Global Cardiac Biomarkers Market Size, Trends & Analysis - Forecasts to 2026 By Type (Troponin (T And I), Myocardial Muscle Creatine Kinase (CK-MB), Natriuretic Peptides [B-Type Natriuretic Peptide (BNP) & N-Terminal Pro-B-Type Natriuretic Peptide (NT-ProBNP)], Ischemia Modified Albumin (IMA), Myoglobin, Others), By Application (Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, Atherosclerosis, Others), By Location Of Testing (Laboratory Testing, Point Of Care (POC) Testing); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

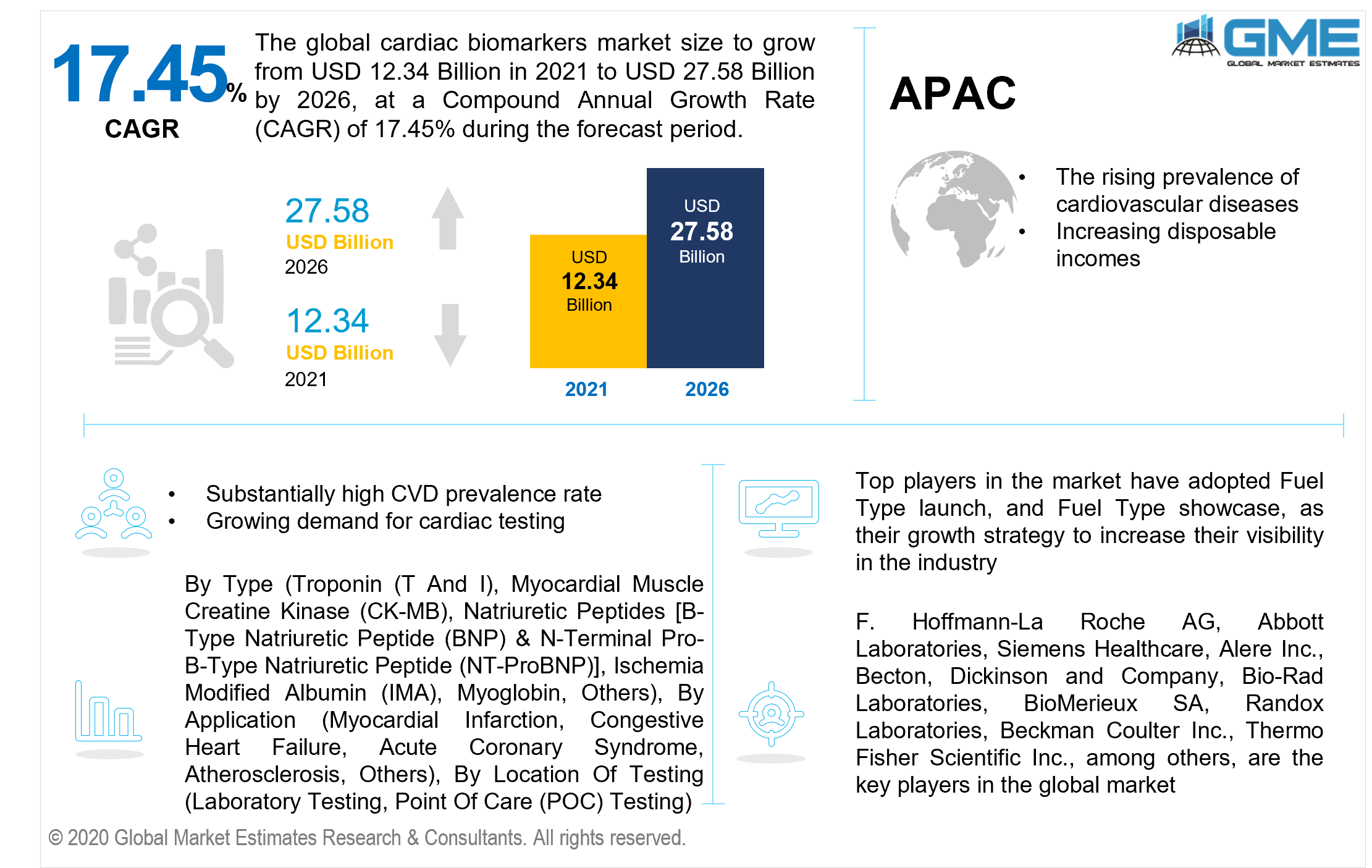

The global cardiac biomarkers market is estimated to be valued at USD 12.34 billion in 2021 and is projected to reach USD 27.58 billion by 2026 at a CAGR of 17.45%. There has been an increase in the proportion of patients enduring acute coronary syndrome (ACS) in recent years, creating a global demand for cardiac marker diagnostics.

Aside from that, soaring patient and medical care service consciousness concerning the relevance of incipient detection of multiple cardiovascular diseases (CVD) is propelling demand for such markers. Furthermore, multiple private and public organizations are investing in research and development activities to improve sophisticated technologies in the domain of cardiac biomarkers.

Moreover, the elevated precision and swift results provided by biomarker diagnostics, as well as the provision of inexpensive cardiac point-of-care diagnostics, are a few of the determinants attributable to the market's development.

During the forecast period, the market is foreseen to benefit from the rising pervasiveness of cardiovascular diseases caused by COVID-19. According to the World Health Organization, approximately 17.7 million people die each year from cardiovascular diseases (CVDs), which are predicted to account for 31% of all mortality globally. COVID-19 has an elevated influence on patients struggling with CVD, and it is expected that patients enduring from COVID-19 will stimulate specific CVD including heart failure and acute coronary syndrome, among many others.

According to a March 2020 NCBI article, even though COVID-19 impacts the respiratory system as well as other linked organ systems, it has a significant influence on CVD. This has resulted in improvised reforms and guidelines for testing COVID-19 patients with biomarkers and other tests in medical care contexts around the world. These are some of the considerations that are foreseen to increase the utilization of biomarker testing globally, thereby driving market advancement. Numerous different pivotal expansion drivers encompass an expansion in the proportion of novel cardiovascular cases diagnosed every year, as well as an increment in demand for disease-specific therapy that employs cardiac biomarkers.

The potential of cardiac markers to accurately and quickly anticipate heart failure after the initiation of chest pain has boosted market advancement. Furthermore, enticing characteristics including high precision, swift results and affordable pricing of cardiac point of care (POC) diagnostics are propelling the global development of the market. To maintain the traction of cardiac marker tests, major producers provide customized solutions. The industrial implementation of multi-menu alternatives for cardiovascular diagnostics utilizing various configurations of such biomarkers, as well as target-oriented approaches, are the market's vital prospects.

Nevertheless, restricted specificity in some circumstances, the progression of other techniques for diagnosing cardiovascular diseases, high treatment costs, a dearth of full proof affirmation, as well as adverse effects including skeletal muscle injury, are limiting the expansion of the markets. A multitude of aspects influences the advancement of the market. The upsurge in demand for early diagnosis and screening of multiple cardiovascular diseases, the progression and enhancement of biomarkers for CVD, and the increase in the patient demographic afflicted by cardiovascular diseases are a few of the significant aspects.

Depending on the type, the market is categorized as Troponin (T and I), Myocardial Muscle Creatine Kinase (CK-MB), Natriuretic peptides - B-type Natriuretic Peptide (BNP) & N-terminal pro-b-type Natriuretic peptide (NT-proBNP), Ischemia Modified Albumin (IMA), Myoglobin, and others.

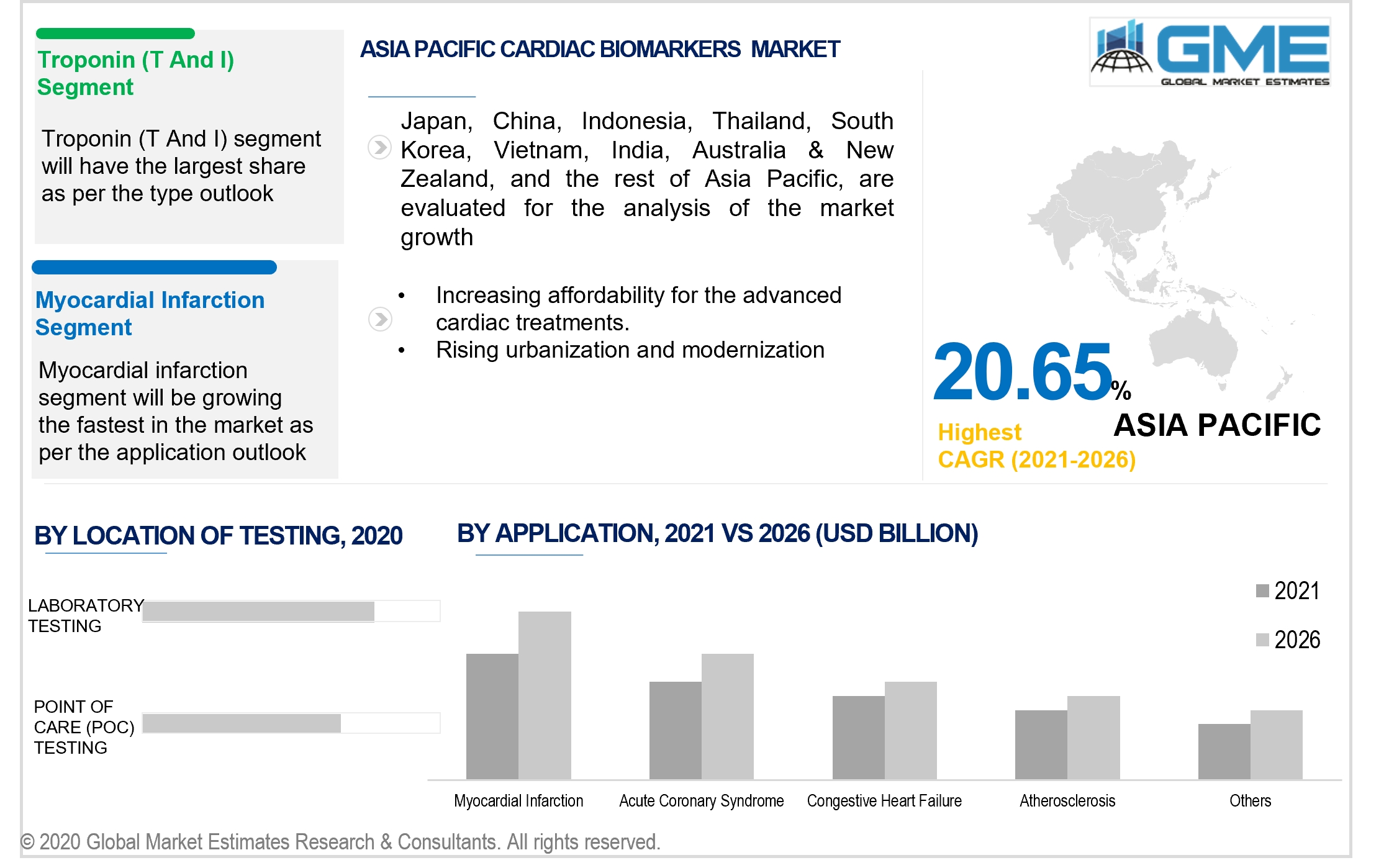

Troponin tests are expected to predominate due to their advantages in the detection of AMI and their effectiveness in the comprehensive and precise prognosis of cardiovascular disorders when compared to other tests, which facilitates in the prevention of detrimental cardiac occurrences The considerations can be ascribed to elevated responsiveness and thoroughness, lengthy elevation time intervals, and quick prognostication of the result or death rates.

Depending on the application, the market is categorized as myocardial infarction, congestive heart failure, acute coronary syndrome, atherosclerosis, and others. Myocardial infarction is foreseen to predominate. The skyrocketing proportion of cardiovascular disorders is a major factor driving the segment's expansion. Many companies are concentrating their efforts on designing ground-breaking product lines for the diagnosis of myocardial infarction. As a consequence of elevated government programs, a rising aging populace, the pervasiveness of an unhealthy & inactive lifestyle among people, smoking & liquor intake, and poor dietary preferences, all of which invariably contribute to obesity, and widespread implementations of biomarkers in cardiovascular diagnostic tests, the myocardial infarction market segment is foreseen to expand over the forecast period.

Depending on the location of testing, the market is categorized as laboratory testing, and point of care (POC) testing. The segment of point of care testing is expected to have the largest market share. The aspects can be attributed to functionalities including high precision, instant results, and affordable pricing. POC screening test kits are compact and portable, allowing for simplicity of usage and comfort, rendering them effective as diagnostic instruments in the home healthcare market.

North America is expected to dominate the market in terms of the revenue share of the overall market. The substantial disease pressure caused by the increased prevalence of coronary heart disease in North America, as well as the growing relevancy of point-of-care diagnosis and treatment, are foreseen to contribute to the demand for biomarkers for CVD. A result of surging concerns about CVD and increased expenditure on research and development of innovative biomarkers which are the potential therapeutics for CVD are vital catalysts for the overall market expansion.

The Asia Pacific region is expected to grow at the fastest rate due to its sizeable core patient demographic, accelerated incorporation of technically sophisticated biomarkers, and increasing proportion of cardiovascular diseases. This rapid growth in the government programs is intended to fuel the introduction of biomarkers for CVD in the APAC area throughout the forecast period.

F. Hoffmann-La Roche AG, Abbott Laboratories, Siemens Healthcare, Alere Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, BioMerieux SA, Randox Laboratories, Beckman Coulter Inc., Thermo Fisher Scientific Inc., among others, are the key players in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Cardiac Biomarkers Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Location Of Testing Overview

2.1.5 Regional Overview

Chapter 3 Global Cardiac Biomarkers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Prevalence Of Cardiovascular Diseases

3.3.1.2 Rising Technological Developments

3.3.2 Industry Challenges

3.3.2.1 High Treatment Costs

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Location Of Testing Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cardiac Biomarkers Market, By Type

4.1 Type Outlook

4.2 Troponin (T And I)

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Myocardial Muscle Creatine Kinase (CK-MB)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Natriuretic Peptides

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.4.2 Market Size, By B-Type Natriuretic Peptide (BNP), 2019-2026 (USD Million)

4.4.3 Market Size, By N-Terminal Pro-B-Type Natriuretic Peptide (NT-ProBNP), 2019-2026 (USD Million)

4.5 Ischemia Modified Albumin (IMA)

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Myoglobin

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

4.7 Others

4.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Cardiac Biomarkers Market, By Application

5.1 Application Outlook

5.2 Myocardial Infarction

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Congestive Heart Failure

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Acute Coronary Syndrome

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Atherosclerosis

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Cardiac Biomarkers Market, By Location Of Testing

6.1 Location Of Testing Outlook

6.2 Laboratory Testing

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Point Of Care (POC) Testing

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Depth Filtration Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Type, 2019-2026 (USD Million)

7.2.3 Market Size, By Application, 2019-2026 (USD Million)

7.2.4 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Type, 2019-2026 (USD Million)

7.3.3 Market Size, By Application 2019-2026 (USD Million)

7.3.4 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.5.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Type, 2019-2026 (USD Million)

7.4.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.4 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.8.2 Market size, By Application, 2019-2026 (USD Million)

7.4.8.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Type, 2019-2026 (USD Million)

7.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.4 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Type, 2019-2026 (USD Million)

7.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.4 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.5.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.6.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Location Of Testing, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 F. Hoffmann-La Roche AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Abbott Laboratories

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Siemens Healthcare

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Alere Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Becton

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Dickinson and Company

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Bio-Rad Laboratories

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 BioMerieux SA

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Randox Laboratories

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Beckman Coulter Inc.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Thermo Fisher Scientific Inc.

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Other Companies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

The Global Cardiac Biomarkers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cardiac Biomarkers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS