Global Brownfield Investment Market Size, Trends & Analysis - Forecasts to 2029 By Type (Industrial Sites, Commercial Properties, Residential Developments, Infrastructure Projects, and Landfills and Contaminated Sites), By Investment Stage (Acquisition and Remediation, Development and Construction, and Operation and Management), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

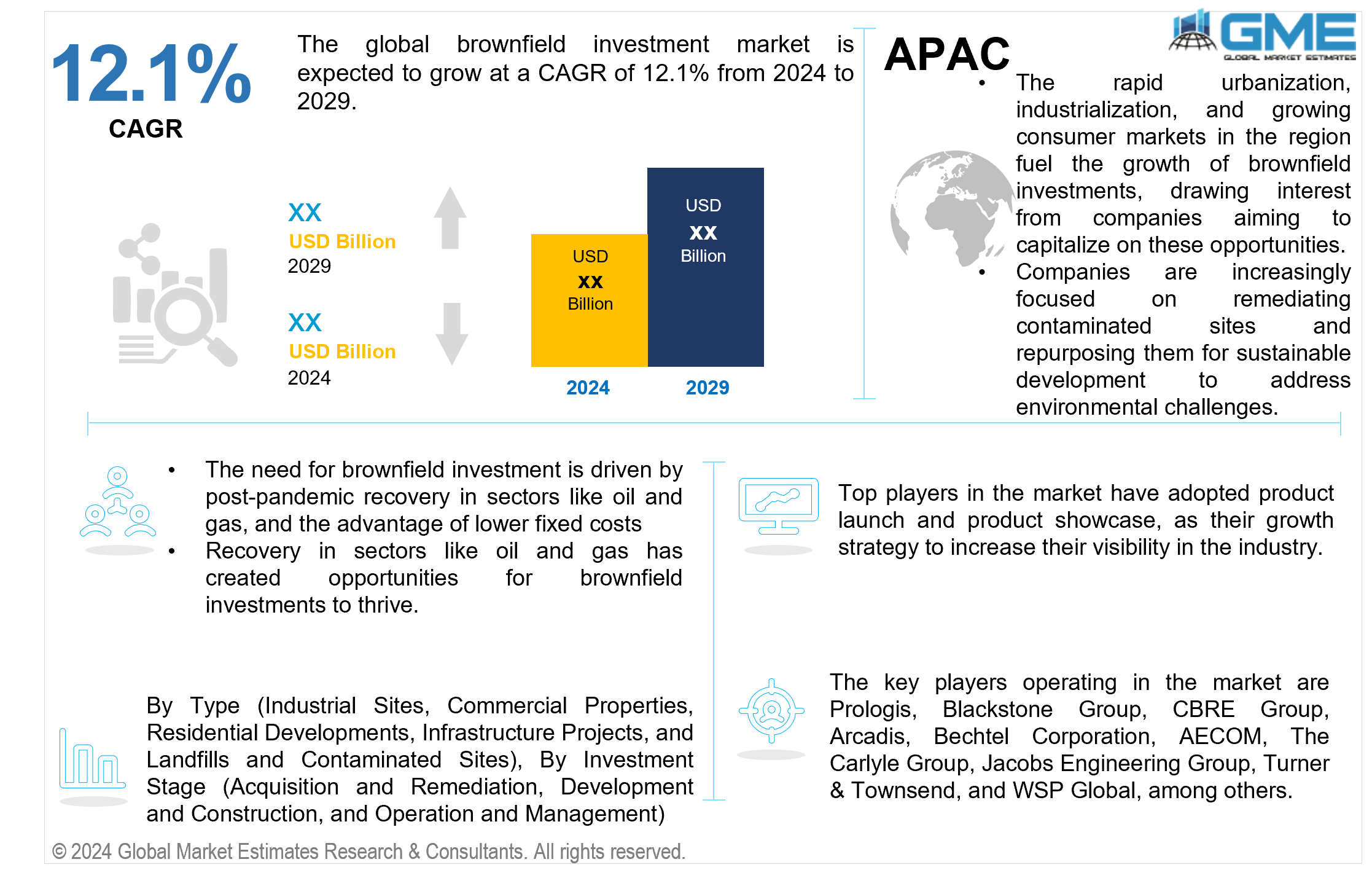

The global brownfield investment market is expected to grow at a CAGR of 12.1% from 2024 to 2029. In this market, companies invest in existing facilities abroad to swiftly access new markets, reduce start-up costs, and utilize existing infrastructure.

The market is mainly driven by post-pandemic recovery in sectors like oil and gas and the advantage of lower fixed costs. One of the key drivers behind brownfield investments is the advantage of lower fixed costs. Companies can significantly reduce their initial investment outlay by utilizing existing facilities, infrastructure, and networks compared to establishing new facilities from scratch. This cost-saving aspect makes brownfield investments appealing for companies looking to enter foreign markets or expand their presence abroad. Recovery in sectors like oil and gas has created opportunities for brownfield investments to thrive. Brownfield investments allow them to quickly establish a presence in these markets and take advantage of the recovering demand, contributing to the growth of the global brownfield investment market.

However, operational inefficiencies may arise if the existing infrastructure cannot be seamlessly adapted to meet the company's production needs, hindering the effectiveness of the investment and potentially affecting profitability.

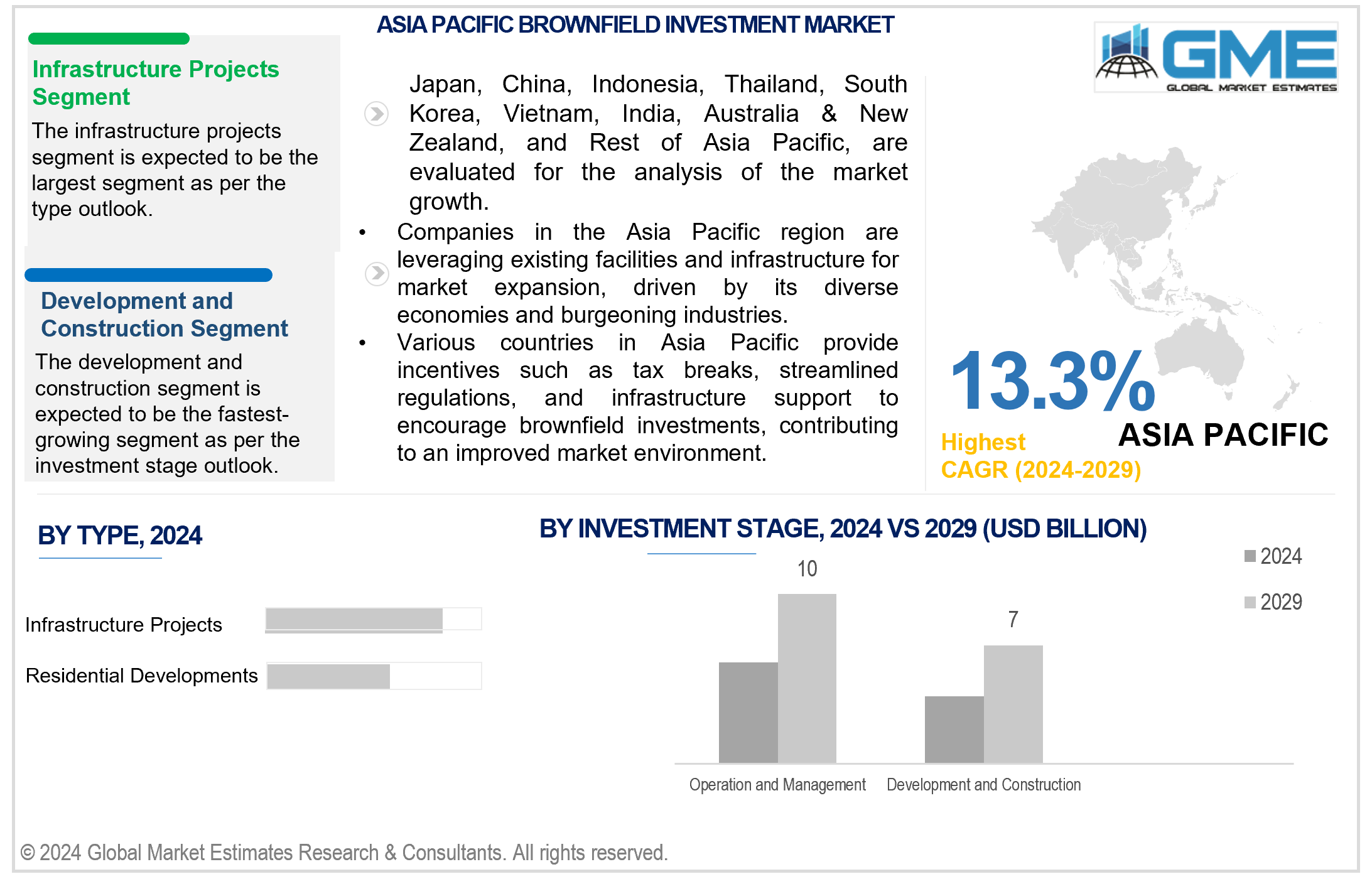

Based on type, the market is segmented into industrial sites, commercial properties, residential developments, infrastructure projects, and landfills and contaminated sites. The infrastructure projects segment is expected to hold the largest share of the market during the forecast period. Brownfield investment in infrastructure projects involves refurbishing or repurposing existing infrastructure assets to meet current needs or expanding their capacity to accommodate growth. This approach offers significant advantages, such as reduced construction time and costs compared to greenfield projects and faster regulatory approvals due to the pre-existing infrastructure.

The residential developments segment is projected to grow fastest during the forecast period. Brownfield investment can benefit residential developments by repurposing underutilized or contaminated sites into viable housing projects. This approach revitalizes urban areas, reduces urban sprawl, and utilizes existing infrastructure, resulting in more sustainable and cost-effective residential developments.

Based on investment stage, the market is segmented into acquisition and remediation, development and construction, and operation and management. The operation and management segment is expected to hold the largest share of the market during the forecast period. Once the facility is acquired, developed, and constructed, the focus shifts to efficiently operating and managing it to generate returns on the investment. This includes coordinating acquisition efforts, overseeing remediation and development activities, and ensuring smooth operations and management post-construction. Effective project management skills are necessary to navigate potential challenges such as infrastructure upgrades, regulatory compliance, and operational inefficiencies.

The development and construction segment is projected to grow fastest during the forecast period. This is because initial investments are made to acquire the brownfield site and remediate existing issues. Once this stage is completed, rapid growth can occur during the development and construction phase as infrastructure is upgraded and adapted to meet the company's specific needs, setting the stage for future operations and management.

North America is analyzed to be the largest region in the global brownfield investment market during the forecast period. The region is witnessing significant activities in brownfield investments across various industries, including manufacturing, energy, and real estate. Factors such as the rising need for infrastructure upgrades, regulatory incentives, and the availability of existing facilities have contributed to the attractiveness of brownfield investments in North America.

Asia Pacific is analyzed to be the fastest-growing region in the brownfield investment market during the forecast period. Companies are increasingly leveraging existing facilities and infrastructure in the Asia Pacific region for market expansion due to its diverse economies and burgeoning industries. The region's rapid urbanization, industrialization, and growing consumer markets are driving the growth of brownfield investments, attracting companies seeking to capitalize on these opportunities. Many countries in the Asia Pacific offer incentives like tax breaks, streamlined regulatory processes, and infrastructure support to encourage brownfield investments, thereby enhancing the overall market environment. These favourable conditions, coupled with strategic government initiatives, create a conducive environment for companies to pursue brownfield investments in the Asia Pacific region and expand their operations successfully.

Prologis, Blackstone Group, CBRE Group, Arcadis, Bechtel Corporation, AECOM, The Carlyle Group, Jacobs Engineering Group, Turner & Townsend, and WSP Global, among others, are some of the key players operating in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2023, Dow announced that its board of directors had declared a Final Investment Decision on the Company's Fort Saskatchewan Path2Zero investment to build the world's first net-zero Scope 1 and 2 emissions-integrated ethylene cracker and derivatives facility in Alberta, Canada.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL BROWNFIELD INVESTMENT MARKET, BY TYPE

4.1 Introduction

4.2 Brownfield Investment Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Industrial Sites

4.4.1 Industrial Sites Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Commercial Properties

4.5.1 Commercial Properties Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Residential Developments

4.6.1 Residential Developments Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Infrastructure Projects

4.7.1 Infrastructure Projects Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Landfills and Contaminated Sites

4.8.1 Landfills and Contaminated Sites Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL BROWNFIELD INVESTMENT MARKET, BY INVESTMENT STAGE

5.1 Introduction

5.2 Brownfield Investment Market: Investment Stage Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Acquisition and Remediation

5.4.1 Acquisition and Remediation Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Development and Construction

5.5.1 Development and Construction Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Operation and Management

5.6.1 Operation and Management Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL BROWNFIELD INVESTMENT MARKET, BY REGION

6.1 Introduction

6.2 North America Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Investment Stage

6.2.3 By Country

6.2.3.1 U.S. Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Investment Stage

6.2.3.2 Canada Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Investment Stage

6.2.3.3 Mexico Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Investment Stage

6.3 Europe Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Investment Stage

6.3.3 By Country

6.3.3.1 Germany Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Investment Stage

6.3.3.2 U.K. Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Investment Stage

6.3.3.3 France Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Investment Stage

6.3.3.4 Italy Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Investment Stage

6.3.3.5 Spain Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Investment Stage

6.3.3.6 Netherlands Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Investment Stage

6.3.3.7 Rest of Europe Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Investment Stage

6.4 Asia Pacific Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Investment Stage

6.4.3 By Country

6.4.3.1 China Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Investment Stage

6.4.3.2 Japan Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Investment Stage

6.4.3.3 India Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Investment Stage

6.4.3.4 South Korea Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Investment Stage

6.4.3.5 Singapore Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Investment Stage

6.4.3.6 Malaysia Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Investment Stage

6.4.3.7 Thailand Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Investment Stage

6.4.3.8 Indonesia Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Investment Stage

6.4.3.9 Vietnam Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Investment Stage

6.4.3.10 Taiwan Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Investment Stage

6.4.3.11 Rest of Asia Pacific Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Investment Stage

6.5 Middle East and Africa Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Investment Stage

6.5.3 By Country

6.5.3.1 Saudi Arabia Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Investment Stage

6.5.3.2 U.A.E. Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Investment Stage

6.5.3.3 Israel Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Investment Stage

6.5.3.4 South Africa Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Investment Stage

6.5.3.5 Rest of Middle East and Africa Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Investment Stage

6.6 Central & South America Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Investment Stage

6.6.3 By Country

6.6.3.1 Brazil Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Investment Stage

6.6.3.2 Argentina Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Investment Stage

6.6.3.3 Chile Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Investment Stage

6.6.3.3 Rest of Central & South America Brownfield Investment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Investment Stage

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Prologis

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Blackstone Group

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 CBRE Group

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Acardis

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Bechtel Corporation

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 AECOM

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 The Carlyle Group

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Jacobs Engineering Group

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Turner & Townsend

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 WSP Global

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Brownfield Investment Market, By Type, 2021-2029 (USD Million)

2 Industrial Sites Market, By Region, 2021-2029 (USD Million)

3 Commercial Properties Market, By Region, 2021-2029 (USD Million)

4 Residential Developments Market, By Region, 2021-2029 (USD Million)

5 Infrastructure Projects Market, By Region, 2021-2029 (USD Million)

6 Landfills and Contaminated Sites Market, By Region, 2021-2029 (USD Million)

7 Global Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

8 Acquisition and Remediation Market, By Region, 2021-2029 (USD Million)

9 Development and Construction Market, By Region, 2021-2029 (USD Million)

10 Operation and Management Market, By Region, 2021-2029 (USD Million)

11 Regional Analysis, 2021-2029 (USD Million)

12 North America Brownfield Investment Market, By Type, 2021-2029 (USD Million)

13 North America Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

14 North America Brownfield Investment Market, By Country, 2021-2029 (USD Million)

15 U.S. Brownfield Investment Market, By Type, 2021-2029 (USD Million)

16 U.S. Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

17 Canada Brownfield Investment Market, By Type, 2021-2029 (USD Million)

18 Canada Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

19 Mexico Brownfield Investment Market, By Type, 2021-2029 (USD Million)

20 Mexico Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

21 Europe Brownfield Investment Market, By Type, 2021-2029 (USD Million)

22 Europe Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

23 Europe Brownfield Investment Market, By Country, 2021-2029 (USD Million)

24 Germany Brownfield Investment Market, By Type, 2021-2029 (USD Million)

25 Germany Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

26 U.K. Brownfield Investment Market, By Type, 2021-2029 (USD Million)

27 U.K. Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

28 France Brownfield Investment Market, By Type, 2021-2029 (USD Million)

29 France Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

30 Italy Brownfield Investment Market, By Type, 2021-2029 (USD Million)

31 Italy Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

32 Spain Brownfield Investment Market, By Type, 2021-2029 (USD Million)

33 Spain Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

34 Netherlands Brownfield Investment Market, By Type, 2021-2029 (USD Million)

35 Netherlands Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

36 Rest Of Europe Brownfield Investment Market, By Type, 2021-2029 (USD Million)

37 Rest Of Europe Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

38 Asia Pacific Brownfield Investment Market, By Type, 2021-2029 (USD Million)

39 Asia Pacific Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

40 Asia Pacific Brownfield Investment Market, By Country, 2021-2029 (USD Million)

41 China Brownfield Investment Market, By Type, 2021-2029 (USD Million)

42 China Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

43 Japan Brownfield Investment Market, By Type, 2021-2029 (USD Million)

44 Japan Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

45 India Brownfield Investment Market, By Type, 2021-2029 (USD Million)

46 India Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

47 South Korea Brownfield Investment Market, By Type, 2021-2029 (USD Million)

48 South Korea Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

49 Singapore Brownfield Investment Market, By Type, 2021-2029 (USD Million)

50 Singapore Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

51 Thailand Brownfield Investment Market, By Type, 2021-2029 (USD Million)

52 Thailand Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

53 Malaysia Brownfield Investment Market, By Type, 2021-2029 (USD Million)

54 Malaysia Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

55 Indonesia Brownfield Investment Market, By Type, 2021-2029 (USD Million)

56 Indonesia Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

57 Vietnam Brownfield Investment Market, By Type, 2021-2029 (USD Million)

58 Vietnam Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

59 Taiwan Brownfield Investment Market, By Type, 2021-2029 (USD Million)

60 Taiwan Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

61 Rest of APAC Brownfield Investment Market, By Type, 2021-2029 (USD Million)

62 Rest of APAC Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

63 Middle East and Africa Brownfield Investment Market, By Type, 2021-2029 (USD Million)

64 Middle East and Africa Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

65 Middle East and Africa Brownfield Investment Market, By country, 2021-2029 (USD Million)

66 Saudi Arabia Brownfield Investment Market, By Type, 2021-2029 (USD Million)

67 Saudi Arabia Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

68 UAE Brownfield Investment Market, By Type, 2021-2029 (USD Million)

69 UAE Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

70 Israel Brownfield Investment Market, By Type, 2021-2029 (USD Million)

71 Israel Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

72 South Africa Brownfield Investment Market, By Type, 2021-2029 (USD Million)

73 South Africa Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

74 Rest Of Middle East and Africa Brownfield Investment Market, By Type, 2021-2029 (USD Million)

75 Rest Of Middle East and Africa Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

76 Central & South America Brownfield Investment Market, By Type, 2021-2029 (USD Million)

77 Central & South America Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

78 Central & South America Brownfield Investment Market, By Country, 2021-2029 (USD Million)

79 Brazil Brownfield Investment Market, By Type, 2021-2029 (USD Million)

80 Brazil Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

81 Chile Brownfield Investment Market, By Type, 2021-2029 (USD Million)

82 Chile Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

83 Argentina Brownfield Investment Market, By Type, 2021-2029 (USD Million)

84 Argentina Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

85 Rest Of Central & South America Brownfield Investment Market, By Type, 2021-2029 (USD Million)

86 Rest Of Central & South America Brownfield Investment Market, By Investment Stage, 2021-2029 (USD Million)

87 Prologis: Products & Services Offering

88 Blackstone Group: Products & Services Offering

89 CBRE Group: Products & Services Offering

90 Acardis: Products & Services Offering

91 Bechtel Corporation: Products & Services Offering

92 AECOM: Products & Services Offering

93 The Carlyle Group : Products & Services Offering

94 Jacobs Engineering Group: Products & Services Offering

95 Turner & Townsend: Products & Services Offering

96 WSP Global: Products & Services Offering

97 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Brownfield Investment Market Overview

2 Global Brownfield Investment Market Value From 2021-2029 (USD Million)

3 Global Brownfield Investment Market Share, By Type (2023)

4 Global Brownfield Investment Market Share, By Investment Stage (2023)

5 Global Brownfield Investment Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Brownfield Investment Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Brownfield Investment Market

10 Impact Of Challenges On The Global Brownfield Investment Market

11 Porter’s Five Forces Analysis

12 Global Brownfield Investment Market: By Type Scope Key Takeaways

13 Global Brownfield Investment Market, By Type Segment: Revenue Growth Analysis

14 Industrial Sites Market, By Region, 2021-2029 (USD Million)

15 Commercial Properties Market, By Region, 2021-2029 (USD Million)

16 Residential Developments Market, By Region, 2021-2029 (USD Million)

17 Infrastructure Projects Market, By Region, 2021-2029 (USD Million)

18 Landfills and Contaminated Sites Market, By Region, 2021-2029 (USD Million)

19 Global Brownfield Investment Market: By Investment Stage Scope Key Takeaways

20 Global Brownfield Investment Market, By Investment Stage Segment: Revenue Growth Analysis

21 Acquisition and Remediation Market, By Region, 2021-2029 (USD Million)

22 Development and Construction Market, By Region, 2021-2029 (USD Million)

23 Operation and Management Market, By Region, 2021-2029 (USD Million)

24 Regional Segment: Revenue Growth Analysis

25 Global Brownfield Investment Market: Regional Analysis

26 North America Brownfield Investment Market Overview

27 North America Brownfield Investment Market, By Type

28 North America Brownfield Investment Market, By Investment Stage

29 North America Brownfield Investment Market, By Country

30 U.S. Brownfield Investment Market, By Type

31 U.S. Brownfield Investment Market, By Investment Stage

32 Canada Brownfield Investment Market, By Type

33 Canada Brownfield Investment Market, By Investment Stage

34 Mexico Brownfield Investment Market, By Type

35 Mexico Brownfield Investment Market, By Investment Stage

36 Four Quadrant Positioning Matrix

37 Company Market Share Analysis

38 Prologis: Company Snapshot

39 Prologis: SWOT Analysis

40 Prologis: Geographic Presence

41 Blackstone Group: Company Snapshot

42 Blackstone Group: SWOT Analysis

43 Blackstone Group: Geographic Presence

44 CBRE Group: Company Snapshot

45 CBRE Group: SWOT Analysis

46 CBRE Group: Geographic Presence

47 Acardis: Company Snapshot

48 Acardis: Swot Analysis

49 Acardis: Geographic Presence

50 Bechtel Corporation: Company Snapshot

51 Bechtel Corporation: SWOT Analysis

52 Bechtel Corporation: Geographic Presence

53 AECOM: Company Snapshot

54 AECOM: SWOT Analysis

55 AECOM: Geographic Presence

56 The Carlyle Group : Company Snapshot

57 The Carlyle Group : SWOT Analysis

58 The Carlyle Group : Geographic Presence

59 Jacobs Engineering Group: Company Snapshot

60 Jacobs Engineering Group: SWOT Analysis

61 Jacobs Engineering Group: Geographic Presence

62 Turner & Townsend.: Company Snapshot

63 Turner & Townsend.: SWOT Analysis

64 Turner & Townsend.: Geographic Presence

65 WSP Global: Company Snapshot

66 WSP Global: SWOT Analysis

67 WSP Global: Geographic Presence

68 Other Companies: Company Snapshot

69 Other Companies: SWOT Analysis

70 Other Companies: Geographic Presence

The Global Brownfield Investment Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Brownfield Investment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS