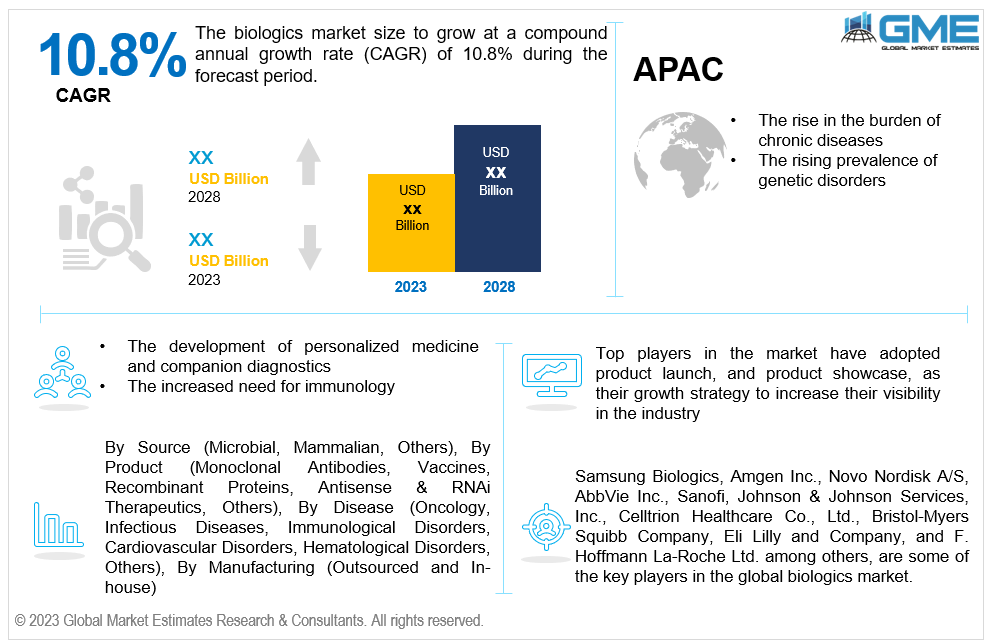

Global Biologics Market Size, Trends & Analysis - Forecasts to 2028 By Source (Microbial, Mammalian, and Others), By Product (Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense & RNAi Therapeutics, and Others), By Disease (Oncology, Infectious Diseases, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, and Others), By Manufacturing (Outsourced and In-house), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global biologics market is projected to grow at a CAGR of 10.8% from 2023 to 2028.

The most recent scientific advances are supported by biologics, which are at the cutting edge of research. Such discoveries are anticipated to develop creative therapies that provide patients with new therapeutic alternatives. The biologics sector includes companies that create biological goods using human DNA and genetically modified proteins. Biologics are subject to testing, safety, effectiveness, marketing, and patenting laws and regulations. Biologic goods are derived from natural sources, such as human, animal, and microbial sources, employing biotechnological procedures and other cutting-edge technologies. These substances control how vital proteins are made, affect human hormones and cell behaviour, and produce substances that activate and suppress the immune system. Furthermore, they change the normal biological intracellular and cellular functions.

The rise in the burden of chronic diseases, growing prevalence of genetic disorders, and the increasing development of personalized medicine and companion diagnostics are expected to support the growth of the market during the forecast period. Moreover, the increased need for immunology, rising expenditure on manufacturing facilities, and robust research and development activities for the development of oral biologics are propelling growth of the market.

Technologies like artificial intelligence (AI), machine learning (ML), cloud-based platforms for treatment, and other software-assisted platforms are some of those paving the way for the creation of new goods and opening up new prospects for market expansion. Additionally, using these technologies creates many opportunities for established market participants and newcomers. However, the market growth is expected to be hampered due to pricing pressure from regulators and a lack of knowledge about biosimilars among primary care physicians and specialists.

Gene therapy is a prominent option in managing genetic illnesses since it provides a more long-lasting therapeutic strategy. As a result, several possible gene treatments are currently undergoing clinical testing. For instance, according to the American Gene & Cell Therapy, 1,745 gene treatments were in various stages of research, from preclinical to preregistration until May 2021. This demonstrates the abundance of possible therapeutics that might enter the market in the upcoming years, supporting the expansion of the biologics industry during the forecast period.

The global biologics market is expected to witness the fastest growth over the next several years due to the productivity of small molecules and the decline in medicinal research and development. The major pharmaceutical companies are concentrating on launching and developing several biopharmaceutical drugs to retain their market image and position. Additionally, scientists and researchers are studying additional species and varieties of biological therapies. The development of reagents and cells that increase the total productivity of biological therapies is expected to drive market growth.

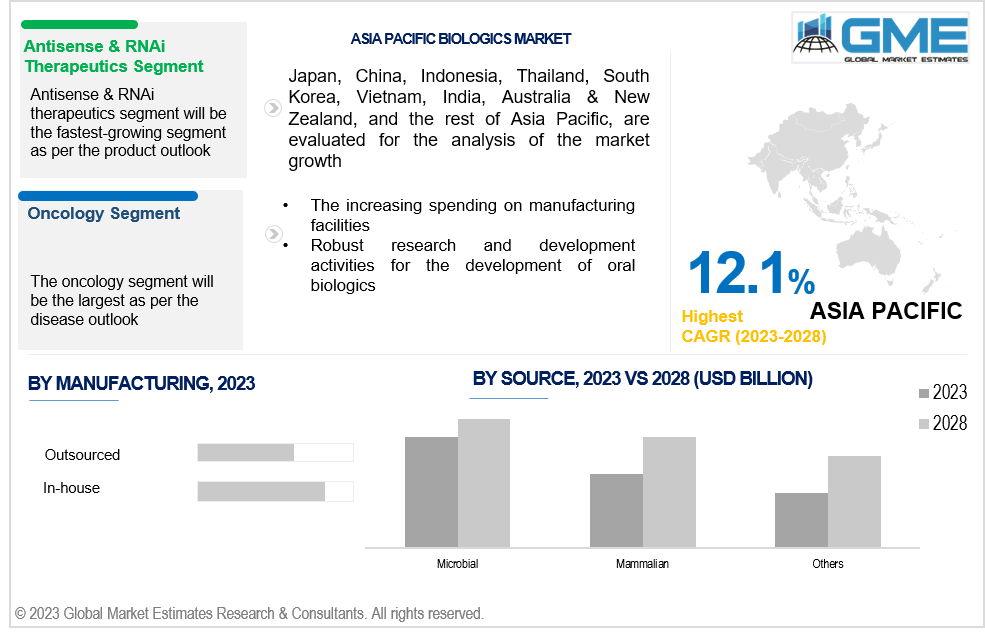

The mammalian segment is expected to be the fastest-growing segment in the market from 2023-2028. The development of technologies for producing mammalian cell lines is one of the primary factors driving the segment growth. The two most often utilized mammalian cell lines are CHO and HEK. These expression systems are primarily employed in producing recombinant proteins and vaccines based on viral vectors.

The microbial segment is expected to hold the largest share of the market. The bulk of biologics that are now authorized are created and produced using microbial expression methods. Due to their adaptability and affordability, several market companies have used microbial cell lines, particularly E. coli, to create a strong biologics pipeline.

The antisense and RNAi therapeutics software segment is anticipated to be the fastest-growing segment in the market from 2023-2028. These biologic products make targeted and effective gene silencing possible, which has sped up the creation and approval of a wide range of gene-silencing medications for genetic illnesses. For instance, in June 2022, the U.S. FDA approved Alnylam Pharmaceuticals, Inc.'s RNAi therapy AMVUTTRA for the treatment of polyneuropathy attributed to familial transthyretin-mediated amyloidosis.

The monoclonal antibodies segment is anticipated to hold the largest share of the market. Healthy cells can be targeted with MABs without suffering any adverse effects. Most biologic drugs that have been authorized so far fall within the category of monoclonal antibodies. The U.S. FDA achieved a significant milestone in 2021 when it approved its 100th monoclonal antibody product, six years after clearing its 50th product in 2015. The market was dominated by humanized monoclonal antibodies because they are less likely than murine or chimeric antibodies to trigger an immunological reaction.

The hematological disorder segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The increasing approvals of gene therapies for uncommon blood diseases like hemophilia is expected to drive the segment growth. For instance, the Hemgenix drug from CSL Behring was approved by the U.S. FDA approval in November 2022. It is indicated for people with haemophilia B. Additionally, in August 2022, Europe authorized BioMarin's ROCTAVIAN for the treatment of hemophilia A. Giroctocogene fitelparovec and fidanacogene elaparvovec, two Pfizer products, are in phase 3 studies for type A and type B hemophilia, respectively.

The oncology segment is expected to hold the largest share of the market. The prostate, breast, lung, and colorectal cancers are the most prevalent. In treating many malignancies, biological therapy is used to halt or postpone the growth of the tumor and halt the spread of illness. The adverse effects of biological therapy are typically less severe than those of other cancer treatments. Cancer biological therapy aims to enliven the immune system to find and destroy cancer cells. The American Cancer Society claims that around 1.92 million new cancer cases and 609,360 cancer-related deaths were reported in the United States in 2022. With a projected 9.6 million deaths from cancer globally in 2020, it is the second-largest cause of death.

The outsourcing segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Numerous CDMOs have constructed modern biologics production facilities, including WuXI Biologics, Lonza, and Samsung Biologics. Working with these CDMOs gives businesses access to manufacturing professionals, facilitating the effective development of downstream processes and the adoption of new technology. The rise in CDMOs and their increased production capacity substantially impact market growth. For instance, WuXi Biologics opened its integrated biologics center in Shanghai in November 2022. End-to-end biologics development facilities, such as product development, quality control, and manufacturing, will be provided by the 1.6 million-square-foot complex.

The in-house segment is expected to hold the largest share of the market. Manufacturing biologic drugs is more complicated than manufacturing small compounds since it uses living microorganism cultures and must go by stringent regulatory standards. The benefit of direct control provided by in-house production allows for daily monitoring of biologic drugs.

North America is expected to be the largest region in the market. This is due to the high prevalence of chronic illnesses, presence of several top biopharmaceutical businesses, attractive reimbursement rules, and large investments in R&D. According to a JAMA Network report, 37% of all pharma spending in the U.S. are on biologics. Some of the factors influencing the market expansion include an increase in the percentage of biologic prescriptions and rising investments in the development of targeted medications.

Asia Pacific is predicted to witness rapid growth during the forecast period. The rising incidence of diseases like cancer, diabetes, and cardiovascular diseases in the Asia Pacific, coupled with a rise in the geriatric population have increased the need for biologics. Market players in the sector are prioritizing meeting this need and investing heavily in the creation of cutting-edge biologic goods. The adoption of biosimilars, which is a key factor in improving the accessibility and cost of biologic therapies, is a significant growth driver for market growth.

Samsung Biologics, Amgen Inc., Novo Nordisk A/S, AbbVie Inc., Sanofi, Johnson & Johnson Services, Inc., Celltrion Healthcare Co., Ltd., Bristol-Myers Squibb Company, Eli Lilly and Company, and F. Hoffmann La-Roche Ltd. among others, are some of the key players operating in the global biologics market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL BIOLOGICS MARKET, BY SOURCE

4.2 Biologics Market: Source Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Microbial Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Mammalian Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL BIOLOGICS MARKET, BY PRODUCT

5.2 Biologics Market: Product Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Monoclonal Antibodies Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Vaccines Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Recombinant Proteins Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Antisense & RNAi Therapeutics

5.7.1 Antisense & RNAi Therapeutics Market Estimates and Forecast, 2020-2028 (USD Million)

5.8.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL BIOLOGICS MARKET, BY DISEASE

6.2 Biologics Market: Disease Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Oncology Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Infectious Diseases Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Immunological Disorders Market Estimates and Forecast, 2020-2028 (USD Million)

6.7.1 Cardiovascular Disorders Market Estimates and Forecast, 2020-2028 (USD Million)

6.8.1 Hematological Disorders Market Estimates and Forecast, 2020-2028 (USD Million)

6.9.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL BIOLOGICS MARKET, BY MANUFACTURING

7.2 Biologics Market: Manufacturing Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 Outsourced Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 In-house Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL BIOLOGICS MARKET, BY REGION

8.2 North America Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1 U.S. Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.2 Canada Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.3 Mexico Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3 Europe Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1 Germany Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.3 France Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.4 Italy Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.5 Spain Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.6 Netherlands Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.7 Rest of Europe Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4 Asia Pacific Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.1 China Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.2 Japan Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.3 India Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.4 South Korea Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.5 Singapore Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.6 Malaysia Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.7 Thailand Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.8 Indonesia Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.9 Vietnam Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.10 Taiwan Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.11 Rest of Asia Pacific Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5 Middle East and Africa Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.1 Saudi Arabia Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.2 U.A.E. Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.3 Israel Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.4 South Africa Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6 Central & South America Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.1 Brazil Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.2 Argentina Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.3 Chile Biologics Market Estimates and Forecast, 2020-2028 (USD Million)

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 JOHNSON & JOHNSON SERVICES, INC.

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Celltrion Healthcare Co., Ltd.

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Bristol-Myers Squibb Company

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 F. Hoffmann La-Roche Ltd.

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11.1 Business Description & Financial Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & Segmentation

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Biologics Market, By Source, 2020-2028 (USD Mllion)

2 Microbial Market, By Region, 2020-2028 (USD Mllion)

3 Mammalian Market, By Region, 2020-2028 (USD Mllion)

4 Others Market, By Region, 2020-2028 (USD Mllion)

5 Global Biologics Market, By Product, 2020-2028 (USD Mllion)

6 Monoclonal Antibodies Market, By Region, 2020-2028 (USD Mllion)

7 Vaccines Market, By Region, 2020-2028 (USD Mllion)

8 Recombinant Proteins Market, By Region, 2020-2028 (USD Mllion)

9 Antisense & RNAi Therapeutics Market, By Region, 2020-2028 (USD Mllion)

10 Others Market, By Region, 2020-2028 (USD Mllion)

11 Global Biologics Market, By Disease, 2020-2028 (USD Mllion)

12 Oncology Market, By Region, 2020-2028 (USD Mllion)

13 Infectious Diseases Market, By Region, 2020-2028 (USD Mllion)

14 Immunological Disorders Market, By Region, 2020-2028 (USD Mllion)

15 Cardiovascular Disorders Market, By Region, 2020-2028 (USD Mllion)

16 Hematological Disorders Market, By Region, 2020-2028 (USD Mllion)

17 Others Market, By Region, 2020-2028 (USD Mllion)

18 Global Biologics Market, By MANUFACTURING, 2020-2028 (USD Mllion)

19 Outsourced Market, By Region, 2020-2028 (USD Mllion)

20 In-house Market, By Region, 2020-2028 (USD Mllion)

21 Regional Analysis, 2020-2028 (USD Mllion)

22 North America Biologics Market, By Source, 2020-2028 (USD Million)

23 North America Biologics Market, By Product, 2020-2028 (USD Million)

24 North America Biologics Market, By Disease, 2020-2028 (USD Million)

25 North America Biologics Market, By Manufacturing, 2020-2028 (USD Million)

26 North America Biologics Market, By Country, 2020-2028 (USD Million)

27 U.S Biologics Market, By Source, 2020-2028 (USD Million)

28 U.S Biologics Market, By Product, 2020-2028 (USD Million)

29 U.S Biologics Market, By Disease, 2020-2028 (USD Million)

30 U.S Biologics Market, By Manufacturing, 2020-2028 (USD Million)

31 Canada Biologics Market, By Source, 2020-2028 (USD Million)

32 Canada Biologics Market, By Product, 2020-2028 (USD Million)

33 Canada Biologics Market, By Disease, 2020-2028 (USD Million)

34 CANADA Biologics Market, By Manufacturing, 2020-2028 (USD Million)

35 Mexico Biologics Market, By Source, 2020-2028 (USD Million)

36 Mexico Biologics Market, By Product, 2020-2028 (USD Million)

37 Mexico Biologics Market, By Disease, 2020-2028 (USD Million)

38 mexico Biologics Market, By Manufacturing, 2020-2028 (USD Million)

39 Europe Biologics Market, By Source, 2020-2028 (USD Million)

40 Europe Biologics Market, By Product, 2020-2028 (USD Million)

41 Europe Biologics Market, By Disease, 2020-2028 (USD Million)

42 europe Biologics Market, By Manufacturing, 2020-2028 (USD Million)

43 Germany Biologics Market, By Source, 2020-2028 (USD Million)

44 Germany Biologics Market, By Product, 2020-2028 (USD Million)

45 Germany Biologics Market, By Disease, 2020-2028 (USD Million)

46 germany Biologics Market, By Manufacturing, 2020-2028 (USD Million)

47 UK Biologics Market, By Source, 2020-2028 (USD Million)

48 UK Biologics Market, By Product, 2020-2028 (USD Million)

49 UK Biologics Market, By Disease, 2020-2028 (USD Million)

50 U.kBiologics Market, By Manufacturing, 2020-2028 (USD Million)

51 France Biologics Market, By Source, 2020-2028 (USD Million)

52 France Biologics Market, By Product, 2020-2028 (USD Million)

53 France Biologics Market, By Disease, 2020-2028 (USD Million)

54 france Biologics Market, By Manufacturing, 2020-2028 (USD Million)

55 Italy Biologics Market, By Source, 2020-2028 (USD Million)

56 Italy Biologics Market, By T Product Type, 2020-2028 (USD Million)

57 Italy Biologics Market, By Disease, 2020-2028 (USD Million)

58 italy Biologics Market, By Manufacturing, 2020-2028 (USD Million)

59 Spain Biologics Market, By Source, 2020-2028 (USD Million)

60 Spain Biologics Market, By Product, 2020-2028 (USD Million)

61 Spain Biologics Market, By Disease, 2020-2028 (USD Million)

62 spain Biologics Market, By Manufacturing, 2020-2028 (USD Million)

63 Rest Of Europe Biologics Market, By Source, 2020-2028 (USD Million)

64 Rest Of Europe Biologics Market, By Product, 2020-2028 (USD Million)

65 Rest of Europe Biologics Market, By Disease, 2020-2028 (USD Million)

66 REST OF EUROPE Biologics Market, By Manufacturing, 2020-2028 (USD Million)

67 Asia Pacific Biologics Market, By Source, 2020-2028 (USD Million)

68 Asia Pacific Biologics Market, By Product, 2020-2028 (USD Million)

69 Asia Pacific Biologics Market, By Disease, 2020-2028 (USD Million)

70 asia Biologics Market, By Manufacturing, 2020-2028 (USD Million)

71 Asia Pacific Biologics Market, By Country, 2020-2028 (USD Million)

72 China Biologics Market, By Source, 2020-2028 (USD Million)

73 China Biologics Market, By Product, 2020-2028 (USD Million)

74 China Biologics Market, By Disease, 2020-2028 (USD Million)

75 china Biologics Market, By Manufacturing, 2020-2028 (USD Million)

76 India Biologics Market, By Source, 2020-2028 (USD Million)

77 India Biologics Market, By Product, 2020-2028 (USD Million)

78 India Biologics Market, By Disease, 2020-2028 (USD Million)

79 india Biologics Market, By Manufacturing, 2020-2028 (USD Million)

80 Japan Biologics Market, By Source, 2020-2028 (USD Million)

81 Japan Biologics Market, By Product, 2020-2028 (USD Million)

82 Japan Biologics Market, By Disease, 2020-2028 (USD Million)

83 japan Biologics Market, By Manufacturing, 2020-2028 (USD Million)

84 South Korea Biologics Market, By Source, 2020-2028 (USD Million)

85 South Korea Biologics Market, By Product, 2020-2028 (USD Million)

86 South Korea Biologics Market, By Disease, 2020-2028 (USD Million)

87 south korea Biologics Market, By Manufacturing, 2020-2028 (USD Million)

88 Middle East and Africa Biologics Market, By Source, 2020-2028 (USD Million)

89 Middle East and Africa Biologics Market, By Product, 2020-2028 (USD Million)

90 Middle East and Africa Biologics Market, By Disease, 2020-2028 (USD Million)

91 MIDDLE EAST AND AFRICA Biologics Market, By Manufacturing, 2020-2028 (USD Million)

92 Middle East and Africa Biologics Market, By Country, 2020-2028 (USD Million)

93 Saudi Arabia Biologics Market, By Source, 2020-2028 (USD Million)

94 Saudi Arabia Biologics Market, By Product, 2020-2028 (USD Million)

95 Saudi Arabia Biologics Market, By Disease, 2020-2028 (USD Million)

96 saudi arabia Biologics Market, By Manufacturing, 2020-2028 (USD Million)

97 UAE Biologics Market, By Source, 2020-2028 (USD Million)

98 UAE Biologics Market, By Product, 2020-2028 (USD Million)

99 UAE Biologics Market, By Disease, 2020-2028 (USD Million)

100 uae Biologics Market, By Manufacturing, 2020-2028 (USD Million)

101 Central & South America Biologics Market, By Source, 2020-2028 (USD Million)

102 Central & South America Biologics Market, By Product, 2020-2028 (USD Million)

103 Central & South America Biologics Market, By Disease, 2020-2028 (USD Million)

104 CENTRAL & SOUTH AMERICA Biologics Market, By Manufacturing, 2020-2028 (USD Million)

105 Central & South America Biologics Market, By Country, 2020-2028 (USD Million)

106 Brazil Biologics Market, By Source, 2020-2028 (USD Million)

107 Brazil Biologics Market, By Product, 2020-2028 (USD Million)

108 Brazil Biologics Market, By Disease, 2020-2028 (USD Million)

109 brazil Biologics Market, By Manufacturing, 2020-2028 (USD Million)

110 Samsung Biologics: Products & Services Offering

111 Amgen Inc.: Products & Services Offering

112 Novo Nordisk A/S: Products & Services Offering

113 AbbVie Inc.: Products & Services Offering

114 Sanofi: Products & Services Offering

115 JOHNSON & JOHNSON SERVICES, INC.: Products & Services Offering

116 Celltrion Healthcare Co., Ltd. : Products & Services Offering

117 Bristol-Myers Squibb Company: Products & Services Offering

118 Eli Lilly and Company, Inc: Products & Services Offering

119 F. Hoffmann La-Roche Ltd.: Products & Services Offering

120 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Biologics Market Overview

2 Global Biologics Market Value From 2020-2028 (USD Mllion)

3 Global Biologics Market Share, By Source (2022)

4 Global Biologics Market Share, By Product (2022)

5 Global Biologics Market Share, By Disease (2022)

6 Global Biologics Market Share, By Manufacturing (2022)

7 Global Biologics Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Biologics Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Biologics Market

12 Impact Of Challenges On The Global Biologics Market

13 Porter’s Five Forces Analysis

14 Global Biologics Market: By Source Scope Key Takeaways

15 Global Biologics Market, By Source Segment: Revenue Growth Analysis

16 Microbial Market, By Region, 2020-2028 (USD Mllion)

17 Mammalian Market, By Region, 2020-2028 (USD Mllion)

18 Others Market, By Region, 2020-2028 (USD Mllion)

19 Global Biologics Market: By Product Scope Key Takeaways

20 Global Biologics Market, By Product Segment: Revenue Growth Analysis

21 Monoclonal Antibodies Market, By Region, 2020-2028 (USD Mllion)

22 Vaccines Market, By Region, 2020-2028 (USD Mllion)

23 Recombinant Proteins Market, By Region, 2020-2028 (USD Mllion)

24 Antisense & RNAi Therapeutics Market, By Region, 2020-2028 (USD Mllion)

25 Others Market, By Region, 2020-2028 (USD Mllion)

26 Global Biologics Market: By Disease Scope Key Takeaways

27 Global Biologics Market, By Disease Segment: Revenue Growth Analysis

28 Oncology Market, By Region, 2020-2028 (USD Mllion)

29 Infectious Diseases Market, By Region, 2020-2028 (USD Mllion)

30 Immunological Disorders Market, By Region, 2020-2028 (USD Mllion)

31 Cardiovascular Disorders Market, By Region, 2020-2028 (USD Mllion)

32 Hematological Disorders Market, By Region, 2020-2028 (USD Mllion)

33 Others Market, By Region, 2020-2028 (USD Mllion)

34 Global Biologics Market: By Manufacturing Scope Key Takeaways

35 Global Biologics Market, By Manufacturing Segment: Revenue Growth Analysis

36 Outsourced Market, By Region, 2020-2028 (USD Mllion)

37 In-house Market, By Region, 2020-2028 (USD Mllion)

38 Regional Segment: Revenue Growth Analysis

39 Global Biologics Market: Regional Analysis

40 North America Biologics Market Overview

41 North America Biologics Market, By Source

42 North America Biologics Market, By Product

43 North America Biologics Market, By Disease

44 North America Biologics Market, By Manufacturing

45 North America Biologics Market, By Country

46 U.S. Biologics Market, By Source

47 U.S. Biologics Market, By Product

48 U.S. Biologics Market, By Disease

49 U.S. Biologics Market, By Manufacturing

50 Canada Biologics Market, By Source

51 Canada Biologics Market, By Product

52 Canada Biologics Market, By Disease

53 Canada Biologics Market, By Manufacturing

54 Mexico Biologics Market, By Source

55 Mexico Biologics Market, By Product

56 Mexico Biologics Market, By Disease

57 Mexico Biologics Market, By Manufacturing

58 Four Quadrant Positioning Matrix

59 Company Market Share Analysis

60 Samsung Biologics: Company Snapshot

61 Samsung Biologics: SWOT Analysis

62 Samsung Biologics: Geographic Presence

63 Amgen Inc.: Company Snapshot

64 Amgen Inc.: SWOT Analysis

65 Amgen Inc.: Geographic Presence

66 Novo Nordisk A/S: Company Snapshot

67 Novo Nordisk A/S: SWOT Analysis

68 Novo Nordisk A/S: Geographic Presence

69 AbbVie Inc.: Company Snapshot

70 AbbVie Inc.: Swot Analysis

71 AbbVie Inc.: Geographic Presence

72 Sanofi: Company Snapshot

73 Sanofi: SWOT Analysis

74 Sanofi: Geographic Presence

75 JOHNSON & JOHNSON SERVICES, INC.: Company Snapshot

76 JOHNSON & JOHNSON SERVICES, INC.: SWOT Analysis

77 JOHNSON & JOHNSON SERVICES, INC.: Geographic Presence

78 Celltrion Healthcare Co., Ltd. : Company Snapshot

79 Celltrion Healthcare Co., Ltd. : SWOT Analysis

80 Celltrion Healthcare Co., Ltd. : Geographic Presence

81 Bristol-Myers Squibb Company: Company Snapshot

82 Bristol-Myers Squibb Company: SWOT Analysis

83 Bristol-Myers Squibb Company: Geographic Presence

84 Eli Lilly and Company, Inc.: Company Snapshot

85 Eli Lilly and Company, Inc.: SWOT Analysis

86 Eli Lilly and Company, Inc.: Geographic Presence

87 F. Hoffmann La-Roche Ltd.: Company Snapshot

88 F. Hoffmann La-Roche Ltd.: SWOT Analysis

89 F. Hoffmann La-Roche Ltd.: Geographic Presence

90 Other Companies: Company Snapshot

91 Other Companies: SWOT Analysis

92 Other Companies: Geographic Presence

The Global Biologics Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biologics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS