Global Blood Culture Tests Market Size, Trends, and Analysis - Forecasts to 2026 By Method (Conventional/Manual Methods, Automated Methods), By Product (Consumables [Blood Culture Media {Aerobic Blood Culture Media, Pediatric Aerobic Blood Culture Media, Anaerobic Blood Culture Media, Mycobacterial Blood Culture Media, Fungi/Yeast Blood Culture Media}, Assay Kits & Reagents, Blood Culture Accessories], Instruments [Automated Blood Culture Systems, Supporting Laboratory Equipment {Incubators, Colony Counters, Microscopes, Gram Stainers }], Software and Services), By Technology (Culture-Based Technology, Molecular Technologies, Microarrays, PCR [Polymerase Chain Reaction], PNA-FiSH [Peptide Nucleic Acid – Fluorescent in Situ Hybridization], Proteomics Technology), By Application (Bacteremia, Fungemia, Mycobacterial Detection), By End User (Hospital Laboratories, Reference Laboratories, Academic Research Laboratories, Other Laboratories), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

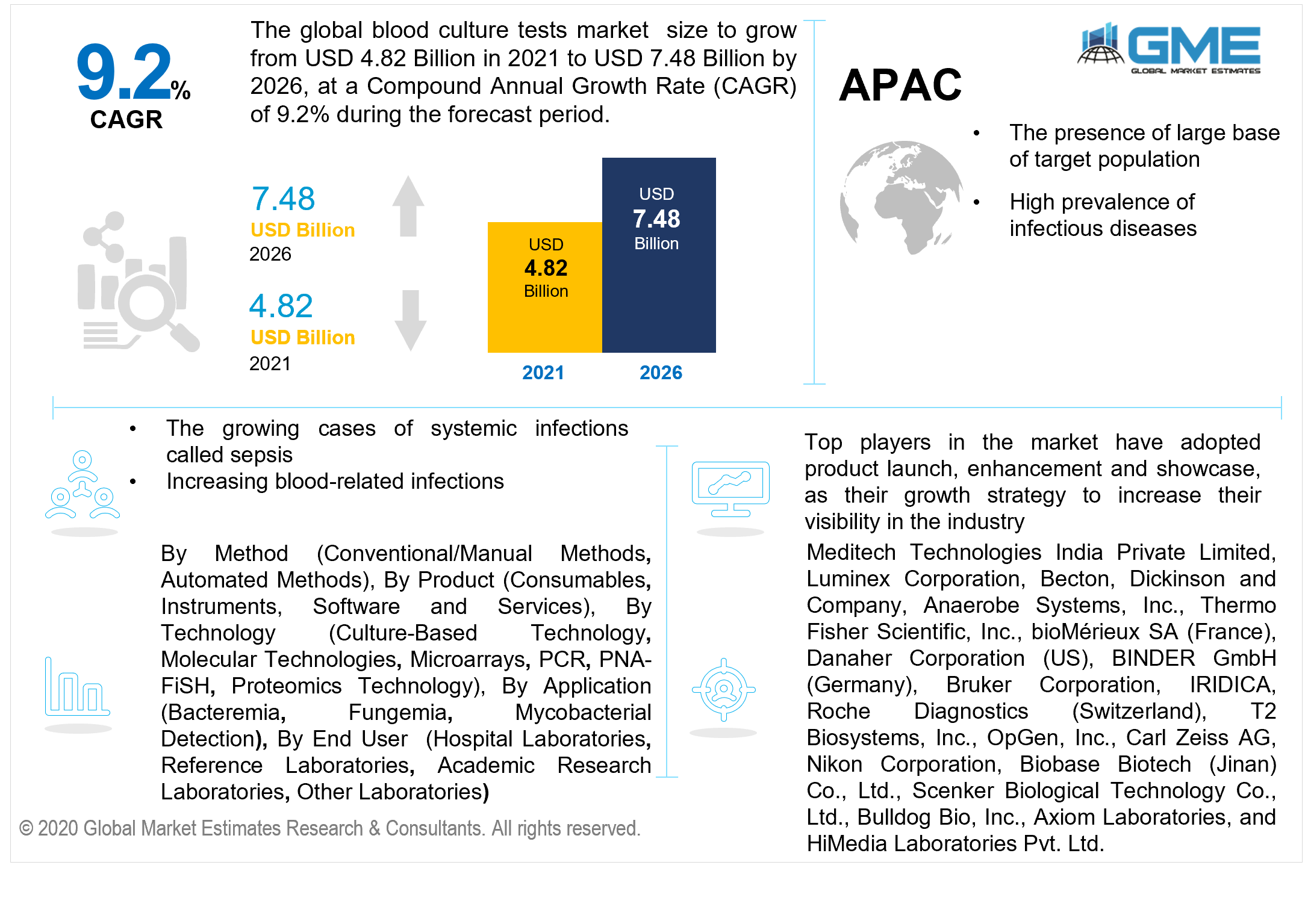

The global blood culture tests market is projected to grow from USD 4.82 billion in 2021 to USD 7.48 billion by 2026 at a CAGR value of 9.2% between 2021 to 2026. The expanding proportion of sepsis cases and significant expense of management, expanding elderly demographic, high frequency of bloodstream disorders, rise in need for quick diagnostic procedures, and predominance of infectious illnesses are all factors driving advancement in the blood culture testing market. The increasing approval rate of novel product lines, including devices and reagents for Bloodstream Infections (BSI) diagnostics, will offer more profitable and attractive possibilities for the blood culture testing market.

Reports have shown that the awareness about the bloodstream infections (BSI) is increasing across the world, and the presence of BSI is predicted to be more in lower and middle income countries. The increasing clinical suspicions for BSI are increasing the requirement of blood culture tests globally. The ignorance towards the BSI can lead to increased death cases. Not only in the lower or middle income countries but also in the higher income countries, every year, approximately 29% of death cases are reported due to undiagnosed and untreated bloodstream infections.

Moreover, the essential requirement to decrease this growing mortality rate is to increase the adaptability to blood cultures and administration of required medical treatments. The 2017 reports of the World Health Organisation (WHO) show that the world witnessed a decline in malaria cases by 47% from 2000 to 2016 and a decline in sepsis mortality cases by 25% from 2000 to 2015. However, the world has also been witnessing a surge in diseases with co-bacterial infections, which are fatal and infectious for the human body, increasing the importance of blood culture in the medical industry globally.

Blood culture tests certainly has high relevance in many countries globally, with the significant impact in increasing the ratio of patient survival and efficient actions of antibiotic treatments. Blood culture brings prevention and control over the spread of BSI and other infectious diseases. Observing and monitoring blood culture test results also helps medical professionals understand the weightage of impact, type, and several blood-borne diseases prevalent in the facility.

Initiatives of international agencies like WHO in collaboration with individual nations to bring down the number of 48 million sepsis cases every year have increased the need and demand for blood culture tests worldwide. WHO's strict guidelines and responses have encouraged the medical sector to enhance their blood culture to diagnose blood infections or sepsis.

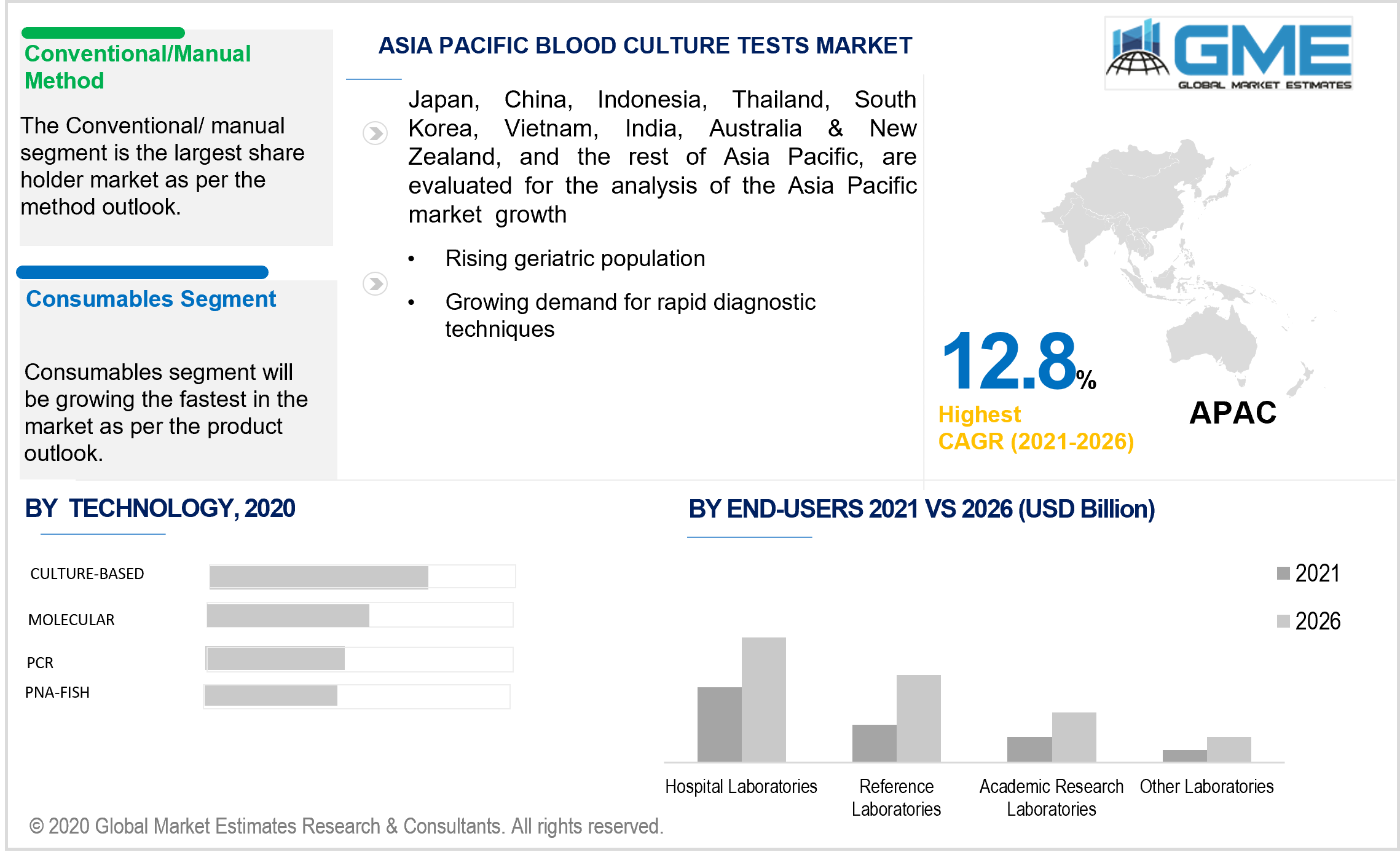

The conventional/ manual method is widely used in the blood culture market. Clinics and laboratories are the centers that majorly undertake the conventional method. The blood is drawn manually and then is tested by the professionals in static incubators and then inspected regularly to observe the sign of growth in the bacterial microorganisms. This method enables the professionals to have control over the setting and prevent any disturbances in surrounding and have a constant check over the test results.

However, it has been predicted that the automated blood culture methods will overtake the demand for manual methods during the forecast period and showcase fast growth rates. This replacement of manual methods with automated methods is currently observed majorly in high-income countries. The technological adaptations have increased the demand for automated methods, increasing the efficiency and precision in carrying out the blood culture tests. These automated methods also provide detailed test reports to the doctors increasing diagnosis and treatment deliverance efficiency. Recent surveys and studies in the lower and middle income countries like India, Egypt, Pakistan have shown better results and high speed in diagnosis by adopting automated methods rather than manual methods.

Consumables are demanded most significantly in the blood culture tests market. Carrying out different blood tests on different individuals with the help of the same needles, syringes, reagents and kits, cotton, and other requisites can be the most prominent reason for the spread of blood-borne infections and diseases. Consumables are the most important necessities for any blood culture test, and the one-time usability of these products showcases constantly increasing demand for them within the market.

These are also considerably cheaper and cost-effective than the instruments that are one-time investments and can be used multiple times to undertake numerous blood culture tests. However, instruments like microscopes, incubators, and automated systems are expected to witness fast growth during the forecast period, pertaining to the increasing number of BSI and sepsis cases.

Culture-based technology holds its dominance over the blood culture test market. As of 2018, this technology was extensively used across the world. The efficiency of this technology in providing access to living microbes, visibility to recognize cell samples, and highly sensitive and effective media results attracted high adaptability to it over the last few decades.

However, the emergence of new advanced diagnostic technologies like PCR and PNA-FiSH is expected to replace the position of culture based technology in the market. These new advanced technologies promote higher accuracies in blood culture tests and are highly time efficient.

A blood culture test is significantly applied to the diagnosis of bacteremia. Bacteremia is the presence of a specific type of bacteria in the bloodstream, causing infections. Bacteremia is commonly found in patients across the world due to various causes like certain bacterial infections, or through injections of recreational drugs, or even through regular day-to-day activities like rigorous tooth floss or brushing, or through improperly undertaken medical procedures.

If these infections are suspected, the professionals highly undertake blood culture tests, where they draw blood and let the microorganisms grow in the laboratory settings, which helps the doctor confirm the presence of bacteremia in the bloodstream and undertake the necessary treatment.

Hospital laboratories are the most significant end users of blood culture testing. The number of blood infections and other infectious diseases suspected by doctors within these hospitals are increasing by the passing year. It becomes beneficial for these hospitals to have laboratories of their own to undertake these blood cultures at any hour of the day, with more efficiency.

Many hospitals across the countries have been adopting centralized laboratories inside their hospital boundaries to enable quick blood culture results to increase productivity and efficiency in the treatments delivered. Increasing awareness programs and stringent guidelines by governmental and international organizations are accelerating hospital laboratories' adaptation and increased blood culture tests.

The reference laboratories are expected to witness fast growth pertaining to the availability of advanced diagnostic technologies and more accurate test results.

North American region holds its dominance over the blood culture tests market. This region is the biggest center of laboratories and application of blood culture tests. Countries like the USA are some of the most significant shareholders in the medical and healthcare sectors. This region is also the most prominent hub of healthcare companies, with extensive blood culture tests for various purposes, from essential infection detection to massive medical research and development projects.

Asia Pacific region is one of the most lucrative regions in today’s world for many emerging companies to grow in. This region has some of the most densely populated countries that are highly vulnerable to excessive blood-borne diseases and infection, thus giving many public and private laboratories the opportunity to carry out their blood culture testing service. Increasing technological advancements are encouraging these lower and middle income countries in the APAC region to adopt higher and more advanced diagnostic technologies to carry out blood cultures.

Many foreign companies in the field of blood culture and diagnostics are targeting countries in APAC to set-up their branches and bring in more funds and investments. The annually increasing sepsis and other BSI cases encourage the government and other organizations in the APAC region to motivate their medical sectors to bring in more R&D and blood culture testings.

Meditech Technologies India Private Limited (India), Luminex Corporation (US), Becton, Dickinson and Company (US), Anaerobe Systems, Inc. (US), Thermo Fisher Scientific, Inc. (US), bioMérieux SA (France), Danaher Corporation (US), BINDER GmbH (Germany), Bruker Corporation (US), IRIDICA (US), Roche Diagnostics (Switzerland), T2 Biosystems, Inc. (US), OpGen, Inc. (US), Carl Zeiss AG (Germany), Nikon Corporation (Japan), Biobase Biotech (Jinan) Co., Ltd. (China), Scenker Biological Technology Co., Ltd. (China), Bulldog Bio, Inc. (US), Axiom Laboratories (India), and HiMedia Laboratories Pvt. Ltd. (India) are some of the most prominent market players.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2020, Becton, Dickinson, and Company (US) announced its partnership with Babson Diagnostics (US) to provide diagnostic testing in retail settings.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Blood Culture Tests Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Method Overview

2.1.3 Technology Overview

2.1.4 End-User Overview

2.1.5 Application Overview

2.1.6 Product Overview

2.1.7 Regional Overview

Chapter 3 Global Blood Culture Tests Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing number of sepsis cases and high cost of treatment

3.3.1.2 Growing demand for rapid diagnostic techniques

3.3.2 Industry Challenges

3.3.2.1 High cost of automated instruments

3.4 Prospective Growth Scenario

3.4.1 Method Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Application Growth Scenario

3.4.5 Product Scenario

3.4.6 Clinical Trial Phase Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Blood Culture Tests Market, By Method

4.1 Method Outlook

4.2 Conventional/Manual Methods

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Automated Methods

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Global Blood Culture Tests Market, By Technology

5.1 Technology Outlook

5.2 Culture-Based Technology

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Molecular Technologies

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 Microarrays

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

5.5 PCR

5.5.1 Market Size, By Region, 2021-2026 (USD Billion)

5.6 PNA-FiSH

5.6.1 Market Size, By Region, 2021-2026 (USD Billion)

5.7 Proteomics Technology

5.7.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Global Blood Culture Tests Market, By End-User

6.1 End-User Outlook

6.2 Hospital Laboratories

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

6.3 Reference Laboratories

6.3.1 Market Size, By Region, 2021-2026 (USD Billion)

6.4 Academic Research Laboratories, Other Laboratories

6.4.1 Market Size, By Region, 2021-2026 (USD Billion)

6.5 Other Laboratories

6.5.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Global Blood Culture Tests Market, By Application

7.1 Application Outlook

7.2 Bacteremia

7.2.1 Market Size, By Region, 2021-2026 (USD Billion)

7.3 Fungemia

7.3.1 Market Size, By Region, 2021-2026 (USD Billion)

7.4 Mycobacterial Detection

7.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 8 Global Blood Culture Tests Market, By Product

8.1 Product Outlook

8.2 Consumables

8.2.1 Market Size, By Region, 2021-2026 (USD Billion)

8.3 Instruments

8.3.1 Market Size, By Region, 2021-2026 (USD Billion)

8.4 Software and Services

8.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 9 Global Blood Culture Tests Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2021-2026 (USD Billion)

9.2.2 Market Size, By Method, 2021-2026 (USD Billion)

9.2.3 Market Size, By Technology, 2021-2026 (USD Billion)

9.2.4 Market Size, By End-User, 2021-2026 (USD Billion)

9.2.5 Market Size, By Application, 2021-2026 (USD Billion)

9.2.6 Market Size, By Product, 2021-2026 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Method, 2021-2026 (USD Billion)

9.2.7.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.2.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.2.7.4 Market Size, By Application, 2021-2026 (USD Billion)

9.2.7.5 Market Size, By Product, 2021-2026 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Method, 2021-2026 (USD Billion)

9.2.8.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.2.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.2.8.4 Market Size, By Application, 2021-2026 (USD Billion)

9.2.8.5 Market Size, By Product, 2021-2026 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Method, 2021-2026 (USD Billion)

9.2.9.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.2.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.2.9.4 Market Size, By Application, 2021-2026 (USD Billion)

9.2.9.5 Market Size, By Product, 2021-2026 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2021-2026 (USD Billion)

9.3.2 Market Size, By Method, 2021-2026 (USD Billion)

9.3.3 Market Size, By Technology, 2021-2026 (USD Billion)

9.3.4 Market Size, By End-User, 2021-2026 (USD Billion)

9.3.5 Market Size, By Application, 2021-2026 (USD Billion)

9.3.6 Market Size, By Product, 2021-2026 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Method, 2021-2026 (USD Billion)

9.3.7.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.3.7.4 Market Size, By Application, 2021-2026 (USD Billion)

9.3.7.5 Market Size, By Product, 2021-2026 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Method, 2021-2026 (USD Billion)

9.3.8.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.3.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.3.8.4 Market Size, By Application, 2021-2026 (USD Billion)

9.3.8.5 Market Size, By Product, 2021-2026 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Method, 2021-2026 (USD Billion)

9.3.9.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.3.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.3.9.4 Market Size, By Application, 2021-2026 (USD Billion)

9.3.9.5 Market Size, By Product, 2021-2026 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Method, 2021-2026 (USD Billion)

9.3.10.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.3.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.3.10.4 Market Size, By Application, 2021-2026 (USD Billion)

9.3.10.5 Market Size, By Product, 2021-2026 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2021-2026 (USD Billion)

9.4.2 Market Size, By Method, 2021-2026 (USD Billion)

9.4.3 Market Size, By Technology, 2021-2026 (USD Billion)

9.4.4 Market Size, By End-User, 2021-2026 (USD Billion)

9.4.5 Market Size, By Application, 2021-2026 (USD Billion)

9.4.6 Market Size, By Product, 2021-2026 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Method, 2021-2026 (USD Billion)

9.4.7.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.4.7.4 Market Size, By Application, 2021-2026 (USD Billion)

9.4.7.5 Market Size, By Product, 2021-2026 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Method, 2021-2026 (USD Billion)

9.4.8.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.4.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.4.8.4 Market Size, By Application, 2021-2026 (USD Billion)

9.4.8.5 Market Size, By Product, 2021-2026 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Method, 2021-2026 (USD Billion)

9.4.9.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.4.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.4.9.4 Market Size, By Application, 2021-2026 (USD Billion)

9.4.9.5 Market Size, By Product, 2021-2026 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2021-2026 (USD Billion)

9.5.2 Market Size, By Method, 2021-2026 (USD Billion)

9.5.3 Market Size, By Technology, 2021-2026 (USD Billion)

9.5.4 Market Size, By End-User, 2021-2026 (USD Billion)

9.5.5 Market Size, By Application, 2021-2026 (USD Billion)

9.5.6 Market Size, By Product, 2021-2026 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Method, 2021-2026 (USD Billion)

9.5.7.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.5.7.4 Market Size, By Application, 2021-2026 (USD Billion)

9.5.7.5 Market Size, By Product, 2021-2026 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Method, 2021-2026 (USD Billion)

9.5.8.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.5.8.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.5.8.4 Market Size, By Application, 2021-2026 (USD Billion)

9.5.8.5 Market Size, By Product, 2021-2026 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Method, 2021-2026 (USD Billion)

9.5.9.2 Market Size, By Technology, 2021-2026 (USD Billion)

9.5.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

9.5.9.4 Market Size, By Application, 2021-2026 (USD Billion)

9.5.9.5 Market Size, By Product, 2021-2026 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 Meditech Technologies India Private Limited (India)

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 Luminex Corporation (US)

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Becton, Dickinson and Company (US)

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 Anaerobe Systems, Inc. (US)

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Thermo Fisher Scientific, Inc. (US)

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 bioMérieux SA (France)

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 Danaher Corporation (US)

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Strategic Positioning

10.8.4 Info Graphic Analysis

10.9 BINDER GmbH (Germany)

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 Bruker Corporation (US)

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.11 IRIDICA (US)

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Info Graphic Analysis

10.12 Roche Diagnostics (Switzerland)

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Info Graphic Analysis

10.13 T2 Biosystems, Inc. (US)

10.13.1 Company Overview

10.13.2 Financial Analysis

10.13.3 Strategic Positioning

10.13.4 Info Graphic Analysis

10.14 OpGen, Inc. (US)

10.14.1 Company Overview

10.14.2 Financial Analysis

10.14.3 Strategic Positioning

10.14.4 Info Graphic Analysis

10.15 Carl Zeiss AG (Germany)

10.15.1 Company Overview

10.15.2 Financial Analysis

10.15.3 Strategic Positioning

10.15.4 Info Graphic Analysis

10.16 Nikon Corporation (Japan)

10.16.1 Company Overview

10.16.2 Financial Analysis

10.16.3 Strategic Positioning

10.16.4 Info Graphic Analysis

10.17 Biobase Biotech (Jinan) Co., Ltd. (China)

10.17.1 Company Overview

10.17.2 Financial Analysis

10.17.3 Strategic Positioning

10.17.4 Info Graphic Analysis

10.18 Scenker Biological Technology Co., Ltd. (China)

10.18.1 Company Overview

10.18.2 Financial Analysis

10.18.3 Strategic Positioning

10.18.4 Info Graphic Analysis

10.19 Bulldog Bio, Inc. (US)

10.19.1 Company Overview

10.19.2 Financial Analysis

10.19.3 Strategic Positioning

10.19.4 Info Graphic Analysis

10.20 Axiom Laboratories (India)

10.20.1 Company Overview

10.20.2 Financial Analysis

10.20.3 Strategic Positioning

10.20.4 Info Graphic Analysis

10.21 HiMedia Laboratories Pvt. Ltd. (India)

10.21.1 Company Overview

10.21.2 Financial Analysis

10.21.3 Strategic Positioning

10.21.4 Info Graphic Analysis

10.22 Other Companies

10.22.1 Company Overview

10.22.2 Financial Analysis

10.22.3 Strategic Positioning

10.22.4 Info Graphic Analysis

The Global Blood Culture Tests Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Blood Culture Tests Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS