Global Bus Rapid Transit System (BRTS) Market Size, Trends & Analysis - Forecasts to 2026 By Bus Type (Standard, Articulated, and Others), By System Type (Open BRT System, Closed BRT System, and Hybrid BRT System), By Fuel Type (Diesel, Natural Gas, and Others), By Region (By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

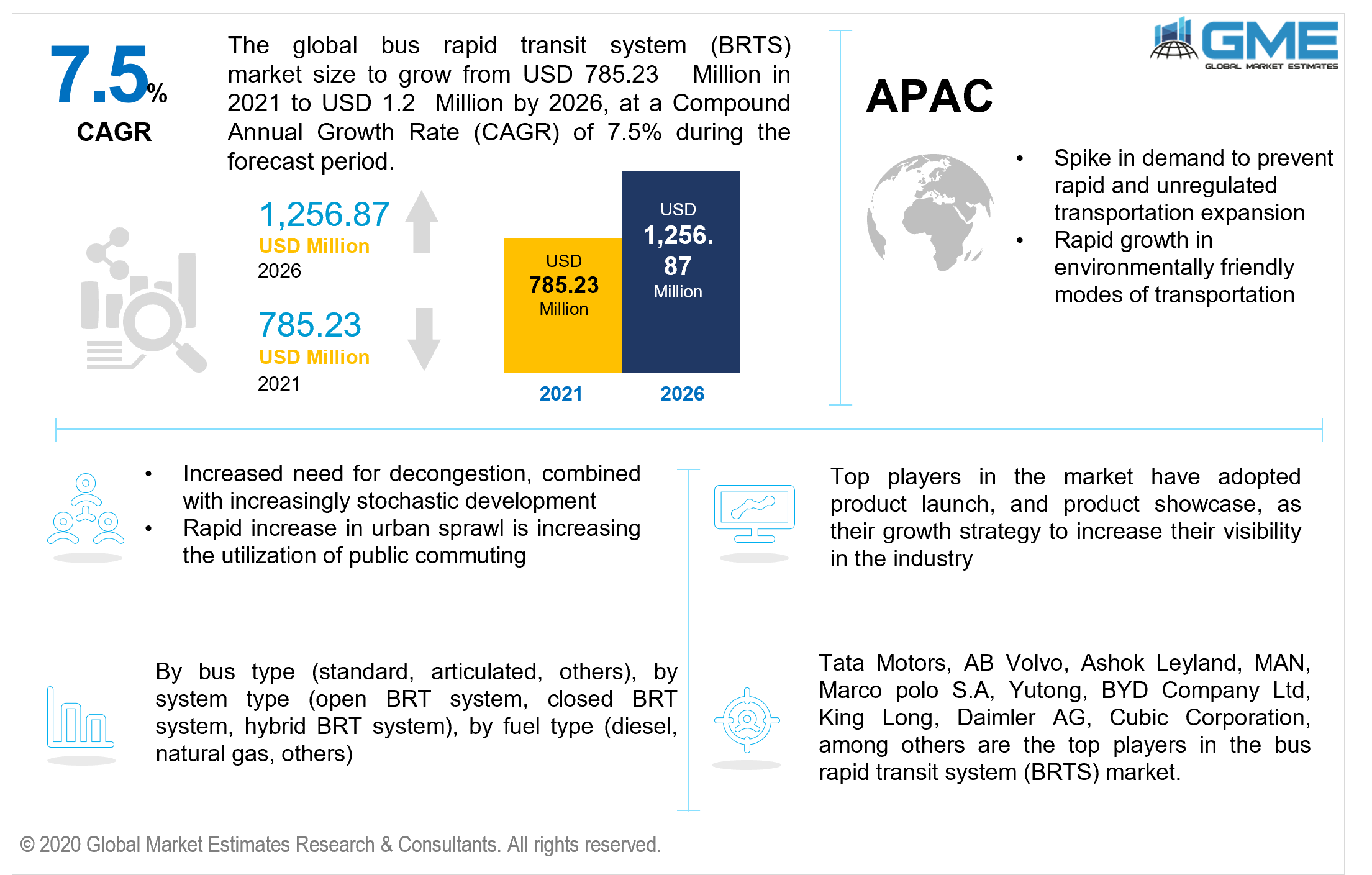

The Global Bus Rapid Transit System (BRTS) Market is projected to grow from USD 785.23 million in 2021 and is expected to reach USD 1,256.87 million by 2026 at a CAGR of 7.5% from 2021 to 2026.

BRTS is becoming increasingly popular among governments looking to increase public transport usage to combat pollution and other issues in cities across the globe. As per World Bank research, 70% of the world's metropolitan populace breaths polluted air and over one billion people are also expected to live in cities with toxic levels of particulate matter. Annually, millions die or endure major health consequences as a result of air pollution. As shown in a WHO investigation, approximately 3 million people die every year as a result of air contamination; this statistic represents approximately 5% of the total 55 million people who die globally every year.

Cities all over the world are looking for sustainable solutions to get inhabitants through their streets swiftly, effectively, and securely. BRTS, a city-based, elevated bus transit system wherein buses run on defined routes, is one such approach. Both in developing and developed economies, BRT is now being extensively used. According to novel research, BRTS can save commuters throughout the globe thousands of hours of commute time. The success of existing BRTS across the globe is paving the path forward for greater adoption of BRTS during the forecast period. BRTS customers in Istanbul, Turkey, for instance, can save 28 days annually switching from other modes of transportation to BRTS. Similarly, commuters in Johannesburg, South Africa, could also save an anticipated 73 million hours between 2007 and 2026. That corresponds to more than 9 million eight-hour working days.

During the forecast period, the increased need for decongestion, combined with increasingly stochastic development with targeted journeys, would drive the demand for BRTS. Furthermore, urban sprawl is increasing the utilization of public commuting, and there is a growing desire to use ecologically friendly and green modes of public mobility, which is boosting market expansion.

The introduction of favorable regulatory requirements encouraging the deployment of effective and sustainable rapid transit systems with minimal impact on the environment is also contributing to market expansion. BRT systems contribute to enhanced pedestrian safety by lowering congestion problems and the likelihood of accidents, injuries, and fatalities. Additional factors, such as major infrastructure growth and extensive usage of advanced communication networks, are likely to further boost the industry.

The transportation sector is one of the many sectors that has felt the brunt of COVID-19's economic impact. The need for passenger transportation has been harmed as a result of the lockdown in many nations. Because of the COVID-19 pandemic, up to one-third of residents in some places have stopped taking public transportation. Lockdowns, the development of remote working, and stay-at-home orders have all resulted in a fall in the number of people commuting, according to research conducted in 104 locations across 28 countries.

Nonetheless, passenger wait times, public health hazards, accessibility issues, and capacity constraints are some of the drawbacks of bus rapid transit. The stigma associated with being a 'bus' is also a key restriction of the bus-rapid-transit system. This may be solved by better system design, well-maintained stations, and, most crucially, bus-only lanes, which will encourage people to leave their cars at home.

Based on the bus type, the market is segmented into standard, articulated, and others. The standard BRTS segment is expected to have the largest share during the forecast period. The growth is attributable to the fact that standard BRTS is designed to outperform a traditional bus system in terms of capacity and dependability. BRTS also aspires to combine the capacity and speed of a metro with the flexibility, cheap cost, and ease of use of a bus system.

Furthermore, specific curbside bus-only lanes reduce BRT travel time, allowing buses to compete with automobiles. BRT is far more dependable, convenient, and faster than ordinary bus services because it has features akin to a light rail or metro system. BRT, with the correct characteristics, can eliminate the delays that plague normal bus services, such as getting caught in traffic and queuing to pay onboard.

Based on the system type, the market is segmented into open BRT system, closed BRT system, and hybrid BRT system. The demand for closed BRTS is estimated to have the largest share in the market during the forecast period. Closed BRT makes it possible for stringent management of the operations, carrying capacity, and minimal queue length in extremely crowded systems, and closed BRT in advanced economies are more likely to be about trying to emulate the experience of rail transit to appeal to presumed entitlements or "choice" rider. The benefits of closed BRT are primarily identity and a few specific types of amenities.

If the buses can proceed off the end of the infrastructure and function as regular buses on local streets, the BRTS system is open. In most circumstances, open BRTS is preferred since the benefits of open BRTS revolve around people's ability to go to destinations and do things more freely. A closed BRTS option, on the other hand, will necessitate more transfers than an open BRT option for people to reach genuine destinations that are beyond the infrastructure.

Based on the fuel type, the market is segmented into diesel, natural gas, and others. The demand for natural gas for operating BRTS is expected to have a lion’s share in the market during the forecast period. This is attributable to the fact that natural gas buses emit 12 % fewer greenhouse gases than diesel buses. Natural gas is also considered to be environment friendly because, unlike other gas, it produces very few remnants as emissions into the environment.

As per the geographical analysis, the market can be classified into North America, Europe, Central, and South America, the Middle East and Africa, and the Asia Pacific regions. The North American region is expected to hold the lion’s share of the global revenue generated in the market. Cities like Ottawa, which support transport-oriented development (TOD) by stressing land use policy to foster future expansion as well as sustain and expand transit ridership, define the market in North America. The cost per kilometer of BRT systems in Europe is comparable to that of other systems, such as those in the Asia Pacific. However, because of the existing public transit in this area, the annual demand is far lower.

The Asia-Pacific region is also expected to become the dominant region during the forecast period The need for BRTS in the region is being driven by a growing desire to prevent rapid and unregulated transportation expansion, as well as a larger need for high-capacity, inexpensive, and environmentally friendly modes of transportation. Furthermore, the quickly growing urban population in the region, as well as BRTS' capacity to improve road safety by managing traffic congestion and lowering the risk of accidents, injuries, and fatalities, are fuelling the market's expansion in the Asia-Pacific region.

Tata Motors, AB Volvo, Ashok Leyland, MAN, Marco polo S.A, Yutong, BYD Company Ltd, King Long, Daimler AG, Cubic Corporation, among others are the top players in the bus rapid transit system (BRTS) market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Bus Rapid Transit Systems (BRTS) Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Bus Type Overview

2.1.3 System Type Overview

2.1.4 Fuel Type Overview

2.1.6 Regional Overview

Chapter 3 Bus Rapid Transit Systems (BRTS) Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The increased need for decongestion, combined with increasingly stochastic development with targeted journeys

3.3.2 End-User Challenges

3.3.2.1 High passenger wait times, public health hazards, accessibility issues, and capacity constraints

3.4 Prospective Growth Scenario

3.4.1 Bus Type Growth Scenario

3.4.2 System Type Growth Scenario

3.4.3 Fuel Type Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Bus Rapid Transit Systems (BRTS) Market, By Bus Type

4.1 Bus Type Outlook

4.2 Standard

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Articulated

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Others

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Bus Rapid Transit Systems (BRTS) Market, By System Type

5.1 System Type Outlook

5.2 Open BRT system

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Closed BRT System

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Hybrid BRT System

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Bus Rapid Transit Systems (BRTS) Market, By Fuel Type

6.1 Diesel

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Natural Gas

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Others

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Bus Rapid Transit Systems (BRTS) Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By System Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By System Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By System Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By System Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By System Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By System Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Bus Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By System Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Fuel Type, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Tata Motors

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 AB Volvo

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Ashok Leyland

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 MAN

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Marco polo S.A

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Yutong

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 BYD Company Ltd

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 King Long

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Daimler AG

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Cubic Corporation

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Infographic Analysis

The Global Bus Rapid Transit System (BRTS) Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bus Rapid Transit System (BRTS) Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS