Global Bioprocess Containers Market Size, Trends & Analysis - Forecasts to 2029 By Type (2D Bioprocess Containers, 3D Bioprocess Containers, and Other Containers and Accessories), By End User (Pharmaceutical & Biopharmaceutical Companies, CROs & CMOs, and Academic & Research Institutes), By Application (Upstream Processes, Downstream Processes, and Process Development), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

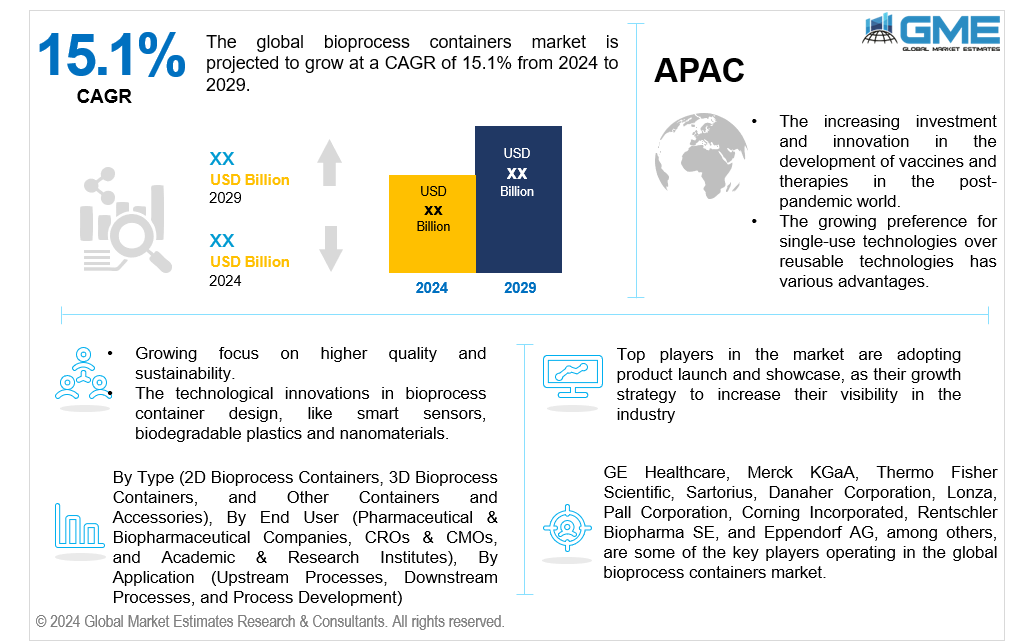

The global bioprocess containers market is projected to grow at a CAGR of 15.1% from 2024 to 2029.

Bioprocess containers play an important role in the biotechnology and pharmaceutical sectors, managing both production and development of biological containers. They are made of biocompatible materials for storing, transporting, and processing biopharmaceuticals like insulin, vaccinations, and enzyme replacements. The global outbreak of COVID-19 has resulted in a global demand for vaccine biomanufacturing containers and its development. The bioprocess container market has grown substantially over time, with the addition of aseptic container systems such as single-use bioprocess containers, bioreactor bags, cell culture bags, and other consumables. Even among the top researchers in the biotechnology field, the reduced risk of cross-contamination and easier logistics associated with single-use systems make them excellent for laboratories where numerous experiments are carried out concurrently. Bioprocess container handling is needed for single-use or reusable containers to maintain integrity of its contents, ensuring they contain are not contaminated or compromised during transport, storage, and processing.

Since the pandemic, bioprocess container suppliers have seen an increase in demand for smaller-scale manufacturing, which, combined with production lines from multiple companies, has enhanced efficiency in delivering specialized bioprocess container technology to the market. The increase in demand for flexible container systems in the market for biomanufacturing containers, such as 3D bags, has led to a rise in production. The growing need for single-use bioprocess containers is driving large-scale production and commercial applications in this industry. Regulatory compliance in bioprocess containers is critical for ensuring the safety, efficacy, and quality of biopharmaceuticals. Any biomanufacturing container must adhere to strict rules established by regulatory authorities such as the United States Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other international standards.

Moreover, the market for bioprocess containers is also expanding due to developments in single-use technology. These containers ensure efficiency and safety by providing sterile environments essential for biopharmaceutical manufacture. Bioprocess container validation is essential for verifying integrity and dependability and fulfilling the strict legal requirements for pharmaceutical production.

The 2D bioprocess containers segment is projected to dominate the market in the forecast period. This segment currently consists of single-use bags for biological fluid storage, mixing, and transportation. They can be encased in numerous layers of environmentally friendly plastic film, lowering the risk of contamination and eliminating the need for cleaning and sterilizing. This makes it the largest market for disposable bioprocess containers used in the biotechnology and pharmaceutical industries. This single-use bioprocess container growth market is expected to develop as bioprocess container technology improves material, capacity, and durability. Sustainability efforts, such as the development of recyclable technologies and effective disposable systems, are also being done to ensure future goals and widespread adoption.

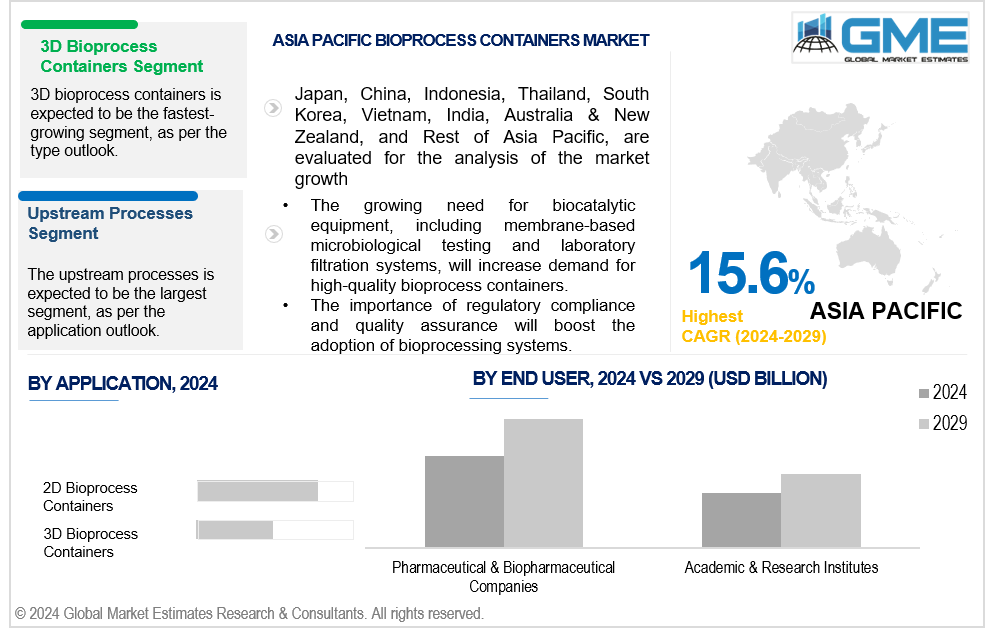

The 3D bioprocess containers segment is predicted to witness the fastest growth between 2024 and 2029. The growth is due to 3D containers being more flexible than 2D containers. They may expand and use the available space to their full potential, resulting in increased capacity. They typically comprise bioreactors, mixing systems, and bulk bioprocess container storage solutions for the biotechnological and pharmaceutical sectors. This bioprocessing industry is expanding at a quicker rate because of lower operating expenses and improved flexibility in transitioning to larger production lines to meet rising demand. The future appears positive, where custom bioprocess containers can cater to unique operational needs with the help of various sensors and data analytics tools that can aid in real-time inventory management to regulate and improve product quality.

The pharmaceutical and biopharmaceutical companies segment is expected to have the largest market share between 2024 and 2029. The global boom in vaccine production and medicine development has helped the sector reach its peak. The containers accelerates the manufacturing process, which involved the cultivation of cells, fermentation, cleansing, and storing. Sterile bioprocess containers reduce the possibility of infection and ensure the safety of the product inside the container. This has allowed for speedier processing times and a rapid creation of new drugs to tackle the growing prevalence of age-related disorders. This increased manufacturing capacity is driven by advanced bioprocessing technologies and a growing need for effective healthcare treatments. This will drive increased research and development efforts by pharmaceutical companies, as they seek to advance flexible container systems to improve bioprocessing efficiency, enhance product safety.

The academic & research institutes segment is expected to be the fastest growing in the forecast period. The utilization of modern bioprocess container applications and equipment in single-use systems has boosted the acceptance of new technologies in research institutions across the globe.

The upstream processes segment is anticipated to be the largest segment in the market from 2024 to 2029. The basic purpose of upstream manufacturing is to create the conditions that allow cells to manufacture the desired protein. Biomanufacturing produces therapeutic proteins, antibiotics, hormones, enzymes, amino acids, blood substitutes, and alcohol for medicinal use. Massive advances in upstream processing in recent years have resulted in the development of modern fed-batch systems capable of producing 10g/L or more of mAb. The highest use of bioprocess containers, particularly during fermentation and culture medium processing, has resulted in this segment being the most expansive.

The downstream processes segment is anticipated to be the fastest growing in the forecast period. A greater focus on efficiency and flexibility in biopharmaceutical packaging will grow the usage of single-use downstream bioprocessing. Single-use systems eliminate the need for lengthy cleaning and approval processes prevalent in previous systems, resulting in significant cost savings. Furthermore, single-use technologies allow producers to swiftly respond to changing production requirements, such as scaling up or down, without incurring significant capital investments.

North America is expected to be the largest region in the global market. The region's dominance has been substantially influenced by the growth of biopharmaceutical R&D. Bioprocess container scalability in pharmaceutical and biotechnology facilities in the region are growing at a rapid pace due to rapid investment in new bioprocess technologies for bioprocess containers further contributing to the market growth. The advent of breakthrough single-use bioprocessing technologies in developed economies such as the United States and Canada, as well as an aging population and a growing need for bioactive compounds, are all important factors driving bioprocess container market growth in this region.

Asia Pacific is predicted to witness rapid growth during the forecast period. The growing need for biocatalytic equipment, including membrane-based microbiological testing and laboratory filtration systems, significantly drives market expansion. The Asia pacific region is rapidly expanding its manufacturing of bioprocess container systems due to several factors, such as increased investments in constructing facilities compatible with bioprocess containers in commercial biopharmaceutical manufacturing, as well as accelerated developments in research and development by pharmaceutical companies, are driving the adoption of bioprocess containers in commercial applications which will fuel regional market growth throughout the projection period.

GE Healthcare, Merck KGaA, Thermo Fisher Scientific, Sartorius, Danaher Corporation, Lonza, Pall Corporation, Corning Incorporated, Rentschler Biopharma SE, and Eppendorf AG, among others, are some of the key players operating in the global bioprocess containers market.

Please note: This is not an exhaustive list of companies profiled in the report.

On April 24, 2023, Merck announced the launch of its UltimusSingle-Use Process Container Film, designed to provide extreme durability and leak resistance for single-use assemblies used for bioprocessing liquid applications.

In May 2023, Eppendorf launched a tool known as a bioprocess autosampler, a device capable of understanding what is going on within the bioreactor, which is essential for maximizing production and quality of bioprocess containers while also guaranteeing they are made in a time and cost-effective manner.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL BIOPROCESS CONTAINERS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL BIOPROCESS CONTAINERS MARKET, BY TYPE

4.1 Introduction

4.2 Bioprocess Containers Market : Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 2D Bioprocess Containers

4.4.1 2D Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 3D Bioprocess Containers

4.5.1 3D Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Other Containers and Accessories

4.6.1 Other Containers and Accessories Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL BIOPROCESS CONTAINERS MARKET, BY END USER

5.1 Introduction

5.2 Bioprocess Containers Market : End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Pharmaceutical & Biopharmaceutical Companies

5.4.1 Pharmaceutical & Biopharmaceutical Companies Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 CROs & CMOs

5.5.1 CROs & CMOs Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Academic & Research Institutes

5.6.1 Academic & Research Institutes Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL BIOPROCESS CONTAINERS MARKET, BY APPLICATION

6.1 Introduction

6.2 Bioprocess Containers Market : Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Upstream Processes

6.4.1 Upstream Processes Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Downstream Processes

6.5.1 Downstream Processes Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Process Development

6.5.1 Process Development Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL BIOPROCESS CONTAINERS MARKET, BY REGION

7.1 Introduction

7.2 North America Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Type

7.2.2 By End User

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Type

7.2.4.1.2 By End User

7.2.4.1.3 By Application

7.2.4.2 Canada Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Type

7.2.4.2.2 By End User

7.2.4.2.3 By Application

7.2.4.3 Mexico Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Type

7.2.4.3.2 By End User

7.2.4.3.3 By Application

7.3 Europe Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Type

7.3.2 By End User

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Type

7.3.4.1.2 By End User

7.3.4.1.3 By Application

7.3.4.2 U.K. Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Type

7.3.4.2.2 By End User

7.3.4.2.3 By Application

7.3.4.3 France Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Type

7.3.4.3.2 By End User

7.3.4.3.3 By Application

7.3.4.4 Italy Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Type

7.3.4.4.2 By End User

7.2.4.4.3 By Application

7.3.4.5 Spain Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Type

7.3.4.5.2 By End User

7.2.4.5.3 By Application

7.3.4.6 Netherlands Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Type

7.3.4.6.2 By End User

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Type

7.3.4.7.2 By End User

7.2.4.7.3 By Application

7.4 Asia Pacific Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Type

7.4.2 By End User

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Type

7.4.4.1.2 By End User

7.4.4.1.3 By Application

7.4.4.2 Japan Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Type

7.4.4.2.2 By End User

7.4.4.2.3 By Application

7.4.4.3 India Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Type

7.4.4.3.2 By End User

7.4.4.3.3 By Application

7.4.4.4 South Korea Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Type

7.4.4.4.2 By End User

7.4.4.4.3 By Application

7.4.4.5 Singapore Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Type

7.4.4.5.2 By End User

7.4.4.5.3 By Application

7.4.4.6 Malaysia Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Type

7.4.4.6.2 By End User

7.4.4.6.3 By Application

7.4.4.7 Thailand Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Type

7.4.4.7.2 By End User

7.4.4.7.3 By Application

7.4.4.8 Indonesia Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Type

7.4.4.8.2 By End User

7.4.4.8.3 By Application

7.4.4.9 Vietnam Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Type

7.4.4.9.2 By End User

7.4.4.9.3 By Application

7.4.4.10 Taiwan Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Type

7.4.4.10.2 By End User

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Type

7.4.4.11.2 By End User

7.4.4.11.3 By Application

7.5 Middle East and Africa Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Type

7.5.2 By End User

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Type

7.5.4.1.2 By End User

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Type

7.5.4.2.2 By End User

7.5.4.2.3 By Application

7.5.4.3 Israel Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Type

7.5.4.3.2 By End User

7.5.4.3.3 By Application

7.5.4.4 South Africa Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Type

7.5.4.4.2 By End User

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Type

7.5.4.5.2 By End User

7.5.4.5.2 By Application

7.6 Central and South America Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Type

7.6.2 By End User

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Type

7.6.4.1.2 By End User

7.6.4.1.3 By Application

7.6.4.2 Argentina Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Type

7.6.4.2.2 By End User

7.6.4.2.3 By Application

7.6.4.3 Chile Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Type

7.6.4.3.2 By End User

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Bioprocess Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Type

7.6.4.4.2 By End User

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 GE Healthcare

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Merck KGaA

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Thermo Fisher Scientific

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Sartorius

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Danaher Corporation

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Lonza

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Pall Corporation

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Corning Incorporated

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Rentschler Biopharma SE

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Eppendorf AG

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Bioprocess Containers Market, By Type, 2021-2029 (USD Mllion)

2 2D Bioprocess Containers Market, By Region, 2021-2029 (USD Mllion)

3 3D Bioprocess Containers Market, By Region, 2021-2029 (USD Mllion)

4 Other Containers and Accessories Market, By Region, 2021-2029 (USD Mllion)

5 Global Bioprocess Containers Market, By End User, 2021-2029 (USD Mllion)

6 Pharmaceutical & Biopharmaceutical Companies Market, By Region, 2021-2029 (USD Mllion)

7 CROs & CMOs Market, By Region, 2021-2029 (USD Mllion)

8 Academic & Research Institutes Market, By Region, 2021-2029 (USD Mllion)

9 Global Bioprocess Containers Market, By Application, 2021-2029 (USD Mllion)

10 Upstream Processes Market, By Region, 2021-2029 (USD Mllion)

11 Downstream Processes Market, By Region, 2021-2029 (USD Mllion)

12 Process development Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

15 North America Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

16 North America Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

17 North America Bioprocess Containers Market, By Country, 2021-2029 (USD Million)

18 U.S. Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

19 U.S. Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

20 U.S. Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

21 Canada Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

22 Canada Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

23 Canada Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

24 Mexico Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

25 Mexico Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

26 Mexico Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

27 Europe Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

28 Europe Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

29 Europe Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

30 Europe Bioprocess Containers Market, By COUNTRY, 2021-2029 (USD Million)

31 Germany Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

32 Germany Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

33 Germany Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

34 U.K. Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

35 U.K. Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

36 U.K. Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

37 France Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

38 France Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

39 France Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

40 Italy Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

41 Italy Bioprocess Containers Market, By End Use , 2021-2029 (USD Million)

42 Italy Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

43 Spain Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

44 Spain Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

45 Spain Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

46 Rest Of Europe Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

47 Rest Of Europe Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

48 Rest of Europe Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

49 Asia Pacific Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

50 Asia Pacific Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

51 Asia Pacific Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

52 Asia Pacific Bioprocess Containers Market, By Country, 2021-2029 (USD Million)

53 China Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

54 China Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

55 China Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

56 India Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

57 India Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

58 India Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

59 Japan Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

60 Japan Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

61 Japan Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

62 South Korea Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

63 South Korea Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

64 South Korea Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

65 Singapore Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

66 Singapore Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

67 Singapore Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

68 Malaysia Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

69 Malaysia Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

70 Malaysia Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

71 Thailand Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

72 Thailand Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

73 Thailand Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

74 Indonesia Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

75 Indonesia Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

76 Indonesia Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

77 Vietnam Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

78 Vietnam Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

79 Vietnam Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

80 Taiwan Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

81 Taiwan Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

82 Taiwan Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

83 Rest of Asia Pacific Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

84 Rest of Asia Pacific Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

85 Rest of Asia Pacific Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

86 Middle East and Africa Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

87 Middle East and Africa Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

88 Middle East and Africa Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

89 Middle East and Africa Bioprocess Containers Market, By Country, 2021-2029 (USD Million)

90 Saudi Arabia Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

91 Saudi Arabia Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

92 Saudi Arabia Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

93 UAE Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

94 UAE Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

95 UAE Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

96 Israel Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

97 Israel Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

98 Israel Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

99 South Africa Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

100 South Africa Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

101 South Africa Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

103 Rest of Middle East and Africa Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

105 Central and South America Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

106 Central and South America Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

107 Central and South America Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

108 Central and South America Bioprocess Containers Market, By Country, 2021-2029 (USD Million)

109 Brazil Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

110 Brazil Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

111 Brazil Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

112 Argentina Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

113 Argentina Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

114 Argentina Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

115 Chile Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

116 Chile Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

117 Chile Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

118 Rest of Central and South America Bioprocess Containers Market, By Type, 2021-2029 (USD Million)

119 Rest of Central and South America Bioprocess Containers Market, By End User, 2021-2029 (USD Million)

120 Rest of Central and South America Bioprocess Containers Market, By Application, 2021-2029 (USD Million)

121 GE Healthcare: Products & Services Offering

122 Merck KGaA: Products & Services Offering

123 Thermo Fisher Scientific: Products & Services Offering

124 Sartorius: Products & Services Offering

125 Danaher Corporation: Products & Services Offering

126 LONZA: Products & Services Offering

127 Pall Corporation : Products & Services Offering

128 Corning Incorporated: Products & Services Offering

129 Rentschler Biopharma SE, Inc: Products & Services Offering

130 Eppendorf AG: Products & Services Offering

131 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Bioprocess Containers Market Overview

2 Global Bioprocess Containers Market Value From 2021-2029 (USD Mllion)

3 Global Bioprocess Containers Market Share, By Type (2023)

4 Global Bioprocess Containers Market Share, By End User (2023)

5 Global Bioprocess Containers Market Share, By Application (2023)

6 Global Bioprocess Containers Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Bioprocess Containers Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Bioprocess Containers Market

11 Impact Of Challenges On The Global Bioprocess Containers Market

12 Porter’s Five Forces Analysis

13 Global Bioprocess Containers Market: By Type Scope Key Takeaways

14 Global Bioprocess Containers Market, By Type Segment: Revenue Growth Analysis

15 2D Bioprocess Containers Market, By Region, 2021-2029 (USD Mllion)

16 3D Bioprocess Containers Market, By Region, 2021-2029 (USD Mllion)

17 Other Containers and Accessories Market, By Region, 2021-2029 (USD Mllion)

18 Global Bioprocess Containers Market: By End User Scope Key Takeaways

19 Global Bioprocess Containers Market, By End User Segment: Revenue Growth Analysis

20 Pharmaceutical & Biopharmaceutical Companies Market, By Region, 2021-2029 (USD Mllion)

21 CROs & CMOs Market, By Region, 2021-2029 (USD Mllion)

22 Academic & Research Institutes Market, By Region, 2021-2029 (USD Mllion)

23 Global Bioprocess Containers Market: By Application Scope Key Takeaways

24 Global Bioprocess Containers Market, By Application Segment: Revenue Growth Analysis

25 Upstream Processes Market, By Region, 2021-2029 (USD Mllion)

26 Downstream Processes Market, By Region, 2021-2029 (USD Mllion)

27 Process Development Market, By Region, 2021-2029 (USD Mllion)

28 Regional Segment: Revenue Growth Analysis

29 Global Bioprocess Containers Market: Regional Analysis

30 North America Bioprocess Containers Market Overview

31 North America Bioprocess Containers Market, By Type

32 North America Bioprocess Containers Market, By End User

33 North America Bioprocess Containers Market, By Application

34 North America Bioprocess Containers Market, By Country

35 U.S. Bioprocess Containers Market, By Type

36 U.S. Bioprocess Containers Market, By End User

37 U.S. Bioprocess Containers Market, By Application

38 Canada Bioprocess Containers Market, By Type

39 Canada Bioprocess Containers Market, By End User

40 Canada Bioprocess Containers Market, By Application

41 Mexico Bioprocess Containers Market, By Type

42 Mexico Bioprocess Containers Market, By End User

43 Mexico Bioprocess Containers Market, By Application

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 GE Healthcare: Company Snapshot

47 GE Healthcare: SWOT Analysis

48 GE Healthcare: Geographic Presence

49 Merck KGaA: Company Snapshot

50 Merck KGaA: SWOT Analysis

51 Merck KGaA: Geographic Presence

52 Thermo Fisher Scientific: Company Snapshot

53 Thermo Fisher Scientific: SWOT Analysis

54 Thermo Fisher Scientific: Geographic Presence

55 Sartorius: Company Snapshot

56 Sartorius: Swot Analysis

57 Sartorius: Geographic Presence

58 Danaher Corporation: Company Snapshot

59 Danaher Corporation: SWOT Analysis

60 Danaher Corporation: Geographic Presence

61 Lonza: Company Snapshot

62 Lonza: SWOT Analysis

63 Lonza: Geographic Presence

64 Pall Corporation : Company Snapshot

65 Pall Corporation : SWOT Analysis

66 Pall Corporation : Geographic Presence

67 Corning Incorporated: Company Snapshot

68 Corning Incorporated: SWOT Analysis

69 Corning Incorporated: Geographic Presence

70 Rentschler Biopharma SE, Inc.: Company Snapshot

71 Rentschler Biopharma SE, Inc.: SWOT Analysis

72 Rentschler Biopharma SE, Inc.: Geographic Presence

73 Eppendorf AG: Company Snapshot

74 Eppendorf AG: SWOT Analysis

75 Eppendorf AG: Geographic Presence

76 Other Companies: Company Snapshot

77 Other Companies: SWOT Analysis

78 Other Companies: Geographic Presence

The Global Bioprocess Containers Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bioprocess Containers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS