Blockchain Technology in BFSI Market Size & Analysis - Forecasts To 2025 By Type (Public, Private, Hybrid), By Application (Smart Contracts, Smart Assets, Clearing and Settlement, Payments, Digital Identity, Others), By End-use (Banks, Insurance Providers, Other Financial Service Providers), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa); Vendor Landscape, End-use Landscape and Competitive Landscape - Global Market Estimates

Blockchain Technology in BFSI Market Insights

The global blockchain technology in the banking, financial services, and insurance (BFSI) industry is expected to grow at a tremendous rate over the coming years. Major factors positively influencing the growth of this market include increased operational efficiency; reduced cost and time of the transaction and transparency are expected to positively influence the growth of the blockchain market in the BFSI sector.

Blockchain Technology in BFSI Market: Type Insights

The blockchain technology market for the energy sector is segmented on the basis of type into public, private, and hybrid. Private blockchain improves operational efficiency to a large extent, however it limits decentralization. Public blockchains are expected to grow at a high rate as it allows interoperability, decentralization, and transparency of operations along with security. The demand for hybrid blockchain solutions is also expected to grow at a significant CAGR over the coming years.

Blockchain Technology in BFSI Market: Application Insights

Blockchain technology on the basis of the application is segmented into smart contracts, smart assets, clearing and settlement, payments, and digital identity among others. The payment segment is expected to grow at the highest CAGR over the coming years on account of the growing number of partnerships between banks and blockchain technology providers in order to reduce cost & time in processing transactions.

Blockchain Technology in BFSI Market: End-use Insights

Blockchain technology on the basis of end-use is segmented into banks, insurance providers, and other financial service providers. The demand for blockchain solutions in the banking sector is projected to occupy a large share in the market. Blockchain solution in the banking sector is expected to enable efficient management and collaboration across regulatory enterprises and businesses.

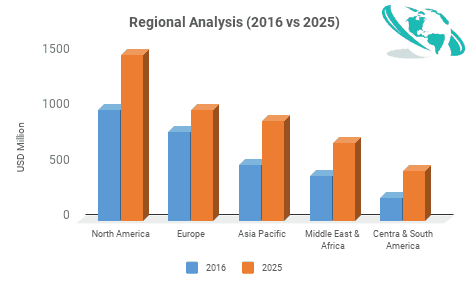

Blockchain Technology in BFSI Market: Regional Insights

The North American and European region is anticipated to witness large investments in blockchain technology as companies in these regions are more open to experimenting with upcoming IT solutions. Blockchain technology developers in the North American and European region have also experienced considerable investments by financial companies in blockchain projects. The Asia Pacific and the Middle Eastern region is expected to grow at a high CAGR over the forecast period on account of rising transactions in short-term bank lending.

Blockchain Technology in BFSI Market: Vendor Landscape

The report contains a chapter dedicated to vendors operating in the market, covering raw material manufactures, equipment developers, manufacturers, and distributors. The report provides these insights on a regional level. This section of the report entails contact details, experience, products manufactured/supplied, and geographical presence of companies.

Blockchain Technology in BFSI Market: End-Use Landscape

The end-use landscape includes a list of current and prospective consumers existing across the regions. This section provides company addresses, contact details, products, and regional presence of companies who are purchasing or are likely to invest in blockchain solutions such as Santander Bank, Canadian Imperial Bank of Commerce, Banco Santander, J.P. Morgan Chase, and Citigroup.

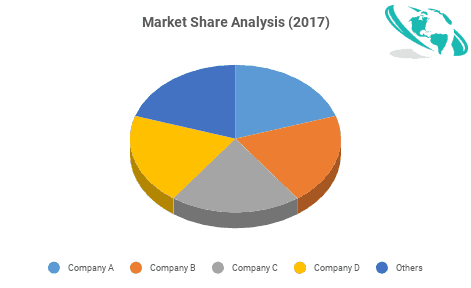

Blockchain Technology in BFSI Market: Competitive Landscape

The global blockchain industry is evolving at a rapid pace on account of its increased preference across various industry verticals. Some of the companies that have taken up projects to provide blockchain technology to the BFSI sector include IBM Corporation, AWS, Microsoft Corporation, Chain, Inc., Coinbase, Digital Asset Holdings, Ripple, R3, Ledger Holdings Inc., and Olympus Labs among others. In September 2017, Microsoft Corporation tied-up with Bank Hapoalim from Israel to develop a system that uses blockchain technology to manage digital bank guarantees.

Please note: This is not an exhaustive list of companies profiled in the report.

The stakeholders to the report include government institutions, banks, financial repositories, insurance providers, exchange market, research organizations, and educational institutes among others.

Check the Press Release on Blockchain Technology Bfsi Market Report???????

We value your investment and offer free customization with every report to fulfil your exact research needs.

The global Blockchain Technology in BFSI Market has been studied from the year 2016 till 2025. However, the CAGR provided in the report is from the year 2017 to 2025. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Blockchain Technology in BFSI Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS