Global Bone Densitometer Devices Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (DXA Systems, Peripheral Bone Densitometers [Radiographic Absorptiometry Scanners & Quantitative Ultrasound Scanners]), By Technology (DEXA, Ultrasound, Quantitative Computed Tomography, Others), By Application (Central Scan, Peripheral Scan), By End-User (Hospital, Clinics, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

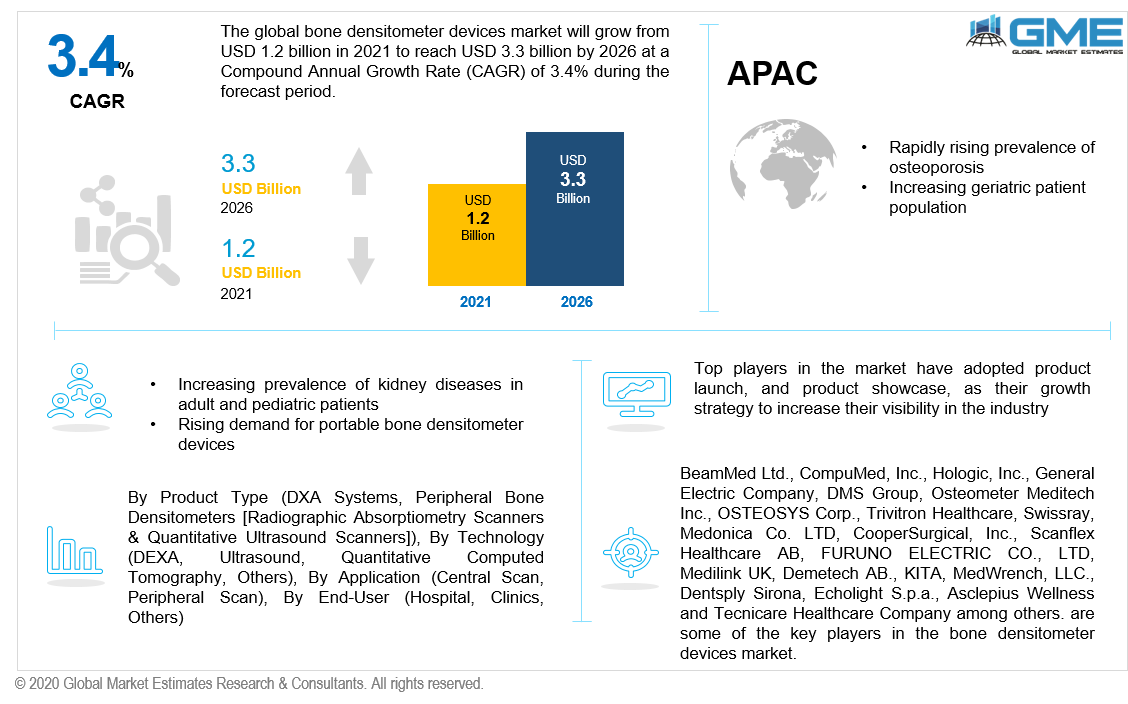

The global bone densitometer devices market will grow from USD 1.2 billion in 2021 to reach USD 3.3 billion in 2026, with a CAGR value of around 3.4%.

A bone densitometer is a medical instrument that uses x-rays to measure the calcium concentration in bone in order to study the bone density and prepare a treatment plan. Bone densitometer devices are used to accurately measure bone density and mineral content in the bones for the diagnosis of osteoporosis or clinical disorders that might cause brittle bones that are prone to fracture.

The increase in the incidence of osteoporosis has increased the demand for bone densitometers during the forecast period. Furthermore, these devices have a variety of benefits such as ease of use, quick turnaround time, non-invasive diagnostic nature, and non-anaesthetic procedure, which make them a reliable procedure for monitoring bone loss.

The rising prevalence of pediatric and adult kidney diseases, rising occurrence of osteoporosis, and the increasing aging population are some of the key factors expected to drive bone densitometer devices market growth during the forecast period. Osteoporosis is considered as a severe public health issue, especially amongst the aging patient pool. As per the WHO 2020’s statistics, over 200 million people worldwide suffer from Osteoporosis, out of which around 30% of patients are women in the United States and Europe. Furthermore, as per the International Osteoporosis Foundation in 2020, Norway is among the highest number of osteoporosis diagnoses per capita in the world.

Rising prevalence of cancer and rising technological developments in the field of portable medical devices to address point of care healthcare demand are anticipated to augment the market growth.

Furthermore, other major factors driving the growth of the market are the increasing healthcare expenses, rising number of arthritis patients, and the rising geriatric patient pool especially in developing regions. Moreover, the rising support from government organizations in the form of research funds to launch smart and portable bone densitometer devices and the rising demand for non-invasive disease diagnosis are some of the trends helping the market attain rapid growth. However, the increasing adoption of refurbished bone densitometer devices in developing regions will pose a challenge for the market growth.

The COVID-19 pandemic had a worldwide impact on healthcare systems. To prevent the spread of the coronavirus, health institutions around the world had imposed lockdown protocols, and the majority of planned and non-urgent surgeries were postponed. Hence, with this, the orthopedic surgeries and diagnostic procedures were postponed too. Thus, the market was affected negatively to a great extent.

The product type segment is categorized as dual-energy X-ray bone absorptiometry (DXA), and peripheral bone densitometers [radiographic absorptiometry scanners & quantitative ultrasound scanners]. Dual-energy X-ray bone absorptiometry or DXA systems segment accounted for the largest share of the market. This segment is also projected to register a higher CAGR during the forecast period. This is because of the added advantages of DXA systems over peripheral DXA systems and high efficient disease diagnostic characteristics.

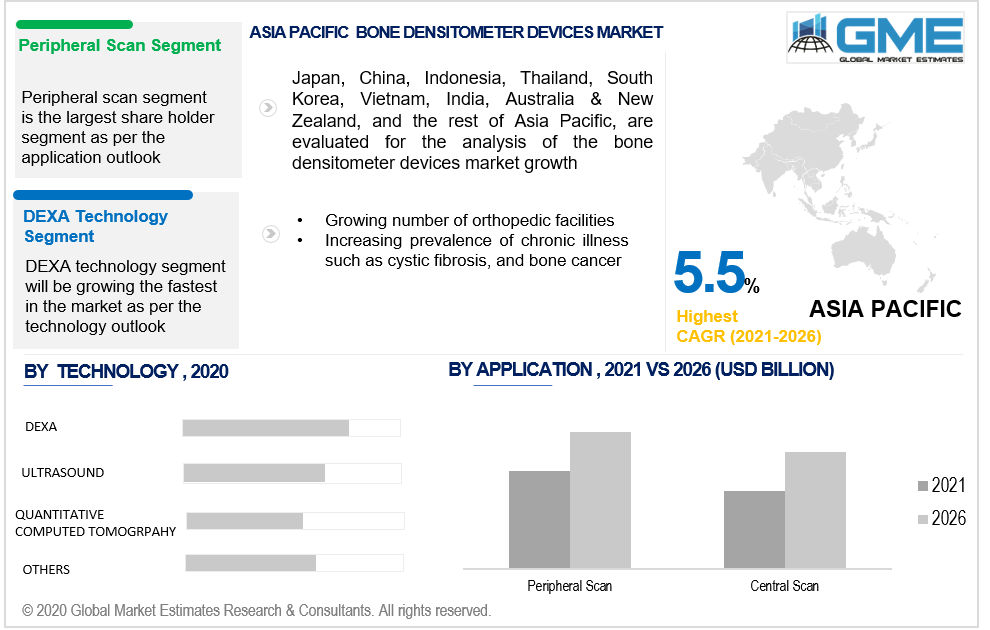

The technology segment is categorized into DEXA/DXA, ultrasound bone densitometer, quantitative computed tomography, others. The DXA system / dual-energy X-ray bone densitometer segment is expected to capture the largest share of the market from 2021 to 2026. DEXA scan equipment is a type of X-ray technique that is used to measure bone loss. A DEXA scanner technology is used to scan both peripheral and central bone mineral density (BMD).

DXA is widely utilized because of its excellent precision, ease of use, and safety for both infants and adults. Some of the leading DEXA scanner manufacturers are MEDILINK, Hologic, GE-Lunar, and Norland who are engaged in the production of DEXA scan machines.

Central scan and peripheral scan are the major segments of the bone density meter device market as per application outlook. The peripheral scan segment is expected to hold the lion’s share of the market during the forecast period. Peripheral devices, which monitor bone density in the wrist, heel, or finger, are frequently available in drugstores and on community mobile health vans. The pDXA devices are more compact than the central DXA devices. They are a portable box-like structure with a section for imaging the forearm or foot and are easy to be used by a radiologist/ technician.

The portable bone densitometer or pDEXA machine uses ultrasonic sound to measure the bone density of the human heel. The output is in a graph format which is in the printed form.

The end-user segment is categorized into hospitals, clinics, and others. In terms of revenue, the hospital segment is expected to dominate the market during the forecast period. Most of the bone density scans are conducted in hospitals. Due to the increasing prevalence of osteoporosis, and other bone-related disorders, chronic kidney disease, and cystic fibrosis, the segment will grow rapidly.

As per the geographical analysis, the global bone densitometer devices market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The largest share of the bone densitometer devices market is mainly due to the presence of key players in the country, rising healthcare expenses, and the increasing occurrence of osteoporosis.

Furthermore, the Asia Pacific region will grow at the highest CAGR during the forecast period. Rising chronic kidney disease, rising discretionary expenses, increasing number of clinics and hospitals, and rising private & public investments for life science research will impact the bone densitometer devices market size positively (x-ray bone densitometers) especially in countries like China, Japan, Malaysia, South Korea, and India. Moreover, increasing R&D investments in the production of advanced healthcare treatment therapies along with the increasing product launch activates are anticipated to boost the APAC regional market growth during the forecast region.

BeamMed Ltd., CompuMed, Inc., Hologic, Inc., General Electric Company, DMS Group, Osteometer Meditech Inc., OSTEOSYS Corp., Trivitron Healthcare, Swissray, Medonica Co. LTD, CooperSurgical, Inc., Scanflex Healthcare AB, FURUNO ELECTRIC CO., LTD, Medilink UK, Demetech AB., KITA, MedWrench, LLC., Dentsply Sirona, Echolight S.p.a., Asclepius Wellness and Tecnicare Healthcare Company among others, are some of the key players in the bone densitometer devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2019, DEX+ signed a partnership agreement with Hologic to distribute its products in developing regions. DEX+ offers devices that are used for body composition measurement.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Bone Densitometer Devices Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 End-User Overview

2.1.3 Application Overview

2.1.4 Technology Overview

2.1.5 Product Type Overview

2.1.6 Regional Overview

Chapter 3 Global Bone Densitometer Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of osteoporosis and kidney disease

3.3.2 Industry Challenges

3.3.2.1 Lack of modern healthcare infrastructure in developing regions

3.4 Prospective Growth Scenario

3.4.1 End-User Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2019

3.11.1 Company Positioning Overview, 2019

Chapter 4 Global Bone Densitometer Devices Market, By End-User

4.1 End-User Outlook

4.2 Hospitals

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Clinics

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Diagnostics Centers

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Bone Densitometer Devices Market, By Application

5.1 Application Outlook

5.2 Peripheral Scan

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Central Scan

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Bone Densitometer Devices Market, By Technology

6.1 Technology Outlook

6.2 DEXA

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Ultrasound

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Quantitative Computed Tomography

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

6.5 Others

6.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Bone Densitometer Devices Market, By Product

7.1 Product Outlook

7.2 DXA Systems

7.2.1 Market Size, By Region, 2019-2026 (USD Billion)

7.3 Peripheral Bone Densitometers

7.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 8 Bone Densitometer Devices Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Billion)

8.2.2 Market Size, By Type, 2019-2026 (USD Billion)

8.2.3 Market Size, By Application, 2019-2026 (USD Billion)

8.2.4 Market Size, By End-User, 2019-2026 (USD Billion)

8.2.5 Market Size, By Technology, 2019-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2019-2026 (USD Billion)

8.2.4.2 Market Size, By Application, 2019-2026 (USD Billion)

8.2.4.3 Market Size, By End-User, 2019-2026 (USD Billion)

Market Size, By Technology, 2019-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2019-2026 (USD Billion)

8.2.7.2 Market Size, By Application, 2019-2026 (USD Billion)

8.2.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.2.7.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Billion)

8.3.2 Market Size, By Type, 2019-2026 (USD Billion)

8.3.3 Market Size, By Application, 2019-2026 (USD Billion)

8.3.4 Market Size, By End-User, 2019-2026 (USD Billion)

8.3.5 Market Size, By Technology, 2019-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

8.3.6.2 Market Size, By Application, 2019-2026 (USD Billion)

8.3.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.3.6.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

8.3.7.2 Market Size, By Application, 2019-2026 (USD Billion)

8.3.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.3.7.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

8.3.8.2 Market Size, By Application, 2019-2026 (USD Billion)

8.3.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.3.8.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2019-2026 (USD Billion)

8.3.9.2 Market Size, By Application, 2019-2026 (USD Billion)

8.3.9.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.3.9.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2019-2026 (USD Billion)

8.3.10.2 Market Size, By Application, 2019-2026 (USD Billion)

8.3.10.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.3.10.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2019-2026 (USD Billion)

8.3.11.2 Market Size, By Application, 2019-2026 (USD Billion)

8.3.11.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.3.11.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Billion)

8.4.2 Market Size, By Type, 2019-2026 (USD Billion)

8.4.3 Market Size, By Application, 2019-2026 (USD Billion)

8.4.4 Market Size, By End-User, 2019-2026 (USD Billion)

8.4.5 Market Size, By Technology, 2019-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

8.4.6.2 Market Size, By Application, 2019-2026 (USD Billion)

8.4.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.4.6.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

8.4.7.2 Market Size, By Application, 2019-2026 (USD Billion)

8.4.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.4.7.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

8.4.8.2 Market Size, By Application, 2019-2026 (USD Billion)

8.4.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.4.8.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2019-2026 (USD Billion)

8.4.9.2 Market size, By Application, 2019-2026 (USD Billion)

8.4.9.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.4.9.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2019-2026 (USD Billion)

8.4.10.2 Market Size, By Application, 2019-2026 (USD Billion)

8.4.10.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.4.10.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Billion)

8.5.2 Market Size, By Type, 2019-2026 (USD Billion)

8.5.3 Market Size, By Application, 2019-2026 (USD Billion)

8.5.4 Market Size, By End-User, 2019-2026 (USD Billion)

8.5.5 Market Size, By Technology, 2019-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

8.5.6.2 Market Size, By Application, 2019-2026 (USD Billion)

8.5.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.5.6.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2019-2026 (USD Billion)

8.5.7.2 Market Size, By Application, 2019-2026 (USD Billion)

8.5.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.5.7.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2019-2026 (USD Billion)

8.5.8.2 Market Size, By Application, 2019-2026 (USD Billion)

8.5.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.5.8.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Billion)

8.6.2 Market Size, By Type, 2019-2026 (USD Billion)

8.6.3 Market Size, By Application, 2019-2026 (USD Billion)

8.6.4 Market Size, By End-User, 2019-2026 (USD Billion)

8.6.5 Market Size, By Technology, 2019-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2019-2026 (USD Billion)

8.6.6.2 Market Size, By Application, 2019-2026 (USD Billion)

8.6.6.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.6.6.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2019-2026 (USD Billion)

8.6.7.2 Market Size, By Application, 2019-2026 (USD Billion)

8.6.7.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.6.7.4 Market Size, By Technology, 2019-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2019-2026 (USD Billion)

8.6.8.2 Market Size, By Application, 2019-2026 (USD Billion)

8.6.8.3 Market Size, By End-User, 2019-2026 (USD Billion)

8.6.8.4 Market Size, By Technology, 2019-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2019

9.2 BeamMed Ltd

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.3 General Electric Company

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Demetech AB

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 DMS Imaging

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Ecolight S.p.A

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Hologic, Inc

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Osteometer Meditech Inc.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.9 Aarna Systems and Wellness Pvt. Ltd

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 Swissray

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 Absolute Medical Services, Inc.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Bone Densitometer Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bone Densitometer Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS