Global Cartoning Machines Market Size, Trends & Analysis - Forecasts to 2026 By Type (Vertical/Top- Load Cartoning Machine, Horizontal/End- Load Cartoning Machine), By End-Use (Food & Beverage, Healthcare & Pharmaceuticals, Consumer Goods, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

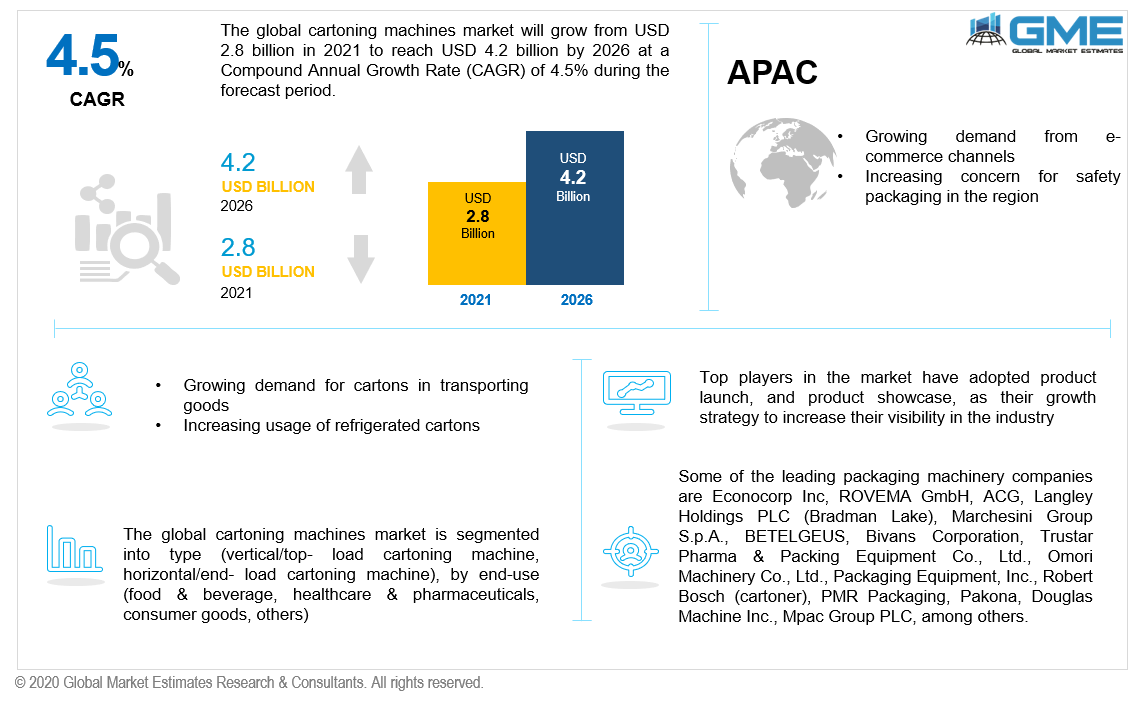

The global cartoning machines market will grow from USD 2.8 billion in 2021 to reach USD 4.2 billion in 2026, with a CAGR of 4.5% during the forecast period.

The global market is likely to expand as packaging machinery evolves. Design enhancements for automation, capacity expansion, and rapid shift in producer focus aids in market advancement. Packaging machines have also played an important role in the growth of cartoning machines. This is due to the development of modern machines as part of cartoning machine producers’ marketing and branding strategy, which is supporting these companies in earning a brand identity.

The rising demand for fully automatic cartoning equipment, expanding demand for cartons in transporting goods, and rising demand from e-commerce platforms are some of the key factors anticipated to push market growth during the forecast period. Cartoning equipment is cost-effective, dependable, and has a small machine footprint. The expansion of carton packaging and FMCG companies are likely to boost the growth of the cartoning equipment market. The continual growth in the cartoning equipment market is attributed to rising industry innovation. Due to this, the market has become highly competitive and has paved the way for many key players and firms to launch innovative products.

Automation has impacted the global manufacturing business and is likely to continue growing at a steady rate, with more enterprises shifting to automated production units that require less human involvement. This opens up plenty of opportunities for the global industrial packing machine market. Cartoning machines are packing equipment that erects, close and enclose, fill and seal carton blanks or folded and side-sealed cartons. Thus, ascribed to these aforementioned aspects the overall market is foreseen to grow.

According to the comprehensive forecast trend analysis, the cartoning equipment market is experiencing substantial expansion in terms of volume due to the ongoing surging demand for secure and convenient packaging. Because of growing globalization, the transit distance for the product is being expanded to maximize product reach, therefore safety has become an essential aspect for the transportation, logistics, and shipping industry. Furthermore, changing consumer preferences and demand for innovative packaging solutions are anticipated to push overall market expansion.

Moreover, the rising healthcare sector is also fueling growth in the global market. The demand to transport and store a variety of clinical supplies offers opportunities for machine manufacturers to design specialized industrial packaging machines. The increasing demand for packed foods and beverages as a result of an expanding middle-class population and urbanization will be a major growth driver. Also, an increased significance on efficiency and rising demand for multi-functional systems are some of the factors driving the industrial packaging equipment market.

The COVID-19 pandemic, which is spreading and causing increased human loss around the world, has resulted in the imposition of a lockdown to decrease infection among the population across countries. The lockdown resulted in the closure of factories and industries, and manufacturing enterprises are highly reliant on the suppliers of raw materials, components, and several components from other countries around the globe. It has been determined that a lack of raw material supply to manufacturing enterprises caused a halt in production.

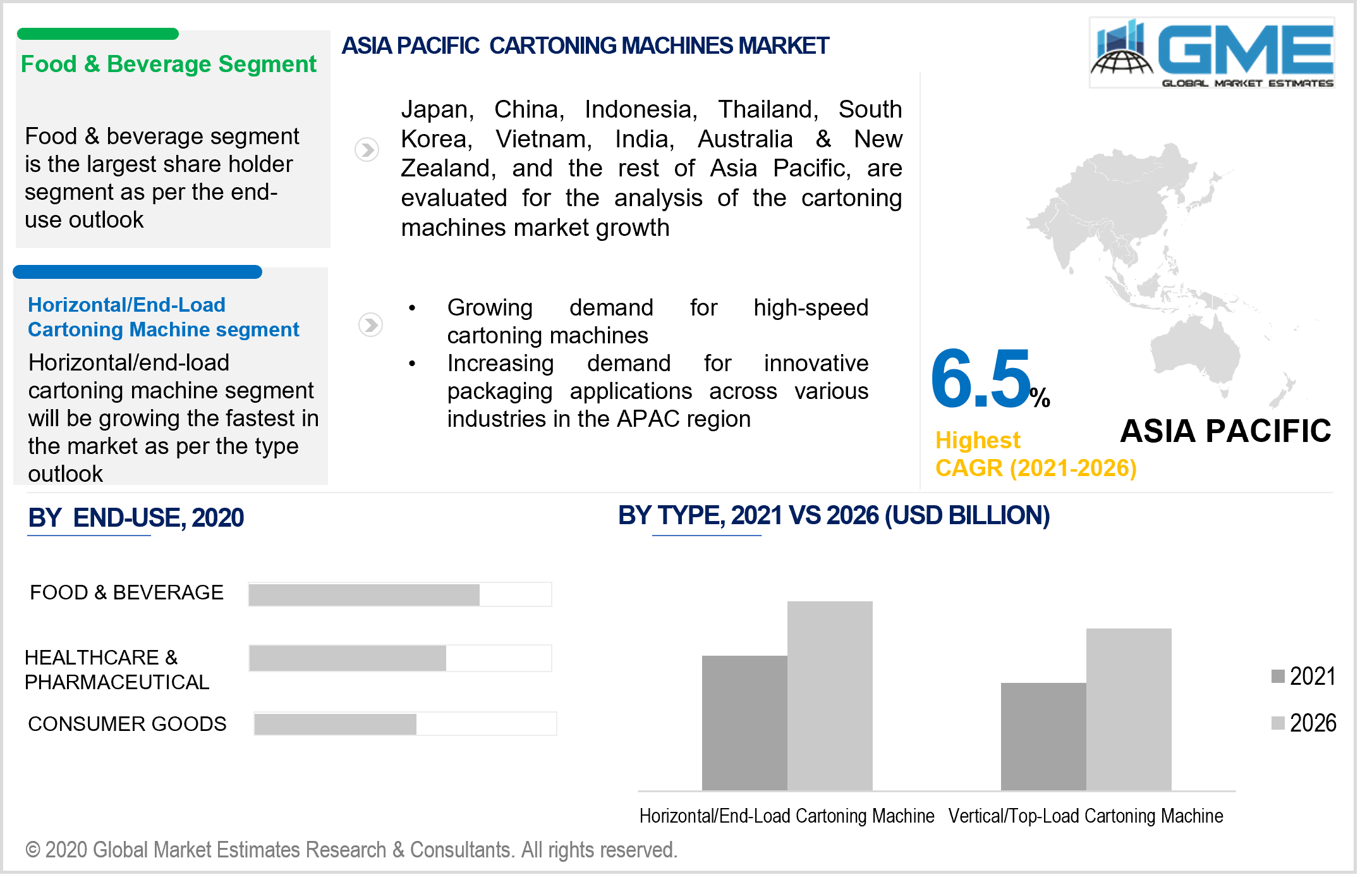

The type segment is categorized into vertical/top-load cartoning machine and horizontal/end-load cartoning machine. The vertical cartoning machine segment is expected to capture the lion’s share of the market because these were the first pieces of equipment devised by the industry for the manufacturing of cartons. Furthermore, since they are widely utilized in food-related implementations, their demand among manufacturing companies is considerable. Moreover, vertical packaging machines are ideal for products sold by weight or volume, and depending on the specifications, the loaded products are glued. Finally, they are dispatched for various operational purposes.

The horizontal cartoning machine segment is expected to grow at the highest CAGR in terms of revenue from 2021 to 2026 due to its higher flexibility and low cost in accommodating a range of carton sizes. The horizontal position is appropriate for end-load cartons, whereas the vertical position is appropriate for top-load cartons. The prevalence of horizontal position cartoning machines is due to the increasing demand for end-load cartons.

Food & beverage, healthcare & pharmaceuticals, consumer goods, and other end-use industries are the major application segments of the market. The food & beverage segment is expected to hold the lion’s share in terms of revenue during the forecast period due to the cartoning product’s efficiency and dependability of food & beverage products. Manufacturers in the food sector are continuously focusing on providing sustainable packaging machines in order to reduce material consumption and boost shelf life. Furthermore, the healthcare sector is expected to witness the highest growth rate in the cartoning equipment market due to the extensive use of trace and track technology, which allows tracing the location of the product during the packaging process.

As per the geographical analysis, the global market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The largest share of the market size in the US is mainly due to the presence of key players in the country, and rising expenses on healthcare equipment and pharmaceutical products.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. Rising demand for new packaging applications across numerous industries including cosmetics, food & beverage, and others, rising demand from e-commerce platforms, and increasing concern for safety packaging will impact the market size in the APAC region positively. Also, the growing usage of refrigerated cartons and increasing demand for high-speed cartoning machines will foster the cartoning equipment market growth during the forecast period.

Some of the leading packaging machinery companies are Econocorp Inc, ROVEMA GmbH, ACG, Langley Holdings PLC (Bradman Lake), Marchesini Group S.p.A., BETELGEUS, Bivans Corporation, Trustar Pharma & Packing Equipment Co., Ltd., Omori Machinery Co., Ltd., Packaging Equipment, Inc., Robert Bosch (cartoner), PMR Packaging, Pakona, Douglas Machine Inc., Mpac Group PLC, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cartoning Machines Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Type Overview

2.1.3 End-Use Overview

2.1.4 Regional Overview

Chapter 3 Global Cartoning Machines Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand from e-commerce channels

3.3.1.2 Increasing demand for eco-friendly packaging in pharmaceuticals

3.3.2 Industry Challenges

3.3.2.1 Emergence of 3D Printing

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cartoning Machines Market, By Type

4.1 Type Outlook

4.2 Vertical/Top Load Cartoning Machine

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Horizontal/End-Load Cartoning Machine

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Cartoning Machines Market, By End-Use

5.1 End-Use Outlook

5.2 Food & Beverage

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Healthcare & Pharmaceuticals

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Consumer Goods

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Cartoning Machines Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By End-Use, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By End-Use, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By End-Use, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By End-Use, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By End-Use, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By End-Use, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By End-Use, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Marchesini Group S.p.A.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Jacob White PackagingLtd.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Robert Bosch LLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Econocorp Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Langley Holdings PLC

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Bivans Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 Packaging Equipment Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 PME Packaging Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Mpac Group PLC

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Douglas Machine Inc.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Cartoning Machines Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cartoning Machines Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS