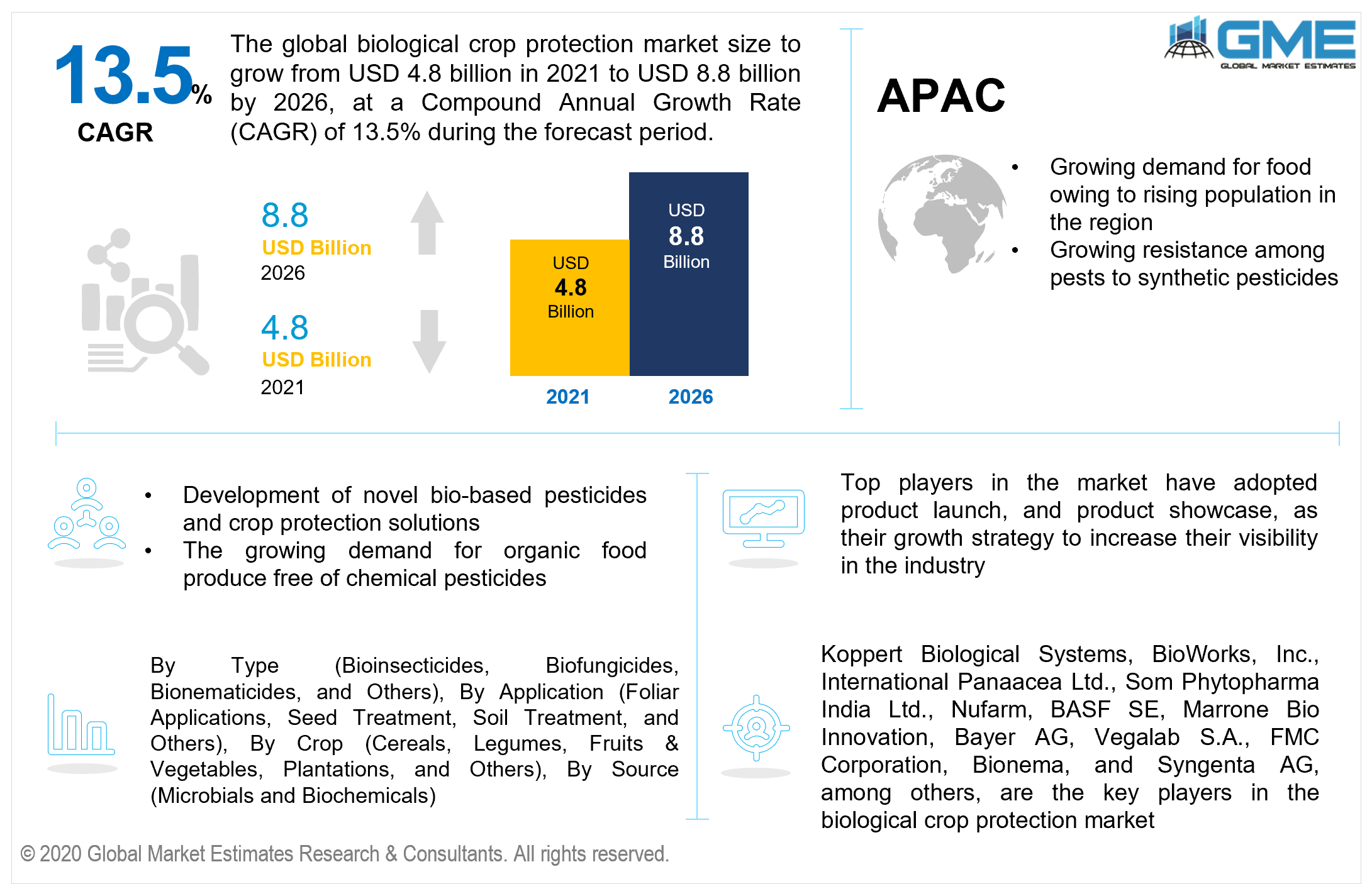

Global Biological Crop Protection Market Size, Trends & Analysis - Forecasts to 2026 By Type (Bioinsecticides, Biofungicides, Bionematicides, and Others), By Application (Foliar Applications, Seed Treatment, Soil Treatment, and Others), By Crop (Cereals, Legumes, Fruits & Vegetables, Plantations, and Others), By Source (Microbials and Biochemicals), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global biological crop protection market is projected to grow from USD 4.8 billion in 2021 to USD 8.8 billion by 2026 at a CAGR value of 13.5%. The agricultural industry has historically relied on pesticides to protect its produce. Growing environmental concerns from the use of pesticides have culminated in the industry looking to biological and environment-friendly methods to protect crops from pests. Chemical pesticides and other crop protection solutions are culpable of various environmental and health issues. These pesticides often leach into the soil causing damage to the environment as the pesticides will eventually end up in water bodies such as groundwater, rivers, and lakes. Prolonged consumption of pesticides can result in a chemical build-up within the organisms consuming these products and will eventually accumulate within the human body causing various health issues. These concerns have resulted in the formulation of stringent regulations concerning the production and usage of pesticides over the years. Biological crop protection methods such as the use of biopesticides are becoming increasingly popular owing to their lower environmental footprint and reduced impact on human life.

The growing demand for agricultural produce from the increasing human population across the globe is one of the major drivers of crop protection. Rapid industrialization, urbanization, and the growing number of supply chain solutions have further increased the demand for agricultural produce. Synthetic pesticides and crop protection techniques are being heavily scrutinized by regulatory bodies with many pesticides such as captan, diuron, chlorpyrifos, and DDT, among others getting banned in many countries across the globe. The development of novel synthetic crop protection solutions is becoming increasingly expensive as they require various approvals that require intensive testing and data collection from the manufacturer’s end. Biopesticides and biological crop protection techniques are relatively less expensive and are faster to develop than their synthetic counterpart.

Pests are building tolerance to chemical pesticides which have resulted in the agricultural industry using greater concentrations and quantities of pesticides to deal with pests. Regulations prevent the over usage of such pesticides which is expected to further enhance the demand for biopesticides and other biological crop protection solutions.

Synthetic crop protection solutions have higher efficiency and are more cost-effective than biopesticides and other biological solutions in the short run which will hamper the growth of the market.

The COVID-19 pandemic had initially resulted in the industry taking a hit owing to lockdowns and supply chain restrictions. But, food crops are essential and sanctions to ensure food supply have lessened the impact of COVID-19 on the biological crop protection industry compared to other industries.

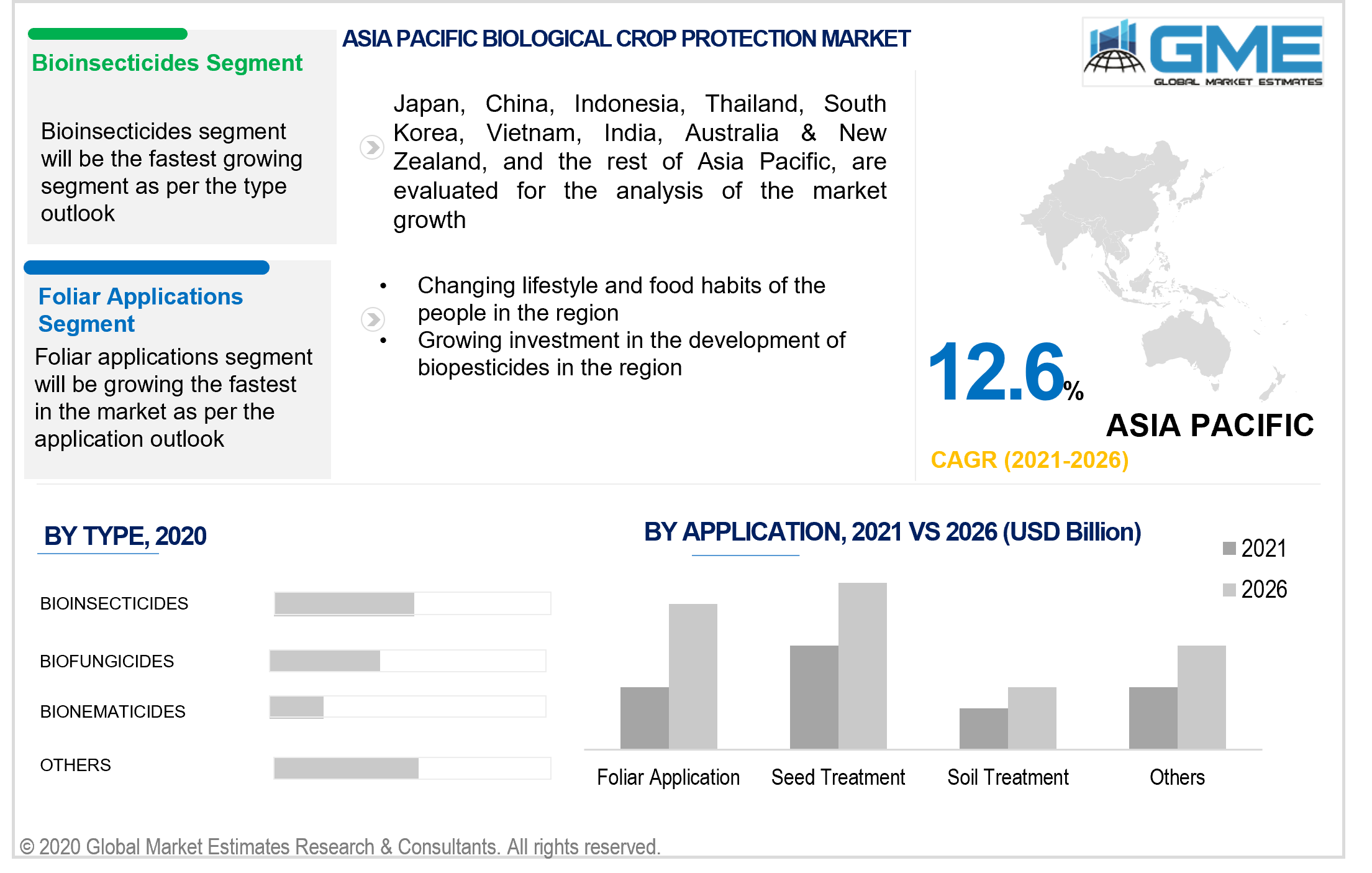

Based on the type of protection solution used, the market is segmented into bioinsecticides, biofungicides, bionematicides, and others. The bioinsecticides segment is envisaged to hold the lion’s share of the biological crop protection market and is anticipated to become the fastest-growing market too during the forecast period. Biopesticides are in high demand owing to the growing number of farmers opting for environmentally safe bioinsecticides over synthetic insecticides. Insects are some of the most common pests that harm crops and insecticides are highly sought out by farmers which is one of the leading factors for the growth of this segment.

Based on the various applications, the market is segmented into foliar applications, seed treatment, soil treatment, and others. The foliar applications segment is envisaged to grow significantly faster than the other segments during the forecast period. Application of crop protection solutions like biopesticides directly on the leaves allows for the most efficient method for eliminating pests like insects and other smaller organisms. The foliar application also prevents pollution of soil and minimizes the risk of the chemicals contaminating the environment. The relative ease of foliar application compared to other application segments has also contributed to the growing demand for this segment.

Based on the type of crop, the market is segmented into cereals, legumes, fruits & vegetables, plantations, and others. The fruits and vegetable segment is expected to hold the dominant share of the biological crop protection market. Fruits and vegetables are highly perishable and without proper protection against pests, entire yields can be ruined. Fruits and vegetables are always in high demand and their demand will only increase owing to the growing population. The growing demand for organic food and pesticide-free vegetables and fruits is expected to further drive the demand for biological crop protection measures.

Based on the source, the market is segmented into microbial and biochemicals. The biochemicals segment is expected to register the largest share of the market owing to the relative ease of synthesis and quicker results compared to microbial-based solutions.

Based on region, the market is segmented into various regions such as North America, Europe, Central and South America, Middle East and Africa, and Asia Pacific regions. The North American region is expected to hold the dominant share of the market. The growing demand for environment-friendly biopesticides, growing demand for green growth processes, and stringent government regulations in the region have led to the dominance of the North American region in the biological crop protection market.

The European region is anticipated to grow at the fastest rate during the forecast period. The European Union’s stringent policies on the quality of food and their proactive measures to mitigate harm from the use of synthetic pesticides are expected to be the major drivers of the biological crop protection market in the region.

Koppert Biological Systems, BioWorks, Inc., International Panaacea Ltd., Som Phytopharma India Ltd., Nufarm, BASF SE, Marrone Bio Innovation, Bayer AG, Vegalab S.A., FMC Corporation, Bionema, and Syngenta AG, among others, are the key players in the biological crop protection market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Biological Crop Protection Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Crop Overview

2.1.5 Source Overview

2.1.6 Regional Overview

Chapter 3 Biological Crop Protection Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for pesticide-free and organic fruits and vegetables

3.3.2 Industry Challenges

3.3.2.1 Synthetic pesticides are perceived to be more efficient and more cost-effective in the short run

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Crop Growth Scenario

3.4.4 Source Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Source Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Biological Crop Protection Market, By Type

4.1 Type Outlook

4.2 Bioinsecticides

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Biofungicides

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Bionematicides

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Biological Crop Protection Market, By Crop

5.1 Crop Outlook

5.2 Cereals

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Legumes

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Fruits & Vegetables

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Plantations

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Other

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Biological Crop Protection Market, By Application

6.1 Application Outlook

6.2 Foliar Applications

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Seed Treatment

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Soil Treatment

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Other

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Biological Crop Protection Market, By Source

7.1 Microbials

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Biochemicals

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Biological Crop Protection Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Type, 2020-2026 (USD Billion)

8.2.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4 Market Size, By Crop, 2020-2026 (USD Billion)

8.2.5 Market Size, By Source, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By Crop, 2020-2026 (USD Billion)

Market Size, By Source, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Source, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Type, 2020-2026 (USD Billion)

8.3.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.4 Market Size, By Crop, 2020-2026 (USD Billion)

8.3.5 Market Size, By Source, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Source, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Source, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Source, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Source, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Source, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Source, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Type, 2020-2026 (USD Billion)

8.4.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.4 Market Size, By Crop, 2020-2026 (USD Billion)

8.4.5 Market Size, By Source, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Source, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Source, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Source, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Source, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Source, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Type, 2020-2026 (USD Billion)

8.5.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.4 Market Size, By Crop, 2020-2026 (USD Billion)

8.5.5 Market Size, By Source, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Source, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Source, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Source, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Type, 2020-2026 (USD Billion)

8.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.4 Market Size, By Crop, 2020-2026 (USD Billion)

8.6.5 Market Size, By Source, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Source, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Source, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Crop, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Source, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Koppert Biological Systems

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 BioWorks, Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 International Panacea Ltd.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Som Phytopharma India Ltd.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Nufarm

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 BASF SE

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Marrone Bio Innovation

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Bayer AG

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Vegalab S.A.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Biological Crop Protection Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biological Crop Protection Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS