Global Bioprocessing Bags Market Size, Trends & Analysis – Forecasts to 2026 By Product Type (Three-Dimensional Bioprocessing Bags, Two-Dimensional Bioprocessing Bags, Multi-Use Bioprocessing Bags, Single-Use Bioprocessing Bags, Others), By Application (Product Transportation, Upstream Process, Product development from living cells or microorganisms, Media Preparation, Process Development, Downstream Process, Others), By End-Use (Biopharmaceutical Industries, Lifesciences Laboratories, Pharmaceutical Companies, Academic Labs, Biotechnology Laboratories), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

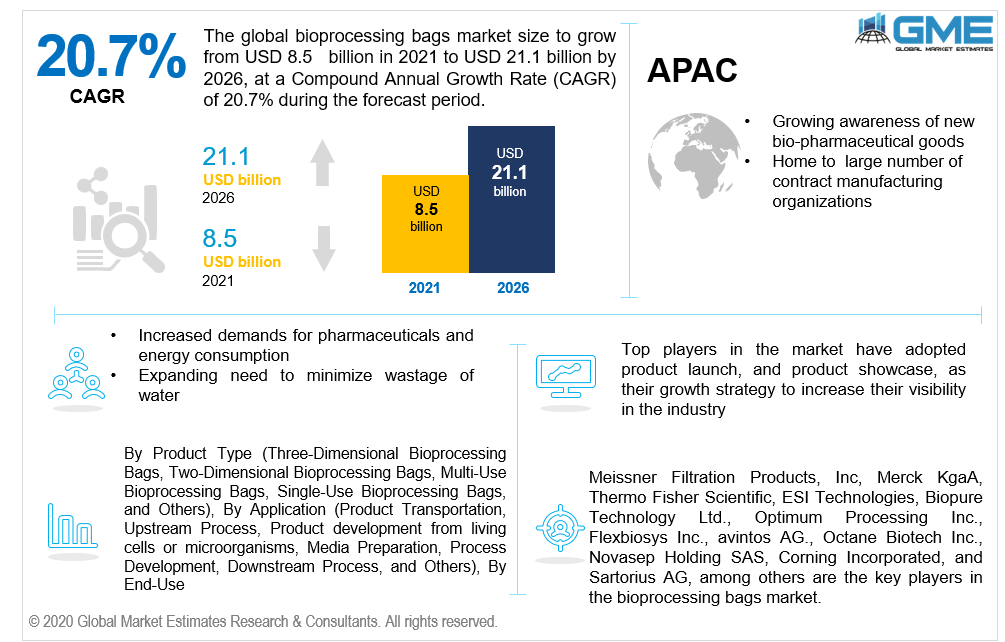

The global bioprocessing bags market is projected to grow from USD 8.5 billion in 2021 to USD 21.1 billion by 2026 at a CAGR value of 20.7% from 2021 to 2026.

In the pharmaceutical industry, bioprocessing bags are one of the prime substitutes to stainless steel, glasses, and rigid plastic tubs. In bioprocessing bags, cell cultures fluids and pollutants can be properly filtered and transferred. Tissue culture solutions and contaminants can be safely stored and transported in bioprocessing bags.

Single-Use Technology (SUT) has encouraged the use of disposable items in the bioprocessing industry due to the benefits, such as a significant reduction in operating cost and facilities building time. As a consequence, the market for bioprocessing bags is expected to grow rapidly during the forecast period.

The bioprocessing bag market is being driven by factors such as increasing demand for pharmaceuticals and energy consumption; rising need to minimize wastage of water, increasing flooring space requirements, and rising risk of possible cross-contamination. Additionally, rising demand for bioprocessing bags from applications such as media storage and preparation, tissue culture, cellular harvesting, buffer storage and handling, and others is expected to fuel market growth over the forecast period.

The market for bioprocess bags during the forecast period is being driven by the rise in research and development activities by pharmaceutical and research universities. Also, factors such as increase in popularity within researchers due to its simplicity, durability, and a lesser danger of cross infection are propelling market growth. For its cost-effectiveness, bioprocessing bags are frequently utilized in pharmaceutical production sectors, propelling the bioprocessing bags market. Also, the bioprocessing bags market is being driven by the rise of biopharmaceutical businesses.

The market for bioprocessing bags is likely to benefit from the expanding usage of solitary techniques for COVID-19 disease outbreak investigations, as well as increased vaccine research by key manufacturers. Furthermore, the success of prescription medications has drawn a large number of investors in the biotech business, which is expected to generate a conducive environment for bioprocess bag makers too.

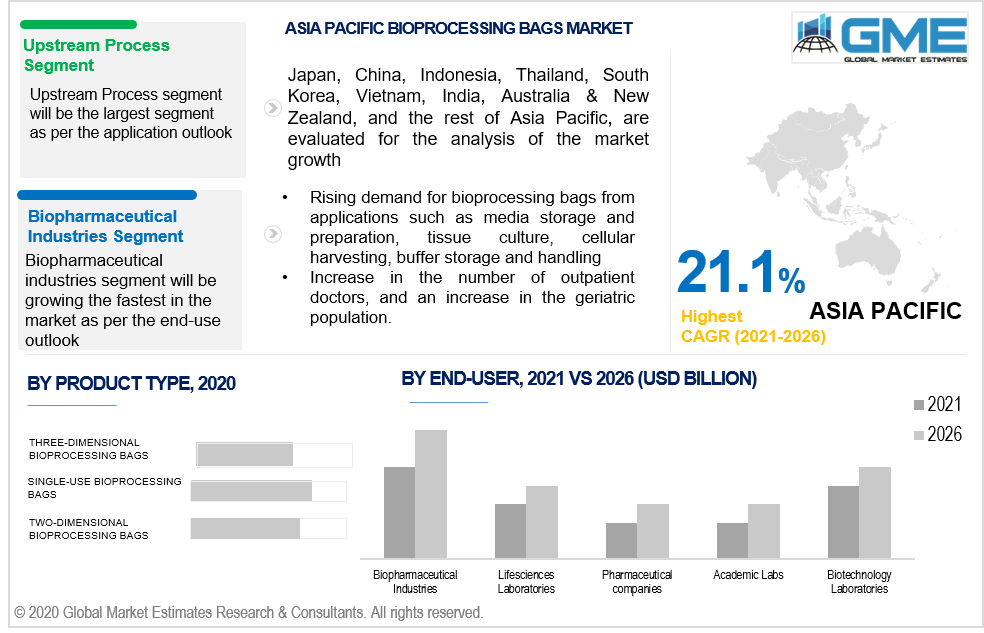

Based on the product type, the market is segmented into three-dimensional bioprocessing bags, two-dimensional bioprocessing bags, multi-use bioprocessing bags, single-use bioprocessing bags, and others. The market for single-use bioprocessing bags segment is expected to be the largest shareholder of the market from 2021 to 2026. Single-use bioprocess bags enables increased manufacturing efficiency. Single-use bioprocessing bags come in a variety of dimensions and are designed to handle processes that include compounds, tissue samples, buffer, sterile medium, and antibodies. As the demand for pharmaceuticals rises and tech firms grow their manufacturing capacity, the need for single-use bioprocessing bags is likely to increase. Rising biotechnology research and development initiatives, as well as policy decisions, are predicted to move the global technology industry forward, resulting in increased demand for bioprocessing bags.

Based on the application, the market is segmented into product transportation, upstream process, product development from living cells or microorganisms, media preparation, process development, downstream process, and others. The market for upstream process segment is expected to be the largest shareholder of the market from 2021 to 2026. The factors driving the segment are increasing demand for high energy-efficient material, and advantage of lesser risk of toxic cross-contamination with lesser space consumption square footage.

Based on the end-use, the market is segmented into biopharmaceutical industries, lifesciences laboratories, pharmaceutical companies, academic labs, and biotechnology laboratories. The market for biopharmaceutical industries segment is expected to be the largest shareholder of the market from 2021 to 2026. The flexibility of bioprocessing bags are more energy-efficient, with extreme temperature endurance. The rising acceptance due to the adaptability and prolonged storage functionality of bioprocessing bags are the reasons driving the growth of this market.

As per the geographical analysis, the market for bioprocessing bags can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the bioprocessing bags market from 2021 to 2026. The capacity of bioprocessing bags to become more energy-efficient, ability to withstand extreme temperatures, and growing use of these bags due to its versatility and prolonged storage function are some of the reasons driving the expansion of market in this region.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest growing segment in the bioprocessing bags market during the forecast period. Since consumers are becoming more aware of the new bio-pharmaceutical goods, the Asia-Pacific countries are predicted to increase at a modest pace. Furthermore, the region is home to a large number of contract manufacturing organizations that are integrating disposable items into their operations. The expanding ageing population is also driving up demand for pharmaceuticals.

Meissner Filtration Products, Inc, Merck KgaA, Thermo Fisher Scientific, ESI Technologies, Biopure Technology Ltd., Optimum Processing Inc., Flexbiosys Inc., avintos AG., Octane Biotech Inc., Novasep Holding SAS, Corning Incorporated, and Sartorius AG, among others are the key players in the bioprocessing bags market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Bioprocessing Bags Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 End-User Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Bioprocessing Bags Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The increasing demands for pharmaceutical drugs

3.3.2 End-User Challenges

3.3.2.1 The lack of understanding of proper handling and a paucity of knowledgeable specialists

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Bioprocessing Bags Market, By Product

4.1 Product Outlook

4.2 Three-Dimensional Bioprocessing Bags

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Two-Dimensional Bioprocessing Bags

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Multi-Use Bioprocessing Bags

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Single-Use Bioprocessing Bags

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Bioprocessing Bags Market, By End-User

5.1 End-User Outlook

5.2 Biopharmaceutical Industries

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Lifesciences Laboratories

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Pharmaceutical Companies

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Academic Labs

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Biotechnology Laboratories

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Bioprocessing Bags Market, By Application

6.1 Product Transportation

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Upstream Process

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Product development from living cells or microorganisms

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Media Preparation

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Process Development

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Downstream Process

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

6.7 Other Applications

6.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Bioprocessing Bags Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.9.2 Market size, By End-User, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Meissner Filtration Products, Inc

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Merck KgaA

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Thermo Fisher Scientific

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 ESI Technologies

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Biopure Technology Ltd

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Optimum Processing Inc

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Flexbiosys Inc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Octane Biotech Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Novasep Holding SAS

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Corning Incorporated

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Infographic Analysis

The Global Bioprocessing Bags Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bioprocessing Bags Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS