 Mexico Bioequivalence Studies Market, By Therapeutic Area Type

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 Synova Health: Company Snapshot

50 Synova Health: SWOT Analysis

51 Synova Health: Geographic Presence

52 Malvern Panalytical Ltd.: Company Snapshot

53 Malvern Panalytical Ltd.: SWOT Analysis

54 Malvern Panalytical Ltd.: Geographic Presence

55 Notrox Research: Company Snapshot

56 Notrox Research: SWOT Analysis

57 Notrox Research: Geographic Presence

58 Charles River Laboratory: Company Snapshot

59 Charles River Laboratory: Swot Analysis

60 Charles River Laboratory: Geographic Presence

61 Icon Plc: Company Snapshot

62 Icon Plc: SWOT Analysis

63 Icon Plc: Geographic Presence

64 Veeda Clinical Research: Company Snapshot

65 Veeda Clinical Research: SWOT Analysis

66 Veeda Clinical Research: Geographic Presence

67 ProRelix Services LLP : Company Snapshot

68 ProRelix Services LLP : SWOT Analysis

69 ProRelix Services LLP : Geographic Presence

70 Kymos Group: Company Snapshot

71 Kymos Group: SWOT Analysis

72 Kymos Group: Geographic Presence

73 CliniExperts, Inc.: Company Snapshot

74 CliniExperts, Inc.: SWOT Analysis

75 CliniExperts, Inc.: Geographic Presence

76 Other Companies: Company Snapshot

77 Other Companies: SWOT Analysis

78 Other Companies: Geographic Presence

The Global Bioequivalence Studies Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bioequivalence Studies Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS