Global Biomedical Refrigerators and Freezers Market Size, Trends & Analysis - Forecasts to 2026 By Type (Blood Bank Refrigerators, Shock Freezers, Laboratory Refrigerators, Laboratory Freezers, Plasma Freezers, Ultra-Low Freezers, and Cryogenic Storage Systems), By Application (Storage Purpose, Transportation Purpose, and Research Activities), By End-User (Hospitals, Pharmacies, Research Laboratories, Blood Banks, and Diagnostic Centers), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

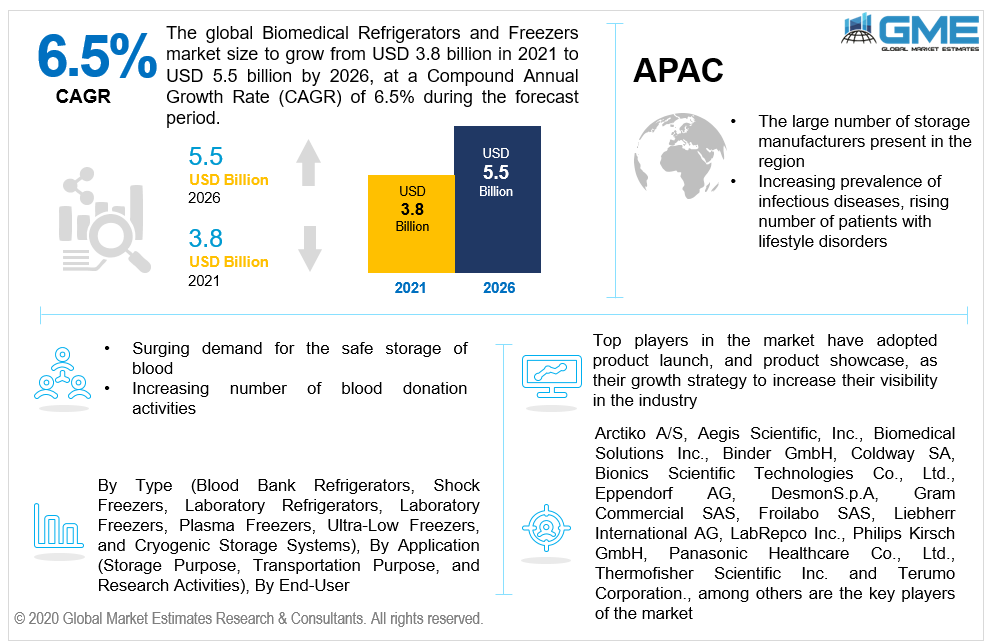

The global biomedical refrigerators and freezers market is projected to grow from USD 3.8 billion in 2021 to USD 5.5 billion by 2026 at a CAGR value of 6.5% from 2021 to 2026.

The market for biomedical refrigerators and freezers will be growing rapidly during the forecast period owing to factors such as surging demand for the safe storage of blood, increasing number of blood donation activities, rising need for blood or blood derivatives from blood banks or storage centers, increasing prevalence of infectious diseases, rising number of patients with lifestyle disorders, and increasing number of road accidents. Moreover, technical advancements in medical refrigerators and rising investment in R&D activities to launch smart and advance biomedical freezers are some of the drivers supporting the growth of the market.

Biomedical freezers or refrigerators are medical storage equipments used to store biological samples such as derivatives of blood, vaccines, blood, biological reagents, drugs, medicines, reagents, flammable chemicals, ribonucleic acid (RNA), and deoxyribonucleic acid (DNA) samples. These freezers are prepared in such a way that they meet the recommended CDC temperature requirements in order to safely store biological samples and drugs/medicines. The low temperature maintained in freezers and refrigerators helps medical samples protect from vulnerable and fluctuating temperatures, that otherwise hamper their viability.

Cooling of any space, material or system to lower than the room temperature or the orgnal temperature of the material is known as freezing. Energy in the form of heat is removed from a low-temperature reservoir and transferred to a high-temperature reservoir. The major applications of biomedical refrigerators or freezers are for storage purpose, transportation purpose, and research activities.

COVID-19 pandemic has caused unprecedented disruption and has had a negative impact on the economy and other markets. However, the market for biomedical refrigerators and freezers was analyzed to be growing the fastest during the pandemic. The market for bio refrigerators and freezers that were dedicatedly used to store of viral specimens, vaccines, and other biological samples witnessed a sudden rise during the pandemic. Hence, the market grew positively and is expected to grow at the same rate during the forecast period.

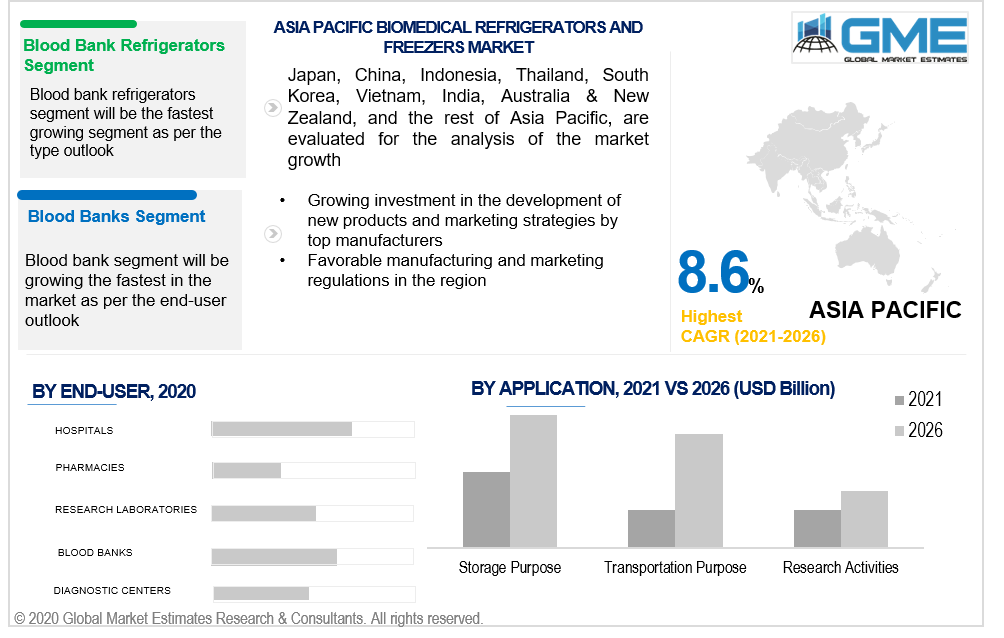

Based on the type the market is segmented into blood bank refrigerators, shock freezers, laboratory refrigerators, laboratory freezers, plasma freezers, ultra-low freezers, and cryogenic storage systems. The blood bank refrigerators is expected to hold the largest share in the market from 2021 to 2026. This is mainly attributed to the increasing demand for blood and blood supplements, increasing need to have a safe storage of blood units and plasma in hospitals and other blood banks centers, and rising road accident cases which involves blood loss.

Based on the application, the biomedical refrigerators and freezers market is segmented into storage purpose, transportation purpose, and research activities. The market for storage purpose is ought to be the largest shareholder during the forecast period. This is mainly because of the rising importance and need for cold storage of blood and biological samples.

Moreover, due to the sudden onset of pandemic, and associated series of vaccination drive, the market for this application is expected to grow rapidly during the forecast period. However, the transportation purpose segment is analyzed to be growing the fastest during the period of 2021 to 2026. Technological advancements in the field of mobile biomedical refrigerators and freezers and rising need for blood source for road accident cases, are some of the factors supporting the growth of segment.

Based on the end-user, the market is segmented into hospitals, pharmacies, research laboratories, blood banks, and diagnostic centers. Blood banks segment is analyzed to be the fastest growing one, whereas hospitals segment is estimated to have the largest share in the market during the forecast period. The largest share of the hospitals segment is mainly due to rising patient admission for blood loss cases, increasing number of surgeries, rising cases of lifestyle disorders and increasing purchasing power to support storage for blood and blood derivative.

As per the geographical analysis, the biomedical refrigerators and freezers market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. Heavy investment in R&D to launch smart and latest biomedical refrigerators and freezers in this region and the growing number of players offering advanced storage systems are the major drivers of the North American market.

The APAC region is expected to grow at a faster rate than any other regions during the forecast period. A large number of patient population clubbed with high prevalence of cancer cases, lifestyle disorders, growing medical tourism, rising number of new blood banks and launch of new hospitals (especially during pandemic), increasing number of blood donation activities, and rising number road accidents in this region are the major drivers of the market’s growth.

Arctiko A/S, Aegis Scientific, Inc., Biomedical Solutions Inc., Binder GmbH, Coldway SA, Bionics Scientific Technologies Co., Ltd., Eppendorf AG, DesmonS.p.A, Gram Commercial SAS, Froilabo SAS, Liebherr International AG, LabRepco Inc., Philips Kirsch GmbH, Panasonic Healthcare Co., Ltd., Thermofisher Scientific Inc. and Terumo Corporation., among others are the key players in the biomedical refrigerators and freezers market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Biomedical Refrigerators and Freezers Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Biomedical Refrigerators and Freezers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for storage and safe transportation of blood and blood derivatives

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness about medical equipment in third world countries

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Biomedical Refrigerators and Freezers Market, By Type

4.1 Type Outlook

4.2 Blood Bank Refrigerators

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Shock Freezers

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Laboratory Refrigerators

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Laboratory Freezers

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Plasma Freezers

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Ultra-Low Freezers

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Cryogenic Storage Systems

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Biomedical Refrigerators and Freezers Market, By Application

5.1 Application Outlook

5.2 Storage Purpose

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Transportation Purpose

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Research Activities

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Biomedical Refrigerators and Freezers Market, By End-User

6.1 Application Outlook

6.2 Hospitals

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Pharmacies

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Research Laboratories

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Blood Banks

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Diagnostic Centers

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Biomedical Refrigerators and Freezers Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Arctiko A/S

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Aegis Scientific, Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Biomedical Solutions Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Binder GmbH

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Coldway SA

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Bionics Scientific Technologies Co., Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Eppendorf AG

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 DesmonS.p.A

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Gram Commercial SAS

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Froilabo SAS

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Biomedical Refrigerators and Freezers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biomedical Refrigerators and Freezers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS