Global Biotechnology and Pharmaceutical Services Outsourcing Market Size, Trends & Analysis - Forecasts to 2028 By Services (Consulting, Auditing & Assessment, Regulatory Affairs, Product Maintenance, Product Design & Development, Product Testing & Validation, Training & Education, and Others), By End-use (Pharma and Biotech), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

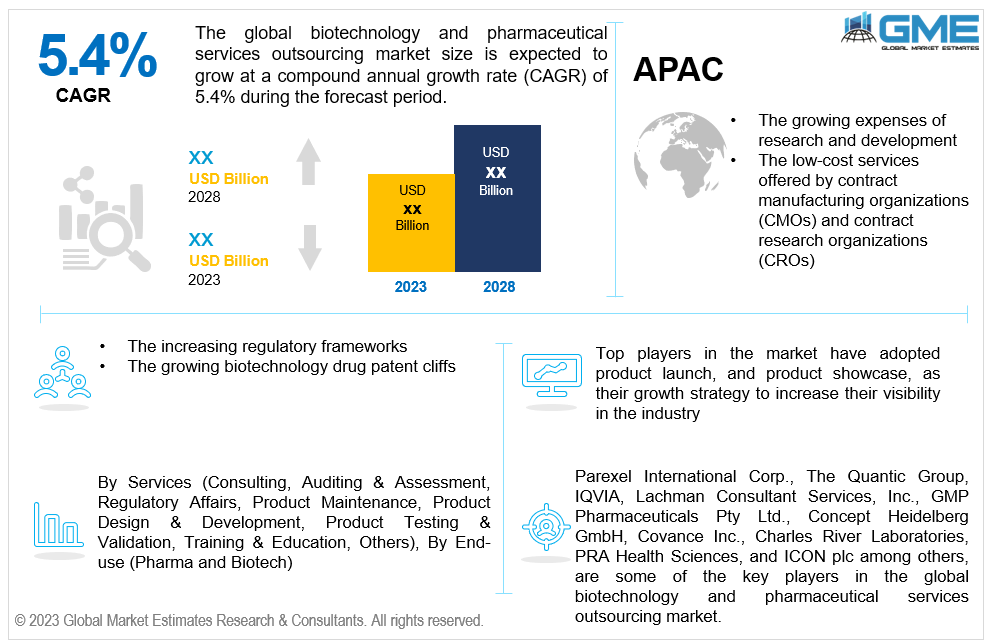

The global biotechnology and pharmaceutical services outsourcing market is estimated to exhibit a CAGR of 5.4% from 2023 to 2028.

The primary reasons that are driving market growth include growing expenses of research and development and low-cost services offered by contract manufacturing organizations (CMOs) and contract research organizations (CROs). CMOs and CROs are specialized organizations with extensive knowledge in their own domains. The specialized expertise and experience of these organizations can be utilized by pharmaceutical and biotechnology businesses to improve their drug development procedures. For example, CMOs possess sophisticated manufacturing skills and technical knowledge to guarantee effective and superior medication manufacture. CROs help to develop safe and effective medications by providing specialized capabilities in performing several phases of clinical trials, including patient recruiting, data gathering, and analysis.

Moreover, when compared to building and sustaining internal competencies, outsourcing to CMOs and CROs can result in considerable cost savings. Facilities for clinical trials or manufacturing might be too expensive to build and run.

The increasing regulatory frameworks and growing biotechnology drug patent risks are expected to support growth of the market. The market is anticipated to expand further, as a result of the growing number of full-service providers that are expected to meet the growing need for accessible drug development and manufacturing. Furthermore, it is anticipated that new product launches, increasing investment in infrastructure, and innovative medication delivery techniques would fuel the need for outsourcing. Due to the fierce competition in the healthcare industry, several companies are choosing to outsource. For instance, in February 2023, Lonza completed expanding its conjugation facility in Visp, Switzerland.

A manufacturing unit and supporting infrastructure were added as part of the expansion, which increased the capability for developing and producing bioconjugates and antibody-drug conjugates for preclinical, clinical, and commercial supply. The need for contract biotechnology and pharmaceutical services has risen, as a result of a growth in R&D efforts for new medication development, combination products, and other sophisticated treatments. In terms of R&D intensity, the global pharmaceutical industry is now ranked second among all industries, which means that R&D investment is increasing and that total spending will likely grow throughout the projected period. According to IQVIA, 15 major pharmaceutical firms including Amgen Inc., Sanofi, etc. invested over USD 133 billion in R&D in 2021.

There is growing demand for specialized expertise in areas such as genomics, proteomics, bioinformatics, and personalized medicine. Outsourcing providers with expertise in these fields can offer valuable insights and services to pharmaceutical companies. Moreover, regulatory requirements in the pharmaceutical sector are stringent and constantly evolving. Outsourcing partners specializing in regulatory compliance and quality assurance can help companies navigate complex regulatory landscapes.

Effective outsourcing agreements can speed up procedures and cut down on the time needed to introduce a medicine to the market. This is essential in the competitive pharmaceutical business, where gaining an early competitive advantage can be very beneficial. Moreover, Pharmaceutical and biotechnology firms can scale up or down their operations in response to project requirements due to outsourcing. When managing numerous projects at once or throughout the clinical trial phases, this flexibility can be extremely helpful.

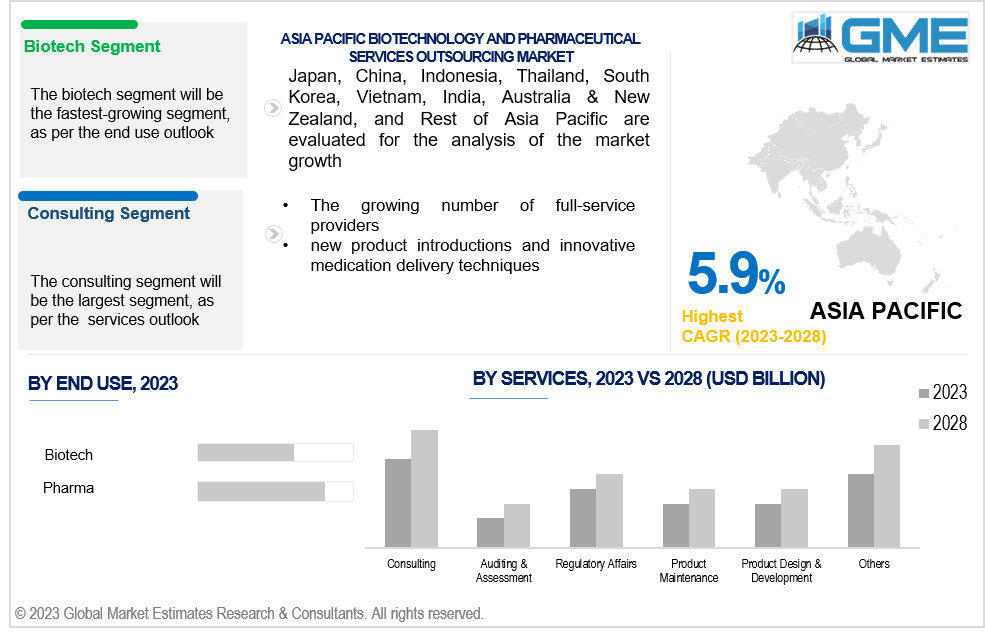

The consulting services segment is expected to hold the largest share of the market. Increasing merger and acquisition (M&A) activities, constantly evolving regulatory protocols, and an increase in the use of consulting services by biotech and pharmaceutical companies to address intellectual property disputes and fraud cases are driving the segment growth. For instance, in 2019, Thermo Fisher Scientific acquired Brammer Bio, a viral vector contract development and manufacturing organization. Consulting services offer strategic direction to biotech and pharmaceutical firms, assisting them in making right choices about their R&D, development, manufacturing, and commercialization plans. Insights from outsourcing experts assist businesses in managing challenging situations by providing information on market dynamics, regulatory changes, and industry trends.

The other services segment is expected to be the fastest-growing segment in the market from 2023-2028. As CMOs are providing services at lower prices, the manufacturers of generic drugs and biosimilar are increasingly outsourced. Contract manufacturing, product upgrades, and IT consultancy are all included in the other segment. Due to rising concerns about biotechnology and pharmaceutical firms' ability to compete in the marketing of their products, complexity of clinical trials, and standard of clinical trials, biostatistics outsourcing is increasing.

The pharma segment is expected to hold largest share in the market during the forecast period. The segment growth is driven by an increase in R&D expenditure by pharmaceutical firms for the development of prospective innovative drugs and an increase in investments by CROs for developing their key strengths. For instance, in order to combine clinical trial knowledge with real-world data analytics and provide a full portfolio of services, IQVIA Holdings Inc. (previously Quintiles and IMS Health) invested in data analytics and technological solutions in 2021. Pharmaceutical businesses can connect with a global network of specialized service providers such as CROs and CDMOs through outsourcing, giving them access to global talent, resources, and markets.

The biotech segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The fast-growing biotech product pipelines and increasing focus on research and development by biotechnology companies are fuelling the segment growth. Additionally, CROs concentrate on customizing their services for smaller biotechnology firms, who have emerged as key participants in the clinical development of novel pharmaceuticals and are in charge of promoting innovation and growth.

North America is expected to be the largest region in the market. The growth is attributed to rising R&D spending in the region from pharmaceutical and life sciences sectors, as well as the presence of multiple well-established CROs and CMOs. For instance, Lonza, a Switzerland-based multinational manufacturing company for the biotechnology, pharmaceutical, and food industries upgraded its inhalation plant in Tampa (United States) in May 2022 to increase its capacity for the research and production of inhaled formulations.

Asia Pacific is expected to witness rapid growth during the forecast period. The pharmaceutical industry is expanding swiftly in the APAC region due to factors including growing aging populations, increasing financial support for CRO and CDMO enterprises, and an increase in the prevalence of chronic illnesses such as cancer and cardiovascular disease. For instance, to expand the cell and gene therapy platform, Porton Advanced Solutions, a China-based CDMO business, raised USD 80 million in August 2022. The availability of trained labour and low investment in manufacturing drugs in this region are expected to encourage contract development and manufacturing.

Parexel International Corp., The Quantic Group, IQVIA, Lachman Consultant Services, Inc., GMP Pharmaceuticals Pty Ltd., Concept Heidelberg GmbH, Covance Inc., Charles River Laboratories, PRA Health Sciences, and ICON plc, among others are some of the key players operating in the global biotechnology and pharmaceutical services outsourcing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Key competitors in the industry are expanding their operations in biotechnology and pharmaceutical industries to offer clear and efficient clinical solutions. For instance, in 2019, IQVIA announced the launch of IQVIA Biotech and its new approach to deliver customised clinical and commercial solutions for small biotech and biopharma companies.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL BIOTECHNOLOGY AND PHARMACEUTICAL SERVICES OUTSOURCING MARKET, BY SERVICES

4.2 Biotechnology and Pharmaceutical Services Outsourcing Market: Services Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Consulting Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Auditing & Assessment Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Regulatory Affairs Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Product Maintenance Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Product Design & Development

4.8.1 Product Design & Development Market Estimates and Forecast, 2020-2028 (USD Million)

4.9 Product Testing & Validation

4.9.1 Product Testing & Validation Market Estimates and Forecast, 2020-2028 (USD Million)

4.10.1 Training & Education Market Estimates and Forecast, 2020-2028 (USD Million)

4.11.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL BIOTECHNOLOGY AND PHARMACEUTICAL SERVICES OUTSOURCING MARKET, BY END-USE

5.2 Biotechnology and Pharmaceutical Services Outsourcing Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Pharma Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Biotech Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL BIOTECHNOLOGY AND PHARMACEUTICAL SERVICES OUTSOURCING MARKET, BY REGION

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1 Parexel International Corp.

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Lachman Consultant Services, Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 GMP Pharmaceuticals Pty Ltd.

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Lachman Consultant Services, Inc.

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Charles River Laboratories

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

2 Consulting Market, By Region, 2020-2028 (USD Mllion)

3 Auditing & Assessment Market, By Region, 2020-2028 (USD Mllion)

4 Regulatory Affairs Market, By Region, 2020-2028 (USD Mllion)

5 Product Maintenance Market, By Region, 2020-2028 (USD Mllion)

6 Product Design & Development Market, By Region, 2020-2028 (USD Mllion)

7 Product Testing & Validation, By Region, 2020-2028 (USD Mllion)

8 Training & Education Market, By Region, 2020-2028 (USD Mllion)

9 Others Market, By Region, 2020-2028 (USD Mllion)

10 Global Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

11 Pharma Market, By Region, 2020-2028 (USD Mllion)

12 Biotech Market, By Region, 2020-2028 (USD Mllion)

13 Regional Analysis, 2020-2028 (USD Mllion)

14 North America Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

15 North America Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

16 U.S. Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

17 U.S. Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

18 Canada Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

19 Canada Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

20 Mexico Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

21 Mexico Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

22 Europe Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

23 Europe Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

24 Germany Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

25 Germany Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

26 U.K. Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

27 U.K. Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

28 France Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

29 France Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

30 Italy Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

31 Italy Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

32 Spain Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

33 Spain Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

34 Netherlands Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

35 Netherlands Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

36 Rest Of Europe Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

37 Rest Of Europe Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

38 Asia Pacific Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

39 Asia Pacific Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

40 China Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

41 China Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

42 Japan Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

43 Japan Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

44 India Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

45 India Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

46 South Korea Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

47 South Korea Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

48 Singapore Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

49 Singapore Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

50 Thailand Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

51 Thailand Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

52 Malaysia Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

53 Malaysia Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

54 Indonesia Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

55 Indonesia Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

56 Vietnam Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

57 Vietnam Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

58 Taiwan Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

59 Taiwan Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

60 Rest of APAC Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

61 Rest of APAC Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

62 Middle East and Africa Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

63 Middle East and Africa Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

64 Saudi Arabia Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

65 Saudi Arabia Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

66 UAE Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

67 UAE Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

68 Israel Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

69 Israel Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

70 South Africa Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

71 South Africa Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

72 Rest Of Middle East and Africa Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

73 Rest Of Middle East and Africa Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

74 Central and South America Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

75 Central and South America Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

76 Brazil Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

77 Brazil Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

78 Chile Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

79 Chile Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

80 Argentina Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

81 Argentina Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

82 Rest Of Central and South America Biotechnology and Pharmaceutical Services Outsourcing Market, By Services, 2020-2028 (USD Mllion)

83 Rest Of Central and South America Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use, 2020-2028 (USD Mllion)

84 Parexel International Corp.: Products & Services Offering

85 The Quantic Group: Products & Services Offering

86 IQVIA: Products & Services Offering

87 Lachman Consultant Services, Inc.: Products & Services Offering

88 GMP Pharmaceuticals Pty Ltd.: Products & Services Offering

89 CONCEPT HEIDELBERG GMBH: Products & Services Offering

90 Lachman Consultant Services, Inc. : Products & Services Offering

91 Charles River Laboratories: Products & Services Offering

92 PRA Health Sciences, Inc: Products & Services Offering

93 ICON plc: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Biotechnology and Pharmaceutical Services Outsourcing Market Overview

2 Global Biotechnology and Pharmaceutical Services Outsourcing Market Value From 2020-2028 (USD Mllion)

3 Global Biotechnology and Pharmaceutical Services Outsourcing Market Share, By Services (2022)

4 Global Biotechnology and Pharmaceutical Services Outsourcing Market Share, By End-use (2022)

5 Global Biotechnology and Pharmaceutical Services Outsourcing Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Biotechnology and Pharmaceutical Services Outsourcing Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Biotechnology and Pharmaceutical Services Outsourcing Market

10 Impact Of Challenges On The Global Biotechnology and Pharmaceutical Services Outsourcing Market

11 Porter’s Five Forces Analysis

12 Global Biotechnology and Pharmaceutical Services Outsourcing Market: By Services Scope Key Takeaways

13 Global Biotechnology and Pharmaceutical Services Outsourcing Market, By Services Segment: Revenue Growth Analysis

14 Consulting Market, By Region, 2020-2028 (USD Mllion)

15 Auditing & Assessment Market, By Region, 2020-2028 (USD Mllion)

16 Regulatory Affairs Market, By Region, 2020-2028 (USD Mllion)

17 Product Maintenance Market, By Region, 2020-2028 (USD Mllion)

18 Product Design & Development Market, By Region, 2020-2028 (USD Mllion)

19 Product Testing & Validation, By Region, 2020-2028 (USD Mllion)

20 Training & Education Market, By Region, 2020-2028 (USD Mllion)

21 Others Market, By Region, 2020-2028 (USD Mllion)

22 Global Biotechnology and Pharmaceutical Services Outsourcing Market: By End-use Scope Key Takeaways

23 Global Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use Segment: Revenue Growth Analysis

24 Pharma Market, By Region, 2020-2028 (USD Mllion)

25 Biotech Market, By Region, 2020-2028 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Biotechnology and Pharmaceutical Services Outsourcing Market: Regional Analysis

28 North America Biotechnology and Pharmaceutical Services Outsourcing Market Overview

29 North America Biotechnology and Pharmaceutical Services Outsourcing Market, By Services

30 North America Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use

31 North America Biotechnology and Pharmaceutical Services Outsourcing Market, By Country

32 U.S. Biotechnology and Pharmaceutical Services Outsourcing Market, By Services

33 U.S. Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use

34 Canada Biotechnology and Pharmaceutical Services Outsourcing Market, By Services

35 Canada Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use

36 Mexico Biotechnology and Pharmaceutical Services Outsourcing Market, By Services

37 Mexico Biotechnology and Pharmaceutical Services Outsourcing Market, By End-use

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Parexel International Corp.: Company Snapshot

41 Parexel International Corp.: SWOT Analysis

42 Parexel International Corp.: Geographic Presence

43 The Quantic Group: Company Snapshot

44 The Quantic Group: SWOT Analysis

45 The Quantic Group: Geographic Presence

46 IQVIA: Company Snapshot

47 IQVIA: SWOT Analysis

48 IQVIA: Geographic Presence

49 Lachman Consultant Services, Inc.: Company Snapshot

50 Lachman Consultant Services, Inc.: Swot Analysis

51 Lachman Consultant Services, Inc.: Geographic Presence

52 GMP Pharmaceuticals Pty Ltd.: Company Snapshot

53 GMP Pharmaceuticals Pty Ltd.: SWOT Analysis

54 GMP Pharmaceuticals Pty Ltd.: Geographic Presence

55 CONCEPT HEIDELBERG GMBH: Company Snapshot

56 CONCEPT HEIDELBERG GMBH: SWOT Analysis

57 CONCEPT HEIDELBERG GMBH: Geographic Presence

58 Lachman Consultant Services, Inc. : Company Snapshot

59 Lachman Consultant Services, Inc. : SWOT Analysis

60 Lachman Consultant Services, Inc. : Geographic Presence

61 Charles River Laboratories: Company Snapshot

62 Charles River Laboratories: SWOT Analysis

63 Charles River Laboratories: Geographic Presence

64 PRA Health Sciences, Inc.: Company Snapshot

65 PRA Health Sciences, Inc.: SWOT Analysis

66 PRA Health Sciences, Inc.: Geographic Presence

67 ICON plc: Company Snapshot

68 ICON plc: SWOT Analysis

69 ICON plc: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Biotechnology and Pharmaceutical Services Outsourcing Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biotechnology and Pharmaceutical Services Outsourcing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS